Protective and Marine Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431958 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Protective and Marine Coatings Market Size

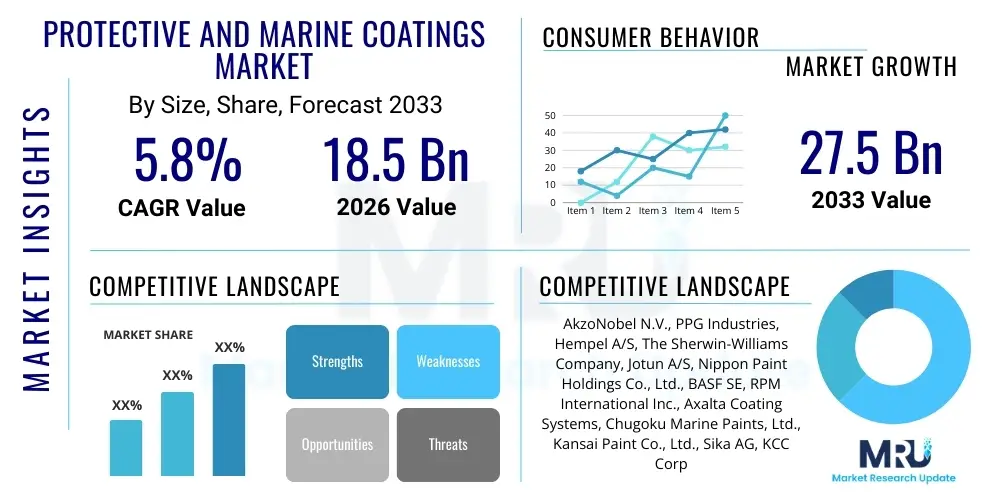

The Protective and Marine Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Protective and Marine Coatings Market introduction

The Protective and Marine Coatings Market encompasses highly specialized paint and coating systems designed to safeguard substrates from harsh environmental conditions, corrosion, abrasion, and fouling. These coatings are essential across critical infrastructure and assets, including offshore oil and gas structures, ships, bridges, industrial plants, and processing facilities. The core function of these products is longevity extension and maintenance cost reduction, achieved through superior barrier protection and adhesion properties. Key chemistries utilized include high-performance epoxy, polyurethane, zinc-based primers, and specialized fouling-release technologies, each tailored for specific operational environments, substrate types, and regulatory compliance standards.

Market growth is substantially driven by the global expansion of the shipping industry, increased investment in renewable energy infrastructure such as offshore wind farms, and the necessity for rigorous maintenance of aging public infrastructure worldwide. Protective coatings address severe atmospheric exposure, chemical spills, and high temperatures prevalent in heavy industry, while marine coatings specifically address biofouling and saltwater corrosion. Furthermore, stringent environmental regulations, particularly regarding volatile organic compounds (VOCs) and the disposal of anti-fouling agents, necessitate continuous research and development into eco-friendly, high-solids, and waterborne formulations. The inherent benefits, such as enhanced asset lifespan, improved operational efficiency, and adherence to international safety standards, solidify these coatings as indispensable components of capital expenditure across industrial and maritime sectors.

Protective and Marine Coatings Market Executive Summary

The Protective and Marine Coatings Market is characterized by robust resilience driven by non-discretionary maintenance cycles and expanding industrialization, particularly in the Asia Pacific region. Business trends indicate a strong shift toward high-performance, solvent-free coatings, accelerated by global regulatory pressures aimed at reducing VOC emissions and minimizing environmental harm from biocides. Key players are focusing on strategic acquisitions to consolidate market share, enhance technological portfolios, and achieve backward integration in raw material supply. Furthermore, the digitalization of coating management, involving sensor technology and predictive maintenance analytics, is emerging as a significant competitive differentiator, optimizing application schedules and reducing downtime for industrial assets.

Regional trends highlight the Asia Pacific's dominance, fueled by massive shipbuilding activity, rapid industrial construction in countries like China and India, and significant infrastructure modernization projects. North America and Europe demonstrate mature markets, primarily emphasizing regulatory compliance, advanced performance requirements for offshore energy transition assets, and the replacement of older, non-compliant coating systems. Segment trends reveal that the use of specialized epoxy coatings remains foundational due to their superior corrosion resistance, while the demand for high-end silicone and fluoropolymer coatings is escalating in niche applications requiring extreme heat, chemical, or abrasion resistance. The marine sector specifically sees strong demand in dry docking and new build segments, focusing intensely on ultra-low friction anti-fouling coatings to achieve fuel efficiency and compliance with the International Maritime Organization (IMO) carbon reduction goals.

AI Impact Analysis on Protective and Marine Coatings Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Protective and Marine Coatings Market primarily revolve around operational efficiency, product innovation speed, and quality control. Common questions include how AI can predict coating failure, optimize formulation chemistry, and automate inspection processes. Users are concerned about the integration costs of smart sensing technologies and the reliability of AI algorithms in interpreting complex environmental data specific to marine environments. The prevailing expectation is that AI will revolutionize asset management by enabling predictive maintenance schedules, reducing unnecessary overhauls, and ultimately lowering life-cycle costs for coated assets suchs as tankers and bridges. Consequently, the focus is shifting toward AI-powered non-destructive testing (NDT) and machine learning models that can correlate vast datasets of environmental stress, coating properties, and historical failure points to provide actionable insights for maintenance planning.

The primary impact of AI is anticipated in the realm of quality assurance and application monitoring. AI-powered vision systems are already being deployed to inspect coating thickness uniformity, identify surface preparation defects, and ensure adherence to manufacturer specifications in real-time, drastically reducing the variability associated with manual inspections. This automation capability is critical in large-scale industrial projects where coating application complexity is high, such as lining storage tanks or applying specialized fireproofing materials. Furthermore, AI facilitates the rapid screening of potential raw materials and polymer structures, accelerating the development cycle for novel, high-performance coatings that meet challenging regulatory mandates, such as developing non-toxic, highly effective anti-fouling solutions.

However, the implementation of AI requires significant investment in data infrastructure and skilled personnel capable of managing complex algorithms and interpreting output. The initial hurdle involves digitizing legacy inspection data and creating comprehensive, standardized databases linking environmental factors (temperature, salinity, UV exposure) to coating performance. While AI promises substantial long-term benefits in maximizing asset uptime and optimizing material usage, its adoption is currently concentrated among large, technologically advanced asset owners and tier-one coating manufacturers, driving a growing technological gap between industry leaders and smaller market participants.

- AI-driven Predictive Maintenance: Utilizing machine learning to forecast the exact time of coating degradation based on operational telemetry and environmental conditions, thereby optimizing re-coating cycles.

- Automated Quality Control: Deployment of computer vision systems to verify application parameters, including film thickness, surface cleanliness, and curing profile, minimizing application failure risks.

- Formula Optimization and R&D Acceleration: AI algorithms rapidly simulate the performance of thousands of chemical combinations, speeding up the creation of sustainable, high-solids, and low-VOC formulations.

- IoT Integration in Coating Systems: Embedding smart sensors within coatings to continuously monitor structural integrity, corrosion initiation, and environmental stress exposure in real-time.

- Supply Chain Resilience: Machine learning models optimize raw material sourcing and inventory management, predicting demand fluctuations and potential geopolitical disruptions affecting key chemical inputs.

- Digital Twin Modeling: Creation of virtual representations of coated assets to simulate environmental exposure and predict coating performance degradation under various operational scenarios.

- Enhanced Anti-Fouling Efficiency: AI aids in analyzing oceanographic data and vessel movement patterns to develop dynamic anti-fouling strategies that minimize drag and improve fuel efficiency.

DRO & Impact Forces Of Protective and Marine Coatings Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant impact forces. A primary driver is the essential need for corrosion protection across global infrastructure, which mandates regular application and renewal of protective coatings irrespective of economic cycles. The restraints largely stem from increasing regulatory burdens, particularly concerning VOC limits and the phase-out of certain biocides, which significantly raises R&D costs and complicates manufacturing processes. Opportunities lie predominantly in the development of sustainable, advanced materials, such as bio-based and self-healing coatings, and the expansion into high-growth sectors like offshore wind energy and water treatment infrastructure, where specialized protective solutions are paramount for long-term operational viability.

Key impact forces include the fluctuating prices of raw materials, such as titanium dioxide, epoxy resins, and petrochemical-derived solvents, which directly affect manufacturer profitability and pricing strategies. Furthermore, the global economic health, particularly trade volume and oil and gas exploration activities, has a cyclical but strong impact on marine new build and offshore protective coating demand. The shift towards sustainable shipping practices and the pressure to reduce carbon footprints are also critical forces, demanding coatings that not only protect but also enhance vessel hydrodynamic performance, pushing innovation toward friction-reducing and non-biocidal anti-fouling technologies that are compliant with global maritime standards.

The long-term resilience of the protective coatings sector, distinct from the more cyclical marine segment, is heavily influenced by government spending on infrastructure maintenance (bridges, pipelines, utilities) and the ongoing need for asset preservation in chemical processing and power generation industries. However, the requirement for highly skilled applicators and the specialized nature of complex coating systems pose logistical and labor constraints, particularly in emerging markets. The competitive landscape is intensely focused on product differentiation based on application ease, speed of cure, and certified long-term performance guarantees, where companies invest heavily in establishing robust track records and maintaining rigorous quality control systems to overcome end-user reluctance regarding switching suppliers.

- Drivers:

- Expanding Global Shipping Fleet and Maintenance Requirements: Continuous demand for dry docking and new vessel construction necessitates large volumes of marine coatings.

- Aging Infrastructure and Corrosion Management: Increased government focus on maintaining existing critical assets (pipelines, bridges, power plants) drives demand for high-durability protective coatings.

- Growth in Offshore Renewable Energy: Massive investments in offshore wind farms require specialized coatings capable of withstanding severe subsea and atmospheric corrosion.

- Stricter Safety and Environmental Regulations: Mandates for corrosion under insulation (CUI) prevention and fire protection systems increase the usage of high-performance protective products.

- Restraints:

- Volatile Raw Material Pricing: Fluctuations in the cost of epoxy resins, solvents, and pigments severely impact manufacturing margins and end-user pricing stability.

- Stringent Environmental Compliance (VOC and Biocides): Regulatory pressure forces costly R&D towards waterborne, high-solids, and solvent-free systems, limiting the use of established, cost-effective formulations.

- Complexity of Application and Skilled Labor Shortage: High-performance coatings require precise surface preparation and skilled application, posing a barrier in regions with inadequate training infrastructure.

- Opportunities:

- Development of Sustainable and Bio-based Coatings: Market acceptance of environmentally friendly, non-toxic, and bio-degradable coating solutions for marine and protective applications.

- Adoption of Smart and Self-Healing Coatings: Integration of advanced chemistries that can autonomously repair minor damage, significantly extending maintenance cycles.

- Increased Focus on Passive Fire Protection (PFP): Growing demand for specialized intumescent coatings in oil and gas and industrial construction for enhanced asset and personnel safety.

- Expansion into Water and Wastewater Treatment Infrastructure: Significant need for chemical-resistant and anti-microbial coatings in expanding municipal utility systems.

Segmentation Analysis

The Protective and Marine Coatings market is primarily segmented based on Resin Type, Technology, Application, and End-use Industry, reflecting the diversity of functional requirements and operational environments. Resin Type segmentation is critical, with Epoxies dominating due to their excellent adhesion and corrosion resistance, followed closely by Polyurethanes known for their superior UV resistance and durability. The Technology segment differentiates between solvent-borne, waterborne, and powder coatings, with high-solids solvent-borne formulations currently holding a significant share in heavy-duty applications due to their proven performance, though waterborne systems are gaining traction driven by environmental compliance efforts.

The Application segmentation is bifurcated into Protective Coatings and Marine Coatings. Protective coatings cover broad industrial segments like Oil & Gas, Infrastructure, Power Generation, and Chemical Processing, where the coatings are tasked with surviving extreme temperatures, corrosive chemicals, and mechanical stress. Conversely, Marine Coatings are strictly focused on the needs of vessels and offshore structures, categorized into anti-fouling (hulls below the waterline), anti-corrosion (ballast tanks, external hull), and specialized cargo tank linings, each addressing highly specific challenges inherent to the aquatic environment and regulatory framework enforced by bodies like the IMO.

The segmentation structure underscores the highly specialized nature of this market, where no single product offers a universal solution. End-user requirements dictate material selection; for instance, petrochemical storage tanks demand high chemical resistance, while military naval vessels require stealth characteristics alongside superior fouling control. This specialization ensures that manufacturers must maintain a comprehensive portfolio across multiple chemistries and application methods, tailoring solutions to optimize the balance between initial cost, application complexity, and guaranteed long-term performance under severe operational stress.

- By Resin Type:

- Epoxy Coatings (High dominance in protective applications due to barrier properties)

- Polyurethane Coatings (Preferred for topcoats requiring UV stability and abrasion resistance)

- Alkyd Coatings (Used in less severe protective environments and general industrial maintenance)

- Acrylic Coatings (Fast-drying, often used as topcoats or maintenance paints)

- Zinc Coatings (Essential for primers in steel structures for galvanic protection)

- Silicone Coatings (High-temperature applications and specialized fouling release)

- By Technology:

- Solvent-Borne Coatings (High performance, gradually being replaced by high-solids)

- Waterborne Coatings (Environmentally compliant, increasing adoption in mainstream applications)

- High-Solids Coatings (Dominant trend, minimizing VOC emissions while maximizing durability)

- Powder Coatings (Niche, used for components requiring thick, durable finishes)

- By Application:

- Marine Coatings:

- Anti-Fouling Coatings (Hulls)

- Anti-Corrosion Coatings (Ballast tanks, decks, superstructure)

- Cargo Hold and Tank Linings (Chemical, product, or crude oil resistance)

- Protective Coatings:

- Structural Steel Coatings (Bridges, buildings)

- Pipeline Coatings (Onshore and offshore)

- Floor and Wall Coatings (Industrial facilities)

- Storage Tank Linings (Internal and external)

- By End-use Industry:

- Oil & Gas (Upstream, Midstream, Downstream infrastructure)

- Shipping (Commercial vessels, passenger ships, naval fleets)

- Power Generation (Nuclear, coal, gas, and renewable energy facilities)

- Infrastructure (Roads, rail, ports, wastewater treatment)

- Chemical Processing (Refineries and manufacturing plants)

- Mining and Construction (Heavy equipment and structural assets)

Value Chain Analysis For Protective and Marine Coatings Market

The Protective and Marine Coatings value chain begins with the upstream procurement of essential raw materials, primarily petrochemical derivatives and specialized minerals. Key inputs include high-performance resins (epoxy, polyurethane, acrylic), functional pigments (titanium dioxide, zinc), various solvents, and performance additives (rheology modifiers, anti-settling agents, biocides). Raw material suppliers, often large chemical conglomerates, hold significant leverage due to the cyclical and concentrated nature of these commodities. Manufacturers must manage complex sourcing strategies to ensure quality consistency and mitigate price volatility, as input costs constitute a substantial portion of the final product price, particularly for high-solids and specialized formulations.

The core of the value chain is the coating manufacturing process, involving sophisticated mixing, dispersion, and quality control procedures to produce performance-validated products. Manufacturers invest heavily in R&D to meet regulatory changes and enhance product performance attributes like faster cure times, lower application temperature limits, and extended service life guarantees. Following manufacturing, the product moves through complex distribution channels. Direct distribution is common for large-scale protective projects and major shipyard contracts, allowing for detailed technical consultation and customized supply logistics. Indirect distribution, involving specialized distributors and authorized dealers, serves the smaller maintenance and repair (M&R) market, ensuring regional availability and immediate technical support.

The downstream segment involves surface preparation specialists and certified coating applicators, who form the final critical link in ensuring product performance, as coating failure is often attributed to poor application rather than material deficiency. End-users (ship owners, infrastructure operators, industrial plant managers) are increasingly demanding comprehensive solutions encompassing product supply, application supervision, and performance monitoring. This trend pushes the value chain towards integrated services, where manufacturers seek to deepen their involvement downstream through training programs, technical field support, and digital tools designed to verify surface profile preparation and environmental conditions before and during coating application.

Protective and Marine Coatings Market Potential Customers

The primary customers for Protective and Marine Coatings are large asset owners and operators across capital-intensive industries whose profitability depends directly on the longevity and operational reliability of their physical infrastructure. In the protective segment, customers include national and municipal infrastructure agencies responsible for maintaining roads, rail systems, and water management facilities, alongside major global corporations in the energy, petrochemical, and manufacturing sectors. These end-users typically purchase in bulk, prioritizing long-term cost of ownership, certified performance against corrosion and chemical attack, and adherence to specific national and international standards like ISO and NACE guidelines.

In the marine segment, the customer base is concentrated among ship owners, fleet managers, and operators of offshore drilling and exploration assets. Commercial shipping entities, including dry bulk carriers, container fleets, and oil tankers, are driven by two major concerns: reducing dry docking frequency and minimizing fuel consumption, making high-performance anti-fouling and anti-corrosion systems paramount. Naval forces and specialized vessel owners, such as cruise line operators, represent niche, high-value segments demanding specialized coatings for unique functional requirements, including fire resistance, low observability, and advanced acoustic dampening properties.

Purchasing decisions across the entire customer spectrum are highly technical and risk-averse. New coating systems undergo extensive vetting and field testing, often requiring performance guarantees extending beyond five years. The decision-making unit typically involves procurement specialists, chief engineers, and quality assurance managers who must balance upfront cost with lifetime performance benefits, regulatory compliance, and ease of application. Furthermore, the rise of offshore renewable energy firms (wind and tidal power) is introducing a new customer segment with extremely specialized demands for subsea and splash zone protection in highly corrosive environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel N.V., PPG Industries, Hempel A/S, The Sherwin-Williams Company, Jotun A/S, Nippon Paint Holdings Co., Ltd., BASF SE, RPM International Inc., Axalta Coating Systems, Chugoku Marine Paints, Ltd., Kansai Paint Co., Ltd., Sika AG, KCC Corporation, Beckers Group, Wacker Chemie AG, Teknos Group, Carboline Company, Altex Coatings Ltd., Tikkurila Oyj (PPG), Hexion Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protective and Marine Coatings Market Key Technology Landscape

The current technology landscape in Protective and Marine Coatings is dominated by advancements focused on sustainability, functional durability, and application efficiency. A major technological push is centered on developing ultra-high solids and 100% solid (solvent-free) epoxy and polyurethane systems. These formulations drastically reduce VOC emissions, complying with increasingly strict global air quality standards, while simultaneously delivering thicker, more robust barrier coats in fewer layers. This allows for faster turnaround times during critical dry docking and industrial maintenance shutdowns, directly translating to enhanced operational efficiency for end-users. Additionally, there is significant research into ambient-curing technologies that function effectively in challenging low-temperature or high-humidity environments, extending the application window for large outdoor projects.

In the marine sector, the technological focus is split between advanced anti-fouling solutions and improved corrosion resistance for ballast tanks and submerged structures. New anti-fouling technologies are moving away from traditional biocide release mechanisms towards sophisticated foul-release coatings, primarily based on silicone elastomers and fluoropolymers. These systems create a low-surface-energy surface, preventing marine organisms from adhering strongly, allowing them to be shed by the vessel's movement, thereby maintaining hull smoothness and drastically reducing hydrodynamic drag and associated fuel consumption. Furthermore, advanced passive fire protection (PFP) coatings, specifically thin-film intumescent epoxies, are seeing rapid adoption in offshore and petrochemical applications, offering superior fire resistance while maintaining structural integrity.

The future technology trajectory involves the integration of nanotechnology and smart materials. Nano-enhanced coatings utilize specialized particles to improve properties such as abrasion resistance, UV stability, and barrier performance at the molecular level, offering extended service life under extreme duress. Concurrently, self-healing coatings, though nascent, represent a groundbreaking technology that can automatically repair micro-cracks and minor damage, significantly delaying the onset of catastrophic corrosion and reducing the frequency of extensive re-coating cycles. Digitalization, through specialized coating software and robotic inspection tools, is also considered a critical technological development, ensuring optimal product selection and adherence to the quality standards required for these highly advanced materials.

- Ultra-High Solids and 100% Solids Systems: Formulations designed to eliminate or drastically reduce solvent content, meeting stringent environmental mandates and providing thicker film builds per coat.

- Foul-Release Technologies: Non-biocidal coatings, typically silicone-based, that prevent the permanent adhesion of marine growth, minimizing hull roughness and maximizing fuel efficiency.

- Advanced Intumescent Passive Fire Protection (PFP): Specialized epoxy and waterborne coatings that swell upon exposure to high heat, creating an insulating char layer to protect steel structures.

- Nanotechnology Integration: Utilizing nanoparticles (e.g., graphene, silicates) to enhance mechanical strength, barrier properties, scratch resistance, and overall durability of the coating matrix.

- Moisture-Cure Urethane Systems: Technologies allowing application in high humidity or damp conditions, expanding the geographic and seasonal viability for protective maintenance projects.

- Anti-Corrosion Primers: Development of chromate-free and zinc-free primers utilizing organic compounds and specialized barrier pigments to achieve long-term galvanic protection without heavy metals.

- Polyaspartic and Fast-Cure Polyurethane: Rapid curing topcoats used when extremely fast return-to-service times are required for industrial flooring and infrastructure projects.

- IoT-Enabled Smart Coatings: Embedding micro-sensors and indicators that change color or transmit data upon localized corrosion initiation or coating breach.

Regional Highlights

- Asia Pacific (APAC): Dominates the market owing to massive shipbuilding volumes in countries like China, South Korea, and Japan, coupled with rapid industrial expansion and infrastructure investment across Southeast Asia. High economic growth drives new construction and maintenance cycles across chemical processing and power generation. Regulatory enforcement of VOCs is increasing, spurring demand for local production of compliant high-solids systems. The expansion of maritime trade routes further cements APAC's position as the primary growth engine for marine coatings.

- North America: Characterized by a highly mature market focused heavily on stringent regulations and high-performance requirements, particularly in the oil and gas midstream sector (pipeline coatings) and aging critical infrastructure renewal projects (bridges and highways). The adoption of automated inspection technologies and high-cost, long-life protective systems is higher here due to high labor costs and emphasis on minimizing downtime. Demand for military marine coatings remains a steady, high-value segment.

- Europe: The market is defined by leading-edge sustainability requirements, especially the aggressive pursuit of low-VOC and non-toxic anti-fouling solutions mandated by the European Union. Significant market activity is centered around the transition to renewable energy, driving substantial demand for highly specialized protective coatings for offshore wind turbine foundations, transition pieces, and substations. Regulatory frameworks like REACH significantly influence raw material sourcing and product formulation complexity.

- Latin America (LATAM): Growth is primarily tied to commodity cycles, notably mining and oil exploration activities in Brazil, Mexico, and Chile. The demand profile favors robust protective coatings for heavy industrial plants and port infrastructure. Market maturity varies widely; while major oil & gas projects demand international-standard high-performance coatings, general industrial maintenance often relies on more cost-effective, conventional formulations.

- Middle East and Africa (MEA): This region is characterized by extreme environmental conditions (high temperatures, high salinity) driving demand for specialized, heat-resistant, and ultra-high durability protective coatings for petrochemical refineries, gas processing plants, and desalination facilities. Large infrastructure projects, particularly in the GCC states (Saudi Arabia, UAE), sustain strong demand. The marine segment is robust, driven by extensive port maintenance and repair activities related to global shipping traffic through key chokepoints.

- China: The single largest contributor to APAC growth, leading global shipbuilding output and heavy infrastructure construction. Focus is on adopting domestic technologies while simultaneously integrating global standards for high-performance protective systems in large-scale energy and chemical projects.

- United States: Driven by infrastructure modernization initiatives and high environmental standards, creating strong demand for complex protective systems for structural steel, bridges, and municipal water utilities, often requiring state-specific compliance certifications.

- Germany and Scandinavia: European hubs for advanced coating R&D, focusing on sustainable, bio-based alternatives and extremely durable coatings necessary for severe North Sea and Baltic Sea marine environments.

- South Korea and Japan: Leaders in high-technology marine coatings, primarily driven by large, sophisticated shipyard operations and naval defense modernization programs, requiring high-specification anti-fouling and corrosion resistance.

- Brazil: Demand is fluctuating based on national economic stability and investment in offshore pre-salt oil and gas exploration, necessitating specialized subsea and splash-zone coatings.

- India: Rapid urbanization and industrial infrastructure development (roads, railways, power) generate robust, consistent demand for general and specialized protective coatings, prioritizing long service life and competitive pricing.

- Canada: Focus is on pipeline integrity coatings for long-distance oil and gas transportation networks, requiring materials capable of withstanding extreme cold and mechanical stress.

- Australia: Strong demand fueled by mining operations and remote infrastructure (e.g., pipelines, processing plants), requiring coatings resistant to highly abrasive and harsh environments.

- Netherlands and UK: High investment in offshore wind energy drives a specific, high-value niche for coatings engineered to withstand intense wave action and atmospheric exposure on critical turbine components.

- Saudi Arabia: Dominated by large, ongoing investments in petrochemical and oil infrastructure, requiring vast quantities of highly specific chemical-resistant and high-temperature protective coatings.

- South Africa: Key African market driven by mining sector maintenance and port infrastructure repair, prioritizing durability and ease of maintenance in challenging climates.

- Mexico: Significant consumer due to automotive manufacturing and energy sector reform, requiring robust protective coatings for facilities and storage infrastructure.

- Turkey: Strategic location bridging Europe and Asia, leading to sustained demand for general industrial and marine maintenance coatings for local shipbuilding and heavy industry.

- Indonesia: Archipelago nation with vast maritime assets, contributing significantly to demand for hull and deck coatings for inter-island transport and fishing fleets.

- France: Focus on high-end niche applications, including nuclear power plant coatings (radiation tolerance) and specialized defense marine programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protective and Marine Coatings Market.- AkzoNobel N.V.

- PPG Industries

- Hempel A/S

- The Sherwin-Williams Company

- Jotun A/S

- Nippon Paint Holdings Co., Ltd.

- BASF SE

- RPM International Inc.

- Axalta Coating Systems

- Chugoku Marine Paints, Ltd.

- Kansai Paint Co., Ltd.

- Sika AG

- KCC Corporation

- Beckers Group

- Wacker Chemie AG

- Teknos Group

- Carboline Company

- Altex Coatings Ltd.

- Tikkurila Oyj (PPG)

- Hexion Inc.

Frequently Asked Questions

Analyze common user questions about the Protective and Marine Coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for Protective and Marine Coatings?

Demand is primarily driven by the necessity of corrosion prevention for critical infrastructure, including global shipping fleets, offshore energy assets, and aging industrial plants. Stricter global regulations (IMO standards, VOC limits) and expansion into high-growth sectors like offshore wind energy further accelerate market growth. The inherent cost savings achieved through extended asset lifespan and reduced maintenance cycles are core economic drivers.

How do environmental regulations impact the formulation and cost of Protective and Marine Coatings?

Environmental regulations, particularly those limiting Volatile Organic Compounds (VOCs) and phasing out harmful biocides used in anti-fouling paints, significantly increase R&D costs. Manufacturers must invest in complex, high-solids, or waterborne formulations, which can be more expensive to produce but offer superior environmental compliance and often improved performance characteristics, contributing to higher average selling prices.

Which coating technology segment exhibits the highest growth potential in the forecast period?

The high-solids and 100% solids technology segment shows the highest growth potential. These systems effectively reduce solvent emissions while allowing for the application of thicker, more durable films in fewer coats. This efficiency is critical for meeting stringent performance standards and minimizing the operational downtime required for protective and marine maintenance applications across all major industrial sectors.

What is the current technological trend regarding anti-fouling coatings in the marine sector?

The dominant technological trend is the shift from traditional biocide-releasing paints to advanced foul-release coatings, typically based on specialized silicone elastomers or fluoropolymers. These technologies function by creating ultra-smooth, low-friction surfaces that prevent bio-adhesion, thereby reducing fuel consumption and complying with international regulations aimed at protecting marine biodiversity.

How is digital technology, such as AI and IoT, influencing asset management in the coatings market?

AI and IoT integration are enabling a paradigm shift toward predictive maintenance. IoT sensors embedded in or near the coatings provide real-time data on environmental stress and potential degradation. AI algorithms analyze this data to accurately predict coating failure, allowing asset owners to schedule re-coating precisely when needed, optimizing resource allocation and maximizing asset uptime across pipelines, bridges, and vessels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager