PSP System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433893 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

PSP System Market Size

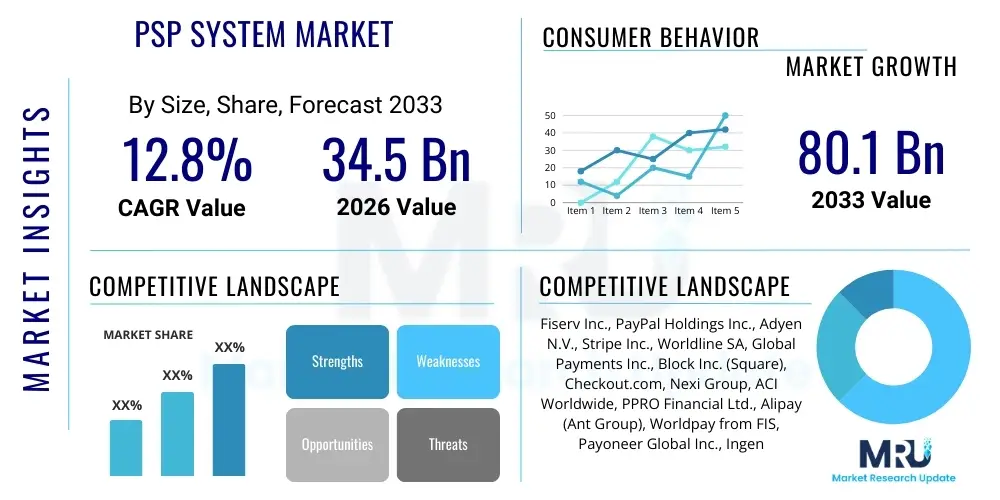

The PSP System Market, which encompasses sophisticated platforms designed for managing high-volume transactions, regulatory compliance, and secure data routing, is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. This substantial growth trajectory is underpinned by the accelerated global adoption of digital payment methods, cross-border e-commerce expansion, and the critical need for real-time risk management and fraud detection mechanisms integrated within these systems.

The market is estimated at USD 34.5 Billion in 2026, driven primarily by investments from the FinTech sector and large-scale enterprises seeking efficient, scalable transaction infrastructure. As organizations transition away from legacy systems and embrace cloud-native, API-driven PSP solutions, market valuation is expected to surge, reflecting the increasing complexity and volume of global financial flows.

By the end of the forecast period in 2033, the PSP System Market is projected to reach USD 80.1 Billion. This significant valuation reflects the continuous innovation in embedded finance, the introduction of decentralized ledger technologies (DLT) in payment processing, and heightened demand for PSP systems offering robust integration with emerging channels such as social commerce and virtual reality platforms. Regulatory harmonization and standardization efforts across major economic blocs also play a critical role in facilitating market expansion and uptake of advanced PSP functionalities.

PSP System Market introduction

The PSP System Market pertains to the ecosystem of technology solutions and service providers specializing in managing the entire transaction lifecycle for merchants, including payment gateway services, fraud prevention, currency conversion, and settlement processes. These systems are foundational components of the global digital economy, enabling seamless financial interaction between consumers, merchants, and financial institutions across various touchpoints, including point-of-sale (POS), e-commerce websites, and mobile applications. The core product description involves highly secure, scalable, and compliant software infrastructure, often deployed through Software-as-a-Service (SaaS) models, designed to handle immense data volume and ensure regulatory adherence, such as PCI DSS compliance and regional KYC/AML regulations.

Major applications of PSP Systems span diverse sectors, including retail and e-commerce, travel and hospitality, gaming (iGaming), digital media, subscription services, and banking and financial services. E-commerce remains the largest application segment, benefiting significantly from PSPs that offer multi-currency support, localized payment methods, and enhanced checkout experiences crucial for reducing cart abandonment rates. The key benefits derived from utilizing sophisticated PSP systems include improved operational efficiency, reduced transaction costs, enhanced security against cyber threats, accelerated cross-border market entry, and superior data analytics capabilities necessary for optimizing business intelligence and consumer targeting.

The primary driving factors propelling the market forward include the rapid proliferation of smartphones and mobile commerce, increased consumer confidence in online financial transactions, and substantial venture capital investment flowing into the FinTech infrastructure space. Furthermore, the mandatory shift towards instant payment schemes (like SEPA Instant Credit Transfer or faster payment initiatives) worldwide necessitates robust, low-latency PSP systems capable of processing real-time transactions 24/7/365. The regulatory push for open banking APIs also encourages the integration of third-party PSPs into traditional banking services, broadening the market scope and applicability.

PSP System Market Executive Summary

The PSP System Market is characterized by intense competition, technological disruption, and rapid consolidation, highlighted by ongoing mergers and acquisitions among established payment processors and agile FinTech startups. Key business trends indicate a strong move toward platform consolidation, where providers aim to offer 'one-stop-shop' services combining payment processing with adjacent value-added services such as embedded lending, loyalty program management, and advanced financial reporting. The shift from transaction-based pricing to subscription or platform-fee models is also gaining traction among enterprises seeking predictable operational expenses. Furthermore, the adoption of proprietary fraud detection algorithms leveraging machine learning is becoming standard, shifting the market focus from basic security to proactive risk intelligence.

Regionally, the market exhibits divergent growth rates. The Asia Pacific (APAC) region stands out as the fastest-growing market, primarily fueled by massive untapped populations adopting digital payments for the first time, particularly in India, Southeast Asia, and China, driven by mobile wallets and QR code systems. North America and Europe remain mature markets, focusing on infrastructure modernization, compliance with stringent data privacy regulations (like GDPR and CCPA), and the integration of alternative payment methods such as cryptocurrencies and 'Buy Now, Pay Later' (BNPL) schemes. Latin America shows immense potential, driven by digitalization efforts and attempts to improve financial inclusion among unbanked populations.

Segmentation trends reveal significant growth in the cloud-based deployment model due to its scalability, flexibility, and reduced infrastructure costs compared to on-premise solutions. Among service types, Payment Gateway and Payment Processing Services dominate in terms of revenue, while Fraud Management and Risk Compliance services exhibit the highest projected CAGR, reflecting the critical need for sophisticated defense against increasingly complex cyber financial crimes. Enterprise size analysis indicates that Small and Medium-sized Enterprises (SMEs) are rapidly adopting SaaS-based PSP solutions, driving volume growth, while Large Enterprises prioritize highly customized, integrated solutions capable of managing global scale and complex multi-region regulatory landscapes.

AI Impact Analysis on PSP System Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the PSP System Market center on four main themes: enhanced fraud prevention efficacy, the potential for personalized payment experiences, efficiency gains through automated compliance monitoring, and the threat of AI-driven competition from new entrants. Users are keenly interested in how AI, specifically machine learning and deep learning models, can move beyond rule-based systems to detect subtle, sophisticated fraud patterns in real-time, significantly lowering chargeback risks and financial losses. There is also substantial inquiry into AI's role in optimizing payment routing—intelligently selecting the least-cost, highest-success rate processing channels—and improving settlement processes through predictive analysis.

The key themes emerging from this analysis confirm that AI is not merely an incremental improvement but a fundamental transformer of the PSP landscape, shifting the focus from reactive processing to predictive intelligence. Concerns often revolve around data privacy when feeding vast transaction data to AI models, algorithmic bias that might unfairly flag legitimate transactions, and the talent gap required to implement and maintain these sophisticated systems. Expectations are high regarding AI's capability to deliver hyper-personalized checkout experiences, potentially boosting merchant conversion rates by instantly offering the most preferred and efficient payment method to individual customers based on historical behavior and contextual data, moving beyond simple geographic preferences.

Ultimately, the consensus among market participants is that future competitive advantage in the PSP market will be inextricably linked to AI capabilities. Providers that successfully integrate proprietary, high-fidelity AI models into their core processing stacks—covering everything from underwriting to settlement—will gain significant market share. AI's ability to automate tedious and error-prone regulatory reporting and compliance checks (e.g., cross-referencing sanctions lists in milliseconds) is viewed as a major operational efficiency driver, reducing human overhead and improving audit readiness, thus fundamentally altering the cost structure of providing PSP services.

- AI enhances fraud detection accuracy by identifying complex, non-linear anomalies in transaction data in real-time.

- Machine Learning optimizes payment routing mechanisms, maximizing acceptance rates and minimizing processing costs.

- AI algorithms personalize checkout flows, dynamically suggesting preferred payment methods to boost merchant conversion.

- Natural Language Processing (NLP) is utilized for automated regulatory change monitoring and compliance documentation generation.

- Predictive analytics enables sophisticated cash flow forecasting and proactive liquidity management for both merchants and PSPs.

- AI-driven chatbots and virtual assistants automate tier-one customer support and dispute resolution processes.

DRO & Impact Forces Of PSP System Market

The PSP System Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and competitive intensity. The primary drivers are the exponential growth of e-commerce across emerging markets, the consumer preference for frictionless digital transactions, and regulatory mandates promoting instant payment systems globally. These forces necessitate continuous investment in scalable, resilient infrastructure. However, the market faces significant restraints, chiefly stemming from the complex and fragmented international regulatory environment, persistent concerns regarding data security breaches and cyberattacks, and the high cost associated with maintaining compliance across multiple jurisdictions, particularly for cross-border transactions. These restraints demand continuous technological upgrades and adherence to evolving security standards like tokenization and advanced encryption.

Key opportunities within the market are centered around the rise of embedded finance, allowing non-financial entities (like retailers or SaaS platforms) to offer financial services directly through integration with advanced PSP APIs. The adoption of blockchain and distributed ledger technology (DLT) promises to revolutionize cross-border payments by reducing latency and cost, offering a significant avenue for PSP innovation. Furthermore, the massive untapped potential of the unbanked and underbanked populations, particularly in Africa and Southeast Asia, presents a substantial opportunity for mobile-centric PSP solutions that require minimal traditional banking infrastructure. The strategic integration of AI into risk management and personalization further enhances the value proposition of modern PSPs.

The impact forces driving market evolution are substantial. The first key force is technological obsolescence, where legacy systems are rapidly being phased out by cloud-native, microservices architecture, compelling existing players to undertake costly digital transformation initiatives. The second force is intense price pressure driven by commoditization of basic processing services, pushing PSPs to differentiate through value-added services such as advanced analytics, merchant financing, and subscription management tools. The third force is regulatory scrutiny, which constantly raises the barrier to entry by requiring sophisticated compliance frameworks. These impact forces collectively favor large, technologically advanced global providers capable of absorbing high compliance costs and rapidly adapting to technological shifts, while simultaneously creating niche opportunities for specialized FinTechs focusing on specific geographies or vertical industries.

- Drivers: Global e-commerce growth; rapid adoption of mobile wallets; regulatory push for instant payments; increased demand for unified commerce experiences.

- Restraints: Complex and fragmented global regulatory landscape; high risk of sophisticated cyber fraud and data breaches; interoperability challenges between legacy systems and modern APIs.

- Opportunities: Expansion of embedded finance; integration of blockchain for cross-border settlement; growth in Buy Now Pay Later (BNPL) schemes integration; servicing the digitally adopting SME segment.

- Impact Forces: Intense competitive pricing leading to margin compression; mandatory shift to advanced security protocols (e.g., 3D Secure 2.0); consolidation via M&A activity among payment technology vendors.

Segmentation Analysis

The PSP System Market is meticulously segmented across various dimensions, including service type, deployment model, enterprise size, and end-user industry, enabling a granular understanding of market dynamics and targeted strategic investment. The segmentation reflects the diverse needs of modern commerce, from small independent merchants requiring simple gateway services to multinational corporations needing complex, multi-regional payment orchestration layers. The segmentation analysis confirms the market's trend toward specialized, vertical-specific solutions rather than a monolithic, one-size-fits-all platform, driven by differing compliance burdens and industry-specific transaction characteristics (e.g., high-risk vs. low-risk transactions).

Based on service type, the market is broadly divided into core processing services (payment gateway, payment processing) and value-added services (fraud and risk management, subscription billing, reporting and analytics). The value-added segments are experiencing faster revenue growth as merchants prioritize reducing operational complexity and increasing conversion rates through enhanced intelligence. Deployment models are seeing a dominant shift toward cloud-based and hybrid solutions, favored for their flexibility, automatic scaling capabilities, and reduced capital expenditure requirements, particularly attractive to rapidly scaling e-commerce businesses and startups.

The enterprise size segmentation highlights a dual market structure: large enterprises demand customized, resilient private cloud solutions with guaranteed uptime and dedicated compliance teams, while SMEs are the primary consumers of standardized, multi-tenant SaaS platforms. End-user segmentation reveals e-commerce and retail as the dominating sectors, though the Travel & Hospitality and Digital Media & Gaming sectors are exhibiting accelerated adoption, driven by their high volume of microtransactions and reliance on seamless, low-latency payment experiences, particularly in international markets where localization of payment methods is crucial for market success.

- By Service Type:

- Payment Processing and Acquiring Services

- Payment Gateway Services

- Fraud Management and Risk Compliance

- Subscription and Recurring Billing Management

- Reporting and Analytics

- Currency Conversion and FX Services

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- Hybrid

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User Industry:

- Retail and E-commerce

- Travel and Hospitality

- Gaming and Betting (iGaming)

- Digital Media and Entertainment

- Financial Services and Insurance (BFSI)

- Healthcare and Government

Value Chain Analysis For PSP System Market

The value chain of the PSP System Market is a complex network involving multiple stakeholders, spanning upstream technology providers, the PSP core platform, distribution channels, and downstream merchants and end-users. Upstream analysis focuses on the providers of foundational technology, including secure hardware modules (HSMs), specialized financial network providers (e.g., Visa, Mastercard), AI and machine learning component developers for fraud detection, and cloud infrastructure providers (AWS, Azure, Google Cloud). The cost efficiency and scalability of these upstream partners directly impact the PSP’s final service quality and cost structure. Optimization at this level often involves securing robust API connections and favorable pricing for high-volume network access, critical for maximizing profitability.

The core of the value chain is the PSP platform itself, which handles transaction orchestration, tokenization, risk scoring, compliance checks, and settlement. Downstream analysis focuses on the distribution channels and the final consumption point. Distribution primarily occurs through direct sales to large merchants, partnerships with integrated software vendors (ISVs) who embed payment capabilities into their industry-specific software (e.g., POS systems for restaurants), and increasingly, through FinTech marketplaces and partnership ecosystems. The effectiveness of the PSP hinges on seamless integration with the merchant’s existing ERP and CRM systems, ensuring minimal friction at the point of interaction (POI).

The distribution channel landscape is bifurcated into direct and indirect methods. Direct sales offer PSPs higher control over the client experience and often cater to Tier 1 and Tier 2 global merchants requiring bespoke solutions and dedicated account management. Indirect channels, primarily through ISVs, referral partners, and aggregators, offer wider market reach, especially to the fragmented SME segment. The growth strategy for most leading PSPs involves a blend of direct engagement for high-value strategic accounts and scalable indirect partnerships to maximize global penetration. The final value delivered to the end-user (the consumer) is the speed, security, and convenience of the transaction, which reinforces the merchant’s brand loyalty and trust.

PSP System Market Potential Customers

The primary potential customers and end-users of PSP Systems are incredibly diverse, spanning the spectrum of businesses engaged in selling goods or services online or through modern point-of-sale systems. The largest customer segment comprises global e-commerce retailers, ranging from pure-play online giants to brick-and-mortar stores rapidly developing omnichannel capabilities. These customers prioritize PSPs offering global reach, seamless integration, high acceptance rates in various geographies, and robust currency management capabilities to handle complex cross-border trade and reduce processing failure rates that lead to lost sales.

A rapidly expanding segment consists of digital service providers, including Subscription-as-a-Service (SaaS) companies, media streaming platforms, and online gaming operators (iGaming). For these businesses, the key buying criterion is the PSP's expertise in recurring billing management, involuntary churn reduction through intelligent retry logic, and compliance with region-specific digital service taxation rules. They require PSPs that can ensure maximum retention by minimizing payment failures and providing detailed lifecycle analytics regarding subscriber payment patterns.

Furthermore, traditional financial institutions (banks) are increasingly becoming potential customers, seeking modern, API-driven PSP solutions to modernize their core infrastructure and compete effectively with agile FinTech disruptors. They leverage PSP systems to white-label payment solutions, enhance their corporate banking offerings, and facilitate faster, more efficient B2B payment flows. Other high-potential segments include large travel aggregators, government agencies modernizing payment collection processes, and embedded finance providers who need reliable, compliant back-end infrastructure to support their novel financial products offered at the point of non-financial transactions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 34.5 Billion |

| Market Forecast in 2033 | USD 80.1 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiserv Inc., PayPal Holdings Inc., Adyen N.V., Stripe Inc., Worldline SA, Global Payments Inc., Block Inc. (Square), Checkout.com, Nexi Group, ACI Worldwide, PPRO Financial Ltd., Alipay (Ant Group), Worldpay from FIS, Payoneer Global Inc., Ingenico (Worldline), Nuvei Corporation, BlueSnap, Ayden, WEX Inc., Dwolla. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PSP System Market Key Technology Landscape

The PSP System Market is fundamentally shaped by continuous technological evolution aimed at improving speed, security, and integration capabilities. One of the most critical technologies is the transition to microservices architecture and cloud-native development. This approach allows PSPs to rapidly deploy new services, scale resources dynamically based on transaction load, and integrate diverse functionalities (like fraud monitoring and foreign exchange) independently. The adoption of modern RESTful APIs is paramount, enabling seamless, low-latency communication between the merchant’s systems, the PSP platform, and the banking networks, thereby accelerating time-to-market for new payment solutions.

Security technologies form the backbone of the PSP ecosystem. Key innovations include advanced tokenization, which replaces sensitive payment data with non-sensitive substitutes (tokens) to reduce the scope of PCI DSS compliance for merchants. Furthermore, the implementation of behavioral biometrics and sophisticated AI-driven fraud detection models, utilizing deep learning networks to analyze subtle anomalies in transactional behavior, significantly surpasses the effectiveness of traditional static rule-sets. Secure Element (SE) technology and Host Card Emulation (HCE) are also crucial for ensuring security in mobile and contact-less payment scenarios, essential components for omnichannel PSP strategies.

Emerging technologies, while still maturing, are set to redefine future PSP systems. Distributed Ledger Technology (DLT) is being explored for its potential to streamline cross-border settlement processes, reducing intermediaries and operational costs, offering near-instantaneous fund transfers instead of multi-day cycles. Additionally, the increasing integration of Web3 and cryptocurrency support into PSP platforms, including stablecoin transaction processing, addresses the rising demand from merchants who wish to accept digital assets. The future technology landscape emphasizes 'Payment Orchestration' layers that intelligently manage multiple external PSPs and payment methods through a single integration point, optimizing performance and resilience for the merchant.

Regional Highlights

The global PSP System Market exhibits significant variation in maturity, growth drivers, and regulatory complexity across major geographical regions. Understanding these regional nuances is essential for market participants seeking optimal expansion strategies and localized product offerings.

- North America (NA): Characterized by high market maturity, technological leadership, and robust infrastructure. The region is driven by the need for advanced fraud detection (due to high rates of card-not-present fraud) and the rapid adoption of BNPL and embedded finance solutions. The US dominates, focusing heavily on modernizing outdated ACH and real-time payment systems.

- Europe: Highly regulated, primarily driven by PSD2 (Payment Services Directive 2) and open banking mandates, which necessitate seamless integration with third-party providers. Western Europe boasts high digital penetration, demanding multi-country compliance, robust consumer authentication (SCA), and support for diverse local payment schemes like SEPA.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive mobile adoption, rapid urbanization, and a shift away from cash. Key drivers include government initiatives promoting digital payments (e.g., in India and Southeast Asia) and the dominance of super-apps and mobile wallet ecosystems (WeChat Pay, Alipay). Localization of payment methods is critical for market entry.

- Latin America (LATAM): A high-potential market struggling with financial inclusion, low card penetration in some areas, and complex cross-border regulations. Growth is spurred by digitalization, government push for instant payment systems (like Pix in Brazil), and high demand for PSPs capable of handling local installment plans and domestic banking transfers.

- Middle East and Africa (MEA): Emerging market characterized by rapid modernization in the GCC countries (UAE, Saudi Arabia) driven by government digital transformation agendas. Africa presents immense long-term opportunity, particularly with mobile money platforms (M-Pesa, etc.) dominating the payment landscape, requiring PSPs specializing in low-infrastructure solutions.

- Emerging Markets Focus: PSPs must focus on enabling cross-border payments seamlessly, supporting highly localized payment methods (e.g., bank redirects, cash vouchers), and navigating complex foreign exchange and remittance regulations, which are often the primary barriers to entry in these high-growth regions.

- Regulatory Divergence: The difference in data localization laws (e.g., in Russia, India) and data privacy regulations (GDPR in Europe vs. CCPA in the US) significantly impacts PSP system architecture, demanding geo-specific data handling and storage capabilities.

- FinTech Ecosystem Strength: Europe and North America have the most concentrated FinTech investment, leading to higher innovation in adjacent PSP services like fraud scoring and chargeback management, creating a competitive environment where operational excellence is mandated.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PSP System Market.- Fiserv Inc.

- PayPal Holdings Inc.

- Adyen N.V.

- Stripe Inc.

- Worldline SA

- Global Payments Inc.

- Block Inc. (Square)

- Checkout.com

- Nexi Group

- ACI Worldwide

- PPRO Financial Ltd.

- Alipay (Ant Group)

- Worldpay from FIS

- Payoneer Global Inc.

- Ingenico (Worldline)

- Nuvei Corporation

- BlueSnap

- Ayden

- WEX Inc.

- Dwolla

Frequently Asked Questions

Analyze common user questions about the PSP System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between a Payment Gateway and a PSP System?

A Payment Gateway primarily focuses on securely transmitting payment information from the customer to the acquiring bank. A full PSP System offers broader services, including the gateway function, merchant acquiring, sophisticated fraud management, currency conversion, settlement, and detailed reporting, providing a complete transaction lifecycle solution.

How is regulatory compliance (like PSD2 SCA) influencing PSP system design?

Regulations like PSD2’s Strong Customer Authentication (SCA) mandate that PSP systems must incorporate advanced authentication layers. This requires PSPs to invest in sophisticated transaction risk analysis (TRA) engines to minimize friction for low-risk transactions while ensuring compliance through two-factor authentication for high-risk payments, significantly impacting system architecture and user experience design.

What role does cloud infrastructure play in the scalability of modern PSP platforms?

Cloud infrastructure (SaaS) is crucial for scalability, enabling PSPs to handle extreme peaks in transaction volume (e.g., during holiday sales or major media events) dynamically without manual intervention. It reduces operational latency, improves global availability, and accelerates the deployment of security patches and new features, leading to higher operational resilience.

Which geographical region is currently experiencing the highest growth in PSP system adoption?

The Asia Pacific (APAC) region is currently experiencing the highest growth rate in PSP system adoption. This is primarily driven by the mass migration to mobile payments, the expansion of e-commerce across emerging economies, and governmental initiatives promoting cashless societies, requiring immense investment in localized PSP infrastructure.

How do PSP Systems address the increasing threat of card-not-present (CNP) fraud?

PSP Systems address CNP fraud through a combination of techniques, including advanced tokenization, robust encryption (like PCI DSS compliance), proprietary AI/ML-driven behavioral monitoring and fraud scoring, and seamless integration of enhanced authentication protocols like EMV 3D Secure 2.0, allowing for real-time risk assessment and proactive decline of suspicious transactions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager