Protocol Converters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439759 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Protocol Converters Market Size

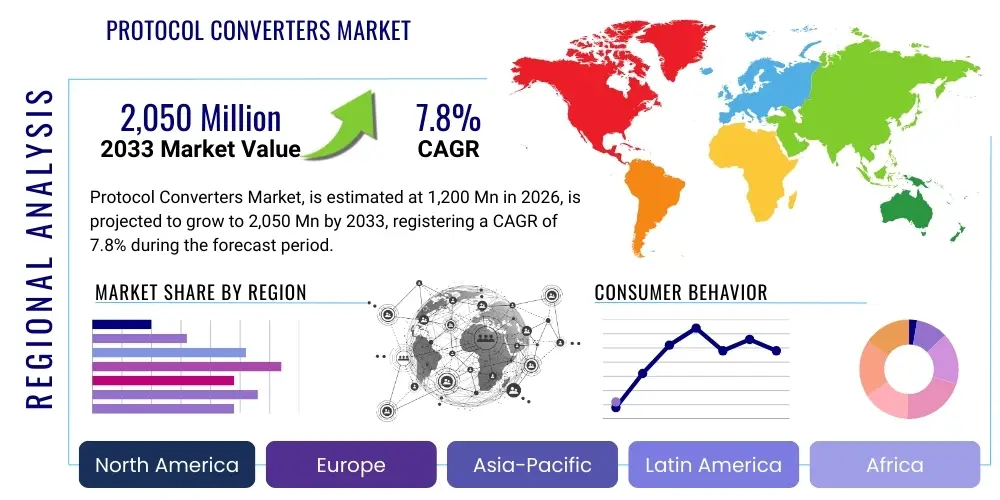

The Protocol Converters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1,200 Million in 2026 and is projected to reach USD 2,050 Million by the end of the forecast period in 2033.

Protocol Converters Market introduction

Protocol converters stand as foundational components in modern industrial and operational technology (OT) landscapes, acting as essential communication bridges that enable disparate systems and devices to interact seamlessly. These devices are critical for integrating a wide array of equipment that often utilizes incompatible communication standards, from legacy serial protocols to contemporary Ethernet-based industrial networks. Their fundamental role involves translating data formats, addressing schemes, and communication methods, thereby fostering a unified and coherent operational environment where all components can "understand" each other, facilitating comprehensive control, monitoring, and data exchange across complex infrastructures.

The product's core functionality is centered on ensuring interoperability, allowing devices, machinery, and control systems from different vendors or generations to collaborate effectively within a single network or across multiple network domains. Major applications span critical sectors such as industrial automation, where they integrate Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), and Human Machine Interfaces (HMIs); building automation systems for HVAC, lighting, and security integration; smart energy grids for power generation and distribution; and the automotive industry for manufacturing and testing. The versatility of protocol converters makes them indispensable tools for creating integrated and efficient operational workflows.

The benefits derived from deploying protocol converters are substantial, including the modernization of existing infrastructure without the prohibitive costs and disruptions of complete overhauls, significant enhancements in operational efficiency through centralized data acquisition, and improved system reliability by mitigating communication bottlenecks. The market's growth is predominantly driven by the accelerating pace of Industry 4.0 initiatives, the pervasive adoption of the Industrial Internet of Things (IIoT), and the increasing demand for real-time data analytics. These factors collectively underscore the critical importance of protocol converters in digital transformation strategies, enabling businesses to leverage connectivity for enhanced productivity, predictive maintenance, and informed decision-making across their value chains.

Protocol Converters Market Executive Summary

The global Protocol Converters Market is currently experiencing a robust growth trajectory, propelled by the relentless pursuit of digital transformation across a multitude of industries and the inherent necessity for seamless communication across increasingly complex and heterogeneous operational environments. Current business trends highlight a pronounced shift towards the development and adoption of smarter, more resilient, and inherently secure converter solutions. These advanced devices are not merely translating data; they are increasingly integrated with functionalities that support distributed intelligence, such as edge analytics and robust cloud connectivity, positioning them as pivotal enablers of next-generation industrial architectures. Manufacturers are keenly focused on incorporating state-of-the-art cybersecurity features and simplifying the configuration and deployment processes to meet the escalating demands for secure and user-friendly integration solutions in today's intricate industrial landscapes.

Regionally, the market dynamics are significantly influenced by varying stages of industrial maturity, technological adoption rates, and investment priorities across different geographical areas. The Asia Pacific (APAC) region stands out as a dominant force, fueled by its rapid industrialization, the widespread establishment of smart factories, and substantial government and private sector investments in critical infrastructure development. Conversely, mature industrial economies in North America and Europe are witnessing sustained demand, primarily driven by the imperative to modernize extensive installed bases of legacy systems and the aggressive adoption of cutting-edge automation technologies. These regions require sophisticated protocol translation capabilities to ensure the continued interoperability and longevity of their existing assets while simultaneously integrating new, advanced systems into their operational frameworks.

Analyzing market segments reveals a clear trend towards the increasing prominence of Ethernet-based protocol converters. This surge is attributed to the ubiquitous nature of IP networks within modern enterprises, coupled with the escalating demand for higher data throughput, enhanced network scalability, and low-latency, real-time communication essential for critical industrial applications. However, the vast installed base of older, fieldbus- and serial-based equipment ensures a persistent and significant demand for traditional serial and fieldbus converters. This dual market requirement underscores the protocol converter's versatile role in bridging both generational and technological gaps. This evolving landscape not only validates the enduring relevance of protocol converters but also emphasizes their pivotal function in enabling the interconnected, data-rich ecosystems that are fundamental to achieving the full potential of Industry 4.0 and beyond.

AI Impact Analysis on Protocol Converters Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Protocol Converters Market predominantly revolve around how AI can introduce intelligence, enhance predictive capabilities, and bolster the security posture of these critical communication devices, rather than rendering them obsolete. Key user themes include the potential for AI to optimize data flow, enable autonomous or self-configuring translation, and provide advanced diagnostics for network anomalies. There is also significant interest in AI's role in strengthening cybersecurity defenses for protocol converters, which are increasingly seen as vulnerable points in interconnected industrial control systems. Users anticipate that AI integration will lead to more adaptive, efficient, and resilient communication infrastructure, capable of proactively addressing operational challenges and threat vectors within complex industrial environments.

- Predictive Maintenance: AI algorithms analyze operational data from protocol converters to predict potential failures or performance degradation, enabling proactive maintenance and minimizing downtime.

- Optimized Data Routing: AI can dynamically learn and adjust data pathways and translation logic to ensure the most efficient and low-latency communication, especially in complex, multi-protocol networks.

- Self-Configuration and Adaptive Translation: AI-powered converters can autonomously detect connected devices and protocols, then self-configure their translation parameters, adapting to new network changes or device behaviors without manual intervention.

- Enhanced Cybersecurity: AI-driven anomaly detection systems can monitor data traffic through converters to identify unusual patterns indicative of cyber threats or unauthorized access, providing real-time security alerts and mitigation.

- Edge Intelligence: Embedding AI capabilities directly into protocol converters allows for local data processing, filtering, and analysis at the network edge, reducing latency and bandwidth requirements for cloud communication.

- Fault Diagnosis and Self-Healing: AI assists in rapid and precise identification of communication errors, protocol mismatches, or hardware malfunctions, and in some advanced scenarios, can initiate self-healing mechanisms to restore connectivity.

- Energy Efficiency Optimization: AI can optimize the operational parameters of converters to reduce power consumption, especially in large-scale deployments, contributing to sustainable industrial practices.

DRO & Impact Forces Of Protocol Converters Market

The Protocol Converters Market is significantly influenced by a dynamic interplay of potent driving forces, formidable restraints, and promising opportunities, all shaped by broader impact forces that dictate the pace and direction of technological evolution and industrial adoption. A primary driver fueling market expansion is the pervasive and rapidly accelerating adoption of Industry 4.0 paradigms and the Internet of Things (IoT) across diverse industrial sectors. These initiatives fundamentally necessitate seamless and robust data exchange across an ever-growing network of disparate operational technologies (OT) and information technologies (IT), demanding sophisticated devices that can bridge communication gaps between a vast array of sensors, actuators, control systems, and enterprise platforms. Additionally, the critical imperative to modernize extensive existing legacy infrastructure without resorting to costly and disruptive complete system overhauls, coupled with the escalating demand for real-time operational data for advanced analytics and informed decision-making, further propels market growth, ultimately driving substantial improvements in efficiency and productivity across the entire industrial value chain.

Despite these powerful market accelerators, the Protocol Converters Market confronts several notable restraints that can impede its full growth potential. A significant challenge lies in the inherent complexity associated with the precise configuration, intricate deployment, and ongoing management of protocol converters, particularly within highly heterogeneous, multi-vendor industrial environments where precise protocol mapping is paramount. Furthermore, the often substantial initial capital investment required for deploying advanced, high-performance converter solutions, especially those featuring enhanced cybersecurity or specialized functionalities, can pose a barrier to adoption for smaller enterprises or projects with constrained budgets. The persistent challenge of ensuring genuine interoperability among the myriad of highly specialized, and frequently proprietary, industrial protocols continues to demand significant engineering effort. Moreover, the escalating concerns over potential cybersecurity vulnerabilities in increasingly interconnected industrial control systems necessitate sophisticated and robust security implementations, which can add significant complexity and cost, alongside the pervasive industry-wide shortage of skilled professionals capable of effectively managing and maintaining these intricate, converged OT/IT systems.

Conversely, the market is poised to capitalize on substantial emerging opportunities that promise to fundamentally redefine its landscape and trajectory. The ongoing global rollout of 5G networks, characterized by ultra-low latency and high bandwidth, combined with the rapid proliferation of edge computing architectures, is creating entirely new avenues for intelligent protocol converters. These converters can now leverage distributed processing capabilities, enabling more responsive and localized data handling critical for time-sensitive applications. The burgeoning integration of artificial intelligence (AI) and machine learning (ML) capabilities directly into converter hardware and firmware is paving the way for truly smart converters. These intelligent devices will offer advanced functionalities such as predictive maintenance, self-healing communication networks, and adaptive, dynamic protocol translation. Furthermore, the expansion of protocol converter applications into nascent, high-growth sectors like smart cities, connected healthcare infrastructure, and renewable energy management presents significant new frontiers for market expansion, driving demand for secure, reliable, and intelligent communication solutions essential for managing critical operations and enabling widespread remote monitoring systems.

Segmentation Analysis

The Protocol Converters Market is meticulously segmented across various critical dimensions to provide a granular understanding of its diverse landscape, product offerings, and end-user demands. This segmentation allows for precise market analysis, identifying key trends, growth areas, and specific challenges within distinct categories. By dissecting the market based on converter types, supported protocols, application areas, and end-use industries, stakeholders can gain comprehensive insights into where demand is strongest and how technological advancements are shaping each sub-segment. This structured view is instrumental for strategic planning, product development, and targeted marketing efforts, ensuring that solutions are tailored to meet the specific requirements of varied operational environments and industry verticals.

- By Type:

- Serial Converters (RS232, RS485, RS422)

- Ethernet Converters (Modbus TCP/IP, Ethernet/IP, PROFINET)

- Fieldbus Converters (PROFIBUS, DeviceNet, CANbus, Foundation Fieldbus)

- Fiber Optic Converters

- Wireless Converters (Wi-Fi, Bluetooth, Cellular, LoRa)

- By Protocol Supported:

- Modbus (RTU, ASCII, TCP/IP)

- PROFIBUS (DP, PA)

- Ethernet/IP

- CANbus

- OPC UA

- BACnet

- DNP3

- IEC 61850

- Others (Profinet, DeviceNet)

- By Application:

- Industrial Automation (PLCs, SCADA, DCS, HMIs)

- Building Automation Systems (BAS)

- Power & Energy (Smart Grids, Substations)

- Oil & Gas (Upstream, Midstream, Downstream)

- Water & Wastewater Management

- Transportation (Rail, Road, Marine)

- Automotive Manufacturing

- Others (Defense, Aerospace, Mining)

- By End-Use Industry:

- Manufacturing (Discrete & Process)

- Utilities (Electric, Water, Gas)

- Commercial & Residential Buildings

- Automotive

- Transportation & Logistics

- Telecommunications

- Healthcare & Pharmaceuticals

- Data Centers

Value Chain Analysis For Protocol Converters Market

The value chain for the Protocol Converters Market is an intricate ecosystem encompassing a series of interconnected activities, beginning from the fundamental sourcing of raw materials and intellectual property all the way through to the final deployment and ongoing maintenance of these critical devices. At the upstream segment of this chain, key participants include specialized manufacturers of high-performance electronic components, such as advanced microcontrollers, robust transceivers, high-speed memory modules, and various passive components essential for circuit design. Alongside these hardware suppliers, software intellectual property (IP) developers play an equally crucial role by providing the sophisticated firmware, complex protocol stacks, and proprietary algorithms that define the converter's core translation capabilities and overall operational intelligence. These foundational components and software libraries are then meticulously integrated by original equipment manufacturers (OEMs), who design, assemble, and rigorously test the final protocol converter units, ensuring adherence to stringent industrial standards, reliability benchmarks, and performance specifications.

As we move into the downstream segment of the value chain, the distribution and deployment channels become critically important for bringing the finished protocol converter products to a diverse and expansive market. System integrators represent a pivotal intermediary, frequently specializing in combining protocol converters with a broad array of other automation equipment, such as PLCs, sensors, and actuators, to engineer and deliver comprehensive, bespoke solutions for highly complex industrial projects. These integrators are indispensable for customizing and implementing systems that meet specific client requirements, often involving intricate network architectures and unique protocol challenges. Furthermore, a vast network of distributors and value-added resellers (VARs) serves as a vital bridge, extending market reach by offering localized sales support, deep technical expertise, and readily available product inventories to a wide spectrum of end-users. These partners are crucial in educating customers, providing presales consultation, and delivering post-sales support, effectively bridging the gap between advanced manufacturers and the varied operational needs of clients across different geographic regions and industrial applications.

The distribution of protocol converters primarily operates through a strategic blend of direct and indirect sales channels, each serving distinct market segments and customer needs. Direct sales approaches are typically employed by manufacturers for engaging with large enterprise clients, undertaking highly specialized, custom-engineered projects, or serving government and defense sectors. This direct interaction allows for the development of close customer relationships, precise customization of solutions, and streamlined feedback loops. Conversely, indirect channels, comprising an extensive network of authorized distributors, specialized resellers, and rapidly expanding online e-commerce platforms, are fundamental for achieving broader market penetration. These channels are particularly effective for reaching small and medium-sized enterprises (SMEs) and for distributing standard, off-the-shelf product offerings. This multifaceted channel strategy ensures widespread product availability, optimizes logistics, and maximizes market reach, ultimately enabling protocol converter solutions to effectively serve the diverse and evolving demands of end-users who rely on these devices to establish and maintain seamless communication within their increasingly interconnected and automated operational environments.

Protocol Converters Market Potential Customers

Potential customers for Protocol Converters encompass an expansive and diverse array of industries and organizations that fundamentally rely on complex interconnected systems for their core operations, and which are actively pursuing digital transformation or optimization initiatives. Foremost among these are the various segments within manufacturing and process industries, including the automotive sector, pharmaceutical companies, chemical producers, food and beverage manufacturers, and metals and mining operations. These industries characteristically employ a heterogeneous mix of legacy machinery and cutting-edge equipment, each often communicating through a different set of industrial protocols. In these environments, protocol converters are absolutely indispensable for enabling critical components such as Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), Human Machine Interfaces (HMIs), and a vast network of sensors and actuators to communicate effectively, thereby ensuring smooth production lines, highly optimized processes, and centralized control across complex and often geographically dispersed operations.

Beyond traditional manufacturing, the utilities and energy sectors represent another significant and growing customer base for protocol converters. This broad category includes power generation plants, extensive electricity transmission and distribution networks, renewable energy facilities (solar farms, wind parks), and water and wastewater treatment plants. In these critical infrastructure domains, precise and reliable data exchange between numerous grid components, sophisticated SCADA (Supervisory Control and Data Acquisition) systems, and advanced energy management systems is paramount for maintaining operational stability, implementing smart grid initiatives, and ensuring the efficient allocation and management of resources. Similarly, the burgeoning building automation sector, encompassing smart commercial buildings, large institutional complexes, and high-tech data centers, heavily relies on protocol converters to integrate disparate systems such as HVAC (heating, ventilation, and air conditioning), lighting controls, advanced security systems, and access control platforms, facilitating unified management, optimizing energy efficiency, and significantly enhancing occupant comfort and overall safety within these modern structures.

Other key end-users driving demand for protocol converters include the dynamic transportation industry, which incorporates railways, intelligent traffic management systems, and smart airport operations; specialized facilities such as oil and gas exploration and production sites; and sophisticated telecommunications infrastructure. Essentially, any organization actively undergoing digital transformation, striving for adherence to Industry 4.0 principles, or seeking to substantially enhance the interoperability, data-sharing capabilities, and overall efficiency of its operational technology (OT) environment represents a prime potential customer. The relentless global drive towards greater automation, the increasing reliance on real-time data analytics, and the continuous expansion of the Industrial Internet of Things (IIoT) across virtually all economic sectors collectively ensure a constantly growing and highly diversified customer base for robust and intelligent protocol converter solutions, positioning them as fundamental enablers of the connected enterprise.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,200 Million |

| Market Forecast in 2033 | USD 2,050 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moxa Inc., Advantech Co., Ltd., HMS Networks, Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, ABB Ltd., Phoenix Contact GmbH & Co. KG, WAGO Kontakttechnik GmbH & Co. KG, B+B SmartWorx (Advantech), Comtrol Corporation, Red Lion Controls (Spectris plc), Digi International Inc., Connect One, Opto 22, ICP DAS Co., Ltd., Antaira Technologies, Korenix Technology (Lantech), Westermo (Ependion), Lantronix Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protocol Converters Market Key Technology Landscape

The Protocol Converters Market is fundamentally underpinned by a highly diverse and continuously evolving technological landscape, which is absolutely essential for enabling seamless and reliable communication across the increasingly complex and often disparate industrial and automation systems of today. At the core of this landscape are robust and specialized hardware platforms, ranging from high-performance Application-Specific Integrated Circuits (ASICs) and flexible Field-Programmable Gate Arrays (FPGAs), designed for ultra-fast, dedicated translation tasks, to versatile microcontrollers and System-on-Chips (SoCs) that offer general-purpose processing capabilities. These meticulously engineered hardware components are designed to support a wide array of physical interfaces, including traditional serial ports (such as RS-232, RS-485, and RS-422), numerous configurations of Ethernet ports (both copper and fiber), and specialized fiber optic connections. This comprehensive support ensures maximum adaptability and compatibility across diverse deployment scenarios, varying network architectures, and a broad spectrum of industrial environments, from factory floors to remote utility substations.

Beyond the physical hardware, sophisticated software and highly optimized firmware constitute the intelligent backbone of modern protocol converters. This includes the development and integration of highly efficient protocol stacks that are capable of handling the intricate nuances of data translation between a multitude of industrial communication standards. These standards encompass widely adopted protocols like Modbus (in its RTU, ASCII, and TCP/IP variants), PROFIBUS, DeviceNet, the increasingly prevalent Industrial Ethernet protocols such as Ethernet/IP and PROFINET, and newer, more versatile standards like OPC UA (Open Platform Communications Unified Architecture) and BACnet. The integration of robust embedded operating systems, often Linux-based or specifically designed real-time operating systems (RTOS), provides a stable, secure, and highly efficient environment for executing complex translation logic, managing critical data buffers, and facilitating secure communication. Furthermore, the development of advanced configuration tools, frequently featuring intuitive web-based graphical user interfaces, significantly simplifies the setup, management, and troubleshooting of these devices, thereby reducing operational complexity and the need for highly specialized technical expertise.

The future trajectory of protocol converters is continuously being shaped by the rapid emergence and integration of next-generation technologies. The escalating demand for secure and highly reliable industrial communication, particularly in critical infrastructure, has driven the incorporation of advanced cybersecurity features directly into converter designs. These include robust VPN (Virtual Private Network) support, integrated firewalls, secure boot mechanisms, and sophisticated data encryption capabilities, all engineered to protect vital operational data from evolving cyber threats. The increasing adoption of wireless communication technologies, such as Wi-Fi, Bluetooth, cellular (4G/5G), and low-power wide-area networks (LoRa), is expanding the deployment flexibility of converters, enabling communication in remote, hazardous, or hard-to-wire locations. Moreover, the nascent but rapidly progressing integration of artificial intelligence (AI) and machine learning (ML) capabilities at the edge is poised to introduce a new generation of smart converters capable of advanced functionalities like predictive diagnostics, self-optimization of communication parameters, and highly adaptive protocol handling, further enhancing their value proposition within the most sophisticated and demanding industrial environments.

Regional Highlights

- North America: This region is characterized by early and widespread adoption of industrial automation and a robust manufacturing sector. Demand is driven by the continuous modernization of existing industrial infrastructure, significant investments in advanced manufacturing technologies, and the rapid expansion of IoT and IIoT deployments across various industries. The United States and Canada are key markets, leading in technological innovation and cybersecurity integration in industrial communication.

- Europe: Europe possesses a strong and mature industrial automation industry, with a particular focus on high-precision manufacturing, energy efficiency, and adherence to stringent regulatory standards. Countries like Germany, the UK, France, and Italy are pivotal, driven by initiatives like Industry 4.0 and a strong emphasis on integrating renewable energy systems into existing grids, necessitating advanced protocol translation for interoperability.

- Asia Pacific (APAC): The APAC region is a dominant growth engine for the Protocol Converters Market, propelled by rapid industrialization, massive infrastructure development projects, and significant government investments in smart factory initiatives. Countries such as China, Japan, India, and South Korea are experiencing substantial growth due to expanding manufacturing bases, smart city projects, and the widespread adoption of automation in diverse sectors.

- Latin America: This region is witnessing a growing industrial sector, with increasing investments in energy, mining, and manufacturing. The demand for protocol converters is escalating as countries like Brazil and Mexico strive to modernize their industrial operations and enhance automation capabilities to improve productivity and competitiveness in the global market.

- Middle East and Africa (MEA): The MEA region is characterized by ongoing large-scale infrastructure development, ambitious smart city projects, and substantial growth in the oil & gas industry. Countries like the UAE, Saudi Arabia, and South Africa are key drivers, with increasing automation efforts in critical sectors creating a strong demand for robust and secure protocol converter solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protocol Converters Market.- Moxa Inc.

- Advantech Co., Ltd.

- HMS Networks

- Siemens AG

- Rockwell Automation, Inc.

- Schneider Electric SE

- ABB Ltd.

- Phoenix Contact GmbH & Co. KG

- WAGO Kontakttechnik GmbH & Co. KG

- B+B SmartWorx (Advantech)

- Comtrol Corporation

- Red Lion Controls (Spectris plc)

- Digi International Inc.

- Connect One

- Opto 22

- ICP DAS Co., Ltd.

- Antaira Technologies

- Korenix Technology (Lantech)

- Westermo (Ependion)

- Lantronix Inc.

Frequently Asked Questions

Analyze common user questions about the Protocol Converters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a protocol converter and why is it essential for industrial automation?

A protocol converter is a device that translates data between different communication protocols, enabling incompatible industrial systems and devices to communicate seamlessly. It is essential for industrial automation to integrate diverse legacy and modern equipment, facilitating unified control, real-time data exchange, and supporting Industry 4.0 initiatives by bridging technological gaps.

How do protocol converters contribute to Industry 4.0 and Industrial IoT deployments?

Protocol converters serve as critical communication gateways in Industry 4.0 and Industrial IoT (IIoT) ecosystems. They enable various sensors, machines, and control systems, regardless of their native communication protocol, to seamlessly feed operational data into centralized analytics platforms or cloud services, thereby facilitating interoperability, data-driven insights, and the connected factory vision.

What are the main types of protocol converters available in the market?

The market offers several main types of protocol converters, including serial converters (for RS232, RS485), Ethernet converters (supporting Modbus TCP/IP, EtherNet/IP, PROFINET), fieldbus converters (for PROFIBUS, DeviceNet, CANbus), fiber optic converters for long-distance and noisy environments, and wireless converters for flexible, remote deployments.

What are the primary challenges associated with deploying protocol converters in an industrial setting?

Key challenges include the complexity of configuring specific protocol mappings, ensuring robust cybersecurity in newly integrated networks, managing initial investment costs for advanced solutions, and addressing potential interoperability issues that can arise from highly customized or proprietary industrial protocol implementations. The need for skilled personnel for deployment and maintenance also presents a challenge.

How is Artificial Intelligence (AI) expected to impact the future of protocol converters?

AI is poised to transform protocol converters by enabling predictive maintenance through advanced data analysis, optimizing data routing for enhanced efficiency, facilitating self-configuration and adaptive translation for new devices, and significantly improving cybersecurity through AI-driven anomaly detection. This integration will lead to more intelligent, resilient, and autonomous communication solutions for industrial environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager