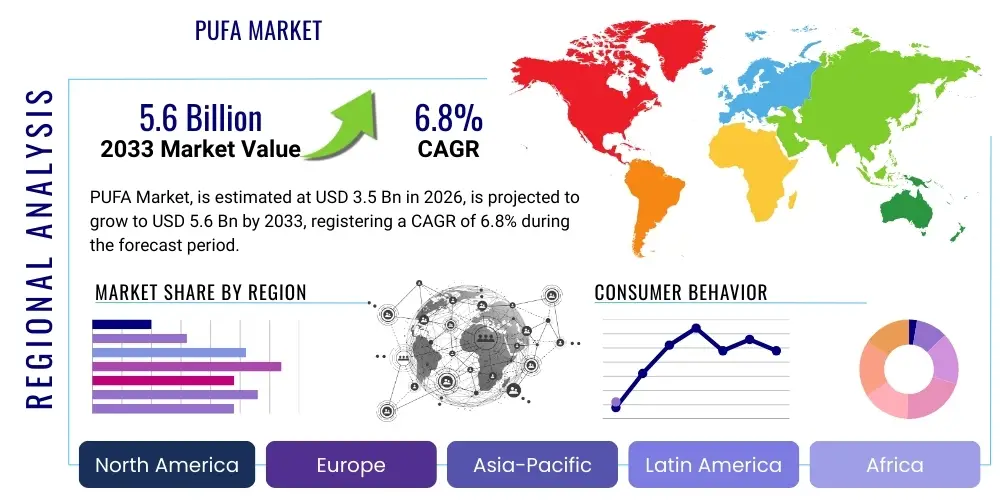

PUFA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436770 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

PUFA Market Size

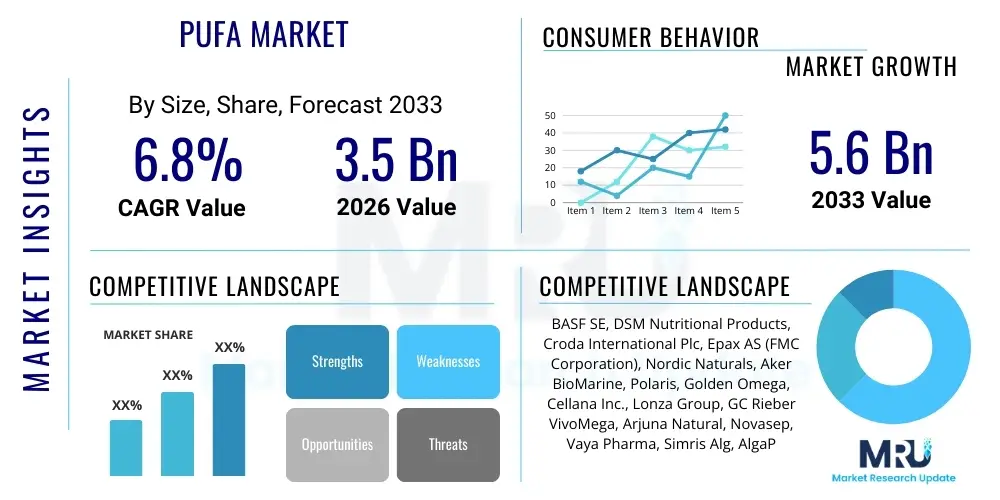

The PUFA Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% (CAGR) between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

PUFA Market introduction

The Polyunsaturated Fatty Acids (PUFA) market encompasses a diverse range of essential fatty acids, primarily Omega-3 (Alpha-linolenic acid, Eicosapentaenoic acid (EPA), and Docosahexaenoic acid (DHA)) and Omega-6 (Linoleic acid and Arachidonic acid (ARA)). These lipids are vital nutrients that the human body cannot synthesize efficiently, making dietary intake or supplementation necessary. PUFAs play a crucial role in maintaining cardiovascular health, neurological function, vision development, and reducing chronic inflammation, driving their demand across functional foods, dietary supplements, and pharmaceuticals.

The core products in this market are differentiated by their source—marine, algal, or plant-based—and their application purity. Major applications span across the nutritional supplements sector, particularly softgel capsules and liquid formulations aimed at the aging population and expectant mothers. Furthermore, the incorporation of PUFAs into functional food and beverage products, such as fortified milk, infant formulas, and bakery items, represents a significant growth trajectory. The rising global awareness regarding preventative healthcare and the proven scientific benefits linking Omega-3 consumption to lower risk of heart disease are primary catalysts fueling market expansion.

Key driving factors include stringent governmental regulations promoting the use of essential nutrients in infant nutrition, rapid advancements in microencapsulation technologies to mask unpleasant tastes and improve product stability, and increasing disposable income in emerging economies. The shift from curative to preventative healthcare models globally strongly favors the sustained demand for high-quality, sustainably sourced PUFA products, pushing manufacturers toward novel sourcing methods like fermentation-derived algal oils.

PUFA Market Executive Summary

The PUFA market is experiencing robust momentum, fundamentally driven by expanding health awareness and technological breakthroughs in sustainable sourcing. Business trends indicate a strong move toward vertical integration among major players, aiming to control the supply chain from raw material extraction (e.g., fishing or cultivation) to final refined products, ensuring quality and consistent supply, particularly for high-purity EPA and DHA derivatives. Furthermore, strategic partnerships between ingredient suppliers and pharmaceutical companies are intensifying, focusing on developing prescription-grade PUFA formulations for targeted therapeutic uses beyond simple dietary supplementation, such as hypertriglyceridemia and chronic inflammatory conditions. This transition signifies a shift in market focus from broad consumer health to specialized medical applications.

Regionally, North America and Europe currently dominate the market share due to high consumer spending on supplements, established regulatory frameworks supporting health claims, and extensive clinical research backing PUFA benefits. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rising per capita income, rapid urbanization leading to lifestyle diseases, and increasing acceptance of Western dietary habits and supplements in countries like China and India. Government initiatives in APAC promoting maternal and infant health, often including recommendations for essential fatty acid intake, further amplify demand in this dynamic region, positioning it as the key growth engine for the next decade.

Segment-wise, the Omega-3 category, specifically driven by high-concentration EPA/DHA products, retains the largest market share, while the Omega-6 segment, despite being larger in consumption volume, is growing slower due to perceived imbalances in modern diets. Among sources, the algal oil segment is rapidly gaining traction. Consumers and regulators increasingly prioritize sustainability and minimizing environmental impact, pushing demand away from traditional fish oil towards microalgae-derived alternatives, which offer vegetarian options and are environmentally responsible. Application-wise, the dietary supplements segment remains paramount, though the clinical nutrition and pharmaceutical segments are growing substantially faster, reflecting the move towards precision health interventions.

AI Impact Analysis on PUFA Market

Common user questions regarding AI's impact on the PUFA market center around optimizing production efficiency, ensuring quality control, and developing personalized nutritional recommendations. Users frequently inquire if AI can reduce the cost of high-purity Omega-3s, specifically EPA and DHA, and whether predictive modeling can enhance the sustainability of marine harvesting or guide the optimization of algal fermentation processes. There is significant interest in how AI-driven genomics and metabolomics can link individual patient biomarkers to specific PUFA formulations, moving beyond generic supplementation towards precision nutrition, thereby validating the therapeutic efficacy of these fatty acids and bolstering consumer trust in product quality and personalization.

AI is fundamentally transforming the R&D and manufacturing landscape within the PUFA industry by offering unprecedented levels of process control and optimization. In R&D, machine learning algorithms analyze vast datasets encompassing genetic markers, dietary habits, and health outcomes to identify new applications and optimize delivery formats, such as highly bioavailable nano-emulsions. On the production front, particularly in the complex and expensive process of microalgae cultivation or enzymatic PUFA synthesis, AI systems are used for real-time monitoring of bioreactor conditions (pH, temperature, nutrient density). This predictive maintenance and yield optimization minimize batch failures, reduce energy consumption, and significantly lower the cost of goods for high-value PUFA concentrates, addressing critical cost restraints traditionally associated with algal oil production.

Furthermore, the utilization of AI extends into the critical area of personalized health and supply chain transparency. AI-powered diagnostic tools analyze individual gut microbiome profiles or genetic predispositions to determine the ideal ratio and dosage of Omega-3 to Omega-6 fatty acids for optimal health outcomes. This personalization capability is a major differentiator in the saturated supplement market. In terms of supply chain, blockchain technology integrated with AI tracking systems ensures verifiable provenance, tracing PUFAs back to their sustainable source, addressing core consumer concerns regarding ethical sourcing and purity, thereby building essential trust in a premium ingredient segment.

- AI-driven optimization of microalgae fermentation parameters to maximize DHA/EPA yield and purity.

- Machine learning algorithms for predictive modeling of global fish stock health, aiding sustainable harvesting practices and regulatory compliance.

- Genomics analysis utilizing AI to tailor PUFA supplementation ratios for personalized nutrition plans and clinical trials.

- Implementation of AI-powered sensors for real-time quality control and contaminant detection during refining processes.

- Use of predictive analytics to forecast demand fluctuations, optimizing inventory management and reducing supply chain waste.

- Enhanced efficacy studies through AI modeling of PUFA interaction with human metabolic pathways.

DRO & Impact Forces Of PUFA Market

The PUFA market is fundamentally driven by growing epidemiological evidence linking Omega-3 consumption to reduced cardiovascular risk and cognitive health benefits, amplified by aging global demographics and rising consumer preference for natural, preventative health solutions. However, the market faces significant restraints, chiefly stemming from regulatory hurdles regarding health claims specificity, sustainability concerns surrounding traditional fish oil sourcing (overfishing), and the inherent susceptibility of PUFAs to oxidation, which compromises product shelf-life and efficacy. Opportunities for growth lie primarily in technological innovations, such as advanced microencapsulation to improve stability and palatability, and the shift towards novel, environmentally friendly sources like microbial fermentation, which promise consistent, high-purity Omega-3s independent of marine resources. These diverse forces—health demand, sustainability concerns, and technological adaptation—exert a significant combined impact, pushing the market toward specialized, high-pvalue, and sustainable ingredients.

Drivers primarily include expanding scientific validation of EPA and DHA therapeutic benefits in clinical settings, especially for conditions like severe hypertriglyceridemia and age-related macular degeneration. The fortification trend in food products, driven by consumer demand for added functional benefits without altering dietary habits, further accelerates market penetration across daily consumed items like dairy and fortified beverages. Moreover, increased spending on healthcare and wellness in developing nations means that PUFAs are moving from niche supplements to standard dietary components, particularly for maternal, infant, and geriatric nutrition, establishing a broader consumer base and ensuring sustained volume demand.

Conversely, significant restraints hinder optimal market growth. The high processing cost required to achieve pharmaceutical-grade purity (above 90% concentration) makes final products expensive, limiting affordability for mass markets. Additionally, the negative public perception surrounding the rancidity and fishy aftertaste of poorly formulated products persists, necessitating continued investment in advanced sensory technologies. A major ongoing restraint is the ecological pressure on marine resources; while regulatory bodies encourage sustainable practices, the reliance on vast volumes of small pelagic fish for industrial PUFA extraction poses a long-term risk to supply stability and brand reputation, prompting the industry to seek alternative, scalable sources.

Opportunities are abundant in the development of targeted, condition-specific formulations using highly bioavailable delivery systems, such as liposomal or phospholipid-bound Omega-3s. The burgeoning pet nutrition and aquaculture feed segments offer untapped high-volume potential for PUFAs, especially as regulations mandate nutritional improvements in farmed fish diets. Finally, the strategic shift towards genetically engineered or heterotrophic microalgae cultivation allows manufacturers to offer scalable, vegan-friendly DHA and EPA, bypassing concerns related to ocean contamination and seasonality, positioning these novel sources as the future market drivers for ingredient security and premium product offerings.

Segmentation Analysis

The PUFA market is intricately segmented based on type, source, application, and form, reflecting diverse consumer needs and production capabilities. Analysis reveals that market dynamics are heavily influenced by the differentiation between Omega-3 and Omega-6 products, with Omega-3s commanding higher revenue due to stronger health claim substantiation and premium pricing. Source segmentation highlights the transition from traditional marine sources (fish oil) to innovative, environmentally conscious alternatives such as algal and microbial oils, driven by sustainability pressures and the growing demand for vegetarian and vegan options. Understanding these segment dynamics is crucial for strategic investment, allowing companies to focus on high-growth areas like pharmaceutical-grade EPA/DHA concentrates and specialized delivery formats like chewable softgels for the pediatric population.

By application, the dietary supplements sector remains the backbone of the market, capitalizing on broad consumer acceptance for general wellness maintenance. However, the fastest-growing segments are clinical nutrition, where PUFAs are used under medical supervision for critical care and metabolic syndrome management, and the pharmaceutical segment, driven by new drug approvals based on high-concentration Omega-3 esters. Furthermore, the segmentation by form, particularly between oils, powders, and emulsions, dictates the feasibility of incorporating PUFAs into various end-products, with microencapsulated powders increasingly popular for food fortification due to their superior stability and ease of integration into dry mixes.

The complexity of market segmentation also allows for nuanced competitive strategies. For instance, companies focusing on the pharmaceutical segment prioritize purity and regulatory compliance (e.g., meeting USP standards), while those targeting the infant formula segment focus intensely on DHA content and contaminant reduction. The geographic spread of raw material extraction further segments the market, influencing pricing and logistics, particularly for fish oil derived from Peruvian anchovy stocks versus algal oil produced in controlled bioreactors in North America or Asia. This multilayered segmentation underscores the necessity for targeted marketing and specialized production infrastructure across the PUFA value chain.

- By Type:

- Omega-3 Fatty Acids (DHA, EPA, ALA)

- Omega-6 Fatty Acids (LA, GLA, ARA)

- By Source:

- Marine (Fish Oil, Krill Oil)

- Plant (Flaxseed Oil, Soybean Oil, Chia Seed Oil)

- Algal/Microbial Oil (Fermentation-derived DHA/EPA)

- By Application:

- Dietary Supplements

- Functional Foods and Beverages

- Pharmaceuticals (Prescription Omega-3)

- Infant Formulas

- Clinical Nutrition

- Animal Feed and Pet Food

- By Form:

- Oil

- Powder (Microencapsulated)

- Emulsion

Value Chain Analysis For PUFA Market

The PUFA market value chain is highly specialized, beginning with the complex and resource-intensive upstream activities of raw material procurement. Upstream analysis involves either harvesting small pelagic fish (anchovies, sardines) for traditional fish oil extraction or developing sophisticated cultivation facilities for algal and plant sources. For marine sources, sustainability certification (e.g., Friend of the Sea, Marine Stewardship Council) is crucial for market entry, adding complexity and cost. Algal cultivation requires significant capital investment in bioreactors and fermentation technology to achieve high yields of DHA and EPA. Success at this stage relies heavily on maximizing yield and ensuring the purity of the crude oil before it enters the refining process.

The midstream process focuses on purification and concentration, which is critical for transforming crude PUFAs into market-ready ingredients. Technologies utilized include molecular distillation, supercritical fluid extraction, and enzymatic hydrolysis to remove impurities, heavy metals, and saturated fats, achieving concentrations ranging from standard 30% to high-potency 90%+ ethyl esters or triglycerides. Following concentration, stabilization techniques such as the addition of antioxidants (e.g., tocopherols) and microencapsulation are employed to enhance shelf-life and mask undesirable odors. High-quality refining is a key differentiator, particularly for the pharmaceutical and infant formula segments where purity standards are exceptionally strict.

Distribution channels for PUFAs are bifurcated into direct and indirect routes. Direct sales often involve B2B transactions where specialized ingredient manufacturers sell bulk concentrates directly to pharmaceutical companies or large supplement brand owners for final formulation and packaging. Indirect channels utilize global distributors and specialized ingredient brokers who manage logistics, quality assurance documentation, and smaller volume sales to regional food manufacturers and private label supplement companies. The downstream market sees the final product reaching consumers through various points, including pharmacies (for prescription PUFAs), mass retail stores, specialized health food stores, and increasingly, e-commerce platforms, which provide brand owners with direct access to consumer data and personalized marketing opportunities.

PUFA Market Potential Customers

The PUFA market targets a broad spectrum of industries, reflecting the diverse physiological benefits of these essential fatty acids. The most significant end-users are nutraceutical and dietary supplement manufacturers, who incorporate refined Omega-3 and Omega-6 ingredients into capsules, tablets, and functional gummies aimed at general wellness, cardiovascular support, and joint health. This segment is highly sensitive to product claims, purity documentation, and competitive pricing. Another primary customer base includes pharmaceutical companies developing prescription medications, such as highly purified ethyl esters of EPA/DHA, used to treat clinical conditions like severe hypertriglyceridemia, requiring ingredients that meet stringent Good Manufacturing Practice (GMP) standards.

A rapidly growing customer segment is the infant formula and pediatric nutrition industry. DHA is mandatory in many global regions for infant brain and visual development, making manufacturers in this sector high-volume buyers who prioritize algal sources to ensure contaminant-free, high-purity ingredients. Additionally, the functional food and beverage sector represents a major potential market, utilizing microencapsulated PUFA powders to fortify products like dairy, bread, and functional drinks without compromising taste or texture. These food manufacturers require easily dispersible and highly stable ingredient forms to withstand processing conditions.

Finally, the aquaculture and animal nutrition sectors constitute a substantial volume market, particularly for feed-grade PUFAs. Aquaculture farms require high-quality Omega-3 oils to enrich farmed fish, increasing their nutritional value for human consumption. Similarly, the premium pet food industry uses PUFAs for skin, coat, and cognitive health in cats and dogs. These industrial customers are focused on cost-effectiveness, large-scale supply continuity, and efficacy in animal health metrics, creating a distinct demand profile compared to the human supplement market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, DSM Nutritional Products, Croda International Plc, Epax AS (FMC Corporation), Nordic Naturals, Aker BioMarine, Polaris, Golden Omega, Cellana Inc., Lonza Group, GC Rieber VivoMega, Arjuna Natural, Novasep, Vaya Pharma, Simris Alg, AlgaPrime (Corbion), Omega Protein Corporation, Solutex, Algamo, Stepan Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PUFA Market Key Technology Landscape

The PUFA market's technological evolution is centered on improving purity, concentration, stability, and achieving sustainable sourcing independence. One of the most critical technologies is supercritical fluid extraction (SFE), which utilizes compressed carbon dioxide as a solvent. SFE is highly favored over traditional chemical methods because it allows for the gentle extraction and fractionation of Omega-3 fatty acids without using harsh organic solvents, resulting in higher purity, reduced thermal degradation, and the efficient removal of contaminants like heavy metals and persistent organic pollutants (POPs). This technology is essential for producing pharmaceutical-grade concentrates and addressing consumer demands for cleaner label ingredients.

Another pivotal technological advancement is microencapsulation, which addresses the inherent instability and undesirable sensory attributes (taste, odor) of PUFAs. Various methods, including spray drying, coacervation, and fluid bed coating, are employed to enclose the liquid oil within a protective matrix (often proteins or carbohydrates). Microencapsulation transforms liquid oil into stable, easy-to-handle powders that can be seamlessly integrated into functional foods, beverages, and dry supplement formulations, significantly extending product shelf life and opening up new application avenues that were previously constrained by oil rancidity.

Furthermore, precision fermentation technology utilizing heterotrophic microalgae (e.g., specific strains of Schizochytrium or Crypthecodinium) represents a disruptive force in sourcing. This controlled biotechnology allows for the large-scale, sustainable production of DHA and, increasingly, EPA, independent of marine resources. This method offers several advantages: zero risk of ocean contaminants, a reliable year-round supply unaffected by fishing quotas or climate change, and the ability to produce vegetarian-friendly Omega-3s. Investment in optimizing bioreactor design and strain engineering is currently defining the competitive edge for ingredient suppliers seeking long-term, sustainable supply guarantees.

Regional Highlights

- North America (U.S. and Canada)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (APAC) (China, Japan, India, South Korea)

- Latin America (LATAM)

- Middle East and Africa (MEA)

North America maintains a dominant position in the global PUFA market, primarily driven by high levels of consumer awareness regarding dietary supplements and the early adoption of functional foods. The U.S. market benefits from extensive marketing efforts, robust clinical research validating Omega-3 benefits, and high per capita expenditure on health and wellness products. Furthermore, stringent regulatory guidelines from bodies like the FDA regarding ingredient safety and purity drive demand for high-quality, traceable PUFA products. The region is a key hub for innovation, particularly in microencapsulation and advanced delivery formats like gummies and personalized liquid shots.

Demand in the region is increasingly shifting toward highly concentrated, high-purity formulations (90%+ EPA/DHA) favored by health practitioners and utilized in specialty prescription drugs. The prevalence of cardiovascular diseases and rising rates of obesity and cognitive disorders among the aging population further stimulate consistent demand for preventative and therapeutic PUFA intervention. The dominance of key multinational players and strong consumer trust in established supplement brands reinforce North America's market leadership. The Canadian market specifically emphasizes regulatory compliance for natural health products, ensuring high ingredient standards.

Europe holds the second-largest share, characterized by mature markets, strong regulatory oversight (EFSA), and a high preference for sustainable and ethical sourcing. European consumers are particularly receptive to products certified by organizations like the Marine Stewardship Council (MSC) and are driving the demand for algal and plant-based alternatives to reduce reliance on fish oil. Germany and the UK are the largest consumers of dietary supplements, while Scandinavian countries, with their inherent connection to marine resources, remain significant producers and refiners of high-quality fish oil and krill oil.

The market in Europe is heavily influenced by the regulation of health claims; manufacturers must adhere to strict EFSA guidelines to market the specific benefits of Omega-3s, leading to a focus on well-researched, evidence-based formulations. Central and Eastern Europe are emerging as fast-growing sub-regions as preventative healthcare expenditure increases. The region is also at the forefront of pharmaceutical development, with European companies leading the commercialization of specialized prescription Omega-3 formulations for cardiovascular risk management and neurological disorders.

The APAC region is projected to be the fastest-growing market globally due to explosive economic growth, rapidly expanding middle-class populations, and significant dietary shifts. In countries like China and India, the rising awareness of essential fatty acids, particularly for maternal and infant health (DHA), is a primary growth engine. Government initiatives promoting nutritional fortification and reducing malnutrition further boost the institutional demand for PUFA ingredients in infant formulas and fortified staple foods.

Japan and South Korea represent technologically advanced markets with a mature supplement culture, focusing on highly specific, high-end products derived from premium sources like microalgae. Conversely, emerging markets in Southeast Asia are driven by affordability, resulting in strong demand for standard-grade fish oils, though the premium segments are quickly developing. The increasing prevalence of lifestyle diseases and a growing acceptance of Western-style supplements position APAC as the critical volume growth region for the forecast period, demanding localized formulation strategies and robust supply chain infrastructure.

The LATAM market, while smaller, is strategically important, particularly due to the massive presence of anchovy fishing and initial processing operations in countries like Peru and Chile, which are major global suppliers of crude fish oil. The internal consumer market is growing steadily, propelled by increasing disposable income and better access to health information, particularly in Brazil and Mexico. Demand is strongest in the functional foods segment, where PUFAs are incorporated into mass-market products. Regulatory environments are fragmenting, necessitating country-specific compliance, but general growth trends mirror the global shift toward preventative nutrition.

The MEA region is characterized by nascent market development but shows significant long-term potential, driven by affluent Gulf Cooperation Council (GCC) countries where high spending on specialized clinical and premium nutritional supplements is common. The region is heavily reliant on imports of both finished goods and refined ingredients. Market growth is gradually accelerating due to rising awareness campaigns and increasing investments in public healthcare infrastructure. Demand is particularly focused on products targeted at maternal and pediatric health, reflecting high birth rates and government focus on early child development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PUFA Market.- BASF SE

- DSM Nutritional Products

- Croda International Plc

- Epax AS (FMC Corporation)

- Nordic Naturals

- Aker BioMarine

- Polaris

- Golden Omega

- Cellana Inc.

- Lonza Group

- GC Rieber VivoMega

- Arjuna Natural

- Novasep

- Vaya Pharma

- Simris Alg

- AlgaPrime (Corbion)

- Omega Protein Corporation

- Solutex

- Algamo

- Stepan Company

Frequently Asked Questions

Analyze common user questions about the PUFA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift from traditional fish oil to algal-based PUFAs?

The primary driver is the increasing demand for sustainable and vegetarian sources of DHA and EPA, bypassing concerns related to marine resource depletion, ocean contamination (heavy metals), and the undesirable sensory attributes of fish oil. Algal oil offers a clean, scalable, and vegan alternative, appealing strongly to environmentally conscious consumers and infant formula manufacturers.

How do Omega-3 PUFAs differ from Omega-6 PUFAs in the context of market growth?

Omega-3 PUFAs (EPA and DHA) are the primary growth engine due to compelling scientific evidence supporting their cardiovascular and cognitive benefits, driving premium pricing and pharmaceutical development. Omega-6 PUFAs are widely consumed through standard diets; market growth for this segment is slower and often focuses on balancing the ratio with increased Omega-3 intake rather than standalone Omega-6 supplementation.

Which technologies are crucial for improving the stability and bioavailability of PUFAs?

Advanced microencapsulation (creating stable powders) and liposomal encapsulation technologies are crucial for protecting PUFAs from oxidation, masking fishy flavors, and significantly enhancing their bioavailability and absorption rates in the human body, thereby ensuring product efficacy and improving consumer compliance.

What regulatory trends are most significantly impacting the marketing of PUFA products?

The most significant regulatory trend involves the rigorous scrutiny of health claims by agencies like the FDA and EFSA, requiring substantial clinical evidence for specific health benefits. Additionally, stringent purity standards (e.g., IFOS certification, USP verification) regarding contaminant levels, particularly for pharmaceutical and infant applications, are shaping the market toward higher-grade concentrates.

What role does the aquaculture industry play in the overall PUFA demand?

The aquaculture industry is a high-volume consumer of PUFAs, using fish oil or specialized algal feed ingredients to enrich farmed fish (like salmon) with essential Omega-3s. This demand is critical for maintaining the nutritional value of farmed seafood, thereby linking the feed segment directly to the human food chain and global PUFA consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Omega-3 PUFA Market Size Report By Type (Fish oil type, Linseed oil type, Algae oil type, Other type), By Application (Dietary supplements, Functional F&B, Pharmaceuticals, Infant formula, Others field), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Omega 3 Pufa Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Eicosapentaenoic Acid (Epa), Docosahexaenoic Acid (Dha), Alpha Linolenic Acid (Ala)), By Application (Pharmaceutical And Clinical Nutrition, Infant Foods, Fortified Foods And Beverages, Nutritional Supplements, Pet Foods), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager