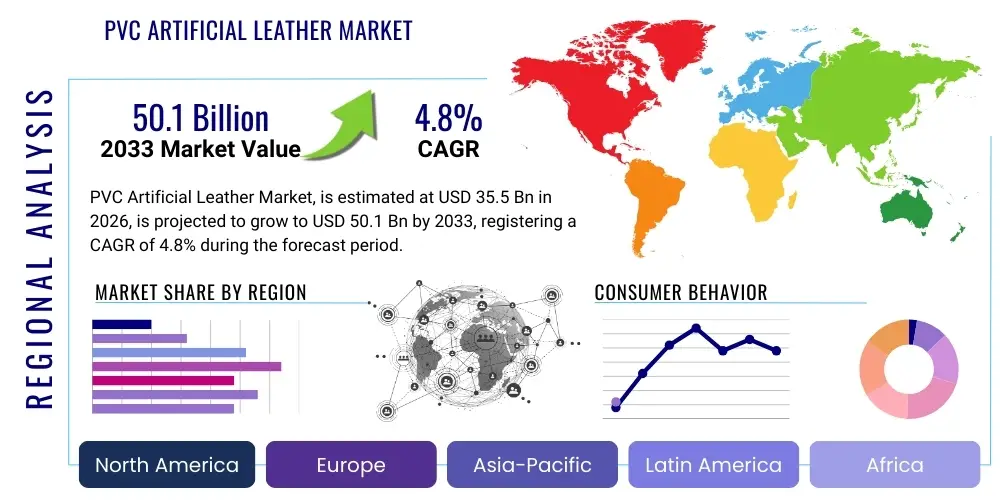

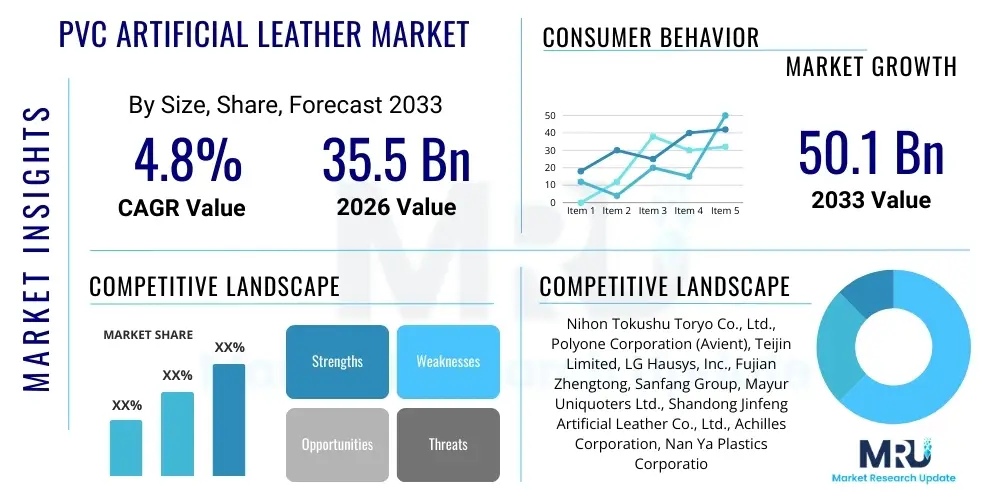

PVC Artificial Leather Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437432 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

PVC Artificial Leather Market Size

The PVC Artificial Leather Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 50.1 Billion by the end of the forecast period in 2033.

PVC Artificial Leather Market introduction

The PVC Artificial Leather Market encompasses the production, distribution, and consumption of synthetic flexible sheeting materials engineered to replicate the aesthetic, tactile, and functional properties of genuine animal hides, utilizing Polyvinyl Chloride (PVC) as the primary polymer matrix. This market segment has solidified its position as a highly resilient and indispensable component within global material supply chains, driven by its exceptional cost-to-performance ratio. Unlike natural leather, which is subject to inherent variations in quality, size, and availability, PVC artificial leather offers predictable material characteristics, standardized large-format rolls, and rapid scalability, making it profoundly suitable for high-volume manufacturing processes, especially those characterized by just-in-time inventory systems. The manufacturing versatility of PVC allows for precise control over parameters such as thickness, abrasion resistance, and texture definition, enabling producers to meet highly specific application requirements across diverse industrial spectra while simultaneously catering to consumer demands for cruelty-free and vegan-friendly product options.

The fundamental product structure typically consists of a foundational fabric layer, which provides tensile strength and dimensional stability—often woven or knitted polyester, cotton, or blended fibers—over which a PVC polymer compound is applied. This compound is a sophisticated mix comprising PVC resin, crucial liquid plasticizers (to impart flexibility), heat stabilizers (to prevent degradation during processing), specialized fillers, and color pigments. The application methods, primarily calendering (for robust, homogenous sheets) or various coating techniques (such as direct or transfer coating for nuanced surface effects), dictate the final material properties and textural fidelity. A key descriptive feature of modern PVC leather is its enhanced physical properties, including superior longevity, impermeability to liquids, excellent resistance to staining and fungal growth, and adaptability to a vast array of embossing patterns that convincingly simulate natural leather grains, from fine nappa to heavy pebbled finishes. These attributes collectively establish PVC artificial leather as a reliable and high-performance material across its established end-use sectors, specifically tailored to withstand rigorous use in commercial and transport environments globally.

The market trajectory is propelled by several macro-environmental and industry-specific factors. Crucially, the exponential expansion of the global automotive industry, particularly in developing economies, drives sustained high demand for durable, affordable interior materials that satisfy increasingly strict regulatory standards concerning safety and interior air quality (low VOC emissions). Furthermore, the residential and contract furniture sectors continue to rely heavily on PVC leather for high-traffic, low-maintenance upholstery solutions, demanding bulk supply and consistent quality. Economic benefits are paramount: the inherent stability of manufacturing costs for synthetic polymers, relative to the volatile pricing and limited availability of natural animal hides, provides a predictable cost basis for large Original Equipment Manufacturers (OEMs). This stability, coupled with technological advancements focused on mitigating the environmental drawbacks of PVC—specifically the transition to non-phthalate plasticizers and the exploration of closed-loop recycling systems—ensures the material’s continued relevance and competitive superiority in the face of alternative synthetic options like polyurethane (PU) leather, solidifying its market dominance in cost-sensitive segments.

PVC Artificial Leather Market Executive Summary

The overarching business trends within the PVC Artificial Leather Market point toward sustained value growth, largely underpinned by efficiency gains through process automation and strategic shifts toward material specialization. Manufacturers are increasingly adopting Industry 4.0 principles, integrating sensors and real-time monitoring across coating and calendering lines to ensure ultra-precise consistency in thickness and texture, thereby reducing waste and enhancing manufacturing throughput. Furthermore, the market exhibits a critical trend toward compliance marketing, where adherence to international chemical regulations (like the banning of certain heavy metals and primary plasticizers) is leveraged as a competitive differentiator, particularly when supplying global automotive and furniture brands that demand robust product stewardship documentation. Strategic mergers and acquisitions are consolidating the competitive landscape, allowing larger entities to capture specialized technology patents and expand their geographic reach into rapidly industrializing regions, optimizing global material flow and ensuring robust supply chain resilience against geopolitical and logistical disruptions.

Regionally, the market's center of gravity remains firmly rooted in the Asia Pacific region, which functions as the principal manufacturing and consumption hub. This regional dominance is intrinsically linked to the immense scale of Asian original equipment manufacturing (OEM) for global supply, spanning footwear, apparel, and vehicles, underpinned by highly cost-competitive labor and established industrial infrastructure. Contrastingly, North American and European markets exhibit slower volume growth but demonstrate an accelerated focus on high-value, niche applications requiring premium specifications, such as antimicrobial treatments for healthcare settings or superior UV stability for recreational vehicles and marine environments. This bifurcation necessitates a dual manufacturing strategy for global players: prioritizing mass-market efficiency and volume in APAC while investing heavily in high-specification customization and advanced R&D in Western regions, managed through highly localized compliance strategies addressing specific regional requirements, particularly those relating to plasticizer migration and stringent fire safety standards.

Segmentation analysis confirms the Automotive application segment's pivotal role in driving high-specification demand, requiring materials with exceptional long-term durability and resistance to extreme temperatures, often utilizing transfer-coated PVC fabrics. Within product types, the move towards specialized Coated Fabrics continues to outpace the traditional Calendered Sheets segment in terms of value growth, reflecting the industry's focus on achieving superior tactile qualities and enhanced performance characteristics, particularly in high-contact areas like seating and armrests, which command premium pricing. The trend towards ethical sourcing and vegan branding further fuels segments within footwear and apparel, driving demand for materials marketed explicitly as cruelty-free alternatives, even as the industry grapples with the complexities of PVC's non-biodegradable nature, prompting ongoing investment in bio-content fillers and sustainable processing solutions to secure long-term segment viability and market acceptance.

AI Impact Analysis on PVC Artificial Leather Market

Analyzing widespread queries reveals that stakeholders are intensely focused on leveraging Artificial Intelligence (AI) and Machine Learning (ML) to overcome persistent operational challenges specific to synthetic material production. Key user concerns include minimizing batch-to-batch inconsistency in color and texture—a long-standing quality control issue in continuous coating processes—and improving the prediction of raw material cost volatility, which significantly impacts complex global pricing strategies for high-volume products. Users are also investigating the potential of AI-driven material informatics to fast-track the development of next-generation PVC formulations that comply with evolving global environmental mandates, particularly those demanding reduced hazardous substance content while maintaining or enhancing critical physical properties such as flex endurance and scratch resistance. The expectation is that AI will transcend simple process automation, moving into sophisticated predictive modeling for both strategic supply chain optimization and fundamental material science research, ensuring material longevity and regulatory compliance.

The integration of AI systems into the PVC artificial leather production lifecycle is fundamentally transforming process control and quality assurance protocols. High-resolution optical inspection systems, powered by deep learning algorithms trained on millions of images, are deployed inline to scrutinize every square meter of material exiting the coating and embossing lines. These systems accurately identify subtle surface imperfections, pinholes, and variations in grain depth that are often undetectable by human operators or traditional machine vision systems, leading to significantly tighter quality tolerances, minimized material waste, and maximized production of highly uniform, certified materials. Furthermore, ML models are utilized to dynamically fine-tune the highly complex parameters of the coating process (e.g., curing oven temperatures, line speed, and viscosity of plastisol) in real-time response to environmental factors, ensuring optimal energy usage and complete material polymerization, thereby significantly maximizing yield and operational efficiency throughout continuous production runs, especially for complex custom orders.

Beyond the factory floor, AI provides critical strategic advantages in supply chain forecasting, demand planning, and sophisticated product development. Predictive analytics models analyze global commodity markets, geopolitical trends, and historical demand patterns to optimize the timing and quantity of purchases for PVC resin, high-performance plasticizers, and textile backings, effectively hedging operational margins against sudden cost spikes in petrochemical feedstocks. In the realm of Research and Development, AI-driven simulations are drastically cutting down the traditionally lengthy empirical testing phase for new material formulations. Researchers input chemical composition data and desired material attributes (e.g., specific cold-crack temperature, hydrolytic stability) into algorithms, which then predict the optimal blending ratios and specific processing conditions necessary to achieve these targets rapidly, accelerating the market introduction of innovative, high-performance, and regulatorily compliant PVC artificial leather products for lucrative niche markets, such as aerospace or high-end maritime applications.

- AI-driven predictive maintenance optimizes calendering and coating machine uptime, boosting Overall Equipment Effectiveness (OEE) by minimizing unplanned stoppages and extending component life.

- Machine learning enhances real-time quality control, automatically identifying subtle defects in texture, color matching consistency, and film thickness across high-speed production lines, ensuring superior product uniformity.

- Computational chemistry accelerates R&D for novel PVC formulations, improving durability and facilitating the rapid development of low-VOC, non-phthalate compliant products essential for regulated markets.

- Generative AI supports the rapid creation of customized patterns and aesthetic finishes, allowing manufacturers to quickly prototype and launch intricate texture designs aligned with current automotive interior and high-end furniture trends.

- AI-powered logistics forecasting optimizes raw material inventory (PVC resin, plasticizers) by accurately predicting demand fluctuations and minimizing exposure to volatile commodity pricing, stabilizing production costs.

DRO & Impact Forces Of PVC Artificial Leather Market

The robust market expansion for PVC Artificial Leather is fundamentally driven by compelling economic and practical factors essential for high-volume industries. The dominant driver is the material’s proven cost-effectiveness, offering a significantly cheaper and more stable alternative to highly priced and supply-volatile natural leather, a necessity for industries reliant on massive scale production such as the Asian automotive sector and mass-market furniture manufacturing. The inherent functional benefits of PVC, including its superior resistance to water, staining, chemicals, and mechanical abrasion, ensure its preferred status in demanding applications where longevity and minimal maintenance are paramount, such as public transport seating and institutional upholstery. Furthermore, the global rise of ethical consumerism and the preference for vegan materials strongly propels demand, allowing manufacturers to market PVC leather as a cruelty-free option, tapping into a growing segment of environmentally conscious yet budget-sensitive consumers, thereby guaranteeing market resilience against conventional material competition and supporting brand reputation.

Despite strong driving forces, the market faces considerable restraints, primarily centered around environmental sustainability and intense regulatory scrutiny across major Western economies. The non-biodegradable nature of PVC poses significant, long-term end-of-life disposal challenges, contributing to landfill accumulation and generating persistent negative public perception regarding plastic waste. More immediate operational restraints involve the tightening global regulations concerning the use of conventional phthalate plasticizers (e.g., DEHP), which necessitates costly reformulations, extensive compliance testing, and often the adoption of more expensive alternative plasticizers (e.g., DOTP or citrate-based systems). This stringent regulatory landscape, particularly enforced in developed regions like the EU through directives such as REACH, increases operational complexity and demands high capital expenditure for equipment upgrades required to handle new, specialized chemical inputs, thereby slowing growth rates and increasing overall product costs in these strictly regulated territories.

Significant opportunities for lucrative growth lie in technological specialization and strategic market diversification into high-performance niche areas. Developing and commercializing specialized, high-grade PVC formulations—such as those engineered with enhanced antimicrobial properties for medical and institutional markets, or highly UV-resistant and cold-crack-resistant formulas for outdoor and marine applications—allows manufacturers to capture higher profit margins outside the commoditized segments. Furthermore, the most transformative opportunity involves the successful integration of renewable, bio-based fillers or recycled content into PVC compounds and investing heavily in advanced chemical recycling processes to achieve closed-loop material cycles. Demonstrating a tangible, verifiable commitment to circular economy principles can radically improve the material's image, potentially mitigating long-term regulatory pressures and opening up new, premium contracts with major global corporations that have aggressive internal sustainability and zero-waste targets. The competitive landscape is defined by the high substitution threat posed by polyurethane (PU) leather and emerging bio-based synthetics, maintaining intense price and performance pressure, and driving the perpetual need for continuous product differentiation based on function, texture fidelity, and superior environmental compliance.

Segmentation Analysis

The segmentation of the PVC Artificial Leather Market provides a detailed framework for understanding specific consumer behaviors and industrial demands across diverse product formats and end-use applications. Analyzing the market by Product Type, we differentiate clearly between Coated Fabrics and Calendered Sheets. Coated Fabrics, characterized by a complex manufacturing process involving the precise application of liquid PVC plastisol onto a pre-treated textile backing, generally yield materials with superior flexibility, improved tactile qualities, and capability for intricate surface textures. This makes them the preferred high-value product for luxury applications such as automotive seating and high-end contract furniture upholstery where aesthetic quality is paramount. In contrast, Calendered Sheets, produced by feeding compounded PVC through heated rollers, offer robust, highly cost-efficient, and dense materials primarily targeted towards standardized, high-volume products such as basic footwear components, floor mats, and simple protective covers, where ultimate material cost efficiency and production speed are the key purchasing criteria for manufacturers.

Application-based segmentation vividly illustrates the primary demand drivers and areas of highest material utilization. The Automotive sector dominates both volume and value consumption globally, relying heavily on PVC's unparalleled resilience to heat, cold, and repeated cleaning cycles, utilizing the material extensively in vehicle interiors—from door panels and dashboards to specialized high-wear seating components. The Furniture and Furnishings segment represents the second largest consumer base, with strong consistent demand from both residential and contract markets, valuing the material for its reliable stain resistance and highly durable nature, which is crucial in hospitality, educational, and institutional environments. Growth in the Footwear and Bags and Luggage segments is notably robust, driven by the need for waterproof, scuff-resistant materials that offer significant aesthetic versatility at an accessible price point, particularly in fast-fashion and athletic shoe markets where design cycles are extremely short and material customization is highly valued to meet rapid seasonal changes.

Further granularity is achieved through segmentation by Manufacturing Process, distinguishing between the traditional Calendering method and various sophisticated Coating methods (direct, transfer, and immersion). The choice of processing technology fundamentally dictates the end material's technical characteristics, the achievable aesthetic finish, and the final cost structure. Transfer coating, for instance, allows for the highly realistic creation of intricate, deeply embossed grain patterns with superior softness, capturing high premium market value in upholstery. Conversely, direct coating is exceptionally efficient for producing homogenous, durable films directly onto a substrate at high speeds. Strategic market positioning thus requires manufacturers to align their core processing technology—whether focused on high-speed volume production (calendering) or advanced surface finishing (coating)—with the performance and aesthetic requirements of the target application segment, ensuring optimized cost structures and strict adherence to necessary performance specifications like specific fire retardancy ratings or required tensile strength for safety-critical components.

- By Product Type:

- Coated Fabrics (High-performance, intricate textures, preferred for automotive interiors and high-end upholstery, often requiring specialized backing materials)

- Calendered Sheets (High volume, cost-effective, robust and dense material, used extensively in footwear, industrial sheeting, and standard accessories)

- By Application:

- Automotive (The largest and most specification-driven segment; utilized for upholstery, internal trims, headliners, and door panels requiring low-VOC and fire retardancy)

- Furniture and Furnishings (Contract and residential seating, institutional upholstery, wall coverings, and specialized decorative panels)

- Footwear (Uppers, linings, shoe components, emphasizing flexibility, weather resistance, and scuff protection)

- Bags and Luggage (Travel bags, backpacks, emphasizing tear strength, water resistance, and abrasion resistance)

- Apparel (Outerwear, rain gear, trims, and fashion accessories, often focusing on flexibility and aesthetic qualities)

- Others (Marine upholstery requiring extreme UV and salt resistance, specialized Medical examination tables, Consumer Electronics protective casings, and industrial tarpaulins)

- By Manufacturing Process:

- Calendering (High-speed, energy-intensive process for cost-efficient production of basic sheets and films)

- Coating (Direct coating, Transfer coating, Immersion coating, used for creating nuanced textures, multi-layered structures, and specific material properties)

- By Region:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (APAC) (China, India, Japan, South Korea, Southeast Asia, Rest of APAC)

- Latin America (LATAM) (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For PVC Artificial Leather Market

The PVC Artificial Leather value chain initiates at the critical upstream stage, where raw material suppliers provide the foundational chemical components necessary for production. This phase is characterized by a strong dependence on the global petrochemical industry for sourcing PVC resin powder (polymerized from vinyl chloride monomer), which inherently links material costs to the high volatility of crude oil and natural gas prices, necessitating careful risk management by major chemical buyers. Essential supporting chemicals include a complex array of plasticizers, such as the emerging non-phthalate alternatives like Dioctyl Terephthalate (DOTP), which are critical for imparting flexibility, controlling texture, and ensuring compliance with stringent regulatory requirements in export markets. Additionally, specialized heat stabilizers, potent UV inhibitors, fire retardants, and high-purity pigments are sourced from global specialty chemical producers. Effective upstream management requires strategic long-term supply contracts and robust hedging mechanisms to secure consistent material supply and quality control for the downstream manufacturing processors.

The core manufacturing stage, or the midstream, involves complex, high-capital processes encompassing precise formulation, compounding, and advanced finishing techniques. Material manufacturers receive the dry PVC resin and liquid additives, which are intensively mixed and compounded before being applied to the textile substrate. The processing method utilized—either the pressure-based calendering technique or various coating methods—fundamentally determines the end product’s performance characteristics, surface morphology, and achievable cost structure. This stage is intensely focused on achieving optimal process efficiency, minimizing energy consumption, and implementing stringent quality control protocols to prevent material defects such as bubbling or inconsistency in film thickness. Investment in state-of-the-art machinery capable of high-precision digital embossing and uniform film application is vital for maintaining competitiveness, especially when serving demanding sectors like high-specification automotive interiors that require precise material standards and validated batch consistency.

The downstream sector of the value chain involves complex logistics networks for distribution, subsequent fabrication into end products, and critical interaction with the final end-user base. Distribution channels are typically bifurcated: direct sales channels cater specifically to major Original Equipment Manufacturers (OEMs) in the automotive sector and large, institutional furniture contract suppliers, providing a highly customized product with integrated logistics support and technical consultation. Indirect channels rely on regional distributors and specialized agents who efficiently handle warehousing, inventory buffering, and localized cutting services for smaller manufacturers, such as independent footwear designers or local upholsterers. The final fabrication phase involves the cutting, stitching, and thermoforming of the artificial leather into finished goods. The efficiency of the downstream operations, particularly the speed of delivery, the complexity of inventory management, and the provision of localized technical support, is crucial for market success, ensuring that the specialized PVC material is correctly utilized to maximize its intended performance in high-volume, rapidly changing production environments.

PVC Artificial Leather Market Potential Customers

The principal and most significant segment of potential customers for PVC artificial leather includes global and regional manufacturers within the automotive industry, encompassing major vehicle OEMs, Tier 1 suppliers, and aftermarket providers. These customers utilize PVC leather extensively for high-traffic vehicle seating surfaces, internal door inserts, specialized trims, and dashboard applications because of its exceptional longevity, resistance to extreme thermal cycling (essential for both hot and cold climates), high cleanability for interior maintenance, and mandatory adherence to specific Federal Motor Vehicle Safety Standards (FMVSS), particularly related to flame resistance and low VOC emissions. For these critical customers, ensuring supply consistency, maintaining high volume capacity, and providing globally unified quality certifications (such as IATF 16949) are non-negotiable purchasing requirements, making the establishment of long-term supply agreements a core strategic element for leading PVC material producers.

A second major customer category encompasses the vast furniture and contract furnishing industry, including international furniture chains, institutional suppliers (serving educational institutions, hospitals, and government offices), and the demanding hospitality sector (hotels and restaurants). These customers are primarily seeking durable, aesthetically versatile, and cost-effective upholstery that can successfully withstand relentless public use and stringent, frequent sanitation protocols. PVC's inherent barrier properties against spills, its resilience to chemical cleaners, and its capacity for high-fidelity leather grain embossing make it a highly attractive, economical solution. Specific demands from this institutional and commercial group often revolve around advanced functional requirements, such such as built-in anti-microbial treatments and specific, documented fire-rating compliance (e.g., Cal 117 or BS 5852 standards), necessitating tailored product lines from PVC artificial leather suppliers to effectively penetrate this robust, but specification-driven, market segment.

Further diversification of the critical customer base includes the global Footwear and Accessories manufacturing sectors, particularly those focused on mass-produced athletic, industrial safety, and casual footwear lines. These customers prioritize PVC materials that offer superior water resistance, flexibility during fabrication, high scuff resistance, and light weight for components like shoe uppers and trims, driven by continuous innovation in design and material performance. Additionally, niche industrial customers, such as manufacturers of specialized protective gear, the marine equipment industry (requiring extreme UV and salt-water resistance for boat upholstery), and specialized medical equipment producers (needing impermeable, easy-to-clean surfaces for examination and therapy beds), form smaller but high-value customer segments. Successfully serving this highly diverse array of potential customers requires PVC leather suppliers to maintain highly specialized R&D capabilities, enabling them to meet unique functional demands—ranging from specific tear strength requirements for safety use to soft-touch finishes for luxury accessory brands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 50.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nihon Tokushu Toryo Co., Ltd., Polyone Corporation (Avient), Teijin Limited, LG Hausys, Inc., Fujian Zhengtong, Sanfang Group, Mayur Uniquoters Ltd., Shandong Jinfeng Artificial Leather Co., Ltd., Achilles Corporation, Nan Ya Plastics Corporation, Jiangsu Huangtai, H.R. Polycoats Pvt. Ltd., Jiaxing Hongrui, Zhejiang Huading, Yantai Wanhua Polyurethanes Co., Ltd., R.K. Leather, Trelleborg AB, Senfa S.A., Kolon Industries, Inc., Guangzhou Huahong, Toli Corporation, Duksung Co., Ltd., Wonyong Industrial Co., Ltd., Sichuan Sanjia, Alfatex Italia S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PVC Artificial Leather Market Key Technology Landscape

The core technological evolution within the PVC Artificial Leather Market is concentrated on advanced chemical formulation and precision manufacturing, aiming to enhance material performance, specifically in areas of durability and tactile quality, while robustly addressing stringent environmental and regulatory constraints. Significant research and development investment is directed towards replacing traditional petroleum-based plasticizers with sustainable, non-phthalate alternatives, most notably the widespread industrial adoption of Dioctyl Terephthalate (DOTP) and innovative bio-based compounds derived from renewable resources like castor or soy oils. This fundamental chemical transformation is rigorously coupled with advancements in thermal stabilization technology, ensuring that these alternative compounds maintain material flexibility, long-term UV resistance, and aging performance without negatively impacting the high-speed manufacturing process or the end product’s crucial long-term durability, a critical requirement for high-exposure applications such as dashboards and outdoor furniture where prolonged sun exposure is inevitable.

In terms of physical processing technology, the industry is increasingly favoring sophisticated coating methods, particularly transfer coating and advanced gravure coating, over basic calendering when superior aesthetics, material hand-feel, and complex tactile qualities are demanded. Transfer coating allows for the creation of multi-layered, porous structures with precise control over the texture and coloration of the surface layer, enabling PVC leather to closely mimic the luxurious feel and natural appearance of premium genuine leather or advanced microfiber materials. Furthermore, the rapid integration of high-resolution digital printing and precision laser embossing technologies allows for highly flexible, customized pattern creation, significantly reducing the lead time for launching new designs and enabling shorter, more responsive production cycles tailored specifically to fast-changing fashion and specialized automotive interior design trends. This precision engineering minimizes start-up material waste and dramatically increases the overall quality and batch-to-batch consistency of the high-value Coated Fabrics segment.

A burgeoning and critical technological area involves sustainability and end-of-life management solutions, which are vital for the long-term viability of PVC materials. While traditional mechanical recycling of complex PVC/textile composites remains structurally and economically challenging due to the difficulty in separating the components, significant R&D efforts are being channeled into innovative chemical recycling, solvent dissolution, and specialized pyrolysis techniques that aim to successfully recover the pure PVC monomer or valuable plasticizers for high-grade reuse. Furthermore, incorporating highly functional performance additives, such as highly effective flame retardants (essential for compliance in public seating and mass transit) and powerful antimicrobial agents, is becoming standard practice, driven by institutional and healthcare sector demands for hygiene and safety. These technological advancements ensure that PVC artificial leather not only remains extremely cost-competitive but also continuously upgrades its functional and environmental profile, solidifying its indispensable role as a key durable material in modern, safety-conscious, and increasingly sustainability-focused global manufacturing supply chains.

Regional Highlights

The Asia Pacific (APAC) region continues to exert profound, dominant influence over the global PVC Artificial Leather Market, serving as the uncontested powerhouse for both massive production capacity and high consumption volume. This industrial dominance is intrinsically linked to the immense scale of industrial output in nations such as China, which is the world’s leading manufacturer across key end-use sectors including footwear, apparel, and automotive components, utilizing PVC material extensively. The presence of highly concentrated, cost-competitive manufacturing clusters, coupled with a massive, rapidly expanding consumer base requiring affordable interior and fashion goods, solidifies APAC's dominant position. The market dynamics here are primarily driven by volume growth, maximizing manufacturing throughput efficiency, and meeting the general market demand for highly cost-effective material solutions, although strict regulatory compliance concerning exports to North American and European markets is now an increasingly vital factor influencing advanced product formulation within the region's largest manufacturing enterprises.

In contrast, the North American and European markets are accurately characterized by their maturity and a strategic premium focus, driven by highly specific regulatory compliance requirements and a deeply embedded consumer preference for high-performance, specialized PVC products. In Europe, the strictures of the REACH chemical directive necessitate that manufacturers operating in or supplying to the region maintain rigorous control over all chemical inputs, particularly plasticizers and heavy metals, actively pushing local production towards verifiable non-phthalate and certified low-VOC formulations. North America exhibits exceptionally strong demand for specialized marine and recreational vehicle upholstery, requiring customized PVC material that offers extreme UV resistance, superior resistance to cold cracking, and enhanced durability against saltwater and climate fluctuations. The growth in these regions is strategically less about overall volume expansion and more about high-value innovation, customization, and guaranteed product certification to stringent local safety and environmental standards, commanding premium pricing.

Latin America (LATAM) and the Middle East and Africa (MEA) represent significant areas of emerging growth, propelled by strong macroeconomic fundamentals and infrastructure development. LATAM, particularly large economies like Brazil and Mexico, is witnessing robust expansion in domestic automotive manufacturing and a growing consumer middle class, which significantly increases the baseline demand for durable, affordable car interiors and modern home furnishings. The MEA region's growth is largely underpinned by massive ongoing construction and rapid urbanization projects, particularly across the Gulf Cooperation Council (GCC) states, which necessitate large volumes of highly fire-retardant, heat-resistant, and highly durable artificial leather for high-traffic public buildings, premium hotels, and developing mass transit systems. While MEA faces unique market challenges related to extreme heat and prolonged dust exposure, driving demand for materials with superior resistance to environmental stress, the market potential remains high due to sustained government investment in infrastructure development and strategic localization of manufacturing capacity.

- Asia Pacific (APAC): Central to global PVC supply chains; massive volume consumption driven by automotive, footwear, and consumer goods output in key countries like China, India, and Vietnam. Focus is on maximum efficiency and low material costs, prioritizing scalability.

- North America: Market leader in specialty high-performance segments (e.g., Marine, RV, contract seating); growth dictated by stringent quality standards, specific UV stability requirements, and mandatory low-VOC standards for vehicle interiors.

- Europe: Highly regulated market environment (REACH compliance); manufacturers prioritize sustainability, certified non-phthalate plasticizers, and high-quality, specialized products for premium automotive and contract furnishing segments.

- Latin America (LATAM): Moderate and stable growth fueled by expanding domestic automotive assembly and furniture production; demand centers around cost-effective, yet quality-controlled materials in major markets such as Brazil and Mexico.

- Middle East and Africa (MEA): Rapidly developing market driven by large-scale infrastructural spending and commercial construction; requirements focus on extreme heat resistance, durability, and essential fire safety compliance in high-occupancy public spaces.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PVC Artificial Leather Market, highlighting their product offerings, strategic initiatives, regional footprint, and recent developments in sustainable manufacturing and advanced coating technologies. These companies maintain extensive production capacities tailored for the high-volume automotive, contract furniture, and consumer goods segments globally, driving innovation in material performance and efficiency in supply chain management.- Nihon Tokushu Toryo Co., Ltd.

- Polyone Corporation (now Avient Corporation)

- Teijin Limited

- LG Hausys, Inc.

- Fujian Zhengtong

- Sanfang Group

- Mayur Uniquoters Ltd.

- Shandong Jinfeng Artificial Leather Co., Ltd.

- Achilles Corporation

- Nan Ya Plastics Corporation

- Jiangsu Huangtai

- H.R. Polycoats Pvt. Ltd.

- Jiaxing Hongrui

- Zhejiang Huading

- Yantai Wanhua Polyurethanes Co., Ltd.

- R.K. Leather

- Trelleborg AB

- Senfa S.A.

- Kolon Industries, Inc.

- Guangzhou Huahong

- Toli Corporation

- Duksung Co., Ltd.

- Wonyong Industrial Co., Ltd.

- Sichuan Sanjia

- Alfatex Italia S.p.A.

Frequently Asked Questions

Analyze common user questions about the PVC Artificial Leather market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between PVC and PU artificial leather?

PVC artificial leather is generally valued for its superior toughness, exceptional abrasion resistance, and excellent impermeability, making it the highly durable choice for industrial and high-wear automotive use. PU (Polyurethane) leather is known for better breathability, a softer touch, and lighter weight, often favored in fashion, though it may exhibit lower long-term resistance against humidity-induced hydrolysis compared to specialized PVC formulations.

How do regulations, such as REACH, impact the PVC artificial leather manufacturing process?

REACH regulations fundamentally necessitate the replacement of traditional plasticizers like specific phthalates with demonstrably safer, non-phthalate alternatives (e.g., DOTP). This regulatory pressure drives significant material formulation R&D, requires costly capital expenditure for process upgrades, and focuses production on chemically compliant, verifiable low-VOC materials, essential for accessing the European market.

Which application segment holds the largest market revenue share for PVC Artificial Leather?

The Automotive application segment consistently commands the largest market revenue share globally. This is due to the immense volume requirements for interior components, coupled with the critical necessity for materials that offer high durability, certified fire resistance (FMVSS compliance), robust UV stability, and essential cost advantages for high-volume vehicle production.

What technological trends are driving sustainable innovation in PVC artificial leather?

Key technological trends focus on sustainability and material health, including the industry-wide transition to non-phthalate and bio-based plasticizers, the adoption of energy-efficient, solvent-free coating systems to substantially reduce VOC emissions, and advanced research into chemical recycling processes aimed at economically recovering pure PVC content and separating it efficiently from the textile backing.

Why is the Asia Pacific region the leading producer and consumer of PVC artificial leather?

APAC maintains its dominance due to its expansive, cost-competitive manufacturing base, especially in the automotive, textile, and footwear sectors (led by China and India), offering superior economies of scale, robust supply chain infrastructure, and direct access to massive, rapidly growing domestic consumer markets requiring high volumes of durable, affordable synthetic materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive PVC Artificial Leather Market Size Report By Type (Seats, Door Panel, Instrument Panel, Consoles, Other), By Application (Passenger Vehicle, Commercial Vehicle), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- PVC Artificial Leather Market Statistics 2025 Analysis By Application (Shoes, Bags, Flooring Materials), By Type (Calender PVC Leather, Rotary Screen Coating PVC Artificial Leather), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager