Production Tubing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439381 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Production Tubing Market Size

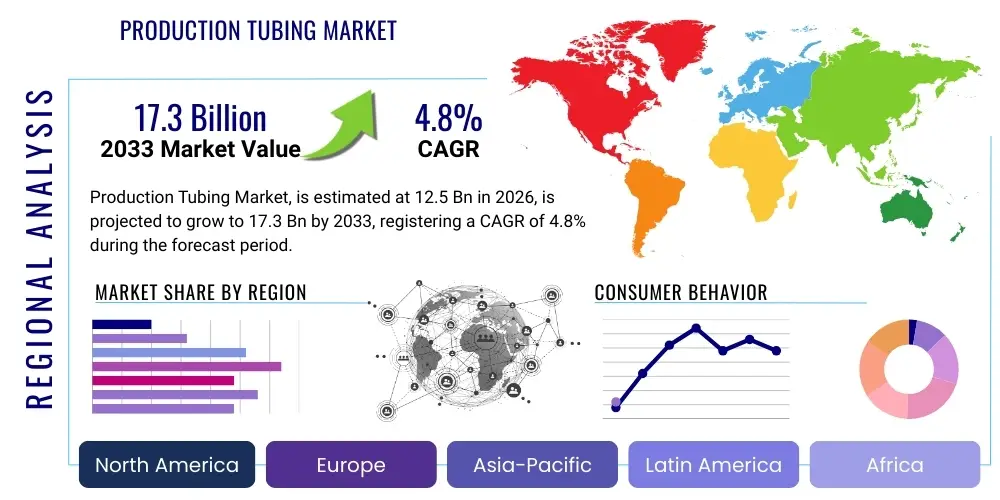

The Production Tubing Market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at a substantial USD 12.5 billion in 2026 and is strategically projected to reach an impressive USD 17.3 billion by the end of the meticulously analyzed forecast period in 2033. This growth trajectory reflects the critical and indispensable role production tubing plays within the global oil and gas industry, underpinning the continued reliance on hydrocarbon resources for energy security and economic development. The expansion is further fueled by significant investments in both conventional and unconventional exploration and production activities worldwide, necessitating an unwavering demand for high-performance and reliable tubular goods designed to withstand increasingly challenging operational environments. The market's valuation highlights the significant capital expenditure involved in ensuring well integrity and optimizing the long-term productivity of oil and gas assets globally, demonstrating its vital contribution to the broader energy sector's infrastructure and operational efficiency. The projected figures underscore a consistent upward trend, driven by technological advancements, evolving energy consumption patterns, and strategic resource development initiatives across key geographical regions, all contributing to the sustained demand for advanced production tubing solutions across the upstream sector.

Production Tubing Market introduction

The Production Tubing Market constitutes an essential and technologically sophisticated segment within the global upstream oil and gas sector, dedicated to the design, manufacturing, supply, and deployment of specialized tubular components crucial for hydrocarbon extraction. Production tubing, also frequently referred to as oil country tubular goods (OCTG) or line pipe specifically adapted for downhole applications, serves as the primary conduit through which crude oil, natural gas, and associated liquids are safely transported from the geological reservoir to the surface wellhead. This vital equipment is meticulously engineered to maintain the structural integrity of the wellbore, optimize the flow dynamics of produced fluids, and ensure the secure, efficient, and uninterrupted extraction of valuable energy resources. The product description emphasizes the diverse material specifications, typically comprising various grades of carbon steel, alloy steel, and increasingly, high-performance corrosion-resistant alloys (CRAs). The selection of these materials is a critical engineering decision, dictated by the highly variable and often extreme downhole conditions encountered, including parameters such as elevated pressures and temperatures, the presence of corrosive agents like hydrogen sulfide (H2S) and carbon dioxide (CO2), and abrasive solids. These conditions necessitate tubing that exhibits exceptional mechanical strength, ductility, and superior resistance to degradation over extended operational periods, thereby ensuring well longevity and operational safety.

Production Tubing Market Executive Summary

The Production Tubing Market is currently navigating a period of significant growth and transformative evolution, underpinned by resilient global energy consumption patterns and continuous technological innovation within the oil and gas upstream sector. Prominent business trends indicate a strategic shift towards the integration of advanced materials, such as high-strength low-alloy steels (HSLA) and an expanded portfolio of highly sophisticated corrosion-resistant alloys (CRAs), including duplex, super-duplex, and nickel-based alloys. These material innovations are imperative for constructing tubing systems capable of withstanding the increasingly harsh operating conditions prevalent in deepwater, ultra-deepwater, and challenging unconventional reservoirs, which often feature extreme pressures, elevated temperatures, and highly corrosive fluid compositions. Concurrently, the market is witnessing an accelerated adoption of digitalization and automation across the manufacturing and deployment value chain. This includes the proliferation of 'smart tubing' solutions, which are integrated with an array of sensors for real-time downhole monitoring, enabling advanced data analytics, predictive maintenance regimes, and enhanced operational safety protocols. This digital transformation aims to optimize well performance, minimize unplanned downtime, and reduce operational expenditures, thereby significantly improving the overall economic viability of E&P projects. The competitive landscape is characterized by a drive towards product differentiation through superior material science, advanced manufacturing precision, and comprehensive service offerings, compelling market players to invest heavily in research and development to maintain their competitive edge and address evolving industry demands for durable and efficient solutions.

AI Impact Analysis on Production Tubing Market

An in-depth analysis of user questions related to the impact of Artificial Intelligence (AI) on the Production Tubing Market reveals a strong prevailing interest in how this transformative technology can fundamentally enhance operational efficiency, significantly reduce costs, bolster safety protocols, and most critically, extend the operational lifespan of invaluable well infrastructure. Users frequently express concerns regarding the substantial initial capital investment required for comprehensive AI integration, the paramount importance of data security and privacy within sensitive operational contexts, the pressing need for highly specialized skills and expertise to manage and interpret AI systems effectively, and the overall reliability and accuracy of AI predictions when applied to the inherently complex and unpredictable downhole environments. There is a palpable eagerness to understand AI's practical and tangible role in revolutionary applications such as advanced predictive maintenance regimes for tubular goods, the real-time optimization of intricate drilling parameters, continuous and automated monitoring of tubing integrity, and the intelligent streamlining of supply chain management for tubular goods and associated components. Specifically, users are keen to grasp how AI can effectively process and derive meaningful insights from the immense volumes of sensor data continuously generated by 'smart tubing' to preemptively identify and mitigate potential failures, thereby drastically minimizing costly operational downtime and significantly reducing the risk of environmental incidents. Essentially, the collective user sentiment points towards a profound desire for clear, concise, and actionable insights into how AI's practical applications can fundamentally transform conventional production tubing operations into more intelligent, proactive, resilient, and economically viable systems, ultimately aiming for enhanced decision-making capabilities, superior asset performance, and unparalleled operational excellence across the entire oil and gas value chain.

- Enhanced Predictive Maintenance and Anomaly Detection: AI algorithms meticulously analyze vast streams of real-time sensor data emanating from smart tubing, including temperature, pressure, vibration, and acoustic signatures. This advanced analytical capability allows for the precise prediction of potential failures, such as corrosion, erosion, fatigue cracking, or material wear, long before they manifest as critical issues. By shifting from reactive repairs to proactive, preventative maintenance, AI significantly extends the effective lifespan of production tubing, minimizes expensive unplanned downtime, and drastically improves overall well uptime and productivity, leading to substantial cost savings and increased operational reliability in the long term.

- Optimized Drilling and Completion Operations: AI-driven models leverage comprehensive geological data, real-time drilling parameters, and extensive historical well performance records to recommend optimal tubing selection, precise placement strategies, and refined operational procedures during drilling and completion phases. This intelligent optimization significantly reduces drilling risks, improves the efficiency of well construction, and ultimately maximizes hydrocarbon recovery rates by ensuring the most suitable tubing configuration for specific reservoir characteristics, thereby accelerating project timelines and improving resource utilization.

- Real-time Well Monitoring and Diagnostic Capabilities: AI systems continuously monitor and interpret complex datasets related to downhole conditions, including fluid flow rates, pressure differentials, temperature gradients, and potential gas leaks within the tubing string. These systems are programmed to immediately flag any anomalous readings or deviations from expected operational parameters, indicating potential integrity issues or impending failures. This real-time diagnostic capability enables rapid intervention, preventing minor issues from escalating into catastrophic failures and ensuring sustained well safety, reducing the likelihood of environmental incidents.

- Intelligent Supply Chain and Inventory Optimization: AI-powered analytics can accurately forecast demand for various specifications and grades of production tubing based on global exploration and production (E&P) project schedules, regional activity levels, historical consumption patterns, and anticipated market shifts. This intelligent forecasting capability optimizes inventory levels, reduces storage costs associated with surplus stock, minimizes lead times for critical components, and ensures the timely and efficient availability of the right tubing at the right location, significantly enhancing logistical efficiency and reducing overall procurement costs.

- Improved Safety Protocols and Environmental Compliance: By leveraging its capability to accurately predict equipment failures and optimize intricate operational parameters, AI directly contributes to the establishment of a safer working environment for personnel involved in E&P activities. Furthermore, it substantially reduces the likelihood of costly and environmentally damaging incidents, such as hydrocarbon spills or leaks caused by breaches in tubing integrity, thereby bolstering environmental compliance and corporate social responsibility efforts, which are increasingly scrutinized by regulators and the public.

- Advanced Material Performance Prediction and Design: AI models can simulate and predict the behavior of novel and existing tubing materials under a wide spectrum of extreme downhole conditions, including high-pressure/high-temperature (HPHT) and highly corrosive environments. This capability assists metallurgical engineers in the rapid development, testing, and selection of new, more durable, and intrinsically corrosion-resistant alloys for highly specialized tubing applications, accelerating innovation in material science and ensuring that materials meet the ever-increasing demands of complex wells.

- Automated Inspection and Enhanced Quality Control: AI-powered vision systems, often integrated with robotic platforms, are increasingly deployed to conduct automated and highly precise inspections of production tubing during various stages of manufacturing and pre-deployment. These systems can identify minute defects, anomalies, or material flaws with significantly higher accuracy and speed than traditional manual inspection methods, ensuring superior product quality, adherence to stringent industry standards, and enhanced reliability of the tubing once installed in the well, thereby preventing costly field failures.

DRO & Impact Forces Of Production Tubing Market

The Production Tubing Market operates within a complex interplay of influential drivers, significant restraints, compelling opportunities, and powerful impact forces that collectively dictate its growth trajectory, shape its competitive landscape, and influence strategic investment decisions across the global energy sector. One of the foremost and most enduring Drivers for market expansion is the relentless and ever-increasing global demand for energy, which is intrinsically linked to industrialization, urbanization, and population growth, particularly in emerging economies. This persistent demand necessitates continuous and substantial investment in oil and gas exploration and production (E&P) activities across a diverse array of geographical regions, from conventional onshore fields to the most challenging frontier offshore environments, ensuring a baseline requirement for production tubing. Furthermore, groundbreaking advancements in drilling and completion technologies, such as highly sophisticated directional drilling, precision horizontal drilling, and multi-stage hydraulic fracturing, have fundamentally revolutionized access to vast unconventional hydrocarbon resources, including shale gas, tight oil, and deep coalbed methane. These innovative techniques inherently demand specialized, high-performance production tubing engineered to withstand the extreme pressures, elevated temperatures, and often highly corrosive environments characteristic of these complex formations. The continuous industry-wide imperative for improving well integrity, extending the productive lifespan of wells, and optimizing overall operational efficiency also acts as a powerful catalyst, compelling operators to invest proactively in premium-grade, technologically advanced tubing solutions capable of delivering superior performance and reliability, thereby safeguarding long-term asset value.

Segmentation Analysis

The Production Tubing Market undergoes meticulous segmentation across several critical dimensions, a process essential for gaining a granular understanding of market dynamics, identifying specific high-growth areas, and strategically tailoring product offerings to meet the highly specialized and diverse operational demands of the global oil and gas industry. These segmentations provide invaluable insights into how various factors influence demand, pricing, and competitive positioning within this specialized sector. The market can be broadly categorized, firstly, by the fundamental material type utilized in tubing construction. This distinction is paramount as the material choice directly dictates the tubing's inherent resistance to severe corrosion, its capacity to withstand immense pressures, and its durability under extreme temperatures. Secondly, segmentation by manufacturing process differentiates between methods that significantly impact the structural integrity, mechanical properties, and overall production cost of the tubing. Thirdly, categorization by application delineates between less arduous onshore environments and the significantly more demanding and technically complex offshore operating conditions, which include shallow water, deepwater, and ultra-deepwater scenarios. Finally, segmentation by end-user identifies the primary consumers and institutional buyers of these mission-critical components, ranging from major E&P companies to specialized service providers. Each of these distinct segments possesses unique characteristics, growth trajectories, and specific demand drivers, all of which are intricately influenced by overarching technological advancements, evolving regulatory frameworks governing oil and gas operations, and the fluctuating intensity of regional exploration and production activities and investment cycles.

A comprehensive analysis of these individual segments is absolutely crucial for providing a detailed, granular view of the market's intrinsic structure and for empowering stakeholders to effectively navigate the inherent complexities of product development, make informed strategic investment decisions, and execute successful market penetration strategies. This approach ensures that highly specific and nuanced needs within the technically demanding oil and gas sector are adequately and precisely addressed with the most appropriate tubular solutions. For instance, the demand profile for corrosion-resistant alloys will be markedly different from that for standard carbon steel, driven by specific well conditions rather than general volume. Similarly, the requirements for deepwater offshore tubing will vary significantly from those for onshore shale plays in terms of material strength, connection integrity, and protective coatings, all of which impact performance and cost. By dissecting the market along these specific lines, market players can identify lucrative niches, anticipate shifts in demand, and allocate resources more efficiently to capitalize on emerging trends and technological disruptions. This detailed segmentation not only elucidates the current market landscape but also provides a strategic framework for forecasting future growth opportunities and adapting to technological disruptions, ensuring that product innovation and market strategies are perfectly aligned with the evolving requirements of the global energy production paradigm to maintain a competitive advantage.

- By Material Type: This segmentation is fundamental, reflecting the diverse downhole environments and their inherent challenges.

- Carbon Steel: Representing a cost-effective and widely adopted solution, carbon steel tubing is predominantly utilized in conventional, less corrosive, and lower-pressure wells where operational demands are less extreme. It is characterized by good mechanical properties, ease of manufacturing, and affordability, but offers limited inherent resistance to severe corrosion.

- Alloy Steel: Offering improved strength, hardness, and enhanced, albeit moderate, corrosion resistance compared to standard carbon steel, alloy steels (often with chromium and molybdenum additions) are employed in more demanding well conditions. These include applications with higher pressures, moderate temperatures, and mildly corrosive fluids, providing a balance between performance and cost-effectiveness.

- Stainless Steel: Providing significantly enhanced corrosion resistance, especially in environments containing deleterious hydrogen sulfide (H2S) and carbon dioxide (CO2), various grades of stainless steel production tubing (e.g., 304, 316, 2205 Duplex) are crucial for sour gas wells and applications where superior anti-corrosion properties are required to ensure well integrity and longevity, balancing cost with specialized performance.

- Corrosion-Resistant Alloys (CRAs): This premium and high-performance segment includes highly specialized high-nickel or chromium alloys, such as duplex, super-duplex, and various nickel-based alloys (e.g., Inconel, Hastelloy). CRAs are specifically engineered for the most aggressive, extremely corrosive, and ultra-high-temperature environments found in deepwater, HPHT (high-pressure, high-temperature), and highly sour gas wells, where conventional steels would fail rapidly. Their exceptional performance and extended service life justify the higher initial investment.

- By Type: This categorizes tubing based on its manufacturing process, significantly influencing its mechanical properties, integrity, and cost.

- Seamless Tubing: Manufactured through a process that does not involve welding, resulting in a continuous, homogeneous structure without any welded seams. Seamless tubing offers superior pressure retention, exceptional structural integrity, and a significantly reduced risk of leakage, making it the preferred and often mandatory choice for critical high-pressure, high-temperature, and ultra-deep applications where absolute reliability and safety are paramount.

- Welded Tubing: Produced by forming flat strips of steel into a tubular shape and then welding the edges longitudinally. While typically more cost-effective and suitable for high-volume production than seamless tubing, welded tubing is generally employed in less stringent or non-critical applications where the potential for seam-related vulnerabilities is not a primary concern, offering a balance of performance and economic viability for a broader range of wells.

- By Application: This differentiates tubing based on its deployment environment, highlighting specific design and material requirements for diverse operational challenges.

- Onshore: Encompasses tubing utilized in land-based oil and gas wells, ranging from conventional vertical wells to complex horizontal and multi-lateral wells in unconventional plays like shale gas and tight oil. Onshore applications often require adaptability to diverse geological conditions, efficient logistics for remote sites, and cost-effective solutions for high-volume drilling campaigns, with varying demands for corrosion and pressure resistance.

- Offshore: Refers to tubing specifically designed and constructed for demanding marine environments, including shallow water, deepwater, and ultra-deepwater wells. Offshore tubing demands significantly higher corrosion resistance due to exposure to seawater, superior structural strength to withstand dynamic loads from currents and waves, and robust connection integrity for exceptionally long, heavy strings, often operating under extreme pressures and temperatures, necessitating premium materials and design.

- By End-User: This segmentation identifies the primary consumers of production tubing products and related services, guiding targeted marketing and sales strategies.

- Oil & Gas Exploration and Production (E&P) Companies: These are the largest direct consumers, including major international oil companies (IOCs), influential national oil companies (NOCs), and a multitude of independent operators. They procure production tubing for their extensive portfolio of new well developments, critical workovers, and ongoing maintenance activities across their global assets, driven by long-term production strategies.

- Drilling Contractors: Companies that provide specialized drilling services to E&P operators often procure and incorporate production tubing as an integral part of their comprehensive integrated service offerings. They ensure a complete and efficient well construction process for their clients, leveraging their expertise in well design and execution to specify appropriate tubing.

- Oilfield Service Companies: These entities offer a broad spectrum of services encompassing well completion, intervention, workover, and production optimization. They frequently specify, procure, and manage the installation of production tubing as part of their integrated solutions, playing a crucial role in ensuring optimal well performance, longevity, and adherence to operational standards.

- Well Intervention Firms: Specialized companies focused on repairing, maintaining, or enhancing the productivity of existing wells, often requiring replacement or additional tubing sections.

- Engineering, Procurement, and Construction (EPC) Contractors: Involved in large-scale energy infrastructure projects, including building new facilities and wells, they procure tubing as part of their comprehensive project scope.

Value Chain Analysis For Production Tubing Market

The value chain for the Production Tubing Market is an intricate and multi-stage ecosystem, meticulously organized to transform raw materials into highly specialized components that are critical for the global oil and gas industry. This chain begins with fundamental upstream activities, which encompass the initial extraction and intensive processing of foundational raw materials. Primarily, this involves the mining of high-grade iron ore, along with various alloying elements such as chromium, nickel, molybdenum, and manganese, all of which are essential for imparting specific mechanical and chemical properties to the final steel product. These raw materials are then transported to primary steel manufacturers, who constitute the crucial initial link in the value chain. At this stage, sophisticated metallurgical processes are employed to convert these raw inputs into high-quality steel billets, blooms, or strips, which serve as the direct feed material for the subsequent manufacturing of tubular products. Quality control at this nascent stage is paramount, as the chemical composition and structural integrity of the base steel directly influence the performance characteristics of the finished production tubing. Investments in advanced smelting technologies and raw material sourcing strategies are key competitive differentiators at this upstream segment, ensuring the consistent supply of high-grade inputs to meet stringent industry standards and avoid supply bottlenecks.

Production Tubing Market Potential Customers

The potential customer base within the Production Tubing Market is extensive and primarily comprises a diverse array of entities actively involved in the exploration, precise development, and long-term production of oil and natural gas resources across the globe. At the forefront of this customer spectrum are the major international oil companies (IOCs) and influential national oil companies (NOCs), which collectively operate vast and intricate exploration and production portfolios. These large-scale operators represent the most significant segment of buyers, requiring substantial quantities of highly specialized and robust production tubing for their ambitious new well developments, critical workover operations aimed at rejuvenating existing wells, and ongoing maintenance activities across their expansive global assets. IOCs and NOCs frequently demand bespoke, high-performance, and custom-engineered tubing solutions, designed to precisely address the unique and formidable challenges presented by ultra-deepwater drilling projects, extreme high-pressure/high-temperature (HPHT) reservoirs, and highly corrosive unconventional resource plays. Their purchasing decisions are often driven by long-term strategic objectives, stringent performance criteria, and an emphasis on minimizing operational risks and maximizing ultimate hydrocarbon recovery, making them highly discerning customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 17.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tenaris S.A., Vallourec S.A., ArcelorMittal, Sumitomo Corporation, Nippon Steel Corporation, JFE Steel Corporation, EVRAZ plc, TMK PAO, JSW Steel Ltd., Baosteel Group Corporation, Sandvik AB, National Oilwell Varco (NOV) Inc., Hunting PLC, Schlumberger Limited, Baker Hughes Company, Halliburton Company, WSP (China) Co., Ltd., SeAH Steel Corporation, TPCO (Tianjin Pipe Corporation), Marubeni-Itochu Steel Inc., United States Steel Corporation, Corinth Pipeworks S.A., Gerdau S.A., Tata Steel Limited, Energex Tube (JMC Steel Group), Forum Energy Technologies Inc., PAO Chelyabinsk Pipe Plant (ChelPipe), Tubos Reunidos S.A. |

| Regions Covered | North America (USA, Canada, Mexico), Europe (UK, Norway, Russia, Germany, France, Italy), Asia Pacific (China, India, Indonesia, Australia, Malaysia, Vietnam, Thailand), Latin America (Brazil, Argentina, Colombia, Venezuela), Middle East and Africa (Saudi Arabia, UAE, Qatar, Kuwait, Iran, Nigeria, Angola, Algeria, Egypt, South Africa). |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Production Tubing Market Key Technology Landscape

The Production Tubing Market is experiencing a profound and rapid technological transformation, primarily driven by the imperative to extract hydrocarbons from increasingly challenging and complex downhole environments while simultaneously enhancing safety, efficiency, and environmental performance. A critical and continuously evolving area of innovation resides within advanced metallurgy and material science. This has led to the development of sophisticated high-strength steel grades, including quenched and tempered alloys, and a significantly expanded portfolio of highly specialized Corrosion-Resistant Alloys (CRAs). These CRAs encompass cutting-edge materials such as super-duplex stainless steels, various grades of Inconel, Hastelloy, and other nickel-based alloys. These advanced materials are meticulously engineered to provide exceptional resistance against extreme pressures, ultra-high temperatures, and aggressively corrosive media such as hydrogen sulfide (H2S), carbon dioxide (CO2), and chloride-rich brines, which are ubiquitously encountered in deepwater, high-pressure/high-temperature (HPHT), and highly sour gas wells. The continuous research into novel composite materials and lightweight alloys also aims to reduce weight and improve handling efficiency, particularly for offshore and remote operations, contributing to reduced installation times and operational costs.

Regional Highlights

- North America: This region stands as a dominant force within the Production Tubing Market, primarily propelled by the extensive and highly dynamic shale oil and gas production activities concentrated across the United States and Canada. The region benefits from a robust and mature energy infrastructure, coupled with a pioneering adoption of advanced drilling technologies, including multi-stage hydraulic fracturing and horizontal drilling. This leads to a consistently high demand for both standard and highly specialized tubing solutions tailored for unconventional plays and the rejuvenation efforts in mature wells. Significant ongoing investments in exploration and production (E&P) activities, alongside a supportive technological ecosystem and experienced workforce, continue to cement North America's leadership position and fuel sustained market growth, particularly in areas requiring high-strength and corrosion-resistant alloys for challenging reservoir conditions and ensuring long-term energy security.

- Europe: The European market, while characterized by mature oil and gas fields predominantly located in the North Sea, exhibits a strong and persistent demand for production tubing, albeit with a distinct focus. The region's imperative is centered on rigorous asset integrity management, ensuring safety, and strategically extending the operational life of existing infrastructure in a highly regulated environment. This drives demand for premium, high-quality, corrosion-resistant, and technologically advanced tubing solutions capable of performing reliably in aging assets and under increasingly stringent environmental compliance standards. Countries like Norway and the UK, with their deep expertise in offshore operations, continue to invest in specialized tubing for subsea and deepwater developments, while Russia remains a significant consumer due to its vast, albeit challenging, continental oil and gas reserves, requiring robust tubular goods for extreme climatic and operational conditions and ensuring energy supply.

- Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as a critical high-growth market for production tubing, driven by a confluence of escalating energy consumption, robust economic expansion, and ambitious new offshore and onshore discoveries. Countries such as China, India, Indonesia, and Australia are witnessing substantial investments in oil and gas exploration and production projects, aimed at meeting their surging domestic energy demands and fostering industrialization. The region's expanding energy infrastructure, coupled with increasing government support for indigenous resource development and significant foreign direct investment, acts as a powerful catalyst for market expansion. Demand here is characterized by a need for both high-volume, cost-effective tubing for new developments and specialized solutions for emerging deepwater and unconventional plays, reflecting the diverse geological and economic landscapes of the region.

- Latin America: This region presents substantial and dynamic opportunities for the Production Tubing Market, primarily driven by significant deepwater projects in countries like Brazil (notably the pre-salt layer) and Mexico. Furthermore, the development of vast unconventional resource plays, such as Argentina's Vaca Muerta shale formation, contributes substantially to the demand for specialized tubular goods. The region's abundant hydrocarbon reserves, coupled with ongoing strategic investments by national oil companies (NOCs) like Petrobras and Pemex, alongside major international players, contribute significantly to the demand for technologically advanced and high-performance production tubing. Despite inherent geopolitical and macroeconomic volatilities that can influence investment cycles and project execution, the long-term potential for resource development ensures sustained market relevance and growth, particularly for advanced tubular solutions.

- Middle East and Africa (MEA): A profoundly crucial region for the global oil and gas industry, MEA commands vast conventional hydrocarbon reserves and is characterized by ongoing, large-scale exploration and production megaprojects. Countries such as Saudi Arabia, the United Arab Emirates, Kuwait, and Qatar are continuously investing heavily in maintaining, expanding, and optimizing their production capacities, thereby requiring a steady and substantial supply of high-performance production tubing for both their extensive onshore and challenging offshore developments. African nations, particularly Nigeria, Angola, and Mozambique, are also seeing increased E&P activities, including deepwater discoveries, driving demand for robust and corrosion-resistant tubing. The strategic importance of this region in global energy supply ensures a strong and consistent market for production tubing, often requiring solutions tailored to extreme temperatures and highly corrosive environments to ensure long-term, reliable production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Production Tubing Market, providing comprehensive insights into their product portfolios, strategic initiatives, market presence, and competitive positioning across various geographies. These companies are at the forefront of innovation, driving advancements in material science, manufacturing processes, and digital integration within the tubular goods sector.- Tenaris S.A.

- Vallourec S.A.

- ArcelorMittal

- Sumitomo Corporation

- Nippon Steel Corporation

- JFE Steel Corporation

- EVRAZ plc

- TMK PAO

- JSW Steel Ltd.

- Baosteel Group Corporation

- Sandvik AB

- National Oilwell Varco (NOV) Inc.

- Hunting PLC

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- WSP (China) Co., Ltd.

- SeAH Steel Corporation

- TPCO (Tianjin Pipe Corporation)

- Marubeni-Itochu Steel Inc.

- United States Steel Corporation

- Corinth Pipeworks S.A.

- Gerdau S.A.

- Tata Steel Limited

- Energex Tube (JMC Steel Group)

- Forum Energy Technologies Inc.

- PAO Chelyabinsk Pipe Plant (ChelPipe)

- Tubos Reunidos S.A.

Frequently Asked Questions

Analyze common user questions about the Production Tubing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is production tubing and what is its fundamental importance in the oil and gas industry?

Production tubing is a highly specialized string of pipe, meticulously designed and strategically installed inside the casing of an oil or gas well. Its primary function is to serve as the critical conduit through which extracted hydrocarbons—encompassing crude oil, natural gas, and associated liquids—are safely and efficiently conveyed from the subterranean reservoir to the surface wellhead. This component is of paramount importance because it is indispensable for maintaining the structural integrity of the wellbore, effectively isolating and preventing the ingress of undesirable formation fluids, optimizing the flow dynamics of produced fluids to maximize recovery, and crucially, ensuring the overall safety and uninterrupted efficiency of hydrocarbon extraction operations. High-quality production tubing plays a vital role in protecting the outer casing from corrosive well fluids and high pressures, managing downhole pressures effectively, and resisting harsh corrosive and abrasive environments, thereby significantly extending the operational life, enhancing the productivity, and ensuring the environmental compliance of the well. Its failure can lead to severe operational downtime, environmental hazards, and substantial financial losses, underscoring its indispensable nature in every production well for sustainable energy output.

Which are the key factors vigorously driving the growth and expansion of the Production Tubing Market globally?

The Production Tubing Market's robust growth is primarily propelled by several powerful and interconnected factors. Foremost among these is the escalating and persistent global demand for energy, which necessitates sustained and substantial investments in oil and gas exploration and production (E&P) activities worldwide, spanning both conventional and unconventional resource plays. Secondly, significant technological advancements in drilling and completion methodologies, such as sophisticated horizontal drilling and multi-stage hydraulic fracturing, have unlocked vast new reserves, demanding highly specialized and high-performance tubing solutions capable of enduring extreme operational conditions. Thirdly, the strategic expansion into challenging deepwater and ultra-deepwater projects, alongside the development of unconventional resources like shale gas and and tight oil, requires tubing capable of enduring extreme pressures, temperatures, and corrosive conditions, driving material innovation. Additionally, the continuous industry-wide imperative for enhancing well integrity, optimizing operational efficiency, reducing overall operational expenditures, and improving safety standards acts as a perpetual catalyst, driving the adoption of premium and technologically advanced tubing solutions. Lastly, the focus on extending the productive lifespan of mature wells through workovers, recompletions, and enhanced oil recovery (EOR) techniques creates a consistent demand for new and replacement tubing, contributing significantly to market expansion and technological upgrading across the sector.

What are the primary types of materials typically utilized in the manufacturing of production tubing and their respective applications?

Production tubing is manufactured from a diverse range of materials, each selected based on specific well conditions and operational requirements to optimize performance and longevity. The most common material types include: Carbon Steel, which is a cost-effective option primarily used in conventional wells with less corrosive environments and lower pressure/temperature demands; it offers good mechanical properties for standard applications and constitutes a large volume segment. Alloy Steel, incorporating elements like chromium and molybdenum, provides improved strength, hardness, and moderate corrosion resistance, making it suitable for more demanding wells with moderate pressures, temperatures, and mildly corrosive fluids; it balances performance with economic considerations. Stainless Steel, such as 304, 316, or 2205 Duplex, offers significantly enhanced corrosion resistance, particularly crucial for sour gas wells containing hydrogen sulfide (H2S) and carbon dioxide (CO2), where superior anti-corrosion properties are essential to prevent material degradation and ensure well integrity. Finally, Corrosion-Resistant Alloys (CRAs), including advanced super-duplex stainless steels and nickel-based alloys like Inconel or Hastelloy, represent the premium segment. These materials are specifically engineered for the most aggressive, extremely corrosive, and ultra-high-temperature/pressure environments found in deepwater, HPHT, and highly sour gas wells, where conventional steels would fail rapidly, justifying their higher cost due to exceptional performance, reliability, and extended service life in extreme conditions.

How is Artificial Intelligence (AI) profoundly impacting and transforming the Production Tubing Market?

Artificial Intelligence (AI) is profoundly impacting and transforming the Production Tubing Market by introducing unprecedented levels of efficiency, safety, and operational intelligence across the value chain. One of the most significant impacts is in predictive maintenance, where AI algorithms meticulously analyze vast streams of real-time data from 'smart tubing' sensors to anticipate potential failures, corrosion, or wear, enabling proactive intervention and dramatically minimizing costly unplanned downtime. AI also plays a crucial role in optimizing drilling and completion operations by processing vast geological and operational datasets to recommend the most effective tubing selection and deployment strategies, thereby reducing risks and maximizing hydrocarbon recovery. Furthermore, AI-powered systems enable real-time well monitoring and diagnostics, continuously evaluating parameters like pressure, temperature, and flow rates to detect anomalies instantly, allowing for rapid response to prevent critical failures. In the supply chain, AI optimizes inventory management and demand forecasting for tubular goods, ensuring timely availability and reducing logistics costs. Beyond operations, AI assists in material science innovation by simulating material behavior under extreme conditions, aiding in the development of new, more durable alloys. Collectively, AI is transforming production tubing from a passive component into an intelligent asset, enhancing decision-making, improving asset performance, bolstering safety protocols, and contributing significantly to the economic viability and environmental responsibility of hydrocarbon extraction processes.

What are the primary restraints and key challenges currently affecting the growth of the Production Tubing Market?

The Production Tubing Market faces several significant restraints and key challenges that can impede its growth trajectory and introduce considerable volatility. A predominant challenge is the inherent and often unpredictable volatility of global crude oil and natural gas prices. Fluctuations in these commodity prices directly impact exploration and production (E&P) capital expenditure budgets, leading to project delays, cancellations, and reduced drilling activity, thereby dampening demand for tubular goods and creating an unstable investment environment. Secondly, increasingly stringent global environmental regulations and the accelerating worldwide shift towards renewable energy sources pose a long-term strategic challenge. Growing societal pressure and governmental policies aimed at decarbonization and diversifying energy portfolios away from fossil fuels can potentially curtail future demand for hydrocarbon-related infrastructure. Thirdly, the exceptionally high capital expenditure associated with technically challenging and complex well projects, such as ultra-deepwater and unconventional resource developments, can deter investments, particularly during periods of economic uncertainty or heightened risk aversion. Furthermore, geopolitical instabilities in key oil-producing regions can disrupt global supply chains, increase operational risks, and negatively impact investment climates. Lastly, the escalating cost of raw materials, especially specialized steel and advanced alloys, constantly presents a significant manufacturing challenge, directly impacting production costs and influencing pricing strategies across the market, making cost optimization a continuous strategic priority for market players in a competitive landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager