Procure to Pay Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431901 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Procure to Pay Software Market Size

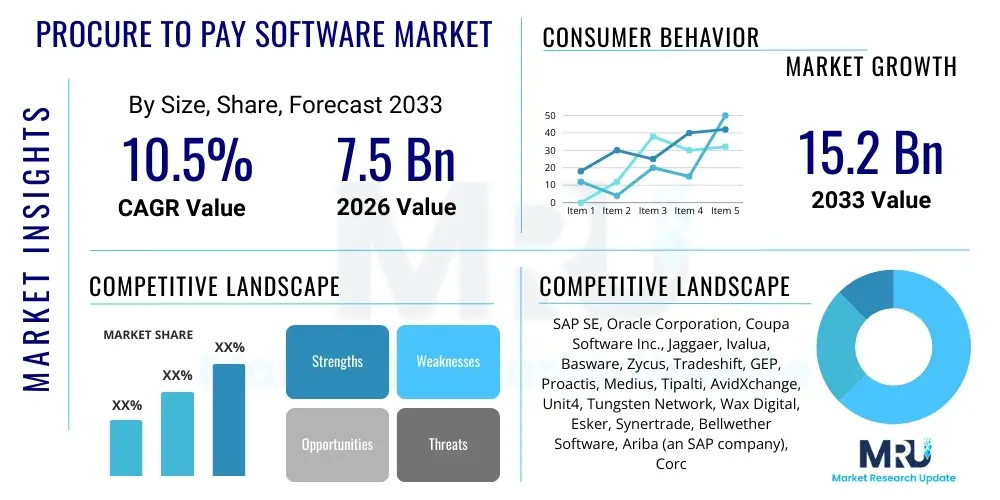

The Procure to Pay Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 15.2 Billion by the end of the forecast period in 2033.

Procure to Pay Software Market introduction

The Procure to Pay (P2P) Software Market encompasses integrated digital platforms designed to manage and optimize the entire procurement lifecycle, extending from the initial requisition of goods or services through to the final payment authorization. These comprehensive solutions serve as a critical component of modern enterprise resource planning (ERP) ecosystems, centralizing traditionally siloed functions such as spend management, supplier relationship management, e-invoicing, and contract compliance. By automating transactional workflows, P2P software minimizes manual intervention, drastically reduces the incidence of payment errors, and provides real-time visibility into organizational spending patterns. This holistic approach ensures that purchasing activities align rigorously with financial strategies and corporate governance policies, transforming the procurement function from a necessary administrative task into a source of strategic cost advantage and operational agility. The proliferation of complex, global supply chains and the heightened scrutiny on corporate financial integrity are the primary structural drivers accelerating the demand for these integrated platforms, positioning P2P systems as essential infrastructure for global enterprises seeking competitive efficiency.

P2P software typically offers modular components that cater to varying organizational needs, facilitating functions critical for both direct and indirect spend categories. Major applications include sophisticated e-Sourcing tools that manage supplier bidding and selection, catalog management for controlled purchasing, automated purchase order generation, and advanced workflow routing for approvals. A key benefit driving adoption is the improvement in compliance and risk mitigation. Modern P2P systems integrate automated checks against regulatory requirements (such as tax compliance and cross-border invoicing rules) and internal purchasing policies, severely limiting maverick spending and improving audit readiness. The shift towards cloud-based Software-as-a-Service (SaaS) delivery models has lowered the barrier to entry for Small and Medium Enterprises (SMEs), allowing them access to enterprise-grade functionality without the substantial upfront capital investment associated with traditional on-premise installations. This democratization of advanced procurement technology is a significant factor contributing to the market's robust growth trajectory across diverse industries globally, spanning manufacturing, retail, finance, and healthcare sectors.

The functionality of contemporary P2P platforms extends beyond mere automation; they increasingly leverage embedded analytics and artificial intelligence (AI) capabilities to deliver predictive and prescriptive insights. These solutions empower procurement professionals to forecast commodity price fluctuations, identify potential supply chain vulnerabilities, and optimize payment terms to manage working capital more effectively. The global push for digital transformation, intensified by the operational challenges exposed during recent economic volatility, has underscored the necessity for resilient, digitized financial processes. By centralizing all spending data and automating transactional labor, P2P software directly contributes to maximizing cost savings, enhancing strategic negotiation power with suppliers, and fostering healthier long-term vendor relationships built on transparent and timely financial interactions. The market is thus defined by continuous innovation focused on seamless integration, high levels of security, and the ability to deliver actionable, real-time intelligence to corporate decision-makers.

Procure to Pay Software Market Executive Summary

The Procure to Pay Software Market is undergoing a rapid evolution characterized by intense technological integration and a fundamental pivot towards comprehensive, modular cloud ecosystems. Key business trends indicate a strong market preference for holistic spend management suites that unify sourcing, contracting, purchasing, and payment functionalities onto a single platform, moving away from fragmented, point solutions. Strategic mergers and acquisitions are prevalent, as larger technology vendors seek to acquire specialized capabilities in areas like electronic invoicing or advanced supplier risk scoring, aiming to build truly end-to-end offerings. Furthermore, the global corporate focus on supply chain sustainability and ethical sourcing has mandated the inclusion of specialized modules within P2P platforms that track supplier performance against environmental, social, and governance (ESG) criteria, making compliance tracking a mandatory feature rather than a niche offering. This shift reflects a broader understanding that procurement is a strategic lever for corporate responsibility and resilience.

Regional dynamics highlight a complex interplay of maturity and accelerated growth. North America continues to generate the largest revenue base, driven by high technology readiness, mature enterprise markets, and substantial IT spending, particularly for integrating AI-driven cognitive capabilities into existing P2P workflows. Conversely, the Asia Pacific (APAC) region is forecasted to achieve the highest compounded annual growth rate (CAGR). This acceleration is fueled by increasing foreign investments, rapid urbanization, and governmental mandates across countries like China, India, and Australia promoting digital business practices and e-invoicing adoption. European market growth is robustly supported by regional standardization efforts, such as the Pan-European Public Procurement Online (PEPPOL) framework, which necessitates standardized, compliant P2P solutions capable of handling complex cross-border value-added tax (VAT) regulations and electronic document exchange, thereby creating guaranteed demand for compliant software.

Segment trends underscore the continuing momentum of the Cloud deployment segment, particularly within the SME category, where affordability and rapid deployment are prioritized. Among large enterprises, while cloud migration is ongoing, demand is also high for specialized integration and consulting services to manage the transition from complex legacy systems without disrupting mission-critical financial operations. Within the solution segment, modules related to e-Invoicing and Spend Analysis are experiencing exceptional growth, as these offer the most immediate and tangible ROI through cost avoidance and improved cash flow management. The industry vertical analysis shows intensified investment in P2P solutions within the Manufacturing sector to optimize complex direct materials procurement, and in the BFSI sector, where the emphasis remains heavily on audit trails, security, and financial regulatory compliance, demanding high levels of platform customization and robust data governance capabilities.

AI Impact Analysis on Procure to Pay Software Market

User inquiries concerning the integration of Artificial Intelligence (AI) and Machine Learning (ML) into Procure to Pay (P2P) processes primarily focus on quantifying efficiency gains and understanding the shift from reactive to proactive procurement strategies. Key questions frequently address how AI achieves 'straight-through' processing rates for invoices without human intervention, the reliability of AI algorithms in fraud detection, and the methods used by ML models to dynamically adjust spending forecasts based on market volatility. There is a strong collective expectation that AI will deliver superior data governance, standardize compliance checks across disparate geographical units, and significantly elevate the strategic capacity of procurement teams by eliminating high-volume, low-value administrative work. Users are specifically seeking platforms that demonstrate tangible capabilities in prescriptive analytics, guiding negotiation strategies and optimizing supplier selection based on holistic performance data, not just price.

The technological impact of AI integration is fundamentally restructuring the operational core of P2P software. Sophisticated ML models are now capable of analyzing massive volumes of unstructured data, such as contract text, supplier emails, and invoice scans, to extract, validate, and categorize information with near-perfect accuracy, which traditional optical character recognition (OCR) systems struggled to achieve. This capability is pivotal for automated three-way matching, where AI verifies that the purchase order, goods receipt, and invoice align perfectly, enabling autonomous approval and payment routing. Furthermore, AI algorithms actively monitor real-time transaction streams to identify anomalies indicative of fraudulent activity or policy breaches, providing a layer of security and audit integrity that vastly surpasses previous manual or simple rules-based detection mechanisms. This shift allows procurement organizations to realize the objective of 'touchless' processing, significantly cutting down operational expenditures and cycle times.

Beyond transactional automation, AI provides profound strategic advantages by enhancing spend visibility and supplier management. Predictive analytics, fueled by ML, can analyze market indicators, geopolitical risks, and historical purchasing data to provide highly accurate cost forecasts, allowing procurement managers to hedge against future price increases and optimize inventory levels. In supplier management, AI-driven scoring systems continuously evaluate vendor risk by analyzing financial health indicators, public news feeds, and compliance records, offering a dynamic and objective assessment that moves beyond static qualification processes. This strategic deployment transforms P2P software into a decision-support system, enabling organizations to manage complex global supply networks proactively, mitigate risks related to non-compliance or supply disruption, and utilize superior data intelligence to maximize commercial value throughout the entire purchasing lifecycle.

- AI drives touchless invoice processing rates exceeding 90% by automating data extraction and three-way matching verification processes.

- Machine Learning enhances spend classification accuracy, leading to superior spend visibility, detailed budgetary control, and enhanced strategic savings identification.

- Predictive analytics enables early identification of supply chain risks, optimizes inventory timing, and supports proactive management of commodity price fluctuations.

- NLP capabilities streamline contract analysis, rapidly highlight deviations from standard terms, and enforce compliance with global regulatory frameworks, reducing legal exposure.

- Intelligent chatbots and virtual agents improve the internal user experience by facilitating requisitioning processes and providing immediate resolution to routine supplier payment queries.

- AI-driven anomaly detection minimizes fraud potential, monitors for internal policy breaches, and ensures strict adherence to corporate purchasing policies automatically and continuously.

DRO & Impact Forces Of Procure to Pay Software Market

The Procure to Pay Software Market is structurally driven by an intense corporate focus on financial optimization, operational resilience, and transparency. A major driver is the global trend towards standardizing and automating high-volume, repetitive financial transactions to reallocate human resources towards strategic planning. The move from paper-based invoicing to mandated electronic invoicing (e-invoicing) across various jurisdictions globally provides a persistent, powerful catalyst for P2P adoption, as businesses seek compliant solutions that can manage these digital formats seamlessly. Furthermore, heightened global competition compels enterprises to gain tighter control over their expenditures, making P2P software, which offers detailed spend analysis and supplier performance metrics, an indispensable tool for maintaining profit margins and ensuring superior working capital management. These drivers are fundamentally reshaping the way enterprises view procurement, moving it from a back-office function to a core strategic competency that requires dedicated technology investment.

Despite strong market momentum, the industry faces significant restraints, primarily centered around the complexity and cost of integration. Large enterprises with decades-old legacy Enterprise Resource Planning (ERP) systems often face substantial challenges and prohibitive costs when attempting to integrate modern, cloud-native P2P solutions, frequently resulting in prolonged implementation cycles and operational disruption. Furthermore, the inherent need for extensive organizational change management represents a soft restraint; successful P2P adoption requires restructuring internal processes and training personnel across finance, procurement, and operations, encountering natural resistance to new workflows. Data security and jurisdictional compliance also pose ongoing challenges; as P2P platforms manage sensitive financial data across diverse international legal frameworks, ensuring robust cybersecurity and adhering to complex data residency laws require continuous, costly technical investment from vendors.

The market is rich with opportunities, particularly stemming from the accelerating adoption of advanced technologies like AI, Blockchain, and IoT. The opportunity to leverage predictive AI to move from reactive cost reporting to proactive financial forecasting and optimization is highly attractive to enterprise clients. Furthermore, the immense, untapped market of Small and Medium Enterprises (SMEs) represents a massive growth opportunity, driven by the increasing availability of affordable, modular, and easy-to-deploy SaaS P2P solutions tailored to their specific scale and budget constraints. The emergence of specialized niche requirements, such as integrating P2P with corporate sustainability reporting systems or leveraging blockchain for enhanced supply chain provenance tracking, provides vendors with continuous avenues for product differentiation and market expansion. The combined impact forces of regulatory pressure, technological innovation, and globalization ensure that market demand will remain robust and highly dynamic throughout the forecast period.

Segmentation Analysis

The segmentation of the Procure to Pay (P2P) Software Market is essential for dissecting the intricate purchasing behaviors and varying requirements across different user groups and implementation environments. Segmentation by component separates the market into Solutions, which are the core software modules (e.g., e-invoicing, spend analysis), and Services, which encompass critical activities like consulting, implementation, and ongoing maintenance. While the Solution segment holds the majority share, driven by the essential requirement for core automation capabilities, the Services segment is growing at an accelerated pace. This growth reflects the high level of technical expertise required to customize and integrate sophisticated P2P platforms with complex, often proprietary, internal business systems, making expert consultation indispensable for maximizing software utility and ensuring project success within large-scale deployments.

Deployment type analysis highlights the definitive dominance of the Cloud (SaaS) model, which is fundamentally reshaping market access and delivery. Cloud solutions offer superior agility, reduced maintenance burden, and continuous feature updates, aligning perfectly with modern IT strategies focused on minimizing capital expenditure and maximizing operational flexibility. While On-Premise installations still persist, primarily in highly secure environments (like government or BFSI institutions) or where legacy infrastructure dictates, the overwhelming trend is towards hybrid or pure-cloud adoption. Enterprise size segmentation clearly separates the needs of Large Enterprises, which demand highly scalable, complex, and customized global solutions often integrating multiple modules and regional tax compliance features, from the needs of Small and Medium Enterprises (SMEs), which prioritize rapid deployment, cost-effectiveness, and ease of use, often favoring bundled or standardized SaaS offerings.

Segmentation by Industry Vertical reveals specific procurement complexities that vendors must address. The Manufacturing sector, for example, requires P2P systems capable of managing both highly complex direct material sourcing alongside indirect MRO (Maintenance, Repair, and Operations) spending, often demanding deep integration with inventory and production scheduling systems. Conversely, the Banking, Financial Services, and Insurance (BFSI) sector places paramount importance on rigorous regulatory compliance, data encryption, and fraud prevention, necessitating P2P solutions equipped with advanced audit capabilities and stringent access controls. The sustained growth across all verticals indicates that the benefits of P2P automation—enhanced visibility, cost reduction, and compliance assurance—are universally recognized strategic priorities, adapting the software to address industry-specific workflows and regulatory landscapes.

- By Component:

- Solution (e-Procurement, e-Invoicing and Accounts Payable Automation, Spend Analysis, Supplier Risk and Performance Management, Contract Management)

- Services (Consulting and Implementation, Managed Services, Training and Support and Maintenance, Customization Services)

- By Deployment Type:

- Cloud (Software-as-a-Service - SaaS, preferred for scalability and reduced IT overhead)

- On-Premise (Used predominantly by organizations with strict data residency requirements or existing large-scale legacy infrastructure)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs, focusing on rapid adoption of standardized cloud modules)

- Large Enterprises (Requiring comprehensive, customized, global P2P suites with deep integration capabilities)

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance, high emphasis on regulatory compliance and security)

- IT and Telecom (Driven by high volume of indirect services spend and rapid technological changes)

- Manufacturing (Complex direct and indirect material procurement, need for integration with supply chain planning)

- Retail and E-commerce (Focus on high transaction volume, inventory correlation, and seasonal spending management)

- Healthcare and Pharmaceuticals (Strict regulatory mandates, complexity of medical supply sourcing, and compliance reporting)

- Others (Government, Education, Energy, focusing on public transparency and budget control)

Value Chain Analysis For Procure to Pay Software Market

The upstream segment of the P2P software value chain is dominated by intense intellectual property development and foundational technological engineering. This phase involves specialized software vendors and infrastructure providers investing heavily in R&D to develop core P2P modules, including sophisticated AI algorithms for cognitive capture, advanced API frameworks for seamless integration, and secure cloud infrastructure hosting capabilities. Key upstream activities include the design of user-friendly interfaces, the engineering of scalable databases capable of handling massive transactional volumes, and ensuring compliance with initial international data privacy and security standards. Success in this segment is highly dependent on a vendor's ability to anticipate technological shifts, such as the rise of blockchain for supply chain visibility, and to continuously update their product roadmap to maintain a competitive feature set, ultimately delivering a robust, secure, and modern core P2P application suite.

The midstream segment centers on the distribution, integration, and customization required to bridge the gap between the generic software product and the client’s unique operational ecosystem. Distribution channels are bifurcated: large P2P vendors often employ direct sales teams for major enterprise accounts, offering comprehensive implementation packages and direct long-term relationship management. Indirect distribution relies heavily on channel partners, value-added resellers (VARs), and regional system integrators, especially in geographically fragmented or emerging markets, who localize the solution and manage complex integration tasks. The services arm of the midstream is crucial, involving intricate processes of migrating historical transactional data, configuring workflows to match specific corporate policies, and ensuring tight integration with legacy financial systems (like Oracle or SAP ERP), which often dictate the pace and success of the entire P2P deployment project.

Downstream activities focus on the delivery of realized value to the end-user organizations, encompassing the ongoing use, support, and continuous optimization of the implemented P2P solution. This stage includes managing supplier onboarding, facilitating electronic document exchange (e-invoicing), executing automated payment runs, and generating crucial strategic spend analysis reports. The value captured downstream manifests as quantifiable metrics: reduction in invoice processing costs, decreased cycle times, improved discount capture due to timely payments, and minimization of non-compliant spending. Ongoing maintenance, customer support, and strategic advisory services ensure that the P2P system evolves alongside the organization’s growth and changing regulatory landscape. The continuous feedback loop from the downstream users concerning functionality and performance is vital for informing the upstream R&D cycle, driving iterative improvements and enhancing the lifetime value of the P2P investment.

Procure to Pay Software Market Potential Customers

The heterogeneity of the Procure to Pay Software Market is reflected in the diversity of its potential customer base, which requires tailored solution strategies based on organizational scale and industry-specific requirements. Large Enterprises (those with annual revenues exceeding $1 billion) constitute the most valuable customer segment, characterized by complex global operations, multi-currency transactions, and extensive supplier relationships demanding sophisticated, multi-module P2P suites. These organizations require solutions capable of enforcing centralized governance across decentralized operations, prioritizing features such as advanced contract management, global tax compliance, and seamless integration with multiple regional ERP instances. For these high-stakes deployments, customers seek established, financially secure vendors who can guarantee long-term system stability, robust security protocols, and substantial implementation support.

The Small and Medium Enterprise (SME) segment represents the largest volume of potential customers and the fastest adoption rate, particularly in developing economies and mature markets where digital processes are becoming standard. SMEs are motivated by the need to professionalize their rudimentary procurement processes, eliminate manual administrative burdens, and quickly gain basic spend visibility necessary for controlling escalating operational costs. The purchasing behavior of SMEs favors easily accessible, subscription-based Cloud P2P solutions that require minimal IT footprint and offer standardized, pre-configured workflows. Vendors targeting SMEs must emphasize low total cost of ownership (TCO), speed of deployment, and intuitive user interfaces that minimize training requirements, allowing for rapid time-to-value realization.

Furthermore, organizations within highly regulated industries such as Healthcare, BFSI, and Government represent critical potential customers, prioritizing P2P solutions that guarantee strict adherence to complex industry-specific regulations, mandatory reporting requirements, and robust audit trails. These sectors view P2P technology not merely as a cost-saving tool but as an essential governance mechanism. Additionally, the rapid digital transformation occurring in emerging markets across APAC and Latin America is creating new pools of customers actively seeking modern, localized P2P solutions to upgrade outdated state-owned and private enterprise procurement processes. Sector-specific customers, particularly within Government and Public Sector entities, present a unique customer profile, driven less by profit maximization and more by mandates for transparency, accountability, and stringent budgeting. This diverse customer landscape necessitates P2P vendors to offer flexible product configuration, modular pricing, and deep vertical expertise to successfully penetrate and service these highly specialized procurement environments effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 15.2 Billion |

| Growth Rate | 10.5% CAGR ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, Coupa Software Inc., Jaggaer, Ivalua, Basware, Zycus, Tradeshift, GEP, Proactis, Medius, Tipalti, AvidXchange, Unit4, Tungsten Network, Wax Digital, Esker, Synertrade, Bellwether Software, Ariba (an SAP company), Corcentric, SutiSoft, Vroozi, Determine (Corcentric), BirchStreet Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Procure to Pay Software Market Key Technology Landscape

The foundational technological infrastructure for the Procure to Pay (P2P) market is overwhelmingly dominated by high-availability, multi-tenant Cloud architecture, primarily delivered through the Software-as-a-Service (SaaS) model. This shift has enabled P2P platforms to handle massive fluctuations in transaction volume, offer robust disaster recovery capabilities, and ensure continuous software updates and security patches without requiring client intervention. A major focus within the landscape is on developing advanced Application Programming Interfaces (APIs) and integration hubs that facilitate frictionless data exchange between the P2P system and the organization’s wider financial and operational ecosystem, including ERPs, inventory management systems, and external banking interfaces. Furthermore, developers are investing in modern microservices architectures, which allow for rapid, independent scaling and deployment of individual P2P modules (e.g., e-invoicing or contract management), enhancing system flexibility and resilience across diverse operational environments globally.

The infusion of Artificial Intelligence (AI) and Machine Learning (ML) is the most critical technological differentiator in the current market, moving P2P functionality into the realm of cognitive automation. AI drives enhancements in data quality and process execution through proprietary algorithms designed for intelligent document capture (IDP), which accurately digitizes and validates unstructured data from complex invoices and receipts. ML models utilize historical transaction data to learn spending patterns, predict supplier payment behaviors, and automatically propose optimal cost codes and approval routes, significantly reducing human touchpoints and associated error rates. Robotic Process Automation (RPA) complements AI by automating structured, repetitive tasks such like routine data reconciliation and report generation, ensuring that the P2P workflow is maximally streamlined, accelerating the entire cash-to-pay cycle, and freeing up human procurement analysts for more strategic, negotiation-focused tasks.

Emerging technologies are increasingly being piloted to enhance specific segments of the P2P value chain. Blockchain technology, or Distributed Ledger Technology (DLT), holds significant promise for improving supplier management by creating immutable records of contracts, certifications, and transaction histories, which enhances trust, streamlines audits, and potentially accelerates cross-border payments through smart contracts. Furthermore, sophisticated Business Intelligence (BI) tools and advanced data visualization platforms are now standard offerings, translating complex spend data into easy-to-digest dashboards that offer immediate, actionable insights into budgetary compliance, supplier performance, and global cost savings opportunities. The convergence of these technologies underscores the market's focus on delivering not just efficiency, but strategic intelligence, positioning P2P software as central to enterprise financial health and competitive advantage in the digital era.

Regional Highlights

The global P2P software market exhibits distinct regional characteristics influenced by economic development, regulatory frameworks, and technological adoption rates. These differences necessitate localized product strategies and customized implementation approaches from vendors to address unique market demands effectively.

- North America: This region is characterized by high digital maturity and leads the market in revenue and technological adoption, driven by early implementation of sophisticated AI and ML capabilities across large enterprises, particularly in the Financial Services and Technology sectors. The region’s focus is on maximizing efficiency through full integration of P2P solutions with complex, multi-functional ERP landscapes and sophisticated vendor risk management.

- Europe: Regulatory compliance is the primary regional driver, specifically the widespread adoption of e-invoicing standards mandated by governments (e.g., Peppol), which necessitates investment in robust, compliant P2P solutions. Germany, the UK, and France are key markets, with demand heavily weighted towards solutions offering strong localization features for VAT and regional tax adherence, focusing on seamless cross-border financial transactions.

- Asia Pacific (APAC): Positioned for the highest growth due to rapid digital transformation across China, India, and Southeast Asian nations. The region is seeing significant adoption among SMEs utilizing cloud-based models for the first time, often bypassing on-premise solutions entirely. Market growth is stimulated by urbanization, infrastructure development, and increased international trade volume, necessitating scalable and flexible P2P systems.

- Latin America (LATAM): This region is heavily influenced by strict governmental regulations regarding mandatory electronic fiscal documents (NF-e). P2P systems are critical here for automating complex tax calculations and reporting requirements mandated by local authorities in countries like Brazil and Mexico, making compliance a non-negotiable feature essential for uninterrupted business operation.

- Middle East and Africa (MEA): Growth is accelerating, supported by government-led initiatives (such as Saudi Vision 2030) promoting economic diversification and digital infrastructure investment. Adoption is strongest in the Public Sector and Energy verticals, where transparency and anti-corruption measures are prioritized through automated procurement systems, driving demand for secure, audit-ready platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Procure to Pay Software Market.- SAP SE

- Oracle Corporation

- Coupa Software Inc.

- Jaggaer

- Ivalua

- Basware

- Zycus

- Tradeshift

- GEP

- Proactis

- Medius

- Tipalti

- AvidXchange

- Unit4

- Tungsten Network

- Wax Digital

- Esker

- Synertrade

- Bellwether Software

- Ariba (an SAP company)

- Corcentric

- SutiSoft

- Vroozi

- Determine (Corcentric)

- BirchStreet Systems

Frequently Asked Questions

Analyze common user questions about the Procure to Pay Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the estimated growth rate (CAGR) for the Procure to Pay Software Market?

The Procure to Pay Software Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period from 2026 to 2033, driven by increasing adoption of cloud-based P2P automation solutions globally and the corporate imperative for strict spend visibility and control.

How does AI impact P2P software functionality and realized ROI?

AI significantly enhances P2P functionality by enabling intelligent automation, particularly in touchless invoice processing, accurate spend classification, and predictive risk management, leading to substantial reductions in manual effort, lower processing costs, and higher return on investment (ROI) derived from optimized payment strategies.

Which deployment model dominates the P2P Software Market and why?

The Cloud-based (SaaS) deployment model currently dominates the P2P Software Market, favored by both SMEs and large enterprises due to its superior scalability, low total cost of ownership (TCO), reduced internal IT infrastructure burden, and rapid implementation time, facilitating quick access to advanced features.

What are the primary drivers accelerating the corporate adoption of modern P2P solutions?

Primary drivers include the corporate mandate for rigorous expenditure control, the necessity for end-to-end digital transformation of often inefficient paper-based procurement processes, and increasingly stringent global and regional regulatory requirements demanding enhanced financial transparency and guaranteed auditability.

Which P2P software segment is experiencing the fastest growth?

The e-Invoicing and Accounts Payable Automation module segment is currently experiencing the fastest growth within P2P solutions, as it offers the most immediate and quantifiable efficiency gains by eliminating manual invoice handling, reducing errors, and accelerating payment cycles, thereby optimizing working capital.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager