PTFE Micronized Powders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431762 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

PTFE Micronized Powders Market Size

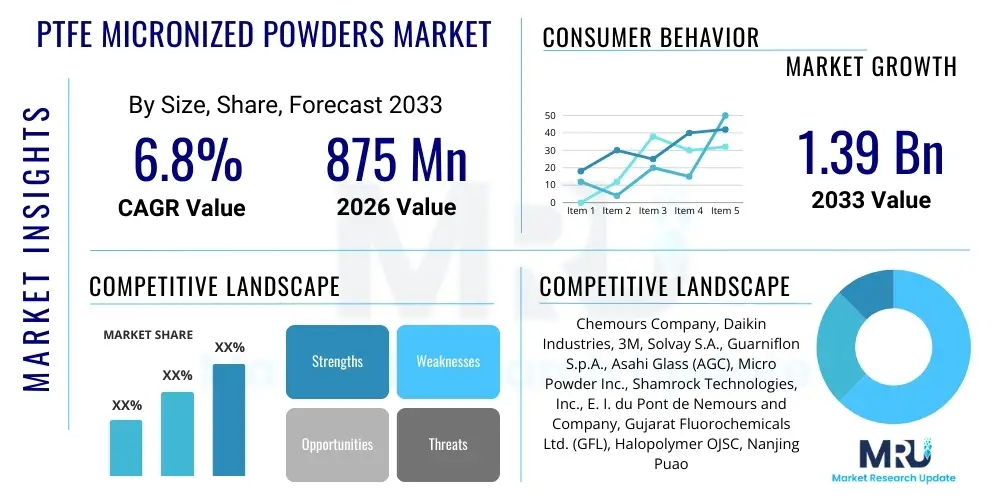

The PTFE Micronized Powders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 875 Million in 2026 and is projected to reach USD 1.39 Billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by the escalating demand for high-performance friction-reducing additives across critical industrial sectors, notably automotive, aerospace, and advanced electronics manufacturing. The unique physical and chemical inertness of PTFE micronized powders makes them indispensable components in formulations requiring enhanced wear resistance and reduced coefficient of friction, solidifying their premium position within the specialty chemicals market globally.

PTFE Micronized Powders Market introduction

The PTFE Micronized Powders Market encompasses specialty fluoropolymer products characterized by extremely low molecular weight and particle sizes typically ranging from 1 to 20 micrometers. These powders are derived from virgin or recycled Polytetrafluoroethylene (PTFE) and undergo sophisticated micronization processes, such as jet milling, to achieve the desired fine particle structure necessary for uniform dispersion in host matrices. Due to their exceptional thermal stability, chemical inertness, and superior non-stick properties, they serve primarily as high-performance additives rather than base materials. Their fundamental purpose is to modify the surface characteristics of coatings, inks, plastics, and lubricants, delivering improved lubricity and anti-wear capabilities.

Major applications of PTFE micronized powders are heavily concentrated in enhancing industrial finishes and specialty lubrication systems. When incorporated into solvent-borne or water-borne coatings, these powders significantly reduce the coefficient of friction and improve scratch resistance, making them crucial for cookware, industrial machinery, and architectural elements. In the automotive sector, they are vital components in interior and exterior components, particularly those subjected to frequent wear, ensuring longevity and performance under harsh operating conditions. Furthermore, their use in printing inks provides enhanced slip and abrasion resistance, improving the print quality and durability of various substrates.

The market driving factors are numerous and interconnected, stemming largely from the global push toward miniaturization and high-efficiency engineering. The inherent benefits, such as excellent thermal endurance up to 260°C and resistance to almost all corrosive chemicals, make these powders irreplaceable in high-stress environments. Rapid industrialization in developing economies, coupled with stringent quality requirements in developed markets for durable, maintenance-free materials, continually fuel the demand for these sophisticated additives. Additionally, advancements in material science enabling cost-effective production techniques for ultra-fine particle sizes are further broadening their applicability across diverse end-use industries.

PTFE Micronized Powders Market Executive Summary

The PTFE Micronized Powders Market is experiencing robust growth fueled by technological advancements in particle size reduction and surface modification, which allow for better dispersion and integration into complex polymer systems. Business trends indicate a strong focus on developing environmentally conscious, low-VOC (Volatile Organic Compound) formulations, prompting manufacturers to invest in micronized powders suitable for water-borne and powder coating systems. The competitive landscape is characterized by a delicate balance between large, integrated chemical companies focusing on virgin PTFE powders and smaller, specialized manufacturers utilizing recycled PTFE feedstocks to offer cost-competitive and sustainable alternatives. Mergers and acquisitions are common strategies deployed by market leaders to consolidate technological expertise and secure regional distribution networks, particularly in fast-growing Asian markets, thereby optimizing the global supply chain efficiency.

Regional trends clearly delineate Asia Pacific (APAC) as the fastest-growing market due to massive investments in manufacturing, electronics, and automotive production, especially in China, India, and South Korea. This region's rapid expansion of infrastructure projects and consumer goods manufacturing requires high volumes of performance coatings and specialized lubricants. Conversely, mature markets in North America and Europe, while exhibiting slower growth rates, maintain a significant market share driven by high regulatory standards and a strong focus on aerospace and medical applications, where premium, ultra-high-purity PTFE powders are mandatory. Regulatory environments in Europe, particularly REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), influence product formulation, pushing manufacturers towards compliant and sustainable sourcing practices, which ultimately shapes regional product offerings.

Segment trends reveal that the Coatings and Industrial Finishes application segment dominates the market share, attributed to the universal need for enhanced durability and reduced friction in painted surfaces. The Lubricants and Greases segment is forecasted to exhibit the highest CAGR, primarily due to the increasing adoption of synthetic lubricants blended with PTFE micronized powders in electric vehicles (EVs) and heavy machinery to reduce energy loss and extend component lifespan. Furthermore, the Electronics segment is witnessing accelerated growth as micronized PTFE is increasingly utilized in advanced wiring insulation and thermal management components where exceptional dielectric properties and high-temperature performance are critical. The customization of particle size distribution (PSD) tailored for specific end-use polymer matrices remains a key technological differentiation strategy among leading vendors.

AI Impact Analysis on PTFE Micronized Powders Market

Common user questions regarding AI's impact on the PTFE Micronized Powders Market primarily revolve around optimizing R&D cycles, improving manufacturing process consistency, and predicting material performance under varied environmental stresses. Users are concerned about how AI can accelerate the discovery of novel PTFE composite formulations, particularly those with enhanced thermal conductivity or unique surface energies, which typically require extensive, slow laboratory experimentation. A significant theme is the application of machine learning for predictive quality control—specifically, ensuring uniform particle size distribution (PSD) and surface modification efficiency in large-scale production runs, thereby minimizing waste and operational costs. Users expect AI to revolutionize supply chain management, optimizing feedstock procurement (TFE monomer) and managing inventory levels based on real-time application demand signals from automotive and electronics end-users globally.

- AI-driven optimization of polymerization kinetics and micronization parameters to achieve precise, narrow particle size distributions (PSDs), enhancing product consistency.

- Predictive maintenance analytics applied to critical processing equipment (jet mills, classifiers) to minimize downtime and maximize production throughput, lowering overall manufacturing costs.

- Accelerated simulation and virtual testing of new PTFE composite formulations, significantly reducing the time required for R&D and product commercialization, particularly for specialized medical and aerospace grades.

- Machine learning algorithms utilized for advanced supply chain forecasting, predicting volatile TFE monomer prices, and optimizing logistics routes for global distribution of PTFE powders.

- Enhanced quality control systems utilizing computer vision and spectral analysis combined with AI to immediately detect and reject batches failing to meet stringent purity and morphological requirements.

DRO & Impact Forces Of PTFE Micronized Powders Market

The dynamics of the PTFE Micronized Powders Market are significantly shaped by a confluence of driving factors (D), restraints (R), and opportunities (O), which collectively dictate the impact forces on market growth. Primary drivers include the massive increase in demand for high-performance additives in the electric vehicle (EV) sector, where efficient thermal management and reduced friction are paramount for battery systems and powertrain components. Furthermore, the miniaturization trend in electronics necessitates coatings and lubricants that perform reliably in extremely small tolerances and high-heat environments. These technological demands elevate the importance of PTFE micronized powders as an essential material for next-generation engineering applications, securing consistent high-value demand across multiple industries. This sustained technological push ensures that market momentum remains positive, despite external challenges.

However, the market expansion is mitigated by specific restraints, notably the high cost of the raw material (TFE monomer) and the energy-intensive nature of the micronization process, which contribute to a higher final product price compared to conventional polymer additives. Regulatory hurdles, particularly concerning fluorochemicals and per- and polyfluoroalkyl substances (PFAS) in certain regions (like Europe and North America), impose stringent compliance requirements on manufacturers, necessitating costly process adjustments and detailed reporting. These environmental concerns often lead to consumer and regulatory scrutiny, posing a challenge to unrestricted market growth. Manufacturers must continuously invest in sustainable processing technologies and explore non-fluorinated alternatives to navigate this complex regulatory landscape, potentially slowing adoption in highly sensitive sectors.

Significant opportunities are emerging from the growing trend toward additive manufacturing (3D printing), where specialized PTFE powders are being developed as flow enhancers and structural modifiers in high-performance polymer filaments. Furthermore, there is an untapped potential in developing biocompatible PTFE micronized grades for the medical device industry, specifically for surgical coatings, temporary implants, and drug delivery systems, capitalizing on PTFE’s excellent inertness. The shift toward utilizing recycled PTFE (reprocessed scrap material) is also creating new market segments, offering more sustainable and cost-effective alternatives, appealing particularly to industries seeking to lower their carbon footprint. These opportunities suggest future avenues for significant product differentiation and market penetration beyond traditional applications.

The primary impact forces acting on this market include intense rivalry among established global chemical manufacturers, high bargaining power of large automotive and aerospace OEMs demanding specialized products, and the persistent threat of substitution from alternative ultra-high molecular weight polyethylene (UHMWPE) or silicone-based additives in lower-performance applications. The rapid advancement in competing material technologies, coupled with fluctuating petrochemical prices impacting TFE production, necessitates continuous technological innovation and robust supply chain risk management for market participants to maintain competitive advantage and sustain profit margins.

Segmentation Analysis

The PTFE Micronized Powders Market is segmented primarily based on particle size distribution, application, and the diverse end-use industries it serves. Understanding these segmentations is crucial for manufacturers to tailor product specifications—such as particle morphology, bulk density, and surface energy—to meet the exacting requirements of specific industrial processes. The segmentation by application reflects the inherent functional differences of the powder: low particle size grades (typically below 5 microns) are favored in thin-film coatings and high-end printing inks for superior smoothness and transparency, while larger particles are often utilized in polymer compounding and structural thermoplastic modification for improved mechanical strength and wear resistance.

Segmentation by end-use industry highlights the critical nature of PTFE micronized powders in high-reliability sectors. The Automotive industry is a massive consumer, utilizing these powders in anti-squeak treatments, internal component lubrication, and specialized coatings for engine parts. The Electronics sector requires ultra-high purity grades for components demanding excellent dielectric properties and thermal resistance. The demand heterogeneity across these segments—from highly sensitive medical applications requiring biocompatible materials to high-volume industrial coatings needing cost-effectiveness—drives product diversification and influences regional production strategies among market players.

The evolving standards for environmental and health safety also contribute to dynamic shifts in segmentation, with increasing demand for PFAS-free or low-fluorinated alternatives beginning to shape new niches within the traditional market structure. The focus on sustainable and recycled PTFE powders represents a new, rapidly growing segment, responding to corporate social responsibility mandates and circular economy initiatives across global manufacturing industries. This structural shift necessitates continuous portfolio adjustments by key market vendors to remain relevant and competitive across all emerging and established segments.

- By Application:

- Coatings & Industrial Finishes

- Lubricants & Greases

- Printing Inks

- Elastomers & Plastics Compounding (Thermoplastics, Thermosets)

- Waxes & Polishes

- Cosmetics

- By End-Use Industry:

- Automotive & Transportation

- Aerospace

- Electronics & Electrical

- Chemical Processing

- Medical & Healthcare

- Consumer Goods

- By Grade (Based on Raw Material Source):

- Virgin PTFE Based

- Recycled/Reprocessed PTFE Based

- By Particle Size:

- Under 5 Microns

- 5 to 10 Microns

- Above 10 Microns

Value Chain Analysis For PTFE Micronized Powders Market

The value chain for PTFE Micronized Powders begins with the upstream sourcing of raw materials, primarily Fluorspar (CaF2), which is processed into Hydrofluoric Acid (HF), and subsequently reacted to produce Chlorodifluoromethane (HCFC-22). The critical step is the pyrolysis of HCFC-22 to generate Tetrafluoroethylene (TFE) monomer, the fundamental building block of PTFE. This upstream segment is highly capital-intensive and concentrated among a few global chemical giants, meaning the supply and price volatility of TFE monomer significantly influence the costs and profitability downstream. Efficient management of this feedstock supply is crucial for maintaining competitive pricing and stable production schedules throughout the chain. Raw material purity directly dictates the quality and applicability of the final micronized product.

Midstream activities involve the polymerization of TFE into high-molecular-weight PTFE resin, followed by specialized processing to create the micronized powder. This process often involves irradiation, grinding, and advanced jet milling techniques to reduce the resin to the desired micronized particle size while maintaining crystallinity and morphology. Different micronization techniques yield different particle shapes (e.g., spherical vs. irregularly shaped), dictating the powder's performance characteristics in specific applications like lubrication or polymer blending. Companies specializing in advanced milling and surface treatment technologies, often leveraging proprietary processes, capture significant value at this stage by producing high-performance, tailored powders.

Downstream distribution channels are bifurcated into direct sales to large, strategic customers (such as major global coatings manufacturers and automotive OEMs) and indirect sales through specialized chemical distributors and regional agents. Due to the high-performance nature and technical specificity of PTFE micronized powders, sales often require deep technical support and collaboration with the end-user’s R&D department. The indirect distribution network, vital for reaching smaller or geographically dispersed consumers in sectors like printing inks and waxes, demands well-trained technical sales teams capable of articulating the complex benefits of incorporating these additives. The proximity to end-use manufacturing hubs, particularly in APAC, is becoming increasingly important for minimizing logistics costs and ensuring timely supply.

PTFE Micronized Powders Market Potential Customers

The potential customer base for PTFE Micronized Powders is diverse, encompassing industries that critically rely on enhanced surface durability, extreme lubricity, and non-stick characteristics in their manufactured goods. The primary buyers are large chemical formulators, including coatings and industrial paint manufacturers that utilize the powder to enhance the slip and abrasion resistance of their finishes, serving everything from consumer appliances to heavy machinery. Furthermore, lubricant and grease manufacturers represent a core segment, blending PTFE powders into synthetic oils and greases to create high-temperature and high-pressure lubricants essential for automotive engine parts, gearboxes, and aerospace components, where traditional lubrication fails under extreme loads or temperatures. These customers seek highly specialized powders tailored for optimal dispersion and stability within their complex fluid systems.

Another significant group of potential customers includes polymer compounders and masterbatch producers who incorporate PTFE micronized powders into engineering plastics (like POM, PEEK, and Nylon) to drastically lower the coefficient of friction and improve the wear rate of the final plastic part. This is particularly relevant for parts used in moving mechanisms within the automotive and electronics industries, such as bearings, bushings, and guides. These buyers value high purity, consistent particle size, and ease of dispersion to ensure the homogeneity and integrity of their composite materials. The demand from these sectors is directly correlated with global manufacturing output and the shift towards replacing metal components with high-performance polymers for weight reduction and increased energy efficiency.

Finally, niche but high-value buyers include manufacturers of advanced printing inks, especially for security printing and high-speed commercial printing, where the powder provides the necessary slip for stacking and handling printed materials without scuffing. Medical device manufacturers also constitute a high-growth customer segment, utilizing PTFE micronized powders in specialized coatings for catheters, guide wires, and surgical tools due to the material's excellent biocompatibility and low-friction interface with human tissue. These customers require documented material traceability, compliance with ISO standards, and often demand pharmaceutical or medical-grade purity levels, making this segment highly discerning regarding supplier selection and product quality assurance protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 875 Million |

| Market Forecast in 2033 | USD 1.39 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chemours Company, Daikin Industries, 3M, Solvay S.A., Guarniflon S.p.A., Asahi Glass (AGC), Micro Powder Inc., Shamrock Technologies, Inc., E. I. du Pont de Nemours and Company, Gujarat Fluorochemicals Ltd. (GFL), Halopolymer OJSC, Nanjing Puao Specialty Materials, Jinhe Fluorochemical Co., Ltd., Dongyue Group, Chenguang Research Institute of Chemical Industry, Trelleborg AB, Ensinger GmbH, Fluoro-Plastics Inc., China Meilan Chemical Group Co., Ltd., Resonac Corporation (Showa Denko) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PTFE Micronized Powders Market Key Technology Landscape

The core technology underpinning the PTFE Micronized Powders market is the precise control over the polymer degradation and subsequent mechanical reduction processes. The most prevalent technique is irradiation and cracking, where high molecular weight PTFE is subjected to electron beam or gamma radiation followed by heat treatment to reduce molecular weight, making it easier to mill. This preliminary step is crucial as it determines the fundamental characteristics, such as melt viscosity and end-group stability, which affect the powder’s compatibility with various solvent systems. Advanced manufacturers are continuously refining the control parameters of this degradation process to create specialty grades with specific low-end molecular weights that are optimally suited for demanding applications like high-solids coatings.

Following the degradation, micronization technologies define the product's ultimate performance. Air jet milling (or fluid energy milling) is the industry standard, utilizing high-velocity air jets to cause particles to collide, resulting in ultra-fine, highly consistent particle sizes, often down to sub-micron levels. Recent technological focus includes developing cryogenic grinding techniques, which mill the PTFE resin below its glass transition temperature, yielding irregularly shaped particles known for superior anti-settling performance in high-viscosity formulations. Furthermore, surface modification technologies, involving chemical treatment or mechanical blending with silanes or other coupling agents, are gaining prominence. These treatments improve the affinity of the non-polar PTFE powder surface to polar host matrices, greatly enhancing dispersion stability and mechanical integration in water-borne systems and specific polymer blends.

Another critical area of technological innovation involves particle classification systems, which ensure the narrow particle size distribution (PSD) required by high-end applications, particularly in the electronics and medical sectors. Using advanced air classifiers and cyclonic separation methods, manufacturers can rigorously separate particles, guaranteeing that specific micronized grades meet strict technical specifications for maximum performance and predictability. The ongoing research focuses heavily on developing sustainable processing methods, including solvent-free and lower-energy milling technologies, as well as optimizing the chemical recycling processes for post-consumer PTFE scrap, thereby addressing both cost and environmental sustainability pressures within the technological landscape.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of growth for the PTFE Micronized Powders Market, driven by the colossal manufacturing base across China, India, and Southeast Asian nations. The region’s explosive expansion in automotive production, particularly electric vehicles (EVs), combined with rapidly growing electronics assembly and consumer goods manufacturing, creates an insatiable demand for performance coatings and lubricants. Government initiatives supporting local manufacturing and infrastructure development further accelerate the consumption of high-durability materials. China, specifically, dominates both the production and consumption landscape, benefiting from localized supply chains and competitive pricing strategies.

- North America: North America holds a significant market share, characterized by high demand for premium, ultra-high-purity PTFE micronized powders, largely from the aerospace, defense, and specialized medical device industries. Innovation is focused on advanced material research and adherence to stringent regulatory standards (e.g., FDA compliance for medical applications). The automotive sector remains a strong consumer, prioritizing lightweighting and performance enhancement in conventional and electric vehicle components, driving demand for specialized anti-friction additives. Investment in sustainable manufacturing practices is also a key regional trend.

- Europe: The European market is highly mature and innovation-driven, with strong emphasis placed on environmental sustainability and regulatory compliance, particularly under the REACH framework. Key demand sectors include specialized industrial machinery, wind energy components, and high-end consumer goods coatings. European manufacturers are leaders in developing environmentally friendly, water-borne coating systems utilizing advanced PTFE micronized powder grades. Growth is steady, focused more on value and specialized applications (e.g., fluoropolymer textiles) than volume, driven primarily by Germany and the Benelux region.

- Latin America (LATAM): The LATAM market represents an emerging opportunity, with fluctuating but positive growth rates tied to industrial development and investment in oil & gas and automotive manufacturing, particularly in Brazil and Mexico. Demand is generally focused on cost-effective, standard industrial grades for coatings and general lubrication needs. Market penetration is often reliant on indirect distribution channels and technical support provided by international suppliers.

- Middle East and Africa (MEA): The MEA region’s demand is concentrated in the petrochemical, oil & gas, and construction sectors, where extreme temperature and corrosive resistance are necessary. PTFE micronized powders are used extensively in specialty sealants, pipeline coatings, and heavy machinery lubricants in demanding desert environments. Growth is influenced heavily by global oil prices and large-scale infrastructure projects, with the Gulf Cooperation Council (GCC) countries being the primary consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PTFE Micronized Powders Market.- Chemours Company

- Daikin Industries, Ltd.

- 3M Company

- Solvay S.A.

- AGC Inc. (Asahi Glass Co.)

- Guarniflon S.p.A.

- Micro Powder Inc.

- Shamrock Technologies, Inc.

- Gujarat Fluorochemicals Ltd. (GFL)

- Halopolymer OJSC

- Nanjing Puao Specialty Materials

- Jinhe Fluorochemical Co., Ltd.

- Dongyue Group

- Chenguang Research Institute of Chemical Industry

- Trelleborg AB

- Ensinger GmbH

- Fluoro-Plastics Inc.

- China Meilan Chemical Group Co., Ltd.

- Resonac Corporation (Showa Denko)

- W. L. Gore & Associates, Inc.

Frequently Asked Questions

Analyze common user questions about the PTFE Micronized Powders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of PTFE micronized powders in coatings and inks?

The primary function is to serve as a high-performance additive that significantly reduces the coefficient of friction and enhances the anti-blocking and abrasion resistance properties of the final film. This improves surface slip, prevents scratches, and extends the durability of the coated or printed material.

How do particle size distribution (PSD) and morphology influence PTFE powder performance?

PSD and morphology are critical determinants of performance; smaller particles (under 5 microns) are favored for thin-film applications requiring high gloss and transparency, while larger, structured particles improve load-bearing capacity and anti-wear properties in lubricants and structural polymers.

Which end-use industries are driving the highest growth rate for PTFE micronized powders?

The highest growth is being driven by the Automotive industry, particularly the Electric Vehicle (EV) segment, due to the critical need for advanced friction control and thermal stability in battery systems, powertrain components, and high-performance synthetic lubricants.

What are the key differences between virgin and recycled PTFE micronized powders?

Virgin PTFE powders are derived directly from primary polymerization and offer superior consistency, purity, and thermal stability. Recycled (reprocessed) PTFE powders are derived from scrap material, offering a more cost-effective and sustainable alternative, primarily used in less stringent industrial applications where ultra-high purity is not essential.

What environmental regulations significantly impact the PTFE Micronized Powders market?

Regulations such as the European Union’s REACH legislation and increasing global scrutiny over PFAS (Per- and Polyfluoroalkyl Substances) significantly impact the market. These regulations enforce stringent limits on manufacturing by-products and require documented material traceability, pushing manufacturers toward cleaner, compliant production methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager