Prostacyclin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434511 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Prostacyclin Market Size

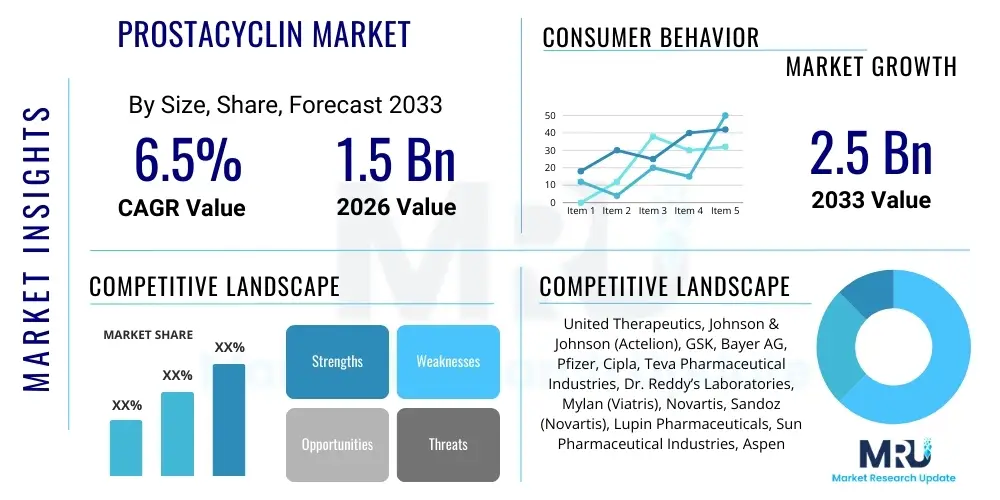

The Prostacyclin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033.

Prostacyclin Market introduction

The Prostacyclin Market encompasses therapeutic agents used primarily in the treatment of cardiovascular and pulmonary diseases, most notably Pulmonary Arterial Hypertension (PAH). Prostacyclin, also known as PGI2, is a potent endogenous vasodilator and inhibitor of platelet aggregation. Synthetic analogs of prostacyclin, such as Epoprostenol, Treprostinil, Iloprost, and Selexipag (an oral IP receptor agonist), form the core offerings of this market. These compounds function by activating prostacyclin receptors, leading to reduced vascular resistance, improved cardiac output, and mitigation of the pathological symptoms associated with high blood pressure in the arteries of the lungs. The complexity of PAH management, which requires sustained, often lifelong treatment, ensures a stable and growing demand for these specialized pharmaceutical products. Furthermore, the development of novel delivery systems, moving from continuous intravenous or subcutaneous infusions to inhaled and oral formulations, significantly drives patient adherence and overall market penetration.

Major applications of prostacyclin analogs extend beyond PAH to include Critical Limb Ischemia (CLI) and systemic sclerosis, where their vasodilatory and anti-platelet properties offer significant therapeutic advantages. The clinical benefits derived from these treatments—including improved exercise capacity, enhanced quality of life, and reduced mortality rates for PAH patients—underscore their commercial importance. Key driving factors include the rising global incidence and prevalence of chronic cardiovascular and respiratory conditions, increasing awareness among clinicians regarding early diagnosis and aggressive management of PAH, and continuous research and development focused on creating more stable and patient-friendly dosage forms. The shift towards oral therapies that minimize infection risks associated with infusion pumps is a critical technological accelerator in this therapeutic domain.

Prostacyclin Market Executive Summary

The Prostacyclin Market is characterized by robust growth, primarily propelled by favorable regulatory landscapes supporting orphan drug designation for PAH treatments and the high pricing models afforded by specialty pharmaceuticals. Current business trends indicate a strong competitive focus on patent expiration management and the subsequent introduction of generic or biosimilar versions, which pressure pricing but dramatically increase patient access in certain geographies. Furthermore, manufacturers are heavily investing in combination therapy studies, integrating prostacyclin analogs with endothelin receptor antagonists (ERAs) and phosphodiesterase type 5 (PDE-5) inhibitors to achieve superior clinical outcomes. The market demonstrates resilience due to the life-threatening nature of PAH, ensuring sustained prescription rates regardless of broader economic fluctuations. Strategic mergers and acquisitions targeting specialty pharma portfolios remain a key strategy for established players seeking to solidify their market dominance and pipeline diversity.

Regionally, North America maintains the largest market share due to high disease prevalence, advanced healthcare infrastructure, aggressive adoption of premium-priced therapies, and favorable reimbursement policies. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by rapidly expanding healthcare spending, increasing governmental focus on chronic disease management, and growing accessibility to specialized medical treatments in emerging economies like China and India. Segment trends show a decisive shift towards oral formulations (e.g., Selexipag) and inhaled therapies (e.g., Iloprost) over traditional continuous infusion systems, reflecting a preference for less invasive administration routes. The application segment remains dominated by Pulmonary Arterial Hypertension (PAH), although the growing recognition of prostacyclin's utility in treating severe peripheral artery disease (PAD) and related conditions is expected to diversify the revenue stream throughout the forecast period.

AI Impact Analysis on Prostacyclin Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Prostacyclin Market frequently center on accelerating drug discovery for novel, highly selective IP receptor agonists, optimizing patient stratification for personalized PAH treatment protocols, and improving the precision of continuous drug delivery devices. Common concerns involve the validation of AI-derived biomarkers in real-world clinical settings and the integration of predictive analytics into existing clinical workflows. Users express high expectations for AI to solve the current challenge of diagnosing PAH earlier and differentiating it from other forms of pulmonary hypertension, often months or even years before current standard diagnostics. The consensus is that AI offers a potent tool for managing the complex, multidrug regimens required for PAH, specifically through analyzing vast patient monitoring data (e.g., wearable tech data, hemodynamic measurements) to adjust dosages dynamically and predict adverse events, thereby improving overall treatment efficacy and safety margins.

The practical application of AI is expected to revolutionize the development lifecycle of new prostacyclin analogs. Machine learning algorithms are increasingly being deployed to screen millions of small molecule compounds, predicting binding affinity and selectivity towards the IP receptor, significantly reducing the time and cost associated with preclinical drug screening. Furthermore, in clinical practice, AI-powered diagnostic tools analyze patient electronic health records (EHRs), echocardiograms, and genetic markers to identify patients at high risk of rapid disease progression, enabling timely and appropriate initiation of high-cost, specialized prostacyclin therapy. This shift towards data-driven personalization is crucial, given the varied individual responses observed across different prostacyclin delivery methods.

In manufacturing and supply chain management, AI algorithms optimize the complex synthesis processes required for these specialized pharmaceutical compounds, ensuring high purity and yield. For patients using infusion-based systems (like Treprostinil), AI embedded within smart pumps can monitor flow rates, battery life, and potential occlusions, proactively alerting both patients and clinicians. This technological enhancement addresses critical patient safety issues associated with continuous infusion, which is vital for the long-term management of PAH, directly translating into improved operational efficiency and patient outcomes across the Prostacyclin Market.

- Accelerated identification of novel, selective IP receptor agonists via ML-driven virtual screening.

- Enhanced personalized dosing and titration protocols using predictive analytics on real-time patient data.

- Improved diagnostic accuracy and earlier detection of Pulmonary Arterial Hypertension (PAH) using deep learning algorithms analyzing imaging and clinical data.

- Optimization of clinical trial design, including patient selection and outcome prediction, reducing development timelines for new analogs.

- AI integration in smart infusion pumps to monitor drug delivery integrity, predict hardware failure, and ensure patient safety for continuous treatments.

- Streamlined manufacturing processes (e.g., synthesis, quality control) using AI for process optimization and anomaly detection.

- AI-driven analysis of pharmacogenomic data to predict individual patient response and minimize the risk of non-response or severe side effects.

DRO & Impact Forces Of Prostacyclin Market

The Prostacyclin Market is shaped by a powerful interplay of drivers, restraints, and opportunities, culminating in significant impact forces. Key drivers include the escalating global prevalence of PAH and related pulmonary hypertensive disorders, the increasing adoption of aggressive, multi-drug regimens recommended by global health organizations, and sustained advancements in drug delivery technology focusing on oral and inhaled routes to enhance patient compliance and convenience. These advancements are critical as they address the inherent difficulties associated with continuous intravenous or subcutaneous administration, which has historically been a significant barrier to therapy initiation and adherence. Furthermore, the strong patent protection and orphan drug status enjoyed by many current prostacyclin analogs allow manufacturers to command premium pricing, fueling high revenue generation and investment in subsequent research and development.

However, the market faces notable restraints. The primary impediment remains the high cost of therapy, often exceeding six figures annually per patient, placing substantial pressure on global healthcare budgets and payer reimbursement systems, particularly in developing economies. Additionally, the side-effect profile of prostacyclin analogs, which includes jaw pain, flushing, headaches, and infusion-site reactions, can lead to treatment discontinuation. The introduction of generic versions following patent expiration (e.g., Epoprostenol generics) poses a pricing restraint, necessitating strategic differentiation through unique delivery systems or novel therapeutic combinations. Regulatory complexities and the stringent requirements for clinical trials involving rare diseases also slow down the approval process for next-generation products.

Opportunities for growth are abundant, centering on the expansion of approved indications beyond PAH, such as treating advanced heart failure, pulmonary fibrosis, and severe Raynaud’s phenomenon. The development of non-prostanoid IP receptor agonists (like Selexipag) offers a significant advantage by improving drug stability and oral bioavailability, paving the way for wider uptake. The market is also being influenced by geopolitical impact forces, where fluctuations in intellectual property protections across regions affect the speed of generic market entry. Sociocultural trends emphasizing quality of life improvements are further driving demand for less invasive, convenient oral and inhaled treatments, thereby continuously pushing innovation in drug formulation and delivery mechanisms.

Segmentation Analysis

The Prostacyclin Market segmentation provides a granular view of therapeutic uptake based on product type, application, route of administration, and end user, crucial for understanding current prescribing habits and future growth trajectories. The market dynamics are highly dependent on the formulation, as administration complexity directly correlates with patient adherence and overall clinical utility. Historically, intravenous and subcutaneous delivery dominated due to the rapid degradation of native prostacyclin, but the emergence of stable analogs and novel oral drugs has fundamentally reshaped the competitive landscape. Analysis of these segments is vital for stakeholders planning strategic investments, focusing research efforts, and tailoring marketing initiatives to specific therapeutic needs or geographic patient populations requiring specialized care for severe pulmonary vascular diseases.

- By Product Type: Epoprostenol, Treprostinil, Iloprost, Selexipag, Others (Beraprost).

- By Application: Pulmonary Arterial Hypertension (PAH), Critical Limb Ischemia (CLI), Other Cardiovascular Indications.

- By Route of Administration: Intravenous (IV) Infusion, Subcutaneous (SC) Infusion, Inhalation, Oral.

- By End User: Hospitals and Clinics, Ambulatory Surgical Centers, Home Care Settings.

Value Chain Analysis For Prostacyclin Market

The value chain for the Prostacyclin Market begins with complex upstream activities involving R&D and the synthesis of active pharmaceutical ingredients (APIs). Manufacturing these highly sensitive and specialized prostanoid and non-prostanoid compounds requires specialized chemistry, rigorous quality control, and significant capital investment, establishing high barriers to entry. Upstream analysis focuses on securing reliable sources for key chemical intermediates and maintaining compliance with stringent Good Manufacturing Practices (GMP). Due to the high potency and specificity required, innovation in synthetic chemistry—particularly achieving high enantiomeric purity—is critical at this stage, influencing both the cost of goods sold and the ultimate profitability of the drug.

Moving downstream, the value chain emphasizes distribution, patient access programs, and specialty pharmacy services. Prostacyclin analogs, especially those requiring continuous infusion, necessitate a cold chain or highly controlled distribution network, often involving specialty distributors who manage complex logistics, including infusion pump maintenance and supply refills. The direct channel includes sales forces engaging specialized cardiologists and pulmonologists, while the indirect channel relies heavily on robust third-party logistics (3PL) providers and specialty pharmacies that handle patient onboarding, training, and ongoing support for complex infusion or inhaled therapies. Effective management of the downstream component is crucial, as successful therapy implementation is highly dependent on patient education and continuous logistical support.

The final stage involves the service layer, including payer negotiations and reimbursement strategies. Given the high cost, market access teams play a vital role in ensuring favorable coverage policies. The critical link in this value chain is the specialty pharmacy, which often acts as the direct interface with the patient, coordinating delivery, managing insurance authorization, and providing clinical support for drug administration. Optimization throughout the value chain, from efficient API production to streamlined specialty distribution, is essential to maximize profit margins and ensure that these life-saving, yet complex, medications reach the targeted patient population without undue delay or logistical complications.

Prostacyclin Market Potential Customers

The primary potential customers and end-users of prostacyclin products are specialized medical facilities and patients requiring advanced management of severe cardiopulmonary conditions. Hospitals and tertiary care centers, particularly those with dedicated cardiac and pulmonary units, constitute the largest organizational buyers, utilizing prostacyclin analogs for initial patient stabilization and managing acute phases of Pulmonary Arterial Hypertension (PAH) and Critical Limb Ischemia (CLI). Within these institutions, the key purchasers are pharmacy and therapeutics (P&T) committees, which evaluate clinical efficacy and cost-effectiveness before inclusion in formularies. The increasing severity and complexity of the target diseases necessitate continuous monitoring and highly specialized drug administration, strongly favoring hospital-based initial treatment.

Beyond traditional hospital settings, the market is rapidly expanding into home care and ambulatory settings, especially as patients transition to stable, long-term therapy using less invasive routes of administration like oral or inhaled forms. Home health agencies and specialty infusion providers represent significant customer segments, purchasing and administering these drugs in a decentralized fashion, which improves quality of life for long-term patients. Individual patients, particularly those diagnosed with PAH (Groups 1 and 4), are the ultimate beneficiaries and drivers of demand, relying on prescriptions from expert pulmonologists and cardiologists. The complexity of these therapies requires a robust support ecosystem, making specialty pharmacies and home infusion services indispensable parts of the customer landscape.

The shift toward preventative and early intervention strategies for PAH is also broadening the customer base to include smaller community clinics and diagnostic centers that prioritize early screening for high-risk populations, particularly those with connective tissue diseases (like systemic sclerosis) who are prone to developing PAH. Furthermore, clinical research organizations (CROs) and academic institutions engaged in drug trials for novel PAH treatments are consistent buyers of established prostacyclin formulations for use as comparator drugs or standard-of-care baseline treatments, ensuring continued transactional activity even outside routine patient care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | United Therapeutics, Johnson & Johnson (Actelion), GSK, Bayer AG, Pfizer, Cipla, Teva Pharmaceutical Industries, Dr. Reddy’s Laboratories, Mylan (Viatris), Novartis, Sandoz (Novartis), Lupin Pharmaceuticals, Sun Pharmaceutical Industries, Aspen Pharmacare, Merck & Co., Arena Pharmaceuticals, Takeda Pharmaceutical Company, Bausch Health, Hikma Pharmaceuticals, Wockhardt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prostacyclin Market Key Technology Landscape

The technology landscape in the Prostacyclin Market is intensely focused on mitigating the stability challenges inherent to prostacyclin molecules and improving patient adherence through less invasive delivery methods. Epoprostenol, being chemically unstable, requires continuous cold storage and complex preparation. The technological innovation shift has moved towards creating stable synthetic analogs, such as Treprostinil, which possesses enhanced chemical stability, allowing for subcutaneous and room-temperature infusion options. Furthermore, advanced controlled-release formulations are crucial for oral treatments, ensuring steady drug release and minimizing dose-related side effects. The complexity of these technologies requires specialized manufacturing equipment and deep expertise in pharmaceutical formulation science, which acts as a key competitive differentiator among leading market players.

A major technological advancement driving market growth is the development of specialized drug delivery systems for inhaled and continuous subcutaneous/intravenous administration. For inhalation therapies (e.g., Iloprost), highly efficient nebulizer systems (e.g., I-Neb, specialized ultrasonic nebulizers) are employed to ensure optimal particle size and deep lung penetration, maximizing systemic absorption while minimizing local side effects. For infusion-based treatments (e.g., continuous Treprostinil), the integration of smart, miniaturized, and programmable infusion pumps, often incorporating wireless connectivity and enhanced battery life, represents significant technological leverage. These sophisticated devices improve patient mobility and lifestyle flexibility, crucial considerations for managing a chronic, severe disease like PAH, and are integral to the therapeutic value proposition.

Looking ahead, the technological frontier includes the development of highly selective non-prostanoid agonists (like Selexipag, which is metabolized into an active IP receptor agonist), offering the benefits of prostacyclin pathway activation without the structural instability or off-target effects of earlier prostanoids. Research is also progressing in gene therapy and cellular delivery systems aimed at endogenous prostacyclin production within the patient's body, though these technologies remain largely preclinical. Current efforts are heavily concentrated on optimizing existing formulations to improve bioavailability and reduce administration frequency, alongside continuous refinement of electronic drug delivery devices for enhanced patient monitoring and safety compliance.

Regional Highlights

- North America: Dominates the global market share due to high awareness of PAH, rapid adoption of advanced therapies, established reimbursement mechanisms, and the presence of major pharmaceutical companies specializing in orphan drugs. The U.S. healthcare system's capacity to absorb high-cost specialty treatments drives premium pricing and market size. Continuous R&D and a significant patient pool diagnosed with idiopathic and connective-tissue associated PAH solidify its leadership position.

- Europe: Represents the second largest market, characterized by standardized clinical guidelines (e.g., European Society of Cardiology/European Respiratory Society) encouraging the use of prostacyclin analogs, particularly in Western European nations. Germany, France, and the UK are key contributors, driven by government support for rare disease treatments and high pharmaceutical spending. Price negotiations and variations in national reimbursement policies across the continent introduce complexity but overall ensure consistent demand.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR during the forecast period. Growth is fueled by increasing healthcare infrastructure investment, rising disposable income, a growing prevalence of cardiovascular diseases, and improving diagnosis rates in populous nations like China and India. Expanding access to specialty pharmaceuticals and the local manufacturing of generic equivalents of older prostacyclin drugs contribute significantly to market expansion, albeit often at lower average selling prices compared to Western markets.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets facing challenges related to reimbursement and low penetration of specialized diagnostics. However, urbanization and increasing awareness are gradually boosting demand. MEA, particularly the GCC countries, shows high potential due to affluent healthcare consumers and high expenditure on specialized medical services, while LATAM focuses on improving drug access through public health initiatives and local sourcing/licensing agreements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prostacyclin Market.- United Therapeutics

- Johnson & Johnson (Actelion Pharmaceuticals)

- GlaxoSmithKline (GSK)

- Bayer AG

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Viatris (Mylan)

- Sandoz (Novartis Group)

- Lupin Pharmaceuticals Inc.

- Sun Pharmaceutical Industries Ltd.

- Aspen Pharmacare Holdings Ltd.

- Merck & Co., Inc.

- Takeda Pharmaceutical Company Limited

- Arena Pharmaceuticals (acquired by Pfizer)

- Bausch Health Companies Inc.

- Recordati S.p.A.

- Hikma Pharmaceuticals PLC

- Wockhardt Ltd.

Frequently Asked Questions

Analyze common user questions about the Prostacyclin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary medical application driving demand in the Prostacyclin Market?

The primary medical application driving demand is the treatment of Pulmonary Arterial Hypertension (PAH), a progressive and life-threatening condition characterized by elevated blood pressure in the pulmonary arteries. Prostacyclin analogs are potent vasodilators that significantly improve exercise capacity, hemodynamics, and survival rates in PAH patients.

Which routes of administration are preferred by patients and clinicians in the current market?

There is a strong preference shift toward less invasive routes, primarily oral formulations (like Selexipag) and inhaled therapies (like Iloprost), due to their enhanced convenience and reduced risk of infections or complications associated with continuous intravenous or subcutaneous infusion systems, leading to better long-term patient adherence.

What are the key technological advancements influencing the future of prostacyclin therapy?

Key advancements include the development of chemically stable, non-prostanoid IP receptor agonists with oral bioavailability, and the integration of smart infusion pump technology with AI-driven monitoring capabilities to optimize continuous drug delivery, ensuring precision dosing and proactive management of potential device issues.

How does patent expiration impact the competitive landscape of the Prostacyclin Market?

Patent expiration, particularly for first-generation drugs like Epoprostenol and certain Treprostinil formulations, introduces generic and biosimilar competition. This increases price pressure, expands patient access globally, and forces originator companies to prioritize pipeline innovation in novel delivery systems or next-generation selective agonists to maintain premium positioning.

Which regional segment is anticipated to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid improvements in healthcare infrastructure, increasing governmental expenditure on chronic disease management, and a growing patient population gaining access to specialized PAH diagnostics and treatment options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager