Protein Inhibitors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436197 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Protein Inhibitors Market Size

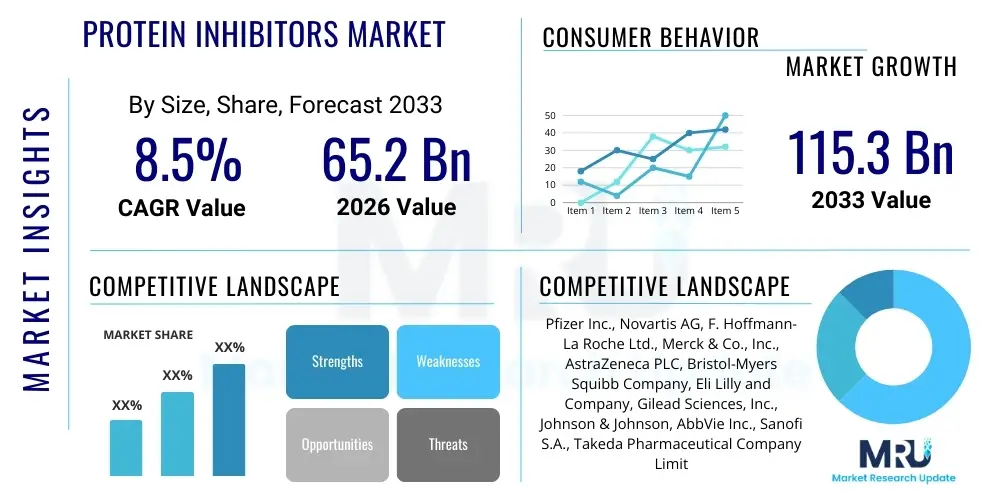

The Protein Inhibitors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 65.2 Billion in 2026 and is projected to reach USD 115.3 Billion by the end of the forecast period in 2033.

Protein Inhibitors Market introduction

The Protein Inhibitors Market encompasses pharmaceutical agents designed to block the function of specific proteins, fundamentally crucial for various biological processes, often linked to disease progression. These inhibitors target enzymes, receptors, or signaling molecules, thereby interrupting pathological pathways central to cancer, viral infections, autoimmune disorders, and metabolic diseases. The strategic development of highly selective inhibitors represents a cornerstone of modern targeted therapy, moving away from generalized treatments towards precision medicine. The efficacy and reduced systemic toxicity of these agents, particularly compared to traditional chemotherapy, are accelerating their adoption globally, driving significant investment into research and development activities focused on novel targets.

Protein inhibitors are broadly classified based on their target mechanism, including kinase inhibitors (targeting signal transduction), protease inhibitors (targeting protein breakdown and viral replication), and phosphatase inhibitors. The primary application landscape is dominated by oncology, where inhibitors targeting EGFR, HER2, and various kinases have revolutionized cancer management. Furthermore, the market is experiencing robust growth in areas like infectious diseases, notably HIV/AIDS and hepatitis C, and in the management of chronic conditions such as rheumatoid arthritis and psoriasis, leveraging their immunomodulatory capabilities. The transition towards small-molecule drugs and biologics with protein inhibitory action underscores the market's evolution.

Key driving factors for market expansion include the surging global prevalence of chronic diseases, particularly cancer and inflammatory disorders, which necessitates the continuous development of novel and effective treatment modalities. Technological advancements in structural biology, high-throughput screening, and computational drug design have significantly accelerated the identification and optimization of potent inhibitor candidates. Moreover, supportive regulatory frameworks for fast-tracking approval of breakthrough therapies, coupled with increasing healthcare expenditure in emerging economies, are providing substantial momentum to the protein inhibitors sector.

Protein Inhibitors Market Executive Summary

The Protein Inhibitors Market is characterized by intense research and development activity, primarily concentrated on developing highly selective agents capable of overcoming resistance mechanisms prevalent in oncology and infectious diseases. Business trends indicate a strong focus on strategic collaborations between large pharmaceutical corporations and specialized biotechnology firms to leverage cutting-edge target identification platforms and accelerate clinical trials. Mergers and acquisitions are frequent, driven by the need to integrate promising pipeline assets, particularly those utilizing next-generation technologies like PROTACs (Proteolysis Targeting Chimeras) and molecular glue degraders, which offer enhanced therapeutic potential beyond simple inhibition.

Regionally, North America maintains the dominant market share, attributed to established infrastructure, high healthcare spending, extensive clinical research networks, and the presence of major pharmaceutical innovators. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by improving healthcare accessibility, a rapidly expanding patient pool, and increased governmental support for domestic biotechnology R&D. European markets remain robust, supported by strong regulatory bodies such as the European Medicines Agency (EMA) and favorable reimbursement policies for advanced targeted therapies. The competition centers on market access strategies, pricing, and generating strong clinical data demonstrating superior safety and efficacy profiles compared to existing standards of care.

In terms of segment trends, kinase inhibitors continue to dominate by type, given their widespread utility across oncology and inflammation, though protease inhibitors are gaining traction in specific infectious disease segments. The application segment remains heavily skewed towards oncology, which commands the largest revenue share. However, the application in rare diseases and neurodegenerative disorders represents a high-potential, underserved area ripe for innovation. Investment in personalized medicine approaches, utilizing companion diagnostics to identify patients most likely to respond to a specific inhibitor, is solidifying the market's shift toward targeted, patient-centric treatment protocols.

AI Impact Analysis on Protein Inhibitors Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Protein Inhibitors Market frequently revolve around accelerating drug discovery timelines, optimizing compound design for better selectivity and reduced off-target effects, and predicting clinical trial success rates. Key themes highlighted include concerns about the accuracy and bias inherent in training datasets, the intellectual property landscape surrounding AI-generated molecules, and the practical implementation barriers within traditional pharmaceutical R&D workflows. Users express high expectations for AI's capability to rapidly screen vast chemical libraries and identify novel, cryptic protein-protein interaction (PPI) sites that were previously considered "undruggable," thus unlocking new therapeutic avenues.

AI's transformative influence is most pronounced in the early-stage identification and validation of protein targets and the subsequent synthesis of novel chemical entities with high binding affinity. ML algorithms analyze complex biological data, including genomic, proteomic, and transcriptomic information, to precisely map disease pathways and predict the structural dynamics of target proteins, allowing for better modeling of inhibitor-target interactions. This capability significantly reduces the time and cost associated with conventional high-throughput screening (HTS), dramatically narrowing down the list of viable candidates that proceed to preclinical testing, leading to a much more efficient discovery pipeline characterized by reduced attrition rates.

Furthermore, AI is instrumental in the process of optimizing drug candidates by predicting absorption, distribution, metabolism, and excretion (ADME) properties and potential toxicity profiles early on. By simulating the biological behavior of thousands of potential compounds, deep learning models assist medicinal chemists in refining structures to improve oral bioavailability and half-life while minimizing undesirable side effects. This data-driven approach not only speeds up the transition from lead optimization to clinical development but also enhances the likelihood of regulatory approval by providing more predictable and robust preclinical data packages.

- Accelerated Target Identification: AI analyzes omics data to prioritize critical protein targets involved in disease pathogenesis, especially in complex multifactorial diseases.

- High-Throughput Virtual Screening: ML models rapidly screen billions of compounds against protein structures, drastically reducing the physical screening requirements.

- Enhanced Compound Optimization: Algorithms predict ADME/Tox properties, guiding the design of inhibitors with improved efficacy, selectivity, and safety profiles.

- Prediction of Resistance Mechanisms: AI identifies structural mutations or pathway changes that confer drug resistance, aiding the development of next-generation inhibitors designed to bypass these challenges.

- Personalized Dosage Recommendations: Machine learning integrates patient specific data (genomics, clinical response) to optimize inhibitor dosing and predict individual treatment outcomes.

DRO & Impact Forces Of Protein Inhibitors Market

The Protein Inhibitors Market is significantly influenced by a dynamic interplay of factors. Drivers include the rising incidence of chronic and complex diseases, rapid technological integration of structural biology and combinatorial chemistry, and increasing pharmaceutical investments in personalized medicine. Restraints encompass the high cost associated with drug development and clinical trials, the persistent challenge of developing selective inhibitors that avoid off-target toxicity, and the rapid emergence of drug resistance requiring continuous innovation. Opportunities lie in targeting previously undruggable proteins, utilizing advanced degradation techniques like PROTACs, and expanding applications into niche therapeutic areas such as neurodegenerative diseases and rare cancers. The market's overall trajectory is defined by the critical need for breakthrough therapies that offer superior efficacy and safety, balancing innovation against regulatory and cost pressures.

The impact forces are substantial, particularly driven by technological breakthroughs in small molecule design. The development of covalent inhibitors, which form stable chemical bonds with their targets, offers enhanced potency and durability, significantly impacting efficacy, while allosteric inhibitors, which bind away from the active site to modulate function, provide a pathway to improved selectivity and reduced competitive resistance. These advancements directly address the primary restraint of off-target effects, thereby increasing the clinical utility and market acceptance of new drugs. Simultaneously, regulatory incentives, such as priority review and orphan drug designation, act as powerful external drivers, encouraging companies to invest in high-risk, high-reward inhibitor development programs.

The market also faces strong internal pressure from expiring patents on blockbuster protein inhibitors, necessitating that manufacturers constantly launch innovative follow-on compounds or combinations to maintain revenue streams. Furthermore, the rising scrutiny over pharmaceutical pricing, particularly in developed economies, acts as a restraint, forcing companies to demonstrate high value and cost-effectiveness to secure favorable reimbursement status. The convergence of computational power and biological data is arguably the most potent long-term impact force, fundamentally reshaping how protein inhibition is conceived and executed, promoting highly efficient, data-driven strategies throughout the entire drug lifecycle.

Segmentation Analysis

The Protein Inhibitors Market is meticulously segmented based on the type of protein targeted, the specific therapeutic application, the route of administration, and the end-user landscape. This segmentation provides a granular view of market dynamics, revealing that the functional classification (Kinase, Protease, etc.) dictates technological focus, while the application segment, primarily oncology, dictates revenue potential and required regulatory pathways. The market structure reflects the complexity of the drug development process, with each segment demanding specialized research expertise and commercial strategies tailored to disease prevalence and specific patient populations.

The dominance of the kinase inhibitor segment stems from the central role kinases play in cellular signaling pathways related to proliferation and survival, making them highly effective targets across numerous cancer types. Conversely, protease inhibitors, vital in managing infectious diseases (e.g., HIV, HCV), display distinct market characteristics driven by pandemic preparedness and specific global health initiatives. The segmentation by end-user, heavily weighted towards hospitals and specialized cancer centers, emphasizes the necessity for these complex treatments to be administered and monitored in highly controlled clinical settings, often requiring specialized diagnostics.

Geographic segmentation is crucial, highlighting the disparity in regulatory approval speed and market access between developed economies, which are early adopters of premium-priced therapies, and emerging markets, which are focused on increasing affordability and access to essential medicines. Understanding these distinct segment characteristics is essential for stakeholders to optimize product positioning, clinical trial design, and distribution logistics to maximize market penetration across diverse global healthcare systems.

- By Type:

- Kinase Inhibitors (Tyrosine Kinase Inhibitors, Serine/Threonine Kinase Inhibitors)

- Protease Inhibitors (HIV Protease Inhibitors, HCV Protease Inhibitors, Others)

- Poly(ADP-ribose) Polymerase (PARP) Inhibitors

- Cyclin-Dependent Kinase (CDK) Inhibitors

- Monoclonal Antibodies (Targeting protein receptors/interactions)

- Others (e.g., mTOR, HDAC, and Proteasome Inhibitors)

- By Application:

- Oncology (Lung Cancer, Breast Cancer, Colorectal Cancer, Hematological Malignancies)

- Infectious Diseases (HIV/AIDS, Hepatitis C, Viral Infections)

- Autoimmune and Inflammatory Diseases (Rheumatoid Arthritis, Psoriasis)

- Neurological Disorders

- Others (Metabolic Disorders, Rare Diseases)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By End User:

- Hospitals and Clinics

- Specialty Centers

- Research Laboratories and Academic Institutes

Value Chain Analysis For Protein Inhibitors Market

The value chain for the Protein Inhibitors Market is complex and highly research-intensive, beginning with fundamental R&D and culminating in patient administration. Upstream activities are dominated by early-stage discovery, target validation, and lead optimization, heavily reliant on sophisticated technologies like structural proteomics, bioinformatics, and high-throughput screening performed by specialized biotech firms and academic institutions. The high intellectual property value generated in this phase necessitates robust patent protection and often leads to collaborative agreements or licensing deals with larger pharmaceutical manufacturers who possess the necessary capital for extensive preclinical development and clinical trials. This phase is critical, as it determines the novelty, selectivity, and druggability of the final compound.

Midstream activities involve large-scale manufacturing and quality control. Given that many protein inhibitors are complex small molecules or biologics, production requires specialized facilities adhering to stringent Good Manufacturing Practices (GMP). This phase involves sourcing highly pure raw materials, complex chemical synthesis or fermentation processes, formulation development to ensure stability and bioavailability, and packaging. Direct involvement in manufacturing provides pharmaceutical companies with greater control over supply chain resilience and cost management, though outsourcing to Contract Development and Manufacturing Organizations (CDMOs) is increasingly common to manage scalability and operational complexity.

Downstream activities focus on distribution, marketing, and commercialization. Distribution channels are highly regulated, utilizing both direct sales forces targeting specialized physicians and institutional procurement departments, as well as indirect channels through major wholesalers, distributors, and specialized hospital pharmacies. Due to the high cost and specialized nature of protein inhibitors, market access strategies, including securing favorable reimbursement from payers and developing patient support programs, are paramount. The final step involves prescription and administration in hospitals or specialty clinics, often requiring continuous post-market surveillance and pharmacovigilance to monitor long-term safety and efficacy.

Protein Inhibitors Market Potential Customers

The primary customers and end-users of protein inhibitors are diverse institutional entities and specialized medical facilities focused on treating chronic and life-threatening diseases. Hospitals, particularly academic medical centers and large integrated healthcare networks, constitute the largest customer segment, driven by the need to manage complex disease states such as late-stage cancers and severe autoimmune disorders requiring advanced, targeted therapies. These institutions serve as major procurement hubs, purchasing large volumes of inhibitors for inpatient and outpatient care, and often participate actively in clinical trials, positioning them as key opinion leaders in treatment adoption.

Specialty cancer centers and oncology clinics represent another critical customer group. As protein inhibitors often require specialized diagnostics and administration protocols (e.g., intravenous infusion or complex oral dosing schedules), these centers are equipped with the infrastructure and personnel—including specialized oncologists, pharmacists, and nurses—necessary to manage these high-value, high-complexity drugs effectively. Their purchasing decisions are heavily influenced by clinical efficacy demonstrated in Phase III trials, regulatory approval status, and the drug’s inclusion in national or international treatment guidelines.

Beyond direct patient care, research laboratories and academic institutions are significant purchasers, utilizing protein inhibitors as chemical tools to study cellular mechanisms, validate new drug targets, and conduct preclinical research. Furthermore, government agencies and public health organizations focusing on infectious disease eradication (like HIV/AIDS or tuberculosis) are substantial customers, particularly in resource-limited settings where large-scale procurement and distribution of generic or essential protease and reverse transcriptase inhibitors are managed through centralized bidding and distribution systems to ensure widespread public access.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.2 Billion |

| Market Forecast in 2033 | USD 115.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer Inc., Novartis AG, F. Hoffmann-La Roche Ltd., Merck & Co., Inc., AstraZeneca PLC, Bristol-Myers Squibb Company, Eli Lilly and Company, Gilead Sciences, Inc., Johnson & Johnson, AbbVie Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Bayer AG, Vertex Pharmaceuticals Incorporated, GlaxoSmithKline PLC, Amgen Inc., Boehringer Ingelheim International GmbH, BeiGene, Ltd., Daiichi Sankyo Co., Ltd., Incyte Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protein Inhibitors Market Key Technology Landscape

The technology landscape governing the Protein Inhibitors Market is rapidly evolving, driven by the need for enhanced specificity, potency, and mechanisms to overcome existing therapeutic limitations. Small molecule development remains central, but the focus has shifted significantly toward rational drug design utilizing computational chemistry, molecular docking, and fragment-based drug discovery (FBDD). These technologies enable researchers to precisely map the binding pockets of target proteins and design compounds with tailored affinity, significantly reducing the empirical trial-and-error often associated with traditional screening. Furthermore, the advent of covalent and allosteric inhibitors, which modulate protein function via unique binding sites, represents a key technological advancement in improving the therapeutic window and addressing resistance mechanisms.

A major paradigm shift is the development and commercialization of targeted protein degradation (TPD) technologies, notably PROTACs and molecular glues. Unlike traditional inhibitors that merely block protein function, TPD molecules utilize the cell’s natural machinery (the ubiquitin-proteasome system) to tag and destroy the targeted protein entirely. This approach offers several advantages, including catalytic activity, the potential to target previously undruggable scaffolding proteins, and sustained biological effect even at lower concentrations. TPD platforms are attracting immense investment, promising a wave of next-generation therapeutic agents with distinct clinical profiles, particularly in high-need oncology indications.

In parallel, high-throughput screening (HTS) continues to be refined through automation and integration with phenotypic screening, allowing rapid assessment of compounds in physiologically relevant contexts. Complementing this is the rising adoption of cryo-electron microscopy (cryo-EM) and X-ray crystallography, which provide high-resolution structural information of target proteins, enabling structure-based drug design (SBDD) with unprecedented accuracy. These integrated technological approaches—from initial virtual design to structural validation and functional degradation—are accelerating the pipeline velocity and expanding the accessible proteome for therapeutic intervention.

Regional Highlights

- North America: This region holds the largest market share, primarily due to the presence of global pharmaceutical headquarters, robust governmental and private funding for biomedical research, and high adoption rates of advanced targeted cancer therapies. The U.S. remains the epicenter for clinical development, supported by favorable regulatory pathways (e.g., FDA fast-track designations) and a sophisticated healthcare reimbursement system that readily accepts high-cost, high-value specialty drugs. Emphasis is placed on precision medicine and advanced small molecule oncology pipelines.

- Europe: The European market is the second-largest, characterized by strong regulatory harmonization through the EMA and significant R&D spending, particularly in the UK, Germany, and Switzerland. While facing pricing pressures and stricter health technology assessment (HTA) requirements, Europe maintains a strong research base, particularly in academic drug discovery and the development of biosimilars for complex protein inhibitors, ensuring high market competition.

- Asia Pacific (APAC): APAC is the fastest-growing market, driven by rapidly improving healthcare infrastructure, massive patient populations (especially for cancer and infectious diseases), and increasing foreign direct investment into local biotech ecosystems (China, Japan, South Korea, India). Governments in this region are actively promoting domestic drug innovation and manufacturing capabilities, though challenges remain regarding intellectual property enforcement and fragmented regulatory approval processes across different countries.

- Latin America (LATAM): Growth in LATAM is spurred by increasing access to private insurance and government efforts to broaden public healthcare coverage. The market is primarily driven by the importation of patented drugs from North America and Europe, with growing demand for generic versions as patents expire. Brazil and Mexico are the dominant markets, focusing on improving access to essential treatments for high-prevalence diseases.

- Middle East and Africa (MEA): This region is heavily reliant on imports of advanced protein inhibitors, particularly in the Gulf Cooperation Council (GCC) countries which possess high per capita healthcare spending. Market expansion is contingent on establishing local manufacturing capabilities, developing consistent regulatory standards, and addressing the significant burden of infectious diseases in the African sub-region, necessitating affordable generic options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protein Inhibitors Market.- Pfizer Inc.

- Novartis AG

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Johnson & Johnson

- AbbVie Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Bayer AG

- Vertex Pharmaceuticals Incorporated

- GlaxoSmithKline PLC

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- BeiGene, Ltd.

- Daiichi Sankyo Co., Ltd.

- Incyte Corporation

Frequently Asked Questions

Analyze common user questions about the Protein Inhibitors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for protein inhibitors in oncology?

Protein inhibitors in oncology primarily act by blocking the function of specific signal transduction proteins, such as kinases (e.g., EGFR, HER2), that drive uncontrolled cell proliferation and survival in cancer cells. This targeted blockade interrupts the growth signals, leading to tumor cell death or cessation of division, forming the basis of precision cancer therapy.

How is Artificial Intelligence (AI) transforming the development of novel protein inhibitors?

AI is transforming development by accelerating target identification, performing high-throughput virtual screening of vast chemical spaces, and optimizing drug candidates for better ADME/Tox properties. AI reduces the R&D cycle time and increases the probability of identifying selective, effective lead compounds against complex protein targets.

What are PROTACs, and how do they differ from traditional protein inhibitors?

PROTACs (Proteolysis Targeting Chimeras) are bifunctional molecules that leverage the cell's ubiquitin-proteasome system to degrade the target protein entirely, rather than just blocking its active site, which is the mechanism of traditional inhibitors. This degradation approach offers the potential for sustained efficacy and overcoming drug resistance.

Which geographical region dominates the Protein Inhibitors Market?

North America currently dominates the Protein Inhibitors Market due to high R&D investment, the strong presence of major pharmaceutical companies, high patient awareness, and favorable regulatory and reimbursement environments supporting the uptake of high-value targeted therapies, especially in oncology.

What are the main restraints impacting the growth of the Protein Inhibitors Market?

The main restraints include the significant cost and duration associated with advanced clinical trials, the ongoing challenge of developing inhibitors with high selectivity to minimize severe off-target toxicity, and the rapid evolution of drug resistance mechanisms in pathogens and cancer cells, necessitating continuous innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager