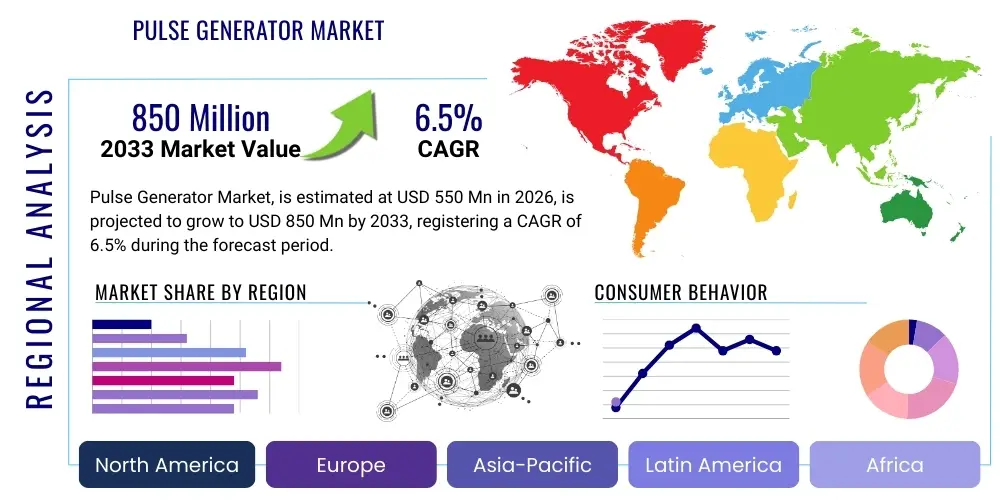

Pulse Generator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437084 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pulse Generator Market Size

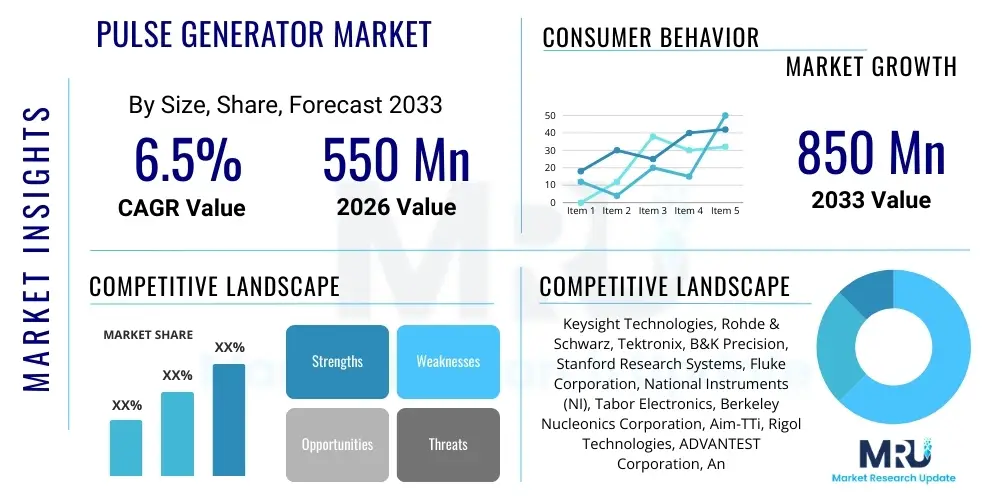

The Pulse Generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 850 Million by the end of the forecast period in 2033.

Pulse Generator Market introduction

Pulse generators are sophisticated electronic devices utilized to generate rectangular pulses or repetitive sequences of pulses with precisely controlled characteristics, including rise time, fall time, pulse width, frequency (pulse repetition rate), and amplitude. These devices are essential components in electronic testing and measurement environments, serving as sources for stimulus signals required for characterizing, debugging, and verifying the performance of electronic circuits, integrated circuits (ICs), and communication systems. The core function of a pulse generator is to provide a highly stable and versatile signal output capable of mimicking real-world transient phenomena or clock signals, which is critical for system validation in high-speed digital electronics and radio frequency (RF) applications. Advanced pulse generators often integrate features like arbitrary waveform generation capabilities, high channel density, and deep memory to support complex testing protocols required in modern technological fields. The increasing complexity of digital systems, particularly those operating in the gigahertz range, necessitates the use of high-performance pulse generators that can deliver signals with extremely low jitter and high fidelity.

The product description encompasses a range of device types, from basic function generators capable of generating square waves to highly specialized digital pattern generators and high-frequency arbitrary pulse generators. Modern pulse generators offer extensive programmability, allowing users to define intricate pulse patterns necessary for stress testing semiconductors, evaluating data bus integrity, and simulating complex communication protocols like PCIe, USB, and Ethernet. Major applications span across diverse sectors, including telecommunications for testing optical and wireless communication infrastructure, aerospace and defense for radar and electronic warfare system development, and medical electronics for imaging and therapeutic device research. Furthermore, they are indispensable tools in research laboratories for fundamental physics experiments, material science research requiring controlled electrical stimulation, and academic institutions for electrical engineering education. The relentless drive towards higher data rates and more energy-efficient components fuels the demand for these precision instruments, pushing manufacturers to continuously innovate in terms of bandwidth, timing accuracy, and channel count.

The primary benefits derived from using precision pulse generators include enhanced measurement accuracy, reduced design cycle time due to reliable characterization, and improved system reliability resulting from comprehensive stress testing. Driving factors for market expansion include the global proliferation of 5G and future 6G networks, which demand complex modulation and high-speed signal integrity testing; the rapid growth of the semiconductor industry, particularly in advanced nodes requiring precise testing of high-speed interconnects; and the increasing investment in defense technologies focusing on sophisticated electronic surveillance and countermeasures. The transition to autonomous vehicles and the corresponding need for reliable sensor interfaces and control systems also contribute significantly to the demand for reliable testing equipment. As digital transition accelerates across industrial and consumer electronics, the foundational role of the pulse generator in ensuring signal quality and system performance solidifies its market position, making it a critical enabling technology for technological advancement.

Pulse Generator Market Executive Summary

The Pulse Generator Market is exhibiting robust growth, propelled by significant business trends such as the pervasive adoption of high-speed digital interfaces and the intensifying focus on signal integrity validation across multiple engineering domains. Key business trends include the convergence of traditional pulse generation capabilities with arbitrary waveform generation (AWG) features, allowing for greater testing flexibility and complexity. Manufacturers are also focusing on modular instrumentation designs, compliant with platforms like PXI and AXIe, which enhances system scalability and reduces overall test footprint, addressing the needs of high-volume manufacturing test environments. Furthermore, there is a clear trend toward software-defined instrumentation, leveraging advanced analytical tools and cloud-based resources to streamline test automation and data processing, thereby improving operational efficiencies for end-users in R&D and production. Strategic partnerships between instrumentation providers and semiconductor foundries are becoming common, ensuring that testing equipment evolves in lockstep with the latest process technology nodes.

Regionally, the market dynamics are dominated by distinct technological drivers. North America remains a mature but highly innovative market, driven by significant defense spending, leading-edge semiconductor R&D, and the presence of major technological giants pioneering new computing paradigms like quantum computing, which requires extremely precise timing control. Asia Pacific (APAC) is projected to demonstrate the fastest growth rate, primarily attributed to massive investments in electronics manufacturing hubs, the rollout of 5G infrastructure, and burgeoning automotive electronics production in countries like China, South Korea, and Taiwan. Europe maintains a strong presence, particularly in specialized industrial automation, high-reliability automotive components, and scientific research sectors, benefiting from stringent quality standards and government-backed initiatives supporting advanced manufacturing technologies. The focus on localizing supply chains and building domestic technological capabilities in APAC is a critical factor reshaping global market distribution, leading to increased demand for both high-end and cost-effective testing solutions.

Segment-wise, the high-frequency and digital pulse generator segments are experiencing accelerated expansion due to the increasing clock speeds of microprocessors and the deployment of advanced communication standards. The Application segment is heavily influenced by the Telecommunication and Aerospace & Defense sectors, which require the highest levels of pulse accuracy and signal fidelity for complex simulations and stress tests. Within the segmentation by type, Digital Pulse Generators, offering precise timing control and complex pattern sequencing, are gaining preference over traditional analog systems, particularly in digital testing and advanced research. The shift toward software-configurable instruments (a sub-trend within the technology landscape) is influencing segment profitability, prioritizing vendors who can offer integrated hardware-software solutions. Overall, the market remains technologically demanding, rewarding vendors who prioritize precision, flexibility, and integration capabilities in their next-generation pulse generation devices.

AI Impact Analysis on Pulse Generator Market

Common user questions regarding AI's impact on the Pulse Generator Market frequently revolve around how artificial intelligence and machine learning (ML) can enhance the efficiency and complexity of automated testing, particularly concerning signal integrity analysis and fault diagnosis. Users are keen to know if AI can optimize test parameter settings, predict equipment failures, or automatically design complex pulse sequences required for novel semiconductor validation. Key themes emerging from these inquiries include the potential for AI-driven anomaly detection in high-speed signals, the automation of test result correlation with manufacturing process variations, and the development of 'smart' pulse generators capable of adapting pulse characteristics in real-time based on test outcomes. There is significant interest in transitioning from fixed, pre-programmed test routines to dynamic, data-driven optimization strategies enabled by ML algorithms, especially in complex, multi-channel testing scenarios where manual optimization is prohibitive. Furthermore, users explore how AI can assist in the calibration and maintenance of these precision instruments, ensuring long-term accuracy and reducing downtime.

- AI-Enhanced Test Automation: Utilizing machine learning algorithms to autonomously optimize pulse sequence parameters and timing margins, reducing human intervention and speeding up characterization processes, especially in high-volume testing of complex integrated circuits.

- Predictive Maintenance and Calibration: Deployment of AI models trained on operational data to forecast potential component degradation or calibration drift in pulse generators, enabling proactive maintenance and minimizing test downtime.

- Signal Integrity Anomaly Detection: Implementing ML for real-time analysis of generated and received pulses, enabling rapid and accurate identification of subtle signal distortions, jitter, and noise that might be missed by conventional threshold-based measurements.

- Intelligent Fault Diagnosis: Integrating AI into test setups to rapidly correlate observed system failures or performance degradation with specific pulse parameters or sequence deviations, accelerating root cause analysis in complex digital systems.

- Generative Test Pattern Design: Using AI to automatically generate optimized, statistically relevant complex pulse patterns (stress vectors) tailored specifically for testing advanced semiconductor designs and communication protocols beyond standard compliance patterns.

- Improved Data Interpretation: AI-powered analytics tools streamline the processing of vast amounts of test data generated by high-channel-count pulse generators, transforming raw measurements into actionable engineering insights regarding system performance and reliability.

DRO & Impact Forces Of Pulse Generator Market

The Pulse Generator Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and competitive landscape. Key drivers include the exponential increase in data transmission speeds necessitated by 5G and 6G technologies, demanding ultra-high-speed pulse generation with femtosecond-level timing precision for component characterization and system validation. Furthermore, the global expansion of the semiconductor industry, specifically the adoption of advanced CMOS nodes and complex System-on-Chips (SoCs), requires increasingly sophisticated stimulus signals to ensure signal integrity and timing closure. The rising investment in electronic warfare, surveillance, and radar systems within the aerospace and defense sector also fuels the demand for high-power, high-frequency pulse generators capable of simulating complex electromagnetic environments. These technological imperatives create a constant market pull for innovation in areas like bandwidth, multi-channel synchronization, and low intrinsic jitter, defining the current market momentum. The transition towards software-defined instrumentation platforms further enhances usability and integration, serving as a secondary growth driver by lowering the barrier to entry for complex testing setups.

Conversely, significant restraints hinder market growth and adoption rates. The primary restraint is the exceptionally high cost associated with developing and acquiring ultra-high-performance pulse generators, particularly those designed for multi-gigahertz operations, which limits their accessibility to smaller research institutions and medium-sized enterprises. Furthermore, the steep technological learning curve associated with operating and integrating these sophisticated instruments acts as a barrier, requiring highly specialized engineering expertise for effective utilization and data interpretation. The market also faces competitive pressure from modular or embedded solutions, where signal generation capabilities are integrated directly into larger Automated Test Equipment (ATE) systems, potentially sidelining standalone pulse generator sales in high-volume manufacturing environments. Economic volatility and extended lead times for highly specialized components necessary for these precision instruments also pose operational challenges for manufacturers, potentially impacting market stability and pricing strategies over the forecast period.

Despite the constraints, numerous opportunities are emerging that promise long-term market expansion. The increasing development of quantum computing infrastructure presents a unique opportunity, as quantum systems rely heavily on extremely precise, synchronized pulse sequences for qubit manipulation and control, requiring pulse generators far exceeding current commercial capabilities. The global expansion of Internet of Things (IoT) devices and the associated need for comprehensive electromagnetic compatibility (EMC) testing and low-power circuit validation also provide a fertile ground for market penetration, particularly for portable and lower-cost general-purpose generators. Moreover, the shift towards electric vehicles (EVs) and autonomous driving necessitates extensive testing of LiDAR, radar sensors, and battery management systems (BMS), all of which require specialized pulse testing for reliability and performance validation. Successful navigation of these impact forces requires vendors to focus on modularity, software integration, and the continuous push for superior timing accuracy, ensuring their products meet the increasingly stringent requirements of emerging high-tech sectors globally.

Impact Forces Summary:

- Drivers: Proliferation of 5G/6G communication systems; rapid advancements in semiconductor technology (high-speed interfaces); increasing defense expenditure on electronic warfare; demand for precise timing in quantum computing research.

- Restraints: High initial investment cost of high-performance units; complexity of operation and need for specialized skills; competitive threat from integrated ATE solutions; economic uncertainties affecting capital expenditure in R&D.

- Opportunities: Expanding applications in electric vehicle electronics (LiDAR/Radar testing); emergence of quantum computing as a major end-user sector; growth in industrial IoT and need for reliable low-power testing; geographical expansion in developing electronics manufacturing hubs (APAC).

Segmentation Analysis

The Pulse Generator Market is segmented based on key functional and application attributes, providing a structured view of market dynamics and specialized demand areas. Segmentation is critical for understanding where technological advancements are concentrated and which end-user sectors exhibit the strongest growth potential. The primary segmentation dimensions include the type of output signal generated (e.g., analog vs. digital), the frequency capabilities, and the diverse applications where these instruments are deployed. These segments reflect the technological maturity and specific testing requirements across various industries, ranging from fundamental scientific research requiring extremely low jitter to high-volume manufacturing demanding robustness and rapid throughput. Analyzing these segments helps stakeholders tailor product development and marketing strategies to specific sub-markets with distinct needs regarding precision, channel density, and price sensitivity.

Segmentation by Type reveals the ongoing shift toward highly sophisticated digital and arbitrary waveform instruments. While Analog Pulse Generators remain relevant for basic electrical testing and classroom education due to their simplicity and lower cost, the complexities of modern digital buses and communication standards mandate the use of Digital Pulse Generators capable of creating complex, multi-level sequences with superior edge rates and timing fidelity. Arbitrary Waveform Generators (AWGs), though often categorized separately, increasingly integrate high-precision pulse generation capabilities, allowing users to simulate real-world impairments and non-ideal signal characteristics necessary for thorough system validation. The frequency segmentation dictates the performance envelope of the devices, with high-frequency generators targeting advanced RF, microwave, and optical testing, while medium and low-frequency units serve general electronics testing and industrial automation applications.

The Application segmentation highlights the primary revenue streams and future growth opportunities. Telecommunication remains a dominant sector, driven by infrastructure upgrades and optical communication testing. The Aerospace & Defense segment demands the most rugged and high-performance equipment for simulating complex radar environments and ensuring electronic system resilience. The Research & Development segment, encompassing academic, governmental, and corporate labs, provides a steady stream of demand for state-of-the-art instruments capable of pushing technological boundaries. Furthermore, the expanding Automotive sector, particularly the development of ADAS (Advanced Driver Assistance Systems) components and EV power electronics, is rapidly increasing its procurement of specialized pulse generators for reliability and functional testing. Understanding the intersectionality of these segments—for example, high-frequency digital pulse generators used in 5G telecommunication testing—is crucial for accurate market forecasting and competitive positioning.

- By Type

- Analog Pulse Generators

- Digital Pulse Generators (High-Speed Logic Testing)

- Arbitrary Waveform Generators (AWG) with Pulse Capabilities

- High-Voltage Pulse Generators

- By Frequency Range

- Low Frequency (Up to 10 MHz)

- Medium Frequency (10 MHz to 500 MHz)

- High Frequency (Above 500 MHz/Gigahertz Range)

- By Application

- Telecommunication (5G/6G, Optical Testing)

- Aerospace and Defense (Radar Simulation, Electronic Warfare)

- Semiconductor Testing and Characterization

- Research and Development (R&D)

- Medical Electronics and Imaging

- Automotive Electronics (ADAS, Power Management)

- Industrial Electronics and Automation

- By Format/Architecture

- Benchtop/Standalone Instruments

- Modular Instruments (PXI, AXIe, VXI)

- Portable/Handheld Devices

Value Chain Analysis For Pulse Generator Market

The value chain for the Pulse Generator Market begins with upstream activities focused on the procurement and manufacturing of highly specialized electronic components. This includes securing high-precision oscillators (for timing accuracy), low-noise power supplies, high-speed digital-to-analog converters (DACs), field-programmable gate arrays (FPGAs) for sequence control, and specialized high-frequency output amplifiers. The stability and performance of the final instrument are critically dependent on the quality and synchronization of these upstream components. Manufacturers must maintain robust relationships with specialized component suppliers, especially those providing advanced semiconductor devices necessary for achieving the required rise/fall times and low jitter specifications essential for gigahertz-range operation. Research and development investment at this stage is intensive, focusing on proprietary circuit design and synchronization techniques to gain a competitive edge in timing fidelity and signal quality, which are primary differentiators in the premium segment of the market.

Midstream activities involve the design, assembly, and rigorous calibration of the pulse generator systems. This phase includes sophisticated software development for user interfaces, test automation, and programming features, often leveraging advanced mathematical models for signal shaping and error correction. Manufacturing processes demand extremely tight tolerances and high-precision assembly environments, particularly for modular and high-frequency instruments where channel isolation and impedance matching are paramount. Calibration is a non-trivial process, requiring advanced metrology standards to ensure traceable timing accuracy and amplitude precision. Marketing and sales efforts follow, where product differentiation is based heavily on technical specifications (e.g., maximum frequency, jitter, channel density, and rise time) and compatibility with industry standards (e.g., PXI, LXI). The complexity of the product necessitates highly technical sales teams capable of providing specialized application support to engineering customers.

Downstream activities center on distribution, sales, and post-sale service. The distribution channel utilizes both direct sales (essential for large governmental contracts, aerospace, and high-volume semiconductor manufacturers where customization is required) and indirect channels, primarily specialized technical distributors and value-added resellers (VARs) who cater to smaller R&D labs and educational institutions. Indirect channels provide local support, inventory management, and regional application expertise. Service and support, including routine maintenance, calibration services, and timely software updates, represent a crucial part of the downstream value proposition, contributing significantly to customer satisfaction and long-term retention, particularly given the high cost and reliance on these instruments for critical testing applications. The trend towards integrated, remote diagnostic capabilities is further optimizing this downstream service model, improving efficiency and reducing the total cost of ownership for end-users.

Pulse Generator Market Potential Customers

Potential customers for pulse generators are diverse, spanning industries that require precise electrical stimulus signals for design, validation, and manufacturing testing. The primary end-users are large multinational technology companies engaged in the development of communication infrastructure and high-performance computing components. Telecommunication companies and their equipment suppliers (e.g., manufacturers of optical transceivers, wireless base stations, and network routers) rely extensively on these devices to test bit error rates and characterize signal fidelity across high-speed data links, making them key buyers, especially for high-frequency and multi-channel synchronization units used in 5G and fiber optic testing. Defense contractors and government research agencies constitute another critical segment, procuring pulse generators for complex radar simulation, electronic countermeasure development, and high-energy physics research, often requiring instruments with specialized high-power or high-voltage capabilities for niche applications.

The semiconductor industry, including wafer fabrication plants, dedicated integrated circuit design houses, and outsourced semiconductor assembly and test (OSAT) providers, represents a consistent and high-volume demand segment. These customers use pulse generators extensively for component-level characterization, validating the timing margins of newly designed chips (DRAM, processors, FPGAs), and conducting rigorous stress testing during both the R&D and manufacturing stages. As chip complexity increases and geometries shrink, the need for increasingly precise and complex pulse patterns grows proportionally. Furthermore, academic and governmental research institutions, such as national laboratories focused on particle physics, plasma research, and advanced materials, are steady buyers, often requiring bespoke or ultra-high-performance instruments to conduct cutting-edge scientific experiments that depend on picosecond-level timing accuracy.

A rapidly expanding customer base includes manufacturers in the automotive and medical device industries. Automotive OEMs and Tier 1 suppliers utilize pulse generators for validating critical components of ADAS systems (e.g., testing the reliability and timing of automotive radar and LiDAR sensors) and characterizing the performance of power electronics in electric vehicles, which require accurate high-voltage pulse simulation. In the medical sector, pulse generators are essential for developing and testing advanced diagnostic imaging equipment (like ultrasound and MRI systems) and therapeutic devices (such as pacemakers and neuromodulation instruments), where signal precision and reliability are non-negotiable regulatory requirements. Targeting these diverse, high-value end-users requires vendors to offer scalable solutions, robust software integration, and compliance with strict industry-specific standards and protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keysight Technologies, Rohde & Schwarz, Tektronix, B&K Precision, Stanford Research Systems, Fluke Corporation, National Instruments (NI), Tabor Electronics, Berkeley Nucleonics Corporation, Aim-TTi, Rigol Technologies, ADVANTEST Corporation, Anritsu Corporation, Good Will Instrument (GW Instek), Spirent Communications, Hameg Instruments, Chroma ATE, Hioki E.E. Corporation, Scientech Technologies, ZTEC Instruments |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pulse Generator Market Key Technology Landscape

The technological landscape of the Pulse Generator Market is rapidly evolving, driven primarily by the need for greater timing accuracy, increased channel density, and higher operational frequencies to support advanced digital and RF applications. A key technological trend is the transition from conventional voltage-controlled oscillators (VCOs) to highly stable, often oven-controlled or rubidium-referenced, clock sources to minimize phase noise and ensure femtosecond-level jitter performance, which is essential for testing high-speed data interconnects (>50 Gbps). Advanced digital synthesis techniques, leveraging state-of-the-art Field-Programmable Gate Arrays (FPGAs) with deep memory architectures, enable the generation of increasingly complex, multi-level pulse sequences and deterministic jitter patterns required for robust protocol compliance testing (e.g., DDR5, PCIe Gen 6). The integration of high-speed digital-to-analog converters (DACs) with high sampling rates into pulse generator designs allows these instruments to blur the line between traditional pulse generation and arbitrary waveform generation, offering unparalleled flexibility in signal creation.

Another crucial technological area is the development of multi-channel synchronization and phase control capabilities. Modern testing scenarios, such as massive MIMO (Multiple-Input Multiple-Output) systems in 5G or advanced quantum computing architectures, demand that multiple pulse outputs be tightly synchronized across different channels with extremely low channel-to-channel skew. Manufacturers are developing proprietary synchronization bus technologies and utilizing precision time protocols (PTP) to ensure deterministic timing across large, distributed test setups. Furthermore, thermal management and output amplifier design have become central to achieving high-fidelity pulses at elevated frequencies. High-performance pulse generators often employ specialized gallium arsenide (GaAs) or gallium nitride (GaN) based output stages to provide the necessary bandwidth, power efficiency, and clean transition characteristics (fast rise and fall times) essential for accurate digital signal emulation without significant overshoot or ringing, maintaining signal integrity even at the load point.

Software and integration technologies represent the third pillar of innovation. Modern pulse generators are designed as networked instruments, often supporting standard interfaces like LXI (LAN eXtensions for Instrumentation) and SCPI, facilitating seamless integration into automated test environments (ATE) controlled by platforms like LabVIEW or Python. The development of intuitive, highly graphical user interfaces (GUIs) simplifies the programming of complex sequences, making high-level capabilities accessible to a broader user base. Critically, the incorporation of advanced measurement functionalities, such as built-in error detection and sophisticated signal analysis tools, transforms the pulse generator from a simple source into an integrated validation system. This focus on intelligent software and modular architectures, particularly within PXI and AXIe formats, allows users to scale their test capabilities while optimizing rack space and minimizing investment risk by future-proofing the test hardware with software updates.

Regional Highlights

- North America: This region maintains its position as a dominant market, largely driven by substantial and continuous investments in defense and aerospace technologies, requiring cutting-edge pulse generators for advanced radar, electronic warfare, and satellite communication testing. The concentration of leading semiconductor developers and major R&D centers (particularly in computing and data centers) fuels high demand for ultra-high-speed digital pulse generators necessary for characterizing memory interfaces and high-speed serial buses (PCIe, USB, Thunderbolt). Furthermore, North America is a crucial hub for emerging technologies like quantum computing and advanced medical electronics, both sectors highly dependent on precision timing instruments. The presence of major test and measurement vendors also contributes to rapid technological adoption and market maturity.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, fueled by massive government and private sector investment in manufacturing capabilities, particularly in China, South Korea, Taiwan, and Japan. The primary drivers include the expansive rollout and ongoing development of 5G/6G network infrastructure and the region's position as the global electronics manufacturing epicenter. The strong presence of contract electronics manufacturers (CEMs) and outsourced semiconductor assembly and test (OSAT) firms creates high demand for standardized and high-throughput modular pulse generators integrated into ATE systems. Increasing domestic R&D spending and the rapid expansion of the automotive electronics industry (especially EVs) further solidify APAC's pivotal role in market growth.

- Europe: Europe represents a technologically mature market characterized by robust demand from the industrial automation, automotive (high-reliability components), and scientific research sectors (e.g., CERN, plasma physics research). The region's stringent quality and safety standards drive the need for highly reliable and precise testing equipment. European countries are leaders in specific niche applications, such as high-precision scientific instrumentation and metrology. While growth rates may be slightly slower than APAC, the market is stable, supported by consistent government funding for advanced manufacturing initiatives and a strong focus on high-reliability aerospace components.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold a smaller share but are demonstrating gradual growth, primarily driven by increasing investments in modernizing telecommunication infrastructure (e.g., initial 5G rollouts) and developing local defense capabilities. The demand in these regions tends to favor general-purpose and cost-effective pulse generators for academic institutions and foundational electronics testing. Economic diversification efforts in the MEA, particularly in establishing technology and R&D hubs, are expected to slowly increase the uptake of advanced testing instruments, providing long-term market potential, particularly in oil and gas related electronic monitoring systems and communication infrastructure testing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pulse Generator Market.- Keysight Technologies

- Rohde & Schwarz

- Tektronix

- B&K Precision

- Stanford Research Systems

- Fluke Corporation

- National Instruments (NI)

- Tabor Electronics

- Berkeley Nucleonics Corporation

- Aim-TTi

- Rigol Technologies

- ADVANTEST Corporation

- Anritsu Corporation

- Good Will Instrument (GW Instek)

- Spirent Communications

- Hameg Instruments

- Chroma ATE

- Hioki E.E. Corporation

- Scientech Technologies

- ZTEC Instruments

Frequently Asked Questions

Analyze common user questions about the Pulse Generator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Pulse Generator and a Function Generator?

A Pulse Generator is specifically designed to create highly precise rectangular pulses with optimized rise/fall times, minimal overshoot, and extremely accurate timing control (low jitter), essential for digital and high-speed testing. A Function Generator, conversely, focuses on generating various continuous waveforms (sine, triangular, square) but generally lacks the necessary timing precision and high-fidelity edge characteristics required for advanced digital system validation.

Which application segment drives the highest demand for ultra-high-frequency pulse generators?

The Telecommunication and Semiconductor Testing application segments are the primary drivers for ultra-high-frequency (Gigahertz range) pulse generators. These sectors require instruments to characterize high-speed serial data links (e.g., 50 Gbps+ optical transceivers) and validate timing margins in advanced semiconductor interfaces like DDR5 and PCIe, where picosecond-level accuracy is mandatory for signal integrity validation.

How is the adoption of 5G technology impacting the Pulse Generator Market?

The transition to 5G significantly boosts the demand for pulse generators capable of generating complex, synchronized, multi-level pulse sequences and high-frequency clock signals (often in the millimeter-wave range). 5G components require rigorous stress testing and accurate characterization of timing dependencies and signal integrity, necessitating specialized, high-performance modular and benchtop pulse generation solutions with superior synchronization capabilities.

What role do modular platforms like PXI and AXIe play in this market?

Modular platforms are increasingly important as they allow users to build highly scalable, high-density test systems with multiple synchronized channels in a compact footprint. Modular pulse generators offer flexibility, lower system costs in high-channel-count applications, and easier integration into automated test equipment (ATE) systems, making them preferred choices for high-volume manufacturing and complex R&D setups requiring system-level integration.

What are the key technical specifications customers prioritize when selecting a pulse generator?

Customers prioritize extremely low jitter and phase noise for deterministic timing accuracy, fast and precise rise and fall times (edge rates) to ensure signal fidelity, high operational frequency (pulse repetition rate), and the ability to generate complex, arbitrary pulse patterns. Multi-channel synchronization capability and deep pattern memory are also crucial for advanced testing scenarios.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager