Projector Lenses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434808 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Projector Lenses Market Size

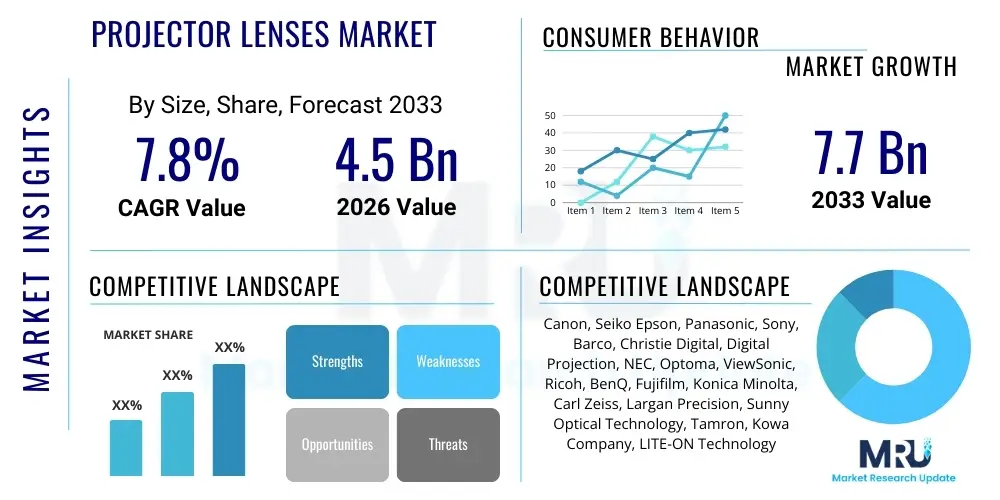

The Projector Lenses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Projector Lenses Market introduction

The Projector Lenses Market encompasses the design, manufacturing, and distribution of sophisticated optical assemblies essential for projecting images onto a screen or surface. These lenses, which are critical components determining the clarity, brightness, and geometric accuracy of the projected image, vary widely based on application, including fixed lenses, zoom lenses, and specialized ultra-short throw (UST) lenses. The core function of a projector lens is to precisely manage the light output from the internal light source (lamp, LED, or laser) and focus it optimally to achieve the desired image size and quality, often requiring complex multi-element glass or plastic configurations to minimize chromatic and spherical aberrations. The increasing professionalization of visualization in corporate, educational, and entertainment settings mandates higher performance optics, thereby driving innovation in lens coatings, material science, and manufacturing tolerances.

Major applications of projector lenses span across educational institutions utilizing them for interactive learning, corporate environments for presentations and video conferencing, and the booming home entertainment sector focusing on high-definition, immersive home theater experiences. Furthermore, large venue applications, such as concerts, sporting events, and digital signage, require specialized, high-luminosity lenses capable of maintaining image fidelity across vast projection distances, often necessitating features like lens shift and electronic adjustments. The fundamental benefits offered by advanced projector lenses include enhanced image sharpness, superior color reproduction, reduced maintenance requirements due to improved longevity, and crucial flexibility in installation, allowing projectors to be mounted closer to or further away from the screen without compromising image integrity.

Driving factors for this market expansion include the global transition towards 4K and 8K resolution displays, which necessitates exceptionally high-quality lens systems capable of resolving minute details without distortion. The rapid proliferation of laser projector technology is another significant catalyst, as laser light sources offer higher brightness and require corresponding thermal stability and optimized refractive indices in the lens assembly. Furthermore, the rising demand for immersive experiences in sectors like simulation, museums, and planetariums, coupled with the increasing adoption of interactive projection systems in retail and education, continues to solidify the projector lens as an indispensable high-value component within the display ecosystem.

- Product Description: High-precision optical assemblies composed of multiple glass or plastic elements designed to focus light emitted by a projector source (DLP, LCD, LCoS) onto a surface, controlling image geometry, clarity, and throw distance.

- Major Applications: Home Cinema/Entertainment, Education & Interactive Whiteboards, Corporate/Business Presentation Rooms, Large Venue Projection (Events, Concerts), Digital Signage, and Simulation.

- Key Benefits: Superior optical clarity and resolution support (up to 8K), customizable throw ratio flexibility (UST, long throw), geometric correction capabilities, and enhanced light transmission efficiency.

- Driving Factors: Increasing global demand for high-resolution 4K/8K visual content, rapid adoption of laser-based projectors requiring specialized optics, and expansion of the interactive display market in educational technology.

Projector Lenses Market Executive Summary

The Projector Lenses Market is characterized by intense technological competition centered on improving resolution capabilities, minimizing optical defects, and optimizing lens designs for new laser light engine architectures. Current business trends indicate a significant pivot toward Ultra-Short Throw (UST) lenses, driven by space constraints in urban environments and the desire for non-intrusive display solutions that eliminate shadowing. Manufacturers are heavily investing in specialized materials, including hybrid glass-plastic elements and high-refractive-index glass, to produce smaller, lighter lenses capable of handling higher light fluxes and maintaining stability under prolonged use, particularly in demanding commercial applications. Furthermore, consolidation among component suppliers and system integrators is leading to standardized lens mount systems and increased emphasis on integrated solutions that simplify calibration and maintenance for end-users.

Regional trends reveal that the Asia Pacific (APAC) region maintains its dominance, primarily fueled by massive infrastructural investments in education, corporate digitalization initiatives, and its established position as the global manufacturing hub for projector systems and components. China, India, and Southeast Asian nations show robust demand, particularly for value-driven and mid-range projectors incorporating high-quality zoom and short-throw lenses in classroom settings. Conversely, North America and Europe exhibit strong demand for high-end, large-venue, and professional simulation lenses, emphasizing durability, precise electronic controls, and advanced features such as motorized shift and focus, driven by professional AV integrators and major entertainment complexes.

Segment trends underscore the burgeoning importance of the short-throw and ultra-short throw lens segments due to their superior utility in tight spaces and their integral role in interactive projection systems. While fixed-focus lenses remain crucial for highly specialized applications requiring maximum image quality stability, the general market momentum favors zoom lenses that offer installation flexibility. The application segment growth is robust across both Corporate and Education sectors globally, but the fastest relative growth is observed in the Home Entertainment segment, spurred by affordable laser projection technology and the consumer desire for cinema-quality experiences in residential settings. Additionally, the shift from traditional lamp projectors to laser projectors necessitates specialized lenses capable of withstanding the higher localized heat generated by laser light, influencing material composition and design across all segments.

AI Impact Analysis on Projector Lenses Market

Common user questions regarding AI's influence on the Projector Lenses Market frequently revolve around automation, performance enhancement, and predictive maintenance. Users are concerned about how AI algorithms can replace or augment manual calibration processes, specifically querying automated geometric correction, dynamic focus adjustment based on ambient conditions, and predictive failure analysis of lens elements due to heat stress or minor alignment shifts. The general expectation is that AI will move the industry toward "set-and-forget" systems, optimizing image quality instantaneously regardless of installation imperfections. Key themes emerging from this analysis include the integration of machine vision systems for real-time lens aberration correction, AI-driven thermal management algorithms extending lens lifespan, and the potential for AI to influence future lens designs by simulating light paths and material interactions more efficiently than traditional modeling, speeding up R&D cycles.

- Automated Calibration: AI algorithms enable real-time, instantaneous geometric correction, keystoning, and focus adjustment, significantly reducing manual setup time, particularly critical for multi-projector blending and stacking in large venues.

- Dynamic Focus & Image Optimization: Machine learning models analyze ambient light, content being displayed, and surface imperfections to dynamically adjust lens parameters (focus motor position, light output) to maintain optimal image clarity and contrast ratio.

- Manufacturing Efficiency: AI-driven quality control utilizes high-speed vision systems to detect microscopic defects in lens elements during production, ensuring tighter tolerances and reducing production waste, leading to higher optical quality products.

- Predictive Maintenance: Sensor data combined with AI analysis monitors lens temperature, vibration, and actuator performance, predicting potential misalignment or failure before it impacts image quality, improving system uptime.

- Optimized Lens Design: Generative design techniques leveraging AI rapidly simulate and iterate through complex lens architectures, optimizing trade-offs between size, weight, optical performance, and cost, accelerating the development of specialized lenses (e.g., UST, high-zoom).

DRO & Impact Forces Of Projector Lenses Market

The Projector Lenses Market is dynamically shaped by a crucial interplay between powerful driving forces and inherent technical limitations, creating a demanding environment for manufacturers. The primary driver is the accelerating consumer and commercial migration towards high-resolution content (4K and beyond), which demands lenses with superior resolving power, minimal distortion, and perfect chromatic fidelity. This is powerfully complemented by the technological shift to laser projection, offering significantly brighter and more color-accurate images, which necessitates robust, heat-resistant lenses capable of managing intense light fluxes. Furthermore, the persistent need for installation flexibility across all major application sectors, ranging from compact classrooms to expansive auditoriums, sustains strong demand for advanced zoom and ultra-short throw lens technologies, which mitigate space constraints and installation complexity. These forces collectively push optical manufacturing tolerances to their absolute limits, ensuring continuous innovation in lens material science.

Conversely, significant restraints hinder market growth and pose challenges to innovation. The high precision required in grinding, polishing, and assembling multi-element lens systems translates directly into high manufacturing costs, particularly for high-end professional and interchangeable lenses, often making them a substantial portion of the overall projector system cost. This cost sensitivity restricts broader adoption in developing markets or cost-conscious educational segments. Furthermore, the intrinsic complexity of managing thermal expansion and material degradation under high heat and intense light output, especially with powerful laser engines, presents a physical limitation that can affect long-term stability and image quality. This necessitates costly solutions such as specialized coatings and temperature control mechanisms, adding layers of complexity to the lens design and maintenance cycle.

The market opportunities are substantial, particularly in emerging technological niches and underserved applications. The rapid advancement of augmented reality (AR) and virtual reality (VR) systems, which utilize micro-projectors requiring extremely miniaturized yet powerful optical assemblies, opens a new, high-growth segment for specialized lens components. Similarly, the trend toward portable and pico-projectors for consumer and business mobility creates opportunities for manufacturers to develop lightweight, durable plastic or hybrid lenses that maintain acceptable image quality in a small form factor. The increasing adoption of smart home ecosystems and interactive retail displays also drives demand for specialized, discrete projection solutions that rely heavily on innovative, non-standard lens designs. Successfully navigating the high manufacturing costs while capitalizing on these emerging high-tech applications will be critical for achieving market dominance.

- Drivers (D): Global increase in demand for 4K/8K resolution projection; proliferation of high-brightness laser and LED projection systems; necessity for flexible installation solutions (UST, high-zoom ratios); expansion of interactive projection technologies in education.

- Restraints (R): Extremely high precision and manufacturing costs associated with professional-grade, multi-element lenses; thermal stability challenges posed by powerful laser light sources affecting lens longevity and performance; competitive threat from flat-panel display cost reductions in smaller venue applications.

- Opportunities (O): Growing demand for ultra-portable and pico-projectors requiring miniaturized optics; integration opportunities within AR/VR devices and head-up displays; potential for advanced material science (e.g., free-form optics) to reduce lens weight and complexity; demand for automated, AI-driven lens calibration systems.

- Impact Forces: Technological advancements in glass and coating materials (High); Price sensitivity in consumer and entry-level corporate segments (Medium to High); Competitive rivalry among Asian and European optical manufacturers (High).

Segmentation Analysis

The Projector Lenses Market is comprehensively segmented based on Type, Technology, Application, and Throw Ratio, reflecting the diverse requirements across professional and consumer markets. The segmentation by Type delineates between fixed lenses, which offer maximum stability and image quality but minimal installation flexibility, and zoom lenses, which dominate the market due to their ability to adjust image size based on variable throw distances. Segmentation by Technology (DLP, LCD, LCoS) reflects the specific optical requirements of different light engine architectures, where each requires lenses tailored to its reflective or transmissive panel properties. Furthermore, the market is critically segmented by Throw Ratio, with Ultra-Short Throw (UST) lenses representing the fastest-growing segment due to their utility in confined spaces, demanding highly complex, specialized optical configurations, often involving mirrors or highly aspherical elements.

- By Type:

- Fixed Lenses

- Zoom Lenses

- Specialty/Interchangeable Lenses

- By Throw Ratio:

- Long Throw Lenses

- Short Throw Lenses

- Ultra-Short Throw (UST) Lenses

- By Technology:

- Digital Light Processing (DLP)

- Liquid Crystal Display (LCD)

- Liquid Crystal on Silicon (LCoS)

- By Application:

- Corporate & Government

- Education (K-12 and Higher Education)

- Home Entertainment/Home Cinema

- Large Venue & Events

- Simulation & Training

Value Chain Analysis For Projector Lenses Market

The value chain for the Projector Lenses Market begins with upstream activities dominated by raw material suppliers specializing in high-quality optical glass, plastic resins, and specialized coatings (e.g., anti-reflection, UV protection). Key suppliers include highly specialized chemical and glass manufacturers who provide tailored materials with specific refractive indices and low dispersion properties required for high-resolution projection. Precision engineering and manufacturing are the next crucial steps, where lens elements are ground, polished, and assembled into complex optical barrels, demanding extremely tight tolerances and often performed in highly controlled, cleanroom environments by specialized optical component manufacturers like those found in East Asia and Germany. R&D investment at this stage focuses heavily on optimizing lens element placement and material selection to minimize aberrations and maximize light throughput.

Midstream activities involve the integration of these precision lens assemblies into the final projector system. This phase is dominated by major projector brands (OEMs) who either utilize proprietary lens designs manufactured in-house or contract third-party optical specialists. Distribution channels for the final product are multifaceted, involving both direct and indirect routes. Direct sales are common for high-end, large venue, or specialized simulation projectors, where manufacturers deal directly with professional AV integrators and specialized corporate buyers. This ensures tailored solutions, installation support, and direct control over the sales process and subsequent warranty provisions.

Indirect distribution forms the majority of the consumer and mid-range corporate market routes, relying heavily on a network of wholesale distributors, mass market retailers (both physical and e-commerce platforms), and value-added resellers (VARs). VARs play a crucial role, particularly in the education and small-to-medium business sectors, by bundling the projector and lens system with associated services such as installation, maintenance, and software integration. Downstream activities involve professional installation and post-sales servicing, where the quality of the lens and its electronic adjustment mechanisms (e.g., lens shift motors) significantly influence customer satisfaction and perceived value. The complexity of interchangeable lenses often requires certified technicians for optimal setup and alignment, solidifying the importance of a robust after-market service network.

Projector Lenses Market Potential Customers

The primary end-users and buyers of projector lenses span a broad spectrum, ranging from large-scale governmental agencies and Fortune 500 corporations to individual consumers focused on home entertainment. Corporations are major customers, utilizing advanced zoom and short-throw lenses for high-impact presentations, board meetings, and collaborative workspaces, often prioritizing high brightness and portability. Educational institutions, including universities and K-12 systems, represent a massive volume market, driving demand for durable, affordable short-throw lenses integrated into interactive whiteboard systems, where robust design and ease of maintenance are critical purchasing factors. The recent increase in hybrid learning models also drives demand for flexible, high-resolution display solutions in varied classroom sizes.

Another significant customer segment is the professional Audio-Visual (AV) integration market, which purchases specialized, interchangeable lenses for use in large venues, museums, simulation centers, and digital art installations. These professional buyers prioritize extremely high lumen output compatibility, precise motorized controls (zoom, focus, shift), and the ability to maintain perfect image alignment over long distances or in multi-projector stacking configurations. These lenses represent premium market value due to the sophisticated engineering required to achieve flawless performance under stringent professional specifications.

The consumer segment, primarily focused on home cinema, is increasingly becoming a powerful market force, particularly with the proliferation of affordable 4K laser projectors utilizing ultra-short throw optics. These customers prioritize high-definition clarity, minimal footprint, and ease of installation, favoring fixed or short-zoom UST lenses that can cast a large image from just inches away from the wall. Furthermore, niche customers, such as digital artists, flight simulator manufacturers, and specialized medical imaging centers, require highly customized projection optics tailored to specific scientific or visual requirements, focusing on extreme color fidelity and geometric accuracy that standard lenses cannot achieve.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canon, Seiko Epson, Panasonic, Sony, Barco, Christie Digital, Digital Projection, NEC, Optoma, ViewSonic, Ricoh, BenQ, Fujifilm, Konica Minolta, Carl Zeiss, Largan Precision, Sunny Optical Technology, Tamron, Kowa Company, LITE-ON Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Projector Lenses Market Key Technology Landscape

The technological landscape of the Projector Lenses Market is primarily driven by advancements in optical design software, precision manufacturing techniques, and the development of new optical materials essential for handling high-intensity light sources. Advanced software tools, including ray tracing and simulation platforms, are crucial for designing complex multi-element lens structures, particularly for ultra-short throw (UST) applications that require highly aspherical elements to correct extreme geometric distortions. The shift toward hybrid optics, combining high-grade glass elements with specialized molded plastic lenses, allows manufacturers to achieve superior performance characteristics, such as reduced weight and size, while managing cost-effectiveness in specific segments like mobile and consumer projection.

A central technological focus remains on minimizing chromatic and spherical aberrations, particularly critical when projecting high-resolution content (4K/8K) onto large screens. This requires the use of Extra-low Dispersion (ED) glass and specialized lens coatings that maximize light transmission and minimize internal reflections (flaring), ensuring optimal contrast and color fidelity. Furthermore, the mechanics of lens control have evolved significantly. Modern high-end projector lenses incorporate sophisticated, high-precision motorized zoom, focus, and lens shift mechanisms, often utilizing stepless servo motors integrated with internal sensors to maintain precise alignment and repeatability, which is paramount in professional stacking and blending installations.

The thermal management technology integrated into lens systems is rapidly gaining prominence due to the widespread adoption of laser projection. Laser light engines generate intense localized heat, necessitating robust lens barrels and mounting systems built from materials that exhibit minimal thermal expansion. Specialized heat-resistant coatings and internal cooling channels (passive or active) within the lens assembly are becoming standard features for professional-grade lenses to ensure long-term optical stability and prevent thermal drift, thereby securing consistent image quality throughout the projector’s operational life. Future technological directions include the increasing utilization of free-form optics, which could potentially reduce the number of elements required, simplifying assembly and further reducing weight while maintaining superior image quality across complex throw ratios.

Regional Highlights

The Projector Lenses Market exhibits distinct demand characteristics across major global regions, influenced by economic development, technological adoption rates, and specific application sector strength. Asia Pacific (APAC) dominates the global market, not only in terms of consumption volume but critically as the primary manufacturing and supply hub for both projector systems and optical components. The region benefits from massive governmental initiatives focused on modernizing educational infrastructure and rapid corporate digitalization, particularly in emerging economies like China, India, and Southeast Asia. The demand here is diversified, encompassing high-volume procurement of short-throw lenses for classrooms alongside specialized high-end optics for professional simulation centers and large corporate headquarters. APAC's cost-competitive manufacturing environment further solidifies its position as the engine of market growth.

North America holds a substantial share, focusing primarily on the premium, professional, and high-end consumer segments. Demand is heavily concentrated in large corporations, federal and state government installations, and the robust entertainment sector (e.g., cinemas, theme parks, high-fidelity home theaters). North American end-users prioritize cutting-edge technology, demanding lenses that support 4K/8K resolutions, feature precise motorized controls for complex installations, and demonstrate long-term reliability. The maturity of the AV integration sector in the US and Canada drives continuous investment in interchangeable, high-specification lenses designed for complex, high-lumen laser projectors used in stacking and blending applications.

Europe represents a stable and mature market, characterized by strong demand across professional, educational, and cultural sectors. Countries like Germany, the UK, and France show significant adoption in museums, public venues, and specialized training facilities, necessitating high-performance optics, particularly high-quality zoom and specialty lenses capable of flexible installations in historic or architecturally sensitive buildings. While Europe's consumption volume might be lower than APAC, its average selling price for projector lenses is typically higher due to the preference for premium, European- or Japanese-manufactured optics that meet stringent quality and safety standards. Latin America, the Middle East, and Africa (LAMEA) represent emerging markets with high growth potential, driven by infrastructure investment and urbanization, though currently limited by slower technology adoption and greater price sensitivity, favoring durable and cost-effective mid-range lens solutions for education and entry-level corporate use.

- Asia Pacific (APAC): Market leader driven by high-volume manufacturing, extensive education sector modernization, and strong consumer adoption of home cinema. Key countries include China, Japan, and South Korea. Focus on UST and high-volume short-throw lenses.

- North America: Strong market for high-end professional and large venue lenses, driven by corporate, government, and simulation applications. Emphasis on high-lumen, 4K/8K compatible, motorized optics.

- Europe: Stable market with high demand from cultural venues, education, and professional AV integration. Preference for premium, reliable optics with precise electronic controls suitable for blending and stacking.

- Latin America (LATAM): Emerging market characterized by increasing investment in corporate and educational technology infrastructure, but highly sensitive to price, favoring cost-effective zoom and fixed lenses.

- Middle East & Africa (MEA): Growth potential tied to urbanization, large infrastructural projects, and expansion of educational services. Regional focus on durable, high-brightness lenses for large conference rooms and public displays.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Projector Lenses Market.- Canon Inc.

- Seiko Epson Corporation

- Panasonic Corporation

- Sony Corporation

- Barco NV

- Christie Digital Systems USA, Inc.

- Digital Projection International

- NEC Corporation

- Optoma Corporation

- ViewSonic Corporation

- Ricoh Company, Ltd.

- BenQ Corporation

- Fujifilm Holdings Corporation

- Konica Minolta, Inc.

- Carl Zeiss AG

- Largan Precision Co., Ltd.

- Sunny Optical Technology (Group) Company Limited

- Tamron Co., Ltd.

- Kowa Company, Ltd.

- LITE-ON Technology Corporation

Frequently Asked Questions

Analyze common user questions about the Projector Lenses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Ultra-Short Throw (UST) projector lenses?

The main driver for UST projector lenses is the increasing necessity for display solutions in small or confined spaces, such as classrooms and urban apartments, as UST optics allow projectors to cast large images from mere inches away, eliminating shadows and simplifying installation.

How does the transition to laser light sources impact the required specifications for projector lenses?

Laser light sources are significantly brighter and generate more localized heat. This mandates that projector lenses utilize materials with higher thermal stability, advanced heat-resistant coatings, and robust mechanical structures to prevent thermal expansion and maintain optimal alignment and image quality over time.

What role does the lens throw ratio play in projector selection, and what are the standard categories?

The throw ratio determines the distance required between the projector and the screen to achieve a specific image size. Standard categories include long throw (ratio > 2.0:1), short throw (ratio 0.5:1 to 2.0:1), and ultra-short throw (ratio < 0.5:1), with throw ratio selection being critical for optimizing installation placement and space utilization.

Which geographical region currently dominates the Projector Lenses Market in terms of both manufacturing and consumption?

The Asia Pacific (APAC) region dominates the market. It serves as the primary global manufacturing base for optical components and simultaneously exhibits the highest consumption volume, fueled by extensive government investment in educational technology and corporate digitization initiatives.

What is the significance of lens shift and motorized controls in modern professional projector lenses?

Lens shift and motorized controls provide essential installation flexibility, allowing the projected image to be moved vertically or horizontally without physically moving the projector or tilting the unit. This is crucial in professional environments for achieving precise alignment, particularly when stacking or blending multiple projectors for seamless large-scale displays.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager