Prosthetic Foot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431534 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Prosthetic Foot Market Size

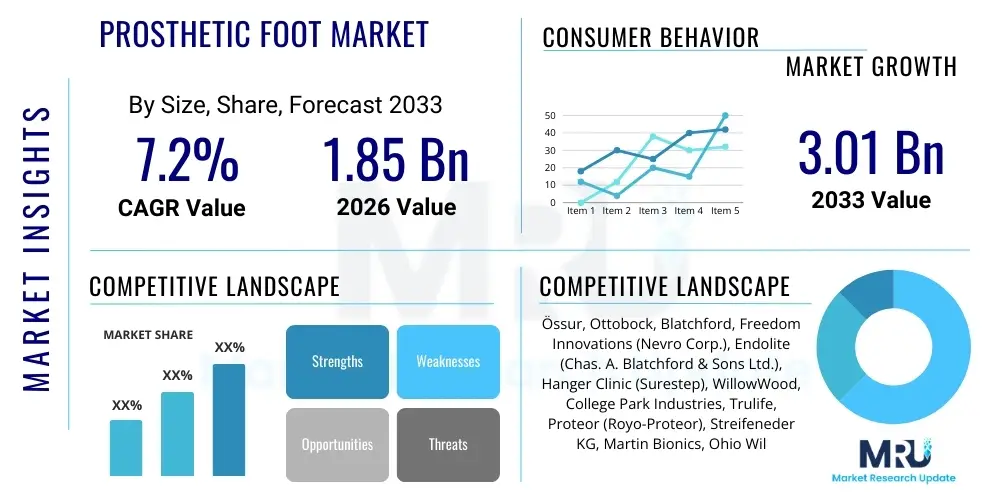

The Prosthetic Foot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.01 Billion by the end of the forecast period in 2033.

The steady expansion of the global prosthetic foot market is fundamentally driven by the increasing prevalence of diabetes, peripheral vascular disease, and traumatic injuries, which are primary causes of limb amputation worldwide. Improved healthcare infrastructure, particularly in developing economies, coupled with enhanced insurance coverage for sophisticated prosthetic devices, further fuels market momentum. Technological advancements, such as the integration of advanced materials like carbon fiber and the development of microprocessor-controlled ankles and feet (MPAFs), significantly enhance functionality and user acceptance, justifying premium pricing and bolstering market size.

Market growth is also influenced by favorable regulatory environments promoting innovation and patient access to advanced mobility solutions. Demand for custom-fit and highly aesthetic prosthetics is rising, particularly among active individuals seeking devices that mimic natural gait and provide superior performance for sports and recreational activities. Moreover, the increasing lifespan of the global population means a larger cohort of elderly individuals requiring reliable prosthetic solutions for maintaining independent mobility and quality of life, cementing a robust outlook for sustained market expansion through 2033.

Prosthetic Foot Market introduction

The Prosthetic Foot Market encompasses the design, manufacture, and distribution of specialized devices intended to replace the function and appearance of a missing biological foot, often resulting from congenital defects, trauma, or disease-related amputation. These devices, ranging from basic SACH (Solid Ankle Cushioned Heel) feet to highly sophisticated dynamic response and microprocessor-controlled systems, are crucial components of lower limb prostheses, restoring stability, enabling gait, and improving the quality of life for amputees globally. The primary product objective is to provide shock absorption, energy return, and multi-axis articulation, tailored to the user’s activity level, weight, and specific amputation level, ensuring optimal biomechanical performance and comfort during ambulation.

Major applications for prosthetic feet span clinical rehabilitation settings, long-term home use, and specialized sports activities. The product scope includes various material constructions such as carbon fiber composites for high energy return, aluminum alloys for lightweight durability, and specialized plastics. Key benefits derived from modern prosthetic feet include enhanced stability on uneven terrain, reduced cognitive load during walking due to advanced sensors and control algorithms, improved cosmetic integration, and prevention of secondary musculoskeletal issues associated with compensatory gait patterns. These advancements have transformed the perception of prosthetic use from simple replacement to functional enhancement.

The market is significantly driven by demographic shifts, including the aging population susceptible to chronic diseases like diabetes, and the increased incidence of road accidents and war-related injuries in certain regions. Furthermore, continuous innovation, particularly in areas like 3D printing for custom sockets and the application of machine learning in microprocessor foot control, acts as a primary growth accelerator. Favorable reimbursement policies, particularly in North America and Western Europe, further ensure patient access to premium products, thereby expanding the total addressable market and encouraging manufacturers to invest heavily in research and development for next-generation bionic and robotic solutions.

Prosthetic Foot Market Executive Summary

The global Prosthetic Foot Market is characterized by robust growth, propelled by the convergence of advanced material science and digital technology. Business trends indicate a strong shift towards highly customized and high-performance devices, particularly microprocessor-controlled (MP) feet, which offer superior adaptation to varying terrains and walking speeds compared to passive devices. Key manufacturers are focusing on strategic acquisitions and partnerships with technology firms to integrate sophisticated sensor technology and AI-driven control systems, streamlining the fitting process through digital scanning and enhancing patient outcomes. Pricing strategies remain premium for energy-storing feet (ESF) and MP models, driven by high R&D costs and clinical necessity, though mid-range carbon fiber options are seeing greater price competitiveness, broadening consumer access.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated reimbursement structures, and the early adoption of cutting-edge prosthetic technology. Europe follows closely, driven by standardized healthcare systems and a high awareness regarding advanced rehabilitation options. The Asia Pacific region, however, is emerging as the fastest-growing market, primarily fueled by the burgeoning medical tourism sector, improving economic conditions, and the vast, yet underserved, population base increasingly afflicted by chronic diseases leading to amputation. Regional variations in demand are notable; North America prioritizes high-activity, technologically integrated feet, while emerging markets focus on durable, cost-effective functional solutions.

Segment trends reveal that the dynamic response foot segment (including carbon fiber variants) retains the largest market share due to its proven efficacy in energy return and functional mimicry, appealing to a broad range of activity levels. Concurrently, the microprocessor-controlled foot segment is witnessing the highest growth rate, despite higher costs, owing to the superior functionality, safety features (e.g., stumble recovery), and improved gait symmetry they provide. By end-user, prosthetic clinics and specialized rehabilitation centers remain the primary points of distribution, emphasizing the importance of expert clinical fitting and gait training, which is essential for maximizing the utility and longevity of these complex medical devices, thereby strengthening the professional services segment of the value chain.

AI Impact Analysis on Prosthetic Foot Market

Analysis of common user questions reveals significant interest and concern regarding the practical integration of Artificial Intelligence (AI) and Machine Learning (ML) into prosthetic foot technology. Users frequently inquire about the feasibility of AI optimizing gait patterns in real-time across varied terrains, the potential for AI-driven diagnostic tools to better predict ideal componentry based on patient specific biomechanics, and the security and privacy implications of prosthetic devices generating vast amounts of movement data. Key themes revolve around enhanced personalization, predictive maintenance, and the aspiration for prostheses that autonomously adapt to environmental changes, minimizing user effort and maximizing safety and natural movement fluidity.

The consensus suggests that AI is poised to revolutionize the Prosthetic Foot Market by moving devices beyond pre-programmed responses towards genuine, dynamic adaptation. AI algorithms can process complex input from inertial measurement units (IMUs), gyroscopes, and pressure sensors embedded in advanced prosthetic feet, learning and instantaneously adjusting ankle and knee joint moments. This capability addresses a major user concern: the inability of current non-microprocessor systems to reliably navigate stairs, ramps, and highly variable outdoor surfaces without conscious effort. Furthermore, AI-driven digital fitting tools, utilizing ML to analyze thousands of anatomical scans and gait profiles, promise to significantly reduce the iterative and often lengthy process of achieving a perfect socket and aligning the prosthetic foot.

Long-term expectations focus on AI enabling true biofeedback mechanisms, where the prosthetic foot communicates functionally relevant sensory information back to the user, potentially mitigating the phenomenon of phantom limb pain and improving proprioception. Concerns, however, persist regarding the high cost associated with AI-integrated devices, which could exacerbate existing disparities in access to advanced technology, particularly in lower-income regions. Manufacturers are strategically addressing these concerns by developing modular, AI-ready platforms that allow for future software updates and integrating robust data encryption protocols to ensure patient data security and maintain compliance with global healthcare privacy regulations like HIPAA and GDPR.

- AI-driven real-time gait optimization and stumble recovery prediction.

- Machine learning algorithms enhancing prosthetic fitting accuracy and reducing fabrication time via personalized design.

- Predictive maintenance schedules developed through analysis of wear patterns and usage data.

- Integration of AI for processing sensory input, potentially enabling biofeedback systems for improved user perception.

- Automation of prosthetic component selection based on patient profile, activity level, and residual limb characteristics.

- Development of personalized control parameters unique to each individual's walking style and muscle activation patterns.

DRO & Impact Forces Of Prosthetic Foot Market

The Prosthetic Foot Market dynamics are shaped by potent Drivers, significant Restraints, and transformative Opportunities, collectively known as DRO, whose interacting forces determine market trajectory. The primary drivers include the escalating global incidence of chronic diseases, notably diabetes leading to peripheral neuropathy and subsequent amputation, alongside increased road traffic accidents and sports injuries. Simultaneously, continuous breakthroughs in material science, particularly the utilization of lightweight, durable, and high-energy-returning carbon fiber composites, and the miniaturization of sensors and microprocessors, propel the demand for sophisticated, functional prosthetic solutions. These drivers are amplified by improving healthcare reimbursement policies in established markets, which make advanced, higher-priced devices accessible to a wider patient demographic.

However, the market faces notable Restraints that temper growth. The high initial cost and subsequent maintenance expenses associated with advanced microprocessor and dynamic response feet constitute a significant barrier, particularly in regions with underdeveloped insurance coverage or lower per capita income. Furthermore, the specialized skillset required for accurately fitting and calibrating sophisticated prosthetic systems limits their widespread deployment, necessitating investment in highly trained certified prosthetists. Regulatory hurdles, although aimed at ensuring safety and efficacy, can often slow the market introduction of novel technologies, while the inherent lack of standardized global reimbursement across all prosthetic types creates market fragmentation and complexity for multinational manufacturers.

The most compelling Opportunities for market expansion reside in the widespread adoption of digital technologies, specifically additive manufacturing (3D printing) for custom sockets and cosmetic covers, which significantly reduces production costs and lead times. The penetration of telehealth and remote monitoring capabilities facilitates better post-fitting adjustments and maintenance, expanding geographical reach. Moreover, increasing focus on geriatric care and veteran support programs, alongside targeted development of affordable, high-quality functional prostheses for emerging markets, presents substantial untapped potential. The convergence of bio-inspired robotics and AI offers the long-term opportunity for truly bionic limbs that seamlessly integrate with the nervous system, redefining the standard of care and unlocking premium value segments.

Segmentation Analysis

The segmentation of the Prosthetic Foot Market is essential for understanding precise demand characteristics and targeting specific patient needs based on product features, underlying technology, and activity level. The market is primarily segmented by product type, material, end-user, and activity level, reflecting the diverse requirements of the amputee population, ranging from K1 (non-ambulatory) to K4 (high-activity users). This granular classification allows manufacturers to optimize their product portfolios and marketing strategies, ensuring alignment with clinical requirements and reimbursement categories. The performance differential between segments, particularly passive mechanical feet versus active microprocessor systems, dictates pricing and market accessibility across different regions.

Segmentation by technology is perhaps the most dynamic area, separating conventional mechanical systems (such as SACH feet and multi-axial feet) from advanced energy storage and microprocessor-controlled feet. The energy-storing feet (ESF) segment, dominated by carbon fiber components, caters heavily to K3 and K4 level users, emphasizing spring dynamics and lightweight construction. Conversely, microprocessor feet represent the premium, fastest-growing segment, offering enhanced safety, stability, and variable terrain performance for a broader K2 and K3 population, often justifying the substantial investment through superior functional outcomes and reduced falls risk.

Further segment refinement based on end-user—including specialized prosthetic clinics, hospitals, and rehabilitation centers—highlights the critical role of professional healthcare providers in the distribution chain. Activity level segmentation (K-levels) directly dictates material choice and technology adoption; for instance, high-impact activities require robust carbon fiber construction, while lower activity levels may utilize more durable, lower-cost polymeric or aluminum solutions. Understanding these segments is crucial for market entry, product development pipeline prioritization, and effective strategic planning in this specialized medical device sector.

- By Product Type:

- Microprocessor-Controlled Feet (MPAFs)

- Dynamic Response/Energy-Storing Feet (ESF)

- Non-Storage/Conventional Feet (e.g., SACH, Single-Axis, Multi-Axis)

- By Material:

- Carbon Fiber Composites

- Aluminum Alloys

- Polymer/Plastic-based Materials

- By Activity Level (K-Levels):

- K1 (Non-ambulatory/Household)

- K2 (Limited Community Ambulator)

- K3 (Community Ambulator, Variable Cadence)

- K4 (High Activity/Sports)

- By End-User:

- Prosthetic and Orthotic Centers

- Hospitals and Rehabilitation Centers

- Ambulatory Surgical Centers

- By Amputation Level:

- Transtibial (Below Knee)

- Transfemoral (Above Knee - Indirect Impact)

Value Chain Analysis For Prosthetic Foot Market

The value chain for the Prosthetic Foot Market begins with Upstream Analysis, which focuses primarily on the sourcing and processing of specialized raw materials. This includes high-grade carbon fiber filaments and prepregs, complex microprocessors and sensors (gyroscopes, accelerometers, pressure plates), specialized polymers for cosmetic covers, and high-strength aluminum and titanium alloys for structural components. Key upstream activities involve maintaining stringent quality control over material properties, ensuring components meet strict medical device standards, and managing global supply chain logistics, often involving specialized chemical and electronics manufacturers. Efficiency at this stage directly impacts the performance characteristics and ultimate cost of the finished prosthetic foot, emphasizing strategic partnerships with high-reliability material suppliers to ensure compliance and innovation.

Midstream activities encompass the actual design, precision manufacturing, assembly, and quality assurance of the prosthetic foot components and systems. This stage is characterized by high technological complexity, requiring advanced robotics, precision molding, and cleanroom assembly for microprocessor components. Direct manufacturing involves skilled technicians and certified engineers who integrate mechanical components with electronic control systems. Distribution channels are highly specialized; the path is predominantly indirect, flowing from manufacturers to regional distributors or directly to specialized prosthetic and orthotic centers (P&O clinics). These centers act as critical gatekeepers, providing the necessary clinical expertise for fitting, alignment, and prescription, which is indispensable for the patient's successful integration of the device.

Downstream Analysis centers on the end-user interaction, which is highly service-oriented. This phase involves clinical assessment, custom socket fabrication, static and dynamic alignment, gait training, and long-term maintenance and repair. Direct channels sometimes involve manufacturers offering training and support directly to large hospital networks, but the majority of sales rely on certified prosthetists. Indirect channels leverage local distributors who handle logistics and inventory for P&O clinics. The value capture at the downstream level is significant, often encompassing the professional fee for the fitting service, which is frequently covered separately by insurance. Optimized logistics, coupled with robust after-sales support and warranty services, are vital for maintaining customer satisfaction and brand loyalty in this high-touch medical device sector.

Prosthetic Foot Market Potential Customers

The potential customer base for the Prosthetic Foot Market primarily comprises individuals who have undergone lower limb amputation due to various etiological factors, alongside children with congenital limb differences. The largest segment of end-users are geriatric and middle-aged individuals suffering from vascular diseases, predominantly linked to Type 2 diabetes and peripheral artery disease (PAD), making cardiovascular health trends a critical indicator of future market size. These patients, often categorized as K2 or K3 activity level, seek robust, stable, and moderate-energy-returning feet that prioritize safety and ease of use over complex high-performance features, often preferring hydraulic or microprocessor features that aid stability on varying home and community surfaces.

A secondary, yet highly influential, customer group includes younger, highly active individuals (K3 and K4 levels), encompassing athletes, military veterans, and trauma survivors. This demographic demands cutting-edge technology, particularly high-performance, lightweight carbon fiber dynamic response feet designed for running, jumping, and high-impact activities. These customers are less sensitive to cost and prioritize functional mimicry and peak athletic performance. Marketing efforts targeting this segment focus heavily on biomechanical advantages, durability under strenuous conditions, and the potential for competitive athletic participation, utilizing specialized clinics and sports rehabilitation centers as key customer access points.

Institutional buyers, such as government agencies (e.g., Veterans Affairs in the U.S.), large public and private hospital systems, and global non-governmental organizations (NGOs) focused on rehabilitation in conflict zones, represent a third, significant customer group. These institutional purchases often prioritize bulk acquisition of reliable, medium-tech devices, focusing on total cost of ownership, long-term durability, and ease of maintenance, rather than the most advanced features. Understanding the procurement cycles and reimbursement criteria of these large institutional customers is crucial for securing high-volume sales and establishing long-term, stable market contracts, necessitating robust adherence to international quality and standardization requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.01 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Össur, Ottobock, Blatchford, Freedom Innovations (Nevro Corp.), Endolite (Chas. A. Blatchford & Sons Ltd.), Hanger Clinic (Surestep), WillowWood, College Park Industries, Trulife, Proteor (Royo-Proteor), Streifeneder KG, Martin Bionics, Ohio Willow Wood, Spinal Technology, Fillauer Companies, Daw Industries, Aetrex Worldwide, Shijiazhuang Wonderfu Rehabilitation Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Prosthetic Foot Market Key Technology Landscape

The technological landscape of the Prosthetic Foot Market is defined by three major pillars: advanced materials, microprocessor control, and digital design/manufacturing. Carbon fiber composites remain foundational, offering unmatched strength-to-weight ratio and dynamic energy return capabilities crucial for high-activity users. The inherent elasticity of carbon fiber allows prosthetic feet to store kinetic energy during the stance phase of walking and release it during the push-off phase, effectively mimicking natural gait mechanics and reducing the energy expenditure required by the amputee. Recent innovations in material science focus on optimizing carbon fiber weave patterns and laminate structures to finely tune the stiffness and energy return characteristics for highly specific user profiles and activities, moving beyond general classifications towards personalized mechanical response.

Microprocessor-Controlled Ankle and Foot (MPAF) systems represent the pinnacle of current prosthetic technology. These devices integrate sophisticated sensor arrays, including gyroscopes, accelerometers, and strain gauges, to continuously monitor the terrain, speed, and angle of ambulation. A central microprocessor uses proprietary algorithms to adjust the ankle joint moment and dorsiflexion/plantarflexion resistance in real time, ensuring optimal alignment and stability. This instantaneous adaptation is vital for navigating stairs, ramps, and uneven outdoor surfaces, significantly reducing the risk of falls—a major concern for amputees. Leading MPAF technologies are increasingly incorporating machine learning and basic AI functionalities to learn the user's specific walking patterns and optimize performance autonomously over time, enhancing functional safety and user confidence.

Digital manufacturing, particularly 3D printing (Additive Manufacturing), is transforming the customization and production process. While not yet the primary method for manufacturing high-stress load-bearing foot plates (which still rely on carbon fiber molding), 3D printing is widely adopted for rapid prototyping, creating custom cosmetic covers, and, most critically, fabricating highly personalized prosthetic sockets. Utilizing digital scanning (CAD/CAM systems) of the residual limb allows for precise, patient-specific socket designs, minimizing fit issues and maximizing comfort, which is the most common cause of prosthetic rejection. This technology drastically reduces the time required for the iterative fitting process, lowers material waste, and opens the door for complex, lattice-structure designs that were previously impossible to achieve with traditional subtractive manufacturing methods, signaling a strong trend towards mass customization in the prosthetic sector.

Regional Highlights

North America holds the largest share in the global Prosthetic Foot Market, driven by several interlocking factors. The region benefits from extremely high healthcare spending, a sophisticated ecosystem of specialized P&O clinics, and favorable, comprehensive reimbursement policies, particularly through governmental programs like Medicare, Medicaid, and the Veterans Health Administration (VA). The U.S. market is characterized by a strong demand for premium, high-tech devices, including Microprocessor-Controlled Feet (MPAFs) and advanced carbon fiber energy-storing prostheses, fueled by high consumer awareness and a cultural emphasis on active lifestyles. Furthermore, the high prevalence of diabetes and related amputations contributes substantially to the overall market volume, necessitating continuous investment in advanced mobility solutions and driving rapid adoption of clinical innovations like AI-assisted fitting and remote monitoring technologies.

Europe represents the second-largest market, characterized by mature healthcare systems (e.g., in Germany, the UK, and France) that provide generally universal access to high-quality prosthetic care. While cost containment and standardization are more pronounced than in the U.S., the demand for mid-to-high level prosthetic feet remains strong, particularly in Central and Western Europe. Key growth drivers include robust governmental investment in rehabilitation services and an aging population requiring durable, reliable mobility aids. The European regulatory framework (MDR) is stringent but fosters high quality, leading to global trust in European-manufactured products. Innovation often focuses on durability, long-term comfort, and aesthetically pleasing designs that integrate seamlessly into daily life, with Germany remaining a key manufacturing and technological innovation hub.

Asia Pacific (APAC) is projected to be the fastest-growing region over the forecast period. This accelerated growth is attributed to rising health awareness, rapidly expanding healthcare infrastructure investments (especially in China, India, and Southeast Asia), and improving economic stability leading to increased disposable income. Although market penetration of high-end MP feet is currently lower than in the West, the sheer size of the patient population, combined with a dramatic increase in lifestyle diseases leading to amputation, presents immense untapped potential. Manufacturers are increasingly targeting APAC with cost-effective, durable, and highly functional mid-range prosthetic feet, focusing on establishing local manufacturing and distribution partnerships to navigate complex regional logistics and penetrate price-sensitive markets effectively. Latin America and the Middle East and Africa (MEA) present niche opportunities, mainly focused on essential functionality, with growth dependent on infrastructure development and subsidized healthcare programs.

- North America (Dominant Market): High healthcare spending, strong presence of key market players, high adoption rate of premium microprocessor feet, and favorable reimbursement environment for advanced technology.

- Europe (Mature Growth): Robust government-funded healthcare systems ensuring access, focus on product quality and standardization (MDR compliance), strong demand for durable carbon fiber solutions, and significant investment in clinical rehabilitation services.

- Asia Pacific (Fastest Growth): Large, underserved patient population, rapid healthcare infrastructure development, increasing incidence of diabetes and trauma, and growing adoption of mid-range functional prosthetics in emerging economies.

- Latin America (Developing): Market growth hindered by economic variability; demand primarily focused on basic and reliable functional feet, with potential centered around urban centers and private healthcare systems.

- Middle East and Africa (Emerging Potential): Driven by humanitarian aid, increasing military-related trauma, and investment in specialized rehabilitation centers, though limited by political instability and economic disparities impacting widespread access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Prosthetic Foot Market.- Össur

- Ottobock

- Blatchford

- Freedom Innovations (A part of Nevro Corp.)

- Endolite (Chas. A. Blatchford & Sons Ltd.)

- Hanger Clinic (Distributor and manufacturer of proprietary lines)

- WillowWood

- College Park Industries

- Trulife

- Proteor (Royo-Proteor)

- Streifeneder KG

- Martin Bionics

- Ohio Willow Wood

- Fillauer Companies

- Daw Industries

- Aetrex Worldwide

- Viacsy Corp

- Spinal Technology

- Orthopédie BOCK O&P Systems

- Teyder SL

Frequently Asked Questions

Analyze common user questions about the Prosthetic Foot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced prosthetic feet?

The primary driver is the rising global incidence of chronic diseases, especially diabetes mellitus and associated peripheral vascular disease, which significantly increases the rate of lower limb amputations. This demographic pressure, combined with technological breakthroughs like carbon fiber and microprocessor integration, fuels the demand for high-performance mobility solutions.

How do Microprocessor-Controlled Feet (MPAFs) differ from standard dynamic response feet?

MPAFs utilize internal sensors and computing power to adjust the ankle joint in real-time based on terrain and walking speed, enhancing stability, safety (stumble recovery), and energy efficiency. Dynamic response feet (typically carbon fiber) are passive systems that store and release mechanical energy but lack active electronic control or adaptation to environment changes.

What role does 3D printing play in the customization of prosthetic feet?

3D printing, or additive manufacturing, is primarily utilized to create highly custom-fit prosthetic sockets and cosmetic covers. This technology rapidly transforms digital scans of the residual limb into precise, comfortable interfaces, significantly reducing fabrication time, material costs, and the need for multiple manual adjustments, thereby improving patient acceptance.

Which geographic region demonstrates the highest growth potential in the prosthetic foot market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR due to rapid improvements in healthcare infrastructure, increasing awareness regarding advanced rehabilitation options, and a vast population increasingly affected by chronic conditions leading to amputation, despite current market segmentation favoring conventional, affordable devices.

What are the key materials used in the manufacture of modern prosthetic feet?

The key materials include advanced carbon fiber composites, favored for their high energy return and lightweight durability, various high-strength aluminum and titanium alloys for structural components, and specialized polymers or silicone for cosmetic sheathing and cushioning elements like the heel pad.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager