Pumpkin Ale Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438588 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Pumpkin Ale Market Size

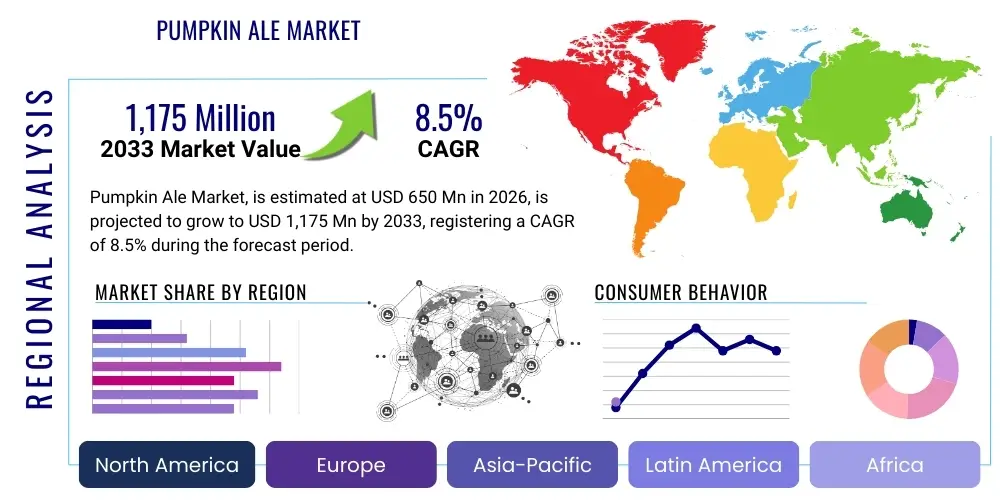

The Pumpkin Ale Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,175 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing consumer preference for seasonal and specialty craft beers, coupled with the rising popularity of limited-edition, flavor-infused alcoholic beverages across major North American and European markets. The market size reflects the compounding effect of expanding distribution channels, particularly in off-trade segments like grocery stores and liquor retailers, catering to the strong seasonal demand from late August through November.

Pumpkin Ale Market introduction

The Pumpkin Ale Market encompasses the production, distribution, and consumption of specialty seasonal beers brewed with pumpkin, pumpkin spices, or natural pumpkin flavorings. This unique market niche thrives primarily during the autumn and early winter months, leveraging the cultural association of pumpkin with the fall harvest and holidays. Pumpkin ales are characterized by their diverse flavor profiles, ranging from subtly spiced, sessionable offerings to strong, imperial varieties, often incorporating cinnamon, nutmeg, allspice, and clove. Major applications include direct consumer consumption in social settings, seasonal culinary pairings, and limited-time offerings in hospitality venues, solidifying their status as a staple in the seasonal craft beer rotation.

The primary benefits driving the market include flavor differentiation, premium pricing potential due to seasonality, and high consumer engagement fostered by limited availability. Driving factors are multifaceted, involving the continued expansion of the global craft beer industry, aggressive seasonal marketing campaigns by major brewers, and growing consumer interest in experimental and localized flavor combinations. Furthermore, the experiential nature of seasonal product launches contributes significantly to sustained market visibility and consumer willingness to pay a premium for these limited-run brews, making them highly profitable for producers during their peak sales window.

Pumpkin Ale Market Executive Summary

The Pumpkin Ale Market exhibits strong seasonality, with peak business trends concentrated in Q3 and Q4, characterized by rapid inventory turnover and heightened marketing expenditure focused on holiday themes. Segment trends highlight a growing preference for higher ABV Imperial Pumpkin Ales and barrel-aged varieties, indicating consumer willingness to invest in premium, complex flavor profiles. The distribution landscape is seeing significant growth in the off-trade channel (retail sales), which capitalizes on bulk purchasing for holiday gatherings, although on-premise consumption remains critical for initial product sampling and brand awareness. Regulatory environments, particularly regarding labeling and ABV limits, influence product formulation and market entry strategies.

Regional trends are dominated by North America, which acts as the primary innovation and consumption hub for pumpkin ales, driven by established craft brewing cultures and deeply ingrained autumnal traditions. Europe, while smaller, is demonstrating rapid acceptance, particularly in the UK and Germany, where local brewers are adapting the style to European palates. Investment in sustainable sourcing of seasonal ingredients and optimizing cold chain logistics for global distribution are critical competitive factors shaping the overall market structure. The market is moderately consolidated, with large macro-brewers increasingly leveraging their extensive distribution networks to compete with artisanal craft breweries during the crucial seasonal window.

AI Impact Analysis on Pumpkin Ale Market

User queries regarding AI's influence predominantly center on how brewers can use predictive analytics to optimize the highly constrained supply chain inherent to seasonal ingredients, specifically focusing on pumpkin and spice sourcing reliability, and minimizing inventory waste post-season. Key themes also involve personalized marketing (identifying consumers most likely to purchase high-priced seasonal items), dynamic pricing strategies based on weekly demand fluctuations, and employing AI in brewing systems for quality assurance and flavor consistency across limited-edition batches. Users are highly concerned about maintaining the artisanal quality of craft beer while adopting large-scale, automated intelligence, seeking solutions that enhance rather than homogenize seasonal variability.

AI is set to revolutionize the efficiency and responsiveness of the Pumpkin Ale supply chain, offering unparalleled precision in forecasting seasonal demand based on granular, localized historical sales data, weather patterns, and social media sentiment analysis. Furthermore, machine learning models can assist master brewers in optimizing fermentation parameters and ingredient combinations, ensuring batch-to-batch flavor stability for highly sensitive spice mixtures, thereby maintaining brand reputation during the critical seasonal rush. This integration moves the industry toward a more agile, demand-driven model, mitigating the significant risks associated with perishable seasonal stocks and enhancing profitability by reducing end-of-season write-offs.

The adoption of AI-driven customer relationship management (CRM) platforms allows brewers to segment their consumer base not just geographically, but based on past purchasing behavior of similar seasonal or high-ABV products. This allows for highly targeted, AEO-optimized digital marketing campaigns that maximize conversion rates during the short sales window. The ability of AI to rapidly analyze point-of-sale data across disparate retail and on-trade locations provides brewers with real-time insights into regional performance, allowing for immediate reallocation of inventory to high-demand areas, a capability crucial for maximizing the yield of a time-sensitive, seasonal product like pumpkin ale.

- Predictive modeling for accurate seasonal demand forecasting and minimizing inventory overhang post-season.

- Optimization of raw material sourcing and logistics for high-variability ingredients (pumpkins and spices).

- AI-enhanced quality control systems ensure flavor profile consistency across various brewing locations and seasonal batches.

- Personalized marketing and dynamic pricing algorithms maximize consumer engagement and revenue during the limited sales window.

- Automated trend detection helps identify emerging consumer preferences for specific spice combinations or barrel aging techniques.

- Efficiency improvements in packaging lines and bottling processes using computer vision systems to maintain high output rates during peak demand.

- Enhanced supply chain visibility and risk management related to extreme weather impacting pumpkin harvest yields.

DRO & Impact Forces Of Pumpkin Ale Market

The Pumpkin Ale Market is driven by strong consumer demand for seasonal novelty and premium craft offerings, benefiting from effective holiday marketing synergy. However, growth is restrained by extreme seasonality, leading to challenging inventory management and high production costs associated with real pumpkin usage versus flavor extracts. Opportunities lie in geographical expansion into emerging craft beer markets, diversification into lower-calorie or low-alcohol seasonal options, and innovative barrel-aging techniques that extend the product's shelf life and premium value. Impact forces, including economic volatility affecting discretionary consumer spending and regulatory shifts in alcohol taxation and distribution laws, strongly influence market access and profitability margins, compelling brewers to adopt lean manufacturing and targeted seasonal strategies.

Segmentation Analysis

The Pumpkin Ale market is primarily segmented based on the type of ale, the distribution channel utilized for sales, the packaging format preferred by consumers, and geographical region. Type segmentation includes Traditional Pumpkin Ale (standard ABV), Imperial Pumpkin Ale (high ABV, often barrel-aged), and Specialty Spice Blends. Distribution channels are critically divided between On-Trade (bars, restaurants) and Off-Trade (retail, liquor stores), with the latter dominating due to seasonal bulk purchases. Packaging segments highlight the ongoing shift towards cans for better preservation and portability, although bottles retain a premium image, particularly for barrel-aged variants. Geographic segmentation reflects the deep penetration in North America versus the emerging status in Asian and Latin American markets.

- By Type:

- Traditional Pumpkin Ale (Standard ABV 5-7%)

- Imperial Pumpkin Ale (High ABV 8%+)

- Barrel-Aged Pumpkin Ale

- Pumpkin Wheat/Lager Hybrids

- By Distribution Channel:

- On-Trade (Restaurants, Bars, Pubs)

- Off-Trade (Retail Stores, Liquor Shops, Supermarkets, Online Sales)

- By Packaging:

- Bottles (12 oz, 22 oz)

- Cans (12 oz, 16 oz)

- Kegs/Draught

- By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Pumpkin Ale Market

The value chain for Pumpkin Ale is highly specialized due to its seasonal ingredient requirements. Upstream analysis focuses on sourcing quality malts, hops, water, and the critical seasonal components: pumpkin pulp (or puree) and specific autumnal spices (cinnamon, ginger, nutmeg). The volatility and seasonality of the pumpkin harvest necessitate strong contractual relationships and forward purchasing by brewers. The central transformation phase involves complex brewing processes, often requiring specialized equipment for spice extraction and blending, followed by rapid packaging and quality control checks to meet the limited market window. Efficient cold chain management during this phase is paramount to maintaining product integrity.

Downstream analysis is dominated by logistics and distribution, where speed is crucial. Due to the limited sales window (typically 10-12 weeks), brewers rely heavily on established regional distribution networks, both direct and indirect, to push products quickly onto retailer shelves and into on-trade locations by early fall. Indirect channels, primarily utilizing large third-party distributors and wholesalers, account for the majority of volume due to their reach and efficiency. Direct sales (brewery taprooms, online ordering) serve as vital customer touchpoints for launching new variants and generating brand loyalty. Retail placement and shelf visibility are fiercely contested during the seasonal launch period.

The final stage involves intense marketing and promotional activities centered around holidays (Halloween, Thanksgiving). Retailers, as potential customers, benefit from the high-margin, high-turnover nature of the product, often giving it prominent end-cap or seasonal displays. Consumer feedback gathered at this stage, particularly through social media and retail data, feeds back into the upstream process for flavor adjustment and forecasting for the subsequent year. Optimization across the entire value chain is focused on mitigating the high risk associated with holding unsold inventory once the seasonal demand dissipates.

Pumpkin Ale Market Potential Customers

The primary customer base for Pumpkin Ale consists of craft beer aficionados aged 25-55 who actively seek out limited-edition, flavor-forward seasonal offerings and demonstrate a higher willingness to pay a premium for specialty brews. This group values novelty and the experiential connection of the product to specific cultural moments (autumn, holidays). Secondary customers include general consumers seeking festive, easy-to-drink options for social gatherings and cooking, typically purchasing through off-trade channels. Targeted marketing emphasizes the unique spice profile and the sense of scarcity associated with seasonal releases, appealing directly to consumers interested in culinary pairings and celebrating traditional fall activities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,175 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boston Beer Company, Anheuser-Busch InBev, Dogfish Head Brewery, Elysian Brewing Company, Harpoon Brewery, New Belgium Brewing Company, Samuel Adams, Shipyard Brewing Company, Heavy Seas Beer, Schlafly Beer, Rogue Ales, Founders Brewing Co., Southern Tier Brewing Company, Uinta Brewing, Peak Organic Brewing Co., Two Roads Brewing Company, Troegs Independent Brewing, Sierra Nevada Brewing Co., Goose Island Brewery, Wachusett Brewing Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pumpkin Ale Market Key Technology Landscape

The technology landscape for Pumpkin Ale production focuses heavily on precision brewing systems designed to handle adjunct ingredients and optimize flavor extraction without compromising yeast health or beer stability. Advanced mash filtration technologies, such as mash filters, are crucial for efficiently processing pumpkin puree and minimizing clogging, thereby improving yield and throughput during the intense seasonal production period. Furthermore, sophisticated spice infusion systems, often incorporating controlled temperature recirculation or specialized steeping vessels, ensure consistent extraction of volatile flavor compounds (like cinnamaldehyde and eugenol) across large batches, a critical factor for maintaining brand integrity in a flavor-driven market segment.

Beyond the core brewing process, the implementation of sophisticated monitoring and control systems—including dissolved oxygen (DO) sensors, precise fermentation temperature controls, and automated cleaning-in-place (CIP) regimes—is essential for maximizing product quality and minimizing oxidation risks, particularly important for high-gravity, spiced beers which are prone to flavor degradation. Modern packaging technologies, specifically high-speed canning lines utilizing double seam quality inspection systems and advanced pasteurization tunnels (where applicable), are paramount for rapid deployment into the off-trade segment and ensuring product freshness throughout the distribution chain, aligning with consumer preference for canned craft beers.

In terms of data management, brewers are increasingly adopting enterprise resource planning (ERP) systems customized for seasonal inventory tracking and forecasting, integrating raw material supply (pumpkins, malt) with finished goods distribution projections. These systems leverage cloud computing and IoT sensors within fermentation tanks and warehouse storage to provide real-time operational visibility. The rapid adoption of direct-to-consumer (D2C) e-commerce platforms, secured by advanced cybersecurity protocols, represents another key technological trend, enabling brewers to bypass traditional distribution constraints and capitalize directly on hyper-local seasonal demand surges and limited-release promotions, significantly enhancing profit margins.

Regional Highlights

North America (NA) stands as the undisputed leader in the Pumpkin Ale Market, accounting for the largest market share in terms of both volume and value. This dominance is attributed to the mature craft beer culture, strong consumer loyalty toward seasonal releases, and the deep cultural integration of pumpkin-flavored products during the fall season (driven heavily by the US and Canada). Major brewers and small craft breweries alike participate intensely in this segment, using it as a benchmark for seasonal success. Distribution networks are highly evolved, ensuring rapid market saturation during the crucial 8-10 week sales period, supported by aggressive retail promotions and seasonal media campaigns which reinforce consumer purchasing habits.

Europe represents the fastest-growing market region for Pumpkin Ale, though starting from a smaller base. Key adoption areas include the United Kingdom, Germany, and Scandinavia, where craft beer movements are robust and consumers are increasingly receptive to flavored and seasonal novelty brews. European consumption often leans towards lower ABV, sessionable pumpkin ales, though imported US imperial varieties hold a significant premium niche. Challenges in Europe include regulatory hurdles regarding adjunct ingredient labeling and less ingrained seasonal consumer habits compared to North America, requiring brewers to focus more intensely on education and taste-profile adaptation to local preferences.

Asia Pacific (APAC) remains a nascent market, but offers substantial long-term opportunity driven by rising disposable incomes and the increasing Westernization of consumption patterns, particularly in urban centers of Japan, Australia, and South Korea. Current demand is predominantly met by imports, targeting expatriate communities and high-end consumers seeking global specialty products. Local production is minimal but emerging, focused on fusion flavors that might incorporate regional spices alongside traditional pumpkin notes. The Middle East and Africa (MEA) and Latin America (LATAM) markets are highly restricted by differing alcohol regulations and lower intrinsic demand for pumpkin-centric flavor profiles, limiting growth primarily to high-tourism areas and specialized metropolitan centers.

- North America (NA): Market dominant; high consumer engagement; mature craft beer infrastructure; rapid seasonal inventory turnover; innovation hub for barrel-aged variants.

- Europe: Rapidly emerging growth market; focus on sessionable ABV; challenges in regulatory environment and establishing seasonal traditions; strong uptake in the UK and Northern Europe.

- Asia Pacific (APAC): Nascent market driven by imports; potential for long-term growth in affluent urban areas; local brewers experimenting with flavor adaptations.

- Latin America (LATAM): Niche consumption focused on metropolitan areas and tourism hotspots; regulatory variation poses significant market entry barrier.

- Middle East & Africa (MEA): Minimal presence due to stringent alcohol regulations; limited sales primarily within specialized hotels and duty-free zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pumpkin Ale Market.- Boston Beer Company

- Anheuser-Busch InBev

- Dogfish Head Brewery

- Elysian Brewing Company

- Harpoon Brewery

- New Belgium Brewing Company

- Samuel Adams

- Shipyard Brewing Company

- Heavy Seas Beer

- Schlafly Beer

- Rogue Ales

- Founders Brewing Co.

- Southern Tier Brewing Company

- Uinta Brewing

- Peak Organic Brewing Co.

- Two Roads Brewing Company

- Troegs Independent Brewing

- Sierra Nevada Brewing Co.

- Goose Island Brewery

- Wachusett Brewing Company

Frequently Asked Questions

Analyze common user questions about the Pumpkin Ale market and generate a concise list of summarized FAQs reflecting key topics and concerns.When is the peak sales season for Pumpkin Ale?

The peak sales season for Pumpkin Ale strictly aligns with autumn, typically launching in late August and reaching maximum distribution and consumer demand throughout September, October, and early November, coinciding with seasonal holiday promotions.

What are the primary ingredients used in modern Pumpkin Ales?

Modern Pumpkin Ales generally use a base of malted barley, hops, water, yeast, and often incorporate real pumpkin puree or concentrated pumpkin flavoring, alongside traditional autumnal spices such as cinnamon, nutmeg, allspice, and clove for characteristic flavor profiles.

Which distribution channel dominates the sales of seasonal Pumpkin Ale?

The Off-Trade channel, including supermarkets, liquor stores, and specialized retail outlets, dominates Pumpkin Ale sales volume, primarily driven by consumer bulk purchasing for home consumption and holiday gatherings during the short seasonal window.

How does the high seasonality of Pumpkin Ale affect inventory management for brewers?

Extreme seasonality necessitates highly accurate demand forecasting and aggressive, rapid distribution, as unsold inventory post-Thanksgiving often leads to significant write-downs, forcing brewers to utilize AI and predictive analytics to minimize waste and maximize seasonal efficiency.

Are there low-calorie or non-alcoholic options available in the Pumpkin Ale segment?

While the segment is traditionally high-calorie, innovation is driving the emergence of low-calorie Pumpkin Ales and specialized craft brewers are beginning to introduce non-alcoholic or low-ABV seasonal spiced brews to capture health-conscious consumers and expand market accessibility.

The intricate supply chain of the Pumpkin Ale market demands precise planning due to the highly volatile nature of its core seasonal ingredients, primarily pumpkins and specific spices which see significant price fluctuations and supply risks related to agricultural yields and global sourcing conditions. The upstream segment must meticulously manage contracts with regional farms and international spice providers to ensure sufficient volume and consistent quality within a narrow procurement window, often months ahead of the brew date. This complexity directly impacts the final cost structure and limits the ability of smaller brewers to compete on scale, favoring those with established, diversified sourcing networks and robust supply chain resilience planning.

The integration of digital tracking systems across the value chain, from fermentation monitoring to final distribution route optimization, is increasingly vital for brewers aiming for maximum efficiency. These systems provide end-to-end visibility, allowing for proactive adjustments to unexpected seasonal disruptions, such as late harvests or sudden spikes in localized consumer demand. The use of advanced analytics to model the optimal time for product release based on predictive climate data and competitor launch timings further highlights the technological sophistication now required to master this highly competitive, time-sensitive seasonal market segment. The effectiveness of the value chain is therefore measured not just by cost efficiency, but by the speed and precision with which products move from tank to consumer shelf within the defined autumnal window.

Regarding market penetration, the Pumpkin Ale segment is heavily influenced by experiential marketing that ties the product to cultural autumn themes. Retailers play a crucial role as gatekeepers, utilizing specialized seasonal displays and cross-promotional strategies (e.g., pairing with fall desserts) to maximize visibility and impulsive purchasing. The increasing role of e-commerce and direct-to-consumer sales, facilitated by technology, allows craft brewers to gather invaluable first-party data, bypassing traditional distributor information lags and enabling real-time iterative improvements to product packaging, flavor profiles, and regional marketing efforts, thereby creating a more responsive and consumer-centric value chain structure.

The ongoing expansion of the craft beer market globally continues to serve as a primary catalyst for the growth of the Pumpkin Ale segment. As consumers become more sophisticated in their beer preferences, they actively seek out variety and limited-time offerings that mark specific times of the year, establishing a ritualistic demand for seasonal specialty products. This trend encourages brewers to constantly innovate within the pumpkin ale category, introducing variations such as sours, stouts, and lactose-infused options, which keeps the segment fresh and attracts new consumers who might not typically prefer traditional ales. Moreover, the inherent storytelling potential of a seasonal brew, linked to harvest traditions and holiday celebrations, provides unique marketing leverage that transcends standard product advertising.

Conversely, the primary restraint remains the highly volatile nature of raw material pricing and the inherent challenge of predicting the exact volume of seasonal demand. Pumpkins, being an agricultural commodity, are susceptible to weather and disease, leading to unpredictable supply costs. Furthermore, the reliance on internationally sourced spices adds logistical complexity and price instability. This forces brewers to make significant financial commitments months in advance, bearing the risk of either overstocking expensive seasonal ingredients or facing shortages during peak demand, both scenarios negatively impacting profitability. Effective risk mitigation strategies, including ingredient substitution research and futures contracting, are essential for financial stability in this niche.

Opportunities for market stakeholders center around geographical diversification and product premiumization. While North America is saturated, untapped potential exists in secondary European markets and rapidly developing APAC regions where seasonal craft consumption is escalating. Furthermore, the trend toward higher-end, barrel-aged Imperial Pumpkin Ales offers significant opportunities for increased average selling prices and higher margin returns. These premium variants extend the perceived value and shelf life of the product, positioning it as a collectible or celebratory item rather than just a transitory seasonal offering. Investment in sustainable and locally sourced ingredients also aligns with modern consumer values, presenting a powerful differentiation opportunity.

The Pumpkin Ale segment’s profitability is significantly influenced by impact forces related to consumer health trends and regulatory changes. Growing interest in low-alcohol and low-sugar beverages requires brewers to reformulate traditional recipes, balancing rich seasonal flavor with modern health metrics, a complex technological challenge. Additionally, shifting government excise taxes on alcohol, particularly on higher ABV beverages (Imperial Ales), directly affects retail pricing and consumer affordability. Navigating these external pressures requires brewers to maintain operational flexibility and adopt transparent labeling practices to sustain consumer trust and compliance across diverse international markets, ensuring the long-term viability of seasonal releases.

The segment concerning packaging is seeing substantial shifts, driven by environmental concerns and consumer convenience. Cans are rapidly gaining market share over traditional glass bottles, even for premium craft products, due to their superior protection against light and oxygen (critical for spice-heavy beers), lighter weight for distribution, and recyclability. Brewers are investing heavily in mobile canning units or dedicated high-speed lines to meet this demand, ensuring the Pumpkin Ale can be distributed widely and rapidly in formats favored by the off-trade consumer. However, bottles still maintain a presence, often reserved for high-end, 750ml, or barrel-aged special releases that emphasize a communal or cellar-worthy appeal, catering to the segment of consumers seeking a ceremonial or gifting product.

The definition of Traditional Pumpkin Ale centers on balance, offering a moderate ABV (typically 5% to 7%) with subtle, well-integrated spice notes that complement the malt character without overwhelming it. These are generally designed for sessionability and broad appeal, serving as entry-points into the seasonal category for many consumers. Conversely, Imperial Pumpkin Ales push boundaries with higher alcohol content (often 8% ABV and above), intense spice additions, and richer, often sweeter bodies. This segment targets experienced craft beer drinkers seeking complexity and intensity, often commanding a higher price point and benefiting from aging potential. The complexity in flavor profiles across these types necessitates specialized yeast strains and temperature control protocols in the brewing process.

The innovation into Barrel-Aged Pumpkin Ale represents the ultra-premium tier of the market. This process involves aging the finished ale in whiskey, bourbon, or rum barrels for several months, which contributes deep vanilla, oak, and spirits notes that interact with the pumpkin spices. This extended aging process moves the consumption window slightly past the immediate autumn peak and into the winter months, offering brewers a strategy for market segmentation and product longevity. This segment requires high initial capital investment in specialized barrel storage facilities and meticulous quality monitoring to prevent spoilage, but yields high margins due to the scarcity and desirability among collectors and serious enthusiasts.

In the context of the Distribution Channel segmentation, the critical distinction between On-Trade and Off-Trade performance is crucial for inventory planning. On-Trade sales provide essential brand exposure, allowing consumers to sample new seasonal releases via draught before committing to purchasing packaged formats. Bars and restaurants often curate unique seasonal pairings, driving premium consumption experiences. However, the Off-Trade channel provides the necessary volume throughput to make the seasonal release economically viable. Retailers' purchasing decisions are often made months in advance based on previous years' performance and forecasted holiday foot traffic, meaning brewers must secure shelf space early and execute impactful point-of-sale displays to capture the consumer's limited attention span during the busy seasonal shopping periods.

Further analysis of the North American market highlights several micro-trends contributing to its dominance. Craft breweries utilize local pumpkin varieties, fostering a regional pride in their seasonal releases (e.g., specific farm partnerships in New England or the Pacific Northwest). Marketing efforts often focus on the limited-time nature of these hyper-local brews, driving immediate consumer action. Moreover, the existing infrastructure for beer festivals and seasonal tastings throughout the fall provides dedicated platforms for sampling and large-scale promotion, mechanisms that are less developed in emerging markets. Regulatory consistency across major US states regarding labeling and alcohol content, although complex, facilitates broader distribution for key national players during the peak season.

The burgeoning European interest is heavily influenced by cross-cultural exchange and the globalization of food trends. In countries like Ireland and the Netherlands, where strong traditional brewing industries exist, local craft brewers are adapting the pumpkin ale concept by substituting or complementing traditional American spice blends with European flavor profiles or regional malt varieties. This localization effort is key to overcoming the initial consumer reluctance towards what might be perceived as an overtly 'American' flavor. Success in Europe hinges on demonstrating that the pumpkin ale is a complex, balanced craft beer, not just a flavored novelty, often achieved through collaborations with established European breweries or participation in major European beer competitions and festivals, validating the quality of the seasonal offering.

For APAC markets, particularly those with a growing middle class in East Asia, the barrier to entry is high logistical costs and consumer unfamiliarity with the flavor. Brewers must rely on specialized importers who can navigate complex import tariffs and cold chain requirements for long-distance shipping. The target consumer segment here is typically younger, highly educated, and receptive to unique, high-status Western products. Strategic market entry involves focusing on major cities (e.g., Tokyo, Shanghai, Sydney) and utilizing premium positioning, often bundling pumpkin ale with other specialty US or European craft beers to introduce the style gradually to an adventurous, affluent consumer base. The long-term success requires local breweries to step in and produce Asian-centric versions, reducing reliance on expensive imports and adapting the product to local tastes, possibly integrating ingredients like ginger or yuzu.

The technological requirement for precise flavor extraction cannot be overstated in this market. The delicate balance of cinnamon, nutmeg, and clove must be consistent across millions of gallons brewed annually by major players. Technological solutions, such as automated dosing systems and spectrophotometry for real-time color and turbidity analysis, ensure that the final product adheres strictly to the brand's established flavor profile. This automation reduces human error in adding highly potent spice extracts, which could otherwise ruin an entire batch. Furthermore, advanced yeast management systems, which track cell vitality and health during the stress of high-gravity, spiced fermentation, are crucial for achieving the desired final ABV and flavor attenuation, confirming the indispensable role of modern brewing technology in meeting high seasonal demand with consistent quality.

Consumer engagement technologies, including augmented reality (AR) features on packaging and QR codes linking to virtual brewery tours or seasonal cocktail recipes, are increasingly being adopted to enhance the Pumpkin Ale experience. These digital tools provide an added layer of interactivity that leverages the limited-edition status of the product, fostering social media sharing and direct brand loyalty. Data gathered from these interactions—such as geo-location of scans, viewing habits, and recipe downloads—feeds back into the marketing strategy, allowing brewers to refine their target audience demographics for the following year. This sophisticated integration of digital technology into physical product packaging is a hallmark of successful seasonal marketing in the craft beverage sector.

Finally, the sustainable sourcing and production aspect, driven by consumer ethical concerns, is becoming a key differentiator. Brewers utilizing blockchain technology to track the provenance of their pumpkins and spices can offer a level of transparency that appeals to the environmentally conscious consumer. Energy-efficient brewing processes, water conservation technologies, and the use of locally sourced ingredients (reducing transportation emissions) are not just operational best practices but powerful marketing tools that align the seasonal product with broader sustainability narratives. This trend confirms that future market success will depend on both flavor quality and ethical supply chain execution, demanding continuous technological and strategic refinement within the highly seasonal Pumpkin Ale Market structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager