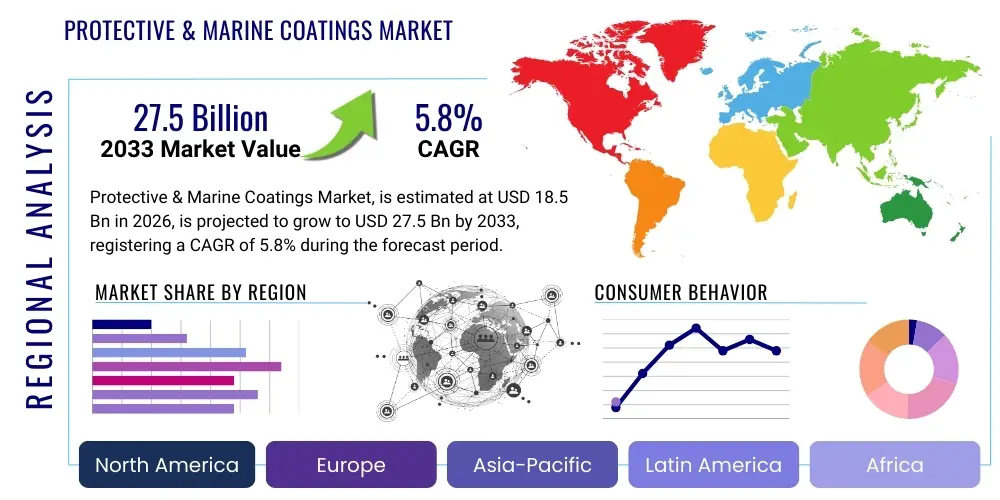

Protective & Marine Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435294 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Protective & Marine Coatings Market Size

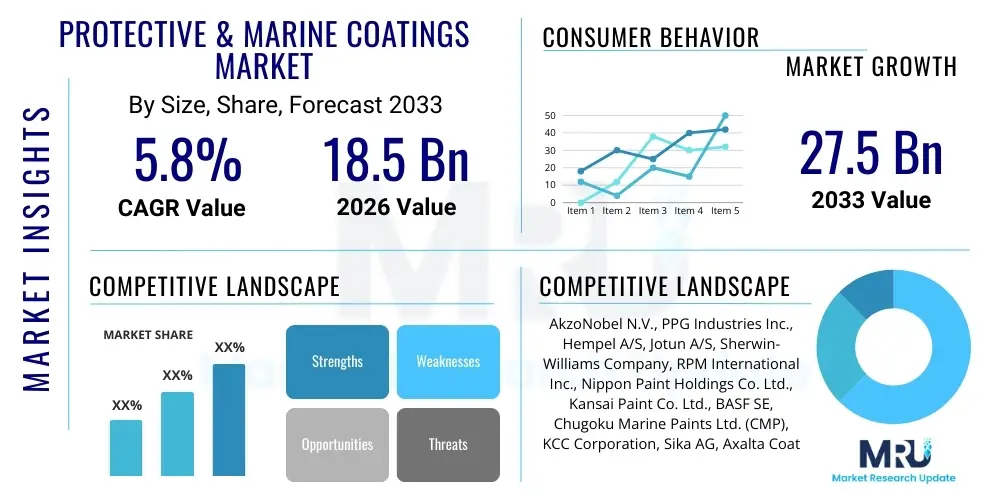

The Protective & Marine Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Protective & Marine Coatings Market introduction

The Protective & Marine Coatings Market encompasses highly specialized paint and coating formulations designed to protect substrates, primarily steel and concrete, from harsh environmental factors such as corrosion, abrasion, extreme temperatures, and biofouling. These coatings are essential components in maintaining the structural integrity and operational efficiency of critical assets across the marine and infrastructure sectors. The marine segment specifically targets vessels, offshore installations, and port facilities, focusing heavily on anti-fouling systems to reduce drag, improve fuel efficiency, and minimize the transfer of invasive aquatic species, aligning with stringent international environmental regulations.

The product portfolio within this market is diverse, including high-performance resins such as epoxy, polyurethane, alkyd, and advanced fluoropolymers. Epoxy coatings are widely utilized for their superior chemical resistance and adhesion, particularly in industrial and structural applications. Polyurethane coatings offer excellent UV resistance and durability, making them suitable for topcoats in harsh outdoor environments. The primary applications span across shipbuilding, maintenance of bulk carriers and LNG tankers, infrastructure projects like bridges and pipelines, and industrial facilities such as refineries and power plants, where longevity and resistance to operational stress are paramount.

The inherent benefits of utilizing high-quality protective and marine coatings include extended asset lifespan, reduced maintenance costs, enhanced safety, and compliance with rigorous industry standards. Driving factors for market expansion include massive global investments in infrastructure development, particularly in emerging economies of the Asia Pacific region, and the necessity for continuous maintenance and retrofitting of aging assets in North America and Europe. Furthermore, increasing regulatory pressure from organizations like the International Maritime Organization (IMO) concerning greenhouse gas emissions and hull maintenance significantly boosts demand for high-solid, low-VOC, and effective anti-fouling solutions.

Protective & Marine Coatings Market Executive Summary

The global Protective & Marine Coatings Market is experiencing robust growth driven by accelerating industrialization, infrastructure rejuvenation cycles, and stringent environmental compliance mandates, especially within the maritime industry. Key business trends indicate a strong shift towards sustainable and high-performance coating technologies, including waterborne, solvent-free, and powder coating systems, aiming to reduce volatile organic compound (VOC) emissions and improve worker safety. Consolidation among major players is observed as companies seek to expand their technological portfolios, particularly in smart coatings and bio-based anti-fouling solutions, ensuring a competitive edge in specialized application areas such as renewable offshore energy installations.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, primarily fueled by extensive shipbuilding activities, rapid urbanization, and colossal investments in chemical processing, oil & gas, and transportation infrastructure, notably in China, India, and Southeast Asian nations. North America and Europe represent mature markets characterized by high regulatory standards, driving demand for premium, specialized protective coatings for maintenance, repair, and overhaul (MRO) operations on existing critical infrastructure, focusing heavily on longevity and corrosion control for pipelines, bridges, and offshore platforms.

Segment trends reveal that the epoxy resin type continues to hold the largest market share due to its versatility and superior resistance profile, while the polyurethane segment is expected to show the highest growth rate driven by demand for durable exterior protection. By application, the marine segment is significantly influenced by global trade volumes and the push for eco-friendly anti-fouling mechanisms, whereas the protective coatings segment sees sustained demand from the oil & gas and power generation sectors, requiring specialized coatings capable of withstanding extreme temperatures and chemical exposure in demanding industrial environments.

AI Impact Analysis on Protective & Marine Coatings Market

User queries regarding AI's influence in the Protective & Marine Coatings Market frequently center on predictive maintenance scheduling, automated quality control, and the acceleration of R&D for novel coating formulations. Users are keen to understand how AI can optimize application processes, minimizing waste and ensuring uniform layer thickness, particularly in complex structures like ship hulls or intricate industrial machinery. Key themes emerging from these questions involve the integration of machine learning algorithms with sensor data (IoT) deployed on vessels or structures to predict coating degradation and corrosion onset, thereby moving maintenance from reactive to proactive models. Concerns often revolve around the initial investment cost for AI infrastructure and the need for specialized training to manage complex predictive analytics platforms within traditional industrial settings.

- AI-driven predictive analytics optimize re-coating schedules, minimizing operational downtime and extending asset life.

- Machine learning accelerates R&D by simulating material interactions and testing novel, sustainable coating formulations much faster than traditional laboratory methods.

- Computer vision systems, integrated with drones and robotic applicators, enable highly accurate quality control and thickness measurement during coating application.

- AI algorithms process vast sensor data from vessels (e.g., speed, fuel consumption, routes) to dynamically adjust anti-fouling effectiveness monitoring and maintenance needs.

- Supply chain optimization through AI improves inventory management for raw materials (resins, pigments) and reduces logistics costs for globally deployed coating projects.

DRO & Impact Forces Of Protective & Marine Coatings Market

The Protective & Marine Coatings Market is driven by the global imperative for corrosion prevention in critical infrastructure and the strict regulatory environment governing maritime activities, countered by volatility in raw material prices and the complex logistics of global application projects. Key drivers include heightened infrastructure spending, particularly in APAC and the Middle East, coupled with the mandatory adoption of high-performance coatings in offshore oil, gas, and renewable energy sectors. Restraints primarily involve the environmental and health concerns associated with high-VOC coatings, forcing manufacturers into costly R&D for compliant, low-solvent alternatives, alongside intense price competition, particularly in generic epoxy and alkyd product lines.

Opportunities for growth are abundant in specialized areas such as passive fire protection (PFP) coatings for safety-critical installations and the development of intelligent, self-healing coatings that can automatically mitigate minor damage. Furthermore, the burgeoning demand for environmentally friendly coatings, including bio-based anti-fouling agents that replace traditional copper-based toxins, represents a significant avenue for market differentiation and premium pricing. The transition towards sustainable coatings, driven by both consumer preference and governmental mandates, offers manufacturers who invest in green chemistry a strong competitive position in the long term.

Impact forces governing this market are characterized by high regulatory pressure (external force) which accelerates technological innovation in areas like hull performance monitoring and environmentally acceptable anti-fouling systems. Economic cycles (external force) heavily influence shipbuilding rates and large capital expenditure projects (like new pipelines or refineries), directly impacting initial coating demand, while the inherent technological complexity of formulating coatings (internal force) acts as a high barrier to entry, maintaining the dominance of established industry players with robust R&D capabilities and global distribution networks. The balance between performance requirements (longevity, protection) and environmental standards (VOC content, biocide leach rate) creates a continuous push and pull dynamic shaping product development priorities.

Segmentation Analysis

The Protective & Marine Coatings Market is comprehensively segmented based on the chemical resin type, the specific application area, and the primary function the coating is designed to serve. This structural segmentation allows stakeholders to analyze market performance across highly specialized niches, reflecting varied end-user requirements, regulatory environments, and performance expectations. The resin type segmentation is critical as it dictates the coating's mechanical and chemical resistance properties, with epoxy and polyurethane dominating based on their robust performance profile across diverse industrial settings. Understanding these segments is vital for effective strategic planning, given the large difference in pricing and application complexity between standard protective coatings and highly specialized marine anti-fouling or fire protection systems.

The application segmentation clearly differentiates between the marine sector (new build, dry dock maintenance, offshore structures) and the heavy-duty protective sector (infrastructure, chemical, power). Growth rates vary significantly between these areas; for instance, the offshore wind farm application segment is currently showing exponential growth, requiring unique high-durability coatings, whereas the general infrastructure maintenance segment provides a stable, long-term revenue stream. The function-based segmentation, focusing on corrosion, fouling, and fire protection, highlights the specific performance mandates that drive purchasing decisions, often dictated by insurance requirements, safety standards, and operational efficiency goals.

- By Resin Type:

- Epoxy

- Polyurethane

- Alkyd

- Acrylic

- Polyester

- Fluoropolymer

- Others (Silicone, Vinyl, Phenolic)

- By Application:

- Marine

- Cargo Ships & Tankers

- Passenger Ships

- Naval Vessels

- Yachts & Recreational Boats

- Protective (Industrial & Infrastructure)

- Oil & Gas (Pipelines, Refineries)

- Power Generation (Nuclear, Coal, Renewable Offshore Wind)

- Chemical & Petrochemical

- Infrastructure (Bridges, Roads, Railways, Water Treatment)

- Mining & Metallurgy

- Marine

- By Technology:

- Solvent-Borne

- Water-Borne

- Powder Coatings

- High-Solids

- By Function:

- Anti-Corrosion Coatings

- Anti-Fouling Coatings (Marine)

- Passive Fire Protection (PFP) Coatings

- Abrasion Resistance Coatings

Value Chain Analysis For Protective & Marine Coatings Market

The value chain for Protective & Marine Coatings is characterized by sequential processes starting from raw material procurement, moving through complex manufacturing and formulation, and culminating in specialized distribution and high-skill application services. Upstream analysis focuses on securing key feedstocks, primarily petrochemical derivatives, which include epoxy resins, polyurethanes, pigments (like titanium dioxide), and specialized additives (e.g., rheology modifiers, biocides). Fluctuations in crude oil prices and the supply dynamics of key chemical intermediates significantly impact the cost structure and profitability of coating manufacturers. Strategic procurement and long-term contracts are crucial in mitigating raw material price volatility, which is a constant challenge for major players.

Midstream activities involve sophisticated research, development, and manufacturing processes, where raw materials are chemically formulated into specialized coating systems tailored for specific environments, such as high-temperature resistance or deep-sea submersion. This stage is dominated by large, integrated manufacturers who possess the necessary intellectual property and production scale to meet stringent performance and regulatory requirements. Key performance indicators at this stage include minimizing VOC content, achieving specific cure times, and ensuring batch-to-batch consistency for complex, multi-component coating systems used in critical applications like ballast tanks or cryogenic pipelines.

Downstream activities involve specialized distribution channels and highly technical application services. Due to the criticality of application quality, especially in marine and complex infrastructure projects, coatings are often sold through specialized distributors or directly to professional applicators and shipyard contractors. Direct sales models are common for major contracts. The application stage is paramount, requiring skilled labor and adherence to strict surface preparation standards (e.g., abrasive blasting) to ensure coating longevity, forming a crucial link between the product's quality and its ultimate performance in the field. Training and certification of applicators remain a key focus area for leading coating suppliers to maintain product integrity.

Protective & Marine Coatings Market Potential Customers

The primary customers for Protective & Marine Coatings are large asset owners and operators requiring durable, high-performance materials to protect capital-intensive investments from degradation. Potential customers include major global shipping companies, shipyards (new construction and maintenance), offshore oil and gas exploration firms, and utility companies managing extensive infrastructure networks. These buyers are highly sophisticated, prioritizing long-term value, regulatory compliance (especially concerning environmental mandates like hull performance), and proven product track records over immediate cost savings. Purchasing decisions are often highly technical, involving extensive testing and validation processes mandated by engineering teams.

In the protective coatings sector, key buyers include governmental bodies and large private contractors involved in major civil engineering projects (bridges, tunnels, water treatment facilities) and industrial conglomerates operating chemical plants, power stations, and manufacturing facilities. For these end-users, the ability of the coating system to prevent catastrophic failure, ensure continuous operation, and meet strict safety standards, such as those related to passive fire protection, is the primary buying criterion. The decision process frequently involves specifying coatings based on ISO standards, NACE certifications, and specific regional environmental guidelines.

Furthermore, specialized segments such as the offshore renewable energy sector (wind and wave power installations) represent rapidly growing customer bases demanding coatings capable of enduring extreme cyclic loading and submersion in highly corrosive marine environments for decades without intervention. Military and naval organizations also constitute a significant and demanding customer group, requiring coatings that offer specialized capabilities such as radar signature reduction, acoustic dampening, and extreme durability against cavitation and abrasion in harsh operational settings globally. The diverse customer landscape necessitates tailored product offerings and robust technical support services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel N.V., PPG Industries Inc., Hempel A/S, Jotun A/S, Sherwin-Williams Company, RPM International Inc., Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd., BASF SE, Chugoku Marine Paints Ltd. (CMP), KCC Corporation, Sika AG, Axalta Coating Systems, Carboline Company, Beckers Group, Wacker Chemie AG, Dow Inc., Tikkurila Oyj, Asian Paints, E.I. du Pont de Nemours and Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protective & Marine Coatings Market Key Technology Landscape

The technological landscape of the Protective & Marine Coatings Market is characterized by continuous innovation aimed at enhancing longevity, reducing environmental impact, and simplifying application processes. A significant technological focus is on developing high-solid and solvent-free coating systems. High-solid coatings contain minimal VOCs, meeting increasingly strict international air quality standards while delivering superior film thickness and protection with fewer coats. This shift minimizes drying time, reduces overall project application costs, and significantly lowers the environmental footprint of large-scale coating projects, making them highly attractive to major industrial and marine operators.

Another pivotal technological advancement involves the development of advanced anti-fouling (AF) solutions. Traditional tributyltin (TBT) and copper-based AF paints are being phased out or heavily regulated due to their toxicity to marine life. The market is transitioning rapidly towards foul-release technology, primarily based on silicone or fluoropolymer chemistries, which create ultra-smooth surfaces that marine organisms cannot adhere to efficiently, relying on the vessel's movement to slough off growth. Concurrently, bio-based AF coatings utilizing natural compounds or non-toxic physical barriers are gaining traction, representing the next generation of ecologically sound hull protection necessary for achieving IMO targets for energy efficiency.

Furthermore, smart coatings and functionalized materials represent a growth frontier. This includes self-healing coatings embedded with microcapsules that release corrosion inhibitors or repair agents when damaged, significantly extending the time between maintenance cycles. The incorporation of nanotechnology enhances mechanical properties, improving scratch resistance and barrier performance at a molecular level. Passive Fire Protection (PFP) technology is also evolving, with intumescent coatings offering improved light weight, durability, and better thermal insulation capabilities, crucial for protecting steel structures in high-risk environments such as offshore platforms and LNG facilities where fire safety is non-negotiable.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by its status as the world's leading region for new shipbuilding and extensive coastal infrastructure development. Countries like China, South Korea, and Japan lead in marine coating consumption, while rapid industrialization and urbanization across India and Southeast Asia fuel the demand for protective coatings in manufacturing, chemical processing, and massive governmental infrastructure projects. The expansion of offshore wind energy in the South China Sea also contributes significantly to specialized coating demand.

- North America: Characterized by a mature market focused on maintenance, repair, and overhaul (MRO) of aging infrastructure, particularly pipelines, bridges, and energy facilities. Strict environmental regulations enforce the adoption of advanced, high-solid, and 100% solid epoxy systems. The region’s energy sector, including shale oil and gas operations, requires high-performance internal pipe coatings capable of resisting aggressive chemical corrosion.

- Europe: Exhibits high demand for technologically advanced and sustainable coatings, strongly influenced by the EU's REACH regulations and directives promoting low-VOC emissions. The market is highly specialized, concentrating on offshore renewable energy (North Sea wind farms) and naval vessel maintenance, driving innovation in bio-based anti-fouling and high-durability passive fire protection coatings. Western European countries are leaders in adopting environmentally responsible coating solutions.

- Middle East and Africa (MEA): Shows high growth potential, primarily driven by massive capital expenditure in the oil and gas sector, including refineries, petrochemical complexes, and export terminals. The harsh desert and marine environments necessitate specialized, high-temperature, and ultra-high-performance protective coatings to manage severe corrosion under extreme climatic conditions. Infrastructure investment in rapidly developing Gulf Cooperation Council (GCC) nations is a major market stimulant.

- Latin America: Market growth is contingent on commodity prices, particularly those related to mining and oil production. Significant demand comes from maintaining existing port facilities, mining infrastructure in countries like Chile and Peru, and oil and gas platforms off the coasts of Brazil and Mexico, requiring substantial anticorrosive coating volumes for asset preservation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protective & Marine Coatings Market.- AkzoNobel N.V.

- PPG Industries Inc.

- Hempel A/S

- Jotun A/S

- Sherwin-Williams Company

- RPM International Inc.

- Nippon Paint Holdings Co. Ltd.

- Kansai Paint Co. Ltd.

- BASF SE

- Chugoku Marine Paints Ltd. (CMP)

- KCC Corporation

- Sika AG

- Axalta Coating Systems

- Carboline Company

- Beckers Group

- Wacker Chemie AG

- Dow Inc.

- Tikkurila Oyj

- Asian Paints

- E.I. du Pont de Nemours and Company

Frequently Asked Questions

Analyze common user questions about the Protective & Marine Coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers for growth in the Protective & Marine Coatings Market?

The market is primarily driven by rigorous international maritime regulations (IMO), escalating global investments in infrastructure development, rising demand for specialized coatings in the offshore renewable energy sector, and the necessity to extend the lifespan of aging industrial assets through comprehensive anticorrosion programs.

Which coating technology is dominating the Protective & Marine sector?

Epoxy coatings, due to their exceptional adhesion, chemical resistance, and durability, remain the dominant resin type, particularly in protective industrial applications and as primers in marine environments. However, high-solid and solvent-free formulations are increasingly replacing traditional solvent-borne technologies to meet environmental compliance standards.

How do stringent environmental regulations affect coating manufacturers?

Environmental regulations, particularly concerning VOC limits and biocide use (such as copper in anti-fouling), force manufacturers to invest heavily in R&D to develop sustainable, water-borne, and bio-based alternatives, significantly increasing development costs but opening premium market opportunities for eco-friendly products.

Which regional market holds the highest growth potential for Protective & Marine Coatings?

Asia Pacific (APAC) holds the highest growth potential, fueled by massive government investment in infrastructure (e.g., ports, bridges, pipelines) and continued dominance in the global shipbuilding industry, particularly across China, South Korea, and Southeast Asian nations.

What is the role of Passive Fire Protection (PFP) coatings in this market?

PFP coatings, especially intumescent types, are crucial for enhancing structural integrity and human safety in high-risk industrial environments like offshore platforms, chemical facilities, and critical infrastructure, protecting steel from catastrophic failure during fire events and ensuring regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager