Pure Wool Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434983 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Pure Wool Market Size

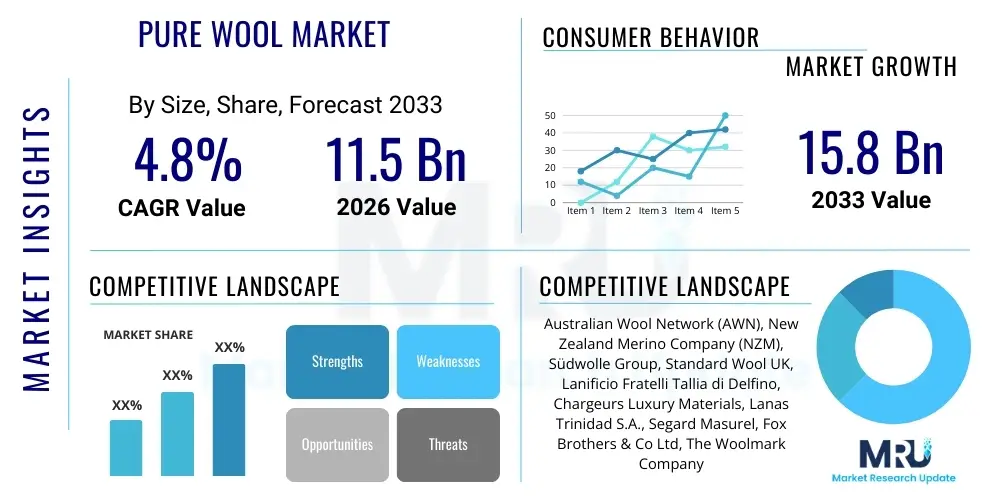

The Pure Wool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 15.8 billion by the end of the forecast period in 2033.

Pure Wool Market introduction

The Pure Wool Market encompasses the global trade and utilization of natural fibers derived exclusively from sheep, often categorized based on breed (e.g., Merino, Shetland, Romney) and quality (virgin wool, recycled wool). This market is fundamentally driven by the inherent properties of wool, including its natural elasticity, superior insulation capabilities, efficient moisture-wicking functionality, and complete biodegradability at the end of its lifecycle. As global consumer preference accelerates its shift toward sustainable, high-quality, and traceable natural textiles, pure wool maintains a premium, non-negotiable position across diverse end-use sectors, primarily high-end apparel, durable home textiles, and specialized industrial applications. The complexity of managing this market involves the intricate sourcing of raw materials, continuous technological innovation in processing (such as developing environmentally friendly superwash methods and guaranteeing non-mulesing certifications), and effectively navigating the evolving landscape of global trade policies and environmental regulations.

The primary applications of pure wool are highly multifaceted, extending significantly beyond traditional winter knitwear, tailored suits, and heavy blankets to sophisticated, advanced technical textiles used intensively in modern outdoor gear, performance base layers, and specialized interior environments. In the luxury apparel segment, pure wool is highly valued, particularly fine-gauge Merino wool, which is utilized for lightweight, next-to-skin garments and exquisitely tailored outerwear, emphasizing paramount comfort, natural breathability, and exceptional product longevity. Furthermore, its crucial application in high-performance home textiles, especially in premium carpets, durable upholstery fabrics, and high-specification bedding products, is overwhelmingly driven by its inherent natural flame resistance, exceptional durability against wear and tear, and natural hypoallergenic properties, making it an indispensable choice in contract furnishing markets demanding safety compliance.

Market growth is substantially bolstered by rapidly evolving global fashion trends that prioritize sustainable luxury, circularity, and verified material provenance, coupled with increasing environmental awareness among affluent consumers regarding the critical issue of microplastic shedding caused by synthetic fibers. Key driving factors propelling the market forward include consistent technological advancements in wool processing, which effectively mitigate common fiber drawbacks like scratchiness and shrinkage, resulting in improved machine washability and broader consumer acceptance in mass-market segments. Additionally, robust and strategically focused promotional efforts orchestrated by influential international wool organizations, centered on transparent traceability, ethical sourcing standards, and the fiber's inherent environmental benefits, are playing an absolutely critical role in reinforcing pure wool's superior market positioning against fierce competition from both competing natural fibers (like cotton and linen) and advanced synthetic alternatives.

Pure Wool Market Executive Summary

The global Pure Wool Market is defined by a landscape of resilient consumer demand and transformative business models, largely fueled by the pervasive sustainability paradigm shift sweeping across the entire global textile industry. Current business trends emphatically highlight a robust emphasis on end-to-end supply chain transparency, with comprehensive ethical certification schemes such as the Responsible Wool Standard (RWS) rapidly transitioning from optional advantages to mandatory prerequisites for high-volume corporate buyers, especially those operating within the stringent regulatory environments of North America and Western Europe. A noticeable pattern of consolidation is emerging among primary wool processors, scourers, and top-makers, a strategic move aiming aggressively for greater economies of scale, standardized production efficiency, and significantly improved raw material quality control mechanisms. Innovation expenditure remains strongly centered on enhancing fiber functionality and versatility, including developing advanced bio-finishing techniques to substantially improve softness, resilience, and dye uptake, thereby ensuring that pure wool remains technically competitive against the latest generation of high-performance synthetic fiber alternatives.

Geographically, regional trends confirm that Asia Pacific (APAC), with major contributions from industrial giants like China, India, and Vietnam, remains the paramount hub for primary wool processing, scouring, and manufacturing, benefiting immensely from extensive, well-established textile production capabilities and an increasingly burgeoning domestic consumption base for premium imported or domestically produced goods. However, the critical sourcing of the highest quality raw material production continues to be heavily concentrated in the Southern Hemisphere, specifically Oceania (Australia and New Zealand), creating structural supply chain dependencies that must be carefully managed through long-term contracts and risk mitigation strategies. European and North American markets retain their leadership in terms of high-value consumption and market price setting, dictating global trends related to ethical labor practices, specific ethical sourcing requirements, sustainable product design methodologies, and strict chemical usage limitations. Periodic geopolitical factors, including recurring trade disputes and fluctuating foreign exchange rates between major wool importing and exporting nations, inevitably introduce complexities and periodic risks to stable pricing and predictable supply flows, necessitating highly agile and diversified procurement strategies from global textile manufacturers.

Analysis of segment trends conclusively reveals that the apparel sector, particularly in categories involving premium tailored outerwear, sophisticated knitwear, and high-performance base layers utilizing ultra-fine Merino wool, commands the largest overall market share and demonstrates the most accelerated growth trajectory, driven by luxury fashion cycles. Demand for highly specialized technical wool products, such as acoustic insulation materials, advanced filtration fabrics, and high-durability commercial carpeting, is also experiencing consistent, measurable growth, primarily driven by stricter regulatory requirements concerning public fire safety standards, energy efficiency mandates, and broad environmental building certifications. The increasing influence of the circular economy paradigm is providing a substantial boost to the recycled and reclaimed wool segment, although its current market volume remains structurally constrained by inherent processing limitations, challenges in maintaining consistent fiber length and quality, and the high energy input required for de-felting and reprocessing compared to the initial processing of virgin wool sources.

AI Impact Analysis on Pure Wool Market

Common user inquiries and industry concerns regarding the transformative impact of Artificial Intelligence (AI) on the Pure Wool Market predominantly center on leveraging AI to optimize highly complex, globally dispersed supply chains, significantly enhancing rigorous product quality verification mechanisms, and accurately predicting the often volatile raw material pricing cycles. Industry stakeholders, ranging from sheep farmers to Chief Procurement Officers, frequently question precisely how AI can establish verifiable, tamper-proof traceability systems running from the sheep farm gate through to the final finished garment, effectively mitigate the increasingly prevalent risks associated with acute climate-related supply disruptions (e.g., severe droughts drastically affecting sheep populations and fleece weight), and crucially assist high-end fashion houses in precision demand forecasting for niche, highly specialized wool products. Key ethical and operational concerns revolve around the responsible deployment of AI in sensitive areas like livestock management and the potential for technological displacement of traditional, skilled manual wool sorting and grading jobs, while commercial expectations are focused relentlessly on achieving unprecedented levels of supply chain efficiency, resource utilization optimization, and transparent sustainability verification.

The strategic implementation of advanced AI techniques is poised to fundamentally revolutionize critical aspects of sheep farming through the application of precision agriculture methodologies. This involves utilizing sophisticated machine learning algorithms to meticulously analyze vast datasets derived from satellite imagery, individual animal health biometrics, and localized environmental variables. The outcome is optimized pasture rotation and management, predictive disease modeling, and ultimately, the ability to achieve consistently higher yield quality and reduced environmental footprint per kilogram of wool produced. Further down the highly complex value chain, AI-powered computer vision systems are proving indispensable for automated fiber grading during the essential scouring and carding processes, ensuring a level of quality consistency and flaw detection that is practically unattainable through traditional manual inspection methods. This deep technological integration serves a dual purpose: it aims not only to substantially reduce operational costs and processing inconsistencies but also to provide definitive, verifiable, and tamper-proof data regarding the exact purity, micron specification, and geographical origin of the wool, directly addressing the core consumer demand for radical transparency in natural fibers.

In the crucial areas of retail planning, inventory management, and demand forecasting, highly sophisticated AI models have become essential tools. They are capable of analyzing nuanced global fashion cycles, rapid micro-trends, and seasonal shifts across multiple geographically diverse markets, allowing manufacturers to drastically optimize inventory levels, synchronize production schedules with real-time sales data, and ultimately reduce the significant economic and environmental waste associated with textile overproduction. Moreover, the implementation of predictive maintenance protocols in critical manufacturing plants, utilizing AI to continuously monitor the performance of highly specialized spinning and weaving machinery, minimizes unexpected downtime and maximizes the efficient use of expensive raw wool materials. This pervasive and transformative impact strategically positions AI not merely as an incremental tool for operational efficiency, but rather as a critical, indispensable enabler for pure wool producers striving to meet increasingly stringent global sustainability reporting requirements and successfully maintain premium pricing strategies in the face of intense competitive pressure from alternative fibers.

- Optimization of grazing patterns and predictive livestock health monitoring using AI-driven precision agriculture systems.

- Enhanced fiber grading, sorting, and quality control through advanced computer vision and machine learning algorithms applied in processing mills.

- Predictive analytics for raw wool price volatility and comprehensive supply chain risk mitigation planning.

- Improved demand forecasting, inventory optimization, and minimization of textile waste for apparel manufacturers and retailers.

- Verification of sustainable and ethical practices (e.g., RWS compliance) via Blockchain technology seamlessly integrated with real-time AI monitoring systems.

DRO & Impact Forces Of Pure Wool Market

The complex market dynamics governing pure wool are intricately governed by a perpetual interplay of natural resource dependencies, rapid technological advancements, and deeply ingrained shifting consumer ideologies. The paramount driver of current market growth is the accelerating global consumer preference for natural, inherently biodegradable, and certifiably sustainable fibers over their synthetic counterparts, a trend particularly pronounced in high-income economies. This preference is vigorously reinforced by compelling marketing campaigns that successfully link wool to concepts of luxury, longevity, and environmental stewardship. Technological innovations that effectively eliminate or minimize traditional wool drawbacks—such as advanced mothproofing treatments, effective non-felt finishes, and enzyme-based softening processes—significantly broaden the fiber's applicability across new product categories. However, the market faces severe structural restraints, primarily the inherent volatility and unpredictability of raw wool pricing, which is acutely sensitive to global climatic events (such as prolonged droughts or unexpected heavy flooding in Australia and New Zealand) and the immediate fluctuations of global commodity and energy markets. Furthermore, the significantly high initial procurement cost of pure wool, especially fine Merino grades, compared robustly against cheap cotton or readily available petroleum-based synthetics, rigorously limits its penetration into highly value-sensitive mass-market apparel segments.

Significant opportunities for profitable market growth are heavily concentrated in the rapid and strategic expansion of performance wool applications, specifically targeting technical segments previously dominated entirely by synthetics, such as sophisticated athletic wear, specialized military and medical textiles, and high-end professional hiking gear. The burgeoning global movement toward a functional circular economy model provides a substantial, long-term avenue for developing scalable, commercially viable, and consistently high-quality recycled and reclaimed wool processing capabilities, which strongly appeals to environmentally conscious major brands seeking to drastically reduce reliance on resource extraction. Strategic market opportunities also explicitly lie in diversifying the global raw material source base, providing robust technological support and favorable trade terms to smaller, emerging regional wool producers, and developing niche, highly certified wool types that command substantially higher premiums based on their impeccable ethical provenance, breed rarity, or unique geographic characteristics (e.g., traceable regenerative wool).

The critical impact forces that fundamentally shape the trajectory and structure of the market include increasingly strict and comprehensive environmental regulations imposed by major consuming regions (specifically the EU's Green Deal initiatives and North American textile safety mandates). These regulations inherently favor natural, low-impact fibers, thus significantly improving the competitive market access and perceived value proposition for pure wool. Conversely, globally rising labor costs across critical processing and manufacturing centers, combined with recurrent international logistical bottlenecks and high energy input requirements for scouring and dyeing, continuously exert downward pressure on manufacturing profit margins. The strong, unified advocacy and dedicated technical support provided by major industry bodies, most notably The Woolmark Company, acts as a crucial stabilizing and growth-driving force, continuously investing significant resources into pioneering research and development to maintain wool’s technical superiority, actively promoting its inherent versatility, and aggressively communicating its undeniable sustainability credentials to both B2B buyers and the final end-consumers worldwide.

Segmentation Analysis

The Pure Wool Market is meticulously segmented primarily based on end-use application, the specific physical product type, fiber diameter (micron count), and the primary distribution channel utilized, collectively reflecting the extensive utility spectrum, inherent quality range, and price hierarchy of the fiber. Analyzing these detailed segments provides crucial strategic insights into differential regional growth rates, preferred technology adoption pathways, and opportunities for significant premiumization across every stage of the global supply chain. The segmentation defined by fiber diameter, measured in microns, is arguably the single most critical market differentiator, as it directly and inexorably correlates with the final end-product quality, tactile feel, and resulting market price. For instance, ultra-fine Merino wool (typically 18.5 microns and below) is exclusively allocated to high-end, next-to-skin apparel and performance base layers, consistently commanding substantially higher prices than coarser wool grades (31.0 microns and above) primarily utilized in bulk industrial felts, insulation, or heavy-duty commercial carpets.

The detailed end-use application analysis confirms that the global apparel industry remains the overwhelmingly dominant consumer, capturing the largest market share, driven aggressively by both fast-moving luxury fashion cycles and the sustained demand for high-performance activewear. This is followed closely by the interior textiles segment (encompassing high-end residential and contract carpets, rugs, and upholstery), where wool's exceptional durability, superior acoustic properties, and inherent natural fire resistance are the primary, non-negotiable benefits driving adoption. The smaller, yet highly technologically important and fast-growing industrial and medical textile segments utilize specialized wool fibers for highly specific niche applications requiring superior thermal insulation (e.g., building materials), advanced sound absorption capabilities, or high-efficiency air and liquid filtration media, showcasing wool's technical versatility beyond traditional textiles.

- By Type:

- Virgin Wool (First-time processed fiber)

- Recycled/Reclaimed Wool (Circular economy focus)

- Organic/Certified Wool (Strict farming standards)

- By Fiber Diameter (Micron):

- Ultra-Fine Wool (Below 19.5 Microns - Luxury Base Layers, Suiting)

- Fine Wool (19.5 to 22.5 Microns - Standard Merino Knitwear)

- Medium Wool (22.6 to 30.9 Microns - Outerwear, Heavy Knitwear)

- Coarse Wool (31.0 Microns and Above - Carpets, Felts, Industrial Use)

- By Application:

- Apparel (Outerwear, Tailored Suiting, Knitwear, Performance Base Layers)

- Interior Textiles (Commercial and Residential Carpets, Upholstery, Rugs)

- Industrial & Technical Textiles (Acoustic Insulation, Filtration Media, Automotive Textiles)

- Bedding and Home Comfort (Duvets, Blankets, Mattress Fillings)

- By Distribution Channel:

- Online Retail (E-commerce platforms, D2C brand channels)

- Offline Retail (Specialty Stores, Department Stores, Boutiques)

- Direct B2B Sales (Mill to Manufacturer bulk contracts)

- Raw Wool Auctions and Brokerage

Value Chain Analysis For Pure Wool Market

The Pure Wool value chain is structurally long, geographically dispersed, and exceptionally complex, originating with intensive upstream activities that encompass specialized sheep farming, timely seasonal shearing, rigorous initial wool classing, and the primary bulk aggregation of raw fiber. These initial activities are strategically concentrated in key global wool-producing nations, predominantly Australia, New Zealand, South Africa, and Argentina. The upstream phase is critically important as it fundamentally dictates the intrinsic quality, micron characteristics, and the ethical/sustainability foundation of the fiber, often influenced by genetic research and land management practices. Following the raw fiber's journey, the wool enters the critical intermediary processing stage which involves high-energy processes such as meticulous scouring (industrial cleaning), necessary carbonizing (removal of vegetable matter), and highly technical top-making (combing and alignment of fibers). These essential midstream activities are crucial for transforming heterogeneous raw fiber into a standardized, usable commodity (wool tops or scoured fleece) and are structurally centralized in specialized, infrastructure-heavy textile processing hubs in the Asia Pacific region, particularly China and India, driven by significant cost efficiencies and specialized machinery capacity.

The downstream analysis focuses intensively on value-adding processes: sophisticated yarn manufacturing (spinning), weaving, knitting, and the complex stages of final dyeing and garment production, where branding, intellectual property, and design innovation impart the majority of the final consumer value. Luxury fashion houses and major global apparel brands act as key demand drivers, setting extremely specific, high-bar quality parameters, often mandating specialized finishing treatments (such as advanced moth-proofing or specific Superwash certification) to enhance final consumer durability and appeal. Distribution channels for the finished products are highly fragmented and competitive, ranging from the traditional, highly centralized auction system for raw wool (a critical and transparent component of the upstream supply) to the complex global logistics networks required for distributing finished goods through diverse retail models, encompassing specialty chains, high-end department stores, and the rapidly growing direct-to-consumer (D2C) online e-commerce platforms.

Direct B2B channels, characterized by established, long-term contractual agreements between large fiber merchants or integrated mills and major garment manufacturers, are essential for ensuring volume stability and predictable pricing for standardized, high-volume wool grades. Conversely, highly fragmented indirect channels, often involving multiple specialized agents, independent brokers, and regional distributors, dominate the trade and circulation of niche, specialty, or lower-volume certified wools. Maintaining verifiable traceability, fiber integrity, and proof of origin throughout this multi-layered, indirect distribution structure poses a continuous and significant technological challenge, driving necessary investment in sophisticated digital identification, sensor-based tracking, and blockchain technologies to credibly connect the final, conscious consumer back to the specific farm or station where the wool was originally shorn.

Pure Wool Market Potential Customers

The primary and largest volume consumers of raw and semi-processed pure wool fiber are specialized textile manufacturers and integrated mills globally that possess the requisite technology for the conversion of scoured wool into refined yarns and finished fabrics. These industrial buyers are internally segmented based on their core functional expertise: knitwear manufacturers prioritize yarns offering superior elasticity, softness, and loft for comfortable garments, while worsted weaving mills focus intently on yarn uniformity and high dimensional stability crucial for tailored garments, high-end suiting, and durable interior textiles. Beyond the immediate textile conversion industry, an absolutely critical segment of potential customers includes the major global fashion conglomerates and ultra-luxury retailers (including large groups like LVMH, Kering, and Richemont) that utilize pure wool as an indispensable, foundational material for their premium and heritage product lines, fundamentally valuing its inherent natural aesthetic, sustainable credentials, and association with enduring quality craftsmanship.

A second, rapidly accelerating customer base is concentrated within the high-performance technical and athletic apparel sector, encompassing influential outdoor and activewear brands (e.g., Icebreaker, Smartwool, Patagonia). These companies rely heavily on the unique properties of ultra-fine Merino wool for their high-tech base layers, mid-layers, and hiking apparel, demanding superior properties like proactive moisture management, high thermal regulation capabilities across diverse climate ranges, and natural odor resistance. These technical customers impose stringent performance testing standards, specific micron count requirements, and often require comprehensive third-party ethical certifications. Furthermore, the specialized contract textiles sector, responsible for supplying high-specification fabrics for corporate environments, premium hotels, luxury cruise ships, and commercial aircraft, represents a particularly strong and stable customer segment due to wool’s excellent inherent flame-retardant properties (meeting necessary safety codes) and its exceptional longevity, guaranteeing low replacement frequency.

Finally, direct end-consumers, especially those within the high-income demographics of mature markets who increasingly prioritize traceable sustainable luxury, product longevity, and completely natural fibers, are the ultimate, determining drivers of underlying market demand and value perception. These highly discerning buyers are significantly influenced by ethical sourcing certifications (RWS, ZQ Merino, etc.) and are consistently willing to pay a substantial premium for guaranteed traceability, environmental transparency, and verifiable quality craftsmanship. This aspirational consumer segment is crucial as it dictates the future direction of product innovation, branding narratives, and advanced sustainable marketing strategies within the global pure wool market ecosystem, emphasizing enduring value over disposable consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 billion |

| Market Forecast in 2033 | USD 15.8 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Australian Wool Network (AWN), New Zealand Merino Company (NZM), Südwolle Group, Standard Wool UK, Lanificio Fratelli Tallia di Delfino, Chargeurs Luxury Materials, Lanas Trinidad S.A., Segard Masurel, Fox Brothers & Co Ltd, The Woolmark Company (Marketing & R&D), Yünsa, Reda, Icebreaker (Brand Focus), Smartwool (Brand Focus), Merino Company, J.H. Ratcliffe & Sons Ltd, Fuhrmann S.A., Godley & Muir, Hainsworth, Sartori & Bottura. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pure Wool Market Key Technology Landscape

The technological evolution within the Pure Wool market is currently and intensely focused on two primary strategic objectives: first, effectively mitigating the fiber's traditional performance drawbacks such as irreversible shrinkage, surface pilling, and tactile scratchiness; and second, ensuring maximum verifiable sustainability and drastically reduced environmental impact throughout every stage of chemical and mechanical processing. Crucial chemical technologies involve developing advanced plasma treatments and innovative, eco-friendly polymer applications that successfully allow the natural wool fiber to be reliably machine-washable (commonly known as the Superwash process) without resorting to harsh chlorination chemicals or fundamentally compromising its inherent protein structure, thereby substantially enhancing consumer convenience and expanding mass-market acceptance. Furthermore, cutting-edge research in bio-finishing utilizes highly specific enzyme treatments to significantly improve the softness, drape, and overall handle of medium to coarser wool types, thereby successfully opening up new, higher-value application possibilities that were previously exclusively limited only to the most expensive, finest Merino fibers.

On the critical mechanical fiber processing and manufacturing side, stringent automation, high-speed capabilities, and extreme precision engineering have become non-negotiable standards. Modern, state-of-the-art combing and spinning machinery now incorporates complex sensor technology and artificial intelligence monitoring, which work collaboratively to minimize unacceptable fiber breakage, reduce material waste, and ensure optimal, industry-leading yarn regularity and strength—properties that are fundamentally crucial for high-speed weaving, complex computerized knitting, and long-term product durability. Recent developmental breakthroughs include the widespread adoption of sophisticated Computer Aided Design (CAD) and advanced simulation software programs that mathematically optimize precise fabric construction parameters (e.g., weave density, stitch pattern) to scientifically enhance intrinsic properties like superior breathability, lightweight construction, and maximal thermal efficiency. This technological investment strategically allows wool products to compete effectively and technically with the latest generation of synthetic performance fabrics in highly contested, demanding markets like professional athletics and military applications.

Most critically, the deep integration of digital technologies, specifically distributed ledger systems (Blockchain) and advanced physical identifiers like high-frequency RFID tagging and forensic DNA markers, is fundamentally and rapidly transforming the entire landscape of supply chain traceability. These integrated digital tools provide indisputable, immutable records of the wool's complete journey: from the accredited sheep station, through the initial scouring and complex dyeing processes, right up to the final retail product shelf. This drastically enhanced, end-to-end transparency is now viewed not simply as a powerful marketing tool, but as an absolute operational necessity for meeting increasingly stringent global regulatory compliance requirements, fulfilling critical contractual obligations related to ethical sourcing certifications like the Responsible Wool Standard (RWS), and robustly underpinning the premium, trusted positioning of pure wool within the extremely competitive global textile economy.

Regional Highlights

The global Pure Wool Market exhibits distinctly polarized geographical consumption and production patterns, which profoundly influence regional investment strategies, local growth trajectories, and the specific technological focus of various market players. Asia Pacific (APAC) currently stands as the undisputed dominant global powerhouse in terms of volume processing capacity and subsequent manufacturing output, driven overwhelmingly by the sheer industrial scale of countries like China, which functions as the world's largest importer and converter of raw wool for transformation into both consumer garments and industrial interior textiles destined for massive global export markets. Furthermore, the region is simultaneously experiencing explosive domestic demand growth for high-quality, premium wool products, a trend directly reflecting rapidly rising disposable incomes and a pronounced consumer shift toward premium, internationally branded textiles. Significant, sustained foreign direct investment in state-of-the-art spinning, dyeing, and automated weaving technologies across key regional production centers (e.g., Vietnam, Bangladesh, and parts of India) is solidly stabilizing the APAC region's entrenched dominant position as the primary global textile manufacturing hub.

Europe represents the highest value-added market segment globally, driven by a long-standing, world-renowned tradition of luxury textile production, particularly centered in manufacturing clusters in Italy (Biella region), the UK (Yorkshire and Scottish Borders), and Germany. This region’s market strategy is acutely focused on ethical sourcing, cutting-edge high fashion, and continuous technical innovation, often specializing in the bespoke utilization of ultra-fine Merino wool for highly specialized tailored clothing, heritage tweed, and advanced performance base layers. The presence of strict, proactive environmental regulations (such as REACH and EU Green Deal initiatives) and extremely strong consumer advocacy for demonstrably natural, low-impact materials ensure consistently high, stable demand for certified, traceable pure wool. North America closely mirrors this high-value consumption profile but places an additional strategic emphasis on high-performance outdoor wear, technical work apparel, and high-end residential and contract home textiles. Sourcing strategies across the region are increasingly rigorous, prioritizing suppliers providing RWS and ZQ Merino-certified wool to fully meet evolving corporate sustainability and ethical governance goals.

The foundational raw material production base remains structurally and geographically concentrated in the high-efficiency farming regions of Oceania (Australia and New Zealand), which collectively provide the vast majority of fine, medium, and specialty-grade wool traded on the international commodity markets. These producing regions are intensely focused on continuous optimization of farm efficiency, utilizing advanced genetic breeding programs, adopting complex water management techniques, and maintaining exceptionally high animal welfare and ethical standards (including non-mulesing practices) to proactively protect their global market share against emerging, smaller, regional producers. Latin America (particularly Argentina and Uruguay, specializing in high-quality finer wools) and the Middle East and Africa (MEA) play smaller but increasingly significant roles, often offering specialized local wool types (e.g., specific regional sheep breeds, Mohair, Alpaca) and incrementally developing their localized processing capacities to cater specifically to domestic market needs, focusing heavily on preserving and promoting regional textile traditions and artisan products, thereby reducing import dependency.

- Asia Pacific (APAC): Dominant processing hub and largest consumer of raw wool; driven by China’s export manufacturing and growing domestic luxury market.

- Europe: Leading market for luxury apparel and high-value textiles; strict adherence to RWS and sustainability standards; key innovation driver in wool finishing.

- North America: Strong demand for high-performance Merino wool in outdoor and activewear; focus on ethical sourcing and transparency.

- Oceania (Australia/New Zealand): Global headquarters for high-quality raw wool production; focus on sustainable farming techniques and genetic improvement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pure Wool Market.- Australian Wool Network (AWN)

- New Zealand Merino Company (NZM)

- Südwolle Group

- Standard Wool UK

- Chargeurs Luxury Materials

- Lanas Trinidad S.A.

- Segard Masurel

- Lanificio Fratelli Tallia di Delfino

- Fox Brothers & Co Ltd

- The Woolmark Company (R&D and Marketing)

- Yünsa

- Reda

- Icebreaker (VF Corporation)

- Smartwool (VF Corporation)

- J.H. Ratcliffe & Sons Ltd

- Fuhrmann S.A.

- Merino Company

- Godley & Muir

- Hainsworth

- Sartori & Bottura

- G Schneider & Co AG

- Tianjin Kingdom International Co. Ltd.

- Cashmere & Fine Wool Merchants S.A.

- Michell Wool

Frequently Asked Questions

Analyze common user questions about the Pure Wool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of current and future growth in the Pure Wool Market?

The primary driver is the accelerating global paradigm shift toward sustainable, natural, and inherently biodegradable textiles. Consumers, particularly in high-income regions, are actively seeking natural alternatives to synthetic fibers to drastically reduce microplastic pollution, thereby driving premium demand for traceable, certified pure wool products with proven environmental credentials.

How does the Responsible Wool Standard (RWS) certification significantly impact global sourcing strategies?

RWS provides verifiable, third-party certification that guarantees sheep are treated ethically and that the land is managed sustainably under stringent environmental protocols. Major global apparel brands and retailers are increasingly mandating RWS compliance, transforming it into a crucial market access and contractual requirement that robustly validates the premium pricing and sustainable provenance of the pure wool fiber.

Which advanced technology is currently most critical for ensuring pure wool traceability and integrity?

The successful integration of Blockchain technology coupled with advanced physical identifiers like RFID tags and microscopic forensic markers is most critical. These technologies collaboratively create an immutable, digitally transparent record of the wool’s origin, processing history, and movement, ensuring complete integrity throughout the long and often complex international supply chain.

What are the main segments of the Pure Wool Market differentiated by fiber quality and end-use?

The market is primarily segmented by fiber diameter (micron count). Key quality segments include Ultra-Fine Wool (under 19.5 microns, used for luxury base layers and suiting), Fine/Medium Wool (for high-end knitwear), and Coarse Wool (used predominantly for durable carpets, felts, and heavy industrial textiles, prioritizing strength over softness).

What strategic role does Artificial Intelligence (AI) play in modern wool processing and sustainable farming?

AI optimizes the pure wool market through multiple channels: implementing precision agriculture (predictive livestock and pasture management), ensuring quality via automated computer vision fiber grading (enhancing quality control in scouring mills), and applying predictive analytics (forecasting volatile commodity prices and optimizing manufacturing flow), ultimately yielding improved efficiency and verifiable sustainability data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager