Puppy Potty Pad Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433860 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Puppy Potty Pad Market Size

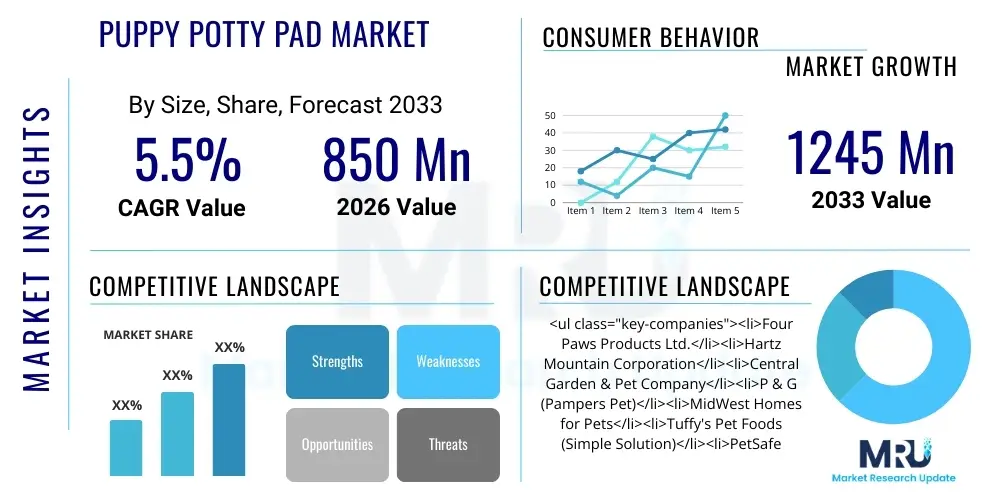

The Puppy Potty Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1245 Million by the end of the forecast period in 2033.

Puppy Potty Pad Market introduction

The Puppy Potty Pad Market encompasses products designed primarily for the hygienic training and confinement of puppies and small domestic pets, focusing on convenience for pet owners living in urban environments or those who require indoor elimination solutions. These products, typically constructed from super-absorbent polymers (SAPs), wood pulp, and non-woven fabric backing, serve as essential tools for housebreaking, offering superior leak protection and odor neutralization compared to traditional newspaper methods. Major applications include training new puppies, assisting aging or incontinent dogs, and providing a clean solution for pets during extreme weather or when owners are away for extended periods. The primary benefit lies in simplifying the house training process, promoting sanitation, and protecting household flooring. Driving factors include the continuous rise in pet ownership globally, the increasing humanization of pets leading to greater expenditure on specialized pet care products, and the ongoing trend of urbanization, which necessitates indoor sanitation methods for apartment living.

Puppy Potty Pad Market Executive Summary

The executive summary highlights robust business trends driven by innovation in materials science, focusing heavily on sustainability and enhanced absorbency. Key trends include the proliferation of biodegradable and bamboo-based pads, the integration of activated charcoal for superior odor control, and the expansion of smart pad technologies utilizing sensors for monitoring pet usage and health. Regional trends indicate North America and Europe retaining market dominance due to high disposable incomes and high pet ownership rates, while the Asia Pacific region, particularly China and India, exhibits the highest growth potential fueled by rapid urbanization and the emerging middle class adopting smaller companion animals. Segment trends show significant acceleration in the premium segment (eco-friendly and highly absorbent pads) and the e-commerce distribution channel, which offers greater consumer convenience, subscription models, and lower logistical costs compared to traditional brick-and-mortar retail.

AI Impact Analysis on Puppy Potty Pad Market

User queries regarding AI in the Puppy Potty Pad market primarily revolve around optimizing supply chain efficiency, personalizing product recommendations, and integrating AI into smart pet care devices. Users seek to understand how machine learning can predict regional demand fluctuations, minimizing waste and optimizing inventory levels across diverse geographic markets. Concerns also center on AI-driven diagnostics, such as integrating ML algorithms into smart potty pads to analyze elimination patterns, track potential urinary tract infections (UTIs) or kidney issues, and alert owners or veterinarians proactively. The primary expectation is that AI will shift the product from a simple consumable item to an integral part of pet health monitoring, enhancing customer retention through tailored subscription services and automated replenishment based on real-time usage data collected via smart devices and centralized platforms.

- AI optimizes manufacturing processes by predictive maintenance, reducing downtime and material waste in pad production.

- Machine learning algorithms enhance supply chain logistics, accurately forecasting localized demand shifts for different pad types (e.g., standard vs. activated charcoal).

- AI-powered e-commerce platforms personalize subscription box contents and delivery schedules based on pet age, breed, and historical consumption rates (AEO/GEO focused personalization).

- Integration of sensor technology and AI enables smart potty pads to monitor pet weight, frequency, and volume of urination, providing early health insights.

- Natural Language Processing (NLP) improves customer service chatbots, offering instantaneous, accurate advice on house-training techniques correlated with specific pad features.

DRO & Impact Forces Of Puppy Potty Pad Market

The market is predominantly driven by increasing pet population and the urbanization trend, compelling pet owners to seek convenient indoor solutions. Restraints include the significant environmental impact associated with disposable, non-biodegradable polymer materials, leading to pressure from consumer groups for sustainable alternatives. Opportunities are emerging through the development and commercialization of eco-friendly products, such as pads made from recycled paper, bamboo, or plant-based plastics, coupled with novel marketing strategies targeting environmentally conscious millennials and Gen Z pet owners. Impact forces such as changing regulatory standards regarding plastic waste, fluctuations in raw material prices (wood pulp, SAP), and intense competition leading to pricing pressures are constantly reshaping the market landscape, pushing manufacturers towards proprietary odor-control technologies and enhanced value propositions.

Segmentation Analysis

The Puppy Potty Pad market is extensively segmented based on criteria such as product type, material composition, distribution channel, and application, reflecting the diverse needs of the global pet-owning population. Product type segmentation distinguishes between standard absorbent pads, specialized activated charcoal pads designed for superior odor absorption, and technologically advanced smart pads. Material composition is increasingly vital, separating traditional polymer-based pads from the rapidly growing eco-friendly alternatives. Distribution channels categorize sales through mass retailers, specialized pet stores, and the burgeoning online/e-commerce sector. This detailed segmentation allows manufacturers to target specific demographic and economic strata, tailoring marketing efforts towards premium buyers seeking sustainability or budget consumers prioritizing cost-effectiveness and bulk purchasing options.

- By Product Type: Standard Potty Pads, Activated Charcoal Pads, Grass Pads (Synthetic), Smart Potty Pads.

- By Material: Polymer-Based (SAP), Wood Pulp, Bamboo/Natural Fiber, Recycled Paper.

- By Size/Absorbency: Small, Medium, Large, Extra Large (High Absorbency).

- By Distribution Channel: Offline (Specialty Pet Stores, Mass Retailers, Veterinary Clinics), Online (E-commerce Portals, Company Websites, Subscription Services).

- By Application: Puppy Training, Senior Dog Care, Travel Use, Indoor Confinement.

Value Chain Analysis For Puppy Potty Pad Market

The value chain for puppy potty pads begins with upstream analysis, focusing heavily on sourcing key raw materials, primarily Super Absorbent Polymers (SAPs), wood pulp (fluff), non-woven fabrics, and plastic liners. Efficiency at this stage is crucial, as raw material cost volatility significantly impacts final product pricing. Manufacturers are increasingly prioritizing supply agreements with biodegradable polymer producers and sustainable forestry operations to hedge against environmental risks and meet evolving consumer demands for eco-friendly products. Innovation in the upstream sector is driven by developing SAP alternatives that offer higher absorbency rates and faster liquid transformation into gel.

Midstream activities involve the conversion process, encompassing sterilization, material lamination, cutting, and packaging. Modern manufacturing facilities utilize high-speed automation to ensure quality consistency and meet large volume demands efficiently. Quality control, particularly regarding leak protection and odor neutralization properties, is a key competitive differentiator at this stage. Effective process management minimizes operational waste, which is vital given the slim profit margins often associated with high-volume, disposable consumer goods.

Downstream analysis covers the distribution channel, which is bifurcated into direct sales (e.g., brand websites offering subscriptions) and indirect sales (retailers and e-commerce giants). The e-commerce channel dominates due to the bulky nature of the product, making subscription models highly attractive for consumers seeking automated replenishment. Strong logistics capabilities and strategic warehousing are essential to manage high turnover and reduce shipping costs, while marketing efforts focus on Search Engine Optimization (SEO) and Answer Engine Optimization (AEO) to capture consumer searches related to "house training tips" or "best puppy pads for apartments."

Puppy Potty Pad Market Potential Customers

The primary end-users of puppy potty pads are households with new puppies (the largest demographic), particularly those residing in urban or suburban apartments where immediate outdoor access is limited or inconvenient. These consumers prioritize ease of use, high absorbency, and effective odor masking during the critical initial months of house training. The rising trend of pet humanization among Millennials and Gen Z contributes significantly, as these buyers are often willing to pay a premium for specialized features like pheromone attractants embedded in the pads or sustainable materials.

A secondary, yet rapidly growing, customer segment includes owners of senior, aging, or chronically ill dogs that suffer from incontinence or mobility issues. For this group, the primary focus shifts from training to comfort and ongoing hygienic management. Pads must be extra-large, highly durable, and designed for long periods of use, offering maximum protection for expensive flooring and bedding. Veterinary clinics and professional pet care facilities (groomers, boarding kennels) also represent significant institutional buyers, demanding bulk quantities of reliable, standard-grade pads for general use and post-operative recovery.

Furthermore, small pet owners, including those with rabbits, ferrets, or guinea pigs, often utilize smaller pads for cage lining and cleanup, expanding the market scope beyond strictly canine applications. The emphasis for all segments remains on convenience, hygiene, and environmental accountability, influencing purchasing decisions towards brands that offer both functionality and sustainable packaging or material sourcing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1245 Million |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered |

|

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Puppy Potty Pad Market Key Technology Landscape

The technology landscape of the Puppy Potty Pad market is predominantly focused on material science and absorption engineering, aimed at maximizing liquid retention while minimizing bulkiness. Core technology utilizes Super Absorbent Polymers (SAPs), which are capable of absorbing hundreds of times their weight in liquid and converting it into a stable gel, preventing tracking and runoff. Recent innovations involve developing multi-layer designs that integrate advanced fluff layers (often specialized wood pulp) and tear-resistant, high-density polyethylene (HDPE) plastic backing to ensure superior leak protection, crucial for premium product lines targeting urban dwellers with delicate flooring.

A secondary, high-growth technological area involves odor control and attractant integration. Odor control technologies range from simple baking soda inclusion to complex activated carbon (charcoal) layers embedded within the pad matrix, chemically neutralizing ammonia-based odors rather than merely masking them. Furthermore, proprietary pheromone technology is utilized to integrate dog-attracting scents into the pads, ensuring that puppies instinctively recognize the pad as the designated elimination area, accelerating the training process and increasing product efficacy metrics.

The most advanced technological frontier involves the convergence of consumables with smart home technology, leading to the emergence of "Smart Potty Pads" or companion devices. These systems integrate low-power pressure sensors, RFID tags, or even sophisticated chemical sensors linked to Wi-Fi. This technology allows the pad system to monitor usage frequency, track total volume output, and communicate data directly to a smartphone application, providing actionable insights into the pet's hydration levels and urinary health, thereby leveraging IoT infrastructure to enhance the value proposition far beyond basic waste containment.

Regional Highlights

- North America: Represents the largest market share, driven by high rates of pet ownership, substantial disposable income, and a strong culture of pet humanization. The US and Canada are pioneers in adopting premium and specialized pads (e.g., sustainable and activated charcoal types). E-commerce penetration is exceptionally high, facilitating bulk purchases and subscription services, which are critical for maintaining continuous supply to consumers.

- Europe: Characterized by stringent environmental regulations, particularly in Western Europe (Germany, UK), which accelerates the demand for biodegradable and eco-friendly potty pads. While growth rates may be steady, the market is mature and highly segmented, with a strong emphasis on quality, safety standards, and locally sourced sustainable materials.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by rapid urbanization, particularly in China, Japan, and South Korea, where apartment living necessitates indoor training solutions. Rising middle-class income and increasing adoption of smaller dog breeds are primary catalysts. Japan, specifically, is a leader in high-tech pet accessories, driving demand for smart pads and advanced odor-neutralizing technologies.

- Latin America (LATAM): Exhibits nascent but strong growth, primarily concentrated in metropolitan areas (Brazil, Mexico). Market penetration is still lower compared to developed economies, presenting significant opportunities for basic, cost-effective standard pads and local manufacturing expansion.

- Middle East and Africa (MEA): A smaller market currently, constrained by lower pet ownership rates in some countries, but showing gradual adoption in wealthier Gulf nations, driven by expatriate populations and growing demand for high-end imported pet products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Puppy Potty Pad Market.- Hartz Mountain Corporation

- Four Paws Products Ltd.

- Central Garden & Pet Company (Simple Solution)

- Unicharm Corporation (Deo-Sheet)

- MidWest Homes for Pets

- PetSafe Brand

- Drylock Technologies NV

- P & G (Focusing on sustainable pet consumables)

- IRIS USA, Inc.

- Ruiya Pet Products Co., Ltd.

- Shanghai Xiaotian Pet Products Co., Ltd.

- Precious Cat, Inc.

- Tuffy's Pet Foods

- WizSmart Pet Products

- Generic and Private Label Brands (e.g., Amazon Basics, Walmart's Pet Brand)

- Petmate

- Cardinal Laboratories

- Wee-Wee Pads

- Dogit

- Nature's Miracle

Frequently Asked Questions

Analyze common user questions about the Puppy Potty Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key benefits of using puppy potty pads over traditional methods like newspapers?

Puppy potty pads offer superior hygiene, better odor control through specialized layers (like activated charcoal), and significantly higher absorbency, preventing urine tracking and protecting floors more effectively than porous newspaper, thus accelerating the house training process and ensuring a cleaner indoor environment.

How is the Puppy Potty Pad market addressing environmental sustainability concerns?

The market is increasingly shifting towards sustainable materials, including biodegradable polymers, bamboo fibers, and recycled paper pulp. Manufacturers are also optimizing packaging and promoting reusable or washable pad alternatives to reduce landfill waste and appeal to environmentally conscious consumers.

What factors determine the best potty pad size for a puppy?

The ideal pad size depends primarily on the puppy's current size and anticipated adult size, and the amount of time the owner is away. Larger breeds require Extra Large or High Absorbency pads to ensure full coverage and prevent accidents near the edges, while small breeds can use standard sizes, reducing waste and cost.

Are smart potty pads worth the investment, and how do they function?

Smart potty pads, often coupled with sensor platforms, are a worthwhile investment for owners prioritizing health monitoring. They track elimination frequency and volume, providing data via an app. This data is critical for early detection of health issues like UTIs or diabetes, integrating pet hygiene into the growing smart home ecosystem.

Which distribution channel dominates the sales of puppy potty pads globally?

The Online/E-commerce distribution channel currently dominates global sales. Its dominance is attributed to the convenience of bulk ordering, competitive pricing, ease of setting up subscription replenishment services (AEO-optimized purchasing cycle), and logistical efficiency for bulky, heavy consumables.

The extensive application of advanced manufacturing techniques, coupled with highly focused marketing strategies leveraging digital platforms, defines the current competitive landscape. The integration of technology in both product composition and distribution is not merely an optional enhancement but a foundational necessity for brands seeking sustained market leadership and consumer loyalty in the highly dynamic and growing pet care sector. Consumer education efforts, often utilizing AEO-driven content and video tutorials, play a vital role in demonstrating the superior value proposition of premium, highly technical potty pad products compared to cheaper, less effective alternatives.

Continuous investment in R&D is imperative for manufacturers to maintain a technological edge. This includes research into naturally derived odor absorbers that surpass activated charcoal, as well as developing next-generation SAPs that break down faster in landfill conditions without sacrificing absorption performance. The regulatory environment, particularly concerning chemical additives and plastic usage, will increasingly influence product formulation. Companies demonstrating proactive compliance and transparency regarding material sourcing are expected to gain significant trust and market share, especially in European and North American markets where consumer scrutiny is high.

The future evolution of the Puppy Potty Pad market points toward highly personalized, AI-driven solutions where the product functions as a data collection tool integrated into the broader veterinary wellness ecosystem. Predictive analytics related to pet behavior and health will become standard features, moving the product category into preventative care. Furthermore, as global logistics improve, particularly in emerging APAC and LATAM markets, the availability of high-quality, specialized products will increase, driving overall market value growth and transforming house training from a tedious task into a seamlessly managed component of pet ownership.

The increasing scrutiny from environmental organizations and the consumer demand for zero-waste alternatives pose both a challenge and a lucrative opportunity. Companies investing heavily in research dedicated to bio-based and compostable materials are positioned for long-term growth. The market dynamic suggests a clear trajectory where standard, low-cost pads will become commoditized, while premium, high-tech, and eco-friendly solutions will command significantly higher margins and drive innovation across the entire value chain. Strategic partnerships with waste management companies to facilitate specialized disposal of pet waste materials could also represent a future avenue for market differentiation and sustained competitive advantage.

Regional dynamics continue to diverge based on income and urbanization patterns. North America and Europe remain focused on premiumization and sustainability, willing to absorb higher costs for ethical sourcing and advanced features. Conversely, high-growth regions in Asia Pacific focus primarily on volume and accessibility, requiring manufacturers to implement highly localized supply chains and distribution networks capable of handling rapid scalability. Success in these emerging markets hinges on adapting product sizing and packaging to dense, small living spaces and leveraging mobile commerce platforms effectively for direct consumer outreach.

The role of regulatory agencies in setting standards for biodegradable claims and chemical safety is also becoming more prominent. Manufacturers must ensure that marketing claims regarding 'natural' or 'eco-friendly' status are verifiable and compliant with global green labeling standards, ensuring consumer trust is maintained. Failure to adhere to these emerging standards could result in significant reputational damage and market exclusion. This regulatory pressure reinforces the value chain shift towards transparent sourcing and robust internal compliance frameworks, particularly for companies operating across multiple international jurisdictions.

The shift towards specialized retail and veterinary channels is notable for high-end medical-grade pads designed for post-operative recovery or chronic incontinence. These channels demand clinical validation and professional endorsements, requiring brands to invest in scientific studies and collaborations with veterinary professionals. This targeted approach contrasts sharply with the mass-market strategy employed for standard training pads, highlighting the segmentation depth within the overall market structure. The continued evolution of the internet of things (IoT) and AI integration will further solidify the premium segment's position, establishing a clear separation between basic commodity pads and integrated pet health technology systems.

Ultimately, the long-term success of stakeholders in the Puppy Potty Pad Market relies on an agile response to evolving consumer demands for sustainability, convenience, and technology integration. Innovation in absorption technology (moving beyond current SAP capabilities), coupled with AEO-driven digital marketing strategies that capture the 'intent' of new pet owners, will be crucial drivers of market expansion through 2033. The focus is moving from simple absorbency to providing a holistic, health-monitoring solution embedded within the daily routine of pet ownership, ensuring sustained profitability and relevance in a highly competitive consumer goods sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager