Prostate Cancer Nuclear Medicine Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432548 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Prostate Cancer Nuclear Medicine Diagnostics Market Size

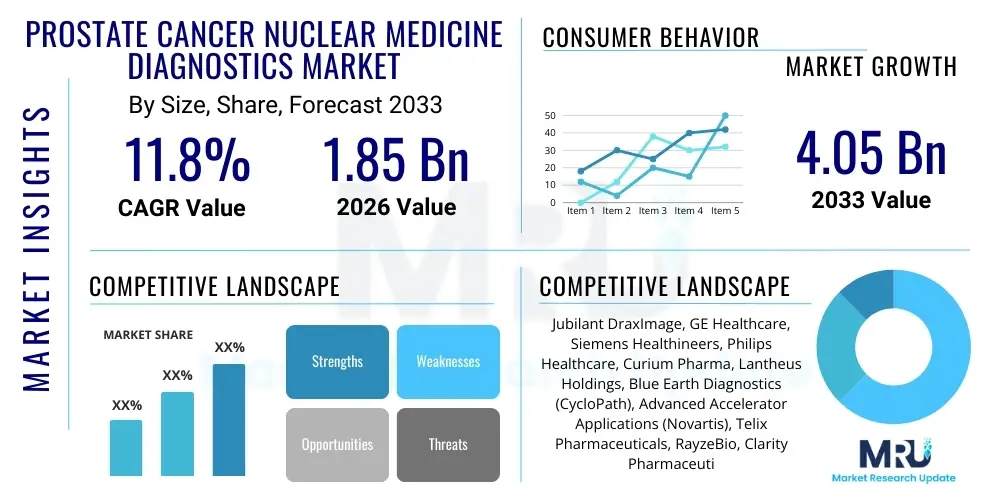

The Prostate Cancer Nuclear Medicine Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 4.05 Billion by the end of the forecast period in 2033.

Prostate Cancer Nuclear Medicine Diagnostics Market introduction

The Prostate Cancer Nuclear Medicine Diagnostics Market encompasses advanced imaging modalities utilizing targeted radiopharmaceuticals to detect, stage, and monitor prostate cancer recurrence. These techniques, primarily Positron Emission Tomography (PET) combined with Computed Tomography (CT) or Magnetic Resonance Imaging (MRI), and Single-Photon Emission Computed Tomography (SPECT), leverage specific molecular targets, most notably Prostate-Specific Membrane Antigen (PSMA). The widespread clinical adoption of PSMA-targeted radiotracers, such as Gallium-68 (Ga-68) PSMA and Fluorine-18 (F-18) PSMA variants, has revolutionized the diagnostic landscape by offering unparalleled sensitivity and specificity, particularly in cases of biochemical recurrence or high-risk primary staging where conventional imaging often fails.

Key products within this domain include diagnostic radiopharmaceuticals like PSMA ligands (e.g., PSMA-11, PSMA-DCFPyL) and choline-based tracers, along with the necessary imaging equipment and cyclotron infrastructure required for production and scanning. Major applications span initial staging for intermediate and high-risk patients, restaging following therapy, detection of metastases, and precise patient selection for emerging radioligand therapy (theranostics). The primary benefit of these diagnostic tools lies in their non-invasive nature and ability to provide highly accurate functional and molecular information, facilitating earlier intervention and enabling personalized treatment strategies based on accurate disease localization and burden.

Market growth is predominantly driven by the increasing global incidence of prostate cancer, continuous technological advancements in radiochemistry leading to novel and commercially viable tracers, and robust clinical evidence supporting the superior efficacy of PSMA-PET compared to traditional bone scans and CT scans. Furthermore, the burgeoning field of theranostics, which pairs diagnostic isotopes with therapeutic isotopes (e.g., Lu-177 PSMA), is structurally enhancing the demand for high-quality nuclear medicine diagnostics, as accurate staging is crucial before initiating targeted radionuclide therapy. Improved reimbursement policies in developed economies and expansion of nuclear medicine infrastructure in emerging markets further accelerate market penetration and adoption rates.

Prostate Cancer Nuclear Medicine Diagnostics Market Executive Summary

The Prostate Cancer Nuclear Medicine Diagnostics Market is experiencing exponential growth, primarily fueled by the paradigm shift toward PSMA-targeted imaging, which significantly enhances diagnostic accuracy in staging and detecting recurrent disease. Business trends highlight a strong focus on strategic partnerships between radiopharmaceutical developers and contract manufacturing organizations (CMOs) to manage complex supply chain logistics, particularly for short half-life isotopes like Gallium-68 and Fluorine-18. Furthermore, major pharmaceutical companies are heavily investing in clinical trials for next-generation PSMA tracers and theranostic pairs, indicating a sustained commitment to integrating diagnostics and therapeutics. Market competitiveness centers on securing regulatory approvals across key geographical markets and optimizing tracer production efficiency to meet escalating clinical demand.

Regionally, North America maintains market dominance, attributed to high prostate cancer prevalence, sophisticated healthcare infrastructure, and favorable reimbursement pathways, particularly in the United States, which saw rapid adoption following FDA approvals for leading PSMA tracers. However, the Asia Pacific region is projected to exhibit the highest growth rate due to rising healthcare expenditure, increasing awareness, and government initiatives aimed at improving cancer diagnostic capabilities. European markets are characterized by strong integration of academic research institutions and commercial entities, leading to rapid clinical uptake, especially in countries with established nuclear medicine networks like Germany and France. Developing nations are focusing on establishing local cyclotron facilities to reduce reliance on imported tracers and enhance accessibility.

Segment trends reveal that the Radiopharmaceuticals segment, specifically the PSMA Ligands sub-segment, is the most dynamic, driven by their superior clinical performance over conventional imaging agents. The PET segment, utilizing technologies like PSMA-PET/CT, holds the largest market share due to its established role as the gold standard for high-sensitivity imaging. In terms of end-users, Hospitals and Specialized Cancer Centers remain the primary purchasers, increasingly investing in advanced hybrid imaging systems (PET/MR) to improve diagnostic precision and workflow efficiency. The rise of theranostics is reinforcing the demand for diagnostic isotopes as companion diagnostics, solidifying the interconnection between the diagnostic and therapeutic segments of nuclear medicine.

AI Impact Analysis on Prostate Cancer Nuclear Medicine Diagnostics Market

User queries regarding AI's influence in prostate cancer nuclear medicine diagnostics typically revolve around themes of automation, quantitative accuracy, clinical workflow integration, and the potential for AI algorithms to outperform human interpreters. Common questions focus on how AI can reduce inter-reader variability, specifically in complex cases involving subtle lymph node metastases or faint lesions in the bone marrow, and whether current reimbursement structures support AI-enhanced diagnostics. Furthermore, there is significant interest in AI's role in predictive modeling—specifically, using imaging biomarkers derived from PSMA-PET scans (radiomics) to forecast treatment response, recurrence risk, and overall patient survival. The primary expectations are that AI will enhance image segmentation, improve lesion detection sensitivity, and facilitate rapid, objective quantitative analysis of tracer uptake parameters, ultimately streamlining the diagnostic process and supporting precision medicine decisions.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transitioning from research novelty to clinical necessity within the nuclear medicine landscape, particularly for prostate cancer diagnostics. AI algorithms are proving instrumental in tasks such as noise reduction and image reconstruction, leading to significantly enhanced image quality, especially in low-dose protocols, which is critical for patient safety and quantitative reliability. Beyond basic image enhancement, AI is being deployed for automated quantification of standardized uptake values (SUV), tumor volume delineation, and the automated detection of small, early-stage metastatic lesions that might be overlooked during manual interpretation, thus minimizing diagnostic errors and improving consistency across different imaging centers.

Crucially, the application of radiomics—the high-throughput extraction of quantitative features from medical images—powered by AI, is establishing robust imaging biomarkers for prostate cancer. These AI-driven radiomic signatures are becoming key components in personalized medicine, providing prognostic information that transcends simple anatomical staging. This allows clinicians to make more informed decisions regarding active surveillance, definitive local therapy, or systemic treatment initiation. The ultimate impact of AI is expected to accelerate the clinical implementation of advanced diagnostic workflows, reduce the time required for image reading and reporting, and establish predictive capabilities that link diagnostic nuclear scans directly to optimized therapeutic outcomes, thereby strengthening the value proposition of nuclear medicine diagnostics.

- AI enables automated segmentation and quantification of PSMA-avid lesions, reducing inter-reader variability.

- Machine Learning algorithms enhance image reconstruction and noise reduction, improving overall image quality and resolution.

- Radiomics, facilitated by AI, extracts complex imaging biomarkers from PET/CT scans to predict treatment response and prognosis.

- AI integration streamlines clinical workflow by automating image review processes and generating structured diagnostic reports swiftly.

- Predictive AI models assist in patient stratification for personalized theranostic approaches using PSMA-PET data.

DRO & Impact Forces Of Prostate Cancer Nuclear Medicine Diagnostics Market

The market dynamics are defined by a powerful convergence of factors: Drivers include the clinical superiority of PSMA-PET/CT over conventional imaging, the integration of diagnostics with therapeutic radiopharmaceuticals (theranostics), and increasing prostate cancer incidence globally. Restraints primarily involve the high cost associated with advanced imaging systems, the short half-life logistics of certain radioisotopes (Ga-68), and stringent regulatory pathways that slow down tracer approval. Opportunities center on the development of novel, longer-shelf-life radiotracers (F-18 based), expansion into localized and regional staging applications, and increased adoption in emerging markets. These factors collectively exert significant impact forces on market expansion, pushing for innovation in supply chain management and tracer chemistry to overcome existing logistical hurdles and meet growing clinical requirements.

Market Drivers

The primary driver for the Prostate Cancer Nuclear Medicine Diagnostics market is the transformative impact of PSMA-targeted radiopharmaceuticals. PSMA-PET imaging offers significantly higher sensitivity and specificity than traditional imaging modalities, particularly in identifying soft tissue and distant metastases at low levels of prostate-specific antigen (PSA) following initial treatment failure. This capability allows for earlier and more precise detection of recurrent disease, fundamentally changing clinical practice guidelines and increasing demand from urologists and oncologists seeking more accurate staging tools. The growing body of clinical evidence from large-scale prospective trials continuously reinforces the diagnostic superiority of PSMA tracers, compelling widespread clinical adoption across global oncology centers and securing favorable coverage decisions from major payers.

Another major impetus is the burgeoning field of theranostics. The success of targeted radionuclide therapy, specifically using Lutetium-177 (Lu-177) PSMA, necessitates accurate diagnostic PSMA-PET scanning as a crucial selection criterion—determining which patients are suitable candidates for therapy based on tumor expression levels. This symbiotic relationship between diagnostics and therapeutics creates an inherent pull for diagnostic isotopes. Furthermore, the global aging population contributes directly to the rising incidence of prostate cancer, creating a larger target patient pool requiring highly accurate initial diagnosis, staging, and continuous monitoring throughout their treatment journey. Continuous investment in hybrid imaging systems (PET/CT and PET/MR) that improve spatial resolution and diagnostic confidence also drives market sophistication and capital expenditure.

Market Restraints

Despite robust growth, the market faces significant restraints, chiefly related to the infrastructural complexity and high capital investment required for nuclear medicine facilities. Establishing and operating a full-scale PET center involves substantial costs for cyclotron installation (for F-18 production), specialized radiochemistry laboratories, and compliance with stringent radiation safety protocols, which restricts rapid expansion, particularly in lower-resource settings. Furthermore, the reliance on short-lived radioisotopes, such as Gallium-68 (half-life of 68 minutes), poses substantial logistical challenges related to manufacturing, transportation, and timely administration. While generator-based systems mitigate some production issues, supply chain disruptions and the need for highly specialized personnel trained in handling and synthesizing these delicate tracers remain persistent hurdles to broader market access.

A second major restraint is the variability and limitations in reimbursement policies across different geographies. While major developed markets like the US and parts of Europe have relatively robust coverage for PSMA-PET, coverage scope can be restricted (e.g., only for specific clinical indications like biochemical recurrence, not routine initial staging), limiting utilization frequency. Furthermore, a shortage of skilled nuclear medicine physicians and radiopharmacists capable of interpreting complex molecular images and managing tracer production represents a bottleneck. These human resource constraints, combined with the need for rigorous quality control standards inherent to molecular diagnostics, can hinder the volume throughput necessary to justify the high initial investment in advanced diagnostic infrastructure, particularly in competitive urban settings.

Market Opportunities

Significant opportunities arise from the ongoing shift toward Fluorine-18 (F-18) based PSMA tracers (e.g., F-18 DCFPyL, F-18 PSMA-1007). F-18 has a longer half-life (110 minutes) compared to Ga-68, allowing for centralized production and distribution to remote or smaller facilities, dramatically expanding geographic accessibility and reducing dependency on local cyclotron facilities. This technological transition lowers logistical barriers and enables wider market penetration, particularly in sprawling geographical areas or developing nations where infrastructure is sparse. Continued research into novel, non-PSMA targets—such as fibroblast activation protein (FAP) and gastrin-releasing peptide receptor (GRPR)—offers diversification potential, addressing prostate cancer subtypes that may not express sufficient PSMA levels for optimal imaging or therapy.

Furthermore, the increased focus on personalized medicine creates a substantial opportunity for utilizing these diagnostics in non-invasive risk stratification and treatment monitoring. For instance, using quantitative PET metrics (radiomics) to assess early response to systemic therapies (chemotherapy or hormonal agents) can inform clinical decisions much faster and more reliably than traditional PSA level tracking. The expansion of clinical indications beyond recurrence detection to primary staging in intermediate and high-risk patients, especially in conjunction with Magnetic Resonance Imaging (PET/MR), represents a large, untapped market segment. Finally, global efforts to streamline regulatory approval processes for diagnostic radiopharmaceuticals, potentially mirroring established pathways in key regions, could expedite time-to-market for promising new tracers, thus accelerating overall market growth.

Impact Forces Summary

- Superior Diagnostic Accuracy: PSMA-PET provides higher specificity and sensitivity than conventional imaging, driving immediate clinical adoption.

- Theranostics Integration: The necessity of PSMA diagnostic scans to select patients for Lu-177 therapy creates an inseparable pull market dynamic.

- Logistical Constraints: Short half-life isotopes and complex supply chain requirements limit accessibility and increase operational costs, acting as a decelerator.

- Regulatory Streamlining: Faster approval of F-18 based tracers and harmonized international standards accelerate product commercialization.

- High Capital Investment: The substantial upfront cost for PET/CT systems and cyclotron facilities restricts entry for smaller healthcare providers.

Segmentation Analysis

The Prostate Cancer Nuclear Medicine Diagnostics Market is comprehensively segmented based on the type of technology used (e.g., PET, SPECT), the specific diagnostic agents (radiopharmaceuticals) utilized, and the end-user setting. This granular segmentation allows for detailed analysis of market dynamics, revealing that the market is heavily skewed towards PET imaging due to its superior resolution and quantitative capabilities. The Radiopharmaceuticals segment, dominated by PSMA ligands, is the core revenue driver and the focus of most research and development investment. Analyzing these segments provides strategic insights into investment areas, such as the transition from Ga-68 to F-18 tracers and the growing procurement power of specialized cancer centers.

The segmentation by product reveals the vital importance of the radioactive material supply chain. The Imaging Equipment segment, though large in capital expenditure, is relatively stable, whereas the Radiopharmaceuticals segment experiences high volatility and rapid innovation based on new ligand discovery and isotope availability. Within the Imaging Equipment category, hybrid systems combining molecular and anatomical imaging, such as PET/CT, continue to lead, while PET/MR systems are gaining traction for their ability to provide simultaneous functional and high-resolution soft-tissue contrast, particularly relevant in pelvic imaging. Furthermore, the segmentation by application highlights the shift from primary staging focus to the intense diagnostic demand generated by biochemical recurrence, which requires extremely high sensitivity for localized disease detection.

End-user segmentation clearly indicates that Hospitals and Specialized Oncology Centers are the primary revenue generation points, owing to the high cost and technical complexity associated with nuclear medicine procedures. These institutions possess the requisite infrastructure, specialized personnel, and high patient volumes necessary to maximize the operational efficiency of advanced imaging units. Conversely, diagnostic imaging centers are increasingly incorporating nuclear medicine services through partnerships or direct investment, aiming to capture the growing outpatient market for PSMA scanning, particularly as reimbursement becomes more established for standard indications.

- By Technology:

- Positron Emission Tomography (PET)

- Single-Photon Emission Computed Tomography (SPECT)

- Hybrid Systems (PET/CT, SPECT/CT, PET/MR)

- By Diagnostic Agent (Radiopharmaceuticals):

- PSMA Ligands (e.g., Ga-68 PSMA, F-18 PSMA)

- Choline Derivatives (e.g., F-18 Choline, C-11 Choline)

- Other Tracers (e.g., F-18 Fluciclovine)

- By Application:

- Initial Staging (High-risk and Intermediate-risk PCa)

- Biochemical Recurrence Detection and Restaging

- Therapy Monitoring and Response Assessment (Theranostics Companion Diagnostics)

- By End User:

- Hospitals

- Specialized Cancer Centers

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

Value Chain Analysis For Prostate Cancer Nuclear Medicine Diagnostics Market

The value chain for the Prostate Cancer Nuclear Medicine Diagnostics Market is highly complex, starting with the upstream sourcing and production of radioisotopes and precursor materials. This stage is dominated by a few specialized vendors and governmental entities managing high-energy particle accelerators or nuclear reactors. Intermediate steps involve radiopharmaceutical manufacturing, where precursor molecules are labeled with the diagnostic isotope (e.g., Ga-68 or F-18) either centrally at large production facilities (for F-18) or locally using generators (for Ga-68). Stringent quality control and regulatory compliance are essential at this phase, requiring significant investment in good manufacturing practice (GMP) facilities.

The downstream segment focuses on distribution and clinical application. Distribution channels are critical, especially given the short half-lives of the tracers, necessitating highly efficient, cold-chain logistics. Direct distribution models are often used for F-18 products traveling from centralized cyclotrons to hospitals, whereas Ga-68 generator systems enable on-site, indirect production at the hospital level. The final step involves the delivery of the diagnostic service, primarily occurring in hospitals and specialized cancer centers equipped with PET/CT or SPECT/CT scanners. Reimbursement mechanisms and clinical guidelines significantly influence the volume and flow of this downstream utilization, dictating patient access and market volume.

Direct sales of imaging equipment (PET scanners) and consumable radiopharmaceuticals to large hospital networks represent the primary direct distribution channel, often coupled with long-term maintenance contracts and dedicated training programs. Indirect channels involve partnerships with Radiopharmaceutical Contract Manufacturing Organizations (CMOs) or specialized couriers who manage the complex transport of time-sensitive tracers. The integrity of the cold chain and adherence to stringent safety regulations throughout the distribution network are paramount, as any delay or contamination renders the diagnostic agent unusable. The efficiency of this value chain determines the cost structure and accessibility of advanced nuclear medicine diagnostics across different healthcare systems.

Prostate Cancer Nuclear Medicine Diagnostics Market Potential Customers

The primary end-users and potential customers of Prostate Cancer Nuclear Medicine Diagnostics are large academic medical centers, specialized private oncology clinics, and regional hospital systems that maintain dedicated nuclear medicine departments. These institutions require high-throughput imaging systems and a reliable supply of complex radiopharmaceuticals to serve high-volume patient populations requiring complex staging and restaging procedures. Specifically, institutions engaging in prostatectomy or radiation therapy programs are crucial customers, as they frequently utilize PSMA scans for pre-operative planning and post-treatment surveillance for biochemical recurrence.

A rapidly expanding customer base includes centralized diagnostic imaging centers that are increasingly establishing PET capabilities to capture outpatient referrals from community urologists and oncologists who require advanced molecular imaging. These centers prioritize tracers with longer shelf lives (F-18) for operational efficiency. Furthermore, Contract Research Organizations (CROs) and pharmaceutical companies are also key buyers, utilizing these diagnostic techniques and agents in clinical trials to evaluate the efficacy of novel cancer drugs, particularly those focused on targeted radioligand therapies (theranostics), where diagnostic imaging serves as a critical biomarker endpoint.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.05 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jubilant DraxImage, GE Healthcare, Siemens Healthineers, Philips Healthcare, Curium Pharma, Lantheus Holdings, Blue Earth Diagnostics (CycloPath), Advanced Accelerator Applications (Novartis), Telix Pharmaceuticals, RayzeBio, Clarity Pharmaceuticals, Eckert & Ziegler, Bracco Imaging, F. Hoffmann-La Roche Ltd, Eli Lilly and Company, Life Molecular Imaging, ITM Isotope Technologies Munich SE, Sotio, Bayer AG, NorthStar Medical Radioisotopes |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prostate Cancer Nuclear Medicine Diagnostics Market Key Technology Landscape

The technological landscape of prostate cancer nuclear medicine diagnostics is dominated by hybrid imaging systems, specifically PET/CT and increasingly PET/MR. PET/CT remains the foundational technology, providing high-resolution functional data on tracer uptake (molecular activity) precisely co-registered with anatomical data (CT) for accurate localization of lesions. Recent advancements in PET detector technology, such as solid-state silicon photomultipliers (SiPMs), have enhanced image resolution, reduced required radiation doses, and shortened scan times, improving both patient experience and image quality for quantitative analysis. The continuous development of specialized software for automated image analysis and quantitative metrics (radiomics) is also a critical technological area.

Radiopharmaceutical chemistry represents the core innovation driver. The transition from older tracers like F-18 fluciclovine and C-11 Choline to high-affinity PSMA ligands marks a major technological milestone. Current research is focused on optimizing the chemical structure of PSMA tracers to improve tumor uptake kinetics and reduce background noise, particularly in the urinary bladder. Furthermore, the standardization of production methods for both Ga-68 (via generators) and F-18 (via cyclotron production) is essential, with robust quality control technology ensuring the purity and stability of the final product prior to injection. This standardization supports the global scaling of these diagnostic agents required for theranostics programs.

Finally, the rapid maturation of the theranostics platform represents the integration of diagnostic and therapeutic technology into a single clinical approach. This requires seamless operational technology that ensures the diagnostic scan (e.g., Ga-68 PSMA PET) is performed using equipment and protocols compatible with the therapeutic agent (e.g., Lu-177 PSMA), ensuring accurate dosimetry calculations for treatment planning. The increasing clinical acceptance of technologies that offer quantitative analysis, such as advanced software packages for automated tumor volume delineation and uptake quantification, solidifies the move toward a highly precise, technologically integrated molecular imaging paradigm.

Regional Highlights

- North America: This region holds the largest market share, driven by rapid regulatory approvals (e.g., FDA approval of key PSMA tracers), high disposable income supporting advanced healthcare technology, and a sophisticated reimbursement environment. The presence of major market players and leading cancer research institutions accelerates the adoption of novel diagnostic protocols. The US market, specifically, is a primary driver due to high prevalence and aggressive adoption of theranostics programs.

- Europe: Characterized by strong academic research and clinical integration, Europe is a highly competitive market. Germany and France are leaders in adopting nuclear medicine, with established networks of cyclotron facilities. However, market growth is often influenced by varied national health technology assessment (HTA) processes and differing reimbursement levels among member states, though the overall shift towards PSMA imaging is robust and rapid, especially in biochemical recurrence settings.

- Asia Pacific (APAC): APAC is anticipated to demonstrate the fastest growth rate over the forecast period. This growth is fueled by increasing foreign investment in healthcare infrastructure, rising prevalence of prostate cancer among rapidly aging populations, and improving access to advanced medical technology, particularly in countries like China, Japan, and India. Governments are increasingly prioritizing cancer diagnostics, leading to the establishment of new PET centers.

- Latin America (LATAM): Market development in LATAM is currently constrained by lower healthcare expenditure and limited access to centralized cyclotron production facilities, leading to a higher reliance on older diagnostic methods. However, major urban centers in Brazil and Mexico are witnessing gradual expansion of nuclear medicine capabilities, often driven by private sector investment and collaborations with international providers to access key radiopharmaceuticals.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated primarily in affluent Gulf Cooperation Council (GCC) nations (UAE, Saudi Arabia) which invest heavily in state-of-the-art medical technology as part of national diversification efforts. The adoption of PSMA diagnostics in these countries is high, often mirroring European and North American standards, although accessibility remains low in sub-Saharan African regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prostate Cancer Nuclear Medicine Diagnostics Market.- Jubilant DraxImage

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Curium Pharma

- Lantheus Holdings

- Blue Earth Diagnostics (CycloPath)

- Advanced Accelerator Applications (Novartis)

- Telix Pharmaceuticals

- RayzeBio

- Clarity Pharmaceuticals

- Eckert & Ziegler

- Bracco Imaging

- F. Hoffmann-La Roche Ltd

- Eli Lilly and Company

- Life Molecular Imaging

- ITM Isotope Technologies Munich SE

- Sotio

- Bayer AG

- NorthStar Medical Radioisotopes

Frequently Asked Questions

Analyze common user questions about the Prostate Cancer Nuclear Medicine Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is PSMA-PET and why is it superior for diagnosing prostate cancer?

PSMA-PET utilizes radiolabeled Prostate-Specific Membrane Antigen (PSMA) ligands injected into the patient. These ligands specifically bind to PSMA protein highly expressed on prostate cancer cells. The PET scan detects the radiation emitted, providing highly sensitive and accurate molecular images, which are superior to conventional CT and bone scans, especially in detecting small, recurrent, or metastatic lesions at low PSA levels.

How is the logistics of short-lived radioisotopes like Gallium-68 managed in this market?

The logistics for Ga-68 are managed primarily through Mo-99/Ga-68 generator systems installed directly at hospital sites. These generators enable on-site production of the diagnostic tracer on demand, bypassing complex transportation needs, thereby maximizing the usable dose window and ensuring timely patient scans. However, F-18 tracers, due to their longer half-life, rely on centralized cyclotron production and efficient cold-chain courier systems for distribution.

What role does the emerging field of theranostics play in the diagnostic market growth?

Theranostics is a significant market driver as it couples diagnostic imaging (e.g., Ga-68 PSMA) with targeted therapy (e.g., Lu-177 PSMA). The diagnostic scan serves as a prerequisite, identifying patients whose tumors sufficiently express PSMA to be eligible for treatment. This diagnostic necessity guarantees sustained demand for PSMA tracers, structurally linking the diagnostic segment to the highly lucrative therapeutic radiopharmaceutical segment.

Are there non-PSMA targeted tracers used in prostate cancer diagnostics?

Yes, while PSMA ligands dominate, older tracers like F-18 Fluciclovine (an amino acid analogue) and C-11/F-18 Choline derivatives are still utilized, primarily in regions where PSMA tracers may not yet be approved or widely available. These non-PSMA agents detect increased cellular metabolism associated with malignancy but generally offer lower sensitivity and specificity compared to the highly targeted PSMA ligands.

How is Artificial Intelligence (AI) influencing the accuracy of nuclear medicine prostate scans?

AI significantly enhances scan accuracy by automating image quantification, standardizing uptake value (SUV) calculations, and reducing image noise. Critically, AI powered radiomics extracts complex quantitative features from the PET images, providing prognostic biomarkers that help predict patient response to specific treatments and improve the overall objectivity and efficiency of image interpretation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager