Professional Pest Control Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433031 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Professional Pest Control Market Size

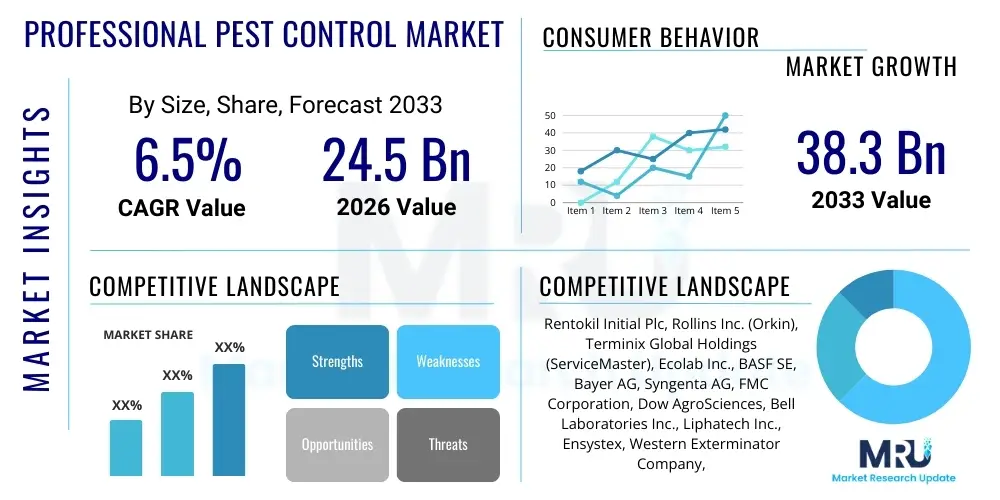

The Professional Pest Control Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 24.5 Billion in 2026 and is projected to reach USD 38.3 Billion by the end of the forecast period in 2033.

Professional Pest Control Market introduction

The Professional Pest Control Market encompasses specialized services provided by certified companies to manage, eliminate, and prevent pest infestations in residential, commercial, and industrial settings. These services utilize advanced techniques, integrated pest management (IPM) strategies, and specialized chemicals or biological agents to control various pests including insects, rodents, and nuisance wildlife. The core product offering revolves around expertise, safety, and guaranteed efficacy, moving beyond simple application to comprehensive risk assessment and long-term prevention planning tailored to specific environmental and regulatory requirements. Key applications span across high-density residential complexes, critical infrastructure like hospitals and food processing facilities, and sensitive commercial spaces such as hotels and educational institutions, where pest control is non-negotiable for hygiene and structural integrity.

The primary benefit of professional pest control lies in safeguarding public health and protecting physical assets from structural damage caused by pests like termites and rodents. These services significantly reduce the risk of disease transmission associated with vectors such as mosquitoes, ticks, and cockroaches, thereby contributing directly to societal well-being and reducing healthcare burdens. Furthermore, in commercial sectors, maintaining a pest-free environment is crucial for regulatory compliance, brand reputation protection, and ensuring uninterrupted operations, especially in supply chain logistics and food manufacturing where contamination risks are highly sensitive. Professional services offer reliability and expertise that DIY methods cannot match, particularly when dealing with severe infestations or complex pest behaviors requiring specialized knowledge and restricted-use products.

Driving factors for market expansion include accelerating urbanization, which concentrates populations and increases waste generation, thereby creating ideal conditions for pest proliferation, particularly in developing economies. Heightened public awareness regarding hygiene standards, coupled with increasingly stringent regulatory mandates for pest management in the food and healthcare industries globally, compels businesses to invest in continuous professional services. Additionally, climate change influences the migration and breeding cycles of several major pest types, expanding their geographical range and increasing the duration of pest seasons, necessitating more frequent and sophisticated professional interventions to mitigate recurring threats.

Professional Pest Control Market Executive Summary

The global Professional Pest Control Market is currently characterized by significant consolidation, with major players aggressively pursuing mergers and acquisitions to expand geographical footprints and diversify service portfolios, particularly towards specialized, non-chemical treatment options like heat treatments and biological controls, aligning with growing sustainability trends. Business trends highlight a strong shift towards subscription-based, recurring service models, emphasizing Integrated Pest Management (IPM) for proactive maintenance rather than reactive extermination, which provides stable revenue streams for service providers. Technology integration, notably the use of IoT sensors, remote monitoring, and advanced data analytics, is rapidly becoming a competitive differentiator, enabling more precise pest detection and resource allocation, optimizing technician efficiency and enhancing service transparency for customers. This focus on efficiency and digitalization is driving investment in training and sophisticated equipment across the industry value chain.

Regionally, North America and Europe remain mature markets characterized by high service penetration and stringent regulatory frameworks, driving demand for specialized, environmentally friendly solutions and advanced certification standards. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, propelled by rapid infrastructure development, exponential population growth, increasing disposable incomes, and subsequent demand for improved living standards and hygiene. Countries like China and India are experiencing significant increases in commercial service adoption, driven by global supply chain requirements and the expansion of multinational food service and hospitality brands. Latin America and the Middle East & Africa (MEA) are also exhibiting steady growth, primarily fueled by tourism development and necessary public health initiatives addressing vector-borne diseases.

Segment trends indicate robust growth in the termite and bed bug control sectors due to their destructive nature and high resistance to traditional treatments, demanding specialized, high-value interventions. The commercial application segment, particularly Food & Beverage Processing and Hospitality, continues to dominate the market share due to stringent compliance requirements and the catastrophic financial and reputational consequences of infestations. Furthermore, there is a pronounced segment shift towards green and organic pest control methods, driven by consumer preference and environmental regulations, pushing manufacturers and service providers to innovate in botanical and low-toxicity product formulations. Digital engagement and customer self-service portals for scheduling and reporting are also becoming standard expectations across all end-user segments.

AI Impact Analysis on Professional Pest Control Market

Analysis of common user questions reveals strong interest focused on how Artificial Intelligence (AI) can revolutionize pest detection accuracy, predictive modeling of infestations, and optimize operational logistics within the Professional Pest Control Market. Users frequently inquire about the reliability of AI-powered monitoring systems, specifically related to distinguishing between pest species and minimizing false positives, and how this technology might reduce the reliance on chemical treatments through targeted application. A major concern revolves around the cost-effectiveness and scalability of implementing sophisticated AI and IoT infrastructure, especially for smaller, independent pest control operators (PCOs). Furthermore, there is substantial curiosity regarding AI's role in synthesizing large datasets (weather patterns, structural data, historical infestation records) to forecast future pest outbreaks, thereby shifting the industry decisively from reactive response to proactive, preventative service provision, ensuring higher customer satisfaction and efficiency gains.

AI is set to transform the market by enabling true integrated smart pest management systems. These systems utilize computer vision algorithms integrated into specialized traps and cameras to automatically identify, count, and track pest activity in real-time, providing highly granular data that far surpasses traditional manual inspections. This automated surveillance capability allows PCOs to pinpoint the exact locations requiring treatment, significantly reducing unnecessary pesticide use and improving the efficacy of treatment plans. Moreover, AI algorithms can analyze complex environmental data inputs, such as humidity, temperature fluctuations, and structural vulnerabilities, to generate probability maps for potential infestation zones, allowing service providers to conduct preventative maintenance calls precisely when and where they are most needed, thereby maximizing resource efficiency and minimizing labor costs associated with routine, unproductive site visits.

Beyond detection and prediction, AI applications are streamlining back-office operations and customer engagement. Machine learning is being applied to route optimization for field technicians, considering real-time traffic, service urgency, and technician skill sets, leading to reduced fuel consumption and increased service capacity per day. For customer relations, AI-powered chatbots and analytical tools process client feedback and service history to personalize maintenance schedules and tailor communication, enhancing the overall customer experience and increasing retention rates. This comprehensive digital transformation driven by AI elevates the professional pest control offering from a manual service industry to a technology-enabled, data-driven preventive health service.

- AI-driven sensor networks provide continuous, automated pest monitoring and real-time identification.

- Predictive analytics models use historical data and environmental factors to forecast outbreak risks and severity.

- Optimized field service routing and scheduling improve technician efficiency and reduce operational costs.

- Computer vision assists in precise pest population estimation, reducing reliance on subjective manual inspection.

- Machine learning algorithms refine Integrated Pest Management (IPM) strategies for hyper-targeted chemical application.

- Enhanced data reporting and transparency facilitate better compliance monitoring for regulated industries (e.g., Food & Beverage).

DRO & Impact Forces Of Professional Pest Control Market

The Professional Pest Control Market growth is substantially driven by increasing global awareness of vector-borne diseases, which necessitates continuous, high-quality pest management services to protect public health, especially in areas affected by expanding mosquito and tick populations due to climate change. Simultaneously, the stringent regulatory environment, particularly concerning food safety and sanitation in developed nations, compels commercial entities to secure professional, documented services, making compliance a key purchasing driver. Restraints primarily involve the environmental and health concerns associated with chemical pesticide use, which forces companies to continually invest in expensive research and development for safer, green alternatives, increasing operational costs. Furthermore, the market faces a continuous challenge from the emergence of pesticide-resistant pest strains, requiring more complex, multi-pronged treatment protocols.

Key opportunities within the market are centered around technological innovation and geographic expansion. The proliferation of smart home technology and IoT devices creates avenues for integrating advanced, AI-enabled monitoring systems into residential and small commercial properties, expanding the reach of preventative services and offering premium packages. Secondly, the rapid urbanization and industrialization occurring in emerging markets, such as Southeast Asia and Sub-Saharan Africa, represent vast untapped potential for scaling professional services, particularly in the newly built commercial and industrial sectors where hygiene standards are rapidly rising. Service diversification into related areas, such as air quality management, insulation installation, and mold remediation, also allows PCOs to leverage existing customer relationships and technician skills for enhanced revenue streams.

The impact forces shaping the market dynamically include high regulatory pressure (Environmental Force), which pushes the industry towards sustainable IPM practices and away from legacy broad-spectrum chemicals. Consumer expectations (Social Force) demand transparency, safety, and immediacy, accelerating the adoption of digital reporting and rapid response systems. Furthermore, the competitive intensity (Economic Force) is high, characterized by the presence of large global consolidators and numerous small, local operators, fostering aggressive pricing strategies and constant pressure for service differentiation through specialized expertise, such as high-risk commodity fumigation or wildlife relocation. Technology (Technological Force) acts as a pervasive impact force, driving efficiency improvements and enabling precision application, fundamentally altering the delivery model of pest control services.

Segmentation Analysis

The Professional Pest Control Market is comprehensively segmented based on the type of pest targeted, the application setting, and the methods or products used for control. This detailed segmentation allows stakeholders to analyze specific demand patterns and regulatory impacts within distinct market niches. The diversity in pest biology, ranging from highly destructive wood-boring insects like termites to pervasive public health pests such as rodents and cockroaches, necessitates varied service offerings, influencing pricing and service contract complexity. Furthermore, the distinction between residential, commercial, and industrial applications is critical, as each end-user category has fundamentally different tolerance levels, regulatory requirements, and service frequency needs, driving differential growth across these segments and dictating the necessary scale and expertise of the service provider.

- Pest Type:

- Insects (Cockroaches, Ants, Bed Bugs, Termites, Mosquitoes, Others)

- Rodents (Rats, Mice)

- Wildlife (Birds, Bats, Skunks, Raccoons)

- Others (Snakes, Spiders, etc.)

- Method of Control:

- Chemical Control (Sprays, Baits, Dusts, Fumigants)

- Mechanical Control (Traps, Barriers, Exclusion Methods)

- Biological Control (Use of natural enemies)

- Physical Control (Heat treatment, Freezing)

- Application:

- Commercial:

- Food & Beverage Processing

- Hospitality (Hotels, Restaurants)

- Healthcare Facilities

- Retail and Warehousing

- Corporate Offices

- Residential

- Industrial

- Agricultural (Limited Professional Services)

- Commercial:

Value Chain Analysis For Professional Pest Control Market

The value chain for the Professional Pest Control Market begins with the upstream segment involving the R&D and manufacturing of active ingredients, formulated pesticides, and specialized control equipment, where key chemical and technological companies play a dominant role. These manufacturers focus heavily on product innovation, adhering to global safety and environmental regulations, ensuring that their formulations address emerging pest resistance issues. Midstream activities involve the distribution of these professional-grade products through authorized national and regional distributors, who manage inventory, logistics, and technical training, ensuring compliance with local hazardous material handling laws. Effective upstream management is critical as the quality and approval status of the products directly influence the service provider’s efficacy and reputation.

The core of the value chain resides in the service provision segment, which includes the pest control operators (PCOs) themselves, ranging from large, multinational corporations to small, independent local providers. These PCOs execute the downstream services: conducting inspections, risk assessments, deploying Integrated Pest Management (IPM) plans, applying treatments, and providing detailed documentation and follow-up monitoring. The distribution channel is predominantly direct, especially for established, recurring commercial contracts, where the PCO interacts directly with the end-user (e.g., hospital administrator, restaurant manager). However, indirect channels also exist, particularly through facilities management companies or property management firms that contract PCO services on behalf of multiple properties or tenants, acting as intermediaries and volume aggregators.

Downstream activities are focused on customer retention and recurring service contracts. The success in the downstream is highly dependent on the quality of the technical labor force, continuous training on new regulations and technologies, and the implementation of customer relationship management (CRM) systems for scheduling and reporting. The shift towards AIO-enabled monitoring systems is increasing the interaction complexity within the downstream, demanding PCOs to manage not only physical treatments but also the data analytics generated by smart traps and sensors. Overall, high competition at the service level drives PCOs to continuously seek operational efficiencies and technological advancements to deliver higher value through comprehensive, data-backed preventative maintenance programs rather than relying solely on product potency.

Professional Pest Control Market Potential Customers

Potential customers for the Professional Pest Control Market are broadly categorized into three main segments: residential, commercial, and industrial, each exhibiting distinct service needs and purchasing behaviors. Residential customers are typically focused on eliminating immediate threats (e.g., termites, bed bugs, or general pests) and require accessible, safe, and immediate services, often driven by comfort and health concerns. This segment increasingly demands environmentally friendly solutions and clear communication regarding treatment schedules and safety protocols. The rise of multi-family housing and complex residential developments also generates substantial demand for bulk contracts managed by property owners or associations.

The commercial sector constitutes the largest and most consistently growing segment, driven by non-negotiable compliance, brand integrity, and the necessity to maintain operational continuity. Key commercial buyers include the Food & Beverage industry (restaurants, processing plants, distribution centers), where sanitation is paramount and regulatory audits are frequent, making long-term, verifiable IPM contracts essential. Similarly, the Hospitality sector (hotels, resorts) and Healthcare facilities (hospitals, clinics) require highly discreet, effective, and frequent pest management to safeguard patient/guest health and reputation, often demanding 24/7 service access and sophisticated reporting systems for internal quality assurance.

The industrial and institutional segments, including warehouses, pharmaceutical manufacturing, governmental facilities, and schools, are also major buyers. These customers typically require specialized services, such as stored product pest control, fumigation of large-scale structures, or complex wildlife management around infrastructure. These contracts are often high-value, long-term engagements emphasizing prevention, detailed structural maintenance advice, and adherence to specific global or national safety standards. Buyers in this segment prioritize expertise, guaranteed results, and comprehensive insurance coverage from their service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 24.5 Billion |

| Market Forecast in 2033 | USD 38.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rentokil Initial Plc, Rollins Inc. (Orkin), Terminix Global Holdings (ServiceMaster), Ecolab Inc., BASF SE, Bayer AG, Syngenta AG, FMC Corporation, Dow AgroSciences, Bell Laboratories Inc., Liphatech Inc., Ensystex, Western Exterminator Company, Massey Services, Arrow Exterminators, Truly Nolen of America, PESTOP, Cleankill Pest Control, Anticimex Group, Killgerm Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Professional Pest Control Market Key Technology Landscape

The professional pest control landscape is undergoing a significant technological evolution, moving away from purely chemical solutions towards sophisticated, data-driven management systems. A cornerstone of this shift is the deployment of Integrated Pest Management (IPM) practices, which are heavily supported by technology such as remote monitoring systems utilizing Internet of Things (IoT) sensors. These sensors, often integrated into traps or detection stations, continuously track pest activity (e.g., rodent movement, cockroach count) and environmental conditions (temperature, humidity). This real-time data is transmitted to centralized platforms, enabling PCOs to obtain immediate alerts and verify treatment efficacy without physical inspection, dramatically improving the precision and speed of response. This remote visibility not only enhances efficiency but also provides verifiable data for regulatory compliance, a significant selling point in the commercial sector.

Further technological advancements include the increasing use of thermal imaging cameras and specialized drone technology for inspecting inaccessible or high-risk areas, such as roof voids, high warehouses, and large external perimeters, particularly for termite and wildlife control. These tools allow technicians to identify hidden infestations and structural vulnerabilities non-invasively, minimizing disruption to clients’ operations. On the chemical side, innovation is focused on developing highly targeted, low-toxicity formulations, including encapsulated active ingredients, pheromone-based disruptors, and botanical extracts, reducing the environmental footprint while maintaining high efficacy against increasingly resistant pest populations. The need for precision application has also spurred the development of advanced dispensing equipment that accurately meters dosages based on real-time data input.

Finally, the operational technology backbone is crucial, involving sophisticated Field Service Management (FSM) software and Customer Relationship Management (CRM) tools customized for the industry. These platforms handle everything from automated scheduling, route optimization via GPS, digital work orders, secure data storage, and detailed client reporting. The convergence of FSM, CRM, and real-time IoT data streams facilitates a truly predictive maintenance model, allowing service providers to manage vast territories and thousands of recurring contracts efficiently. The adoption of augmented reality (AR) is also emerging, assisting technicians in the field with complex diagnoses and structural mapping, ensuring consistent service quality regardless of individual experience level.

Regional Highlights

- North America: North America, particularly the United States, commands the largest share of the professional pest control market globally, characterized by high consumer awareness, widespread adoption of annual service contracts, and robust commercial demand driven by stringent sanitation laws, especially in the food and healthcare sectors. The market here is mature but highly competitive, dominated by large national and international chains like Rollins and Rentokil Initial, alongside a strong base of regional operators. Growth is fueled by continuous structural pest issues like termites and bed bugs, requiring high-value, specialized treatments, and a steady movement towards highly regulated, sustainable IPM approaches. Technological adoption, including remote sensing and AI-powered diagnostics, is highest in this region, driven by the need for operational efficiency in high-wage economies.

- Europe: The European market demonstrates steady growth, highly influenced by evolving EU directives emphasizing environmental protection, reduced reliance on chemical treatments, and mandatory biocide regulations (e.g., Biocidal Products Regulation, BPR). This regulatory landscape pushes innovation towards non-toxic and mechanical control methods, favoring sophisticated IPM strategies. Western European countries exhibit high market maturity, with consistent demand from the hospitality and manufacturing industries, while Eastern Europe is witnessing faster growth fueled by rising hygiene standards and globalization of food supply chains. The market structure features strong regional leaders and increasing activity from private equity-backed consolidators seeking to unify fragmented national markets.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period due to explosive population growth, rapid urbanization, and massive infrastructure development, leading to increased pest pressure and higher demand for preventative services. China, India, and Southeast Asian nations are key growth engines, driven by the expansion of international commercial businesses, which bring global sanitation standards. The region faces significant public health challenges from vector-borne diseases, creating high institutional and governmental demand for large-scale mosquito and rodent control programs. While the market is highly fragmented, with many small operators, there is increasing investment by global players looking to capitalize on this enormous latent demand and drive professionalization.

- Latin America: This region shows stable growth, primarily driven by tourism, commodity production, and public health campaigns. Countries like Brazil and Mexico see high demand for both residential and commercial services, often related to managing tropical and sub-tropical pests, including significant mosquito and cockroach populations. Economic stability and disposable income levels influence the residential market, while the commercial sector, particularly agriculture-related storage and processing (fumigation services), provides consistent high-value contracts. Regulatory frameworks are often less mature than in North America or Europe, leading to variability in service quality and pricing, although professionalization efforts are increasing.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated in the Gulf Cooperation Council (GCC) countries due to massive construction projects, hospitality sector expansion, and climate conditions that foster intense pest activity. High temperatures and water scarcity necessitate specialized, often chemical-intensive solutions, particularly for desert pests and structural invaders. Africa’s market is largely driven by public health initiatives focusing on vector control in response to endemic diseases, often supported by international aid or government contracts. The commercial growth is tied directly to foreign investment and the adherence to imported standards in oil & gas and logistics industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Professional Pest Control Market.- Rentokil Initial Plc

- Rollins Inc. (Orkin)

- Terminix Global Holdings (ServiceMaster)

- Ecolab Inc.

- BASF SE

- Bayer AG

- Syngenta AG

- FMC Corporation

- Dow AgroSciences

- Bell Laboratories Inc.

- Liphatech Inc.

- Ensystex

- Western Exterminator Company

- Massey Services

- Arrow Exterminators

- Truly Nolen of America

- Anticimex Group

- Killgerm Group

- Pest Control India Pvt. Ltd. (PCI)

- Cook’s Pest Control

Frequently Asked Questions

Analyze common user questions about the Professional Pest Control market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Integrated Pest Management (IPM) and why is it replacing traditional chemical control?

IPM is a holistic, sustainable approach emphasizing prevention, monitoring, and non-chemical methods before resorting to targeted chemical use as a last resort. It is replacing traditional methods because it offers superior long-term control, minimizes environmental impact, reduces health risks, and effectively mitigates pest resistance, aligning with global regulatory and consumer demand for sustainability.

How is technology, specifically IoT and AI, transforming professional pest control services?

IoT sensors and AI are introducing real-time, 24/7 remote monitoring and predictive analytics into the industry. This technology enables PCOs to accurately detect, identify, and localize infestations automatically, optimizing resource allocation, reducing unnecessary service visits, and ensuring hyper-targeted treatment, thereby significantly enhancing efficiency and reporting transparency for commercial clients.

Which pest segment drives the highest demand for specialized professional services globally?

The Termite control segment typically drives the highest value demand for specialized services due to the catastrophic structural damage caused by these pests. Control requires highly specific chemical barriers, monitoring systems, and advanced treatment methods (such as fumigation or baiting) that command premium pricing and specialized technical expertise, often involving multi-year service guarantees.

What are the primary challenges affecting market growth in mature regions like North America and Europe?

The primary challenges include stringent regulatory restrictions on key chemical active ingredients, leading to continuous R&D pressure for alternatives; the high operational cost of adopting new technologies and training skilled labor; and the increasing resistance of major pests (e.g., bed bugs, rodents) to established treatment protocols, demanding more complex and costly solutions.

How significant is the commercial application segment compared to the residential segment in terms of market revenue?

The commercial segment is significantly more valuable in terms of overall market revenue compared to residential services. Commercial customers, particularly those in Food & Beverage, Hospitality, and Healthcare, require mandatory, high-frequency, long-term contractual services driven by strict regulatory compliance, leading to higher average contract values and stable recurring revenue streams for PCOs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager