Pulsed Power Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436189 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pulsed Power Systems Market Size

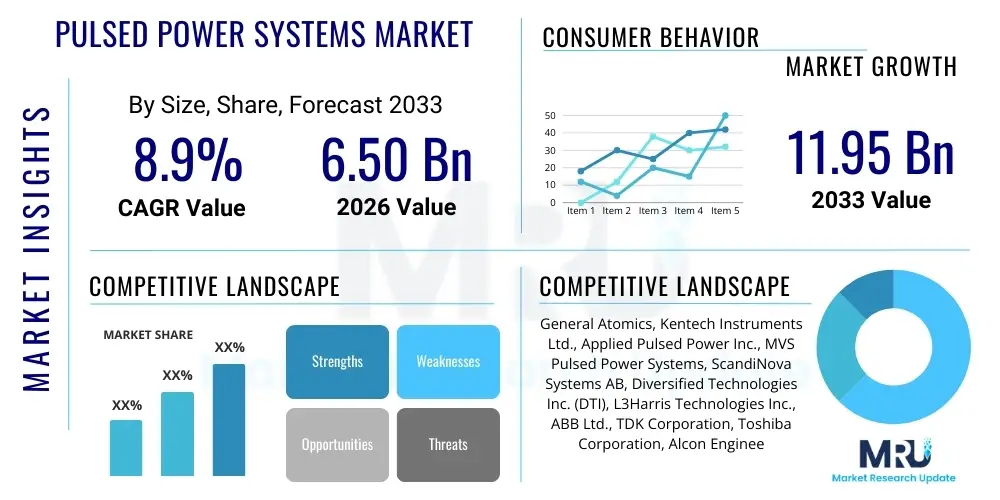

The Pulsed Power Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 6.50 Billion in 2026 and is projected to reach USD 11.95 Billion by the end of the forecast period in 2033.

Pulsed Power Systems Market introduction

The Pulsed Power Systems (PPS) Market encompasses technologies designed to accumulate and rapidly release high levels of electrical energy in short bursts, typically measured in microseconds or nanoseconds. These systems are foundational components in specialized applications requiring immense power delivery, often exceeding the capabilities of continuous-wave power sources. Products range from compact solid-state pulsers utilized in medical devices and industrial processing to extremely large capacitor banks and high-voltage generators employed in advanced research and defense programs. The core functionality revolves around efficient energy storage, fast switching mechanisms, and precision control over the discharge profile, which is critical for the success of diverse high-energy physics experiments and commercial processes.

Major applications of pulsed power systems span defense, directed energy weapons (DEW), high-power microwave (HPM) generation, medical treatments (such as non-thermal plasma sterilization and targeted drug delivery), and sophisticated industrial processes including materials processing, shock hardening, and environmental remediation. The inherent benefit of PPS lies in its ability to deliver peak power far exceeding the average power capacity of the system, enabling unique effects that are unattainable through conventional methods. This capability is paramount in driving innovation in fields such as fusion energy research (e.g., magnetic confinement and inertial confinement fusion) and advanced lithography techniques necessary for semiconductor manufacturing.

The market is primarily driven by escalating global defense spending focused on modernization and the development of next-generation weapon systems, particularly those utilizing electromagnetic launch technologies and directed energy. Furthermore, the increasing adoption of pulsed electric field (PEF) technology in food preservation and biomedical research, coupled with continuous technological advancements in solid-state switches and compact energy storage components (like high-density capacitors), contribute significantly to market expansion. These driving factors underline the necessity for lighter, more reliable, and higher-frequency pulsed power solutions across multiple strategic sectors.

Pulsed Power Systems Market Executive Summary

The global Pulsed Power Systems market exhibits robust growth driven by geopolitical tensions fueling defense expenditures and technological breakthroughs in medical and industrial applications. Business trends indicate a strong shift towards solid-state switching components replacing traditional gas and mechanical switches, leading to enhanced system reliability, reduced footprint, and higher pulse repetition rates. Key market players are concentrating on strategic collaborations, mergers, and acquisitions to consolidate expertise in high-voltage engineering and component miniaturization, particularly targeting applications in fusion research and advanced manufacturing. The demand for highly specialized power conditioning units (PCUs) tailored for extreme operating environments is also driving innovation in material science and thermal management within PPS development.

Regionally, North America maintains its dominance due to substantial investments by governmental agencies, such as the Department of Defense (DoD) and the Department of Energy (DoE), in high-power physics research and the deployment of advanced defense technologies. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid industrialization, increasing R&D activities in countries like China and South Korea concerning semiconductor fabrication and laser processing, and rising defense modernization budgets. European growth is steady, bolstered by collaborative fusion research projects like ITER and a focus on industrial applications for plasma technology and non-destructive testing.

Segment trends highlight the growing prominence of the capacitor segment within the components category, owing to continuous improvements in energy density and durability. By application, the defense and aerospace segment remains the largest revenue contributor, primarily driven by directed energy weapons and radar systems. Concurrently, the medical and healthcare segment is witnessing accelerated adoption of compact pulsed power sources for electrotherapy, cancer ablation, and plasma medicine, positioning it as the fastest-growing application segment over the forecast period. End-user trends show increasing adoption within academic research institutions for frontier science applications requiring ultra-high energy pulses.

AI Impact Analysis on Pulsed Power Systems Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Pulsed Power Systems Market typically center on how AI can enhance system predictability, optimize complex pulse sequences, and manage the extensive data generated during high-energy physics experiments. Users frequently inquire about the feasibility of using machine learning for fault detection in high-stress components like switches and capacitors, predicting component lifespan under extreme load, and developing self-correcting pulsed power architectures. Furthermore, there is significant interest in how AI can accelerate the design cycle of new pulsed power generators by simulating complex electromagnetic phenomena and thermal dynamics more efficiently than traditional simulation software, leading to faster deployment of novel technologies in fields like fusion energy.

AI's integration offers substantial advantages in optimizing the operational parameters of Pulsed Power Systems, which often involve managing hundreds of variables simultaneously to achieve a desired output. Machine learning algorithms can analyze vast datasets from past operations to fine-tune pulse shaping, timing, and synchronization across multiple stages, drastically improving energy transfer efficiency and precision. This level of optimization is crucial for demanding applications, such as controlling plasma confinement in fusion reactors or ensuring precise delivery in medical ablation treatments. By automating complex calibration routines, AI minimizes human error and reduces the downtime required for system maintenance and tuning.

The long-term expectation is that AI will transform pulsed power reliability and accessibility. By employing predictive maintenance models trained on component degradation signatures (e.g., changes in switch resistance or capacitor leakage), AI can schedule proactive repairs, preventing catastrophic failures in critical defense or research facilities. Moreover, AI-driven automation simplifies the operation of historically complex equipment, potentially lowering the required expertise level for operating advanced systems, thereby broadening the commercial and industrial application base of pulsed power technologies beyond specialized research centers.

- AI optimizes pulse generation efficiency and timing precision, crucial for fusion and directed energy applications.

- Machine Learning (ML) enables advanced predictive maintenance, forecasting failure in high-stress components like switches and insulation.

- Generative AI assists in the rapid design and simulation of novel pulsed power topologies and high-voltage structures.

- AI algorithms facilitate real-time fault detection and self-correction, enhancing system reliability and operational lifespan.

- Data analytics driven by AI accelerates the interpretation of complex experimental results in high-energy physics research.

DRO & Impact Forces Of Pulsed Power Systems Market

The Pulsed Power Systems market is primarily driven by the escalating demand for directed energy weapons (DEWs) and advanced electromagnetic launch systems in global defense sectors, coupled with significant governmental investment in thermonuclear fusion research, which fundamentally relies on large-scale pulsed power installations. However, the market faces constraints due to the inherent complexity and high manufacturing costs associated with high-voltage, high-current components, particularly specialized switches and high-energy density capacitors, alongside the significant technical challenges related to managing electromagnetic interference (EMI) and ensuring long-term component reliability under extreme stress cycles. These technological hurdles necessitate continuous, capital-intensive research and development efforts, which can be prohibitive for smaller market entrants.

Opportunities for market expansion are abundant in the burgeoning field of industrial non-thermal processing, including pulsed electric field (PEF) treatment for food and water sterilization, and plasma-assisted manufacturing techniques for materials modification and surface treatment. Furthermore, the development of compact, reliable solid-state pulsed power systems opens new avenues in mobile defense platforms and accessible medical devices. The industry is witnessing impact forces stemming from increasing pressure to miniaturize and enhance the mobility of systems, moving away from bulky, laboratory-scale setups toward deployable, rugged units suitable for diverse operational environments, thereby accelerating technological innovation in power density and thermal management.

The interplay between these drivers, restraints, and opportunities dictates the market trajectory. While military modernization provides immediate, high-value contracts (Driver), the stringent requirements for component endurance and safety regulations (Restraint) force manufacturers to innovate continually. This necessary innovation, particularly in solid-state switching (Opportunity), acts as a primary Impact Force, pushing the entire technological envelope toward higher efficiency and reduced maintenance profiles. The market dynamism is heavily influenced by large, long-term governmental research commitments (e.g., fusion programs) which stabilize demand despite high capital expenditures and technical risks.

Segmentation Analysis

The Pulsed Power Systems market is intricately segmented based on component type, application, and end-user, reflecting the diverse and specialized requirements of its clientele across defense, industry, and research. Segmentation by component is crucial as it highlights the technological bottlenecks and innovations, specifically focusing on energy storage (capacitors, batteries), switching mechanisms (thyristors, spark gaps, solid-state switches), and pulse forming networks (PFNs). The increasing shift toward robust solid-state switches, offering higher repetition rates and longevity, is a defining trend within this component segmentation. Understanding the performance limits and costs associated with each component type allows suppliers to tailor systems for specific requirements, such as high repetition rate industrial use versus single-shot, ultra-high energy defense applications.

Application-based segmentation provides insight into where pulsed power technology creates the most transformative impact. Defense applications, encompassing directed energy weapons, high-power microwave (HPM) systems, and advanced radar, demand the highest power density and robustness. Conversely, industrial applications, such as water treatment, sterilization, and material processing, emphasize reliability, cost-efficiency, and higher average power output at moderate energy levels. The medical segment, though smaller, is experiencing rapid growth, driven by the need for precision energy delivery in non-invasive treatments like irreversible electroporation (IRE) and plasma dermatology. These application domains have vastly different regulatory environments and purchasing cycles, influencing market dynamics significantly.

End-user segmentation further clarifies the demand landscape, distinguishing between government entities (defense, national laboratories), industrial manufacturers, and academic and research institutions. Government and research sectors are typically the earliest adopters of cutting-edge, high-cost technologies, driving innovation in fusion energy and high-energy physics. Industrial users, however, prioritize proven reliability and scalability for mass production processes. This segmentation is essential for strategizing market entry and product development, as the sales cycle, certification requirements, and expected system lifespan vary dramatically between a government-funded fusion test facility and a commercial food processing plant utilizing PEF technology.

- By Component:

- Capacitors (High-Energy Density, High-Voltage)

- Switches (Solid-State, Thyratrons, Spark Gaps, Ignitrons)

- Pulse Forming Networks (PFNs)

- Power Conditioning Units (PCUs)

- High Voltage Generators

- By Application:

- Defense and Aerospace (Directed Energy Weapons, Electromagnetic Launchers, Radar)

- Medical and Healthcare (Electroporation, Sterilization, Ablation)

- Industrial Processing (Material Treatment, Water Treatment, Non-Thermal Sterilization)

- R&D and Scientific Applications (Fusion Research, Particle Accelerators, High-Energy Physics)

- By End-User:

- Government and Defense Organizations

- Industrial Manufacturing

- Research and Academic Institutions

- Medical Device Manufacturers

Value Chain Analysis For Pulsed Power Systems Market

The value chain for the Pulsed Power Systems market is characterized by intense specialization across several stages, beginning with the highly technical upstream component manufacturing. Upstream activities involve the design and production of proprietary, highly specialized materials and components, such as high-voltage dielectrics, advanced semiconductor switches (e.g., silicon carbide and gallium nitride-based devices), and specialized high-density capacitors engineered to withstand extreme transient voltage and current stresses. This phase demands deep material science expertise and cleanroom manufacturing capabilities. Key challenges at this stage include sourcing rare or controlled materials and ensuring stringent quality control for components that are non-standard and often custom-designed for specific system requirements. The performance and reliability of the final PPS unit are critically dependent on the quality and endurance of these specialized components.

The midstream segment involves the system integrators and original equipment manufacturers (OEMs) who design the overall pulsed power architecture, integrating the specialized components into complex pulse generators, control systems, and power supplies. This stage encompasses sophisticated engineering disciplines, including electromagnetic compatibility (EMC) management, thermal modeling, and the design of robust mechanical enclosures. Integration requires high-level expertise in synchronization, control software development, and testing protocols to ensure the delivered pulse meets the precise specifications required by the end application, particularly in mission-critical defense and fusion energy systems. System integration often involves substantial intellectual property related to proprietary pulse-forming techniques and switching algorithms.

Downstream analysis focuses on distribution and post-sales service, which are crucial given the complexity and capital cost of PPS. Distribution channels are predominantly direct, involving close consultation between the manufacturer/integrator and the end-user (e.g., defense agencies or national labs) due to the custom nature of the systems. Indirect channels, primarily specialized distributors or agents, are sometimes utilized for standard industrial or medical devices. Post-sales service, maintenance, and system upgrades constitute a significant portion of the value chain, requiring highly skilled field engineers trained in high-voltage safety and component replacement. The longevity and continuous operational requirements of PPS necessitate comprehensive long-term service contracts, securing sustained revenue streams for system integrators. The high customization level means that the distribution channel is highly regulated, particularly when systems are exported internationally, requiring adherence to strict export control regulations like ITAR.

Pulsed Power Systems Market Potential Customers

The primary end-users and buyers of Pulsed Power Systems are concentrated in sectors requiring the rapid deposition of immense electrical energy for highly specialized tasks. Governmental defense organizations and military contractors represent the largest segment, purchasing PPS for the development and deployment of advanced weapon platforms, including directed energy weapons (lasers and HPM), electromagnetic railguns, high-power radar installations, and sophisticated electronic warfare systems. These customers prioritize robustness, miniaturization, high reliability under extreme conditions, and compliance with stringent military specifications (Mil-Spec). Their purchasing decisions are often tied to long-cycle, high-value procurement programs and defense budget allocations, making them cornerstone clients for high-end PPS manufacturers.

Scientific research institutions, including national laboratories and academic bodies focused on high-energy physics, materials science, and especially thermonuclear fusion (such as ITER and other national fusion facilities), form another critical customer base. These organizations require bespoke, massive-scale pulsed power generators capable of delivering ultra-high energies (mega-joules) for transient experiments lasting mere microseconds. Their buying criteria are driven by experimental needs—maximum energy output, pulse stability, and diagnostic integration capabilities—often necessitating custom-built systems with long procurement and commissioning timelines. These customers are crucial for driving innovation in component endurance and system scale.

The third major customer segment includes industrial manufacturers and medical device companies. Industrial users, particularly those involved in material processing (e.g., shock hardening, advanced welding), environmental technology (e.g., wastewater treatment using plasma), and food processing (PEF systems), seek reliable, modular, and cost-effective PPS solutions with high average power and high repetition rates. Medical end-users, mainly hospitals and specialized clinics, along with medical device OEMs, procure smaller, precision-focused pulsed power units for non-invasive surgical techniques (e.g., IRE) and sterilization applications. For these commercial customers, factors such as low operating cost, long component life, ease of maintenance, and regulatory certification (FDA, CE) are paramount considerations, driving demand for solid-state, compact solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.50 Billion |

| Market Forecast in 2033 | USD 11.95 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Atomics, Kentech Instruments Ltd., Applied Pulsed Power Inc., MVS Pulsed Power Systems, ScandiNova Systems AB, Diversified Technologies Inc. (DTI), L3Harris Technologies Inc., ABB Ltd., TDK Corporation, Toshiba Corporation, Alcon Engineering, Fast-Co. Ltd., IXYS Corporation (Littelfuse), Lucent Technologies, Starfire Industries LLC, RPC, Inc., North Star Research Corporation, Eagle Harbor Technologies, General Electric, and Sumitomo Electric Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pulsed Power Systems Market Key Technology Landscape

The technological landscape of the Pulsed Power Systems market is rapidly evolving, driven primarily by the pursuit of higher power density, increased pulse repetition frequency (PRF), and improved component lifetime. A central technological shift is the transition from conventional gas-filled tube switches (like thyratrons and spark gaps) and mechanical switches toward advanced solid-state switching technologies, predominantly utilizing high-power semiconductors based on Silicon Carbide (SiC) and Gallium Nitride (GaN). These wide-bandgap materials enable switches with significantly faster rise times, lower jitter, higher voltage and current handling capabilities, and, most critically, dramatically longer operating lifetimes and higher repetition rates, essential for commercial and tactical applications requiring continuous operation rather than single-shot capability.

Another pivotal area of innovation involves energy storage components, particularly high-density capacitors and advanced compact battery systems. Manufacturers are focusing on developing capacitors with superior energy density, reduced equivalent series resistance (ESR), and improved thermal stability to allow for smaller, lighter pulsed power modules. Dielectric materials research, including the use of specialized polymer films and ceramic composites, is key to achieving these performance enhancements while maintaining reliability under extreme voltage stresses. Furthermore, the integration of advanced diagnostic and control systems, often leveraging Field-Programmable Gate Arrays (FPGAs) for precise timing and synchronization, is crucial for shaping complex pulse waveforms required for sophisticated applications like targeted medical treatments and magnetic compression systems.

The emergence of modular and deployable pulsed power architectures represents a significant technological advancement, moving away from centralized, laboratory-scale systems. This trend is vital for defense applications requiring compact, mobile power sources for vehicle-mounted directed energy systems and electromagnetic launchers. This modularity requires sophisticated power conditioning units (PCUs) that can efficiently manage energy flow, minimize power losses, and isolate high-voltage stages from sensitive control electronics. Overall, the technology landscape is characterized by a strong interdisciplinary approach, integrating advanced material science, semiconductor physics, high-voltage engineering, and complex control theory to continually push the boundaries of achievable peak power and system longevity.

Regional Highlights

Geographically, the Pulsed Power Systems Market is segmented into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA), with each region exhibiting distinct growth drivers and technological adoption rates. North America currently dominates the global market, a position cemented by immense defense spending by the US government and extensive funding allocated to national laboratories for fusion energy research (e.g., NIF, Sandia National Laboratories). This region possesses a mature ecosystem of specialized manufacturers, high-tech component suppliers, and a strong academic research base, leading innovation in solid-state switching and directed energy weapon development.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market throughout the forecast period. This rapid expansion is driven by substantial government investments in military modernization programs, particularly in China, India, and South Korea, focusing on advanced radar and electronic warfare systems. Additionally, rapid industrial growth and the adoption of pulsed power for commercial applications, such as semiconductor lithography, advanced material processing, and environmental remediation technologies in industrialized Asian economies, are contributing significantly to market demand. Increased R&D spending in fusion and accelerator physics also supports high-end PPS procurement in countries like Japan and China.

Europe holds a significant market share, driven primarily by collaborative multinational research projects, notably the International Thermonuclear Experimental Reactor (ITER) project, which requires massive, custom-built pulsed power infrastructures. European countries are also leaders in applying pulsed power in industrial settings, particularly in advanced manufacturing and plasma technology for surface modification. The Middle East and Africa (MEA) and Latin America currently represent smaller market shares, but increasing defense investments, particularly in the UAE and Israel, and nascent adoption of industrial pulsed power applications for water treatment and mining processes are expected to stimulate moderate growth in these regions.

- North America: Market leader due to high US DoD expenditure, robust academic research in fusion energy, and early adoption of advanced solid-state PPS technology.

- Asia Pacific (APAC): Fastest-growing region, fueled by military modernization, strong industrial demand in China and South Korea, and investment in semiconductor fabrication processes.

- Europe: Stable growth driven by large-scale collaborative research projects (e.g., ITER) and established industrial applications of plasma and non-thermal processing technologies.

- Middle East & Africa (MEA): Emerging market with growth linked to increasing regional defense procurement and limited adoption of environmental pulsed power technologies.

- Latin America: Growing slowly, primarily driven by investments in national research institutions and nascent industrial applications in high-voltage testing and mining.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pulsed Power Systems Market.- General Atomics

- Kentech Instruments Ltd.

- Applied Pulsed Power Inc.

- MVS Pulsed Power Systems

- ScandiNova Systems AB

- Diversified Technologies Inc. (DTI)

- L3Harris Technologies Inc.

- ABB Ltd.

- TDK Corporation

- Toshiba Corporation

- Alcon Engineering

- Fast-Co. Ltd.

- IXYS Corporation (Littelfuse)

- Lucent Technologies

- Starfire Industries LLC

- RPC, Inc.

- North Star Research Corporation

- Eagle Harbor Technologies

- General Electric

- Sumitomo Electric Industries

Frequently Asked Questions

Analyze common user questions about the Pulsed Power Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the current growth of the Pulsed Power Systems Market?

The market growth is primarily driven by defense applications, particularly the development and deployment of Directed Energy Weapons (DEW) and Electromagnetic Launchers (EML). Significant investments in thermonuclear fusion research and the increasing commercial use of Pulsed Electric Field (PEF) technology in food and water processing are also major contributors.

How is solid-state switching technology impacting the future of pulsed power systems?

Solid-state switching, utilizing materials like SiC and GaN, is revolutionizing PPS by enabling higher pulse repetition frequencies (PRF), significantly improved system reliability, reduced physical size (miniaturization), and longer component lifetimes. This technology is critical for transitioning PPS from single-shot research tools to robust commercial and tactical systems.

Which geographical region holds the largest market share for Pulsed Power Systems, and why?

North America holds the largest market share, predominantly due to vast government funding from the U.S. Department of Defense and the Department of Energy directed towards defense modernization programs, advanced high-energy physics research, and the presence of leading technological integrators and component manufacturers in the region.

What are the key technical challenges restraining market expansion in this sector?

Key restraints include the high manufacturing cost and technical complexity of high-voltage components, particularly specialized high-energy density capacitors and durable switches. Ensuring long-term component reliability under extreme transient electrical stress and effectively mitigating electromagnetic interference (EMI) from high current surges remain significant technical hurdles.

How is pulsed power technology being utilized in the medical and healthcare sector?

In the medical sector, PPS is utilized for non-thermal treatments such as Irreversible Electroporation (IRE) for targeted tumor ablation, plasma sterilization of instruments, and certain drug delivery applications. The focus here is on developing compact, highly precise, and reliable solid-state generators for controlled energy delivery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager