PV Monitoring Technologies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438030 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

PV Monitoring Technologies Market Size

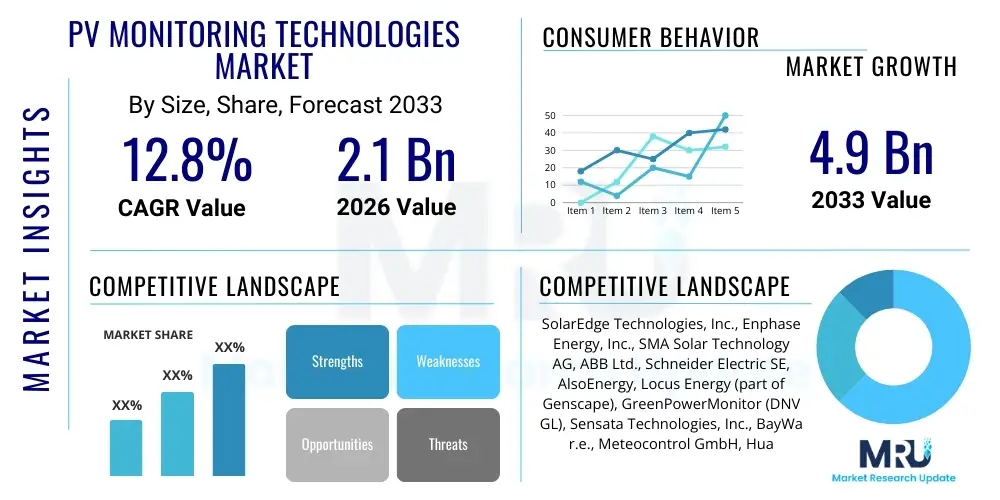

The PV Monitoring Technologies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033. This substantial expansion is driven by the global imperative for energy transition, increasing adoption of utility-scale solar farms, and the growing complexity of photovoltaic (PV) systems which necessitates advanced, real-time performance tracking and diagnostic capabilities. The transition from basic data logging to sophisticated predictive analytics platforms characterizes this market's trajectory.

PV Monitoring Technologies Market introduction

The PV Monitoring Technologies Market encompasses hardware and software solutions designed to measure, analyze, and report the performance of photovoltaic power plants, ranging from small residential rooftop systems to vast utility-scale solar farms. These technologies include sensors, data loggers, communication systems (such as cellular, Wi-Fi, and Ethernet), and sophisticated cloud-based software platforms that utilize advanced algorithms for fault detection, performance ratio calculation, and predictive maintenance scheduling. The primary objective is to maximize energy harvest, minimize operational costs, and ensure the long-term viability and efficiency of solar assets, thereby optimizing the return on investment (ROI) for asset owners and operators.

Key products within this domain include Supervisory Control and Data Acquisition (SCADA) systems tailored for solar, specialized data acquisition systems (DAS), inverter-integrated monitoring solutions, and dedicated meteorological stations. These systems aggregate critical data points, such as irradiance levels, module temperature, voltage, current, and power output, transforming raw telemetry into actionable insights. The integration of these tools is crucial for identifying deviations from expected performance, pinpointing specific equipment failures, and managing warranties and maintenance contracts effectively across diverse geographical portfolios. The increasing penetration of decentralized renewable energy sources makes robust monitoring indispensable for grid stability and asset management.

Major applications span utility-scale solar power plants, commercial and industrial (C&I) installations, and residential rooftop systems, each requiring tailored monitoring complexity. Benefits derived from deploying these technologies include enhanced energy production yields through rapid fault correction, reduced operational expenditure (OpEx) via optimized maintenance schedules, increased asset lifespan, and improved transparency for financial reporting and regulatory compliance. Driving factors underpinning market growth include decreasing hardware costs, rising global solar capacity additions, stringent regulatory requirements for renewable energy asset performance, and the accelerating integration of IoT and cloud computing capabilities into operational technology (OT) infrastructure.

PV Monitoring Technologies Market Executive Summary

The PV Monitoring Technologies Market is characterized by rapid technological evolution, shifting towards decentralized intelligence and predictive analytics driven by artificial intelligence (AI) and machine learning (ML). Business trends indicate a strong move towards integrated solutions combining monitoring, asset performance management (APM), and energy forecasting into single, comprehensive platforms offered on a Software as a Service (SaaS) model. Strategic collaborations between hardware manufacturers (inverters, sensors) and software developers are defining the competitive landscape, aiming to offer seamless, end-to-end operational visibility. Furthermore, standardization in communication protocols (like Modbus and SunSpec) is facilitating interoperability, reducing integration complexity and costs for large-scale deployments.

Regionally, Asia Pacific (APAC) continues to dominate the market, fueled by massive solar capacity additions in China, India, and Southeast Asia, necessitating robust monitoring infrastructure for newly deployed utility and C&I projects. North America and Europe, while representing mature markets, exhibit strong growth driven by refurbishment projects, heightened focus on performance optimization of existing assets, and strict regulatory adherence, particularly concerning grid interconnection stability and reporting requirements. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, driven by government incentives for renewable energy adoption and large-scale desert solar projects where remote monitoring is critical for efficient O&M.

Segmentation trends highlight the increasing prominence of the Software segment over the Hardware segment, primarily due to the recurring revenue model of SaaS platforms and the continuous value derived from algorithmic enhancements and data analytics. Among application segments, utility-scale solar farms remain the largest consumers of advanced monitoring solutions, demanding highly sophisticated SCADA and fleet management systems. However, the C&I segment is exhibiting the fastest growth, propelled by the need for customized monitoring solutions that integrate solar production data with commercial energy consumption profiles for self-consumption optimization and demand charge management. The shift towards module-level monitoring (MLM) is also a significant trend, offering granular performance data essential for complex installations and ensuring safety protocols.

AI Impact Analysis on PV Monitoring Technologies Market

User inquiries regarding AI's impact on PV monitoring primarily center on operational efficiencies, cost reduction, and the reliability of automated fault detection. Common questions ask how AI algorithms can differentiate between various types of performance loss (e.g., shading, soiling, equipment degradation) and if AI can truly predict failures before they occur. Users are keen to understand the shift from reactive maintenance, based on manual alarms, to proactive, predictive maintenance scheduled optimally by ML models. Furthermore, there is significant interest in how AI enhances energy forecasting accuracy, which is critical for grid operators and revenue planning, and the potential for AI-driven cybersecurity enhancements for monitoring platforms.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming PV monitoring from a data visualization tool into a smart, self-optimizing asset management system. AI algorithms analyze massive datasets generated by solar plants (terabytes of time-series data related to production, weather, inverter status, and grid conditions) far more efficiently than human operators or traditional statistical methods. This advanced processing capability allows for the development of highly accurate digital twin models of solar assets, enabling precise comparison of real-time performance against expected theoretical output, instantly flagging anomalies that might indicate subtle degradation or system faults invisible to conventional monitoring thresholds.

Specifically, AI contributes significantly to predictive maintenance, moving the industry beyond time-based or reactive corrective actions. ML models trained on historical failure data can detect precursor indicators—subtle changes in electrical parameters or thermal signatures—associated with impending failures in inverters, combiner boxes, or module junctions. This ability to forecast failures allows maintenance teams to schedule interventions precisely when needed, minimizing downtime and maximizing the plant's capacity factor, thereby enhancing overall operational profitability and reducing the need for costly, routine manual inspections.

- AI-driven Predictive Maintenance: Enables accurate forecasting of component failures (inverters, DC optimizers) minimizing unplanned downtime.

- Automated Fault Diagnostics: Uses deep learning to classify and localize specific faults (e.g., potential induced degradation, soiling, arc faults) with high precision.

- Performance Baseline Modeling: Creates high-fidelity digital twins of PV assets for real-time performance ratio deviation analysis, accounting for environmental variables.

- Enhanced Energy Forecasting: Improves the accuracy of short-term and long-term energy yield predictions crucial for grid integration and financial settlement.

- Optimized Cleaning Schedules: Utilizes ML to analyze soiling rates and economic models to determine the optimal time for module cleaning interventions, maximizing net revenue.

- Cybersecurity and Anomaly Detection: Applies AI to monitor network traffic and system behavior, quickly identifying and mitigating sophisticated cyber threats targeting operational technology (OT) networks.

DRO & Impact Forces Of PV Monitoring Technologies Market

The PV Monitoring Technologies Market is dynamically influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary drivers propelling market expansion include the exponential growth in global solar installations, particularly in the utility sector, where monitoring systems are mandatory for effective asset management and compliance. Secondly, the increasing need for operational efficiency and reduced LCOE (Levelized Cost of Electricity) compels asset owners to adopt advanced analytics to squeeze maximum performance from existing and new installations. Furthermore, decreasing costs of sensors, data acquisition hardware, and cloud computing infrastructure make sophisticated monitoring solutions financially viable across all system sizes.

Conversely, significant restraints hinder market penetration, particularly in emerging economies and smaller projects. High initial investment costs, complexity in integrating heterogeneous systems (different inverter brands, data loggers, and legacy systems), and concerns over data security and privacy remain substantial barriers. The shortage of skilled personnel capable of installing, maintaining, and interpreting the complex data generated by advanced monitoring platforms also limits adoption. Furthermore, fragmented regulatory environments concerning data localization and reporting standards across different regions create implementation challenges for global operators seeking standardized solutions.

Opportunities for exponential growth lie in the development of highly specialized, vertically integrated solutions focusing on specific niche problems, such as integrating monitoring with storage systems (solar+storage) and advanced grid services (e.g., curtailment management, frequency regulation). The burgeoning residential sector offers significant growth potential for simplified, plug-and-play monitoring solutions integrated directly into smart home ecosystems. Furthermore, the mandatory implementation of module-level power electronics (MLPE), such as micro-inverters and DC optimizers, drives the demand for granular, high-resolution data monitoring, presenting a lucrative avenue for software platform providers to offer enhanced diagnostic capabilities.

The impact forces within the market are predominantly technological and regulatory. The rapid pace of hardware standardization (e.g., smart combiner boxes) and the evolution of cloud-based data processing exert strong upward pressure on solution quality and accessibility. Regulatory mandates in mature markets, requiring verifiable performance guarantees and detailed operational reporting, solidify the foundational demand for reliable monitoring. Competition intensity is high, driven by new entrants offering low-cost, AI-enabled SaaS models, forcing incumbent hardware vendors to rapidly transition towards hybrid hardware/software offerings to maintain relevance and market share.

Segmentation Analysis

The PV Monitoring Technologies market is systematically segmented based on Component, Application, and Technology, reflecting the diverse requirements and complexity levels across the solar industry. Component segmentation differentiates between the physical infrastructure required for data acquisition (Hardware) and the analytical tools used for processing and visualizing the data (Software). Application segmentation delineates the end-use environment, ranging from massive utility projects to distributed residential systems, each demanding different levels of scalability and diagnostic depth. Technology segmentation focuses on the underlying methods of data transfer and system architecture, such as centralized SCADA versus decentralized IoT platforms. These segmentations are critical for vendors to tailor their offerings and for asset owners to select solutions that match their operational scale and investment profile, ensuring optimal system performance and cost efficiency tailored to specific project needs.

- Component:

- Hardware (Data Loggers, Sensors, Communication Devices, Combiner Boxes)

- Software (Cloud-based/SaaS, On-Premise, Analytics Platforms, SCADA Systems)

- Application:

- Utility-Scale

- Commercial & Industrial (C&I)

- Residential

- Technology:

- Wired Monitoring

- Wireless Monitoring (Cellular, Satellite, RF Mesh)

- Module-Level Monitoring (MLM)

- End-User:

- PV Developers

- Asset Owners/Investors

- O&M Service Providers

- EPC Contractors

Value Chain Analysis For PV Monitoring Technologies Market

The value chain for PV monitoring technologies begins with upstream activities focused on the manufacturing and supply of specialized electronic components. This includes the production of high-precision sensors (irradiance, temperature), microcontrollers for data loggers, communication modules (3G/4G/5G, LoRaWAN), and the development of core proprietary algorithms embedded in inverters and monitoring devices. Key upstream players include specialized sensor manufacturers and electronics component suppliers. Quality control and standardization in this stage are critical, as the accuracy of the monitoring system is directly dependent on the fidelity of the raw data collected by these components.

Midstream activities primarily involve the system integrators and software development houses. These entities design, integrate, and deploy the complete monitoring solution, which includes configuring the Data Acquisition System (DAS), integrating it with the PV plant’s inverters and meters, and deploying the monitoring software platform (either cloud-based or on-premise SCADA). This stage requires significant expertise in IT/OT convergence, data management, and cybersecurity. Distribution channels play a vital role here, often involving direct sales to large utility clients or indirect distribution through EPC (Engineering, Procurement, and Construction) firms who bundle monitoring solutions into the overall plant construction contract. The software element, typically delivered as SaaS, involves maintaining scalable cloud infrastructure and continuous feature updates.

Downstream activities are dominated by O&M (Operations and Maintenance) providers, asset managers, and the end-users (PV asset owners). These stakeholders utilize the monitoring data and insights for day-to-day operations, performance optimization, financial reporting, and compliance verification. Direct distribution is common for large utility contracts where the software vendor works closely with the asset owner throughout the asset lifecycle. Indirect distribution channels, often utilized for residential and smaller C&I installations, involve distributors and installers who purchase pre-packaged monitoring hardware bundled with inverters and provide basic O&M services. The ongoing subscription revenue from software maintenance and advanced analytics constitutes a major part of the downstream value capture.

PV Monitoring Technologies Market Potential Customers

The primary customers for PV monitoring technologies are entities involved in the ownership, operation, and maintenance of solar photovoltaic assets across all scales. End-users fall broadly into three critical categories: PV Asset Owners and Investors, Operations and Maintenance (O&M) Service Providers, and Engineering, Procurement, and Construction (EPC) firms. Asset owners, including independent power producers (IPPs), utility companies, and infrastructure funds, require monitoring systems to protect their investments, guarantee performance ratio agreements (PRAs), and provide accurate financial reporting to stakeholders. Their focus is on high-level fleet management, portfolio optimization, and long-term degradation assessment, demanding highly robust and scalable cloud-based analytics platforms.

O&M service providers, who are contracted by asset owners to manage the day-to-day functioning of the plants, represent a vast customer base specifically interested in detailed diagnostics and rapid fault isolation capabilities. They prioritize monitoring systems that offer high data resolution, customizable alarming, integration with computerized maintenance management systems (CMMS), and mobile accessibility for field technicians. The efficiency gains delivered by predictive maintenance features directly translate into higher profitability for O&M firms, making sophisticated analytics a key selling point. Their adoption is driven by the need to manage geographically distributed assets with minimal manpower efficiently.

EPC contractors, particularly those involved in constructing utility-scale and large C&I projects, serve as significant initial purchasers. They often select and install monitoring hardware and software as part of the total project delivery scope. EPC firms value ease of installation, robust integration capabilities with various inverter technologies, and streamlined commissioning processes. Their selection criteria are often based on proven reliability and vendor track record during the crucial initial operational phase. Lastly, residential customers and small business owners, while seeking simpler, cost-effective solutions, represent a growing segment, often receiving monitoring capabilities bundled directly with their inverter purchases, focusing primarily on basic performance tracking and self-consumption optimization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SolarEdge Technologies, Inc., Enphase Energy, Inc., SMA Solar Technology AG, ABB Ltd., Schneider Electric SE, AlsoEnergy, Locus Energy (part of Genscape), GreenPowerMonitor (DNV GL), Sensata Technologies, Inc., BayWa r.e., Meteocontrol GmbH, Huawei Technologies Co., Ltd., Solis Inverters (Ginlong Technologies), Fronius International GmbH, Tigo Energy, Inc., QOS Energy (part of Enel Group), KACO new energy GmbH (part of Siemens), Draker Corporation, Solar-Log GmbH, MaxGen Energy Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PV Monitoring Technologies Market Key Technology Landscape

The technological landscape of the PV Monitoring Market is rapidly evolving, moving beyond simple data logging towards sophisticated, interconnected smart systems utilizing Internet of Things (IoT) architecture. Key technology drivers include the proliferation of low-cost, high-performance sensors and data acquisition hardware, often integrated directly into smart combiner boxes and modern inverters, eliminating the need for separate dedicated data loggers in many cases. Communication infrastructure has matured significantly, leveraging cellular networks (4G/5G), specialized low-power wide-area networks (LPWAN) like LoRaWAN for large geographical sites, and robust industrial Ethernet for localized plant communication. This diversity in connectivity ensures reliable data transmission even in remote solar farm locations, which is paramount for real-time asset performance management.

Central to the modern monitoring stack is the adoption of Cloud Computing and Big Data Analytics platforms. These platforms provide the necessary scalability and computational power to process terabytes of raw data generated by large solar fleets. Technologies such as high-frequency sampling, data compression algorithms, and highly parallelized processing are employed to transform raw telemetry into usable performance metrics, enabling rapid visualization and trend identification. Furthermore, the development of open application programming interfaces (APIs) and standardized communication protocols (like SunSpec Modbus) facilitates seamless integration between different hardware components and third-party Asset Performance Management (APM) software, fostering an ecosystem of specialized analytical tools that can be layered onto core monitoring platforms.

The emerging frontier is defined by the integration of Artificial Intelligence (AI) and Machine Learning (ML) techniques directly into both the software and hardware layers. On the software side, ML models are used for anomaly detection, differentiating between genuine equipment faults, temporary weather effects, and long-term degradation mechanisms. Hardware innovations, particularly in Module-Level Monitoring (MLM) enabled by power electronics like micro-inverters and DC optimizers, provide granular data necessary for advanced diagnostic techniques such as IV curve tracing and automated electroluminescence (EL) image analysis. Furthermore, the increasing focus on cybersecurity necessitates the deployment of intrusion detection systems and encrypted communication channels specifically tailored for industrial control systems (ICS) environments, ensuring the operational resilience of monitoring networks against escalating cyber threats.

Regional Highlights

The global PV Monitoring Technologies Market exhibits distinct growth patterns and maturity levels across key geographical regions. Understanding these regional dynamics is essential for market players formulating expansion and localization strategies. Each region presents unique challenges related to climate, grid infrastructure, regulatory mandates, and project scale, all of which influence the demand for specific monitoring solutions, from simple residential trackers to advanced SCADA systems for ultra-large utility projects.

- Asia Pacific (APAC): Dominates the market share due to the highest volume of new PV capacity additions, particularly in China and India. The region demands robust, cost-effective monitoring solutions for vast utility-scale projects and high-density distributed generation. Key focus areas include severe climate monitoring (cyclones, dust storms) and managing grid instability through accurate forecasting and curtailment optimization tools.

- North America (NA): Characterized by a strong emphasis on regulatory compliance, bankability, and high performance assurance. Growth is driven by complex financing structures (requiring accurate reporting), the widespread adoption of AI/ML for predictive maintenance, and the integration of PV monitoring with energy storage (solar+storage) systems for grid flexibility services.

- Europe: A mature market focused on optimizing the performance of aging solar assets and adhering to strict European grid codes. Demand is high for retrofitting legacy systems with advanced IoT and AI analytics platforms to improve LCOE and for highly efficient Module-Level Monitoring (MLM) in residential and small commercial sectors due to complex roof layouts and safety regulations.

- Latin America (LATAM): An emerging high-growth region driven by substantial utility-scale project development in countries like Brazil and Chile. The primary market need is for reliable, remote monitoring solutions utilizing satellite or cellular communication due to often limited terrestrial network infrastructure in remote project sites. Focus is on theft prevention and remote operational control.

- Middle East and Africa (MEA): Poised for rapid growth driven by large-scale desert solar projects demanding monitoring systems engineered to withstand extreme heat and high soiling rates. Key requirements include advanced soiling loss detection algorithms, aerial inspection integration, and high-security monitoring infrastructure for geographically dispersed assets in challenging environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PV Monitoring Technologies Market.- SolarEdge Technologies, Inc.

- Enphase Energy, Inc.

- SMA Solar Technology AG

- ABB Ltd.

- Schneider Electric SE

- Huawei Technologies Co., Ltd.

- AlsoEnergy (part of Stem, Inc.)

- GreenPowerMonitor (DNV GL)

- Meteocontrol GmbH

- Locus Energy (part of Genscape)

- Sensata Technologies, Inc.

- BayWa r.e.

- Solarediag

- Solargis

- Fronius International GmbH

- Tigo Energy, Inc.

- QOS Energy (part of Enel Group)

- Solar-Log GmbH

- MaxGen Energy Services

- SenseHawk (part of Autodesk)

- AE Solar

- GoodWe Power Supply Technology Co., Ltd.

- Wundergy

- SunPower Corporation

- Renesola Ltd.

- SunGrow Power Supply Co., Ltd.

- Inaccess

- Samil Power Co., Ltd.

- Zigor Corporacion

- Solaris Technologies

- Power Factors LLC

- Alectris

- Scout Clean Energy

- Ingeteam S.A.

- Refusol

Frequently Asked Questions

Analyze common user questions about the PV Monitoring Technologies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between SCADA systems and cloud-based monitoring platforms?

SCADA (Supervisory Control and Data Acquisition) systems are typically deployed on-premise for utility-scale plants, offering high control functionality and real-time, localized data processing for critical plant operations. Cloud-based platforms, conversely, offer scalable, flexible data aggregation and long-term analytical capabilities (often SaaS), focusing on portfolio-level performance analysis, reporting, and predictive diagnostics across distributed assets.

How does Module-Level Monitoring (MLM) benefit solar asset owners?

MLM, facilitated by micro-inverters or DC optimizers, provides granular data on individual module performance. This level of detail is crucial for precise fault detection, identification of complex shading losses, optimizing energy harvest in complex installations, and ensuring safety through rapid arc fault detection and shutdown capabilities, maximizing overall system lifetime yield.

What are the key cybersecurity concerns associated with PV monitoring systems?

Key cybersecurity concerns include unauthorized access to operational technology (OT) networks, which could lead to manipulation of energy production (e.g., forced curtailment), data breaches of sensitive performance metrics, and the use of compromised data loggers as entry points for wider network attacks. Robust encryption and network segmentation are essential mitigation strategies.

Which geographical region is expected to lead the demand for PV monitoring solutions during the forecast period?

The Asia Pacific (APAC) region is projected to maintain its leadership in market demand, primarily driven by the massive scale of new utility and commercial PV installations, particularly in high-growth solar markets like China, India, and Australia, necessitating scalable infrastructure monitoring and performance verification tools.

How is Artificial Intelligence (AI) fundamentally changing solar Operations and Maintenance (O&M) practices?

AI is transforming O&M from reactive to predictive by using machine learning models to analyze operational data and forecast component failures (e.g., inverter faults, connector degradation) days or weeks in advance. This allows O&M providers to schedule maintenance optimally, significantly reducing downtime, maximizing the capacity factor, and decreasing overall labor costs associated with unnecessary site visits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager