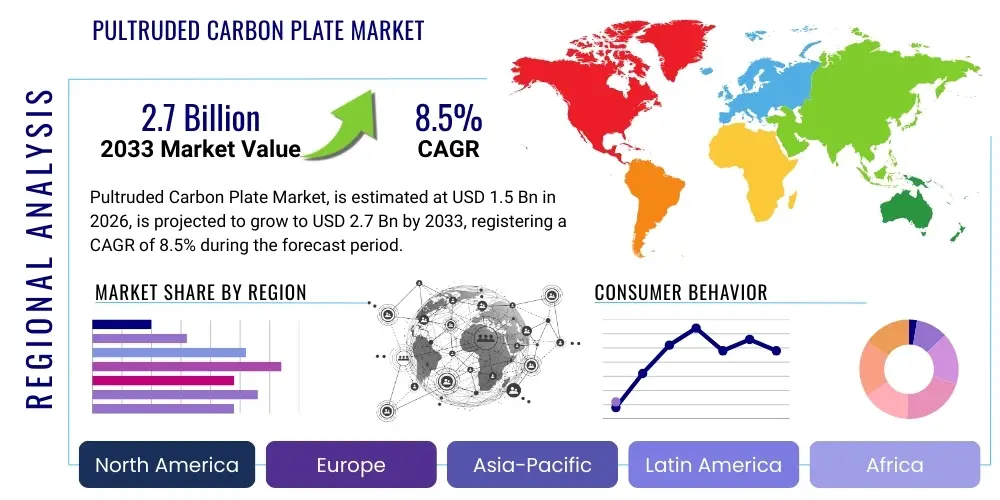

Pultruded Carbon Plate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435962 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Pultruded Carbon Plate Market Size

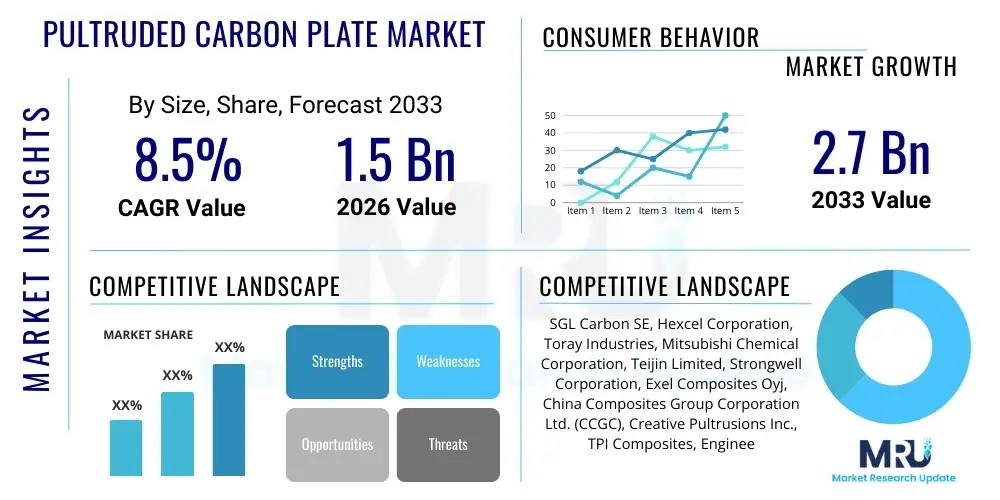

The Pultruded Carbon Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.7 Billion by the end of the forecast period in 2033.

Pultruded Carbon Plate Market introduction

The Pultruded Carbon Plate Market encompasses the global manufacturing, distribution, and utilization of composite plates produced via the pultrusion process, specifically utilizing carbon fibers as the primary reinforcement material. Pultrusion is a highly efficient manufacturing technique that involves pulling continuous fibers, impregnated with a thermosetting resin matrix (such as epoxy, polyester, or vinyl ester), through a heated die to form a rigid, constant-cross-section profile. Pultruded carbon plates are renowned for their exceptional mechanical performance, characterized by high tensile strength, superior stiffness, low density, excellent corrosion resistance, and fatigue life. These attributes make them highly suitable replacements for traditional materials like steel, aluminum, and certain conventional composites in demanding environments.

Major applications for pultruded carbon plates span critical sectors including infrastructure repair and reinforcement (specifically bridge and concrete structural strengthening), aerospace components requiring lightweight yet robust solutions, wind energy (rotor blade stiffeners), automotive lightweighting, and consumer goods demanding high performance (e.g., sporting equipment). The primary benefit derived from these plates is the significant reduction in weight combined with enhanced load-bearing capabilities, directly translating into improved energy efficiency and prolonged structural service life. The manufacturing process ensures precise fiber alignment along the length of the profile, maximizing the utilization of the carbon fiber's anisotropic properties, which provides mechanical advantages unattainable through standard molding techniques.

Driving factors for the sustained market expansion include increasingly stringent regulations concerning fuel efficiency and emissions in the transportation sector, necessitating lightweight material adoption. Furthermore, the global push towards maintaining and rehabilitating aging civil infrastructure, coupled with the rapid growth of the wind energy sector requiring stronger and lighter blade components, significantly accelerates demand. Technological advancements focusing on optimizing resin systems and increasing pultrusion line speeds are simultaneously lowering production costs, making carbon plate solutions more economically viable compared to their high initial costs, thereby broadening their market applicability across various industrial segments globally.

Pultruded Carbon Plate Market Executive Summary

The Pultruded Carbon Plate Market is characterized by robust growth, driven primarily by the global imperative for lightweighting across critical industries and the increasing necessity for long-lasting, high-performance materials in civil engineering applications. Current business trends indicate a strong focus on automated pultrusion technologies, allowing for higher volume production and greater consistency in material quality. Strategic mergers, acquisitions, and technological collaborations among raw material suppliers (carbon fiber producers) and specialized pultruders are defining the competitive landscape, aiming to vertically integrate the supply chain and secure stable access to high-grade carbon precursors. Furthermore, sustainability initiatives are pushing manufacturers to explore bio-based resins or recyclable carbon fiber processes, although thermoset systems currently dominate due to their superior performance characteristics. The demand for customized cross-sections and complex geometries is also rising, moving the market beyond simple rectangular plates to tailored profiles for specific structural reinforcement needs.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure development projects, surging automotive production, and substantial investments in renewable energy infrastructure, particularly in China and India. North America and Europe, while mature markets, maintain significant market share due to the early adoption of advanced composites in aerospace, defense, and structural repair sectors. These regions demonstrate high penetration rates in niche, high-value applications such as seismic retrofitting and specialized industrial machinery. Regulatory environments concerning fire safety and material compatibility are also influencing regional product specifications, particularly in European construction standards, requiring specialized resin formulations. The Middle East and Africa (MEA) are emerging regions, showing potential growth linked to large-scale construction projects and expanding oil and gas exploration infrastructure requiring corrosion-resistant materials.

In terms of segment trends, the infrastructure segment, particularly concrete reinforcement and bridge rehabilitation, remains the dominant application area, driven by governmental spending on aging assets. Material segmentation reveals that plates utilizing high-modulus carbon fibers are gaining traction, especially where absolute stiffness and minimal deflection are paramount, such as in precision machinery and satellite components, despite their higher cost. The epoxy resin segment leads the resin type market due to its excellent adhesion properties, superior strength, and chemical resistance. However, vinyl ester resins are also experiencing increased demand in chemical processing and marine environments where enhanced hydrolytic stability is required. Segment evolution is increasingly characterized by co-pultrusion—combining carbon fiber with glass fiber or aramid—to achieve optimized cost-performance ratios for mass-market applications like automotive body panels and large-scale architectural elements, balancing cost constraints with performance demands.

AI Impact Analysis on Pultruded Carbon Plate Market

User queries frequently center on how Artificial Intelligence (AI) can optimize the notoriously complex pultrusion manufacturing process, specifically targeting defect detection, quality control, and predictive maintenance. Users are keenly interested in leveraging AI for material formulation, asking if machine learning can predict the optimal carbon fiber volume fraction, resin viscosity, and cure profile required to achieve specific anisotropic performance metrics, thereby reducing the dependency on extensive physical prototyping. Furthermore, common questions relate to the supply chain efficiency, exploring AI's role in forecasting raw material price fluctuations (especially for precursor carbon fibers) and optimizing inventory levels for continuous production lines. The key themes summarized across user concerns are achieving zero-defect manufacturing, accelerating material innovation cycles, and enhancing overall operational efficiency to combat the high processing costs historically associated with advanced composites.

- AI-driven Quality Control: Implementation of real-time machine vision systems combined with deep learning algorithms to detect micro-cracks, void content, and fiber misalignment during the pulling process, ensuring instantaneous adjustments and minimizing scrap rates.

- Predictive Maintenance: Utilization of sensor data (temperature, pressure, pull speed) analyzed by AI models to anticipate equipment failure (e.g., die wear, heating element degradation), thereby scheduling proactive maintenance and maximizing uptime.

- Material Optimization: Machine learning algorithms used to simulate and optimize resin-fiber interaction and curing kinetics, enabling rapid development of new composite formulations tailored for specific end-use environments (e.g., high temperature, extreme corrosion).

- Process Parameter Tuning: AI systems dynamically adjust variables such as pull speed, temperature zones, and resin impregnation pressure to maintain optimal processing conditions despite variations in raw material batches or environmental factors, leading to higher throughput.

- Supply Chain Resilience: AI predictive analytics used to forecast carbon fiber availability, manage volatility in precursor material costs, and optimize global logistics, ensuring a smooth and uninterrupted flow of materials for continuous production.

DRO & Impact Forces Of Pultruded Carbon Plate Market

The market dynamics for Pultruded Carbon Plates are primarily driven by the imperative for enhanced performance and durability across critical sectors, counterbalanced by persistent challenges related to cost and complex manufacturing. Key drivers include aggressive lightweighting targets in aerospace and automotive industries, pushing the substitution of traditional metals, and extensive infrastructure repair programs globally utilizing the superior strength-to-weight ratio and corrosion resistance of carbon plates for structural reinforcement (e.g., bridges, concrete structures). Opportunities arise from developing niche applications in electric vehicles (EVs), where battery enclosures and crash structures require specific high-performance, lightweight composites, and the burgeoning urban air mobility (UAM) sector demanding novel structural solutions. The critical restraint remains the high initial cost of carbon fiber raw materials compared to conventional materials, coupled with the capital intensity of establishing high-speed pultrusion facilities, limiting widespread adoption in cost-sensitive applications.

Impact forces significantly shaping the market include the threat of substitutes, particularly advanced thermoset and thermoplastic composites produced via alternative methods (e.g., RTM, autoclave molding) that may offer competitive performance in specific geometries, though often at higher cost or slower rates. Buyer power is moderate; large end-users, especially those in aerospace and defense, dictate stringent quality and certification requirements, placing pressure on pricing and compliance. Supplier power is high, dominated by a few major carbon fiber manufacturers globally, whose pricing and availability directly influence the profitability and stability of the pultrusion market. The intensity of rivalry among existing competitors is moderate to high, centered on process efficiency, patent protection for novel fiber alignments, and market specialization (e.g., focusing solely on specialized infrastructure retrofitting products or aerospace-grade plates).

Technological advancement acts as a crucial enabling force, continuously mitigating the restraints. Innovations in lower-cost precursor materials, development of faster curing resin systems suitable for high-speed pultrusion, and advancements in automated quality inspection are collectively improving the efficiency and reducing the final cost of pultruded carbon plates. Furthermore, increasing regulatory support for sustainable and durable construction materials provides a strong tailwind, compelling construction firms and government agencies to adopt long-life composite solutions. The interplay of these forces suggests a market trajectory favoring specialized, high-performance applications initially, with gradual cost reduction leading to greater penetration in mass-market industrial and consumer applications over the forecast period.

Segmentation Analysis

The Pultruded Carbon Plate Market is extensively segmented based on parameters crucial to material composition, performance characteristics, and end-use application. Key segmentations include classifying the market by Fiber Type (Standard Modulus, Intermediate Modulus, High Modulus), by Resin Type (Epoxy, Vinyl Ester, Polyester), and by Application (Construction & Infrastructure, Wind Energy, Automotive & Transportation, Aerospace & Defense, Industrial, and Sporting Goods). This granular analysis is vital for understanding specific demand drivers; for instance, High Modulus fibers are predominantly used in aerospace and precision industrial applications requiring absolute stiffness, while Epoxy resins dominate due to their superior structural performance and adhesion qualities, especially in construction reinforcement where fatigue resistance is paramount.

Geographic segmentation remains a fundamental differentiator, reflecting regional variances in infrastructure spending, industrial maturity, and regulatory adherence. APAC's dominance is linked to volume-driven construction and wind energy projects, whereas North America and Europe focus on specialized, certified products for aerospace and structural retrofitting. Furthermore, the market can be segmented by profile thickness and width, as standardized and customized dimensions cater to different load requirements and installation methods, influencing pricing and distribution strategies across the global supply chain. The complexity of these segmentations underscores the highly specialized nature of the pultruded composites industry.

- By Fiber Type:

- Standard Modulus (SM)

- Intermediate Modulus (IM)

- High Modulus (HM)

- Ultra-High Modulus (UHM)

- By Resin Type:

- Epoxy

- Vinyl Ester

- Polyester

- Others (Polyurethane, Phenolic)

- By Application:

- Construction & Infrastructure (FRP Reinforcement, Bridge Repair, Seismic Retrofitting)

- Wind Energy (Rotor Blade Stiffeners)

- Automotive & Transportation (Chassis Components, Structural Frames)

- Aerospace & Defense (Internal Structures, Drone Components)

- Industrial (Machinery Components, Corrosion-Resistant Equipment)

- Sporting Goods & Consumer Electronics

- By Profile Geometry:

- Standard Rectangular Plates

- Customized T-Sections and I-Beams (Pultruded Structural Shapes)

Value Chain Analysis For Pultruded Carbon Plate Market

The Pultruded Carbon Plate value chain begins with the upstream segment, dominated by the procurement and manufacturing of key raw materials, primarily carbon fiber (precursors like PAN or pitch) and specialized thermosetting resins (epoxy, vinyl ester). This upstream segment is characterized by high capital investment and advanced chemical processes, leading to significant supplier bargaining power. Fiber manufacturing cost dictates a large proportion of the final product cost, making stable, long-term supply agreements crucial for pultruders. Technological refinement in precursor processing is essential here to improve fiber quality and consistency, which directly impacts the mechanical properties of the final plate. The intermediate stage involves the core pultrusion manufacturers, who convert these raw materials into finished plates using specialized, high-precision machinery. Success in this stage relies heavily on process optimization, quality control (minimizing voids), and intellectual property related to proprietary die designs and continuous manufacturing techniques.

The distribution channel for pultruded carbon plates is bifurcated into direct and indirect routes. Direct distribution is common for large, specialized projects, such as aerospace contracts or major infrastructure reinforcement initiatives, where the pultruder works closely with engineering firms or end-users to provide tailored specifications, certification, and just-in-time delivery. This channel requires specialized sales teams with deep technical knowledge. Conversely, indirect distribution utilizes specialized composite material distributors, industrial suppliers, and regional dealers, particularly for standardized products targeted at smaller construction projects, industrial maintenance, or consumer applications. These intermediaries manage inventory, cut-to-size services, and provide local market access, especially important in fragmented geographical markets where localized inventory is necessary for quick project turnaround.

The downstream analysis focuses on the end-users, which include construction contractors, engineering procurement and construction (EPC) companies, automotive OEMs, aerospace Tier 1 suppliers, and wind turbine manufacturers. Integration within the downstream market is critical, often requiring specific training for installation and handling, particularly in structural repair applications where precise bonding and adherence protocols must be followed. The efficiency of the entire value chain is dictated by the seamless communication between pultruders and application engineers to ensure the material specification meets the stringent operational requirements. Given the focus on durability and structural integrity, traceability and certification documentation, provided throughout the chain, are mandatory for high-value applications, adding significant compliance complexity.

Pultruded Carbon Plate Market Potential Customers

The potential customer base for Pultruded Carbon Plates is highly diverse yet primarily concentrated in sectors requiring extreme durability, high strength-to-weight ratios, and resistance to environmental degradation. Within the Construction & Infrastructure segment, major buyers include governmental transportation departments responsible for bridge and highway maintenance, civil engineering firms specializing in seismic retrofitting of existing structures, and large concrete repair contractors. These customers seek plates for external reinforcement (strengthening beams and columns) to extend the lifespan of aging assets, driven by public safety and economic concerns regarding structural integrity. Their procurement decisions are heavily influenced by material life-cycle cost analysis and adherence to national and international building codes regarding composite reinforcement materials.

Another significant group comprises entities in the renewable energy sector, specifically wind turbine manufacturers and their component suppliers. These customers purchase pultruded plates primarily for use as load-bearing spars and stiffeners within long rotor blades, where minimizing weight while maximizing stiffness is crucial for enhancing energy capture efficiency and reducing operational loads. The increasing size of modern wind turbines necessitates the superior performance characteristics that only carbon fiber pultrusions can reliably deliver. Similarly, the Automotive and Aerospace industries represent key, high-value customers. Automotive OEMs utilize these plates for structural components in high-performance vehicles and increasingly in electric vehicle battery housings and impact protection systems, demanding high production consistency and complex profiles optimized for crash absorption.

Finally, niche industrial and consumer sectors also form important customer segments. Industrial manufacturers use these plates for corrosion-resistant components in chemical processing plants or high-speed machinery where vibration dampening and precise dimensional stability are required. Sporting goods manufacturers, such as those producing high-end bicycles, racing drones, and maritime equipment, seek pultruded plates for their light weight and superior structural performance. For all customer types, the shift towards composite materials is ultimately motivated by total cost of ownership reduction, including lower maintenance requirements and extended asset lifespan, rather than merely the initial purchase price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon SE, Hexcel Corporation, Toray Industries, Mitsubishi Chemical Corporation, Teijin Limited, Strongwell Corporation, Exel Composites Oyj, China Composites Group Corporation Ltd. (CCGC), Creative Pultrusions Inc., TPI Composites, Engineered Composites Ltd., Pultrex, Pultron Composites, FibreGlast Developments Corp., TenCate Advanced Composites, BASF SE, Arkema S.A., AOC Resins, Scott Bader Company Ltd., Gurit Holding AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pultruded Carbon Plate Market Key Technology Landscape

The technological landscape of the Pultruded Carbon Plate Market is continuously evolving, focusing on enhancing processing speed, minimizing defects, and expanding material capabilities. One critical area of innovation is the development of high-speed pultrusion equipment, utilizing radio frequency (RF) or microwave curing techniques instead of traditional thermal ovens. These methods dramatically accelerate the resin curing process, enabling faster line speeds and higher production volumes, thereby improving the cost-effectiveness of carbon pultrusion. Furthermore, advancements in specialized resin formulations, particularly low-viscosity, fast-curing epoxy systems and toughened vinyl ester resins, are necessary to cope with these higher speeds while maintaining optimal fiber wet-out and reducing internal stress within the cured profile. This technological push is essential for carbon pultrusion to compete effectively with high-volume manufacturing methods used for metallic components.

Another major technological thrust is centered on process automation and monitoring. The integration of advanced sensor technology, such as distributed fiber optic sensors or ultrasonic testing equipment, allows for continuous, non-destructive evaluation of the plate quality immediately post-die. These monitoring systems are integrated with computerized process control loops that automatically adjust parameters—like die temperature, pull force, and resin bath level—to maintain precise specifications. Furthermore, innovation in material preparation, including spread tow technologies for carbon fiber tows, is being utilized to improve fiber packing efficiency and uniformity within the plate, leading to higher mechanical performance and reduced material consumption. The precision required for structural aerospace and high-modulus applications necessitates these sophisticated feedback control systems.

The shift towards thermoplastic pultrusion represents a significant emerging technological trend. While thermoset resins (epoxy, vinyl ester) dominate the current market, thermoplastic matrices (e.g., PEEK, PAEK, PP) offer advantages such as faster processing, enhanced impact resistance, and, crucially, recyclability. Thermoplastic pultrusion requires specialized heating and consolidation techniques, often involving in-situ polymerization or localized infrared heating, which are more complex than thermoset curing but align better with circular economy goals. This technology, although currently niche and expensive, promises to unlock new high-volume applications, particularly in the automotive sector, where repairability and end-of-life considerations are increasingly important for long-term material viability.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, propelled by unprecedented investment in infrastructure development, rapid urbanization, and expansive wind energy capacity additions, particularly in China, Japan, and South Korea. China dominates the regional consumption due to its massive construction sector and government initiatives supporting composite utilization in high-speed rail and utility infrastructure. Local manufacturing capabilities are rapidly maturing, driving down production costs and increasing regional self-sufficiency, making it a highly competitive market environment.

- North America: This region is a mature market characterized by high adoption rates in demanding, high-value applications such as aerospace, defense, and structural rehabilitation projects. Demand is stable, driven by stringent safety regulations requiring the retrofitting of aging bridges and buildings against seismic activity. The U.S. remains the central hub, focusing heavily on utilizing intermediate and high-modulus carbon plates for specialized military and commercial aviation programs, where performance outweighs cost concerns.

- Europe: Europe exhibits strong growth rooted in the wind energy sector and rigorous automotive lightweighting targets mandated by EU emissions standards. Germany, Spain, and the Scandinavian countries are key consumers, particularly for carbon plates utilized in wind turbine blade reinforcement. The European market emphasizes sustainability and traceability, leading to higher interest in advanced resins and potentially recyclable thermoplastic pultrusions, setting a benchmark for environmental compliance in composite manufacturing.

- Latin America (LATAM): LATAM is an emerging market with potential concentrated in Brazil and Mexico, linked to oil and gas infrastructure expansion and developing transportation networks. Adoption is currently slower, constrained by economic volatility and higher import costs, but the need for durable, corrosion-resistant materials in tropical coastal environments offers a clear long-term growth trajectory for specialized carbon plates.

- Middle East and Africa (MEA): This region is niche but growing, driven by large-scale commercial construction and the persistent demand for corrosion-resistant solutions in the oil and gas processing infrastructure. High temperatures and corrosive coastal atmospheres necessitate the superior chemical resistance of pultruded composites, making them a strategic choice for critical assets, particularly in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pultruded Carbon Plate Market.- SGL Carbon SE

- Hexcel Corporation

- Toray Industries

- Mitsubishi Chemical Corporation

- Teijin Limited

- Strongwell Corporation

- Exel Composites Oyj

- China Composites Group Corporation Ltd. (CCGC)

- Creative Pultrusions Inc.

- TPI Composites

- Engineered Composites Ltd.

- Pultrex

- Pultron Composites

- FibreGlast Developments Corp.

- TenCate Advanced Composites

- BASF SE

- Arkema S.A.

- AOC Resins

- Scott Bader Company Ltd.

- Gurit Holding AG

Frequently Asked Questions

Analyze common user questions about the Pultruded Carbon Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of pultruded carbon plates over traditional materials like steel or aluminum?

Pultruded carbon plates offer significantly higher strength-to-weight and stiffness-to-weight ratios, leading to substantial weight savings. They provide exceptional corrosion resistance, superior fatigue performance, and low thermal expansion, ensuring greater structural longevity and reduced maintenance costs compared to metals, particularly in harsh or aggressive chemical environments.

Which application segment drives the highest demand for pultruded carbon plates globally?

The Construction and Infrastructure segment is the primary demand driver. These plates are extensively used for structural strengthening, specifically for reinforcing concrete beams and columns in bridges, parking garages, and seismic retrofitting projects, utilizing their high tensile strength to extend the operational life of civil infrastructure assets.

How does the type of carbon fiber modulus affect the performance and cost of pultruded plates?

Fiber modulus (Standard, Intermediate, High) determines the stiffness of the plate. High Modulus (HM) fibers offer maximum stiffness with minimal deflection, crucial for aerospace and precision machinery, but are significantly more expensive. Standard Modulus (SM) fibers are utilized for applications where strength and cost-effectiveness are balanced, such as basic construction reinforcement.

What is the role of continuous manufacturing automation in the Pultruded Carbon Plate Market?

Automation, including high-speed RF curing and integrated AI-driven quality inspection, is essential for reducing processing time, lowering manufacturing defects, and improving batch consistency. This technological refinement helps mitigate the high cost barrier of pultruded composites, enabling scalability necessary for mass-market penetration in sectors like automotive and large-scale industrial use.

What are the key regional growth areas expected for carbon pultrusion adoption between 2026 and 2033?

Asia Pacific (APAC), particularly China and India, is projected to exhibit the highest growth rates due to large-scale infrastructure projects and investment in renewable energy (wind turbine blades). North America and Europe will maintain leadership in high-value, specialized applications like aerospace and defense, driven by technology and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager