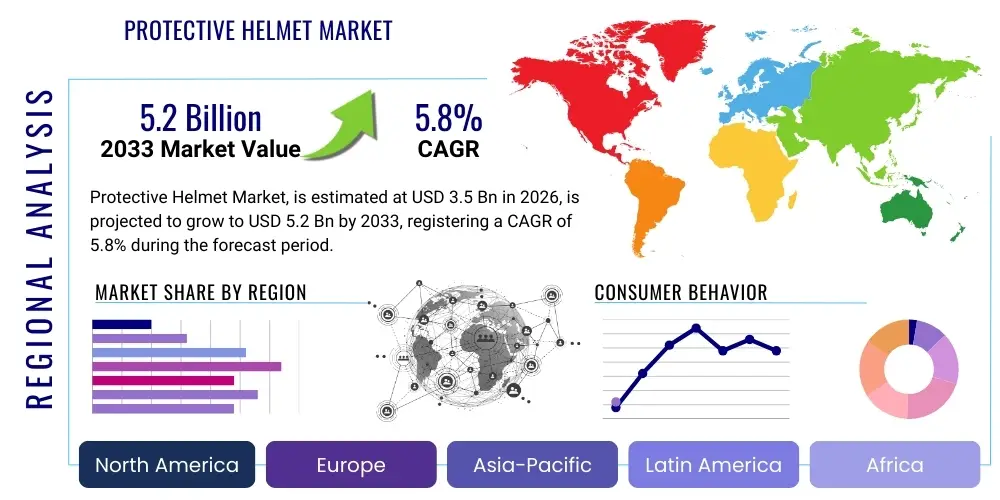

Protective Helmet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434524 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Protective Helmet Market Size

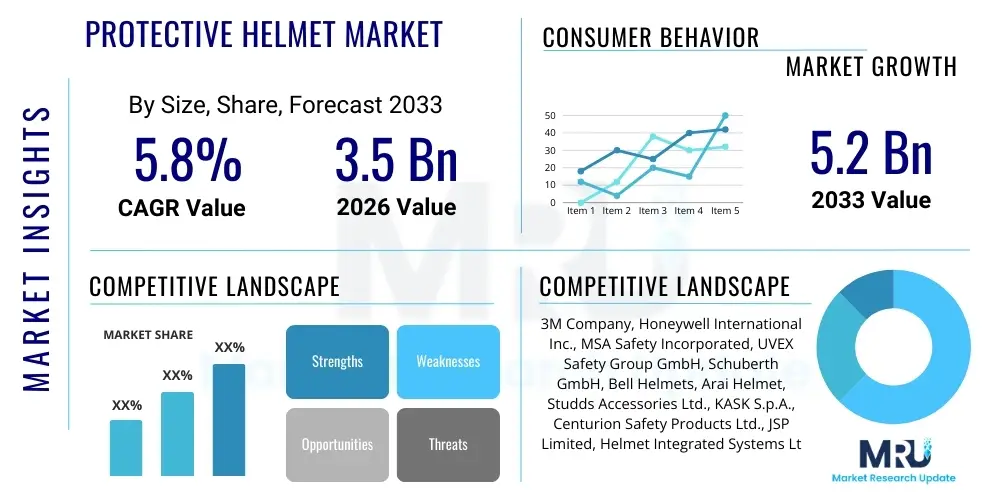

The Protective Helmet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Protective Helmet Market introduction

The Protective Helmet Market encompasses a diverse range of headgear designed to mitigate the risk of severe head injuries resulting from impact, penetration, or shock absorption across various high-risk environments. These essential safety devices are broadly categorized into industrial safety helmets, specialized sports helmets (including cycling, motorcycling, and winter sports), and tactical/military applications. The core function revolves around utilizing sophisticated materials, such as high-density polyethylene (HDPE), acrylonitrile butadiene styrene (ABS), polycarbonate, carbon fiber composites, and aramid fibers, to distribute impact forces over a wider area, minimizing localized trauma. The market’s continuous evolution is driven by stringent governmental safety regulations across the construction, manufacturing, and mining sectors, coupled with growing consumer awareness regarding safety in recreational activities. Furthermore, design improvements focusing on ergonomics, ventilation, and integration of communication systems are expanding the adoption rate globally.

A key characteristic of modern protective helmets is the shift from passive protection to active safety features. Products now frequently incorporate liners designed with rotational impact protection systems (like MIPS) to address oblique impacts, which often lead to more severe concussive injuries. Major applications span industrial settings, where compliance with OSHA and CE standards is mandatory, and the rapidly growing high-performance sports segment, where lightweight materials and aerodynamic efficiency are crucial alongside superior protection. Benefits derived from the use of these helmets include reduced incidence of traumatic brain injuries (TBIs), lower long-term healthcare costs associated with workplace accidents, and improved worker productivity due to enhanced comfort and security.

The driving factors for market expansion are multifaceted, anchored significantly by rapid urbanization and large-scale infrastructure projects, particularly in Asia Pacific and Latin America, which mandate high levels of worker safety. Simultaneously, technological advancements, such as the integration of IoT sensors for real-time monitoring of impact, temperature, and wearer vitals, are transforming traditional hard hats into smart personal protective equipment (PPE). This integration not only enhances immediate safety response but also provides valuable data for preventative safety analytics, thus creating significant demand from large enterprises focused on minimizing liability and maximizing operational safety metrics.

Protective Helmet Market Executive Summary

The Protective Helmet Market is currently navigating a pivotal shift characterized by accelerated technological integration and evolving regulatory landscapes focused on rotational energy management. Key business trends indicate a strong move toward premiumization, where end-users, especially in developed economies, are willing to invest in helmets offering advanced materials (e.g., carbon fiber for weight reduction) and integrated electronics (e.g., communication devices, GPS trackers). Strategic mergers and acquisitions are common among large players aiming to consolidate regional market presence and acquire specialized technologies, particularly in sensor manufacturing and composite material processing. Furthermore, sustainability is becoming a non-negotiable factor, pushing manufacturers to explore recyclable materials and implement circular economy principles in their product lifecycle management, appealing to corporate social responsibility mandates.

From a regional perspective, the Asia Pacific (APAC) region stands out as the primary engine of market growth, driven by massive investments in residential, commercial, and transportation infrastructure in countries like China, India, and Southeast Asia. While North America and Europe remain mature markets characterized by strict enforcement of ANSI and EN standards, growth in these regions is primarily fueled by replacement cycles and the adoption of high-value, smart helmet solutions in mining and specialized manufacturing. The Middle East and Africa (MEA) present nascent yet rapidly growing opportunities, particularly in Gulf Cooperation Council (GCC) countries investing heavily in megaprojects that require state-of-the-art safety equipment for large expatriate workforces. These regional dynamics necessitate customized product offerings that account for specific climatic conditions, such as enhanced heat dissipation features for tropical environments.

Segment trends reveal that the Industrial Safety Helmet segment maintains the largest market share due to universal application across construction and heavy industries. However, the Sports Helmet segment, particularly motorcycling and performance cycling helmets, is projected to register the fastest CAGR, buoyed by increased disposable income, growing participation in adventure sports, and continuous innovations in lightweight materials and aerodynamic design. Material-wise, the demand is shifting away from traditional HDPE toward durable yet lighter polycarbonate and advanced composites, reflecting the dual need for superior protection and wearer comfort. Segmentation by technology highlights the rapid uptake of helmets equipped with integrated MIPS technology and other advanced impact liner designs, emphasizing protection against oblique impacts over linear impacts alone.

AI Impact Analysis on Protective Helmet Market

User queries regarding the impact of Artificial Intelligence on the Protective Helmet Market frequently center around three core themes: predictive safety, ergonomic design optimization, and real-time risk mitigation. Users often ask, "How can AI prevent accidents using helmet data?" or "Are AI-designed helmets safer?" The collective expectation is that AI will move helmets beyond passive protection into proactive safety tools. This includes the use of machine learning algorithms to analyze physiological data (heart rate, fatigue indicators) collected via integrated sensors and environmental data (proximity warnings, air quality) to predict and alert wearers to imminent hazards before an accident occurs. Furthermore, AI is crucial in optimizing the complex geometrical structures of helmet shells and liners, simulating millions of impact scenarios to achieve maximum energy absorption with minimal material usage, leading to lighter and more effective products tailored to specific application risks. The summarized consensus is that AI deployment will transform helmets from basic protective gear into sophisticated, interconnected nodes within a broader industrial safety ecosystem, significantly enhancing overall operational safety metrics.

- AI-Driven Design Optimization: Machine learning algorithms analyze extensive biomechanical data and impact simulation results to refine helmet geometry, liner density, and ventilation systems, maximizing protective capability while minimizing bulk and weight.

- Predictive Maintenance and Safety: AI analyzes data streams from integrated sensors (accelerometers, gyroscopes, biometric monitors) to detect patterns indicative of fatigue, heat stress, or unauthorized behavior, generating proactive alerts to supervisors or the wearer.

- Real-Time Hazard Identification: Integration of computer vision capabilities in specialized helmets (often linked to edge computing) allows for instantaneous detection of hazardous objects, unsafe working conditions, or compliance breaches (e.g., proper chinstrap usage).

- Supply Chain and Inventory Management: AI algorithms forecast demand variability based on construction cycles, regulatory changes, and regional consumption patterns, optimizing inventory levels and reducing waste in the manufacturing and distribution process.

- Custom Fit and Personalization: Utilizing 3D scanning and AI interpretation, manufacturers can offer custom-fitted helmet liners, ensuring optimal contact and energy dissipation specific to the individual user’s head morphology, significantly improving safety and comfort.

DRO & Impact Forces Of Protective Helmet Market

The market dynamics of the Protective Helmet sector are governed by a robust interplay between regulatory enforcement, material science limitations, and technological innovation opportunities. The primary driver is the continually escalating stringency of occupational health and safety (OHS) regulations worldwide, mandating the use of certified head protection in industrial environments, enforced by bodies such as OSHA (North America) and the European Agency for Safety and Health at Work (EU). This regulatory push is complemented by the high rate of infrastructure development globally, particularly in emerging economies where substantial public and private investments are generating continuous, large-scale demand for safety equipment. Furthermore, the increasing awareness and participation in extreme and recreational sports globally necessitate specialized, high-performance helmets that adhere to evolving safety standards, such as those set by Snell or ECE certifications for motorsports, creating a high-value segment.

However, the market faces significant restraints that temper overall growth. A major challenge is the inherent trade-off between protection level, weight, and wearer comfort. Highly protective helmets often suffer from poor ventilation and increased bulk, leading to user fatigue and non-compliance in industrial settings, which undermines the core safety objective. Additionally, the high cost associated with advanced materials like carbon fiber composites, integrated sensors, and complex MIPS liners can deter adoption in price-sensitive markets, especially in large-scale government or construction procurement where budget constraints are paramount. There is also the restraint posed by the counterfeit market, particularly in APAC, where non-certified, cheaper products compromise both safety standards and legitimate manufacturers' profitability.

Opportunities for growth are concentrated in the integration of smart technologies (IoT, AR) and expansion into specialized niches. The development of helmets with integrated communication systems, heads-up displays (HUDs) for augmented reality (AR) instructions, and real-time environmental monitoring capabilities represents a significant avenue for premium market capture. Furthermore, addressing the comfort constraint through advanced ventilation and material engineering (e.g., porous structures, phase-change materials) offers substantial market differentiation. The overall competitive landscape is characterized by moderate intensity, primarily driven by product innovation and regulatory compliance, with key impact forces including the increasing bargaining power of large industrial buyers and the moderate threat of substitutes, particularly in non-regulated or low-risk applications, though the core mandated markets remain protected by law.

Segmentation Analysis

The Protective Helmet Market segmentation provides a granular view of diverse end-user requirements, material preference, and application-specific standards. The market is primarily divided based on Type (Industrial, Sports, Motorcycle, Tactical), Material (ABS, Polycarbonate, Fiber Composites), and Application (Construction, Mining, Oil & Gas, Transportation, Recreation, Defense). The Industrial segment dominates the revenue share due to pervasive safety mandates in heavy industries, requiring robust, often standardized head protection. Conversely, segments driven by consumer choice, such as Motorcycle and Sports helmets, focus intensely on aesthetics, aerodynamics, and advanced rotational impact technology, commanding higher price points and showcasing rapid innovation cycles. Analyzing these segments is crucial for manufacturers to tailor their R&D and marketing strategies, ensuring compliance and maximizing penetration in specific risk environments.

Material segmentation reflects the ongoing material science race to balance high impact resistance with lightweight characteristics. While ABS and Polycarbonate remain the economical backbone for standard industrial and entry-level sports helmets, fiber composites (including fiberglass, aramid fiber, and carbon fiber) are increasingly prevalent in high-performance applications where maximizing protection while minimizing neck strain is essential, such as Formula 1 racing, military operations, and professional cycling. Furthermore, application analysis reveals distinct differences in required features; for instance, mining helmets require integrated lighting and fire resistance, while construction helmets prioritize visibility and electrical insulation. This granular division allows for strategic market targeting, focusing resources where specific technology adoption yields the highest return on investment.

- By Type:

- Industrial Safety Helmets (Hard Hats)

- Motorcycle Helmets (Full-Face, Modular, Open-Face, Off-Road)

- Sports Helmets (Cycling, Skiing & Snowboarding, Equestrian, Watersports)

- Tactical and Military Helmets (Ballistic and Non-Ballistic)

- By Material:

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Polycarbonate (PC)

- Fiber Composites (Carbon Fiber, Fiberglass, Aramid Fiber)

- By Application:

- Construction and Infrastructure

- Manufacturing and Utilities

- Mining and Oil & Gas

- Transportation and Logistics

- Sports and Recreation

- Defense and Law Enforcement

Value Chain Analysis For Protective Helmet Market

The Protective Helmet market's value chain begins with upstream analysis focusing on raw material procurement, which is highly sensitive to global petrochemical and fiber markets. Key inputs include petroleum-derived resins (for ABS, PC, HDPE), specialized fabrics (aramid, fiberglass), and high-cost composite fibers (carbon fiber). Manufacturers must manage volatility in these commodity markets, which directly impacts production costs. Crucial upstream activities also involve R&D and testing for advanced liner materials (e.g., expanded polystyrene, proprietary foams) and impact systems (e.g., MIPS licensing). Strategic partnerships with chemical suppliers specializing in lightweight, impact-resistant polymers are vital for maintaining a competitive edge and ensuring material quality meets stringent regulatory standards.

The midstream process involves manufacturing, assembly, and rigorous testing. This stage is capital-intensive, requiring advanced molding technologies (injection molding, compression molding) and quality assurance facilities to obtain certifications (e.g., DOT, ECE, ANSI, EN). Direct distribution involves manufacturers supplying large industrial clients (B2B sales to construction conglomerates or military organizations) through dedicated sales teams and enterprise resource planning (ERP) systems. This channel prioritizes bulk orders, customized features (company logos, specialized mounts), and long-term service contracts. Indirect distribution is prevalent for consumer-facing segments (sports and motorcycle helmets), relying heavily on wholesalers, authorized distributors, specialty retail stores (bike shops, sporting goods), and increasingly, expansive e-commerce platforms.

Downstream analysis focuses on logistics, marketing, and post-sale support. For industrial helmets, the downstream challenge involves timely delivery to often remote construction or mining sites and providing training on compliance and fit. For consumer markets, brand building, celebrity endorsements (in sports), and digital marketing are paramount, emphasizing safety features, aesthetics, and comfort. The shift to direct-to-consumer (D2C) models via e-commerce allows manufacturers greater control over branding and pricing. Furthermore, the end-of-life management for protective helmets, including recycling programs for plastic components, is becoming an increasingly important downstream factor driven by circular economy demands and government legislation.

Protective Helmet Market Potential Customers

Potential customers for the Protective Helmet Market are highly segmented, reflecting the diverse applications and regulatory requirements driving demand. The largest buyer group comprises industrial end-users, primarily large multinational construction firms, heavy manufacturing plants, and entities in the energy sector (oil & gas, mining, utilities). These customers purchase industrial safety helmets (hard hats) in bulk, driven by mandatory safety regulations and are typically focused on compliance, durability, and cost-effectiveness for large workforces. Government bodies and defense organizations represent another major customer segment, procuring specialized tactical and ballistic helmets that require high-level certifications, often through complex tendering processes prioritizing performance characteristics like blast protection, communication integration, and compatibility with night-vision systems.

Another significant customer segment is the consumer market, driven by discretionary spending and safety awareness, comprising motorcyclists, cyclists, and participants in winter and adventure sports. These buyers, facilitated by retailers and e-commerce platforms, prioritize aesthetics, comfort features (ventilation, padding), integrated technology (Bluetooth, action camera mounts), and specific safety certifications relevant to their sport (e.g., ECE 22.06 for motorcycles). While industrial buyers seek compliance and bulk value, consumer buyers seek premiumization and performance differentiation, resulting in higher average selling prices (ASPs) in the sports segment.

Emerging potential customers include organizations implementing advanced occupational safety protocols through IoT adoption. These customers are not merely buying helmets but investing in a comprehensive safety system. They include tech-forward logistics companies, automated factory operators, and specialized maintenance crews that require smart helmets capable of real-time monitoring, geo-fencing, and AR integration for complex tasks. This customer profile is highly lucrative as they require ongoing software maintenance, data analytics support, and frequent hardware upgrades, creating a robust recurring revenue stream for manufacturers positioned in the smart PPE space.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Honeywell International Inc., MSA Safety Incorporated, UVEX Safety Group GmbH, Schuberth GmbH, Bell Helmets, Arai Helmet, Studds Accessories Ltd., KASK S.p.A., Centurion Safety Products Ltd., JSP Limited, Helmet Integrated Systems Ltd. (HIS), Drägerwerk AG & Co. KGaA, Retrospec, Specialized Bicycle Components, Sena Technologies, Inc., Lazer Helmets, Limar Helmets, Scott Sports SA, POC Sweden AB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protective Helmet Market Key Technology Landscape

The protective helmet market is undergoing a significant technological renaissance, moving from simple impact absorption to complex, data-driven safety management systems. One of the most impactful innovations is the adoption of Rotational Impact Protection Systems (RIPS), such as MIPS (Multi-directional Impact Protection System) or similar proprietary technologies. These systems, incorporated between the comfort padding and the helmet shell, allow a slight relative movement of the head relative to the helmet during oblique impacts. This simple yet critical mechanism significantly reduces the rotational forces transmitted to the brain, which are the primary cause of concussions and diffuse axonal injury. Originally popularized in sports helmets, RIPS adoption is rapidly spreading into high-end industrial and tactical head protection, setting a new benchmark for safety performance beyond traditional linear impact absorption testing.

The second major technological thrust involves the integration of Smart Helmet technologies, leveraging the Internet of Things (IoT). These devices embed microprocessors, various sensors (GPS, ambient temperature, humidity, acceleration, gyroscope), and communication modules (Bluetooth, Wi-Fi, 4G/5G). In industrial settings, smart helmets can track worker location, detect falls or unauthorized movement, monitor biometric data (e.g., heart rate to detect fatigue), and provide two-way communication via integrated microphones and speakers. This connectivity transforms the helmet into an active safety and asset management tool, allowing centralized safety officers to monitor hundreds of workers in real-time, drastically reducing response times to emergencies and enhancing compliance enforcement on site.

Furthermore, material science advancements continue to push the boundaries of performance and weight. The increased use of advanced composites, including various carbon fiber weaves and hybrid matrix materials, is crucial for developing ultra-lightweight, high-strength shells required in motorsports and tactical defense. Complementary innovations include the development of shear-thickening fluids and specialized energy-absorbing foams (e.g., viscoelastic polyurethane) that dynamically stiffen upon impact, offering superior energy management within a thinner profile. Looking ahead, Augmented Reality (AR) integration, where micro-projectors display critical information (maps, schematics, safety warnings) onto the visor, is moving from niche military applications to specialized industrial maintenance and logistics roles, signaling a convergence of protection and operational assistance.

Regional Highlights

- North America (NA): Characterized by stringent, federally enforced safety standards (e.g., ANSI/ISEA Z89.1 for industrial helmets and DOT/Snell for motorsports), North America is a highly mature market focused on premiumization and advanced technology adoption. The growth here is primarily driven by replacement cycles and the increasing demand for smart helmets in the Oil & Gas, utility, and complex construction sectors. The US market is highly competitive, emphasizing product liability protection, driving manufacturers to invest heavily in certifications and advanced features like MIPS and integrated biometric monitoring.

- Europe: The European market is highly regulated by CE marking and EN standards (e.g., EN 397 for industrial use). This region demonstrates a strong preference for high-quality, ergonomic, and sustainable products. Germany, the UK, and France are key contributors, driven by manufacturing excellence and strong labor union influence pushing for the highest levels of worker protection. Europe is also a leader in specialized sports helmet manufacturing, driven by high disposable incomes and a strong cycling and motorcycling culture. Innovation focuses heavily on materials that meet strict environmental and recyclability mandates.

- Asia Pacific (APAC): APAC is the fastest-growing region, powered by explosive infrastructure development, rapid urbanization, and massive manufacturing output in countries like China, India, and Indonesia. While price sensitivity remains a factor in certain segments, the overall growth is volumetric. Regulatory bodies are steadily increasing safety enforcement, pushing demand from low-cost, traditional plastic hard hats toward higher-standard ABS and polycarbonate models. Japan and South Korea represent advanced sub-markets focused on high-tech integration, while emerging economies fuel large-scale industrial safety procurement.

- Latin America (LATAM): Growth in LATAM is closely linked to mining activities, energy projects, and large-scale public works, particularly in Brazil, Mexico, and Chile. The market faces challenges related to inconsistent regulatory enforcement and economic volatility. However, large multinational companies operating in the region often mandate international safety standards (e.g., US or European standards), creating pockets of demand for high-quality, certified protective gear, particularly in the premium mining safety segment.

- Middle East and Africa (MEA): This region is experiencing significant market growth fueled by vast construction projects (e.g., Saudi Arabia’s Vision 2030, UAE’s expansion) and the oil and gas sector. The demand is unique due to extreme climatic conditions, requiring helmets with enhanced UV protection, superior ventilation, and resistance to high heat. While cost remains a factor, the high-risk nature of the dominant industries ensures a mandatory and growing demand for specialized, robust industrial safety helmets that often adhere to international standards due to the high presence of global EPC firms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protective Helmet Market.- 3M Company

- Honeywell International Inc.

- MSA Safety Incorporated

- UVEX Safety Group GmbH

- Schuberth GmbH

- Bell Helmets

- Arai Helmet

- Studds Accessories Ltd.

- KASK S.p.A.

- Centurion Safety Products Ltd.

- JSP Limited

- Helmet Integrated Systems Ltd. (HIS)

- Drägerwerk AG & Co. KGaA

- Retrospec

- Specialized Bicycle Components

- Sena Technologies, Inc.

- Lazer Helmets

- Limar Helmets

- Scott Sports SA

- POC Sweden AB

Frequently Asked Questions

Analyze common user questions about the Protective Helmet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for advanced Protective Helmets?

The primary drivers are stringent governmental occupational health and safety (OHS) regulations across major industries (construction, mining), coupled with growing global infrastructure investment and increasing consumer adoption of high-performance sports, necessitating superior safety gear.

What role does MIPS technology play in modern helmet safety?

MIPS (Multi-directional Impact Protection System) is a crucial safety innovation that allows the helmet shell to slide relative to the wearer's head during oblique impacts, significantly reducing the dangerous rotational forces transmitted to the brain, thereby lowering the risk of concussions.

Which material segment holds the largest share in the Protective Helmet Market?

While advanced fiber composites are growing rapidly in premium segments, Acrylonitrile Butadiene Styrene (ABS) and High-Density Polyethylene (HDPE) still dominate the market by volume, primarily due to their cost-effectiveness and pervasive use in standard industrial safety helmets.

How are Smart Helmets contributing to industrial safety?

Smart helmets integrate IoT sensors, GPS, and communication modules to provide proactive safety solutions. They monitor worker vitals (fatigue, heart rate), detect impacts or falls, and facilitate real-time communication and geo-fencing, enhancing site management and emergency response capabilities.

Which region is expected to exhibit the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to register the fastest growth, fueled by immense ongoing infrastructure and construction projects, rapid industrialization, and the gradual adoption of stricter workplace safety standards across emerging economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager