Prohibition Signs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437820 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Prohibition Signs Market Size

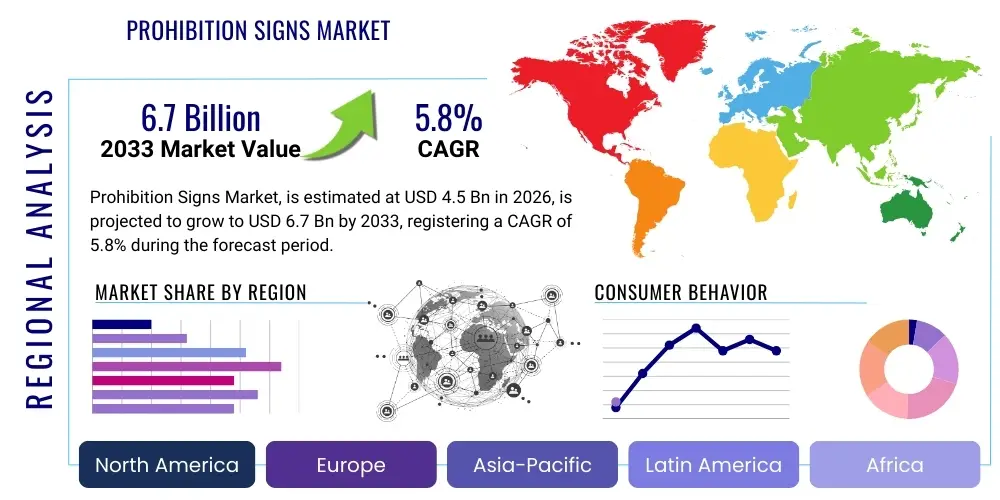

The Prohibition Signs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by rigorous enforcement of global occupational safety and health regulations, mandatory updates to infrastructure safety standards, and increasing corporate accountability across high-risk industries such as manufacturing, construction, oil and gas, and transportation. The necessity of clear, standardized visual communication to prevent accidents and ensure legal compliance forms the bedrock of this steady market growth. Furthermore, the longevity and replacement cycles of signage, coupled with the introduction of advanced, durable materials, contribute significantly to market valuation.

Prohibition Signs Market introduction

The Prohibition Signs Market encompasses the manufacturing, distribution, and deployment of standardized visual indicators explicitly designed to forbid actions or access in specified environments to maintain safety, security, and regulatory compliance. These signs adhere strictly to international standards, such as ISO 7010, ensuring universal comprehension regardless of language barriers. Key products range from basic plastic and aluminum decals to highly durable, photoluminescent, and retroreflective signage critical for high-visibility and emergency applications. Major applications span industrial safety zones, public infrastructure (transportation hubs, construction sites), commercial facilities, healthcare centers, and educational institutions where preventing unauthorized activities like smoking, entry, or specific operational procedures is paramount for operational integrity and life safety.

The primary benefits derived from these products include tangible reductions in workplace incidents, enhanced adherence to global regulatory frameworks (like OSHA and EU Directives), and minimization of organizational legal liability associated with non-compliance. Prohibition signs act as the first line of defense in risk mitigation strategies, clearly communicating necessary behavior modification to prevent accidents, property damage, and operational delays. As regulatory bodies worldwide continue to strengthen safety protocols, the demand for high-quality, durable, and easily identifiable prohibition signage escalates, reinforcing its status as an indispensable safety component across all industrial and public sectors.

Driving factors for this market include the global expansion of industrial and infrastructure development, which inherently increases the need for mandatory safety signage. Furthermore, continuous technological advancements in sign materials, such as the integration of UV-resistant coatings and highly visible glow-in-the-dark properties, enhance product lifespan and effectiveness, particularly in harsh environments. The growing awareness among businesses regarding the catastrophic costs associated with safety violations—including fines, lawsuits, and reputation damage—provides a substantial impetus for proactive investment in compliance signage, thereby propelling sustained market expansion across all geographical regions.

Prohibition Signs Market Executive Summary

The Prohibition Signs Market is characterized by stable demand driven almost entirely by regulatory pressure and compliance mandates rather than discretionary consumer spending. Current business trends indicate a strong move toward standardization, with ISO 7010 becoming the de facto global standard, compelling manufacturers to invest in standardized graphic libraries and production processes. A significant trend involves the adoption of high-performance materials, including specialized plastics and marine-grade aluminum, designed to withstand extreme temperature variations, chemical exposure, and prolonged outdoor use, catering specifically to the oil and gas, chemical, and maritime sectors. Furthermore, the rise of e-commerce platforms has streamlined the procurement process for standardized signage, allowing small and medium-sized enterprises (SMEs) to easily access regulatory compliant products, thereby widening the market reach and increasing fragmentation among specialized providers.

Regionally, North America and Europe maintain market leadership due to stringent, well-established occupational safety regulations enforced by agencies like OSHA (US) and ECHA (EU). These regions demonstrate mature markets emphasizing replacement, modernization, and advanced materials. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by rapid industrialization, massive infrastructure projects (e.g., high-speed rail, manufacturing hubs), and the recent implementation or reinforcement of local safety legislation, particularly in emerging economies like India, China, and Southeast Asian nations. Latin America and the Middle East & Africa (MEA) are also experiencing growth tied to resource extraction projects and urbanization, necessitating fundamental safety signage across construction and mining sites, though adoption rates remain somewhat volatile based on governmental enforcement consistency.

Segmentation trends highlight the increasing dominance of the Photoluminescent and Reflective sign segments, driven by regulatory demands for emergency egress path marking and visibility in low-light conditions, particularly within transportation infrastructure and high-rise commercial buildings. By end-use, the manufacturing and construction sectors remain the largest consumers, given their inherently high-risk environments and mandated compliance requirements for machinery guarding and site access control. Material segmentation shows a subtle shift away from basic vinyl and toward more durable, sustainable, and specialized materials like specialized polymers and treated metals, reflecting a market preference for long-term investment over cost minimization, particularly among major corporate entities aiming for zero-incident policies.

AI Impact Analysis on Prohibition Signs Market

Common user questions regarding AI's impact on the Prohibition Signs Market generally revolve around four key themes: Will traditional signs become obsolete due to smart monitoring? Can AI help customize regulatory signage requirements automatically? How will digital signage, enabled by AI, replace physical signs? And what role does machine learning play in optimizing sign placement and ensuring compliance audit readiness? Users are concerned about the longevity of the physical signage market in an increasingly digitized world, recognizing that while the core regulatory requirement for physical signs persists, the peripheral ecosystem of monitoring and enforcement is rapidly evolving through smart technologies. They seek clarity on whether AI integration will lead to premium, data-driven signage solutions or simply render passive physical signs irrelevant in advanced industrial settings. The underlying expectation is that AI will transform compliance management, but the regulatory necessity of a physical, universally understandable prohibition marker will likely remain intact for the foreseeable future, especially in emergency scenarios.

AI's direct impact on the production of passive physical prohibition signs remains minimal, as the manufacturing process focuses on material science and printing precision, not complex data processing. However, AI significantly influences the market indirectly through enhanced enforcement, monitoring, and auditing processes. Machine vision systems, powered by deep learning, are increasingly deployed in high-risk industrial environments to monitor compliance with safety protocols. These systems can automatically detect non-compliance (e.g., unauthorized entry into a restricted area marked by a prohibition sign) and trigger immediate alerts, linking the passive sign's message directly to active enforcement. This enhanced monitoring capability necessitates higher quality, standardized, and properly positioned physical signs to serve as verifiable data points for the AI systems.

Furthermore, AI algorithms are being developed for advanced compliance management software. These tools can analyze regional, national, and site-specific regulatory changes and automatically generate precise signage installation plans, optimizing location, quantity, and type of prohibition signs required to achieve full legal conformity. This application improves the efficiency of safety managers and drives demand for accurate, highly compliant product inventories from manufacturers. Therefore, while AI doesn't manufacture the sign, it increases the importance of highly standardized, compliant physical signs by making their presence and correct placement verifiable and auditable, reinforcing the market's dependence on certified products rather than diminishing it.

- AI-enabled machine vision systems enhance compliance monitoring around prohibited areas.

- AI algorithms optimize the placement and selection of signs based on real-time regulatory changes and site hazard assessments.

- Predictive analytics can forecast potential non-compliance zones, driving proactive installation of new prohibition signs.

- AI assists in automated auditing processes, confirming that installed signs meet visibility and regulatory standards (AEO/GEO relevance: AI validates physical compliance).

- Integration with IoT systems allows physical signs to trigger digital alerts or warnings when violated, bridging the digital and physical safety gap.

- The development of smart compliance software increases the demand for digitally certifiable and standardized physical signage products.

DRO & Impact Forces Of Prohibition Signs Market

The Prohibition Signs Market is fundamentally influenced by stringent regulatory frameworks, which act as the primary driver, alongside fluctuating raw material costs (Restraint) and the opportunity presented by integrating signage with smart safety systems. The persistent enforcement of global standards like ISO 7010, coupled with local occupational safety acts (OSHA, WHS), mandates the use of clearly defined prohibition signs, ensuring continuous baseline demand regardless of economic cycles. Restraints often center on the volatility of raw material prices, specifically plastics (PVC, polycarbonate) and metals (aluminum), which directly impact manufacturing costs and, consequently, final pricing and profit margins. Opportunities are vast in the realm of advanced materials (e.g., self-cleaning, energy-harvesting, highly durable composites) and the integration of signs into broader IoT safety ecosystems, offering manufacturers avenues for value addition beyond basic compliance products. These factors collectively exert significant impact forces on market dynamics, defining growth ceilings and technological adoption rates.

Drivers: Global legislative mandates requiring comprehensive safety signage are the paramount driver. As industries globalize, the need for universally understandable signage prevents misinterpretation and reduces risks in multinational workforces. Increased public and corporate focus on Environmental, Social, and Governance (ESG) standards pushes companies toward best-practice safety implementations, creating a favorable climate for high-quality sign procurement. Furthermore, recurring mandatory safety audits and the severe penalties associated with non-compliance (fines, operational shutdowns) ensure consistent replacement and expansion demand, especially in rapidly developing economies undergoing infrastructure modernization.

Restraints: The market faces significant headwinds from the commodity pricing of essential manufacturing inputs. Additionally, the proliferation of low-cost, non-compliant, or poorly manufactured signs, often available through unregulated online channels, poses a restraint on premium manufacturers by commoditizing the entry-level segment and potentially compromising safety standards if utilized by unaware buyers. Another restraint involves the long product lifecycle of high-durability signs; while beneficial for end-users, it reduces the frequency of replacement cycles, slightly tempering volume growth in mature industrial sites.

Opportunity: Technological advancements offer substantial opportunities. Developing specialized signs for extreme environments—such as marine, deep-sea exploration, or high-temperature manufacturing—opens niche, high-margin markets. The integration of QR codes, RFID tags, or basic sensor capabilities into physical signs transforms them into smart assets that can interface with facility management systems, offering real-time inventory tracking, usage verification, and maintenance scheduling. This shift towards smart compliance solutions provides diversification opportunities for established market players beyond traditional printing and material conversion.

Impact Forces: The bargaining power of buyers is moderate; while many standardized signs are commodities, the need for certified, high-compliance specialty signs gives power to reputable suppliers. The threat of substitutes is low, as no viable alternative currently exists for legally mandated physical signs, although digital displays pose a minor threat in specific, non-emergency contexts. The intensity of rivalry is high, particularly in the basic compliance segment, driven by price competition. However, in the high-durability and specialized material segments, rivalry is lower, driven instead by technical expertise and regulatory certifications. Supplier power is generally moderate to high, heavily dependent on the volatility and limited sources of specialized materials like reflective sheeting or photoluminescent pigments.

Segmentation Analysis

The Prohibition Signs Market is analyzed based on multiple critical dimensions, including Material Type, Type of Signage, and End-User Industry. Segmentation by Material Type is crucial as it determines durability, environmental resistance, and cost, influencing selection based on the installation environment (e.g., high-impact areas require polycarbonate, outdoor chemical facilities require marine-grade aluminum). The Type of Signage segmentation often distinguishes between standard compliance signs, specialized highly visible signs (photoluminescent, reflective), and electronic/digital signs (though the latter remains niche in true prohibition scenarios), which dictates specific regulatory standards and required functionalities.

Segmentation by End-User Industry is the most dominant analytical axis, reflecting distinct market volumes and purchasing criteria. The construction and heavy manufacturing sectors demand large volumes of robust, temporary, and permanent signage, driven by high workforce turnover and frequent site reconfiguration. Conversely, the healthcare and transportation sectors require high-specification, standardized, and often high-visibility signage tailored for emergency egress and specific equipment prohibition. Understanding these industrial requirements allows manufacturers to tailor compliance packages, streamline distribution channels, and focus marketing efforts toward sectors experiencing high regulatory compliance growth or infrastructure investment.

The continuous refinement of international standards necessitates that manufacturers segment their product offerings based on specific geographical and technical compliance certifications, such as meeting NFPA requirements in the US or specific EU safety directives (e.g., concerning harmful chemical resistance). This ensures that products are not only physically durable but also legally valid in the intended jurisdiction. This rigorous compliance segmentation is critical for market access, especially for global manufacturers serving multinational corporations that require consolidated safety procurement solutions across diverse international operational sites.

- Material Type

- Aluminum (Durable, outdoor use, industrial)

- Plastic/PVC (Cost-effective, indoor, temporary)

- Polycarbonate (High impact resistance)

- Vinyl/Adhesive Labels (Equipment marking, temporary use)

- Fiberglass and Composites (Chemical resistance, extreme environments)

- Type of Signage

- Standard Non-Reflective

- Photoluminescent/Glow-in-the-Dark (Emergency egress)

- Reflective (Low-light visibility, road safety)

- Custom/Multi-Language Signs

- End-User Industry

- Manufacturing and Industrial Facilities

- Construction and Infrastructure Development

- Oil, Gas, and Mining

- Transportation and Logistics (Airports, Ports, Rail)

- Healthcare and Pharmaceutical

- Commercial and Retail Spaces

- Government and Public Sector

- Printing Technology

- Screen Printing (Durability, high volume)

- Digital Printing (Customization, low volume)

- Engraving and Etching

Value Chain Analysis For Prohibition Signs Market

The Value Chain for the Prohibition Signs Market begins with the Upstream Analysis, focusing on the procurement of raw materials, primarily specialized plastics (PVC, polycarbonate, acrylic sheets), metals (aluminum), and high-quality reflective and photoluminescent films, along with specialized UV-resistant inks and adhesives. The profitability in the upstream segment is highly dependent on effective commodity risk management, as pricing volatility of oil-derived plastics directly impacts input costs. Suppliers of highly specialized reflective sheeting (like 3M or Avery Dennison) hold significant bargaining power due to their proprietary technology and compliance certifications necessary for premium, high-visibility signage required in regulated industries such as transportation.

The core midstream activities involve Manufacturing and Conversion, encompassing the design standardization (adherence to ISO, ANSI, OSHA formats), printing (screen, digital, UV inkjet), lamination, die-cutting, and quality control processes, ensuring durability and regulatory compliance. Companies that invest heavily in automated production and rigorous quality assurance protocols (QC) gain competitive advantages by reducing unit costs while maintaining certified compliance. The downstream analysis focuses on Distribution and Installation. Prohibition signs are often sold directly to large industrial entities or through robust indirect channels, including specialized safety equipment distributors, industrial supply wholesalers (e.g., Grainger, Fastenal), and, increasingly, dedicated e-commerce platforms specializing in compliance solutions. Direct sales are common for customized or large-volume procurement by major corporations.

The final stage involves end-user deployment and ongoing maintenance/replacement. Specialized distributors provide value-added services such as site audits, compliance consulting, and professional installation, which are crucial, particularly for complex systems like emergency egress path marking. The predominance of indirect distribution is due to the need for broad market penetration and leveraging existing relationships that industrial supply houses have with diverse end-users. Direct sales are often reserved for highly technical applications or custom sign projects where intellectual property protection or high-level consultation is required, thus ensuring the efficient flow of compliant products from raw material extraction to final, safety-critical installation.

Prohibition Signs Market Potential Customers

Potential customers and end-users of prohibition signs span nearly every sector of the modern economy, unified by the universal need to adhere to workplace safety regulations and manage public liabilities. The most significant and high-volume consumers are concentrated in industries characterized by high operational risk, heavy machinery use, or public access complexity. The Construction and Infrastructure sector is a perennial large buyer, driven by temporary site requirements, evolving safety zones, and mandatory public hazard warnings, requiring large volumes of temporary, weather-resistant signs for access prohibition, scaffolding restrictions, and hard hat mandates. Similarly, the Manufacturing and Industrial sector, encompassing automotive, aerospace, and general fabrication plants, requires extensive permanent signage for machinery lockout/tagout procedures, restricted access areas, and specific chemical handling prohibitions, dictated by strict government oversight agencies.

Beyond traditional industrial sectors, the Transportation and Logistics industry (ports, airports, warehouses, railway operations) represents a fast-growing customer base. Their need is driven by complex logistics protocols and public safety mandates, demanding high-specification, retroreflective, and often photoluminescent signage for prohibiting unauthorized vehicle or pedestrian movement, or entry into sensitive security zones. Healthcare facilities are also critical customers, utilizing prohibition signs to manage infection control (e.g., 'No Entry' during specific procedures), chemical storage restrictions, and access to highly sensitive medical equipment or records. These customers prioritize sanitation, clear communication, and often require unique material compositions resistant to cleaning chemicals.

In essence, the end-user market is broadly divided into regulatory-driven mandatory buyers (Industrial, Construction, Utilities) and liability-driven prudent buyers (Commercial Real Estate, Retail, Education). For a prohibition sign provider, understanding the specific regulatory matrix governing each sector—OSHA for manufacturing, FAA/IMO for transportation, NFPA for fire safety—is essential for successful market penetration. The trend toward centralized procurement in large multinational corporations also means that suppliers capable of delivering standardized, globally compliant sign packages across multiple jurisdictions hold a substantial advantage when targeting these large, high-value potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brady Corporation, 3M Company, Seton (Brady), Safetysign.com, Emedco, Graphic Products, Clarion Safety Systems, National Safety Signs, Safety Media, Accuform Manufacturing, Northern Safety & Industrial, Custom Signs, J. J. Keller & Associates, Zarges GmbH, Signmark, Visual Marking Systems, ComplianceSigns.com, Hi-Vis Safety, Vimar Systems, Heskins. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prohibition Signs Market Key Technology Landscape

The Prohibition Signs Market technology landscape is less about radical digital innovation and more focused on advancements in material science, durable printing methods, and ensuring compliance effectiveness under extreme conditions. A critical technological aspect is the development and application of highly durable, specialized substrates, such as industrial-grade aluminum with anodized finishes, and engineered thermoplastics (e.g., high-density polyethylene and specialized PVC films) that resist chemical corrosion, high UV exposure, and physical abrasion. Advances in material composition ensure longer sign lifecycles, reducing replacement frequency and offering better long-term value to industrial end-users. Furthermore, the mandatory adoption of standardized colors and pictograms (ISO 7010) requires precision color management and printing technology to guarantee international regulatory adherence and prevent visual ambiguity, driving investment in calibrated UV digital and specialized screen-printing equipment.

Another significant technological driver involves enhancing visibility and functionality, particularly through photoluminescent and retroreflective technologies. Photoluminescent (glow-in-the-dark) signs utilize strontium aluminate pigments to absorb ambient light and emit a bright glow during power outages or darkness, making them essential for emergency egress route markings and safety path finding. Retroreflective technology employs microprismatic lenses or glass beads embedded in the film to return light directly to the source, maximizing visibility in low-light environments, critical for roadside and high-traffic industrial areas. Manufacturers are continually refining these material compositions to offer extended luminosity periods and greater reflectivity, exceeding minimum regulatory performance specifications (such as ASTM standards).

The nascent integration of smart technologies represents the cutting edge of the market, although it affects the peripheral ecosystem more than the passive sign itself. This includes using specialized high-resolution digital printing methods that allow for the seamless integration of machine-readable codes (QR codes, barcodes) or embedded RFID/NFC tags directly into the sign material without compromising durability. These features allow facility managers to link the physical sign directly to digital safety data sheets, maintenance schedules, or localized hazard warnings via mobile devices, effectively creating an ‘Internet of Signs’ (IoS). While the physical sign remains static, its digital linkage transforms its function from a purely passive warning to an interactive safety asset, improving compliance management and inventory tracking efficiency within large organizations.

Regional Highlights

- North America: North America, particularly the United States and Canada, represents a mature and highly regulated market segment. Growth is primarily fueled by rigorous enforcement of Occupational Safety and Health Administration (OSHA) and ANSI standards, which mandate specific sign formats and applications. The region demonstrates high demand for durable, high-visibility signage (including reflective and photoluminescent options) required in the sprawling industrial, construction, and oil and gas sectors. Replacement cycles are steady, and technological adoption is high, particularly regarding digital compliance management systems that interface with physical signage audits. The legal environment necessitates high-quality, certified products to mitigate corporate liability, driving premium pricing and focusing competition on compliance certainty.

- Europe: The European market is characterized by strong emphasis on standardization, driven by harmonized directives across the European Union and the widespread adoption of the ISO 7010 standard for graphic symbols. Germany, the UK, and France are key contributors, spurred by advanced manufacturing standards and complex infrastructure networks (e.g., subterranean rail systems requiring advanced egress signage). The market exhibits strong demand for eco-friendly and sustainably sourced sign materials due to strict environmental regulations. The mature manufacturing base ensures high product quality, and the regulatory environment prioritizes worker protection and standardized hazard communication across multiple member states, reinforcing continuous, stable demand.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive industrialization, massive public infrastructure investment (e.g., Belt and Road Initiative projects), and urbanization across China, India, and Southeast Asia. While regulatory enforcement historically varied, governments are increasingly adopting global safety standards to protect large workforces and attract foreign investment. This region demands high volumes of cost-effective, yet compliant, standardized signs for new factory construction and large-scale utility projects. The key growth driver is the move from basic, non-compliant signage to standardized, certified products as local safety standards mature and are actively enforced by regional labor ministries.

- Latin America (LATAM): Growth in LATAM is closely tied to commodity markets, particularly mining and resource extraction, which require robust safety signage. Brazil and Mexico are the dominant markets, with demand influenced by local adaptations of international safety frameworks. The market often favors cost-efficiency, but there is a growing need for multi-lingual signage due to diverse indigenous and migrant workforces. Infrastructure development and increased foreign direct investment are gradually pushing regional quality standards upward, though distribution channels can be fragmented.

- Middle East and Africa (MEA): The MEA region's demand is concentrated in the high-growth sectors of oil, gas, petrochemicals, and mega-construction projects (e.g., Saudi Arabia’s Vision 2030). These sectors demand highly specialized signs capable of withstanding extreme heat, sand abrasion, and corrosion. Compliance is often mandatory based on international project specifications (e.g., European or American standards), creating a high-specification niche market. However, market size is volatile, linked directly to the pace of major capital expenditure projects, necessitating suppliers capable of rapid, specialized production and logistics in remote areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prohibition Signs Market.- Brady Corporation

- 3M Company

- Seton (A Brady Corporation Company)

- Safetysign.com

- Emedco

- Graphic Products

- Clarion Safety Systems

- National Safety Signs

- Safety Media

- Accuform Manufacturing

- Northern Safety & Industrial

- Custom Signs

- J. J. Keller & Associates

- Zarges GmbH

- Signmark

- Visual Marking Systems

- ComplianceSigns.com

- Hi-Vis Safety

- Vimar Systems

- Heskins

- Almetek Industries

- Reid Supply Company

- ID Products

- Safety Signs and Signals

Frequently Asked Questions

Analyze common user questions about the Prohibition Signs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary global standards governing prohibition sign design and usage?

The primary global standard is ISO 7010, which specifies graphically based safety signs for all public and work areas, ensuring universal recognition of prohibition symbols. In the United States, regulations are primarily driven by OSHA (Occupational Safety and Health Administration) and ANSI Z535 standards, particularly concerning sign formatting, signal words, and durability requirements for workplace compliance.

Which material types offer the highest durability for outdoor and industrial prohibition signs?

For maximum durability in harsh outdoor and industrial environments, marine-grade aluminum and high-impact polycarbonate are the preferred material types. These materials offer superior resistance to UV degradation, chemical exposure, extreme temperature fluctuations, and physical impacts, leading to extended service life and sustained compliance effectiveness.

How is the adoption of IoT and AI influencing the demand for physical prohibition signs?

IoT and AI do not replace physical prohibition signs; rather, they enhance their effectiveness by providing active monitoring and compliance verification. Machine vision systems use AI to confirm that areas marked by physical prohibition signs are being adhered to, increasing the strategic importance and mandatory placement of certified physical signage within smart safety ecosystems.

Which end-user segment is currently driving the highest growth rate in the market?

The Construction and Infrastructure Development segment, alongside the Manufacturing sector, remains the largest consumer. However, the Asia Pacific (APAC) region’s rapid industrialization and governmental enforcement of new safety standards are driving the highest proportional market growth rate due to widespread mandatory sign installation in new facilities and construction sites.

What is the key difference between photoluminescent and retroreflective prohibition signage?

Photoluminescent signs absorb ambient light and emit a glow in the dark, primarily used for emergency egress path marking during power failures. Retroreflective signs use specialized films to bounce incident light (like from a flashlight or headlight) directly back to the source, making them highly visible in low-light conditions, mainly used for traffic or vehicular safety applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager