Pulmonary Drug Delivery Devices & Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435581 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pulmonary Drug Delivery Devices & Systems Market Size

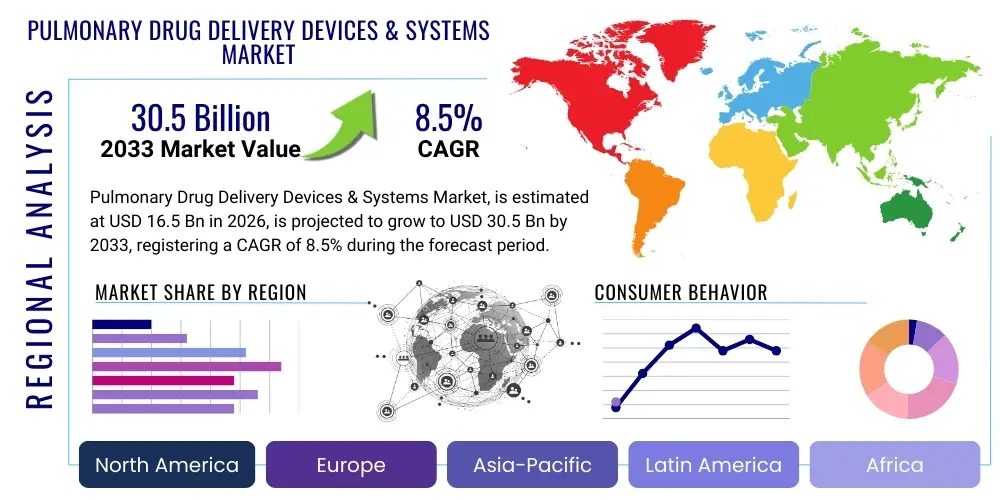

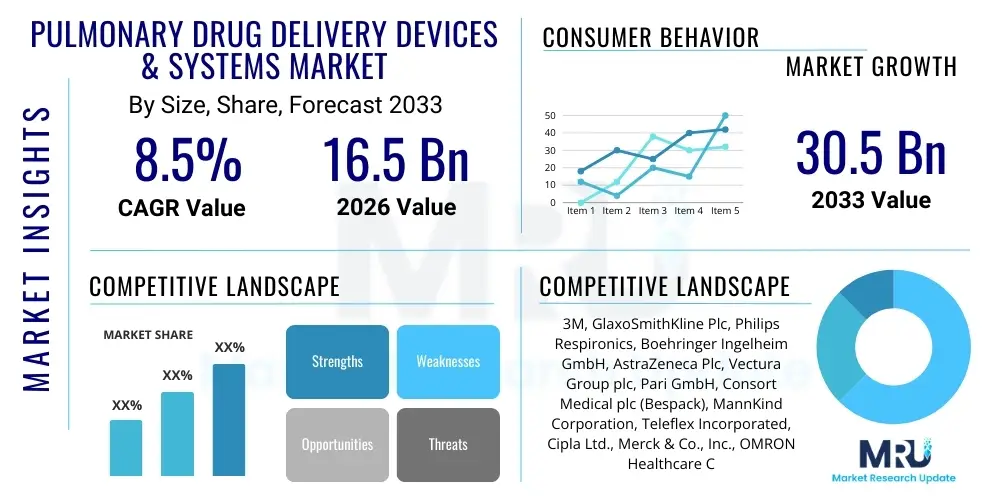

The Pulmonary Drug Delivery Devices & Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 16.5 Billion in 2026 and is projected to reach USD 30.5 Billion by the end of the forecast period in 2033.

Pulmonary Drug Delivery Devices & Systems Market introduction

The Pulmonary Drug Delivery Devices & Systems Market encompasses a range of specialized medical equipment and formulations designed to administer therapeutic agents directly into the lungs. This method is highly effective for treating chronic respiratory conditions such as asthma, Chronic Obstructive Pulmonary Disease (COPD), cystic fibrosis, and increasingly, systemic diseases requiring rapid onset of action or targeted lung deposition. The primary objective of these systems is to maximize the deposition of the drug in the lower respiratory tract while minimizing systemic side effects, thereby enhancing therapeutic efficacy and patient compliance. Key product types include Metered Dose Inhalers (MDIs), Dry Powder Inhalers (DPIs), and nebulizers, each offering distinct advantages in terms of portability, drug stability, and patient usability.

The market expansion is fundamentally driven by the escalating global prevalence of chronic respiratory diseases, intensified air pollution levels, and demographic shifts characterized by an aging population highly susceptible to pulmonary ailments. Furthermore, significant technological advancements, particularly in developing smart, connected inhalers that provide adherence monitoring and dosage confirmation, are revolutionizing patient management and data collection in clinical settings. The transition from conventional systemic drug administration to localized pulmonary delivery is accelerating due to superior pharmacokinetic profiles and improved patient quality of life associated with targeted therapies. Pharmaceutical companies are actively investing in novel formulations—including large molecule biologics and peptide drugs—suitable for aerosolization, broadening the therapeutic scope of pulmonary delivery systems beyond traditional small molecule bronchodilators and corticosteroids.

Pulmonary drug delivery devices are critical components of modern respiratory care, serving applications across home care, hospitals, and specialized clinics. Beyond established applications like COPD and asthma management, emerging applications include lung cancer treatment, vaccination via inhalation, and systemic drug delivery bypassing gastrointestinal degradation. The overall market trajectory is influenced by regulatory environment shifts, increasing demand for patient-centric devices, and robust research and development activities focused on improving lung deposition efficiency and reducing reliance on propellants with high global warming potential (e.g., transitioning from CFC to HFA propellants, and further towards propellant-free DPIs).

Pulmonary Drug Delivery Devices & Systems Market Executive Summary

The global Pulmonary Drug Delivery Devices & Systems Market is experiencing robust growth fueled by technological innovation in device design and the expanding clinical utility of inhaled therapies. Business trends highlight a strong emphasis on developing 'smart' inhalers integrated with digital health platforms to monitor usage patterns, improve adherence rates, and provide real-time data to healthcare providers, transforming chronic disease management into a precision health discipline. Furthermore, major pharmaceutical firms are focusing on developing complex biologic formulations (such as inhaled insulin or inhaled antibodies) compatible with existing or next-generation delivery platforms, driving high-value product launches and significant competitive differentiation. Mergers and acquisitions are common strategies utilized by large device manufacturers to acquire specialized dry powder formulation technologies or proprietary valve systems, consolidating market expertise and optimizing production efficiencies.

Geographically, North America currently holds the dominant market share due to high prevalence of COPD and asthma, advanced healthcare infrastructure, and favorable reimbursement policies for respiratory care devices. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion in APAC is attributable to vast, untapped patient populations, increasing access to modern healthcare facilities, and significant growth in healthcare expenditure, particularly in densely populated nations like China and India, which face severe air quality challenges exacerbating respiratory conditions. Europe maintains a strong position, driven by stringent regulatory focus on environmentally sustainable propellants and high adoption rates of advanced nebulization technologies in hospital settings.

From a segmentation perspective, Dry Powder Inhalers (DPIs) are anticipated to be the fastest-growing segment, largely displacing older MDI technologies due to their propellant-free nature, greater stability for certain drug compounds, and ease of use for many patient demographics. However, nebulizers remain indispensable in pediatric and severe hospital cases where patients cannot achieve the necessary inhalation flow rates. Device manufacturers are also segmenting the market based on disease application, with COPD management remaining the largest revenue contributor, though severe asthma and increasingly, non-traditional pulmonary applications are providing new avenues for sustained market expansion and diversification of product portfolios.

AI Impact Analysis on Pulmonary Drug Delivery Devices & Systems Market

User queries regarding the impact of Artificial Intelligence (AI) on pulmonary drug delivery systems frequently center on optimizing patient compliance, predicting exacerbations, and personalizing treatment regimens. Common questions inquire about the efficacy of AI in analyzing inhalation technique errors detected by smart inhalers, the role of machine learning in refining aerosol particle size distribution for improved lung deposition, and the use of large language models (LLMs) to synthesize real-world evidence (RWE) from connected devices for drug effectiveness studies. Users are particularly keen on understanding how AI can move pulmonary care from reactive management to proactive, preventative intervention, thereby reducing hospital readmission rates and improving long-term therapeutic outcomes.

The consensus theme is that AI represents a crucial paradigm shift, transforming pulmonary drug delivery from a passive mechanism into an active, data-driven system. Key expectations revolve around enhancing the precision of drug delivery, primarily through algorithms that analyze variables such as ambient humidity, patient breath profiles, and device mechanics to adjust dosage delivery parameters dynamically. Furthermore, the integration of AI models allows for sophisticated analysis of adherence data collected by smart inhalers, identifying complex patterns correlated with poor outcomes, enabling clinicians to intervene with tailored coaching or medication adjustments based on predictive insights rather than historical averages.

The implementation of AI/ML technologies is rapidly optimizing the entire lifecycle of pulmonary devices, from R&D to patient use. During research, AI accelerates the identification of optimal drug formulations suitable for aerosolization and simulates complex lung airflow dynamics, reducing reliance on expensive and time-consuming physical prototyping. In clinical practice, AI-powered diagnostic tools integrated into spirometry and connected inhalers can differentiate between asthma and COPD symptoms more precisely and flag high-risk patients who are likely to misuse their devices, ensuring that the therapeutic promise of advanced delivery systems is fully realized in real-world settings, driving efficiency and better resource allocation within healthcare systems.

- AI-powered adherence monitoring and behavioral coaching via smart inhaler data analysis.

- Machine learning optimization of aerosol formulation design and particle engineering for targeted lung deposition.

- Predictive analytics for anticipating respiratory exacerbations based on physiological and environmental sensor data.

- Automated feedback systems embedded in devices to correct patient inhalation technique in real-time.

- Accelerated discovery of novel inhaled therapeutics using AI for target identification and compound screening.

DRO & Impact Forces Of Pulmonary Drug Delivery Devices & Systems Market

The Pulmonary Drug Delivery Devices & Systems Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces shaping its future trajectory. Key drivers include the overwhelming global burden of chronic respiratory diseases, particularly COPD and asthma, which necessitate consistent, effective drug management via inhalation. Furthermore, continuous advancements in pharmaceutical technology, such as the development of carrier-based dry powder formulations and high-efficiency nebulizers, significantly improve drug bioavailability and deposition accuracy. The opportunity landscape is vast, centered on the expansion of inhaled therapies into systemic applications (e.g., pain management, hormonal replacement, and vaccines) and the increasing development of combination products that integrate multiple drugs into a single device for improved patient convenience and adherence. Conversely, market growth is often restrained by the high cost associated with advanced device development, the complexity of regulatory pathways for combination products, and persistent issues related to poor patient compliance due to incorrect inhalation technique, particularly with MDIs.

The primary impact forces driving market evolution are rooted in technological refinement and demographic pressures. The transition towards smart, digital health-enabled devices is a powerful force, as these systems generate valuable real-world data crucial for outcome-based reimbursement models and personalized medicine. Regulatory pressures, especially those mandating the phase-out of environmentally harmful propellants (CFCs and high GWP HFAs), compel manufacturers to invest heavily in propellant-free alternatives like DPIs and nebulizers, fundamentally restructuring the device landscape. Moreover, the increasing adoption of personalized healthcare models demands flexible delivery systems capable of administering customized doses, pushing innovation towards adaptable and highly accurate dosing mechanisms.

Overall market dynamics are highly sensitive to policy changes and intellectual property (IP) protection surrounding branded devices. The potential for bioequivalence challenges and the subsequent entry of generic inhaled products (often referred to as 'follow-on' or 'authorized generic' devices) exert downward pressure on pricing, forcing originators to differentiate through advanced features like connectivity and superior user experience. Successful navigation of these impact forces requires device manufacturers to prioritize sustainability, digital integration, and patient education programs to maximize the clinical benefit of their sophisticated products and ensure sustained revenue growth in a highly competitive therapeutic area.

Segmentation Analysis

The Pulmonary Drug Delivery Devices & Systems Market is intricately segmented based on device type, application, formulation type, and end-user, allowing for nuanced analysis of market dynamics and targeted strategic planning. Device type segmentation is critical, dividing the market into traditional Metered Dose Inhalers (MDIs), advanced Dry Powder Inhalers (DPIs), and various types of nebulizers (jet, ultrasonic, and mesh). This categorization reflects varying levels of patient dexterity required, cost profiles, and suitability for different drug chemistries (e.g., solid powders versus liquid solutions/suspensions). The formulation segment, encompassing suspensions, solutions, and dry powders, is growing rapidly due to the need for stabilizing increasingly complex drug molecules, including biologics and peptides, which are challenging to aerosolize effectively while maintaining therapeutic integrity.

Application-based segmentation highlights the market's primary revenue streams, dominated by chronic diseases such as COPD and asthma, which account for the vast majority of prescriptions globally. However, emerging segments like cystic fibrosis, respiratory distress syndrome (RDS), and non-traditional applications (pulmonary hypertension, inhaled vaccines) are driving innovation and offering high growth potential. The market structure is further defined by end-user segments, recognizing the difference in purchasing power and device requirements between hospitals, which prioritize high-output, continuous nebulization systems, and home care settings, which demand portable, user-friendly, and cost-effective personal inhalers. This multifaceted segmentation helps stakeholders identify specific niches for investment, focusing either on high-volume chronic disease management or high-value specialty applications requiring sophisticated delivery mechanisms.

Understanding these segments is vital for effective market penetration strategies, as pricing, regulatory requirements, and competitive landscapes differ significantly across device types. For instance, DPIs are gaining traction due to superior drug stability and environmental advantages (propellant-free), leading to substantial investment in novel powder formulation technologies. Conversely, nebulizers, particularly high-efficiency mesh nebulizers, are seeing renewed interest due to their ability to deliver high doses rapidly to patients unable to cooperate with standard inhaler techniques. The intersection of these segments—such as smart DPIs used for COPD management in the home care setting—represents the most aggressive areas of technological development and market competition, driven by the overarching goal of improving patient outcomes through precise and reliable dosing.

- By Device Type:

- Metered Dose Inhalers (MDIs)

- Conventional MDIs

- Smart MDIs (Connected Devices)

- Dry Powder Inhalers (DPIs)

- Single-Dose DPIs

- Multi-Dose DPIs

- Nebulizers

- Jet Nebulizers

- Ultrasonic Nebulizers

- Mesh Nebulizers

- By Application:

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

- Cystic Fibrosis (CF)

- Pulmonary Arterial Hypertension (PAH)

- Allergic Rhinitis

- Others (Systemic Delivery, Pain Management, Vaccines)

- By Formulation Type:

- Solutions

- Suspensions

- Dry Powders (Micro-particles and Nano-particles)

- By End-User:

- Hospitals and Clinics

- Home Care Settings

- Ambulatory Surgical Centers

Value Chain Analysis For Pulmonary Drug Delivery Devices & Systems Market

The value chain for the Pulmonary Drug Delivery Devices & Systems Market is complex, beginning with pharmaceutical research and extending through to patient utilization, involving multiple specialized entities. Upstream analysis focuses on raw material procurement, which includes securing high-purity propellants (for MDIs), specialized polymers and plastics for device casings, and active pharmaceutical ingredients (APIs). Critically, the upstream phase involves extensive R&D dedicated to formulation science—specifically, ensuring drug stability and achieving optimal aerodynamic particle size distribution (APSD) for lung deposition. Specialized contract manufacturing organizations (CMOs) often handle the complex processes of micronization and particle engineering necessary for DPI and MDI formulations, requiring sophisticated containment and quality control systems to meet rigorous regulatory standards.

Midstream activities revolve around the manufacturing, assembly, and quality assurance of the delivery devices themselves. This stage involves precision engineering for components such as valves, actuators, dosage counters, and the integration of electronic components for smart devices. High capital investment is required for automated assembly lines capable of handling highly sensitive components and ensuring dose-to-dose consistency—a paramount regulatory requirement. The distribution channel is bifurcated, involving direct sales forces targeting major hospitals and key opinion leaders (KOLs), and indirect channels leveraging established wholesalers, distributors, and pharmacy chains. The effectiveness of this distribution network is crucial for maintaining the cold chain (where necessary) and ensuring device availability across diverse geographical regions, particularly in fast-growing developing markets.

Downstream analysis centers on market access, prescription, and patient interaction. Regulatory approval and market authorization are critical bottlenecks, requiring extensive clinical trials and human factors testing to demonstrate safety, efficacy, and ease of use. Once approved, marketing efforts focus on educating physicians about optimal device selection based on patient profile and disease severity. Direct interaction involves pharmacists providing patient counseling on correct inhalation technique, which is a major determinant of therapeutic success. The proliferation of digital platforms and connected health systems now represents the final stage of the value chain, enabling post-market surveillance, adherence tracking, and personalized patient support, thereby completing the feedback loop between patient usage data and future product improvements.

Pulmonary Drug Delivery Devices & Systems Market Potential Customers

The primary consumers and end-users of Pulmonary Drug Delivery Devices & Systems are patients suffering from chronic and acute respiratory ailments who require targeted lung therapies to manage their conditions effectively. These patients form the largest customer base, relying on long-term prescriptions for maintenance drugs administered via inhalers or nebulizers. Within the patient demographic, two critical sub-segments exist: the elderly population, who often require simpler, passive inhalation devices like nebulizers due to reduced dexterity and inspiratory flow capacity, and the pediatric population, for whom spacer devices (for MDIs) or low-volume nebulizers are essential to ensure adequate drug delivery and minimize systemic exposure.

Beyond individual patients, the institutional sector represents a significant volume purchaser. Hospitals, specifically emergency departments and intensive care units (ICUs), are major consumers of high-performance nebulization systems for rapid treatment of acute respiratory distress and severe exacerbations of COPD or asthma. Specialist pulmonology clinics and ambulatory care centers also constitute key institutional customers, focusing on purchasing a diverse range of devices for diagnostic testing, patient training, and initiating long-term therapy. These institutional buyers prioritize durability, ease of sterilization, and high throughput capability.

Furthermore, government healthcare agencies, large insurance providers, and pharmaceutical companies indirectly serve as critical customers by influencing demand, funding purchasing decisions, and determining formulary inclusion. Pharmaceutical companies, in particular, are perpetual customers of device manufacturers through outsourcing agreements (CDMOs) for the production of pre-filled, integrated drug-device combination products, ensuring a steady demand for innovative delivery platforms that enhance the efficacy and market appeal of their proprietary drug formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 16.5 Billion |

| Market Forecast in 2033 | USD 30.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, GlaxoSmithKline Plc, Philips Respironics, Boehringer Ingelheim GmbH, AstraZeneca Plc, Vectura Group plc, Pari GmbH, Consort Medical plc (Bespack), MannKind Corporation, Teleflex Incorporated, Cipla Ltd., Merck & Co., Inc., OMRON Healthcare Co., Ltd., ResMed Corp., AptarGroup, Inc., Propeller Health (ResMed), Teva Pharmaceutical Industries Ltd., H&T Presspart, Allied Healthcare Products Inc., GF Health Products Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pulmonary Drug Delivery Devices & Systems Market Key Technology Landscape

The technology landscape of pulmonary drug delivery systems is rapidly evolving, driven by the need for higher drug efficiency, better patient compliance, and environmental sustainability. A foundational technology involves the Metered Dose Inhaler (MDI), which relies on a pressurized propellant (now typically Hydrofluoroalkane or HFA) to generate a high-velocity plume. Recent technological advancements in MDIs focus on developing dose counter mechanisms, breath-actuated valves to simplify coordination, and most significantly, the integration of sensors to create 'smart MDIs.' These smart systems log usage data, including time, date, and sometimes even sound profiles indicating correct inhalation, significantly enhancing therapeutic monitoring and generating crucial real-world evidence for pharmacovigilance studies.

Dry Powder Inhalers (DPIs) represent the leading edge in propellant-free delivery, utilizing the patient's inspiratory effort to de-aggregate and aerosolize the drug powder. Technological innovation here centers on optimizing powder formulations, such as carrier-based systems (e.g., lactose carriers) or advanced formulation technologies (e.g., spray-dried or precipitated particles) to control particle size in the crucial 1-5 micron range for deep lung penetration. Device improvements include multi-dose reservoirs and sophisticated mechanical mechanisms (e.g., swirling chambers or cyclonic separation) designed to minimize internal device retention and ensure consistent dosing even at varying inhalation flow rates. This focus on device mechanics and formulation physics is key to maximizing the efficiency and reliability of DPIs, making them highly attractive alternatives to propellants.

Furthermore, Mesh Nebulizers are a revolutionary technology supplanting older jet and ultrasonic systems. These devices use a vibrating mesh or aperture plate to create highly precise, low-velocity aerosols, dramatically reducing treatment time and increasing drug delivery efficiency while operating silently. The integration of digital health platforms is the overarching technological trend, connecting all device types (MDIs, DPIs, and nebulizers) to cloud-based monitoring systems. This connectivity facilitates telemedicine, enables algorithm-driven feedback on inhalation technique, and offers comprehensive patient monitoring, shifting the focus from simply delivering the drug to ensuring the drug is delivered correctly and consistently over the long term, thereby transforming the standard of care for chronic respiratory diseases through digital optimization.

Regional Highlights

- North America: North America, led by the United States, commands the largest share of the global pulmonary drug delivery market, attributed to its advanced healthcare infrastructure, high awareness regarding respiratory diseases, and the presence of major device manufacturers and pharmaceutical companies. The region benefits from robust R&D investment, leading to the rapid adoption of smart inhalers and cutting-edge mesh nebulizer technology. Favorable reimbursement policies and high prevalence rates of asthma and COPD necessitate continuous, technologically superior treatment options. The market is highly mature but continues to grow through the introduction of premium-priced, digitally-enabled combination products and strong regulatory emphasis on innovation in device mechanics.

- Europe: Europe represents a mature market with significant demand, particularly driven by countries such as Germany, the UK, and France. Strict European Union (EU) regulations regarding environmental sustainability have accelerated the transition away from high Global Warming Potential (GWP) propellants, boosting the adoption of Dry Powder Inhalers (DPIs) and low-GWP MDI alternatives. The focus is on harmonizing device standards across the EU and integrating pulmonary care into national digital health strategies, supporting the growth of interconnected medical devices and remote patient monitoring systems.

- Asia Pacific (APAC): The APAC region is projected to register the fastest growth rate globally, driven by soaring air pollution levels, a rapidly expanding elderly population, and significant improvements in healthcare access and expenditure, particularly in China and India. While price sensitivity remains a factor, increasing urbanization and the resulting rise in respiratory illnesses are creating massive patient populations. The market is shifting from primarily utilizing affordable conventional nebulizers and generic MDIs toward sophisticated multi-dose DPIs, fueled by growing public and private investment in advanced therapeutic options.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, primarily centered in larger economies like Brazil and Mexico. Market penetration of advanced devices remains lower compared to North America and Europe, largely due to economic disparities and fragmentation in healthcare systems. However, increasing awareness campaigns and government efforts to improve access to essential respiratory medicines are gradually boosting the demand for reliable and cost-effective inhaler technologies. Generic drug-device combinations play a crucial role in expanding patient access across the region.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market characteristics. Growth in the Gulf Cooperation Council (GCC) countries is strong, mirroring Western trends due to high disposable income and advanced medical tourism infrastructure, resulting in high adoption rates of premium devices. Conversely, the African sub-Saharan market faces challenges related to infrastructure and pricing, relying heavily on NGO initiatives and public health programs. The market potential is significant, driven by infectious respiratory diseases and the increasing incidence of chronic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pulmonary Drug Delivery Devices & Systems Market.- 3M

- GlaxoSmithKline Plc

- Philips Respironics

- Boehringer Ingelheim GmbH

- AstraZeneca Plc

- Vectura Group plc

- Pari GmbH

- Consort Medical plc (Bespack)

- MannKind Corporation

- Teleflex Incorporated

- Cipla Ltd.

- Merck & Co., Inc.

- OMRON Healthcare Co., Ltd.

- ResMed Corp.

- AptarGroup, Inc.

- Propeller Health (ResMed)

- Teva Pharmaceutical Industries Ltd.

- H&T Presspart

- Allied Healthcare Products Inc.

- GF Health Products Inc.

Frequently Asked Questions

Analyze common user questions about the Pulmonary Drug Delivery Devices & Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards Dry Powder Inhalers (DPIs) over Metered Dose Inhalers (MDIs)?

The primary drivers are environmental sustainability and improved drug stability. DPIs are propellant-free, addressing global concerns regarding HFA emissions (high global warming potential). Additionally, DPIs are often preferred for delivering large-molecule biologics and peptides due to the enhanced stability of drugs in a dry powder form, and for patients who struggle with the hand-breath coordination required for MDIs.

How are 'Smart Inhalers' changing the management of chronic respiratory diseases?

Smart inhalers, equipped with sensors and connectivity, are fundamentally improving patient adherence and outcomes. They monitor and record dosage timing and usage patterns, providing objective data to healthcare providers to identify poor compliance or device misuse. This real-time data allows for personalized interventions, leading to fewer exacerbations and hospitalizations, optimizing long-term disease management.

What is the significance of mesh nebulizer technology in the hospital setting?

Mesh nebulizers utilize vibrating plates to produce fine, consistent aerosols efficiently and silently, significantly reducing treatment time compared to older jet nebulizers. In hospital settings, they are crucial for treating critically ill patients, infants, and those with severe airflow limitations who cannot achieve the required inspiratory flow rates for standard inhalers, ensuring maximum drug deposition with minimal drug waste.

Which geographic region presents the highest growth opportunities for pulmonary devices?

The Asia Pacific (APAC) region is projected to offer the highest growth potential (CAGR). This acceleration is due to the rising prevalence of respiratory diseases fueled by high air pollution, coupled with substantial, rapidly increasing investments in healthcare infrastructure and rising disposable incomes that improve access to advanced, modern drug delivery devices.

What major regulatory challenge impacts the market for new pulmonary drug delivery systems?

The most significant regulatory challenge is demonstrating bioequivalence and dose consistency for combination products (drug and device). Regulatory bodies demand rigorous testing to ensure the device delivers the intended dose accurately across its entire lifespan and under varying patient conditions (e.g., flow rates), often necessitating extensive and costly human factors validation studies for new device designs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager