Procurement Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431857 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Procurement Outsourcing Market Size

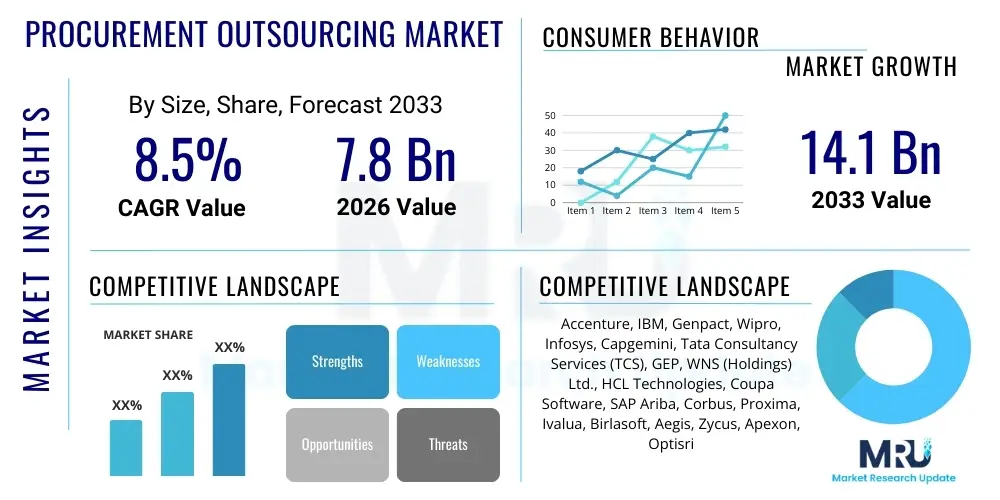

The Procurement Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 7.8 Billion in 2026 and is projected to reach USD 14.1 Billion by the end of the forecast period in 2033.

Procurement Outsourcing Market introduction

The Procurement Outsourcing Market encompasses the delegation of specific procurement activities or the entire procurement function to external third-party service providers. This strategic business model allows organizations to focus on core competencies, achieve significant cost reductions, and enhance efficiency in their purchasing processes. Modern procurement outsourcing solutions go beyond mere transactional processing; they integrate advanced technology, strategic sourcing expertise, and comprehensive category management capabilities to drive value creation across the entire supply chain.

Major applications of procurement outsourcing span various industry verticals, including manufacturing, retail, healthcare, and financial services, focusing heavily on indirect spend categories like IT, marketing, and corporate services, as well as complex direct spend areas. The primary benefits realized by companies adopting this model include immediate cost savings, improved compliance and risk management, access to specialized market intelligence, and optimized supplier relationship management. By leveraging the service provider's global scale and specialized talent pool, organizations can standardize processes and implement best practices more rapidly than internal efforts would allow.

Key driving factors accelerating market adoption include the increasing complexity of global supply chains, the imperative for digital transformation within procurement departments, and the mounting pressure on Chief Procurement Officers (CPOs) to deliver measurable shareholder value through efficiency gains. Furthermore, the volatility in commodity prices and the need for enhanced supply chain resilience following recent global disruptions have cemented the necessity for flexible, expert-driven procurement operations, fueling the expansion of outsourcing services that offer dynamic risk mitigation and superior sourcing strategies.

Procurement Outsourcing Market Executive Summary

The Procurement Outsourcing Market is experiencing robust growth, primarily driven by large enterprises seeking greater spend visibility and lower operational expenditure, alongside SMEs increasingly leveraging outsourcing for access to enterprise-grade procurement technology they cannot afford internally. Business trends indicate a definitive shift towards outcome-based contracts and the integration of advanced digital tools, notably Artificial Intelligence (AI) and Machine Learning (ML), to enhance strategic sourcing and demand forecasting accuracy. Service providers are evolving from purely labor arbitrage models to knowledge-based partnerships, offering deep category expertise critical for complex spend categories, particularly in raw materials and intricate services.

Regional trends highlight North America and Europe as dominant markets due to high maturity in supply chain management and early adoption of digital procurement solutions. However, the Asia Pacific region is projected to exhibit the fastest growth, propelled by rapid industrialization, increasing foreign direct investment in manufacturing hubs like China and India, and a burgeoning number of multinational corporations establishing sourcing centers there. This APAC growth is characterized by a high demand for transactional P2P (Procure-to-Pay) services and compliance management solutions tailored to diverse local regulatory landscapes.

Segment trends underscore the increasing dominance of strategic sourcing and category management services, reflecting the desire of client organizations to outsource high-value, non-transactional work that directly impacts profitability. While transactional P2P remains foundational, the highest growth rates are observed in Source-to-Contract (S2C) services, which utilize predictive analytics for supplier risk assessment and contract lifecycle optimization. Furthermore, the manufacturing vertical remains the largest consumer of procurement outsourcing, but the high-tech and BFSI sectors are demonstrating accelerated adoption as they navigate complex software licensing and specialized compliance procurement needs.

AI Impact Analysis on Procurement Outsourcing Market

Users frequently inquire about AI's potential to automate core procurement tasks, leading to job displacement among human analysts, and conversely, its ability to elevate the strategic role of CPOs. Key concerns revolve around the accuracy of AI in predicting supply chain disruptions, the security of sensitive supplier data when processed by automated systems, and the implementation complexity and return on investment (ROI) associated with integrating new AI tools into legacy ERP systems. Expectations are high regarding AI's capability to deliver 'touchless' procurement processes, offering superior spend anomaly detection and generating highly personalized, prescriptive sourcing recommendations that human analysts might overlook, thereby driving unprecedented efficiencies and deeper market insights for outsourced service providers and their clients.

The integration of Artificial Intelligence (AI) is fundamentally reshaping the competitive landscape of the Procurement Outsourcing Market. AI tools are enabling service providers to transition from tactical execution to strategic consultation. Specifically, AI-powered predictive analytics enhance demand forecasting accuracy, allowing for preemptive adjustments in sourcing volumes and supplier negotiations, which is critical in volatile markets. Moreover, natural language processing (NLP) is dramatically improving contract management efficiency by automating the extraction of key terms, identifying contractual risks, and ensuring compliance across vast portfolios of supplier agreements, significantly reducing manual review time.

This technological shift enhances the value proposition of outsourcing firms. By automating routine, high-volume tasks such as invoice processing, low-value requisition approvals, and basic vendor selection through Robotic Process Automation (RPA) and ML algorithms, outsourcing providers can redirect their expert staff to focus on high-impact activities like complex negotiation strategy and innovative supply chain design. This dual benefit—reduced operational cost through automation combined with enhanced strategic insight—solidifies procurement outsourcing as an essential component of modern enterprise digital transformation strategies.

- Enhanced Spend Visibility: AI algorithms analyze fragmented data across systems to provide real-time, comprehensive spend categorization and compliance monitoring.

- Predictive Risk Management: Machine Learning models forecast supplier failure rates, geopolitical disruptions, and commodity price volatility, enabling proactive sourcing adjustments.

- Intelligent Automation (RPA): Automated processing of transactional activities like purchase order creation, invoice matching (P2P), and low-value requisition fulfillment.

- Optimized Supplier Negotiation: AI platforms recommend optimal negotiation levers and price points based on historical data and real-time market trends.

- Contract Lifecycle Management (CLM) Automation: NLP tools accelerate contract review, compliance checking, and identification of non-standard clauses.

DRO & Impact Forces Of Procurement Outsourcing Market

The procurement outsourcing market is influenced by a powerful combination of drivers (D), restraints (R), and opportunities (O), which collectively define the impact forces shaping its trajectory. A primary driver is the intense focus by global enterprises on achieving operational excellence and realizing immediate, measurable cost savings in a highly competitive economic environment. Organizations are increasingly recognizing that procurement, traditionally an administrative function, can be a major source of strategic advantage if managed by specialized, scalable external partners. Simultaneously, the accelerating digitization of procurement processes necessitates significant upfront investment in technology, which smaller and even mid-sized companies often lack the capital or internal expertise to implement, driving them towards outsourcing providers who offer technology access as a service.

Restraints, however, pose challenges to widespread adoption. Key among these is the pervasive resistance to change within client organizations, particularly reluctance to relinquish control over highly strategic direct procurement categories and sensitive supplier relationships. Concerns regarding data security and the protection of proprietary sourcing strategies when entrusting them to third-party providers also act as a significant barrier. Additionally, the complexity involved in meticulously defining the scope of outsourced services and establishing robust, quantifiable service level agreements (SLAs) often proves challenging, potentially delaying or complicating implementation processes, especially across fragmented regional operations.

Opportunities within the market are predominantly centered on technological innovation and geographic expansion. The continuous development of advanced analytical tools, cloud-based source-to-pay (S2P) platforms, and AI-driven predictive capabilities creates opportunities for service providers to offer highly differentiated and high-value strategic services. Furthermore, there is a substantial untapped market in the mid-market segment (SMEs), which requires standardized, affordable, yet sophisticated procurement solutions. Service providers focusing on niche industry-specific category expertise—such as healthcare procurement of specialized medical devices or high-tech sourcing of semiconductors—stand to gain significant market share by demonstrating deep vertical knowledge, thus capitalizing on specific, complex client needs.

Segmentation Analysis

The Procurement Outsourcing Market is segmented across various dimensions, including the type of component outsourced, the service model deployed, the organization size of the client, and the specific industry vertical served. This segmentation is crucial as it dictates the complexity of the service offerings, the necessary technological investment, and the pricing structure. For instance, the distinction between Source-to-Pay (S2P) and Procure-to-Pay (P2P) services determines whether the outsourcing engagement focuses on high-level strategic activities (S2P) or high-volume transactional efficiency (P2P), with the former demanding specialized category expertise and the latter relying heavily on automated platforms.

Further breakdown by service type highlights the growing importance of strategic sourcing and category management, which are increasingly being bundled with advanced spend analysis tools to provide continuous value improvement rather than just cost reduction. Organizations are moving away from piecemeal outsourcing towards integrated, end-to-end solutions that cover the entire procurement lifecycle. This shift is particularly evident in large multinational corporations seeking global harmonization of their procurement policies and technology infrastructure under a single service provider contract, demanding greater flexibility and scalability.

From an end-user perspective, while large enterprises represent the largest revenue base due to their massive spend volumes and complex global operations, the SME segment is rapidly accelerating its adoption rate. SMEs often lack dedicated procurement departments and sophisticated technology stacks, making outsourcing an attractive and necessary path to institutionalize professional purchasing practices and gain immediate access to global supplier networks and competitive pricing formerly reserved for larger players. This nuanced segmentation allows market players to tailor specific solutions, optimizing their delivery models for profitability and client satisfaction across diverse buyer profiles.

- By Component:

- Source-to-Pay (S2P) Outsourcing

- Procure-to-Pay (P2P) Outsourcing

- Source-to-Contract (S2C) Outsourcing

- By Service Type:

- Strategic Sourcing and Category Management

- Transactional Procurement (P2P execution)

- Spend Analysis and Demand Management

- Supplier Relationship Management (SRM)

- Risk and Compliance Management

- By Organization Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Industry Vertical:

- Manufacturing (Automotive, Industrial)

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Packaged Goods (CPG)

- IT and Telecom

- Healthcare and Pharmaceuticals

- Energy and Utilities

Value Chain Analysis For Procurement Outsourcing Market

The value chain for the Procurement Outsourcing Market begins with upstream activities involving technology providers and talent acquisition. Upstream analysis focuses heavily on the development and maintenance of sophisticated, cloud-based Source-to-Pay (S2P) technology platforms, often requiring strategic partnerships between outsourcing firms and leading software vendors (e.g., SAP Ariba, Coupa, Oracle). Equally critical is the talent pool—sourcing, training, and retaining category experts who possess deep market knowledge across various specialized industries, as the intellectual capital of the service provider forms the core value offering.

Midstream activities constitute the core delivery process, encompassing the transition, transformation, and ongoing management stages of the client’s procurement function. This involves initial diagnostics, process reengineering, standardization of policies, and migration onto the service provider’s platform. Direct activities include executing strategic sourcing events, negotiating contracts, and managing supplier performance. Indirect activities involve internal support functions like IT maintenance, financial reporting for cost savings realization, and legal compliance checking that underpin the service delivery.

Downstream analysis focuses on service delivery and market reach. The distribution channel is predominantly direct, where large outsourcing providers engage directly with clients through complex, multi-year contracts managed by dedicated client relationship teams. However, indirect channels, such as alliances with consulting firms or technology resellers, play a role in lead generation and implementation support. The ultimate delivery of value occurs at the client interface, characterized by transparent reporting of cost savings, improved efficiency metrics, and enhanced risk posture, ensuring the outsourced function remains seamlessly integrated with the client’s broader business strategy and financial objectives.

Procurement Outsourcing Market Potential Customers

Potential customers for procurement outsourcing services are predominantly large multinational corporations (MNCs) operating across multiple geographies, characterized by highly complex supply chains and substantial annual spend volumes. These large enterprises, often headquartered in North America and Western Europe, seek immediate access to global sourcing expertise and advanced technological platforms to centralize fragmented spending, drive standardization, and achieve significant economies of scale. Their primary focus is on strategic categories, where external experts can leverage specific market intelligence to secure superior terms and mitigate geopolitical risks that impact their core production or service delivery.

The secondary, yet rapidly expanding, customer segment consists of Small and Medium Enterprises (SMEs) that face internal constraints, specifically the lack of robust dedicated procurement teams and the inability to afford enterprise-level S2P software licenses. For SMEs, outsourcing offers an accessible way to professionalize their buying processes, ensure regulatory compliance, and immediately tap into the pricing power of larger aggregated spend pools managed by the service provider. This segment typically focuses on outsourcing high-volume, transactional P2P processes and general indirect spend categories like office supplies, fleet management, and marketing services, valuing simplicity and speed of implementation.

Furthermore, organizations undergoing significant corporate restructuring, mergers and acquisitions (M&A), or rapid expansion often become high-potential customers. In M&A scenarios, outsourcing is utilized as a swift, effective tool to integrate disparate procurement functions and systems under a single, unified structure. Similarly, organizations in highly regulated sectors such as pharmaceuticals, aerospace, and banking, which have stringent compliance and quality assurance requirements, are ideal candidates for outsourcing specialized functions like clinical trial procurement or regulatory IT sourcing, seeking partners who can guarantee adherence to complex industry-specific standards and audit protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.8 Billion |

| Market Forecast in 2033 | USD 14.1 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, IBM, Genpact, Wipro, Infosys, Capgemini, Tata Consultancy Services (TCS), GEP, WNS (Holdings) Ltd., HCL Technologies, Coupa Software, SAP Ariba, Corbus, Proxima, Ivalua, Birlasoft, Aegis, Zycus, Apexon, Optisri |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Procurement Outsourcing Market Key Technology Landscape

The technological backbone of the modern Procurement Outsourcing Market is dominated by advanced, cloud-based Source-to-Pay (S2P) platforms, which offer end-to-end functionality from strategic sourcing through operational P2P execution. These platforms, often provided by specialized software vendors like Coupa, SAP Ariba, or integrated offerings from outsourcing firms themselves, are essential for aggregating spend data globally, enforcing compliance, and standardizing diverse procurement processes across multinational client organizations. Cloud deployment is now the standard, providing scalability, flexibility, and accelerated implementation cycles crucial for achieving rapid cost savings and maintaining business continuity.

Beyond the core S2P systems, the technology landscape is rapidly being defined by the integration of emerging technologies, primarily Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA). RPA is heavily utilized for high-volume, repetitive transactional tasks such as automated invoice processing, three-way matching, and managing low-value, compliant purchase orders, significantly driving down the cost-to-serve for outsourcing providers. Meanwhile, AI and ML are leveraged for strategic functions, including supplier risk sensing, predictive commodity pricing, and dynamic sourcing optimization, moving the outsourced function beyond simple cost reduction into complex strategic decision support.

Furthermore, specialized technologies supporting the digital procurement ecosystem include Blockchain for enhanced supply chain transparency and secure record-keeping, crucial for verifying the authenticity and provenance of high-value goods. Data visualization and advanced analytics tools are vital for translating massive volumes of transactional data into actionable insights for the client’s management team. These technological investments enable service providers to offer highly differentiated solutions that promise not just operational efficiency, but competitive intelligence, securing the future relevance of the procurement outsourcing model in the digital era.

Regional Highlights

- North America: This region holds the largest market share, characterized by high technological maturity, early adoption of digital S2P platforms, and substantial expenditure on complex strategic sourcing services, particularly within the BFSI, high-tech, and pharmaceutical sectors. The presence of numerous large multinational corporations and robust regulatory frameworks drives continuous demand for sophisticated compliance and risk management outsourcing solutions.

- Europe: A mature market focused heavily on achieving sustainable procurement goals and enhanced supply chain resilience. Demand is strong for category management services, especially in indirect spend, as European companies prioritize standardization across diverse national regulatory environments. Germany and the UK are key contributors, emphasizing advanced analytics and AI integration to optimize continental sourcing strategies.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, massive foreign investment in manufacturing, and the expansion of domestic enterprises. While initial demand centered on transactional P2P services (labor arbitrage), the market is quickly evolving to require strategic sourcing expertise, particularly in China, India, and Southeast Asian manufacturing hubs, where managing complexity and ensuring ethical sourcing are critical.

- Latin America (LATAM): Growth is steady, driven by the need for currency risk mitigation and regulatory compliance across volatile local markets. Companies in LATAM leverage outsourcing primarily to gain access to centralized global supplier networks and standardized processes that stabilize their local procurement functions against economic fluctuations.

- Middle East and Africa (MEA): Emerging market focused heavily on large-scale infrastructure and energy projects. Outsourcing adoption is accelerating in the Gulf Cooperation Council (GCC) countries, primarily focused on managing complex capital expenditure (CapEx) procurement and ensuring transparency and efficiency in government-linked tenders and supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Procurement Outsourcing Market.- Accenture

- IBM

- Genpact

- Wipro

- Infosys

- Capgemini

- Tata Consultancy Services (TCS)

- GEP

- WNS (Holdings) Ltd.

- HCL Technologies

- Coupa Software (Strategic Partners/Technology Providers)

- SAP Ariba (Strategic Partners/Technology Providers)

- Corbus

- Proxima

- Ivalua

- Birlasoft

- Aegis

- Zycus

- Apexon

- Optisri

Frequently Asked Questions

Analyze common user questions about the Procurement Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Procurement Outsourcing Market?

The Procurement Outsourcing Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period from 2026 to 2033, driven by digitalization and demand for strategic category expertise.

Which services within procurement outsourcing are experiencing the fastest growth?

Strategic Sourcing and Category Management services, along with advanced Spend Analysis solutions leveraging AI, are showing the fastest growth, moving beyond traditional transactional Procure-to-Pay (P2P) services.

How is AI impacting the value proposition of outsourcing providers?

AI significantly enhances the value proposition by automating transactional tasks (RPA) and offering predictive insights for risk management and demand forecasting, shifting the provider role from executor to strategic consultant.

What are the primary restraints hindering market adoption?

Key restraints include organizational resistance to relinquishing control over strategic spend, persistent concerns regarding data security when handled by third parties, and challenges related to integrating outsourced operations with existing IT infrastructure.

Which geographical region dominates the Procurement Outsourcing Market?

North America currently holds the largest market share due to its high maturity, substantial corporate spend volumes, and early adoption of end-to-end digital Source-to-Pay (S2P) solutions across various industries.

The continued convergence of globalization and digital technology is driving a paradigm shift in how corporations view and manage their procurement functions. The complexity inherent in managing diverse international supply bases, coupled with fluctuating tariffs and increasing environmental, social, and governance (ESG) compliance requirements, has made in-house procurement increasingly resource-intensive and risk-prone. Outsourcing providers, equipped with proprietary technology, global process frameworks, and specialized talent, offer an attractive solution that bundles efficiency gains with heightened risk mitigation capabilities. This transition from a cost-cutting measure to a strategic enabler is fundamentally redefining the client-provider relationship in the marketplace.

Furthermore, the focus on sustainable and ethical sourcing practices is emerging as a critical differentiator for service providers. Clients are increasingly demanding verifiable transparency regarding the sustainability footprint of their supply chains. Outsourcing firms are responding by integrating advanced auditing and monitoring tools, often leveraging blockchain technology, to track product origins and ensure compliance with international labor and environmental standards. This move ensures that procurement not only delivers cost savings but also strengthens corporate responsibility, appealing particularly to organizations facing high public scrutiny or operating in sensitive consumer markets.

The competitive dynamics within the Procurement Outsourcing Market are intensifying, with providers constantly investing in technological upgrades and specialized vertical expertise to secure long-term contracts. There is a noticeable trend towards consolidation, as larger global players acquire niche specialists to rapidly build capabilities in highly specific categories, such as cloud services procurement or complex clinical trials sourcing. This consolidation reflects the client requirement for integrated service providers capable of managing both highly standardized P2P tasks and highly bespoke, strategic S2C functions globally under a single unified governance model.

Technology innovation remains central to market expansion. The successful deployment of predictive analytics allows outsourcing firms to move beyond retrospective reporting. They can now provide prescriptive recommendations on when to hedge against commodity price swings or identify optimal times to onboard alternative suppliers, based on real-time global economic indicators. This predictive capability transforms procurement from a reactive expenditure function into a proactive profit driver, significantly boosting the ROI calculation for potential clients considering outsourcing their functions.

A major area of opportunity lies in the specialization of outsourcing services based on industry vertical. While horizontal solutions cover general indirect spend, the true value addition comes from deep category expertise. For example, outsourcing firms specializing in healthcare procurement must possess intricate knowledge of regulatory compliance, GPO relationships, and medical device lifecycle management, requiring a tailored approach far beyond standard procurement processes. Similarly, automotive sector outsourcing demands specialized risk management related to Tier 1 and Tier 2 supplier insolvency and adherence to strict quality control standards, ensuring a differentiated service offering that locks in long-term client engagements.

The shift towards modular and flexible outsourcing models is another significant trend. Instead of demanding clients commit to outsourcing their entire procurement department, providers are offering customizable service blocks, allowing organizations to start with a single function, such as spend analysis or contract management, and expand the scope incrementally as confidence and cost savings materialize. This modularity lowers the barrier to entry for cautious clients and enables them to tailor the solution precisely to their existing technological gaps and internal resource limitations, thereby optimizing both expenditure and functional performance.

Geographically, while North America and Europe maintain dominance, the aggressive expansion of outsourcing firms into high-growth markets like Southeast Asia and Eastern Europe is strategically important. These regions offer substantial potential both as sourcing locations (driving demand for localized strategic sourcing services) and as consumer markets, where multinational clients require compliant, regionally-adapted P2P systems. Establishing robust operational hubs in these emerging economies allows providers to offer competitive labor arbitrage combined with localized expertise, creating a dual advantage for their global client base.

The regulatory environment also plays a crucial role in driving outsourcing adoption. The introduction of stricter mandates regarding data privacy (like GDPR), cross-border trade controls, and anti-corruption policies necessitates rigorous compliance frameworks. Outsourcing providers leverage their expertise and technology to ensure clients adhere to these complex, evolving international standards, minimizing legal and financial risks associated with non-compliance. This regulatory complexity acts as a potent driver, particularly in regulated industries like pharmaceuticals, defense, and financial services, where compliance failure carries severe penalties.

In summary, the Procurement Outsourcing Market is characterized by a mature strategic base, relentless technological innovation (especially AI/ML), and a geographic pivot towards high-growth emerging economies. The market is evolving into a specialized consultancy model where service providers are valued not just for cost reduction but for providing strategic business intelligence, resilience against supply chain volatility, and guaranteed adherence to global regulatory and ethical standards.

The competitive intensity is also prompting service providers to invest heavily in specialized talent acquisition, particularly those with deep expertise in digital transformation and data science, moving away from purely operational roles. The long-term success of outsourcing vendors hinges on their ability to integrate AI-driven insights directly into the client’s strategic decision-making process, ensuring that the outsourced procurement function delivers sustained, measurable competitive advantage rather than just short-term cost savings. The emphasis on partnership and shared risk/reward models is cementing the evolution of the procurement outsourcing industry toward long-term, value-centric collaboration.

Further analysis of the client base reveals that companies engaged in significant organizational changes, such as divestitures or carve-outs, represent particularly fertile ground for new contracts. These events necessitate the rapid establishment of independent, functioning procurement departments, often with compressed timelines. Outsourcing offers a quick-to-market solution, allowing the newly formed entity to instantly access functional procurement processes, experienced staff, and necessary technology infrastructure without the delay and capital expenditure required for internal build-out. This quick mobilization capability is a strong selling point for outsourcing firms in complex M&A scenarios.

Regarding technological integration complexity, one significant challenge that acts as a restraint is the fragmented technology landscape within client organizations. Many enterprises still rely on outdated or disparate Enterprise Resource Planning (ERP) systems, which complicates the seamless integration of modern S2P platforms offered by outsourcing providers. Successful transformation therefore often requires the service provider to dedicate significant resources to complex system integration and data cleansing activities, impacting the initial implementation timeline and overall project cost. Managing this integration risk effectively is a key competitive capability for market leaders.

Finally, the growing environmental consciousness among consumers and regulators is influencing sourcing decisions across the board. Procurement outsourcing providers are increasingly expected to demonstrate capabilities in "green procurement," helping clients identify suppliers that adhere to strict environmental standards, minimize waste, and utilize sustainable materials. This capability is becoming non-negotiable for securing contracts in environmentally sensitive sectors like apparel, fast-moving consumer goods (FMCG), and construction, driving demand for specialized sourcing expertise focused on sustainability metrics.

This dynamic environment mandates continuous adaptation and innovation among market participants. Those who successfully leverage AI for predictive sourcing and integrate robust compliance mechanisms will be best positioned to capture the accelerating strategic spend outsourcing opportunities throughout the forecast period. The market's shift emphasizes knowledge capital and technological superiority over simple labor arbitrage, confirming its trajectory as a high-value professional service domain.

The increasing regulatory scrutiny on supply chain resilience, particularly post-pandemic, has pushed risk mitigation to the forefront of procurement outsourcing drivers. Clients are not just seeking cost reduction but assurance of supply. Outsourcing providers must demonstrate robust, multi-tier supplier visibility and rapid recovery strategies. Their ability to manage supplier consolidation risk, geopolitical instability, and logistics bottlenecks via advanced tracking and alternative sourcing algorithms significantly enhances their appeal to CPOs focused on operational continuity and minimizing revenue loss from stock-outs.

The demand for talent management within procurement departments also fuels outsourcing growth. The global shortage of highly specialized procurement professionals, particularly those skilled in specific technical categories (e.g., cloud security, complex machinery parts) and digital tools, is pushing companies to externalize these functions. Outsourcing firms maintain global talent pools and continuous training programs, offering clients instant access to expertise they cannot recruit or retain internally, effectively democratizing high-level procurement knowledge and skill sets across different organization sizes and industry sectors.

Moreover, the shift toward subscription and consumption-based business models is influencing procurement for IT and specialized services. Outsourcing providers are adapting their category management services to handle these complex contractual structures, helping clients optimize consumption patterns and manage 'shadow IT' spend. This requires sophisticated understanding of software licensing, cloud architecture, and utility-based pricing models, establishing a niche for specialized technology procurement outsourcing that is growing rapidly, particularly within the BFSI and high-tech verticals.

The structure of the global economy, characterized by persistent inflationary pressures and geopolitical uncertainty, further reinforces the value proposition of procurement outsourcing. In inflationary environments, securing fixed or favorable pricing terms and engaging in hedging strategies become paramount. Outsourcing experts leverage their scale and market intelligence to execute complex sourcing strategies that buffer clients against volatility, thereby delivering tangible financial protection that far outweighs the cost of the outsourcing service itself, driving increased investment in strategic sourcing and negotiation services.

The market also benefits from the maturity and standardization of the Source-to-Pay technology ecosystem. As platforms become more user-friendly and offer greater integration capabilities (APIs), the complexity of transition projects decreases, accelerating time-to-value for the client. This technological standardization lowers implementation risks, making the decision to outsource more palatable for clients who previously viewed technological transition as a significant deterrent, thus broadly expanding the addressable market, particularly towards the mid-market segment which prioritizes speed and simplicity.

In conclusion, the Procurement Outsourcing Market is transitioning from a service focused on reducing labor costs to one centered on delivering digitally enabled, data-driven strategic intelligence. The interplay of AI, globalization, and increased regulatory burdens guarantees sustained, high-value demand for external expertise across the strategic, tactical, and operational layers of the procurement function, positioning the market for continued strong growth through 2033.

The need for innovation in contract management is a powerful underlying driver. Traditional legal departments often struggle to efficiently manage the vast number of contracts generated by a global supply chain. Outsourcing providers utilize advanced Contract Lifecycle Management (CLM) systems powered by NLP and AI, which not only store and manage contracts but also proactively flag expiry dates, compliance risks, and opportunities for renegotiation. This capability significantly enhances governance and reduces leakage, making it a highly attractive service element for risk-averse organizations.

Finally, the growing adoption of shared service centers (SSCs) for internal functions inadvertently boosts the outsourcing market. As companies refine their SSC models, they frequently realize that while centralizing certain transactional activities is efficient, managing the entire global procurement scope requires the scale and continuous innovation offered by specialized outsourcing vendors. This often leads to a hybrid model where SSCs manage internal P2P processes, while complex category management and strategic sourcing are entrusted to external experts, highlighting the nuanced integration possibilities within the market landscape.

The strong focus on outcome-based pricing models, where the outsourcing provider’s compensation is partially tied to the quantifiable cost savings or efficiency gains delivered to the client, has substantially increased client confidence. This alignment of interests mitigates the traditional risk associated with fixed-fee models, ensuring that the provider remains incentivized to implement continuous improvement and adopt the latest cost-saving technologies and strategies. This commercial structure is becoming the standard for strategic sourcing and category management contracts, further legitimizing the outsourced model as a guaranteed driver of enterprise value.

The ongoing globalization of production and consumption requires procurement functions to manage highly fragmented and geographically diverse supplier bases. Outsourcing firms possess the necessary global footprint, local language capabilities, and expertise in international trade regulations (including import/export duties and customs laws) to navigate this complexity seamlessly. This global capability is vital for multinationals looking to de-risk their supply chain dependency on single regions while maintaining cost efficiency and operational fluidity across all markets.

Technological differentiation is increasingly achieved through proprietary intellectual property (IP) developed by outsourcing firms, which includes specialized category knowledge databases, benchmark data, and bespoke AI algorithms trained on vast amounts of procurement transaction data. This proprietary technology allows the service providers to generate superior market insights and negotiation strategies that generic S2P platforms cannot replicate, securing a competitive advantage and providing tangible, hard-to-replicate value for their client partnerships.

In essence, the Procurement Outsourcing Market is thriving by transforming the cost center of procurement into a strategic profit lever, enabling clients to achieve agility, resilience, and superior cost performance in an increasingly volatile global economic climate. This sustained evolution, supported by continuous technological advancement and specialized domain knowledge, ensures the market’s continued strong growth trajectory.

The requirement for real-time visibility into committed and actual spend is paramount for effective financial management, particularly in large, decentralized organizations. Outsourcing providers implement unified P2P platforms that centralize requisitioning, ordering, and invoicing data, offering CFOs immediate and accurate spend reports. This enhanced financial governance and transparency is a critical driver, particularly in publicly traded companies where accurate accruals and compliance reporting are subject to stringent external audit requirements and shareholder scrutiny.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Procurement Outsourcing Services Market Size Report By Type (Business Process Outsourcing Services, Category Management, Source Management, Procurement Management, Supplier Management, Procure to Pay, Consulting Services), By Application (Marketing Related Services, IT Related Services, HR Related Services, Facilities Management & Office Services, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Procurement Outsourcing Market Size Report By Type (Direct Procurement, Indirect Procurement), By Application (CPG and Retail, BFSI Sector), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager