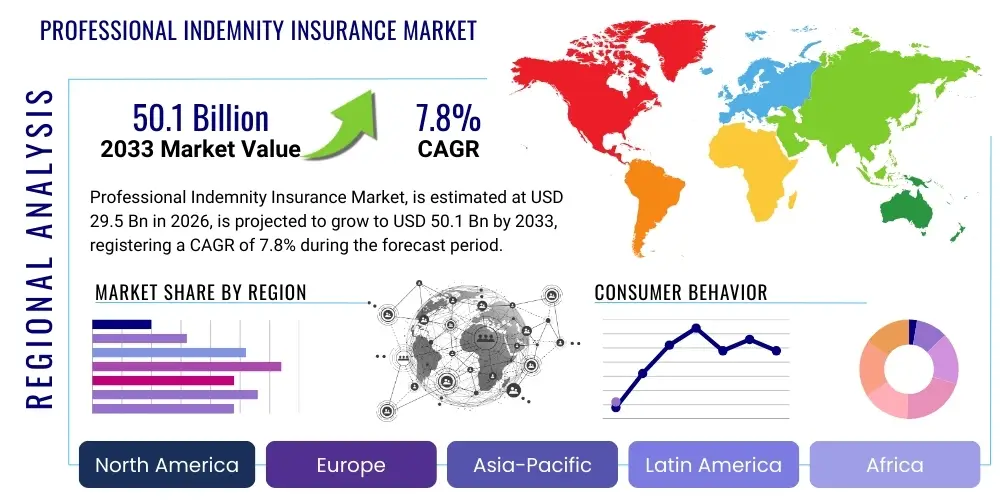

Professional Indemnity Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438053 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Professional Indemnity Insurance Market Size

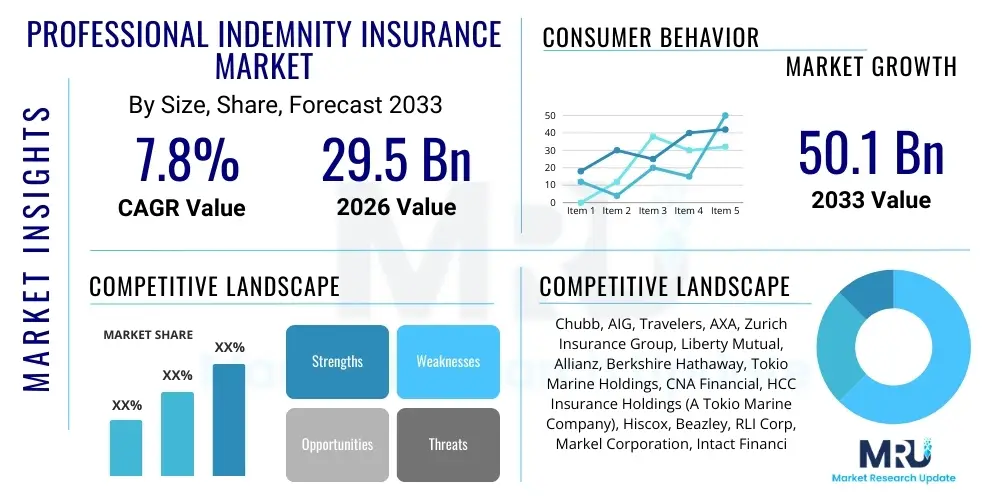

The Professional Indemnity Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 29.5 Billion in 2026 and is projected to reach USD 50.1 Billion by the end of the forecast period in 2033.

Professional Indemnity Insurance Market introduction

The Professional Indemnity (PI) Insurance Market, often referred to as Errors and Omissions (E&O) insurance, provides crucial financial protection for professionals against claims of negligence, errors, or omissions in the provision of their specialized services. This market encompasses a wide range of knowledge-based industries, including legal, medical, architectural, engineering, financial services, and increasingly, technology and consulting sectors. The fundamental product covers legal defense costs and damages awarded in a lawsuit, arising from a professional failing to meet the expected standard of care, ensuring business continuity even when facing complex and expensive litigation.

Major applications of PI insurance are centered around mitigating liability exposure that traditional General Liability policies do not address. For instance, a technology consultant needs PI coverage for faulty software advice leading to client financial loss, while a lawyer needs it for missed deadlines or incorrect legal counsel. Key benefits include safeguarding corporate reputation, stabilizing cash flow during legal disputes, and satisfying mandatory contractual obligations often imposed by clients or regulatory bodies. The inherent risk profile of professional services, which relies heavily on intellectual output and advice, makes PI coverage an indispensable component of modern risk management frameworks across developed and developing economies.

The primary driving factors propelling market expansion include the global increase in litigation culture, higher consumer expectations regarding professional accountability, and the rapid digitization of services which introduces complex new failure points, especially related to data security and algorithmic performance. Furthermore, stricter regulatory regimes requiring mandatory insurance for specific professional licenses in sectors like healthcare and financial auditing are consistently bolstering demand. These macroeconomic and legislative trends collectively ensure sustained growth in the PI market, necessitating continuous innovation in policy design and risk modeling.

Professional Indemnity Insurance Market Executive Summary

The Professional Indemnity Insurance Market is currently experiencing robust growth driven primarily by structural shifts in the global economy toward service-based industries and the rising complexity of professional liability exposures, particularly those linked to digital transformation and intellectual property. Key business trends indicate a strong move toward bespoke policy development, moving away from standardized templates to address highly specialized risks associated with emerging technologies like artificial intelligence and blockchain consultancy. Insurers are investing heavily in advanced data analytics and underwriting technology (InsurTech) to better quantify and price these non-traditional exposures, leading to higher efficiency in claims handling and greater customization of coverage limits and deductibles tailored to specific industry verticals.

Regional trends demonstrate North America and Europe maintaining dominance due to high levels of professional maturity, stringent regulatory enforcement, and a litigious environment that necessitates high coverage limits. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, spurred by rapid industrialization, increasing foreign direct investment in professional services, and the establishment of robust legal frameworks in countries like China and India. This regional diversification requires insurers to develop flexible policy wordings that comply with varying local legal standards and regulatory requirements, necessitating localized product strategy and distribution partnerships.

Segment trends highlight the IT and Consulting sector as the highest growth segment, overwhelmingly driven by cyber liability overlap and the inherent risks in providing complex technological advice. Conversely, established sectors like legal and financial services remain the largest revenue contributors, characterized by stable, high-value renewal rates. Policy trends are shifting toward 'Blended Policies' that integrate elements of pure PI, Cyber Liability, and D&O (Directors & Officers) coverage, reflecting the interconnected nature of modern business risks. The overarching theme is risk convergence, compelling both carriers and consumers to seek comprehensive, modular insurance solutions.

AI Impact Analysis on Professional Indemnity Insurance Market

Common user questions regarding AI's impact on the Professional Indemnity Insurance Market frequently center on identifying who is liable when an AI system makes an error—the developer, the implementer, or the professional relying on the output. Users also inquire about how AI tools are automating or streamlining traditional underwriting processes, affecting premium calculations, and whether current PI policies adequately cover algorithmic bias, machine learning malfunctions, and deepfake generated professional misconduct. The overwhelming user expectation is that AI will simultaneously create significant new risk exposure for consultants and developers while offering substantial tools for insurers to improve efficiency and predictive modeling capabilities.

The integration of artificial intelligence systems into professional services fundamentally alters the traditional definition of professional negligence, shifting the focus from human error to algorithmic fault. This transition necessitates a radical reassessment of policy wordings, exclusions, and causation modeling in claims. For underwriters, AI offers the ability to process vast amounts of unstructured data, improving the speed and accuracy of risk assessment for complex, novel exposures, leading to more granular pricing. However, the resulting 'black box' problem—where the decision-making process of advanced AI is opaque—presents a major challenge in determining causation and ultimate liability, potentially increasing the frequency and severity of claims related to automated advice or services.

Furthermore, AI deployment is leading to the creation of entirely new professional categories, such as AI ethicists and machine learning operations (MLOps) engineers, all requiring specialized PI coverage. As firms increasingly rely on AI to perform complex tasks previously handled by humans, the scale of potential error increases exponentially. The market response involves developing specialized AI Liability endorsements or standalone policies that specifically address intellectual property infringement arising from training data, regulatory non-compliance due to algorithmic outputs, and the financial losses resulting from flawed automated recommendations. This dual-sided impact of AI—as a risk multiplier and a potent analytical tool—will define the future trajectory of the PI insurance sector.

- Increased complexity in determining liability causation (human versus algorithmic error).

- Development of specialized AI E&O policies covering algorithmic bias and model failure.

- Automation of underwriting and claims processing via AI and machine learning tools.

- Emergence of new, high-risk professional segments (Data Scientists, Prompt Engineers).

- Challenges in risk assessment due to the 'black box' nature of proprietary AI systems.

- Potential for reduction in human error claims offset by increased exposure to systemic technical failure.

DRO & Impact Forces Of Professional Indemnity Insurance Market

The Professional Indemnity Insurance Market operates under a powerful mix of dynamic forces, including robust regulatory expansion, escalating societal expectations of professional conduct, and inherent economic volatility. Drivers center primarily on the global increase in litigation frequency and severity, particularly in North America, coupled with mandatory insurance requirements across regulated professional fields like financial advisory and medical practice. Restraints, conversely, include the high capital requirements necessary for underwriting complex, catastrophic risks and the resistance from smaller professional firms to bear the rising costs of comprehensive premiums, especially in volatile economic climates. Opportunities reside significantly in leveraging InsurTech platforms to access untapped emerging markets and creating highly specialized products addressing next-generation risks, such as those related to cyber-physical systems and complex cross-border transactions.

Key drivers include the dramatic rise in civil litigation tied to corporate malfeasance and the increasing digitalization of every professional service, which expands the potential surface area for errors leading to financial loss, intellectual property disputes, or data breaches. The tightening of professional standards by governing bodies globally also pushes firms to secure higher limits of liability coverage. Conversely, a significant restraint is the cyclical nature of the reinsurance market, which dictates pricing stability and capacity availability for primary insurers, often leading to unpredictable hardening or softening cycles. Additionally, the challenge of standardizing policy definitions across diverse international jurisdictions complicates cross-border service provision and market expansion for multinational carriers.

The impactful opportunity lies in creating scalable solutions for small and medium-sized enterprises (SMEs) that are increasingly engaging in high-risk consulting but lack tailored coverage options. Impact forces driving market structure include continuous legislative changes (e.g., data privacy regulations like GDPR), which immediately translate into new liability exposures for covered professionals. These forces necessitate constant policy innovation and aggressive risk management consulting services from insurers, moving the PI market beyond simple risk transfer toward comprehensive risk mitigation partnerships. The balance between capitalizing on digitization and mitigating the associated liability risks remains the central dynamic defining market performance.

Segmentation Analysis

Segmentation is crucial for accurately assessing and pricing risk within the Professional Indemnity Insurance Market, given the highly disparate exposure levels across different professions. The market is broadly categorized by Coverage Type (Claims-Made versus Claims-Occurring), End-User Industry (reflecting varying risk profiles such as medical, legal, and IT), and Policy Limit (determining the size and potential severity of the liability assumed). The End-User segmentation, in particular, drives underwriting profitability, as risks associated with a low-stakes graphic design consultant are fundamentally different from those of a high-stakes corporate auditor, requiring distinct actuarial models and pricing strategies.

Analyzing the distribution channel is also essential, distinguishing between traditional brokers, direct sales, and rapidly growing online aggregator platforms. Brokers remain dominant for complex, large-limit policies due to the need for intricate negotiation and tailored policy drafting. However, digital platforms are capturing significant market share in the SME sector by offering simplified, modular products with rapid quotation capabilities. This shift towards digital distribution is lowering acquisition costs for carriers but necessitates significant investment in user experience and compliance automation, ensuring that online sales maintain the required regulatory standards for complex financial products.

The segmentation structure enables insurers to focus resources on segments showing high growth potential, such as IT and specialized healthcare, while maintaining stable, large books of business in mature sectors like financial services and architecture. Furthermore, the granularity provided by segmentation allows for targeted marketing efforts and the development of value-added services, such as specialized legal counsel networks or proactive risk management portals, enhancing policyholder loyalty and reducing overall loss ratios for specific professional classes. Effective segmentation is the foundation of competitive differentiation in this highly specialized risk transfer domain.

- By Coverage Type:

- Claims-Made Policies (Dominant and preferred for PI coverage)

- Claims-Occurring Policies (Less common for PI)

- By End-User Industry:

- Architects & Engineers (A&E)

- Financial Services (e.g., Accountants, Auditors, Financial Advisors)

- Legal Services (Attorneys, Solicitors)

- Healthcare & Medical Professionals

- IT & Consulting Services (Software Developers, Management Consultants)

- Media & Marketing Professionals

- Others (e.g., Real Estate Agents, Tutors)

- By Policy Limit:

- Low Limit (SMEs, small practices)

- Medium Limit

- High Limit (Large corporations, multinational consulting firms)

- By Distribution Channel:

- Brokers and Agents

- Direct Sales

- Bancassurance

- Online Aggregators/InsurTech Platforms

Value Chain Analysis For Professional Indemnity Insurance Market

The value chain for the Professional Indemnity Insurance Market begins with upstream activities focused on data collection and actuarial modeling, where specialized risk data—including historical claims, economic forecasts, and regulatory changes—is gathered and analyzed to define potential loss frequency and severity. This upstream segment is highly reliant on sophisticated data vendors, legal experts, and reinsurance providers who supply the necessary capital and technical expertise to assess catastrophic risk potential and allocate appropriate capital reserves. Effective upstream management ensures that the pricing of professional liability risk is both competitive and profitable, requiring continuous refinement of predictive analytics tools.

The midstream involves the core activities of policy design, underwriting, marketing, and distribution. Underwriting is the critical stage, utilizing the upstream risk models to tailor policy terms, exclusions, and limits for individual or corporate clients. Distribution, handled by brokers (indirect) or direct sales channels, involves matching the complex policy structure to the specific needs and regulatory environment of the professional. Brokers play an essential role in mediating the complexity between the carrier's technical risk appetite and the client's practical coverage requirements, often facilitating the placement of large or specialty risks that require access to multiple carriers.

Downstream activities are dominated by claims management and policyholder service, which are pivotal in determining customer satisfaction and ultimately, carrier profitability. Efficient and specialized claims handling, particularly the rapid appointment of expert defense counsel, minimizes litigation costs and potential payouts. The final stage involves reinsurance, where primary carriers transfer portions of their risk portfolio to maintain capital solvency and capacity, completing the cyclical flow of risk and capital within the insurance ecosystem. Direct channels are generally favored by smaller carriers targeting standardized SME risks, while indirect channels (brokers) control the majority of the complex corporate PI market.

Professional Indemnity Insurance Market Potential Customers

Potential customers for Professional Indemnity Insurance are any individuals or entities whose core business involves providing specialized advice, design, or services based on expertise, and where financial harm could result from errors or omissions. The buyer demographic is extremely broad, ranging from sole practitioners like independent consultants and financial planners to vast multinational corporations providing complex engineering, auditing, or IT solutions. The primary motivation for purchase extends beyond mere regulatory compliance, increasingly encompassing contractual requirements from sophisticated clients who mandate specific levels of PI coverage before entering into service agreements.

The IT and Technology sector represents a rapidly expanding buyer base, fueled by increasing reliance on software development, data analytics, cybersecurity consulting, and cloud services. These buyers seek policies that often blend PI with Cyber and Technology E&O coverage, reflecting the interwoven nature of their risks. In contrast, traditional buyers in the Legal and Accounting sectors are motivated by stringent bar association or regulatory body requirements and the necessity of protecting significant client funds and proprietary information, requiring high limits of liability coverage reflective of multi-million dollar corporate transactions.

Healthcare professionals, including clinics, specialized surgeons, and telehealth providers, constitute a segment where PI coverage (often termed Medical Malpractice) is mandatory and driven by patient safety regulations and the potential for severe physical harm claims, differing significantly from the purely financial loss focus in the consulting sectors. Essentially, any professional who accepts responsibility for providing intellectual or advisory services is a potential customer, seeking insurance not just as a defensive shield against lawsuits but as a prerequisite for commercial viability and reputation management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 29.5 Billion |

| Market Forecast in 2033 | USD 50.1 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chubb, AIG, Travelers, AXA, Zurich Insurance Group, Liberty Mutual, Allianz, Berkshire Hathaway, Tokio Marine Holdings, CNA Financial, HCC Insurance Holdings (A Tokio Marine Company), Hiscox, Beazley, RLI Corp, Markel Corporation, Intact Financial Corporation, Hartford Financial Services Group, RSA Insurance Group, QBE Insurance Group, Great American Insurance Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Professional Indemnity Insurance Market Key Technology Landscape

The technology landscape within the Professional Indemnity Insurance Market is rapidly evolving, driven primarily by the necessity to handle complex risk data and streamline inefficient, paper-heavy underwriting processes. Key technology adoption revolves around InsurTech solutions focused on enhancing data ingestion, risk modeling, and distribution. Predictive analytics and machine learning are crucial for underwriters to assess novel risks, such as liability associated with autonomous systems or complex regulatory compliance failures, moving beyond reliance solely on historical claims data. Furthermore, the use of APIs allows carriers to seamlessly integrate with third-party data providers (e.g., industry performance metrics, legal databases) to gain a more comprehensive, real-time view of a potential policyholder's risk profile.

Another significant technological shift involves the application of robotic process automation (RPA) in policy administration and claims processing. RPA reduces the manual effort required for routine tasks like data entry, policy issuance, and simple claims triage, significantly speeding up turnaround times and reducing operational costs. Blockchain technology is also being explored, particularly for secure data sharing between primary carriers, reinsurers, and brokers, enhancing transparency and efficiency in capital placement and cross-border transactions, although widespread adoption remains nascent but promising for high-value contracts.

Distribution technology, specifically mobile applications and online portals, is transforming how Professional Indemnity policies are quoted and sold, especially to the vast SME segment. These digital platforms leverage automated questionnaires and quick risk scoring algorithms to provide near-instantaneous quotes, improving customer experience and access to coverage. This focus on digital distribution, coupled with advanced risk modeling using big data techniques, allows insurers to manage the increasing scale and complexity of professional liability risks while maintaining competitive pricing and operational agility in a highly specialized and competitive market environment.

Regional Highlights

The Professional Indemnity Insurance Market exhibits distinct regional dynamics shaped by differing legal systems, economic maturity, and regulatory environments.

- North America (NA): Represents the largest and most mature market, characterized by a highly litigious culture, substantial policy limits, and stringent mandatory insurance requirements, particularly for legal and medical professionals. The US market drives global innovation in policy wordings, especially for specialized risks like Cyber E&O and tech liability, due to the high concentration of technology firms and venture capital. Significant regulatory bodies and powerful professional associations ensure robust and consistent demand.

- Europe: A dominant region driven by mandatory professional liability insurance across the European Union for numerous sectors (e.g., auditors, insurance brokers). The market is segmented by national jurisdictions, each with specific legal precedents, but unified by overarching EU regulations like GDPR, which significantly increases liability exposure for data-handling professionals. The UK remains a major global center for specialty insurance and reinsurance placement, influencing global pricing and capacity.

- Asia Pacific (APAC): Expected to be the fastest-growing market segment, fueled by rapid infrastructural development (boosting demand for A&E coverage), expanding financial services sector, and increasing professionalization of local economies. Key growth countries include China, India, and Southeast Asian nations, where economic liberalization and rising awareness of professional standards are creating vast, previously untapped client bases. Challenges include diverse regulatory frameworks and developing local expertise in complex underwriting.

- Latin America (LATAM): A developing market facing challenges related to economic volatility and less mature legal systems, resulting in lower overall penetration rates compared to NA or Europe. Growth is concentrated in metropolitan areas and specific regulated sectors (e.g., oil and gas engineering, large financial institutions). Market expansion is contingent on regulatory stability and increased foreign investment driving demand for internationally compliant professional services.

- Middle East and Africa (MEA): A nascent market segment, primarily driven by massive government-led infrastructure and energy projects, creating high demand for high-limit PI coverage for international engineering and construction firms operating in the region. Financial centers like the UAE and Qatar exhibit higher maturity in professional liability demand, mirroring European regulatory standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Professional Indemnity Insurance Market.- Chubb

- AIG

- Travelers

- AXA

- Zurich Insurance Group

- Liberty Mutual

- Allianz

- Berkshire Hathaway

- Tokio Marine Holdings

- CNA Financial

- HCC Insurance Holdings (A Tokio Marine Company)

- Hiscox

- Beazley

- RLI Corp

- Markel Corporation

- Intact Financial Corporation

- Hartford Financial Services Group

- RSA Insurance Group

- QBE Insurance Group

- Great American Insurance Group

Frequently Asked Questions

Analyze common user questions about the Professional Indemnity Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between Professional Indemnity (PI) and General Liability (GL) insurance?

PI insurance covers financial loss arising from professional errors, omissions, or negligence in the provision of services (intangible risk). GL insurance covers claims related to bodily injury or property damage resulting from business operations (tangible risk) on the policyholder's premises or caused by their product.

How does the Claims-Made policy basis function in Professional Indemnity?

A Claims-Made policy only covers claims that are made against the professional and reported to the insurer during the policy period, provided the error or omission occurred on or after the retroactive date specified in the policy. This is the standard structure for PI coverage due to the potential long latency period of professional errors.

Which professional sector is currently driving the highest growth in PI insurance demand?

The Information Technology (IT) and Consulting sector is experiencing the highest growth in demand. This is driven by the increasing complexity of software development, digital transformation risks, reliance on data analytics, and the inherent liability exposure linked to cyber security advice and algorithmic performance failures.

What is the main impact of Artificial Intelligence (AI) on professional liability risk?

AI complicates the traditional determination of liability by introducing algorithmic faults and systemic bias as potential causes of loss, shifting the focus from individual human error to shared responsibility between the system developer, the data provider, and the professional deploying the AI solution.

Why is adequate Professional Indemnity coverage considered essential for contract fulfillment?

Many sophisticated clients, particularly government entities and large corporations, mandate specific minimum PI coverage limits as a contractual prerequisite to mitigate their own operational and financial exposure to professional failure, making the policy a necessary ticket to secure high-value contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager