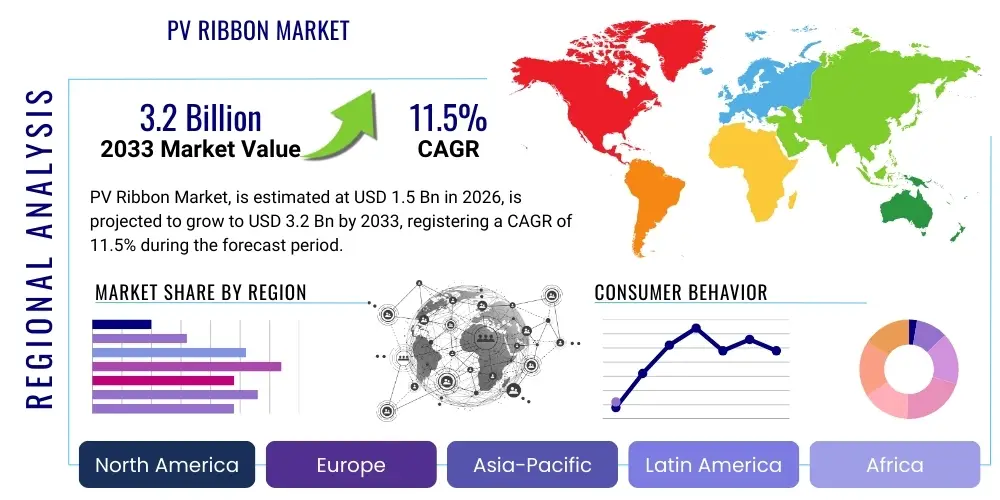

PV Ribbon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437025 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

PV Ribbon Market Size

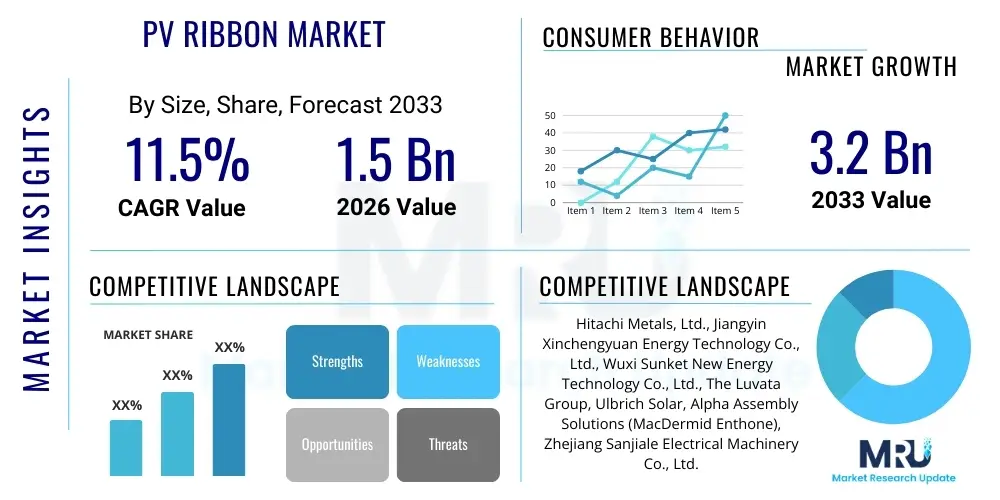

The PV Ribbon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

PV Ribbon Market introduction

The Photovoltaic (PV) Ribbon Market is intrinsic to the solar energy supply chain, fundamentally serving as the conductive element utilized to interconnect individual solar cells within a photovoltaic module. These ribbons, primarily composed of tinned or coated copper, are critical for minimizing electrical resistance and efficiently transporting the generated direct current (DC) from the cells to the junction box. The primary applications span across crystalline silicon (c-Si) modules—including monocrystalline and polycrystalline types—as well as specialized thin-film solar modules. The technological evolution of PV ribbons directly contributes to enhanced module efficiency and overall power output, a critical factor driving global solar adoption.

The manufacturing process of PV ribbons demands high precision, involving stringent control over dimensions, surface flatness, and solder coat composition to ensure optimal electrical contact and mechanical durability under long-term outdoor exposure. Benefits derived from advanced PV ribbons include reduced module shading losses, improved reliability against thermal cycling stress, and compatibility with next-generation high-efficiency cell architectures such as PERC (Passivated Emitter Rear Cell), TOPCon (Tunnel Oxide Passivated Contact), and HJT (Heterojunction Technology). These innovations are essential as the industry shifts towards bifacial and half-cut cell modules, requiring specialized interconnection solutions.

Major driving factors influencing market expansion include robust global government subsidies and renewable energy mandates promoting solar installations, the continuous decline in the levelized cost of electricity (LCOE) derived from solar power, and significant technological advancements like Multi-Busbar (MBB) configurations and Light Capturing Ribbons (LCR). Furthermore, the increasing demand for high-power, high-efficiency solar modules in utility-scale, commercial, and residential applications is directly translating into heightened demand for advanced, thin, and durable PV ribbons globally.

PV Ribbon Market Executive Summary

The PV Ribbon market is currently characterized by intense competition driven by technological miniaturization and the relentless pursuit of higher module efficiency. Business trends indicate a clear shift towards specialized products, particularly ultra-thin interconnectors and highly flexible ribbons designed for Multi-Busbar (MBB) technology and novel cell soldering processes (e.g., lower temperature soldering). Key industry players are focusing on backward integration into specialized copper sourcing and coating technologies to ensure material quality and supply chain resilience. Strategic collaborations between PV ribbon manufacturers and major Tier 1 solar module producers are essential for co-developing products compatible with upcoming high-efficiency cell formats, securing long-term supply contracts, and solidifying market leadership in a volume-driven environment.

Regionally, the Asia Pacific (APAC) continues its unparalleled dominance in the market, primarily fueled by massive solar manufacturing capacity centered in China, which dictates global supply, pricing, and technological adoption rates. While APAC remains the manufacturing powerhouse, strong demand growth is observed across Europe and North America, supported by favorable policy environments and ambitious decarbonization goals. These Western regions are focusing more on utilizing higher-quality, premium ribbons, often those developed to maximize power output and longevity, thereby driving innovation in materials science and coating chemistry. Geopolitical stability and trade dynamics, particularly regarding solar component tariffs, introduce regional nuances in sourcing strategies.

Segment trends highlight the escalating dominance of specialized ribbons, particularly the transition away from traditional 2-Busbar or 5-Busbar designs towards 9BB, 10BB, 12BB, and even higher MBB configurations. This shift necessitates thinner, more numerous interconnectors to minimize resistive losses and shading. Furthermore, the adoption of Light Capturing Ribbons (LCR) is growing rapidly, as these products are engineered with specialized surface profiles (e.g., textures or coatings) to reflect light back onto the solar cell, thus boosting overall energy conversion efficiency without increasing cell area. The crystalline silicon segment remains the core application, but demand for high-reliability ribbons in specialized applications, such as flexible or building-integrated PV (BIPV), offers niche growth opportunities.

AI Impact Analysis on PV Ribbon Market

Common user questions regarding AI’s influence on the PV Ribbon market generally revolve around how artificial intelligence can enhance manufacturing precision, optimize material usage, and predict potential failures in the production line or during module operation. Users are keen to understand the applications of machine learning in defect detection, specifically regarding minute flaws in the ribbon’s surface coating or geometry that could compromise module reliability. Another key area of inquiry is the use of AI-driven predictive maintenance systems to minimize unplanned downtime in high-speed, high-volume ribbon plating and tinning processes, ensuring consistently high-quality output necessary for mass production. Furthermore, there is significant interest in how AI simulation tools can accelerate the research and development of novel ribbon materials and specialized surface textures (like LCRs) optimized for specific light wavelengths or cell architectures.

The implementation of AI and machine learning models significantly enhances the operational efficiency of PV ribbon manufacturing. In high-speed production environments, automated optical inspection (AOI) systems powered by deep learning algorithms can identify and classify microscopic surface defects, dimensional inconsistencies, and soldering integrity issues far faster and more accurately than traditional methods. This capability is crucial for maintaining the extremely tight tolerances required for next-generation solar cells, particularly those used in Multi-Busbar configurations. By minimizing waste and maximizing throughput, AI deployment directly reduces manufacturing costs, thereby contributing to the overall cost reduction trend in solar module production.

Beyond quality control, AI tools are revolutionizing supply chain and inventory management within the PV ribbon sector. Machine learning algorithms analyze complex data sets, including copper commodity prices, global demand fluctuations, and logistic lead times, to provide highly accurate forecasts for raw material procurement. This predictive capability allows manufacturers to hedge against material price volatility and maintain optimal inventory levels, especially concerning critical elements like high-purity oxygen-free copper and specialized solder alloys (e.g., lead-free compositions). Such data-driven decisions ensure sustainable production and better responsiveness to the dynamic demands of the global solar module market.

- AI-powered Automated Optical Inspection (AOI) for detecting micro-defects in coating and geometry.

- Predictive maintenance schedules for high-speed tinning and rolling machinery to ensure zero unplanned downtime.

- Machine learning optimization of solder paste composition and temperature profiles for enhanced adhesion and conductivity.

- Supply chain optimization using AI forecasting models to manage raw copper commodity price volatility.

- Simulation of new ribbon designs (e.g., LCR texture) to predict optical and electrical performance before physical prototyping.

DRO & Impact Forces Of PV Ribbon Market

The PV Ribbon Market is fundamentally driven by the accelerating global adoption of solar photovoltaics, spurred by strong governmental support, carbon neutrality commitments, and the increasing economic competitiveness of solar energy against fossil fuels. Technological advancements, particularly the widespread integration of high-efficiency cell technologies like PERC, TOPCon, and HJT, necessitate specialized, thinner, and highly reliable ribbons (MBB and LCR), acting as a primary impact force. Conversely, the market faces significant restraints stemming from the inherent volatility of raw material prices, primarily copper, which accounts for a substantial portion of the ribbon's cost. Additionally, the continuous need for miniaturization pushes manufacturing tolerances to extreme limits, posing technical challenges in maintaining defect-free mass production.

Major opportunities are emerging from the growing trend of bifacial PV modules, which require highly specialized, reflective ribbons to maximize light absorption on both sides of the panel. The continuous innovation in soldering technologies, moving towards lower-temperature processes (e.g., for HJT cells) and specialized adhesives, opens new avenues for material development in PV ribbons that are thermally stable yet highly conductive. Furthermore, the expansion into niche markets such as flexible solar PV, BIPV, and portable solar applications demands novel ribbon solutions that offer enhanced flexibility, durability, and reduced weight compared to conventional products. These forces collectively shape the competitive landscape and technological trajectory.

The overall impact forces are strongly positive, driven predominantly by the unstoppable global energy transition. While material cost fluctuations present ongoing pressure, the technological imperatives—higher efficiency and long-term reliability—ensure a robust demand for premium, differentiated PV ribbon products. The market's future growth is tied directly to the success of advanced PV architectures; hence, manufacturers that can quickly adapt their products to new cell designs (like silicon wafer thinning or advanced doping profiles) will gain significant competitive advantage. Regulatory frameworks mandating higher local content or environmentally friendly manufacturing practices (e.g., lead-free soldering) also act as critical external impact forces compelling innovation and compliance.

Segmentation Analysis

The PV Ribbon market is comprehensively segmented based on its product type, application technology, and the material composition used in its manufacturing. Understanding these segmentations is crucial for manufacturers to tailor their product offerings to specific technological requirements and market demands. The primary segment distinguishing ribbons is based on the coating material and configuration, reflecting performance characteristics such as electrical conductivity, shading ratio, and soldering compatibility. The evolution of solar cell technology, especially the migration toward Multi-Busbar systems and novel cell structures, necessitates continuous refinement and introduction of new ribbon types to meet enhanced efficiency targets.

By application, the market is overwhelmingly dominated by Crystalline Silicon (c-Si) technology, which includes standard mono- and polycrystalline modules, as well as high-efficiency variants like PERC and TOPCon. Within this application segment, there is a clear trend toward specialized interconnectors, such as Light Capturing Ribbons (LCRs), which optimize optical performance. The thin film segment, while smaller, requires ribbons with specific characteristics to ensure reliable connection with amorphous silicon, CdTe, or CIGS cells, often focusing on high flexibility and low processing temperatures. The material composition segmentation details whether the ribbon is standard tinned copper or specialized coated copper, which influences thermal stability and corrosion resistance.

Geographical segmentation provides a critical view of manufacturing capabilities versus demand centers. Asia Pacific leads manufacturing, driven by China's immense solar production capacity, whereas demand is strong globally. The market analysis requires a detailed breakdown of these segments to forecast growth accurately and identify key investment areas, ensuring that technological roadmaps align with the evolving needs of global solar module assemblers seeking cost reduction and performance maximization.

- By Product Type:

- Tinned Copper Ribbon (Standard Interconnector)

- Coated Copper Ribbon (Specialized Coatings)

- Light Capturing Ribbon (LCR)

- Multi-Busbar Ribbon (MBB)

- By Application:

- Crystalline Silicon Modules (Monocrystalline, Polycrystalline, PERC, TOPCon, HJT)

- Thin Film Modules (a-Si, CdTe, CIGS)

- By Material Composition:

- Copper Core

- Solder Coating (Lead-based, Lead-free, Low-melting point)

- By End-User:

- Utility-Scale Solar Projects

- Commercial & Industrial (C&I)

- Residential Solar Installations

- Specialty PV (BIPV, Flexible Solar)

Value Chain Analysis For PV Ribbon Market

The PV Ribbon market value chain initiates with the upstream supply of raw materials, primarily high-purity oxygen-free copper rod and specialized solder alloys (tin, lead, silver, bismuth). Upstream analysis involves assessing the global copper mining and refining industry, which dictates the base material cost and quality. Manufacturers must secure reliable and cost-effective sourcing agreements, as copper commodity price volatility directly impacts profitability. The quality of the copper rod—specifically its purity and mechanical properties—is paramount, as it determines the ribbon’s electrical conductivity and ability to withstand the subsequent rolling and coating processes without fracturing or developing internal stresses.

The core manufacturing process constitutes the midstream segment, encompassing rolling (to achieve ultra-thin dimensions), cleaning, and the critical electroplating or hot-dipping process for applying the solder coating. This stage requires significant capital investment in highly specialized, precision machinery capable of producing large volumes of uniform ribbon with micron-level accuracy. Distribution channels are varied, including both direct sales from the ribbon manufacturer to major Tier 1 solar module integrators and indirect sales through specialized component distributors and regional suppliers, particularly for smaller module assemblers. Direct sales offer greater control over quality feedback and enable collaborative development, which is increasingly preferred by large module manufacturers.

The downstream segment involves the integration of the PV ribbon into the final solar module assembly, where automated stringing and soldering machines connect the solar cells. The performance of the ribbon is verified during module testing for efficiency and reliability (e.g., thermal cycling tests). The ultimate buyers or end-users are solar project developers (for utility scale), C&I businesses, and residential owners, whose demand for high-performance and reliable modules drives the technological specifications required upstream. The efficiency and reliability of the ribbon directly translate into the LCOE of the solar project, making it a critical component that influences downstream deployment success.

PV Ribbon Market Potential Customers

The primary consumers of PV ribbons are manufacturers of photovoltaic modules, ranging from large, multinational Tier 1 companies dominating the global market to smaller, regional assembly operations focused on niche or specialized products. These module manufacturers require PV ribbons in vast quantities to connect millions of individual solar cells annually. Their purchasing decisions are heavily influenced by the ribbon’s mechanical specifications (thickness, width), electrical properties (conductivity, resistance), compatibility with specific soldering temperatures (crucial for HJT cells), and adherence to stringent quality and longevity certifications, such as those related to IEC standards.

Specific potential customers include major players integrating high-efficiency cells like PERC, TOPCon, and bifacial modules, as these technologies necessitate highly specialized Multi-Busbar (MBB) and Light Capturing Ribbons (LCR) to realize their full potential. Furthermore, companies specializing in advanced or non-standard PV applications—such as Building-Integrated Photovoltaics (BIPV), flexible solar panels for transportation or portable devices, and specialized military or aerospace solar arrays—represent niche but high-value customer segments. These specialized applications often demand ribbons that excel in flexibility, corrosion resistance, and specific aesthetic qualities.

Beyond direct module manufacturers, potential customers also include research institutions and advanced solar technology developers who procure small batches of specialized ribbons for prototyping and testing next-generation solar cell designs. Procurement departments within large-scale solar project developers, though not direct buyers of the ribbon itself, exert significant influence over their module suppliers, often specifying preferred ribbon types or performance metrics to ensure the longevity and output of their multi-gigawatt power plants. This influence mandates that PV ribbon suppliers maintain consistent quality and traceability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals, Ltd., Jiangyin Xinchengyuan Energy Technology Co., Ltd., Wuxi Sunket New Energy Technology Co., Ltd., The Luvata Group, Ulbrich Solar, Alpha Assembly Solutions (MacDermid Enthone), Zhejiang Sanjiale Electrical Machinery Co., Ltd., Kunshan Lian Teng Electronic Co., Ltd., Suzhou Kingstone Electronic Material Co., Ltd., Jinko Solar Co., Ltd. (Internal Supply), Aiko Solar Energy Co., Ltd. (Internal Supply), Ningbo Haixin Solar Technology Co., Ltd., Solar Ribbon Technology Co., Ltd., Shanghai Aerospace Automobile Electromechanical Co., Ltd., Bando Chemical Industries, Ltd., Jiangsu Shunfeng Photovoltaic Technology Co., Ltd., Shanghai Feixing New Energy Materials Co., Ltd., Kunshan Huifeng Ribbon Co., Ltd., ZTT Group, Tongling Nonferrous Metals Group Holding Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PV Ribbon Market Key Technology Landscape

The PV Ribbon market is defined by several pivotal technological advancements aimed at maximizing solar cell efficiency and enhancing module durability. Central to this landscape is the widespread adoption of Multi-Busbar (MBB) technology, which utilizes 9 to 16 thin ribbons instead of the traditional 2 to 5 thick ribbons. This innovation reduces the current path length, thereby lowering resistive losses and minimizing shading on the cell surface. MBB ribbons must be extremely thin and highly precise in their dimensions to be successfully integrated by automated stringing machines, demanding superior manufacturing control over the copper rolling and coating process. The integration of MBB is critical for high-efficiency modules like half-cut and shingled cells.

Another dominant technological trend is the development and utilization of Light Capturing Ribbons (LCRs). These ribbons are designed with specialized surface treatments or geometric profiles (e.g., highly textured or segmented surfaces) that redirect incident sunlight back onto the adjacent solar cells, particularly beneficial for reducing the optical losses that naturally occur due to the ribbon's opacity. LCR technology offers a passive gain in module efficiency, significantly contributing to a higher power output for the same cell area. The optimization of these surface textures requires advanced engineering to balance optical reflectivity with the necessary electrical conductivity and soldering compatibility, ensuring that the ribbon's mechanical integrity is not compromised.

Furthermore, the shift towards next-generation cell structures like Heterojunction Technology (HJT) is driving material innovation. HJT cells are highly temperature-sensitive, necessitating the use of low-temperature soldering processes (often below 180°C) to prevent cell degradation. This has forced PV ribbon manufacturers to develop specialized low-melting-point solder alloys, frequently incorporating bismuth, which is crucial for achieving a reliable connection without causing thermal stress to the cell. Parallel innovations include lead-free solder coatings, driven by environmental regulations (e.g., RoHS compliance in Europe), pushing the industry toward sustainable and high-performance material solutions.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC, particularly China, maintains an overwhelming lead in the PV Ribbon market, acting as the global manufacturing hub for solar cells and modules. This region possesses the largest installed capacity for PV ribbon production, benefiting from integrated supply chains, competitive manufacturing costs, and substantial domestic demand from gigawatt-scale solar projects. India, Vietnam, and Thailand are also emerging as significant manufacturing and consumption centers, driven by local solar incentive schemes and foreign investment diversifying away from China.

- North America (NA) Demand and Quality Focus: North America represents a critical demand market characterized by a strong emphasis on module longevity, performance warranty, and high efficiency, especially within utility-scale projects and high-value distributed generation. While manufacturing presence is less dominant compared to APAC, the demand for premium, highly certified PV ribbons compatible with the latest MBB and bifacial technologies is robust. Trade policies and tariffs influence sourcing, often prioritizing suppliers capable of meeting stringent quality standards and traceability requirements.

- Europe Market Innovation and Regulatory Compliance: Europe serves as a significant adopter of high-efficiency solar modules and is a key driver for technological innovation, particularly concerning environmental standards. The EU's robust regulatory framework, notably regarding lead-free component usage (RoHS directives), has compelled ribbon manufacturers to invest heavily in specialized, low-temperature, lead-free solder solutions. Germany, Spain, and the Netherlands lead regional consumption, focusing on both residential and large-scale solar farm deployments requiring durable, high-performance PV ribbons.

- Latin America (LATAM) Emerging Growth: LATAM is experiencing rapid growth in solar deployment, primarily driven by utility-scale projects in Brazil, Chile, and Mexico, facilitated by abundant solar resources and favorable government auction mechanisms. The demand is largely focused on cost-effective, reliable ribbons suitable for large-scale production, though quality requirements are tightening as developers seek lower degradation rates over the project lifespan.

- Middle East and Africa (MEA) Project Scale Demand: The MEA region is characterized by exceptionally large-scale solar projects, particularly in the UAE and Saudi Arabia, which demand massive volumes of PV modules optimized for high-temperature and high-irradiance desert environments. Ribbons used in this region must offer superior thermal stability and corrosion resistance, driving demand for specialized coated ribbons that ensure reliability under harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PV Ribbon Market.- Hitachi Metals, Ltd.

- Jiangyin Xinchengyuan Energy Technology Co., Ltd.

- Wuxi Sunket New Energy Technology Co., Ltd.

- The Luvata Group

- Ulbrich Solar

- Alpha Assembly Solutions (MacDermid Enthone)

- Zhejiang Sanjiale Electrical Machinery Co., Ltd.

- Kunshan Lian Teng Electronic Co., Ltd.

- Suzhou Kingstone Electronic Material Co., Ltd.

- Jinko Solar Co., Ltd. (Internal Supply)

- Aiko Solar Energy Co., Ltd. (Internal Supply)

- Ningbo Haixin Solar Technology Co., Ltd.

- Solar Ribbon Technology Co., Ltd.

- Shanghai Aerospace Automobile Electromechanical Co., Ltd.

- Bando Chemical Industries, Ltd.

- Jiangsu Shunfeng Photovoltaic Technology Co., Ltd.

- Shanghai Feixing New Energy Materials Co., Ltd.

- Kunshan Huifeng Ribbon Co., Ltd.

- ZTT Group

- Tongling Nonferrous Metals Group Holding Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PV Ribbon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a PV Ribbon in a solar module?

The PV Ribbon's primary function is to act as the essential conductive element (interconnector and busbar) that collects and transports the generated electrical current from individual solar cells to the module's junction box, minimizing resistive losses and optimizing power output.

How is Multi-Busbar (MBB) technology impacting the demand for PV Ribbons?

MBB technology significantly increases the demand for ultra-thin PV ribbons (9BB, 12BB, or more). This shift requires higher precision ribbons to reduce shading losses, lower current path resistance, and enhance overall module efficiency, driving innovation in ribbon geometry and material science.

What are Light Capturing Ribbons (LCRs) and why are they used?

LCRs are specialized ribbons featuring textured or profiled surfaces designed to reflect incidental light back onto the solar cell. They are used to improve the module’s optical performance and achieve efficiency gains without increasing the cell area, especially critical in high-efficiency module manufacturing.

What are the key drivers for using lead-free solder in PV Ribbons?

The key drivers are stringent environmental regulations, particularly in Europe (RoHS compliance), and a growing industry commitment to sustainability. Lead-free solder, often using tin and silver alloys with bismuth, ensures ecological responsibility while maintaining high performance and reliability.

How does the volatile price of copper affect the PV Ribbon market?

Copper is the primary raw material, making up the core of the PV ribbon. Volatility in copper commodity prices directly impacts the manufacturer's cost of goods sold and overall profitability. Companies mitigate this through hedging strategies and optimizing ribbon thickness for material reduction.

Which geographical region dominates the global PV Ribbon manufacturing?

The Asia Pacific (APAC) region, dominated by China, holds the largest share in global PV Ribbon manufacturing capacity, leveraging established solar supply chains and economies of scale to meet massive global module production demands.

What role does AI play in the PV Ribbon manufacturing process?

AI is increasingly utilized in Automated Optical Inspection (AOI) for rapid defect detection, ensuring micron-level dimensional accuracy, and optimizing high-speed manufacturing parameters to reduce waste and enhance consistency in the ribbon's coating and geometry.

How do PV ribbons support next-generation cell technologies like HJT and TOPCon?

PV ribbons support HJT (Heterojunction Technology) and TOPCon by utilizing specialized, low-melting-point solder alloys (often below 180°C) to prevent thermal degradation during the interconnection process, thereby maintaining the cell's high inherent efficiency.

What are the primary challenges in the PV Ribbon market regarding miniaturization?

The primary challenges involve maintaining mechanical integrity and electrical performance while continually reducing the ribbon's thickness (miniaturization), which necessitates extremely precise rolling processes and robust coating adhesion to ensure long-term durability in solar modules.

What is the typical lifespan expected from modern PV Ribbons in solar modules?

Modern, high-quality PV ribbons are designed to last the entire operational life of the solar module, typically 25 to 30 years, resisting degradation from thermal cycling, humidity, and UV exposure through advanced material coatings and robust copper cores.

How does the adoption of bifacial solar modules influence ribbon design?

Bifacial modules require PV ribbons that are optimized for minimal shading on both the front and rear sides. Specialized ribbons often feature enhanced reflectivity or are thinner to maximize the light captured from the back side of the cell, improving overall power generation.

What are the main segments of PV Ribbons by product type?

The main segments include standard Tinned Copper Ribbons, specialized Coated Copper Ribbons, Multi-Busbar (MBB) Ribbons, and advanced Light Capturing Ribbons (LCR), each tailored for different solar cell architectures and efficiency goals.

In the value chain, which upstream component is most critical for PV Ribbon quality?

High-purity oxygen-free copper rod is the most critical upstream component, as its purity and mechanical characteristics directly determine the ribbon’s final electrical conductivity and ability to withstand high-speed processing without defects.

What is the significance of thermal cycling tests for PV Ribbons?

Thermal cycling tests are crucial for verifying the mechanical reliability of PV ribbons, simulating the repeated expansion and contraction stresses experienced in outdoor environments. Successful testing ensures that the ribbon connection will not fracture or delaminate over decades of use.

Who are the typical end-users influencing the demand for specialized PV ribbons?

End-users such as utility-scale solar project developers, who prioritize longevity and LCOE reduction, significantly influence demand, pushing module manufacturers to procure specialized, high-reliability ribbons that guarantee minimal power degradation over the project's warranty period.

How do specialized coatings on PV ribbons enhance performance?

Specialized coatings, such as tin-based solder alloys, are applied to PV ribbons to ensure optimal soldering compatibility with solar cells, provide corrosion resistance, and facilitate low-temperature interconnection crucial for sensitive cell types like HJT.

What are the market opportunities presented by Building-Integrated Photovoltaics (BIPV)?

BIPV offers market opportunities for flexible, aesthetic, and non-standard PV ribbons that can be seamlessly integrated into construction materials, requiring specialized solutions that balance performance, weight reduction, and durability for architectural applications.

Which factors drive the demand for low-temperature soldering PV ribbons?

The demand is driven by the increasing adoption of highly sensitive cell technologies, particularly Heterojunction (HJT) cells, which suffer performance degradation if exposed to high soldering temperatures, requiring ribbons coated with low-melting-point solder alloys.

How does PV ribbon manufacturing contribute to the reduction of solar LCOE?

By enabling higher cell efficiency (through MBB and LCR technologies) and ensuring long-term module reliability, advanced PV ribbons directly contribute to lowering the Levelized Cost of Electricity (LCOE) derived from solar power, making it more competitive globally.

What is the expected CAGR for the PV Ribbon Market between 2026 and 2033?

The PV Ribbon Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 11.5% during the forecast period from 2026 to 2033, driven primarily by exponential global solar capacity additions.

What is the significance of the shift from 5-Busbar to 12-Busbar configurations?

The shift from 5-Busbar to 12-Busbar configurations is significant because it reduces the effective current collection distance, minimizing energy loss due to internal resistance and drastically lowering the impact of shading, thereby boosting the output of high-efficiency solar cells.

What key material restraint challenges the growth of the PV Ribbon market?

The core restraint is the high dependency on the global supply and price stability of high-purity copper, which is a globally traded commodity subject to significant price volatility due to geopolitical and economic factors, impacting production costs heavily.

How does the quality of the PV ribbon impact the module warranty?

The quality and reliability of the PV ribbon are critical; failures such as joint cracking or corrosion can lead to significant power degradation. Therefore, module manufacturers rely on high-quality ribbons to confidently offer long-term performance warranties (25+ years).

Which type of PV ribbon is crucial for maximizing light absorption in solar cells?

Light Capturing Ribbons (LCRs) are crucial for maximizing light absorption as their specially treated surfaces reflect non-absorbed light back onto the adjacent active areas of the solar cell, providing an effective boost to energy conversion efficiency.

How do tariffs and trade barriers affect the procurement strategies of PV ribbons in North America and Europe?

Tariffs and trade barriers often necessitate diversification of sourcing outside major manufacturing hubs, encouraging module assemblers in North America and Europe to prioritize suppliers with established local presence or those offering premium quality to justify higher procurement costs.

What is the role of the solder alloy in the performance of a PV ribbon?

The solder alloy (the coating) ensures a permanent, low-resistance electrical and mechanical bond between the copper ribbon and the solar cell contacts. Its composition is critical for determining soldering temperature compatibility, bond strength, and resistance to environmental stress.

Why is dimension precision vital for Multi-Busbar PV ribbons?

Dimension precision is vital for MBB ribbons because the ultra-thin, numerous wires must align perfectly with the cell’s contact points. Any inconsistency can lead to automated stringing machine errors, poor soldering, or micro-cracks in the fragile solar cells.

What is the distinction between interconnector ribbons and busbar ribbons?

Interconnector ribbons connect cells in a series, carrying current from one cell to the next. Busbar ribbons (or main busbars) collect the current from the interconnectors within the module and conduct it out to the junction box.

In the context of the PV Ribbon market, what defines the 'midstream' segment?

The midstream segment involves the specialized manufacturing processes of the PV ribbon, including the precise cold-rolling of the copper core, surface preparation, and the application of the solder coating via hot dipping or electroplating techniques.

How does the PV ribbon market address the need for extreme durability in harsh environments like the Middle East?

The market addresses durability needs by developing specialized corrosion-resistant coatings and solder alloys that withstand high temperatures, intense UV radiation, and high humidity, ensuring the ribbon maintains its performance and structural integrity over long operational periods.

What competitive advantage is gained by backward integration in the PV ribbon value chain?

Backward integration (e.g., controlling copper sourcing or in-house rolling) provides competitive advantages by ensuring consistent raw material quality, reducing exposure to volatile commodity price swings, and enabling tighter control over production costs and lead times.

Which application segment currently holds the largest market share for PV ribbons?

The Crystalline Silicon (c-Si) module segment, including both mono- and polycrystalline technologies, overwhelmingly holds the largest market share for PV ribbon applications, driven by its dominance in global solar module production.

What emerging material alternatives are being researched for traditional copper ribbons?

Research is focusing on ultra-thin aluminum, silver-coated copper alloys, and conductive adhesives (ECAs) as potential alternatives, aiming for reduced weight, lower material costs, or enhanced flexibility, especially for advanced cell concepts and BIPV applications.

How do PV ribbon manufacturers ensure compliance with international quality standards?

Manufacturers ensure compliance by adhering to rigorous testing protocols like IEC 61215 and IEC 61730 for module reliability, conducting internal quality checks (e.g., peel strength, resistance measurements), and maintaining ISO-certified production environments.

What is the significance of the forecasted CAGR of 11.5% for the PV Ribbon market?

The 11.5% CAGR signifies a rapid and sustained expansion of the market, indicating that global solar installations are growing at an accelerating rate and that continuous technological demands for high-efficiency ribbon types are maintaining strong component value.

Which market trend requires the fastest adaptation from PV Ribbon manufacturers?

The fastest trend requiring adaptation is the rapid transition to higher-efficiency cell technologies (e.g., TOPCon and HJT) which necessitate immediate shifts in product design to accommodate ultra-thin profiles, more busbars, and specific low-temperature solder coatings.

What market restraint is linked to the thickness of PV ribbons?

The thickness limitation restraint relates to the trade-off between electrical conductivity (favoring thicker ribbons) and shading loss (favoring thinner ribbons). Continuous miniaturization increases mechanical fragility and manufacturing complexity.

How does solar cell wafer thinning impact PV ribbon requirements?

As solar cell wafers become thinner and more fragile, PV ribbons must be optimized to exert minimal mechanical stress during the soldering process, requiring highly flexible materials and extremely precise temperature control during interconnection to prevent cell damage.

What distinguishes Coated Copper Ribbons from standard Tinned Copper Ribbons?

Coated Copper Ribbons often utilize specialized alloys or proprietary surface treatments beyond standard tin/lead compositions. These specialized coatings are engineered for specific properties, such as enhanced anti-corrosion capability, optimized reflectivity (LCR), or ultra-low melting points.

Why is traceability important in the PV Ribbon supply chain?

Traceability is important to guarantee quality control and address potential failures. It allows module manufacturers and project developers to track the exact source and batch of ribbons used, which is critical for fulfilling warranty claims and performing root cause analysis of module defects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager