Professional Liability Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435515 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Professional Liability Insurance Market Size

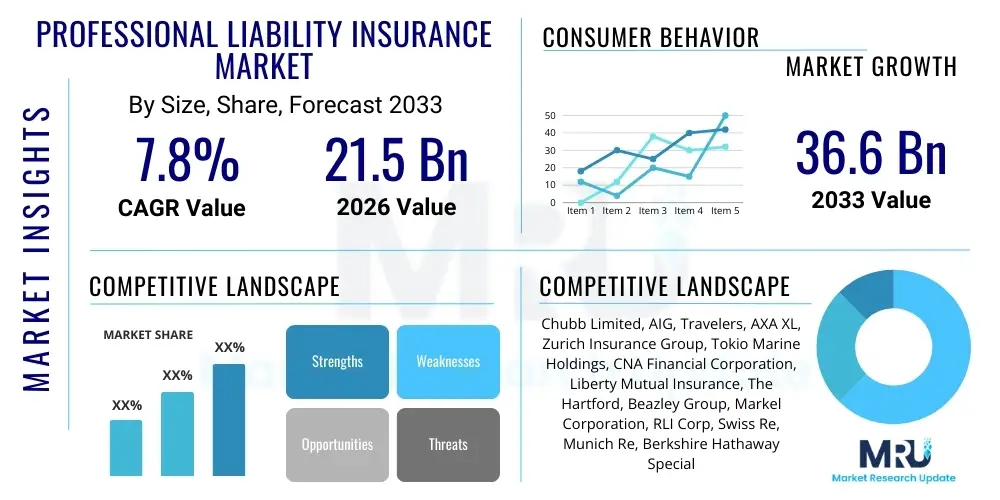

The Professional Liability Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $21.5 Billion in 2026 and is projected to reach $36.6 Billion by the end of the forecast period in 2033.

Professional Liability Insurance Market introduction

Professional Liability Insurance (PLI), often referred to as Errors and Omissions (E&O) insurance, constitutes a specialized segment within the broader commercial insurance landscape designed to protect professionals, such as consultants, accountants, lawyers, architects, and technology providers, against liability claims arising from negligence, errors, or omissions in the performance of their professional duties. Unlike General Liability Insurance, which covers physical harm or property damage, PLI specifically addresses financial losses suffered by third parties due to professional malpractice or failure to perform agreed-upon services adequately. The necessity for PLI has escalated significantly in recent years due to increasing litigation rates, heightened regulatory scrutiny across various industries, and the growing complexity of professional services, particularly within the digital and healthcare sectors. The core product offering includes coverage for defense costs, settlements, and judgments associated with covered claims, providing a critical financial safeguard that allows professionals and firms to mitigate catastrophic financial risks inherent in their service delivery models.

Major applications of professional liability coverage span across highly regulated and knowledge-intensive industries where intellectual property, fiduciary responsibility, and advisory services are paramount. Key sectors driving demand include the burgeoning fields of Information Technology (IT) and cybersecurity consulting, where data breaches and system failures can result in massive client losses. Furthermore, the robust expansion of the healthcare sector necessitates comprehensive malpractice insurance for medical professionals, while financial services firms require strong E&O policies to cover fiduciary breaches or faulty investment advice. The widespread adoption of remote work models and the reliance on digital platforms further exacerbate liability exposure, making PLI an indispensable tool for maintaining operational continuity and client trust in a highly interconnected global economy. The market structure is characterized by both standard policy offerings and highly customized risk transfer solutions tailored to unique professional exposures, ensuring relevance across diverse organizational sizes and scopes of service.

The primary benefits of securing adequate Professional Liability Insurance are rooted in financial protection and enhanced corporate credibility. By transferring the financial burden of potential lawsuits to an insurer, professionals safeguard their personal and business assets, ensuring stability even when facing expensive, drawn-out legal proceedings. Driving factors propelling market growth include the globalization of professional services, which introduces complex jurisdictional risk, and the rapid pace of technological innovation, which creates new categories of risk, such as algorithmic bias or autonomous system failure. Additionally, increased consumer awareness regarding their rights and expectations from service providers leads to higher claimant frequency. Regulatory mandates in certain professions, requiring proof of insurance for licensing or contract bidding, further solidify PLI's position as a foundational requirement for modern professional practice. These systemic drivers collectively fuel sustained growth and sophistication within the underwriting and claims management segments of the PLI market.

Professional Liability Insurance Market Executive Summary

The Professional Liability Insurance (PLI) market is experiencing dynamic shifts characterized by heightened pricing segmentation, increasing demand volatility tied to economic cycles, and a critical focus on emerging digital risks such as cyber liability and technological errors and omissions (Tech E&O). Business trends indicate a consolidation among major carriers aiming for greater operational efficiency and enhanced data analytics capabilities, crucial for accurate risk modeling in rapidly evolving professional sectors like legal, medical, and engineering consultation. Furthermore, there is a distinct trend towards integrated risk management solutions, where PLI is bundled with general liability and cyber insurance products, offering comprehensive protection packages to clients. Insurtech adoption is profoundly impacting distribution channels and claims processing, enabling faster underwriting decisions and personalized policy customization based on real-time professional risk assessments, thus optimizing the customer journey and improving carrier profitability margins.

Regional trends reveal significant market maturity and penetration in North America and Europe, driven by stringent regulatory frameworks, deeply embedded litigious cultures, and high concentrations of professional services firms. North America, particularly the United States, remains the largest market due to high litigation costs and mandatory insurance requirements in several high-risk professions. Conversely, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, primarily fueled by rapid industrialization, the formalization of professional practices in emerging economies like India and China, and increased foreign direct investment, which demands international standards of risk coverage. Latin America and the Middle East & Africa (MEA) present untapped potential, characterized by increasing urbanization and the development of modern infrastructure projects, though growth in these areas is often tempered by political volatility and inconsistent enforcement of liability laws, requiring highly specialized local underwriting expertise.

Segmentation trends highlight the increasing dominance of the claims-made policy form, favored by carriers for its predictability in long-tail liability exposures, although occurrence-based policies maintain relevance in specific fields like medical malpractice. By industry vertical, the Technology, Media, and Telecommunications (TMT) segment is expanding rapidly, demanding bespoke Tech E&O policies that address software performance, service level agreements (SLAs), and intellectual property infringements. The financial services segment continues to require robust Directors and Officers (D&O) and E&O coverage amidst complex regulatory environments like Basel III and stringent data privacy laws. Segment-specific pricing volatility remains high, with sectors experiencing increased litigation (e.g., construction design) seeing higher premiums and stricter terms, underscoring the insurer's need for granular data and predictive modeling to manage concentration risk effectively across the diverse professional landscape. The convergence of professional liability with general cyber coverage continues to blur traditional segment boundaries, driving innovation in combined policy offerings.

AI Impact Analysis on Professional Liability Insurance Market

Common user questions regarding AI's impact on Professional Liability Insurance revolve primarily around the changing nature of negligence and the attribution of blame when autonomous or algorithmic systems cause harm. Users frequently inquire about who holds liability—the software developer, the AI operator, or the professional relying on the output—and how current E&O policies will adapt to cover 'algorithmic errors.' There is significant interest in whether AI can enhance underwriting accuracy by rapidly processing vast datasets on professional risk profiles, thereby leading to personalized pricing and potentially fairer premiums. Conversely, concerns exist about the potential for 'black box' AI models to increase systemic risk and challenge the traditional investigation and defense processes within claims management, especially concerning data bias and model transparency. These inquiries collectively highlight a fundamental market expectation that AI will simultaneously create new liability exposures (algorithmic malpractice) while providing powerful tools for improved risk assessment and operational efficiency within the insurance ecosystem itself.

The introduction of sophisticated AI tools into professional practice, ranging from AI-powered diagnostic tools in healthcare to automated financial modeling in advisory services, fundamentally redefines the concept of professional error. When an AI algorithm provides flawed advice leading to client loss, the question shifts from human negligence to product liability coupled with professional reliance. This transition necessitates a radical restructuring of traditional PLI policies, which were historically designed to cover human judgment failures. Insurers are now compelled to develop specialized endorsements or entirely new product lines—often termed 'AI E&O' or 'Tech-Enabled Malpractice'—that explicitly address the unique risks associated with the deployment and reliance on automated decision-making systems. The challenge lies in quantifying the risk of algorithmic failures, which differ substantially from human error patterns, requiring highly specialized technical expertise in claims investigation and defense.

Furthermore, AI significantly impacts the operational side of the insurance industry. Machine learning is rapidly being deployed to enhance underwriting models, allowing carriers to process complex submissions faster, analyze legal precedent and claim histories more accurately, and segment risks with unprecedented granularity. This technological uplift facilitates more dynamic pricing and tailored policy structures, moving away from broad industry categories toward highly specific risk profiles based on the firm's actual technology stack and deployment of automation. However, this relies heavily on high-quality, unbiased data. If the AI systems used by insurers perpetuate historical biases found in claim data, it could lead to potential regulatory scrutiny and liability issues for the insurer itself, related to unfair discrimination in pricing or coverage decisions. Therefore, while AI offers substantial efficiency gains, its implementation must be rigorously monitored for fairness and transparency, especially given its role in mitigating the novel risks it helps to create.

- AI-Driven Algorithmic Error Liability: New category of risk where professional loss stems from flawed AI output rather than human negligence.

- Enhanced Underwriting Precision: AI improves risk segmentation, enabling dynamic pricing and more accurate premium calculation based on real-time risk factors.

- Claims Process Automation: Implementation of AI and natural language processing (NLP) accelerates claims triage, investigation, and fraud detection.

- Data Bias Risk: If underlying data used by AI models is biased, it introduces liability for unfair or discriminatory coverage decisions by the insurer.

- Need for Tech E&O Integration: Traditional PLI policies must be restructured or augmented to explicitly cover technological risks, including software failure and system downtime.

- Regulatory Complexity: Increased regulatory focus on AI governance and accountability, impacting policy drafting and compliance requirements for professionals.

- Shifting Blame Attribution: Difficulty in determining liability among the developer, implementer, and user of the AI system during a professional claim event.

DRO & Impact Forces Of Professional Liability Insurance Market

The Professional Liability Insurance market is driven by a confluence of systemic factors, including the pervasive increase in regulatory oversight across global economies, which mandates higher standards of professional conduct and corresponding insurance coverage, particularly in finance and healthcare. Simultaneously, the proliferation of sophisticated technology introduces new, complex risks (e.g., cyber and data privacy liabilities) that traditional general liability policies do not adequately address, compelling professionals to seek specialized E&O protection. These driving forces are amplified by a worldwide trend of heightened consumer and client awareness regarding rights and the propensity to litigate against perceived service failures, maintaining sustained pressure on premiums and claim frequency across all professional sectors. This expanding risk landscape ensures that PLI remains a non-discretionary expenditure for most modern professional practices. However, several inherent market restraints temper this growth, most notably the high cost and volatility of premiums, especially in hard market cycles, which can be prohibitive for smaller firms and individual practitioners, potentially leading to underinsurance or non-compliance. Furthermore, the variability in insurance regulations across different jurisdictions complicates cross-border service provision and policy standardization, posing significant administrative and underwriting challenges for global carriers.

Opportunities for market expansion are abundant, particularly through technological innovation and demographic shifts. The explosive growth of the gig economy and independent consulting mandates the creation of tailored, affordable short-term PLI products designed specifically for freelancers and contractors who operate without the coverage umbrella of a large organization. Furthermore, the underdeveloped markets in emerging economies represent substantial long-term growth potential as professional standards formalize and local economies mature. Insurtech partnerships and advanced data analytics offer significant opportunities to refine risk modeling, reducing the information asymmetry between underwriters and policyholders, which could lead to more stable and attractive pricing structures. The expansion of integrated policy offerings, combining traditional E&O with bespoke cyber and D&O coverage, also opens new revenue streams by addressing the convergence of operational, technological, and professional risks within a single product framework.

The impact forces within the PLI market are characterized by intense regulatory pressure and high cyclical sensitivity. Regulatory changes, such as new data privacy laws (e.g., GDPR, CCPA), immediately translate into increased liability exposure for professionals handling client data, directly impacting PLI demand and policy limits. Economic cycles profoundly influence litigation patterns; recessions often correlate with an uptick in claims related to poor investment advice or bankruptcy-related professional services. Furthermore, social inflation—the tendency for jury awards and legal defense costs to increase significantly above general inflation rates—exerts immense upward pressure on claims severity and, consequently, on premium levels. These combined internal and external forces necessitate constant vigilance and flexibility from insurers, demanding continuous product innovation and robust reinsurance strategies to manage large, unexpected liability losses inherent in this specialized risk transfer domain.

Segmentation Analysis

The Professional Liability Insurance market is meticulously segmented across multiple dimensions, primarily defined by the type of coverage provided, the specific industry vertical served, the policy coverage limit purchased, and the operational size of the insured entity (small, medium, or large enterprise). Segmentation by coverage type is critical, differentiating standard E&O (generic services) from specialized products such as medical malpractice (malpractice insurance) and technological E&O (Tech E&O). This granular breakdown allows carriers to accurately price and underwrite risks specific to the professional duties and regulatory requirements of each sector. The fastest-growing segments are centered on technology and healthcare, reflecting the accelerated digital transformation and demographic changes globally, which inherently introduce new vectors of professional error liability.

Analyzing the market by industry vertical provides crucial insight into risk concentration and growth drivers. Segments such as Financial Services and Legal Services, characterized by high fiduciary responsibility and strict regulatory environments, are mature but demand high-limit policies due to potential large financial losses. Conversely, the Architecture and Engineering segment, though subject to less frequent claims than healthcare, faces high-severity exposure related to design flaws and structural failures. Segment performance is highly correlated with legislative changes; for instance, any modification to medical tort reform laws directly impacts the medical malpractice segment’s profitability and pricing strategy. Therefore, successful market navigation requires carriers to possess deep, sector-specific underwriting expertise and responsive product development capabilities that track industry-specific regulatory and technological evolution.

The segmentation by policy size and organization size is fundamental to distribution strategy and pricing methodology. Small and Medium Enterprises (SMEs) often purchase standardized, packaged policies, relying heavily on broker advice and digital platforms for quick acquisition, driving volume growth. Large multinational firms, however, require highly bespoke, layered programs often involving multiple international carriers and complex reinsurance structures to cover global operations and high-limit exposures (e.g., excess liability). Understanding the distribution channel preference (direct, agency, or broker) within each size segment is paramount for achieving market share. The ongoing market trend involves creating more modular policy designs that allow customization for SMEs while retaining the efficiency of standardized product delivery, balancing the need for specific risk protection with administrative simplicity across the entire spectrum of professional businesses.

- By Coverage Type:

- Errors and Omissions (E&O) Insurance

- Medical Malpractice Insurance

- Directors and Officers (D&O) Liability Insurance

- Fiduciary Liability Insurance

- Technology Errors and Omissions (Tech E&O)

- By Industry Vertical:

- Healthcare and Medical Professionals

- Legal Services

- Financial Services (Accounting, Consulting, Investment)

- Technology, Media, and Telecommunications (TMT)

- Architecture and Engineering (A&E)

- Real Estate Professionals

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Policy Form:

- Claims-Made Policies

- Occurrence-Based Policies

Value Chain Analysis For Professional Liability Insurance Market

The Professional Liability Insurance value chain initiates with the upstream activities of data sourcing and risk modeling, which rely heavily on actuaries, data scientists, and specialized legal experts to develop accurate premium calculations and predict future claim severity and frequency based on historical professional data and prevailing legal environments. This phase is crucial as it determines the carrier's profitability and competitive positioning. Key upstream components include advanced catastrophe modeling, regulatory compliance analysis, and the utilization of third-party data aggregators and Insurtech platforms that provide behavioral risk insights. The quality and accessibility of this granular professional data directly influence the efficiency and precision of the underwriting process, particularly in niche high-risk segments like cyber consulting and intricate medical procedures, where traditional data sets may be insufficient to fully capture evolving liability exposures. Investment in proprietary risk data platforms is a hallmark of sophisticated carriers seeking a competitive edge in pricing accuracy.

Midstream activities encompass core insurance functions: underwriting, policy administration, and marketing/distribution. Underwriting involves the critical decision-making process where the carrier assesses individual professional risk, determines coverage limits, sets deductibles, and finalizes the premium. Distribution channels—spanning direct sales, independent agents, and large global brokers—play a vital role in connecting the complex product to the varied end-users. Brokers are particularly influential in the PLI market due to the specialized nature of the risk, often providing risk advisory services beyond simple policy placement. Policy administration utilizes sophisticated core systems (often cloud-based) for billing, policy issuance, and endorsements, emphasizing digital accessibility and seamless integration with broker portals. Efficiency in this midstream segment directly correlates with customer satisfaction and reduced operational costs, driving the ongoing trend toward digitalization and automation in policy management.

Downstream activities center on claims management, loss adjustment, legal defense, and reinsurance. Claims handling is the ultimate test of the policy and the carrier’s service commitment, requiring highly experienced claims adjusters and specialized defense counsel who understand the nuances of professional malpractice law (e.g., standard of care definitions). Effective and timely claims resolution minimizes financial leakage and preserves the carrier's reputation. Reinsurance represents the final critical step, where primary carriers transfer portions of their accumulated risk exposure, particularly for high-severity, low-frequency events, to specialized global reinsurers. Direct and indirect distribution channels coexist; direct channels leverage online platforms for standardized, smaller policies (e.g., for sole proprietors), offering immediate quotation and binding, while indirect channels (brokers/agents) dominate the complex, large-account segment, providing customized risk transfer solutions and advisory services necessary for navigating intricate global regulatory environments and high-stakes liability exposures.

Professional Liability Insurance Market Potential Customers

The potential customer base for Professional Liability Insurance is vast and heterogeneous, encompassing virtually any individual or organization that provides expert advice, design, or specialized services for a fee, where a failure to perform such services could result in financial or personal damage to a client or third party. Primary end-users include all licensed professionals operating under state or federal regulations that mandate adherence to a specific standard of care. These buyers are acutely aware of their litigation exposure and typically prioritize coverage limits and robust defense counsel networks over marginal premium savings. Specific high-value customer segments include large hospitals and physician groups requiring high-limit medical malpractice coverage, multinational accounting firms needing worldwide E&O coverage against fiduciary breaches, and major technology consultancies that require integrated Tech E&O and cyber liability protection against system failures and data privacy claims. The demand from these established sectors remains high, driven by persistent legal and regulatory risk inflation.

A significant, rapidly expanding cohort of potential customers resides in the freelance and gig economy sectors. Individual consultants, IT contractors, marketing specialists, and virtual assistants often work independently or for multiple clients, lacking the protective indemnity coverage provided by large employers. This demographic represents a large volume opportunity for carriers offering flexible, affordable, and easily accessible digital policies. Furthermore, the growth in regulated industries such as cannabis consulting, ESG (Environmental, Social, and Governance) advisory services, and specialized data analytics firms continually introduces new classes of professional risk exposure. These emerging sectors necessitate innovative and highly tailored PLI products, requiring underwriters to quickly develop expertise in previously uncategorized professional duties and their associated liability footprints, thereby expanding the overall scope of insurable professional services.

In essence, the end-users of PLI are segmented by their exposure level, regulatory environment, and organizational structure. For regulated sectors, purchasing PLI is a matter of mandatory compliance, whereas for others, particularly in the advisory and creative fields, it is a crucial component of risk mitigation and commercial contract requirement. Potential buyers are actively seeking policies that clearly articulate coverage in modern scenarios, such as breaches of service level agreements (SLAs), negligent misrepresentation in digital contexts, and vicarious liability arising from subcontracted work. The decision to purchase is increasingly influenced by the ability of the carrier to provide value-added services, such as preemptive risk assessment, legal guidance, and access to specialized defense panels, transforming the policy from a reactive mechanism into a proactive risk management partnership, ultimately driving customer loyalty and retention across all organizational sizes and professional domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $21.5 Billion |

| Market Forecast in 2033 | $36.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chubb Limited, AIG, Travelers, AXA XL, Zurich Insurance Group, Tokio Marine Holdings, CNA Financial Corporation, Liberty Mutual Insurance, The Hartford, Beazley Group, Markel Corporation, RLI Corp, Swiss Re, Munich Re, Berkshire Hathaway Specialty Insurance, Everest Re Group, QBE Insurance Group, Hiscox Ltd., AXIS Capital Holdings, Arch Capital Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Professional Liability Insurance Market Key Technology Landscape

The core technology landscape supporting the Professional Liability Insurance market is rapidly transforming from legacy, manual processes to highly automated, data-driven platforms, primarily driven by the need for enhanced risk accuracy and operational efficiency in managing complex, long-tail liabilities. Central to this transformation is the integration of advanced data analytics and machine learning (ML) capabilities within underwriting engines. Carriers utilize ML to process unstructured data, such as legal documents, professional disciplinary records, and detailed loss runs, allowing for a more precise assessment of an applicant's true risk profile than traditional actuarial methods. This technological capability enables hyper-segmentation of risks, moving beyond broad industry classifications to price policies based on individual firm behavior, technology adoption, and client base complexity. The focus is on predictive modeling to forecast not only the likelihood of a claim but also its potential severity, optimizing capital allocation and premium stability for the carrier.

Furthermore, the digital distribution channel relies heavily on Insurtech solutions, including cloud-native policy administration systems (PAS) and sophisticated Customer Relationship Management (CRM) tools designed for the specialized needs of brokers and agents dealing with PLI. These technologies facilitate straight-through processing (STP) for simple E&O policies, reducing issuance time from days to minutes, thereby significantly improving the customer experience, particularly for small businesses and independent contractors. Blockchain technology is also being explored, particularly in reinsurance and parametric insurance segments, for enhancing data security, increasing transparency in claims settlement processes, and managing global policy compliance across multiple jurisdictions through immutable distributed ledgers. The goal is to streamline the complex documentation and verification requirements inherent in professional liability claims.

Finally, technology related to claims handling and risk mitigation is becoming crucial differentiator. Natural Language Processing (NLP) and Optical Character Recognition (OCR) tools are utilized to rapidly scan, categorize, and analyze legal correspondence and court filings, speeding up the initial triage of claims. Beyond reactive claim management, carriers are increasingly offering technology-enabled risk mitigation services, such as access to cybersecurity consultants or legal compliance software, often integrated into the policy purchase. This shift from merely covering losses to actively preventing them showcases the evolving role of technology as a critical element in the value proposition of modern professional liability insurers. The ongoing investment in these technologies is paramount for maintaining competitiveness and adapting to the dynamic risk landscape driven by artificial intelligence and increasing cyber dependency across all professional sectors.

Regional Highlights

- North America: This region dominates the global Professional Liability Insurance market, driven primarily by the highly litigious environment in the United States and Canada, coupled with mandatory insurance requirements across key sectors like healthcare and finance. The market is characterized by high premium volumes, frequent, high-severity claims (especially medical malpractice), and rapid adoption of specialized coverage such as Tech E&O due to the concentration of global technology firms. Insurers here heavily invest in sophisticated legal defense networks and advanced data modeling to manage complex jurisdiction-specific risks.

- Europe: Europe is a mature market, heavily influenced by varied national legal traditions and the stringent regulatory environment imposed by the European Union, particularly concerning data protection (GDPR) and professional standards. The demand is strong across the UK, Germany, and France, with significant growth in D&O and fiduciary liability driven by corporate governance requirements. The market is moderately fragmented, with local carriers maintaining strong footholds, though global brokers facilitate complex, cross-border professional risk placements, addressing multinational liability concerns efficiently.

- Asia Pacific (APAC): APAC represents the fastest-growing regional market, propelled by accelerating economic development, rising professionalization of services, and increasing awareness of liability risk in developing economies (China, India). While penetration rates remain lower than in the West, market expansion is robust, particularly in construction, engineering, and technology consulting. Challenges include diverse regulatory environments and inconsistent legal infrastructure, requiring carriers to tailor products significantly to local legal standards and professional customs.

- Latin America (LATAM): This region is an emerging market for PLI, characterized by high urbanization rates and developing regulatory frameworks. Growth is concentrated in financial services and infrastructure projects in countries like Brazil and Mexico. The market faces constraints due to macroeconomic volatility and lower litigation rates compared to North America, but increasing foreign investment and the need for international standard compliance are steadily boosting PLI uptake, particularly among firms servicing international clientele.

- Middle East and Africa (MEA): Growth in MEA is highly localized, driven by major infrastructure and oil and gas projects requiring international compliance standards (A&E liability) and the expansion of modern healthcare systems. The region is seeing increasing demand for D&O and financial institution professional liability, particularly in financial hubs like Dubai and Riyadh. Market maturity is varied, often dependent on the stability of local legal systems and the enforcement of contractual liabilities, making it a specialized market requiring careful political and regulatory risk assessment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Professional Liability Insurance Market.- Chubb Limited

- American International Group, Inc. (AIG)

- The Travelers Companies, Inc.

- AXA XL

- Zurich Insurance Group

- Tokio Marine Holdings, Inc.

- CNA Financial Corporation

- Liberty Mutual Insurance

- The Hartford Financial Services Group, Inc.

- Beazley Group

- Markel Corporation

- RLI Corp

- Swiss Re

- Munich Re

- Berkshire Hathaway Specialty Insurance

- Everest Re Group, Ltd.

- QBE Insurance Group

- Hiscox Ltd.

- AXIS Capital Holdings Limited

- Arch Capital Group Ltd.

- Crum & Forster

- W. R. Berkley Corporation

- Aon plc

- Marsh & McLennan Companies

- Gallagher (Arthur J. Gallagher & Co.)

Frequently Asked Questions

Analyze common user questions about the Professional Liability Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between Professional Liability Insurance and General Liability Insurance?

Professional Liability Insurance (PLI), or E&O, covers financial losses caused by professional errors, negligence, or failure to perform services. General Liability Insurance covers bodily injury or property damage claims resulting from standard business operations, excluding professional advice or service failure. PLI is specific to the intellectual and advisory aspects of a professional's work.

How is the market adapting to professional liability risks arising from Artificial Intelligence (AI) adoption?

The market is adapting by developing specialized Tech E&O endorsements and new policies specifically addressing algorithmic negligence, data bias, and reliance on autonomous systems. Insurers are focusing on attributing liability in scenarios where AI output leads to client financial loss, requiring a shift in underwriting focus from human error to technological product failure.

Why is the Asia Pacific (APAC) region experiencing the fastest growth in the PLI market?

APAC's accelerated growth is fueled by rapid urbanization, increased professionalization of local services, greater awareness of litigation risks, and rising foreign direct investment which mandates adherence to international insurance standards, particularly in the technology and engineering sectors.

What major factors are restraining the growth of the Professional Liability Insurance market?

Primary restraints include high premium volatility, particularly in hard market cycles which can deter small businesses; regulatory complexity across multiple jurisdictions complicating cross-border policy placement; and inherent challenges in accurately quantifying novel, emerging risks like systemic cyber threats and highly complex technological errors.

Are Professional Liability policies typically 'Claims-Made' or 'Occurrence' based?

Professional Liability policies are predominantly written on a 'Claims-Made' basis. This means the policy only covers claims reported during the policy period, provided the wrongful act also occurred after the designated retroactive date. This format is preferred by carriers for managing the long-tail nature of professional liability exposures, unlike 'Occurrence' forms which cover incidents that happen during the policy period regardless of when the claim is reported.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager