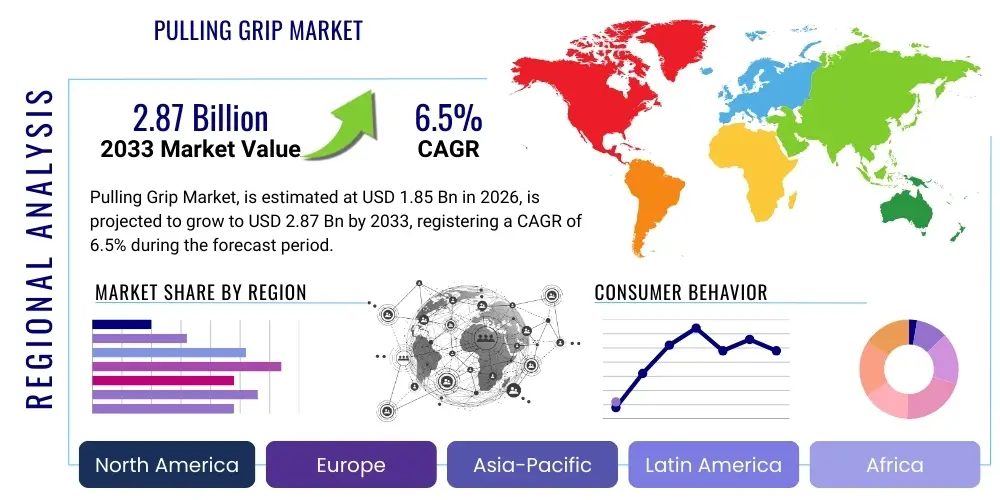

Pulling Grip Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437840 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Pulling Grip Market Size

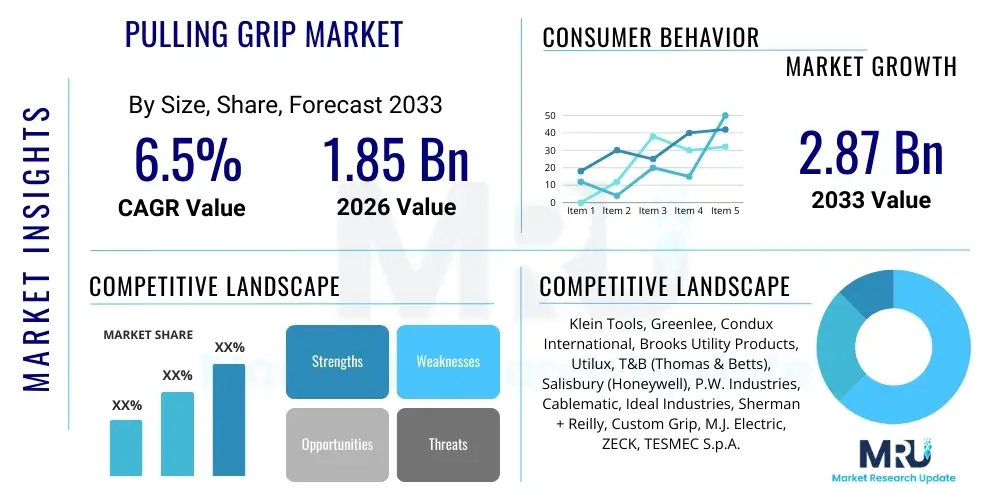

The Pulling Grip Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

Pulling Grip Market introduction

The Pulling Grip Market encompasses specialized mechanical devices engineered for securely gripping, supporting, and pulling cables, wires, and conductors through conduits, ducts, and trenches during installation and maintenance operations. These critical components are foundational in the infrastructure development of power transmission, telecommunications, and construction sectors globally. Pulling grips, often fabricated from materials like galvanized steel, stainless steel, or high-strength synthetic fibers (such as Kevlar), are designed to distribute the pulling tension evenly across the conductor, minimizing stress concentrations and preventing insulation damage or conductor distortion. Their application is paramount in ensuring the integrity and longevity of complex wiring systems, particularly those requiring installation over long distances or through challenging environments with multiple bends and obstructions. The market's growth is inherently linked to global investments in smart grids, 5G network expansion, and large-scale renewable energy projects that necessitate extensive cable deployment.

The product portfolio within the pulling grip market is diverse, classified primarily by application type (e.g., underground, overhead, single weave, double weave, and specialized feeder grips) and material composition (e.g., non-conductive versus highly durable metal mesh). Major applications span electrical contracting, utility maintenance, industrial automation, and civil engineering projects where the safe handling of heavy electrical or fiber optic cables is non-negotiable. A key product feature driving market adoption is the ability of modern grips to handle extreme tension loads while providing a reliable, non-slip attachment point, significantly improving installation efficiency and worker safety. Furthermore, technological advancements in material science have led to the introduction of corrosion-resistant and highly flexible grips, broadening their utility in marine and chemically challenging industrial settings.

The market is primarily driven by accelerating global urbanization, which mandates continuous expansion and upgrade of existing utility infrastructure, particularly in high-growth regions like the Asia Pacific and Latin America. Government initiatives promoting rural electrification and the build-out of resilient energy transmission networks also serve as potent market catalysts. The inherent benefits of using certified pulling grips—including reduced installation time, prevention of costly cable damage, and adherence to stringent safety regulations (such as OSHA standards)—cement their necessity across professional construction and maintenance industries. These factors, combined with the increasing replacement cycles of aging infrastructure in developed economies, ensure sustained demand throughout the forecast period, positioning pulling grips as indispensable tools for modern infrastructure development.

Pulling Grip Market Executive Summary

The Pulling Grip Market is poised for robust expansion, fundamentally driven by pervasive global trends in energy transition and digital connectivity infrastructure development. Key business trends indicate a strategic pivot towards high-performance materials and specialized, application-specific grips capable of handling the larger, heavier cables associated with offshore wind farms, extensive metropolitan rail systems, and high-voltage direct current (HVDC) transmission lines. Manufacturers are increasingly focusing on integrating features that provide real-time tension monitoring capability, often through embedded sensor technology, thus offering a critical value-add to large infrastructure contractors. Furthermore, consolidation among key players and strategic collaborations to standardize grip designs across international regulatory frameworks are shaping the competitive landscape, prioritizing durability and safety compliance.

Regionally, the Asia Pacific (APAC) continues to lead the market, fueled by massive government investments in smart cities, rapid industrialization in countries like India and China, and aggressive deployment of 5G networks, all of which require extensive conduit and cable installation work. North America and Europe, while mature, exhibit steady demand driven primarily by infrastructure refurbishment projects, grid modernization efforts (including undergrounding overhead lines for resilience), and the burgeoning need for specialized grips compatible with sensitive fiber optic cables. Regulatory environments in these developed regions, emphasizing worker safety and installation quality, also strongly influence the adoption of premium, certified pulling grips, often favoring suppliers who provide detailed material traceability and performance guarantees.

Segment trends reveal that the double weave grips segment, offering superior strength and grip distribution, maintains dominance, particularly for heavy-duty applications. However, the use of specialized synthetic grips is growing rapidly in environments sensitive to electromagnetic interference (EMI) or where cable insulation is extremely delicate, such as in data center construction. The end-user segment is increasingly bifurcated: utilities demand high volume, standardized grips for routine maintenance, while specialized contractors require highly customized, small-batch grips for complex, high-stress installations. This demand dynamic encourages market segmentation innovation, driving both cost optimization in standard production lines and premium pricing for highly engineered solutions.

AI Impact Analysis on Pulling Grip Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Pulling Grip Market reveals several core themes centered on operational efficiency, predictive maintenance, and design optimization. Users frequently ask if AI will automate cable pulling entirely, how AI-driven analytics can prevent cable damage during high-tension pulls, and whether machine learning algorithms are being used to optimize grip materials and designs for specific environmental loads. The overriding concern is not the direct replacement of the physical grip, but rather the augmentation of the cable installation process—making it smarter, safer, and less prone to human error or unforeseen mechanical failure. Key expectations revolve around using AI to process sensor data from smart grips and related pulling equipment (like winches), providing instantaneous feedback on friction, tension deviations, and identifying optimal pulling speeds, thereby dramatically reducing the risk of catastrophic cable failure, which can cost millions in project delays.

The primary influence of AI in this domain is felt upstream in the design and manufacturing phases and downstream in the execution and monitoring phases of cable installation projects. AI-driven simulation software can analyze vast datasets concerning material fatigue, environmental conditions, and installation geometry to recommend highly specific grip specifications, ensuring the chosen product is perfectly matched to the operational requirements. This shift moves grip selection from a generalized empirical decision to a precise, data-backed engineering choice. Furthermore, integrating AI into cable pulling monitoring systems allows for predictive analytics; by continuously processing tension, vibration, and temperature data from the conduit run, the system can alert operators to impending issues (like snags or excessive friction build-up) minutes or hours before damage occurs, enabling proactive intervention and enhancing the reliability of complex installations.

The long-term impact of AI will likely involve the creation of "self-adjusting" pulling systems, where smart grips communicate tension readings directly to automated pulling winches. This closed-loop system, controlled by machine learning algorithms, dynamically adjusts the pulling force and speed in real-time based on calculated stress points within the conduit run. This technological evolution transforms the pulling grip from a simple mechanical device into an intelligent node within a larger, automated installation network. Although the market for the physical grips remains essential, the added value will increasingly lie in the integrated digital services and data analytics capabilities offered alongside the hardware, pushing manufacturers towards becoming holistic solution providers focused on intelligent cable management throughout the installation lifecycle.

- AI optimizes grip design based on complex load simulations and material stress analysis.

- Predictive analytics use sensor data from smart grips to forecast potential cable damage or snags during installation.

- Machine learning algorithms enhance real-time tension control in automated cable pulling systems.

- AI aids in quality control during manufacturing by analyzing material consistency and weave pattern integrity.

- AI contributes to site logistics by optimizing inventory management of various specialized grip types needed for large projects.

DRO & Impact Forces Of Pulling Grip Market

The market for pulling grips is governed by a dynamic interplay of factors encapsulated by Drivers, Restraints, and Opportunities (DRO), significantly shaped by impactful external forces. A core driver is the unrelenting global demand for electrical power and high-speed data connectivity, necessitating continuous expansion and modernization of transmission and distribution networks worldwide. This demand is further amplified by regulatory drivers promoting renewable energy integration (e.g., solar and wind farms), which require extensive cable infrastructure connecting remote generation sites to load centers. However, the market faces significant restraints, notably the high upfront cost associated with specialized, high-capacity grips and the inherent risks associated with using substandard, non-certified products in critical infrastructure projects, which can lead to catastrophic failures. Furthermore, the specialized nature of the grips often requires highly trained labor for proper application, posing a constraint in regions with skilled labor shortages.

Opportunities for growth are substantial, primarily stemming from innovations in material science, offering lighter, stronger, and more flexible grips suitable for modern composite cables, particularly fiber optics and sensitive shielded cables. A major opportunity lies in the underdeveloped markets of emerging economies, where large-scale utility build-outs are just beginning, offering greenfield sites for standardized grip deployment. The trend towards undergrounding cables in urban and storm-prone areas—a resilience-focused strategy—also presents a lucrative opportunity, as underground installation processes are significantly more reliant on precision-engineered pulling grips compared to overhead line installation. The shift toward sustainable manufacturing practices, focusing on recyclable and environmentally friendly grip materials, also opens pathways for competitive differentiation and market entry.

The market is subjected to several critical impact forces. Economic impact forces, such as fluctuating raw material costs (steel, specialized plastics), directly affect manufacturing overhead and final product pricing, leading to margin volatility. Technological impact forces, particularly the integration of Internet of Things (IoT) sensors into grips for tension monitoring, are transforming the value proposition from a hardware component to a data-enabled asset. Regulatory forces, including evolving international standards for load testing and safety compliance (e.g., ISO and ASTM standards), impose rigorous requirements on manufacturers, simultaneously raising the barrier to entry for smaller firms and enhancing consumer confidence in certified products. Finally, environmental impact forces push the industry toward grips designed for extreme weather conditions and those made from sustainable, bio-degradable or easily recyclable materials, aligning with global corporate social responsibility objectives.

- Drivers: Global expansion of power transmission grids, rapid deployment of 5G and fiber optic networks, and increased infrastructure spending in renewable energy sectors.

- Restraints: Volatility in raw material prices (metals), lack of standardization across certain specialized applications, and the persistent use of cheap, non-certified alternatives leading to safety compromises.

- Opportunities: Integration of IoT and sensing technology for "smart pulling," growth in underground and subsea cable installation projects, and market penetration in high-growth emerging economies.

- Impact Forces: Strict safety regulations (mandating certified products), technological advancements (smart grips), and macro-economic factors influencing large-scale construction project timelines.

Segmentation Analysis

The Pulling Grip Market segmentation provides a crucial framework for understanding the diverse applications and end-user requirements driving market dynamics. The primary segmentations are typically categorized by Weave Type, Material, Application, and End-User Industry, each reflecting specific performance demands. Weave type, such as single, double, or triple weave, directly correlates with the tensile strength and gripping force required, with multi-weave grips being indispensable for heavy-duty power cables. Material segmentation differentiates between traditional galvanized steel, which offers high durability and cost-effectiveness, and specialized non-metallic grips, which are favored for use with sensitive fiber optic or high-voltage cables where conductivity must be avoided. This detailed segmentation allows manufacturers to tailor their product offerings precisely to the stringent functional and safety criteria of niche applications, ensuring optimal performance and compliance.

Segmentation by application clarifies whether the grip is intended for light-duty (e.g., residential wiring), medium-duty (e.g., commercial buildings), or heavy-duty (e.g., utility transmission lines, subsea projects). Within the application sphere, specific designs emerge, such as revolving eye grips for preventing twisting, or closed-mesh designs for superior cable end protection. This granularity is essential because a pulling grip suitable for an indoor industrial control panel installation would be wholly inadequate for pulling high-tension cable across a mountainous terrain or underwater. Consequently, the performance metrics (such as maximum rated load and cable diameter tolerance) vary wildly across these application segments, directly influencing pricing and market share distribution among specialized manufacturers.

The End-User segmentation remains critical, dividing demand between electric utilities (which prioritize reliability and scale), telecommunications (which demand precision and protection for fragile cables), and the construction sector (which often values versatility and cost-efficiency for varied project sizes). Analyzing these segments reveals distinct procurement patterns; utilities often enter into long-term supply agreements for standardized heavy-duty products, whereas construction contractors frequently purchase on a project-by-project basis, often favoring readily available, versatile grips. The consistent analysis of these interlinked segments is vital for strategic planning, resource allocation, and identifying rapidly evolving demand pools within the broader infrastructure landscape.

- By Weave Type:

- Single Weave Pulling Grips

- Double Weave Pulling Grips (Dominant for heavy load)

- Triple Weave Pulling Grips

- Rotary Pulling Grips

- By Material:

- Galvanized Steel Pulling Grips

- Stainless Steel Pulling Grips

- Non-Metallic/Synthetic Fiber Pulling Grips (e.g., Aramid/Kevlar)

- By Application:

- Light Duty (Instrumentation/Control Cable)

- Medium Duty (Commercial/Residential Wiring)

- Heavy Duty (Transmission & Distribution/Utility Lines)

- Specialty/Subsea Applications

- By End-User Industry:

- Electric Utilities (T&D)

- Telecommunications and Data Centers

- Construction and Civil Engineering

- Industrial and Manufacturing Facilities

- Mining and Oil & Gas

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Pulling Grip Market

The value chain of the Pulling Grip Market begins with the upstream activities centered around the procurement and processing of raw materials, primarily high-grade steel wire (galvanized or stainless) and specialized synthetic fibers. Upstream efficiency dictates the final cost and quality, requiring strong relationships with key metallurgical suppliers to ensure consistency in tensile strength and corrosion resistance. Manufacturers must focus on specialized weaving and braiding techniques, which are proprietary processes determining the mechanical performance of the grip. Quality control at this stage is paramount, involving rigorous testing of material composition and load-bearing capacity before the final assembly of the grip eye and connection hardware. Automation in the weaving process is a growing trend, aiming to reduce labor costs and ensure geometric precision critical for even load distribution.

Midstream activities involve the fabrication, assembly, and rigorous certification of the finished pulling grips. Direct manufacturers invest heavily in R&D to develop innovative designs (e.g., closed-mesh terminations, swivel eye components) that address evolving cable installation challenges, such as tighter bending radii or extremely long pulls. Distribution channels form the critical link to the downstream market. The channel structure is typically bifurcated into direct sales to large electric utility companies or major infrastructure contractors, where bulk orders and customization are common, and indirect sales through specialized industrial distributors, electrical wholesalers, and e-commerce platforms, serving the vast construction and maintenance contractor base. The indirect channel relies heavily on the distributor's ability to maintain inventory of diverse grip types and provide quick fulfillment for emergency repair or small project needs.

Downstream analysis focuses on the end-user application and post-sale service. The primary buyers are electrical engineers, project managers, and installation crews whose purchasing decisions are influenced not just by price, but predominantly by safety certifications, load rating guarantees, and brand reputation for reliability. Service offerings, such as mandatory periodic load testing or training on proper grip application techniques, are becoming crucial differentiators, enhancing the overall value proposition. The market is also heavily influenced by rental companies, particularly for ultra-heavy-duty or highly specialized grips, which reduces the capital expenditure burden on smaller contracting firms, thereby broadening access to high-quality equipment.

Pulling Grip Market Potential Customers

The primary consumers and buyers in the Pulling Grip Market are entities involved in the deployment, maintenance, and expansion of critical infrastructure networks that rely on extensive cabling systems. Electric Utilities, including Independent System Operators (ISOs) and regional power distribution companies, constitute the largest and most consistent customer base. These organizations require heavy-duty, high-capacity grips for installing power transmission cables (up to 500kV) and distribution lines, often demanding double or triple weave galvanized steel options built to withstand extreme mechanical stress during subterranean or overhead installation projects. Their purchasing cycle is typically long-term, focused on quality, standardization across their fleet, and robust adherence to industry safety protocols (e.g., ASTM F1821 standards).

A rapidly expanding customer segment is the Telecommunications and Data Center Industry. With the relentless expansion of 5G infrastructure, fiber-to-the-home (FTTH), and hyperscale data centers, these buyers require specialized, non-metallic or synthetic fiber grips. Their priority is cable protection; the delicate nature of fiber optic cables necessitates grips that distribute tension gently and prevent kinking or crushing, leading to high demand for single-weave, closed-end grips with lower pulling capacities but higher precision. Contractors specializing in horizontal directional drilling (HDD) for conduit placement are also crucial customers, needing grips designed for abrasive environments and continuous rotation.

Furthermore, General Construction and Civil Engineering firms represent a highly diverse customer group, purchasing a wide range of grips for commercial building wiring, street lighting, transit systems (subways, rail), and municipal water pumping stations. This segment values versatility and quick availability, often sourcing products through local electrical supply houses. Industrial facilities, particularly in the Oil & Gas, Mining, and Manufacturing sectors, purchase grips for highly specialized applications involving hazardous environments, requiring corrosion-resistant materials (stainless steel) or chemically inert synthetics. These end-users demand grips designed to meet specific regulatory requirements related to explosion proofing or high temperature tolerance, indicating a move towards premium, highly certified products across all major infrastructure sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Klein Tools, Greenlee, Condux International, Brooks Utility Products, Utilux, T&B (Thomas & Betts), Salisbury (Honeywell), P.W. Industries, Cablematic, Ideal Industries, Sherman + Reilly, Custom Grip, M.J. Electric, ZECK, TESMEC S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pulling Grip Market Key Technology Landscape

The technology landscape of the Pulling Grip Market is shifting beyond simple mechanical engineering toward material science and digital integration, primarily focused on enhancing safety, reliability, and installation efficiency. The foundational technology remains the precise weaving and braiding of high-tensile wire mesh, but advancements now involve composite material integration. For instance, manufacturers are increasingly using aramid fibers (like Kevlar) in conjunction with traditional steel for applications requiring exceptional strength-to-weight ratios and non-conductivity, crucial for sensitive electrical environments and helicopter stringing operations. Furthermore, specialized coatings, such as polymer encapsulation and advanced galvanization processes, are being deployed to significantly extend the lifespan of grips in highly corrosive environments, particularly in marine or underground utility applications where traditional steel grips might fail prematurely due to rust and abrasion.

A significant technological advancement is the integration of embedded smart technology, transforming standard pulling grips into "smart grips." This involves incorporating miniature, ruggedized strain gauge sensors or passive RFID tags directly within or near the termination point of the grip. These sensors communicate wirelessly with external monitoring systems, providing operators with real-time data on pulling tension, force applied, and occasionally, environmental factors like temperature. This real-time feedback loop is essential for adhering to the maximum pulling tension limits specified by cable manufacturers (often referred to as the Maximum Allowable Tension or MAT), thereby preventing costly overstressing and subsequent cable damage. This convergence of IoT and mechanical tools marks a major shift towards preventive installation management, moving away from purely reactive failure analysis.

Furthermore, technology is impacting the design and manufacturing process itself. Computer-Aided Design (CAD) and Finite Element Analysis (FEA) are routinely used to simulate complex loading scenarios, optimizing the grip’s weave geometry and termination design to ensure uniform stress distribution under maximum load. This predictive engineering capability allows companies to certify their products with greater accuracy and develop custom grips for unique, high-stress projects (e.g., deep-sea cable laying) much faster than traditional iterative testing methods. The emphasis on certified load ratings and traceable manufacturing batches, often facilitated by automated laser etching and advanced material tracking systems, reinforces the technological commitment to safety and regulatory compliance across the industry.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and is projected to exhibit the highest growth rate due to unprecedented investments in infrastructure development, particularly in India, China, and Southeast Asia. The rapid rollout of national fiber backbones, extensive urbanization projects demanding new power grids, and substantial government funding for smart city initiatives are the primary drivers. The region's vast geographical span and diverse environmental conditions also necessitate a wide variety of specialized grips, from heavy-duty transmission grips to standard light-duty construction types.

- North America: This region is characterized by high demand for premium, certified products driven by stringent safety regulations and the urgent need for grid modernization. Key activities include the replacement of aging infrastructure, the undergrounding of utility lines to enhance resilience against severe weather, and massive expansion in renewable energy connectivity (wind and solar). The U.S. and Canada are early adopters of smart grips and automated pulling systems, prioritizing high-efficiency and safety-focused installations.

- Europe: Europe represents a mature market with steady growth driven by cross-border energy interconnection projects and offshore renewable energy expansion (especially in the North Sea). Strict environmental and quality standards (e.g., CE marking) enforce the use of high-quality, traceable pulling grips. The focus here is often on specialized subsea and industrial grips, catering to the complex logistics of deep-water cable installation and highly regulated industrial plant environments.

- Latin America (LATAM): This region offers significant potential due to ongoing electrification projects and economic expansion leading to increased construction activity. Brazil and Mexico are leading the charge, requiring substantial amounts of medium to heavy-duty pulling grips for new power transmission lines and telecommunication networks. Market growth, however, is often constrained by economic volatility and reliance on imported materials.

- Middle East and Africa (MEA): Growth is primarily fueled by large-scale mega-projects in the GCC countries (e.g., NEOM in Saudi Arabia) focusing on new infrastructure build-out, including vast solar energy farms and associated transmission infrastructure. In Africa, rural electrification initiatives and the expansion of mobile networks drive demand for standard and lightweight grips. The region often requires highly durable grips capable of withstanding extreme desert temperatures and abrasive conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pulling Grip Market.- Klein Tools

- Greenlee (Textron)

- Condux International

- Brooks Utility Products

- Utilux

- T&B (Thomas & Betts)

- Salisbury (Honeywell)

- P.W. Industries

- Cablematic

- Ideal Industries

- Sherman + Reilly

- Custom Grip

- M.J. Electric

- ZECK

- TESMEC S.p.A.

- Hubbell Incorporated

- The Crosby Group

- Fiskars Group (for some industrial tooling)

- Preformed Line Products (PLP)

- DCD Design & Manufacturing

Frequently Asked Questions

Analyze common user questions about the Pulling Grip market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between single, double, and triple weave pulling grips?

The weave type determines the strength and flexibility. Single weave grips are generally lighter duty and offer higher flexibility. Double weave grips are standard for heavy-duty utility pulling, providing significantly higher tensile strength and better load distribution. Triple weave grips are reserved for the heaviest applications requiring maximum grip security and load capacity.

How do I select the correct pulling grip size for a specific cable installation?

Selection is based on three critical factors: the outside diameter (OD) of the cable, the maximum calculated pulling tension (MAT), and the environment of the pull (e.g., straight run vs. multiple bends). The grip's rated capacity must always exceed the MAT, and its gripping range must securely accommodate the cable's exact OD to prevent slippage or damage.

Are non-metallic pulling grips suitable for high-tension utility applications?

Yes, advanced non-metallic grips, often made of aramid fibers (like Kevlar), are increasingly suitable for high-tension work, especially where non-conductivity is mandatory, such as near energized lines or sensitive electronic equipment. While traditionally lower capacity, newer composite designs rival the strength of steel grips while offering superior flexibility and lighter weight.

What role does IoT and sensor technology play in modern pulling grips?

IoT integration transforms standard grips into smart grips by embedding strain sensors that monitor pulling tension in real-time. This data prevents operators from exceeding the Maximum Allowable Tension (MAT) of the cable, dramatically reducing the risk of internal damage, ensuring compliance, and optimizing installation efficiency.

Which regions are driving the largest growth opportunities for pulling grip manufacturers?

The Asia Pacific (APAC) region, driven by extensive 5G rollout, massive urbanization projects, and utility grid expansion in nations like India and China, presents the highest growth opportunities. Additionally, niche markets like offshore wind farm installation in Europe are driving demand for highly specialized subsea grips.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager