Project Logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434156 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Project Logistics Market Size

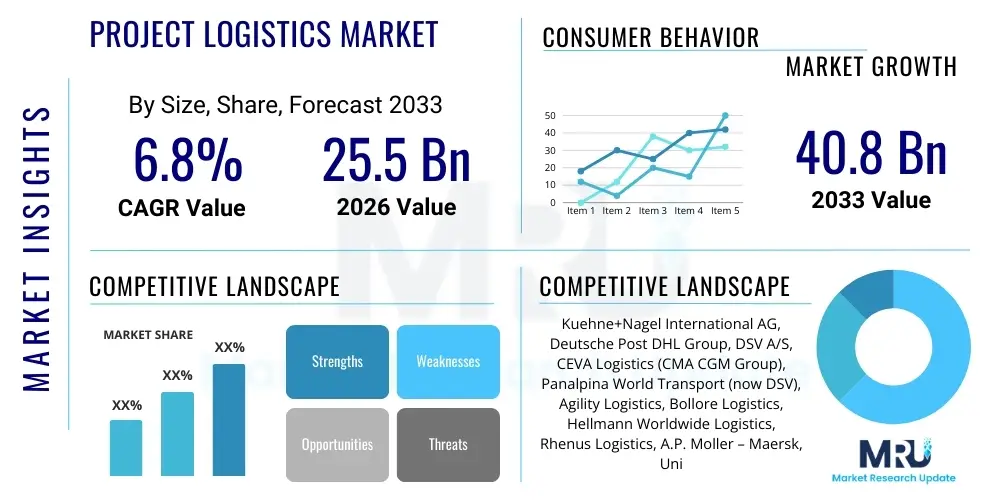

The Project Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $25.5 billion in 2026 and is projected to reach $40.8 billion by the end of the forecast period in 2033.

Project Logistics Market introduction

Project logistics encompasses the specialized movement, storage, and management of large, complex, high-value, or critical cargo required for construction, infrastructure development, and industrial projects. This sector is fundamentally different from general freight forwarding due to the customized nature of its services, which often involve multimodal transportation planning, regulatory compliance across borders, specialized heavy-lift equipment, and strict adherence to project timelines. The sheer scale and complexity of transporting items such as turbine components, refinery modules, or vast solar farm installations necessitate deep engineering expertise and robust risk management strategies, positioning project logistics providers as critical partners in global capital expenditure ventures.

The primary services offered within this market span the entire supply chain lifecycle for a project, starting from initial feasibility studies and route surveys, through customs clearance and regulatory compliance, to final on-site delivery and installation support. Major applications are prominently observed in the energy sector, particularly in renewable energy projects (wind farms, solar plants), oil and gas exploration (upstream and midstream infrastructure), and large-scale public infrastructure initiatives (bridges, railways, ports). Benefits derived from specialized project logistics include minimized delays, optimized cost structures through efficient route planning, enhanced safety protocols for handling dangerous or oversized materials, and reduced project risk exposure for the client.

Driving factors propelling market growth include the global shift toward renewable energy sources, requiring extensive logistics for wind turbine and solar panel components; substantial governmental and private investment in infrastructure development across Asia Pacific and the Middle East; and the resurgence of mining and manufacturing sectors necessitating the movement of heavy machinery. Furthermore, increasing globalization of manufacturing supply chains means that components for a single project often originate from multiple continents, dramatically increasing the complexity and demand for expert project logistics coordination. The market is characterized by high barriers to entry due to the necessity for specialized assets, experienced personnel, and comprehensive global networks, ensuring dominance by established, large-scale service providers.

Project Logistics Market Executive Summary

The Project Logistics Market is poised for substantial expansion, primarily fueled by massive global investments in the energy and infrastructure sectors. Key business trends indicate a strong move toward integrated, end-to-end logistics solutions, where clients prefer single-source providers capable of managing all facets from port-to-site. This shift drives merger and acquisition activity among logistics firms aiming to expand their geographic footprint and specialized heavy-lift capabilities. Furthermore, technological adoption, particularly in real-time tracking, risk simulation software, and digital documentation, is becoming a prerequisite for competitive service delivery, enhancing operational efficiency and transparency across complex supply chains.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, largely due to unprecedented infrastructure spending in emerging economies like India and Indonesia, coupled with China's continuous industrial and energy projects. The Middle East and Africa (MEA) region also demonstrates high growth potential, driven by significant oil, gas, and large-scale urban development projects (e.g., NEOM in Saudi Arabia). North America and Europe, while mature, maintain stable demand primarily through large-scale renewable energy installations and necessary upgrades to aging infrastructure, demanding high levels of technical precision and specialized compliance adherence.

Segment trends reveal that the Sea Freight segment continues to dominate the market by Mode of Transport, owing to its cost-effectiveness for oversized and heavy cargo required for major projects. However, the Road and Rail segments are experiencing robust growth in intra-regional and last-mile connectivity, crucial for remote site deliveries. By End-Use Industry, the Energy & Power sector—especially renewables—is the primary revenue generator, followed closely by the Infrastructure segment, reflecting the global focus on decarbonization and modernization. The demand is increasing for specialized value-added services such as customs brokerage, risk assessment, and technical consultancy, indicating a shift from purely transactional services to high-value strategic partnerships.

AI Impact Analysis on Project Logistics Market

Common user questions regarding AI's impact on project logistics center on efficiency gains, predictive capabilities, and risk mitigation in highly dynamic environments. Users frequently inquire about how AI can optimize multimodal route planning considering real-time variables (weather, port congestion), automate complex customs documentation, and improve scheduling precision for just-in-time delivery of critical components. The primary concerns revolve around data security, the initial investment required for AI infrastructure, and the potential displacement of human planning roles. Overall expectations are high, anticipating that AI will move project logistics from a reactive, experience-based model to a proactive, data-driven system, thereby reducing the margin for error and enhancing cost predictability for mega-projects.

AI adoption is poised to revolutionize the planning and execution phases of project logistics, which are inherently data-intensive and prone to disruption. Machine learning algorithms can process vast amounts of historical data related to route performance, geopolitical stability, port capacity, and specialized equipment availability to generate predictive models far superior to traditional manual planning. This predictive capability allows logistics managers to identify potential bottlenecks weeks in advance, enabling dynamic reallocation of resources and pre-emptive risk mitigation. For instance, AI systems can forecast optimal loading strategies for breakbulk vessels, minimizing the number of voyages required and significantly reducing transportation costs and carbon footprint.

Furthermore, AI significantly enhances operational transparency and decision-making during the execution phase. Computer vision and sensor data analysis, powered by AI, can monitor cargo integrity, loading sequence accuracy, and on-site movements in real-time, instantly flagging deviations from the pre-approved plan. The automation of administrative tasks, such as generating compliance reports and cross-referencing global regulatory standards, drastically cuts down on administrative overhead and minimizes the risk of costly customs delays. This shift means project logistics providers can offer higher levels of certainty and accountability to clients managing multi-billion dollar capital projects, establishing AI as a core competitive differentiator rather than merely an efficiency tool.

- AI-Powered Route Optimization: Machine learning algorithms analyze real-time data (weather, traffic, regulatory changes) to determine the safest and most cost-effective multimodal transport pathways for oversized cargo.

- Predictive Risk Management: AI models forecast potential delays (e.g., port congestion, equipment breakdown) allowing for proactive scheduling adjustments and resource deployment.

- Autonomous Documentation Processing: AI automates the generation and verification of complex customs declarations, trade compliance documents, and international permits, reducing human error.

- Enhanced Site Monitoring: Utilizing computer vision for real-time tracking of cargo handling, ensuring adherence to safety protocols and planned movement sequences at construction sites.

- Demand Forecasting and Resource Allocation: AI optimizes the positioning and maintenance schedules of specialized assets (heavy-lift cranes, specialized trucks) based on anticipated project demand cycles.

DRO & Impact Forces Of Project Logistics Market

The Project Logistics Market is profoundly influenced by a complex interplay of global economic, political, and regulatory factors encapsulated in the Drivers, Restraints, and Opportunities (DRO). Key drivers include the global energy transition toward renewables, necessitating large-scale component movement, and significant governmental investment in infrastructure renewal projects, especially in rapidly urbanizing regions. These forces generate predictable, high-volume demand for specialized logistics services. Counterbalancing these drivers are significant restraints, primarily high operational risk associated with handling oversized and complex cargo, regulatory heterogeneity across international borders, and the persistent shortage of skilled labor and specialized assets, which constrain operational scaling and efficiency.

Opportunities for growth are concentrated in technological integration, such as the adoption of IoT for enhanced visibility and AI for optimized route planning, which promises to mitigate existing risks and improve operational throughput. The increasing trend of modular construction also presents an opportunity, as components are manufactured off-site and require highly synchronized, just-in-time logistics services. Furthermore, providers who can develop sustainable logistics solutions, utilizing greener fuels and optimizing route efficiency to reduce emissions, will gain a competitive edge as client companies prioritize Environmental, Social, and Governance (ESG) criteria in their procurement processes. These opportunities demand significant capital expenditure but promise substantial long-term returns.

Impact forces on the market are categorized into direct and indirect pressures. Direct forces include fluctuating costs of specialized assets (vessels, heavy haulers), geopolitical instability affecting established trade routes, and evolving international trade agreements that impact customs duties and clearance times. Indirect forces involve the cyclical nature of end-use industries—a downturn in oil prices, for instance, dramatically reduces capital projects in the upstream sector—and the tightening of insurance and liability requirements for high-risk cargo movements. Success in this market is therefore dependent not just on operational excellence but also on robust risk intelligence, deep regulatory knowledge, and financial resilience against market volatility.

Segmentation Analysis

The Project Logistics Market is broadly segmented based on the complexity and nature of the services required, the mode of transportation utilized, and the primary industrial application of the delivered materials. This multi-dimensional segmentation allows logistics providers to tailor their capabilities, assets, and risk management strategies to specific client needs. The analysis of these segments highlights where the strongest growth trajectories lie—namely within the specialized services supporting the energy transition—and reveals the foundational dependence of the market on reliable, large-volume sea freight for global transportation of major components.

By dissecting the market along these lines, stakeholders gain insights into competitive intensity and barriers to entry within specific niches. For example, the regulatory hurdles and capital required for the specialized Rail segment (transporting super-heavy, oversized loads across continents) differ significantly from the requirements for the more commoditized Road segment (last-mile delivery of standard heavy construction components). Strategic investment decisions, such as fleet expansion or technology adoption, are therefore directly guided by detailed segment performance and future growth projections, ensuring resources are optimally allocated to maximize returns in high-growth areas like offshore wind logistics.

- By Mode of Transport:

- Sea Freight (Dominant due to heavy-lift and breakbulk capability)

- Road Transport (Crucial for last-mile and remote site delivery)

- Rail Transport (Important for inland, long-distance heavy haulage)

- Air Freight (Used for high-value, time-critical spare parts and components)

- By Service Type:

- Transportation and Distribution (Core movement services)

- Warehousing and Storage (In-transit and long-term storage near project sites)

- Planning and Consulting (Route surveys, feasibility studies, risk assessment)

- Value-added Services (Customs brokerage, heavy-lift handling, insurance)

- By End-Use Industry:

- Energy and Power (Oil & Gas, Renewable Energy, Nuclear)

- Infrastructure (Roads, Bridges, Ports, Airports)

- Mining and Extractive Industries

- Manufacturing (Plant relocation and heavy machinery transport)

- Others (e.g., Aerospace components, specialized governmental projects)

Value Chain Analysis For Project Logistics Market

The value chain in the Project Logistics Market is extensive and highly specialized, beginning upstream with the original equipment manufacturers (OEMs) and raw material suppliers who produce the large components necessary for capital projects. Upstream analysis focuses on the efficient interface between manufacturers and logistics providers, particularly concerning packaging specifications, documentation readiness, and the preparation of components for heavy transport. Ensuring that components are ready on schedule and comply with multimodal transport standards is crucial, as any upstream delay cascades into significant project overruns downstream. Strong collaboration at this stage minimizes storage costs and optimizes the mobilization phase of the project.

The core mid-stream activities involve the specialized logistics providers, covering planning, freight forwarding, customs clearance, heavy-lift operations, and multimodal execution. Distribution channels are highly complex, often integrating direct contractual relationships between the project owner/EPC contractor and the logistics provider (Direct Channel). This direct model is typical for large, strategic projects requiring tailored solutions and dedicated asset deployment. Indirect distribution involves utilizing third-party agents, specialized brokers, or regional carriers to manage specific segments of the route, particularly in regions where the primary provider lacks a physical presence or specific regulatory expertise.

Downstream analysis focuses on the delivery, positioning, and post-delivery support at the final project site (e.g., a remote mine, a wind farm hub, or a refinery construction area). The final leg of the journey often involves the highest risk and requires significant civil engineering and temporary infrastructure to manage the last-mile delivery of super-heavy cargo. Value capture in the downstream is maximized through efficient on-site coordination, use of specialized installation teams (often contracted by the logistics provider), and successful handover to the Engineering, Procurement, and Construction (EPC) firm. The complexity of the entire chain necessitates sophisticated IT systems to maintain visibility and control from the factory floor to the final installation point.

Project Logistics Market Potential Customers

The primary consumers (End-Users/Buyers) of project logistics services are entities undertaking large-scale capital expenditure (CapEx) projects that require the movement of non-standard, critical, or oversized materials. These customers can be segmented into distinct industry verticals, each with unique requirements regarding cargo type, risk profile, and regulatory adherence. The largest and most demanding customer segment remains the Engineering, Procurement, and Construction (EPC) firms, who serve as the project managers and often outsource the entire logistics package to specialized providers to ensure timely and budget-compliant delivery of all materials to the job site.

Another major customer base includes independent energy developers and utility companies, particularly those focused on building renewable energy infrastructure such as offshore wind farms, geothermal plants, and large utility-scale solar arrays. These buyers prioritize logistics providers with proven expertise in handling extremely high-value, fragile components (e.g., rotor blades, specialized solar inverters) and those capable of operating under strict environmental regulations, especially in the marine environment. The decision criteria for these customers heavily favor reliability, specialized asset availability, and a strong safety track record over pure cost considerations.

Furthermore, major international mining corporations, oil and gas exploration companies, and large manufacturing conglomerates (e.g., automotive or chemical plant builders) represent critical end-users. Mining projects often occur in remote, challenging geographical locations, requiring highly customized road and air logistical support. Oil and gas projects demand expertise in handling hazardous materials and modules weighing thousands of tons, requiring specialized heavy-lift vessels and sophisticated jacking and skidding operations. For these customers, logistical precision is paramount, as delays can halt multi-million dollar construction schedules, making the logistics provider an integral risk mitigation partner.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $40.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuehne+Nagel International AG, Deutsche Post DHL Group, DSV A/S, CEVA Logistics (CMA CGM Group), Panalpina World Transport (now DSV), Agility Logistics, Bollore Logistics, Hellmann Worldwide Logistics, Rhenus Logistics, A.P. Moller – Maersk, United Parcel Service (UPS), Schenker AG (DB Schenker), Geodis, Mammoet, Sarens NV, Cosco Shipping Specialized Carriers Co. Ltd., Blue Water Shipping, Fagioli Group, Bertling Logistics, BDP International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Project Logistics Market Key Technology Landscape

The Project Logistics Market is increasingly dependent on advanced technological solutions to manage the inherent complexities of oversized cargo movements and extended project timelines. The core technology landscape is defined by the integration of robust Enterprise Resource Planning (ERP) systems specifically tailored for project freight management, which enable comprehensive oversight of resource allocation, financial management, and compliance documentation across multiple international jurisdictions. Furthermore, specialized Computer-Aided Design (CAD) software and 3D modeling are crucial for pre-visualization of heavy-lift operations, route mapping, and clearance studies, ensuring the feasibility and safety of transport plans long before execution begins. These systems are essential for simulating stress loads and movement paths, minimizing on-site surprises.

The most significant technological shift involves the integration of visibility and real-time monitoring tools. This includes wide-scale adoption of Internet of Things (IoT) sensors attached to critical cargo components and specialized transport assets. These sensors provide continuous data streams regarding location, temperature, vibration, and humidity, ensuring cargo integrity is maintained throughout the journey, which is vital for sensitive high-value components like gas turbines or highly calibrated manufacturing equipment. This enhanced visibility is supported by proprietary cloud-based platforms that aggregate data, providing stakeholders—from the project owner to the site foreman—with a single, authoritative source of information regarding cargo status and predicted time of arrival.

Future technology focuses heavily on automation and predictive analytics. The use of drones for high-definition surveying of remote project sites and potential transport corridors is rapidly increasing, offering a faster and safer alternative to traditional ground surveys. Moreover, Artificial Intelligence (AI) and Machine Learning (ML) are being deployed for dynamic risk assessment and automated contract management, streamlining the complex process of global procurement and subcontracting. Blockchain technology is also gaining traction, particularly for creating immutable and transparent records of custody, ensuring regulatory compliance and reducing the likelihood of fraudulent documentation, which is a major concern in high-value international shipments.

Regional Highlights

The Project Logistics Market exhibits significant regional variations driven by differing levels of infrastructure investment, regulatory environments, and the concentration of specific end-use industries. Asia Pacific (APAC) stands out as the powerhouse region, primarily fueled by massive infrastructural build-outs in populous nations like India, continuous industrial expansion in Southeast Asia, and China’s ongoing Belt and Road Initiative (BRI) projects, which necessitate vast cross-border logistics capabilities. The region's growth is predominantly concentrated in the Energy & Power sector (both traditional and renewable) and large-scale urban development projects, demanding high volumes of project freight services and positioning APAC as the largest revenue contributor globally.

North America and Europe represent mature markets characterized by stringent safety regulations and a high demand for high-value, technically complex logistics solutions. In North America, growth is largely driven by large-scale shale gas projects, pipeline construction, and significant investment in offshore wind energy across coastal regions. European growth, while steady, is focused on the decommissioning of older industrial assets and the repowering of renewable energy sites, alongside complex cross-border logistics within the EU framework. These regions set the global benchmark for safety protocols and require providers to possess sophisticated insurance and compliance mechanisms, fostering innovation in specialized transport techniques and digital management systems.

The Middle East and Africa (MEA) region presents a high-growth, high-volatility environment. The Middle East segment is dominated by megaprojects funded by sovereign wealth funds, particularly in developing non-oil sectors (tourism, technology infrastructure, and housing), such as the Saudi Vision 2030 initiatives. These projects require extraordinary logistical capacity for massive, high-speed construction. Africa's market growth is localized but strong, driven by mining expansion and essential energy infrastructure projects, often requiring logistics providers to navigate extremely challenging terrains, underdeveloped port facilities, and complex local governance structures, placing a premium on localized expertise and robust risk planning.

- Asia Pacific (APAC): Highest growth market driven by infrastructure mega-projects, aggressive renewable energy targets, and strong governmental investment across nations like India, China, and Vietnam.

- North America: Stable demand centered on energy sector (renewables and gas), pipeline infrastructure, and stringent safety compliance requirements, leading the adoption of advanced tracking technology.

- Europe: Focus on decarbonization and modernization; strong demand for complex cross-border logistics supporting offshore wind construction and plant decommissioning projects.

- Middle East and Africa (MEA): High potential fueled by large-scale national development plans (e.g., in Saudi Arabia and UAE) and essential mining and energy infrastructure development in Sub-Saharan Africa.

- Latin America: Growth tied to commodity prices, driving demand for specialized logistics in mining, oil exploration, and hydropower projects, often involving challenging mountainous or jungle terrain routes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Project Logistics Market.- Kuehne+Nagel International AG

- Deutsche Post DHL Group

- DSV A/S

- CEVA Logistics (CMA CGM Group)

- A.P. Moller – Maersk

- Schenker AG (DB Schenker)

- Bollore Logistics

- Agility Logistics

- Hellmann Worldwide Logistics

- Rhenus Logistics

- United Parcel Service (UPS)

- Geodis

- Mammoet

- Sarens NV

- Cosco Shipping Specialized Carriers Co. Ltd.

- Blue Water Shipping

- Fagioli Group

- Bertling Logistics

- BDP International

- C.H. Robinson Worldwide, Inc.

Frequently Asked Questions

Analyze common user questions about the Project Logistics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between standard freight forwarding and specialized project logistics?

Project logistics focuses exclusively on the movement of oversized, overweight, or critical components integral to large capital projects, requiring highly specialized assets (heavy-lift cranes, breakbulk vessels), customized planning, route surveys, and significant on-site coordination. Standard freight forwarding typically handles standardized containerized or general cargo volumes with less complexity and lower risk profiles.

Which end-use industry is currently driving the most growth in the Project Logistics Market?

The Energy and Power sector, specifically the renewable energy sub-segment (wind, solar, and hydro power), is the primary growth driver. The global transition to sustainable energy requires the transportation of massive, complex components like wind turbine blades and tower segments, which necessitates specialized project logistics services on a global scale.

How does geopolitical instability impact project logistics operations?

Geopolitical instability introduces significant volatility, leading to abrupt changes in sanctioned trade routes, increased insurance premiums, heightened security risks in certain regions, and delays in obtaining necessary customs clearances and permits. Providers must integrate advanced risk intelligence and maintain flexible, adaptable operational plans to manage these unpredictable variables effectively.

What is the role of technology such as IoT and AI in mitigating risk within project logistics?

IoT sensors provide real-time, granular visibility into cargo location and condition (e.g., vibration, tilt), enabling immediate corrective action if damage is imminent. AI leverages historical and real-time data to perform predictive risk modeling and optimize multimodal routes dynamically, significantly enhancing operational efficiency and reducing unexpected delays or damages that could jeopardize project timelines.

What are the primary challenges faced by project logistics providers operating in emerging markets?

Challenges in emerging markets often include underdeveloped infrastructure (poor road networks, limited port capacity), bureaucratic complexity leading to lengthy customs and permit processes, and high regulatory opacity or volatility. Providers must rely on strong local partnerships and deep regulatory expertise to navigate these operational constraints effectively and ensure project viability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager