Programmable Infusion Pumps and Catheters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435143 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Programmable Infusion Pumps and Catheters Market Size

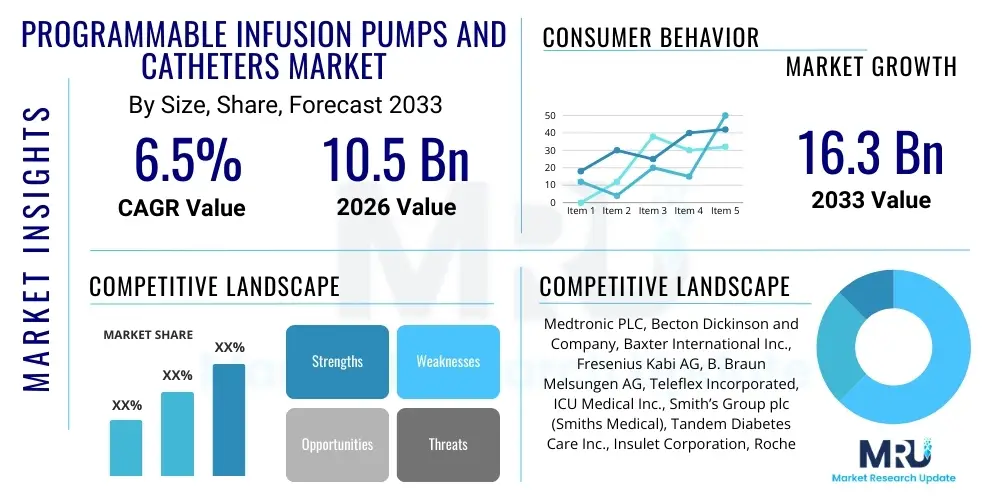

The Programmable Infusion Pumps and Catheters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $16.3 Billion by the end of the forecast period in 2033.

Programmable Infusion Pumps and Catheters Market introduction

The Programmable Infusion Pumps and Catheters Market encompasses highly sophisticated medical devices essential for the precise delivery of fluids, nutrients, and medications, such as insulin, antibiotics, chemotherapy drugs, and pain relievers, directly into a patient's body in controlled amounts. Programmable pumps are characterized by their ability to automate complex delivery schedules, ensuring high accuracy and reducing the potential for human error associated with manual drug administration. These systems are crucial in settings ranging from acute care hospitals and specialized clinics to home healthcare, driving demand through improved patient safety and workflow efficiency.

Major applications for these systems span across critical care, oncology, chronic pain management, and notably, diabetes care, where smart insulin pumps are becoming standard. The technological convergence of programmable logic, wireless connectivity, and advanced safety features, such as Dose Error Reduction Software (DERS) and integrated drug libraries, defines the current generation of devices. These innovations not only enhance therapeutic effectiveness but also enable seamless data integration with Electronic Health Records (EHRs), facilitating better clinical decision-making and remote monitoring. The evolution of catheter technology, providing specialized access points and minimizing risks of infection or phlebitis, complements the operational precision of the pumps, offering a unified solution for controlled substance delivery.

Key market benefits include enhanced medication safety through precise dosage control, improved patient mobility, and reduced length of hospital stays due to the feasibility of ambulatory and home infusion therapies. Driving factors propelling this market include the escalating global prevalence of chronic diseases requiring long-term pharmacological management, the aging population necessitating extensive medical interventions, and substantial investments in smart healthcare infrastructure. Furthermore, regulatory bodies are increasingly favoring connected devices that offer robust traceability and safety protocols, thereby accelerating the adoption of advanced programmable systems over conventional gravity-fed or non-programmable mechanical pumps.

Programmable Infusion Pumps and Catheters Market Executive Summary

The Programmable Infusion Pumps and Catheters Market is experiencing robust expansion driven by critical advancements in patient safety features, particularly the mandatory integration of intelligent software designed to mitigate medication errors. Current business trends indicate a strong industry focus on developing interoperable smart pumps capable of communicating bidirectionally with hospital IT systems, ensuring seamless data flow and enhanced clinical oversight. Mergers and acquisitions focusing on specialized catheter technologies and wireless connectivity platforms are reshaping the competitive landscape, pushing larger players toward offering holistic, integrated infusion management platforms rather than standalone devices. The shift towards miniaturization, driven by increasing demand for wearable and ambulatory pumps, represents a significant growth vector, allowing patients greater freedom and quality of life.

Regionally, North America maintains the leading market share due to its sophisticated healthcare infrastructure, high adoption rate of advanced medical technology, and significant expenditure on chronic disease management, particularly oncology and pain therapy. Europe follows closely, characterized by stringent regulatory standards (like MDR), which necessitate the rapid upgrade of existing pump fleets to comply with enhanced safety and data security requirements. The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by improving healthcare access, rapid infrastructure development in emerging economies like China and India, and a burgeoning patient pool suffering from lifestyle-related chronic ailments such as diabetes, driving substantial investment in programmable systems.

Segmentation analysis reveals that the Volumetric Pumps segment, critical in hospital acute care settings, continues to hold the largest revenue share, though the Specialty Pumps segment, including insulin and pain management systems, is witnessing the fastest expansion due to their targeted therapeutic application. Within End-Users, Hospitals remain the primary purchasers, yet Alternate Care Settings, including Ambulatory Surgical Centers (ASCs) and Home Healthcare facilities, are increasingly crucial due to the global movement toward decentralized care. Segment trends are converging on maximizing connectivity, security, and user experience, emphasizing pumps that minimize setup time and reduce cognitive load on clinical staff, thereby translating technological complexity into simplified operation.

AI Impact Analysis on Programmable Infusion Pumps and Catheters Market

Common user questions regarding the integration of Artificial Intelligence (AI) into the Programmable Infusion Pumps and Catheters market center heavily on safety, predictive maintenance, and autonomous dosage adjustment. Users frequently inquire about the reliability of AI algorithms in complex clinical scenarios, such as titration during critical care, and the regulatory pathways governing AI-driven therapeutic delivery. Key themes emerging from these concerns include validating AI's role in predicting potential occlusions or device malfunctions, optimizing complex polypharmacy delivery schedules, and establishing clear lines of accountability when dosage errors occur due to algorithmic decisions. There is high expectation that AI will transition pumps from reactive devices to proactive, self-optimizing therapeutic systems, significantly reducing the risk of infusion-related adverse events and improving patient outcomes through highly personalized medication profiles.

The integration of AI leverages real-time physiological data collected from peripheral monitoring devices, transforming traditional programmable pumps into 'smart' analytical tools. Machine learning models analyze trends in patient vital signs, drug absorption rates, and historical response data to fine-tune infusion rates dynamically, ensuring the therapeutic window is optimally maintained. This capability moves beyond static drug libraries to context-aware delivery, minimizing over- or under-dosing. Furthermore, AI enhances operational efficiency by optimizing pump deployment, predicting battery life failures, and identifying necessary calibration schedules, thereby reducing equipment downtime and streamlining hospital inventory management. This shift introduces a new paradigm of precision infusion therapy, requiring collaboration between medical device manufacturers, clinical informaticists, and regulatory bodies to ensure patient safety remains paramount.

- AI enhances Dose Error Reduction Software (DERS) through predictive modeling, anticipating potential dosage conflicts or patient sensitivities before administration begins.

- Machine learning algorithms optimize personalized titration schedules in real-time based on continuous monitoring of patient physiological parameters (e.g., blood pressure, glucose levels).

- Predictive maintenance analytics, powered by AI, forecast pump failures, occlusion risks, and component degradation, increasing device uptime and operational reliability.

- AI facilitates robust cybersecurity monitoring by identifying and flagging anomalous network activity, protecting connected smart pumps from unauthorized access or manipulation.

- Improved workflow efficiency is achieved by AI-driven automated documentation and integration with EHRs, reducing manual data entry burden on nursing staff.

DRO & Impact Forces Of Programmable Infusion Pumps and Catheters Market

The market growth is primarily driven by the imperative need for enhanced patient safety, stemming from high-profile instances of medication errors associated with conventional infusion methods. The increasing incidence of chronic diseases, particularly diabetes and cancer, mandates sophisticated, long-term drug delivery solutions, providing a continuous demand impetus. Opportunities arise significantly from the advancement of wireless connectivity and interoperability standards (HL7, FHIR), allowing seamless integration into hospital digital ecosystems and paving the way for advanced remote monitoring solutions. These dynamics collectively exert a powerful, positive impact force, transforming infusion therapy from a manual process into a highly automated and interconnected clinical discipline.

However, significant restraints temper this expansion. High initial procurement costs associated with advanced programmable systems, especially those featuring DERS and connectivity capabilities, pose a substantial challenge, particularly in low-resource settings. Furthermore, recurring high-profile recalls related to software glitches, battery failures, and complex usability issues severely undermine clinical trust and necessitate exhaustive regulatory oversight, slowing the pace of adoption. The market also grapples with the complexity of ensuring robust cybersecurity for networked devices, as connected pumps represent potential vulnerabilities that could compromise patient safety and data privacy, requiring continuous and costly security updates.

Impact forces are multifaceted: technological advancements act as a major accelerating force, pushing device capabilities toward smaller, smarter, and more personalized systems. Conversely, regulatory scrutiny, while ensuring safety, acts as a decelerating force, introducing lengthy and expensive certification processes. The ongoing shift toward home healthcare and ambulatory settings presents a substantial opportunity force, expanding the market scope beyond traditional hospital walls. Strategic responses to these forces involve rigorous post-market surveillance, investment in user-friendly interfaces to minimize training requirements, and collaborative efforts to establish industry-wide cybersecurity standards, ensuring long-term market sustainability and growth.

Segmentation Analysis

The Programmable Infusion Pumps and Catheters market is meticulously segmented based on product complexity, therapeutic application, and end-user setting, reflecting the diverse clinical needs inherent in modern healthcare delivery. Segmentation by product type distinguishes between large volume, syringe, and ambulatory pumps, each catering to specific flow rate and portability requirements. Application segmentation highlights the dominance of oncology and pain management, while end-user categorization emphasizes the crucial role of institutional settings versus increasingly important alternate care sites. This structure provides manufacturers with targeted strategies to address specific clinical workflows and regulatory demands across the global market.

- By Product Type:

- Volumetric Pumps

- Syringe Pumps

- Ambulatory/Portable Pumps

- Enteral Pumps

- Implantable Pumps

- By Application:

- Oncology/Chemotherapy

- Pain Management (PCA Pumps)

- Diabetes (Insulin Pumps)

- Gastroenterology

- Pediatrics/Neonatology

- Blood Transfusion

- By Technology:

- Smart Pumps (with DERS and Connectivity)

- Traditional Pumps

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings

- Long-Term Care Facilities

Value Chain Analysis For Programmable Infusion Pumps and Catheters Market

The value chain for Programmable Infusion Pumps and Catheters begins with upstream activities focused on the procurement of high-precision components, including microprocessors, specialized plastics for pump casings, high-grade polymers for catheter construction, and sophisticated sensor technology. Key upstream drivers are technological innovation in miniaturization and the stringent quality control required for medical-grade materials, ensuring biocompatibility and device longevity. Manufacturers must manage complex global supply chains for electronics and disposable sterile components, facing pressure related to raw material costs and compliance with ISO standards for medical device production.

The manufacturing phase involves complex assembly, software integration, and rigorous testing, particularly concerning the validation of Dose Error Reduction Software (DERS) and cybersecurity features. Direct distribution channels, where large manufacturers sell directly to major hospital networks, are prevalent, offering specialized training, technical support, and long-term service contracts crucial for complex capital equipment. Indirect channels involve authorized distributors and Group Purchasing Organizations (GPOs), particularly effective for reaching smaller clinics and home healthcare providers, facilitating procurement efficiency and competitive pricing.

Downstream activities center on deployment, training, maintenance, and ongoing consumables supply (catheter sets, administration sets). Post-sale service is a critical value differentiator, encompassing remote monitoring capabilities, software updates, and predictive maintenance to minimize pump downtime, a vital factor in acute care settings. The final stage involves the end-user clinical application, where the seamless interaction between the device and healthcare provider determines therapeutic effectiveness and patient satisfaction, reinforcing the necessity for continuous clinical feedback loops to inform future product development and regulatory compliance.

Programmable Infusion Pumps and Catheters Market Potential Customers

The primary customers for Programmable Infusion Pumps and Catheters are institutional purchasers characterized by high volume usage and stringent quality requirements, predominantly hospitals. Within the hospital setting, key buyers include critical care units, operating theaters, pediatric wards, and oncology centers, where the need for precise, continuous, and often multi-channel infusion is paramount. These institutional customers often prioritize features such as interoperability with existing electronic health records (EHRs), centralized alarm management systems, and large standardized drug libraries to ensure enterprise-wide safety protocols.

Secondary, yet rapidly growing, customer segments include Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics focusing on chronic disease management (e.g., pain clinics and dialysis centers). These facilities require portable, user-friendly pumps that support rapid patient turnover and maintain high safety standards without the extensive infrastructure of a large hospital. Furthermore, the burgeoning home healthcare segment, driven by value-based care models, represents an increasing number of potential buyers, particularly for small, lightweight ambulatory and patch pumps tailored for patient self-administration and remote clinician oversight.

For specialized devices, such as implantable or wearable insulin pumps, the direct end-user (the patient) or their payer (insurance company) becomes a crucial decision-maker, focusing on parameters like ease of use, comfort, battery life, and connectivity to mobile health applications. Procurement decisions across all segments are heavily influenced by clinical efficacy data, total cost of ownership (including consumables), compliance with national safety guidelines, and the reliability of after-sales technical support provided by the device manufacturer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $16.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic PLC, Becton Dickinson and Company, Baxter International Inc., Fresenius Kabi AG, B. Braun Melsungen AG, Teleflex Incorporated, ICU Medical Inc., Smith’s Group plc (Smiths Medical), Tandem Diabetes Care Inc., Insulet Corporation, Roche Diagnostics, Moog Inc., Terumo Corporation, Zimmer Biomet Holdings, Boston Scientific Corporation, Johnson & Johnson, Nipro Corporation, Zyno Medical LLC, Micrel Medical Devices SA, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Programmable Infusion Pumps and Catheters Market Key Technology Landscape

The technological landscape of Programmable Infusion Pumps is rapidly evolving, moving beyond simple volumetric control to encompass sophisticated connectivity and intelligent safety mechanisms. The single most impactful technology is the integration of Dose Error Reduction Software (DERS) and comprehensive drug libraries, which utilize built-in logic and pre-set limits to prevent clinically significant medication overdoses or underdoses. This advancement directly addresses primary concerns regarding medication administration safety and is increasingly mandated by regulatory bodies globally. Furthermore, the shift towards smart pump technology, which incorporates Wi-Fi and Bluetooth capabilities, allows pumps to communicate wirelessly with centralized hospital servers and Electronic Health Records (EHRs), streamlining documentation and enabling real-time remote monitoring by clinical pharmacists and nurses, ensuring immediate intervention when safety limits are breached.

Miniaturization and sensor technology represent another critical development axis. The increasing popularity of lightweight, ambulatory, and patch-based pumps—especially prominent in insulin and chronic pain management—is driven by advancements in microfluidics and smaller, more efficient battery technology. These wearable systems incorporate highly sensitive pressure sensors and air-in-line detection mechanisms that enhance patient safety while significantly improving mobility and convenience for long-term therapy. The development of advanced antimicrobial catheter materials, often incorporating silver or other specialized coatings, is essential in reducing Catheter-Related Bloodstream Infections (CRBSIs), which remains a major complication and cost burden in infusion therapy, thereby integrating safety features across both the pump and the delivery vehicle.

Finally, the growing adoption of sophisticated data analytics and AI/Machine Learning models is defining the next generation of infusion technology. Beyond basic DERS, new systems are integrating predictive maintenance algorithms that analyze usage patterns and component diagnostics to forecast potential hardware failures, thereby maximizing uptime and device reliability. Moreover, advanced integration with patient monitoring devices allows for closed-loop systems, particularly in diabetes care, where continuous glucose monitor (CGM) data dynamically informs and adjusts insulin delivery in a semi-autonomous fashion, representing the pinnacle of precision medicine application within this market sector.

Regional Highlights

North America currently dominates the Programmable Infusion Pumps and Catheters Market, primarily driven by early and widespread adoption of smart pump technology, substantial healthcare expenditure, and a highly competitive landscape fostering continuous innovation. The stringent regulatory environment, particularly concerning patient safety standards set by the FDA, mandates the use of DERS-equipped smart pumps in acute care settings, fueling demand for replacement and upgrade cycles. The U.S. market benefits from robust reimbursement policies for chronic disease treatments, ensuring accessibility to high-cost, advanced infusion systems, particularly within oncology and complex pain management programs. Technological leadership and high levels of awareness regarding infusion errors further solidify this region's market supremacy.

Europe represents a mature market with significant growth potential, characterized by high adoption rates in countries such as Germany, the UK, and France. The transition to the Medical Device Regulation (MDR) has accelerated the need for compliance-driven upgrades, forcing manufacturers to modernize legacy pump fleets to meet enhanced safety and data documentation requirements. While adoption is high, market dynamics are influenced by national healthcare budgets and centralized purchasing by large public health systems, which often prioritize cost-effectiveness alongside safety features. Focus in this region is placed heavily on standardization, interoperability, and cybersecurity measures to protect patient data within interconnected hospital networks.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, driven by demographic changes, rapidly expanding healthcare infrastructure, and rising disposable incomes across developing nations like India, China, and South Korea. Increased awareness and investment in managing chronic conditions, particularly diabetes and cardiovascular diseases, necessitate the deployment of modern infusion systems. Although the initial adoption might favor cost-effective traditional pumps in rural areas, major urban medical centers are rapidly installing advanced smart pump technology to align with international standards. Market entry strategies in APAC often focus on localized manufacturing and specialized training programs to address the diverse healthcare settings and varying levels of clinical expertise across the region.

Latin America and the Middle East & Africa (MEA) represent emerging markets with nascent but accelerating growth. In Latin America, economic volatility and inconsistent healthcare funding present adoption barriers, leading to slower procurement cycles; however, growth is notable in private healthcare sectors aiming for high-quality care. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits high investment in state-of-the-art medical technology funded by oil wealth, driving demand for premium, highly connected smart pump systems in newly constructed specialized hospitals. Market development in these regions is heavily reliant on international partnerships, technology transfer, and overcoming infrastructural limitations related to reliable power supply and network connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Programmable Infusion Pumps and Catheters Market.- Medtronic PLC

- Becton Dickinson and Company (BD)

- Baxter International Inc.

- Fresenius Kabi AG

- B. Braun Melsungen AG

- Teleflex Incorporated

- ICU Medical Inc.

- Smith’s Group plc (Smiths Medical)

- Tandem Diabetes Care Inc.

- Insulet Corporation

- Roche Diagnostics

- Moog Inc.

- Terumo Corporation

- Zimmer Biomet Holdings

- Boston Scientific Corporation

- Johnson & Johnson

- Nipro Corporation

- Zyno Medical LLC

- Micrel Medical Devices SA

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Programmable Infusion Pumps and Catheters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a smart programmable infusion pump over a traditional pump?

The primary benefit of a smart programmable infusion pump is enhanced patient safety through integrated Dose Error Reduction Software (DERS) and drug libraries. These features validate and restrict medication dosage entries, significantly mitigating the risk of medication administration errors.

How does the shift to home healthcare impact the demand for infusion pumps?

The shift to home healthcare drastically increases demand for highly portable, lightweight, and user-friendly ambulatory and patch-based programmable pumps. These systems allow patients to manage complex therapies outside clinical settings while maintaining safety and remote connectivity for clinician oversight.

What role does cybersecurity play in the Programmable Infusion Pumps Market?

Cybersecurity is critical as smart pumps are networked medical devices vulnerable to external threats. Manufacturers must ensure robust encryption and intrusion detection to protect patient data and prevent unauthorized manipulation of dosage delivery, maintaining device integrity and patient safety.

Which segment of programmable infusion pumps is growing fastest?

The Ambulatory/Portable Pumps segment, particularly specialized insulin pumps and patient-controlled analgesia (PCA) pumps, is experiencing the fastest growth, driven by the increasing incidence of chronic diseases and the preference for treatments that offer greater patient mobility and autonomy.

What is the Compound Annual Growth Rate (CAGR) projected for this market?

The Programmable Infusion Pumps and Catheters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, reflecting continuous technological adoption and the rising global burden of chronic diseases.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager