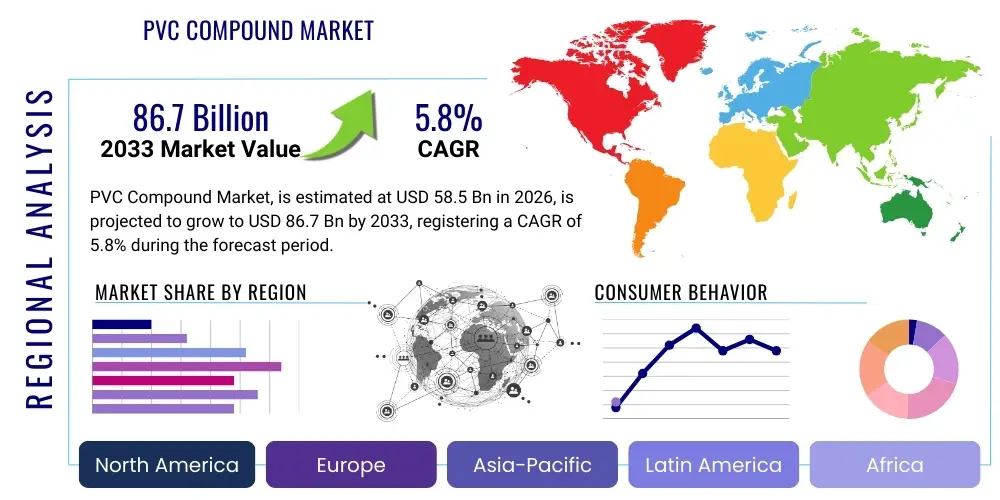

PVC Compound Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434597 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

PVC Compound Market Size

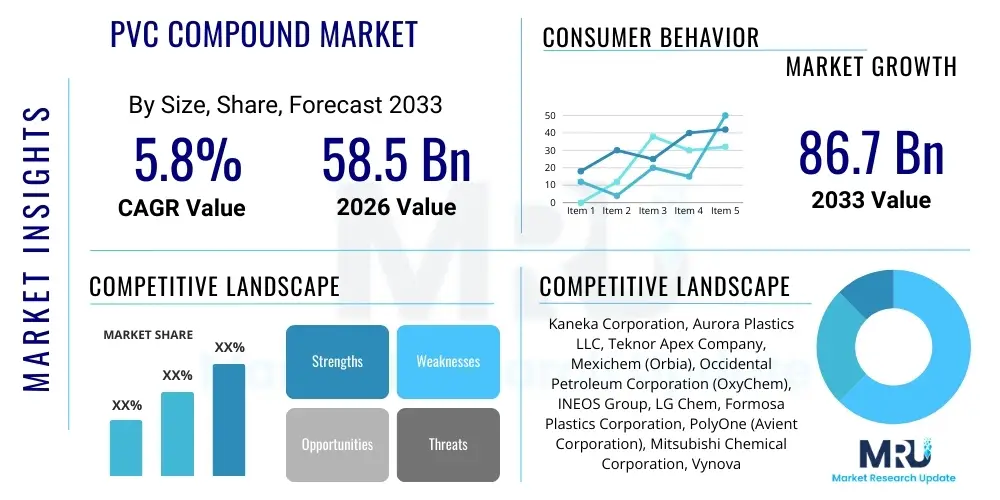

The PVC Compound Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $58.5 Billion in 2026 and is projected to reach $86.7 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the robust resurgence in global construction activities, particularly in developing economies, which rely heavily on Polyvinyl Chloride (PVC) compounds for piping, window profiles, and wiring insulation.

The valuation reflects the increasing demand for specialized PVC formulations, including flexible, rigid, and thermoplastic elastomers (TPE) based compounds, that meet stringent regulatory standards for safety and environmental performance across diverse industries. Furthermore, the push towards replacing traditional materials like metal and glass with lightweight, cost-effective, and highly durable polymer solutions in the automotive and electrical sectors significantly contributes to the projected market capitalization. Key market dynamics also involve fluctuations in raw material prices, primarily ethylene and chlorine, necessitating continuous innovation in compounding processes to maintain competitive pricing structures globally.

PVC Compound Market introduction

The PVC Compound Market encompasses the global trade and consumption of various formulations derived from Polyvinyl Chloride resin mixed with additives such as plasticizers, stabilizers, lubricants, fillers, and pigments to achieve specific physical and chemical properties required for end-use applications. PVC compounds are highly versatile, offering excellent chemical resistance, durability, cost-effectiveness, and flame retardancy, making them indispensable across multiple industrial and consumer sectors. The resultant compounds are categorized based on flexibility (rigid or flexible) and application, ranging from high-pressure piping systems and intricate medical tubing to wire insulation and flooring materials. This fundamental versatility ensures sustained demand even amidst evolving material competition.

Major applications for these compounds span across construction and infrastructure, where rigid PVC is essential for window and door profiles (fenestration) and sanitation piping; the automotive industry, utilizing flexible PVC for interior components and cables; and the medical field, employing specialized compounds for blood bags and sterile tubes. The inherent benefit of PVC compounds lies in their tailorability; manufacturers can precisely adjust formulation components to meet exacting specifications concerning temperature resistance, electrical conductivity, or UV stability, critical factors driving adoption in harsh operating environments. Furthermore, PVC's relative ease of processing via extrusion, injection molding, and calendering makes it a material of choice for high-volume manufacturing.

Driving factors propelling the market include rapid global urbanization and the consequent necessity for massive infrastructural development, particularly in Asia Pacific and Latin America. Additionally, stringent safety regulations mandating fire-resistant and low-smoke zero-halogen (LSZH) compounds in electrical installations are forcing compound manufacturers to introduce high-performance, compliant products. The ongoing technological advancements in plasticizer chemistry, shifting away from phthalates towards sustainable alternatives like bio-based plasticizers, are also bolstering market attractiveness and addressing environmental concerns, thereby securing PVC's future position as a dominant polymer.

PVC Compound Market Executive Summary

The global PVC Compound Market is characterized by robust business trends centered on sustainability and specialty applications, particularly the development of non-phthalate and bio-based compounds to comply with evolving environmental directives such as REACH in Europe and similar regulations in North America. Market consolidation is observed as major global players seek to acquire specialized compound manufacturers to expand their product portfolios, especially in high-growth segments like medical-grade and food-contact PVC. Profitability in the sector is increasingly tied to operational efficiency and the ability to manage volatile feedstock pricing, pushing manufacturers towards backward integration and advanced compounding technologies to minimize production costs and ensure supply chain stability.

Regionally, Asia Pacific (APAC) maintains its dominance, driven by extensive infrastructural projects, booming construction sectors in China and India, and expanding manufacturing hubs requiring vast quantities of PVC for wire and cable sheathing, and pipe systems. North America and Europe, while mature markets, exhibit strong growth in premium and specialized segments, focusing heavily on rigid PVC for energy-efficient building applications and advanced flexible compounds for niche medical devices. Conversely, regions in the Middle East and Africa (MEA) are emerging as significant growth areas, fueled by government investments in utilities and public housing, necessitating reliable and durable plumbing and electrical materials. The stringent recycling standards in Europe are also stimulating significant investments in vinyl recycling infrastructure, which impacts the compounding industry by introducing recycled content streams.

Segment trends reveal that the rigid PVC segment, predominantly used in construction pipes and fittings, accounts for the largest market share due to its superior mechanical strength and longevity. However, the flexible PVC segment, critical for wire insulation, automotive parts, and consumer goods, is projected to register the fastest CAGR, stimulated by increased production of electric vehicles (EVs) that require complex wiring harnesses and lightweight interior components. Application-wise, the building and construction sector remains the primary consumer, though the medical segment is seeing accelerated demand for specialized, highly regulated compounds following heightened global focus on healthcare infrastructure and disposable medical device safety standards post-pandemic.

AI Impact Analysis on PVC Compound Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the PVC Compound Market revolve around optimizing formulation complexity, predicting raw material price volatility, enhancing quality control during extrusion, and accelerating the development of novel sustainable compounds. Users are keenly interested in how machine learning algorithms can manage the vast number of input variables—including plasticizer type, stabilizer ratios, and filler particle size—to predict precise mechanical and thermal properties of the final compound before physical testing. A significant concern is the deployment cost and the necessary data infrastructure required to train complex AI models, particularly for smaller compounders. The key themes emerging from user inquiries underscore the expectation that AI will primarily revolutionize process efficiency, significantly reducing wastage and shortening the R&D cycle for compliance-driven products, ultimately lowering the total cost of production and enhancing market responsiveness.

The implementation of AI and predictive analytics is moving the compounding industry from reactive quality control to proactive process optimization. By deploying sensors across mixers, extruders, and pelletizers, massive datasets on temperature, pressure, torque, and material flow rates are generated. AI algorithms process this real-time data to identify anomalies, predict equipment failure, and auto-adjust machine parameters to maintain tight quality tolerances, which is especially crucial for high-specification compounds used in medical or aerospace applications. This level of automated process management minimizes off-spec material generation and boosts overall throughput, directly impacting profitability. Furthermore, AI is utilized in advanced inventory management systems to forecast demand fluctuations based on global economic indicators and specific downstream industry trends, optimizing procurement strategies for key feedstocks like PVC resin and expensive specialty additives.

AI's role extends significantly into sustainable compound development. Researchers leverage AI models to screen thousands of potential non-phthalate plasticizers or bio-based fillers against performance metrics and toxicity profiles simultaneously, dramatically accelerating the time-to-market for environmentally friendly products. This capability is pivotal in meeting sustainability mandates, allowing compounders to quickly pivot away from restricted substances without compromising the mechanical integrity or longevity of the final product. The ability of generative AI to propose novel polymer structures or additive combinations based on desired physical outputs represents a frontier that promises to unlock PVC compounds with unprecedented properties, such as enhanced heat deflection or superior chemical resistance in corrosive environments.

- AI-driven optimization of extrusion and mixing processes to reduce energy consumption and material scrap rates.

- Machine learning algorithms predict final compound properties (e.g., tensile strength, flexibility) based on input raw material ratios, accelerating R&D.

- Predictive maintenance schedules for compounding machinery reducing downtime and maximizing operational efficiency.

- Advanced supply chain forecasting and risk assessment for volatile raw material prices (ethylene, chlorine).

- AI screening of sustainable, non-phthalate plasticizers and bio-fillers for rapid compliance testing and product formulation.

DRO & Impact Forces Of PVC Compound Market

The PVC Compound Market is substantially influenced by interconnected drivers, restraints, and opportunities that shape its growth trajectory and competitive landscape. Key drivers include persistent global urbanization and the resultant surge in construction and infrastructure projects, particularly in emerging economies demanding cost-effective and durable materials for pipes, cables, and window frames. This demand is further amplified by the growth in the renewable energy sector, which requires extensive wiring and cabling protected by highly durable PVC compounds. However, the market faces significant restraints, primarily regulatory scrutiny, especially in Europe and North America, regarding the use of traditional phthalate plasticizers and heavy metal stabilizers, forcing expensive and time-consuming reformulation efforts. Volatility in the prices of crude oil derivatives, which impacts ethylene production, poses a continuous challenge to maintaining stable profit margins across the value chain. These forces necessitate strategic resource management and consistent technological investment to navigate complex market conditions and maintain competitiveness.

Opportunities for growth are concentrated in the development and commercialization of specialized, high-performance PVC compounds tailored for niche applications. The medical device industry, with its stringent biocompatibility and sterilization requirements, presents a lucrative opportunity for non-DEHP, medical-grade flexible compounds. Similarly, the automotive sector, driven by the electric vehicle revolution, requires lightweight, flame-retardant, and low-VOC (Volatile Organic Compound) compounds for cable jackets and interior trim. Furthermore, advancements in polymer recycling technologies and the increasing acceptance of recycled PVC (r-PVC) in non-critical applications offer compounders a pathway to demonstrate environmental stewardship and secure future-proof supply chains. Strategic partnerships between compounders and recycling specialists are becoming crucial to capitalize on the circular economy transition and mitigate landfill disposal pressures.

The impact forces currently restructuring the market include accelerating technological substitution by advanced polymers (like polyolefins in certain pipe applications), necessitating innovation in PVC properties to retain market share. Simultaneously, the force of corporate sustainability mandates is pushing major end-users (e.g., construction firms, automotive manufacturers) to prioritize suppliers demonstrating strong environmental governance and offering certified sustainable products. Geopolitical stability also acts as a powerful force, affecting global trade routes and the localized availability of key raw materials. Compound manufacturers must respond strategically by investing in compounds that offer enhanced fire safety (LSZH), improved durability, and demonstrable regulatory compliance, ensuring long-term viability in increasingly competitive and regulated global markets.

Segmentation Analysis

The PVC Compound Market segmentation offers a granular understanding of the diverse product formulations and end-use applications driving market demand. Segmentation is primarily defined by the type of compound (rigid or flexible), the process technology utilized (extrusion, injection molding, or calendering), and the primary application industry (construction, automotive, medical, packaging). This layered structure highlights the necessity for compound manufacturers to maintain highly specialized production capabilities to meet the distinct performance specifications required across these various segments. For instance, compounds required for extruded pipes demand high tensile strength and rigidity, while those for injection-molded automotive grommets require specific heat resistance and flexibility tolerances.

The core distinction rests between rigid and flexible PVC compounds. Rigid PVC, which contains little to no plasticizer, dominates volume consumption due to its widespread use in large-scale construction applications such as potable water pipes and window profiles, where mechanical integrity and stiffness are paramount. Conversely, flexible PVC, formulated with significant levels of plasticizers, is essential for applications requiring pliability, such as wire and cable insulation, hoses, and highly regulated medical products. The growth rate of the flexible segment is often higher, propelled by technological evolution in electronics and specialized consumer goods requiring custom plasticization.

The third major segmentation criterion involves application. The construction sector remains the largest consumer, leveraging PVC for durability and cost-efficiency. However, the automotive and medical segments, while smaller in volume, represent high-value markets demanding specialized, certified, and premium compounds. Understanding these segment dynamics is critical for market participants, as investment in R&D must align with the specific regulatory and performance hurdles inherent in each end-use sector, such as fire safety standards in transit infrastructure or biocompatibility testing in healthcare.

- By Type:

- Rigid PVC Compounds (RPVC)

- Flexible PVC Compounds (FPVC)

- Chlorinated PVC (CPVC)

- By Application/End-Use Industry:

- Building & Construction (Pipes & Fittings, Window Profiles, Flooring)

- Wire & Cable Insulation (Power, Communication, Automotive)

- Packaging (Films, Bottles)

- Automotive (Interior Trim, Under-the-Hood Components, Wire Harnesses)

- Medical (Tubing, Blood Bags, Masks)

- Consumer Goods (Footwear, Toys)

- By Process:

- Extrusion

- Injection Molding

- Calendering

- Coating

- By Stabilizer Type:

- Calcium-Zinc (Ca-Zn) Stabilizers

- Organotin Stabilizers

- Lead Stabilizers (Decreasing Use)

Value Chain Analysis For PVC Compound Market

The PVC Compound Market value chain commences with the upstream extraction and processing of fundamental feedstocks: ethylene (derived from crude oil or natural gas) and chlorine (derived from brine through electrolysis). These primary chemicals are reacted to produce Vinyl Chloride Monomer (VCM), which is then polymerized to form PVC resin powder, the core raw material. The efficiency and cost structure at this initial stage are highly sensitive to global energy prices and geopolitical stability. Major chemical producers often engage in vertical integration to control VCM and PVC resin production, mitigating price volatility and securing supply for downstream compounding operations.

The midstream component involves the compounding process itself, where PVC resin is mixed with specialized additives—including plasticizers, heat stabilizers, lubricants, impact modifiers, and fillers—to create the final compound pellet or powder that exhibits desired physical properties. This stage is crucial for value addition, as compounders apply proprietary formulations and technology (e.g., twin-screw extrusion, high-intensity mixing) to meet stringent customer specifications across flexibility, durability, and compliance. The cost of specialty additives, particularly high-performance plasticizers and non-toxic stabilizers (like Ca-Zn), significantly influences the final compound price. Compounders operate either independently, serving diverse end-users, or as integrated units within larger plastics conglomerates.

The downstream distribution channels are multifaceted, utilizing both direct and indirect routes to reach end-users. Direct distribution is common for large-volume industrial purchasers, such as major pipe manufacturers or cable companies, where continuous supply and technical support are paramount. Indirect channels involve regional distributors and specialty material traders who handle smaller volumes, manage inventory, and provide localized service to small and medium-sized enterprises (SMEs) engaged in injection molding or low-volume extrusion. The efficiency of logistics and warehousing is critical, especially for specialized compounds requiring controlled storage conditions. The final stage is the end-user application—ranging from construction sites installing drainage systems to hospitals using sterile medical tubing—where the compound is transformed into the finished product, marking the culmination of the value chain.

PVC Compound Market Potential Customers

Potential customers for PVC compounds are diverse and spread across every major industrial sector, fundamentally requiring materials that balance high performance, longevity, and cost-effectiveness. The largest segment of buyers consists of manufacturers in the building and construction sector, including producers of rigid pipes and fittings (for water, sewer, and conduit systems), manufacturers of window and door profiles (fenestration), and flooring product companies (e.g., vinyl flooring tiles and sheet goods). These buyers seek compounds offering superior resistance to corrosion, high tensile strength, UV stability, and compliance with national fire and building codes, ensuring long-term infrastructural integrity.

The second major cohort comprises electrical and telecommunications manufacturers, specifically those producing wires, cables, and optical fiber jackets. These customers require highly specialized flexible PVC compounds that meet exacting standards for electrical insulation, heat resistance, and increasingly, low-smoke, zero-halogen (LSZH) properties for applications in public spaces and transit systems. Compound quality directly dictates the safety rating and operational life of the final wire or cable product, necessitating tight supplier relationships and rigorous quality certifications from compound providers.

A rapidly growing segment includes manufacturers of automotive components and medical devices. Automotive buyers prioritize compounds that are lightweight, flame-retardant (critical for EVs), and exhibit low fogging characteristics for interior trims and harnesses. Medical device manufacturers, on the other hand, represent the most stringent buyers, demanding non-toxic, USP Class VI certified compounds (often non-DEHP flexible formulations) suitable for prolonged contact with biological fluids, such as in IV sets, blood storage bags, and respiratory masks. These specialized customer segments typically require customized compound lots and extensive regulatory documentation, representing a premium market for compound manufacturers capable of consistent, certified production.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $58.5 Billion |

| Market Forecast in 2033 | $86.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kaneka Corporation, Aurora Plastics LLC, Teknor Apex Company, Mexichem (Orbia), Occidental Petroleum Corporation (OxyChem), INEOS Group, LG Chem, Formosa Plastics Corporation, PolyOne (Avient Corporation), Mitsubishi Chemical Corporation, Vynova Group, Shintech Inc., Westlake Chemical Corporation, Chemson Polymer-Additive AG, Geon Performance Solutions, Nanya Plastics Corporation, DCM Shriram Ltd., Sylvin Technologies, Alphagary, and Benvic Europe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PVC Compound Market Key Technology Landscape

The technological landscape of the PVC Compound Market is continually evolving, focusing on enhancing processing efficiency, material performance, and environmental compliance. A central pillar of innovation is the advancement in compounding technology, specifically the implementation of high-throughput, continuous mixing systems, such as advanced twin-screw extruders. These systems offer superior shear control and heat dissipation, allowing compounders to incorporate higher filler loadings (like calcium carbonate) or sensitive specialty additives (like non-phthalate plasticizers) without degrading the polymer matrix, thereby improving material consistency and reducing operational costs. Furthermore, developments in gravimetric feeding systems ensure precise dosing of multiple components simultaneously, which is crucial for manufacturing highly specialized, uniform compounds for regulated industries like healthcare.

Another significant technological shift is the adoption of new additive chemistry, moving away from traditional stabilizing and plasticizing agents. Driven by regulatory pressure, there is substantial research and development in Calcium-Zinc (Ca-Zn) stabilizers to replace heavy-metal and lead-based stabilizers, focusing on formulations that match or exceed the long-term heat stability and weathering performance of older systems. Similarly, the industry is heavily investing in sustainable plasticizers, including bio-based alternatives (derived from sources like soybean oil or castor oil) and cyclohexanoates, which offer comparable performance to restricted phthalates while ensuring compliance with stringent food-contact and medical safety standards. This substitution requires complex reformulation and rigorous performance validation testing.

Process simulation and modeling technologies are also becoming integral. Compounders are increasingly utilizing sophisticated software tools to model the flow and thermal profile of materials within the mixing equipment. This computational approach allows for virtual testing of new formulations and process conditions, optimizing parameters to minimize energy consumption and maximizing dispersion quality before commencing expensive physical trials. This application of digital tools, often linked with AI predictive capabilities, represents a fundamental technological pivot towards smarter, more efficient, and data-driven manufacturing processes, ensuring that PVC compounds maintain their competitive edge against newer thermoplastic materials.

Regional Highlights

- Asia Pacific (APAC): Dominance and Infrastructure Growth Driver

APAC stands as the undisputed leader in the global PVC Compound Market, both in terms of production capacity and consumption volume. This dominance is intrinsically linked to the unprecedented pace of infrastructural development, rapid urbanization, and massive manufacturing output across major economies like China, India, and Southeast Asian nations. The demand is heavily concentrated in the construction sector, requiring vast quantities of rigid PVC for water management systems, drainage, and residential and commercial electrical conduits. Furthermore, the region is a global hub for electronics manufacturing and automotive production, driving demand for flexible PVC in wire and cable jacketing. While local competition is intense, the sheer scale of government-backed infrastructure projects ensures sustained high demand, although the region is currently grappling with the dual challenge of raw material price volatility and increasing regulatory scrutiny regarding waste management.

The market trajectory in APAC is further influenced by massive investments in affordable housing projects and the expansion of national power grids, which necessitates reliable and durable polymer materials. Countries such as India and Vietnam are experiencing significant growth due to relocation of manufacturing activities and increased domestic consumption. This robust demand profile supports both bulk production of standard-grade compounds and growing niche requirements for higher-performance, fire-resistant compounds required in modern high-rise and industrial complexes. The shift towards sustainable practices is slower than in Europe but is accelerating, particularly in export-focused manufacturing, compelling compounders to gradually introduce non-phthalate and environmentally improved formulations.

- North America: Focus on Specialty and Regulatory Compliance

The North American market is mature, characterized by high barriers to entry and a strong emphasis on premium, specialized compounds that offer enhanced performance characteristics. Growth in this region is primarily driven by replacement demand in existing infrastructure and the adoption of high-value applications in the medical and automotive industries. Regulatory standards, notably those related to material safety (such as the phasing out of lead and certain phthalates) and fire safety (NFPA standards), heavily dictate product composition and market requirements. Compounders operating in this region must possess advanced R&D capabilities to ensure continuous compliance and certification for specialized products.

A major growth propeller in North America is the resurgence in residential and commercial construction coupled with significant governmental investment in water and sewer infrastructure upgrades, favoring rigid PVC and CPVC due to their longevity and corrosion resistance. The automotive sector, particularly the rapidly expanding electric vehicle segment, demands lightweight, durable, and highly flame-retardant compounds for complex wiring harnesses, pushing manufacturers towards innovative compound solutions. While volume growth is steady, value growth is accelerated by the focus on custom, high-margin, specialized PVC formulations, moving the market away from bulk commodity products towards performance-centric solutions.

- Europe: Sustainability and Circular Economy Leadership

Europe represents the global vanguard for sustainability in the PVC market, largely shaped by stringent environmental regulations like REACH and Waste Framework Directives. This region exhibits the highest concentration of demand for certified sustainable compounds, including non-phthalate plasticized PVC and high volumes of recycled PVC (r-PVC). The implementation of the circular economy model strongly influences purchasing decisions, with end-users actively seeking compounds with traceable, certified recycled content, especially for long-life cycle applications like window profiles and pipes (via initiatives like VinylPlus).

The European market, despite slower overall economic growth compared to APAC, sees innovation-led demand, particularly for rigid PVC used in energy-efficient fenestration systems and high-specification wire and cable compounds required for renewable energy installations (solar and wind farms). Manufacturers must strategically invest in recycling infrastructure and advanced formulation science to remain competitive. The regulatory environment acts as both a constraint and a catalyst, forcing compounders to abandon outdated chemistries while simultaneously creating opportunities for market differentiation through the supply of innovative, highly compliant, and sustainable PVC compound solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PVC Compound Market.- Kaneka Corporation

- Aurora Plastics LLC

- Teknor Apex Company

- Mexichem (Orbia)

- Occidental Petroleum Corporation (OxyChem)

- INEOS Group

- LG Chem

- Formosa Plastics Corporation

- PolyOne (Avient Corporation)

- Mitsubishi Chemical Corporation

- Vynova Group

- Shintech Inc.

- Westlake Chemical Corporation

- Chemson Polymer-Additive AG

- Geon Performance Solutions

- Nanya Plastics Corporation

- DCM Shriram Ltd.

- Sylvin Technologies

- Alphagary

- Benvic Europe

Frequently Asked Questions

Analyze common user questions about the PVC Compound market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the growth of the PVC Compound Market?

The market is primarily driven by accelerating global urbanization, significant public and private investment in infrastructure (especially water and telecommunications networks), and the inherent cost-effectiveness and durability of PVC compounds compared to traditional materials like metal or concrete, ensuring high demand in construction and utility sectors.

How are environmental regulations impacting the formulation of PVC compounds?

Stringent environmental regulations, notably in Europe and North America, are mandating the phase-out of traditional additives like heavy metal stabilizers and certain phthalate plasticizers (e.g., DEHP). This drives innovation towards safer, sustainable alternatives such as Calcium-Zinc (Ca-Zn) stabilizers and bio-based, non-phthalate plasticizers, increasing R&D expenditure for compounders.

Which application segment holds the largest share in the PVC Compound Market?

The Building and Construction segment holds the largest market share. PVC compounds are extensively used for rigid applications like piping, conduit systems, and window profiles due to their long lifespan, resistance to corrosion, and excellent mechanical strength, making them essential for modern infrastructure development.

What is the role of recycled PVC (r-PVC) in the current market dynamics?

Recycled PVC is gaining critical importance, particularly in Europe, driven by circular economy goals and corporate sustainability mandates. r-PVC is increasingly being incorporated into non-critical, durable goods like window profiles and flooring, helping reduce waste and providing compounders with a sustainable, cost-effective feedstock source, although quality control remains vital.

What technological advancements are shaping the future of PVC compounding?

Future compounding is shaped by the integration of AI for process optimization and formulation prediction, the adoption of advanced high-shear twin-screw extruders for material consistency, and the complete transition to high-performance, non-toxic additive chemistries to meet the rigorous safety and longevity requirements of specialized industries like medical and electric vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- PVC Compound Market Size Report By Type (Non-Plasticised PVC, Plasticised PVC), By Application (Pipe & Fitting, Profiles & Tubes, Wire & Cable, Film & Sheet, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- PVC Compound Market Statistics 2025 Analysis By Application (Pipe & Fitting, Profiles & Tubes, Wire & Cable, Film & Sheet), By Type (Non-Plasticised PVC, Plasticised PVC), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager