PVC Paste Grade Resins Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436941 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

PVC Paste Grade Resins Market Size

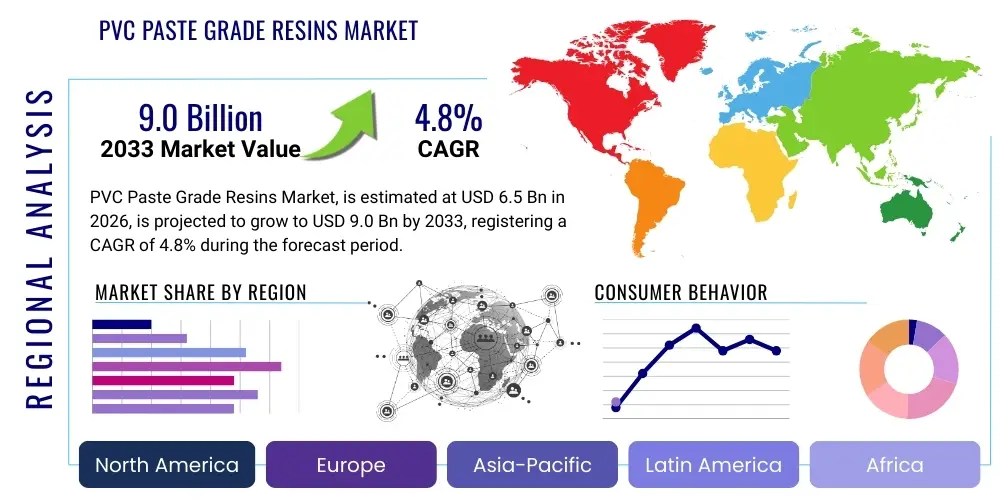

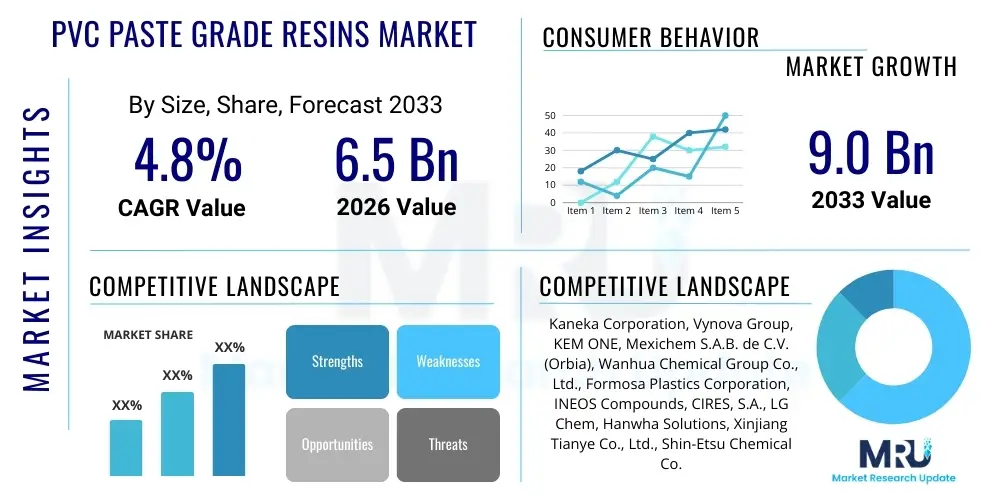

The PVC Paste Grade Resins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

PVC Paste Grade Resins Market introduction

The PVC Paste Grade Resins Market, often referred to as PVC plastisol resins, encompasses fine particle size polyvinyl chloride polymers specifically designed to be mixed with plasticizers, stabilizers, and other additives to form liquid or paste-like materials (plastisols) without the need for volatile organic solvents. These unique rheological properties make them indispensable in manufacturing processes that utilize spread coating, dipping, rotational molding, or spraying techniques. Their versatility stems from the ability to achieve high solid content and stable viscosity, which is critical for producing smooth, uniform films and coatings across various substrates. The primary composition and structure of these resins facilitate efficient fusion upon heating, enabling the final product to exhibit excellent physical characteristics, including flexibility, abrasion resistance, and chemical inertness.

Major applications of PVC paste resins span several high-volume industries, particularly construction, automotive, and textiles. In construction, they are foundational components for high-durability floor coverings (e.g., cushion vinyl flooring), wall coverings, and roofing membranes, capitalizing on their moisture resistance and ease of cleaning. For the automotive sector, PVC plastisols are crucial for sealing joints, protecting underbodies from corrosion and chipping (anti-chip coatings), and manufacturing components like filters and gaskets. Furthermore, the textile industry utilizes these resins for artificial leather production, conveyor belts, and technical fabrics, demanding high tear strength and flexibility.

The market growth is fundamentally driven by the accelerating demand for flexible, durable, and cost-effective materials in rapidly industrializing economies, particularly across Asia Pacific. Key benefits such as superior adhesion to diverse substrates, excellent dielectric properties, and inherent fire retardancy position PVC paste resins as preferred materials over alternatives in specialized coating applications. Additionally, ongoing innovations focusing on low-migration plasticizers and improved resin formulations that reduce processing temperatures contribute significantly to their continued adoption, ensuring compliance with stringent regulatory requirements while enhancing manufacturing efficiency.

PVC Paste Grade Resins Market Executive Summary

The global PVC Paste Grade Resins market is characterized by robust growth, primarily fueled by the burgeoning construction and automotive sectors, particularly in emerging markets. Current business trends indicate a strong focus on developing specialty grades that offer enhanced performance characteristics, such as lower viscosity for high-speed coating applications and improved resistance to UV radiation and harsh chemicals. Furthermore, there is a pronounced shift towards sustainable formulation strategies, incorporating bio-based plasticizers and optimizing resin particle morphology to reduce the overall environmental footprint, responding directly to tightening global regulatory scrutiny and evolving consumer preferences for eco-friendlier materials. Competition remains intense, centered around technological advancements in polymerization techniques and achieving supply chain resilience amidst fluctuating feedstock prices.

Regionally, the Asia Pacific (APAC) stands out as the dominant market, driven by massive infrastructure development projects, high-volume production of textiles, and rapid expansion of the automotive manufacturing base, especially in China, India, and Southeast Asian countries. North America and Europe, while being mature markets, are focusing heavily on product innovation, particularly in medical devices (e.g., blood bags, tubing) and high-specification industrial coatings. European trends are heavily influenced by REACH regulations, driving the adoption of non-phthalate plasticizer systems, necessitating continuous R&D investment by regional players to maintain market share and compliance, thus prioritizing product safety and material transparency.

Segment trends reveal that the Homopolymer segment (based on resin type) maintains the largest volume share due to its wide applicability in general-purpose coatings and flooring, offering a favorable balance of cost and performance. However, the Copolymer segment is projected to experience faster growth, driven by specialized applications requiring unique characteristics, such as improved clarity, specific viscosity ranges, or adhesion properties critical for demanding automotive and medical applications. Application-wise, the flooring and wall coverings segment remains the primary revenue driver, but the automotive segment is exhibiting significant acceleration due to the increasing use of plastisols for noise, vibration, and harshness (NVH) damping, seam sealing, and corrosion protection in modern vehicles.

AI Impact Analysis on PVC Paste Grade Resins Market

User queries regarding AI's influence in the PVC Paste Grade Resins market primarily revolve around three core themes: optimizing complex polymerization processes, enhancing material prediction and quality control, and streamlining intricate supply chain logistics involving vinyl chloride monomer (VCM) and plasticizers. Users are keenly interested in how machine learning algorithms can predict the precise rheological behavior of various plastisol formulations under different processing conditions, thereby minimizing waste and reducing time-to-market for new specialized resin grades. Concerns often surface regarding the initial investment cost for implementing AI-driven monitoring systems and the availability of sufficiently high-quality, structured data necessary to train predictive models specific to highly variable polymerization reactors.

The integration of Artificial Intelligence and advanced data analytics is poised to fundamentally transform the manufacturing and application of PVC paste resins. In the manufacturing phase, AI algorithms are being deployed to monitor, adjust, and stabilize continuous polymerization reactions. By analyzing real-time sensor data—such as temperature, pressure, reaction speed, and particle size distribution—AI can dynamically optimize inputs to ensure batch consistency and achieve target specifications (e.g., K-value, intrinsic viscosity) with unparalleled precision. This predictive control minimizes deviations, increases yield, and significantly reduces energy consumption associated with manual process adjustments, leading to tangible operational cost savings.

Beyond process control, AI plays a pivotal role in materials informatics, accelerating the development of novel PVC formulations. Researchers leverage AI models to predict the performance characteristics (e.g., tensile strength, peel adhesion, viscosity stability) of thousands of potential combinations of resins, plasticizers, fillers, and stabilizers before they are synthesized in the lab. This capability drastically shortens the R&D cycle, enabling manufacturers to rapidly respond to market demands for specialized, high-performance plastisols, particularly those that comply with new environmental regulations, such as phthalate-free or low-VOC requirements, thereby enhancing market responsiveness and innovation efficiency.

Furthermore, AI-driven solutions are crucial for optimizing the complex supply chain inherent to the PVC sector. Predictive modeling helps anticipate demand fluctuations in end-use sectors like construction and automotive, enabling manufacturers to better manage inventory levels of feedstock (VCM, EDC) and final resin products. Machine learning algorithms analyze global logistics data, weather patterns, and geopolitical risks to optimize transportation routes and minimize disruptions, particularly for high-value or regulated chemical shipments, thus ensuring timely delivery and contributing to improved customer satisfaction and operational stability in a globally interconnected market.

- AI optimizes polymerization process parameters (temperature, pressure, catalyst dosage) to ensure batch consistency and desired particle morphology.

- Machine learning models predict the rheological and mechanical properties of new plastisol formulations, accelerating R&D of specialty resin grades.

- Predictive maintenance schedules for polymerization reactors and compounding equipment are enhanced, minimizing downtime and maintenance costs.

- AI improves supply chain resilience by forecasting demand fluctuations and optimizing inventory management for VCM and plasticizers.

- Advanced vision systems integrated with AI algorithms enhance quality control by automatically identifying defects in coated films or molded products.

- Data analytics supports energy consumption optimization in drying and curing processes, contributing to lower manufacturing costs and reduced carbon footprint.

DRO & Impact Forces Of PVC Paste Grade Resins Market

The PVC Paste Grade Resins market is navigating a complex interplay of forces, where robust industrial demand counterbalances significant environmental and regulatory headwinds. Key drivers include the rapid expansion of the construction industry globally, particularly the surge in residential and commercial flooring projects that heavily rely on cushion vinyl and other PVC-based coverings due to their durability and cost-effectiveness. Concurrently, the increasing utilization of plastisols in the automotive sector for sound insulation, underbody protection, and sealing applications provides a substantial, high-growth avenue. However, these growth catalysts face continuous restraint from evolving regulatory frameworks, most notably concerning the use of conventional plasticizers (like phthalates), which necessitates costly reformulation efforts and investments in alternative chemistries. The market dynamic is further shaped by the volatility of key raw material prices, specifically ethylene and chlorine derivatives, which impacts profitability and necessitates sophisticated hedging strategies across the value chain.

Market growth is largely driven by technological advancements that enhance product safety and performance. The opportunity landscape is expansive, centered on the development and commercialization of bio-based or renewable plasticizers that can seamlessly substitute traditional petroleum-derived compounds, addressing sustainability concerns and unlocking premium market segments. Furthermore, emerging markets in Southeast Asia, Latin America, and Africa present significant untapped potential for standard and specialty PVC paste resins, driven by urbanization and improved standards of living demanding more durable household and commercial products. Manufacturers are also seizing opportunities through the innovation of specialty paste resins that offer ultra-low viscosity or rapid fusion characteristics, catering to advanced manufacturing processes such as high-speed rotational molding and precision coating applications in the medical sector.

The impact forces influencing the market's trajectory include the inherent difficulty and cost associated with transitioning large-scale production facilities to new, environmentally compliant feedstocks. While drivers push volume, the restraints impose margin pressure and dictate innovation timelines. The substitution threat, primarily from thermoplastic polyurethanes (TPUs) or silicone materials in high-performance applications, remains a constant impact force, especially where extreme temperature resistance or specific non-migration properties are paramount. Success in navigating this environment depends heavily on strategic investments in high-barrier technologies, efficient raw material sourcing, and localized production hubs that minimize logistical costs and adapt quickly to region-specific environmental mandates.

Segmentation Analysis

The PVC Paste Grade Resins market is meticulously segmented based on type, application, and end-use industry, reflecting the diverse requirements of the global manufacturing landscape. Segmentation by resin type broadly categorizes products into Homopolymers and Copolymers, each serving distinct functional needs. Homopolymers, being the most common, are utilized where standard mechanical properties and cost-efficiency are primary concerns, finding extensive use in general floor coverings and artificial leather. Copolymers, incorporating co-monomers like vinyl acetate, are engineered for specific attributes such as lower fusion temperatures, improved clarity, or enhanced adhesion, making them indispensable for specialized coatings, dipping applications, and printing inks.

The application segmentation is crucial for understanding revenue streams, with the main categories including floor and wall coverings, artificial leather, automotive coatings, sealing compounds, and medical products. Floor and wall coverings represent the largest application segment due to the vast global construction activity and the inherent durability and hygiene offered by PVC plastisol coatings. However, the automotive segment is witnessing the most rapid technological advancement, driven by the need for light-weighting and superior noise and vibration dampening materials. Sealants and adhesives, critical for construction and industrial assembly, rely on the excellent gap-filling and flexible nature of PVC paste formulations.

Further granularity in the market is provided by end-use industry analysis, which includes Construction, Automotive, Textiles, Footwear, and Medical sectors. The construction sector remains foundational, dictating the overall market volume. The medical sector, while smaller in volume, demands the highest purity and regulatory compliance, utilizing PVC paste resins for items like tubing, blood bags, and gloves, driven by stringent pharmacopeial standards. Manufacturers strategically focus their R&D efforts on these diverse segments to develop tailored products, ensuring optimal performance for specific manufacturing processes, such as maximizing fluidity for rotomolding or ensuring rapid gelation for high-speed spreading processes.

- By Resin Type:

- Homopolymer Paste Resins (Standard K-value for general purposes)

- Copolymer Paste Resins (Modified for low fusion temperatures and high clarity)

- By Application:

- Floor and Wall Coverings (Cushion vinyl, non-slip surfaces)

- Artificial Leather (Upholstery, garments)

- Automotive Coatings and Sealants (Underbody coatings, seam sealing, NVH dampening)

- Dipping and Coating (Gloves, tool handles, protective coatings)

- Rotational Molding (Toys, balls, specialized containers)

- Adhesives and Sealants (Construction, industrial assembly)

- Medical Products (Blood bags, IV tubing, catheters)

- By End-Use Industry:

- Construction

- Automotive

- Textiles and Footwear

- Medical

- Consumer Goods

Value Chain Analysis For PVC Paste Grade Resins Market

The value chain for PVC Paste Grade Resins begins with the upstream chemical industry, focusing on the production of basic feedstocks. This stage involves the extraction and refinement of ethylene and chlorine, which are then processed into ethylene dichloride (EDC) and subsequently into vinyl chloride monomer (VCM). The efficient, large-scale production of VCM is highly capital-intensive and subject to volatile energy and commodity prices, significantly impacting the final resin cost. Key upstream challenges include managing the environmental risks associated with chlorine chemistry and ensuring a continuous, stable supply of VCM, which is the sole precursor to PVC polymerization. The profitability of the entire downstream chain is highly sensitive to price movements at this foundational level.

The midstream segment is dominated by PVC manufacturers who specialize in producing paste grade resins through emulsion or microsuspension polymerization techniques. This process involves the meticulous control of particle size, distribution, and porosity, crucial factors that determine the rheological behavior (viscosity and stability) of the final plastisol. Manufacturers often differentiate themselves here through technological innovation, focusing on producing specialty grades that require less plasticizer or offer superior shelf life. Following resin production, the chain moves to compounders and formulators, who blend the resin with various additives—plasticizers (often representing the highest non-resin cost), stabilizers, pigments, and fillers—to create the final, ready-to-use plastisol or dry blend specific to the end-user's application.

Distribution channels are bifurcated into direct sales for high-volume, specialized customers (e.g., large automotive OEMs or global flooring manufacturers) and indirect sales through regional distributors and chemical traders for smaller and medium-sized enterprises. Direct channels allow for customized technical support and tailored product delivery, fostering strong relationships. Indirect channels provide market penetration and logistical coverage in geographically dispersed areas. Downstream, the end-user industries (e.g., construction materials producers, textile coaters) process the plastisols using techniques like spread coating, dipping, or molding to create finished goods. The efficiency and quality of the finished product are heavily reliant on the technical collaboration between the resin manufacturer, the compounder, and the final processor, underscoring the necessity of integrated technical services throughout the value chain.

PVC Paste Grade Resins Market Potential Customers

The primary consumers of PVC Paste Grade Resins are industrial entities involved in large-scale manufacturing processes requiring flexible, durable, and chemically resistant coatings or molded parts. Leading potential customers include multinational floor covering manufacturers who utilize these resins to produce cushion vinyl, luxury vinyl tiles (LVT) backings, and seamless industrial flooring. These buyers prioritize resins that offer consistent viscosity, low foaming during processing, and excellent fusion characteristics to ensure high-speed production and superior surface finish, demanding volumes measured in thousands of tons annually to support global distribution networks.

Another significant customer base resides within the automotive manufacturing ecosystem, encompassing original equipment manufacturers (OEMs) and Tier 1 suppliers specializing in component production. These customers require highly specialized plastisols for critical applications such as automotive underbody coatings (for corrosion and stone chip protection), seam sealants, and NVH damping pads applied within the vehicle chassis. Procurement in this sector is driven by stringent specifications concerning adhesion, long-term durability under extreme temperatures, and regulatory compliance regarding heavy metals and specific volatile organic compounds (VOCs). The relationship with these customers is often long-term and relies on co-development and rigorous quality certification.

Furthermore, textile and technical fabric manufacturers represent a consistently high-volume segment, utilizing PVC paste resins for creating artificial leather, conveyor belts, tarpaulins, and specialized safety fabrics. For these applications, end-users seek resins that provide superior textile adhesion, flexibility for folding and stretching, and desirable surface aesthetics (texture and gloss). Finally, the medical device sector, though smaller in volume, constitutes a high-value customer group demanding ultra-pure, non-toxic, and biocompatible paste resins for critical applications like blood storage bags, medical tubing, and certain types of protective gear. This segment necessitates complete material traceability and adherence to global medical standards (USP Class VI).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kaneka Corporation, Vynova Group, KEM ONE, Mexichem S.A.B. de C.V. (Orbia), Wanhua Chemical Group Co., Ltd., Formosa Plastics Corporation, INEOS Compounds, CIRES, S.A., LG Chem, Hanwha Solutions, Xinjiang Tianye Co., Ltd., Shin-Etsu Chemical Co., Ltd., PolyOne Corporation (Avient), Axiall Corporation (Westlake Chemical), Ercros S.A., China General Plastics Corporation, Vestolit GmbH (Mexichem), Reliance Industries Limited, Solvay S.A., Thai Plastic and Chemicals PCL. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PVC Paste Grade Resins Market Key Technology Landscape

The manufacturing technology for PVC Paste Grade Resins is critically centered on advanced polymerization techniques, primarily Emulsion Polymerization (E-PVC) and Microsuspension Polymerization (M-PVC). E-PVC yields extremely fine particles, which are essential for achieving the low initial viscosity required for paste applications. Recent technological advancements in this area focus on optimizing the stabilizer systems and reducing the residual emulsifier content, thereby improving the long-term viscosity stability (shelf life) of the resultant plastisols and minimizing potential foaming during processing. M-PVC is employed to produce resins with a slightly larger particle size and a different morphology, often used in blends to control rheology or for specific applications like synthetic leather, where higher plasticizer absorption capacity is needed. Continuous process monitoring and control using highly sensitive instrumentation are now standard to ensure uniform particle size distribution (PSD), which is the single most important factor determining paste behavior.

Beyond the polymerization reactor, significant technological focus is placed on the compounding and formulation stage, particularly concerning plasticizer technology. The phasing out of traditional phthalates, driven by global regulations such as REACH and CPSIA, has spurred intensive research into high-performance, non-phthalate alternatives, including terephthalates (DOTP), adipates, and bio-based plasticizers derived from renewable sources. Key technological innovation involves developing high-efficiency plasticizers that maintain the desired flexibility and processability characteristics while offering improved toxicological profiles. Furthermore, the development of specialty additives, such as anti-microbial agents, low-smoke additives, and specialized heat stabilizers, allows PVC paste resins to penetrate highly regulated sectors like medical and public infrastructure.

The application technology landscape is evolving through sophisticated coating and molding equipment designed to handle higher throughputs and complex shapes. For coating applications (e.g., flooring), precision metering pumps and knife-over-roll systems are being integrated with real-time viscosity and temperature sensors to ensure film thickness consistency across wide web widths. In rotational molding, technologies focus on creating finer particle PVC powders optimized for rapid melting and improved flowability within the mold cavity, reducing cycle times and improving surface aesthetics of complex rotational molded parts. The adoption of automation and digitalization across these processing technologies ensures material efficiency and product quality compliance, cementing the relevance of PVC paste resins in modern, high-specification manufacturing environments.

Regional Highlights

The regional market dynamics for PVC Paste Grade Resins are defined by differing levels of industrial maturity, regulatory pressures, and construction activity, creating distinct growth patterns across the globe. The Asia Pacific (APAC) region currently holds the dominant position, accounting for the largest share of global consumption. This dominance is attributed to robust urbanization, massive infrastructure spending, and the region serving as the global manufacturing hub for textiles, footwear, and consumer goods. China and India are the primary consumption drivers, characterized by high demand for PVC floor coverings, artificial leather production, and automotive components. The lower regulatory burden compared to the West, coupled with high production capacities, further supports rapid market expansion in this region, though there is a growing internal focus on sustainable material usage in key markets like Japan and South Korea.

Europe represents a mature but highly innovation-driven market, where growth is constrained by slower overall industrial expansion but buoyed by stringent quality standards and demand for specialty, high-performance resins. European manufacturers are leaders in developing non-phthalate and bio-based formulations, largely mandated by the REACH regulatory framework, making compliance a prerequisite for market participation. The focus here is on high-value applications such as advanced medical devices, high-specification industrial coatings, and premium automotive components where material safety and performance traceability are paramount. This strong regulatory environment pushes regional players toward continuous technological advancement and sustainable practices, often setting global benchmarks for resin formulation safety.

North America maintains a stable market share, characterized by steady demand from the resilient construction and automotive sectors. While the US and Canada have strong domestic manufacturing bases, they also see significant imports of finished goods. The market here is driven by technological uptake, particularly in high-durability floor coverings (vinyl sheet and tile) and protective automotive coatings. Unlike Europe, regulatory transitions regarding plasticizer use have been more fragmented but are nonetheless influencing manufacturer strategies, pushing towards adoption of DOTP and other non-phthalate options to address growing consumer safety concerns and localized state-level regulations. Latin America and the Middle East & Africa (MEA) offer high growth potential, driven by burgeoning construction activity and industrial diversification, representing future opportunities for established global resin suppliers.

- Asia Pacific (APAC): Dominant market share fueled by rapid urbanization, extensive infrastructure development in China and India, and high-volume textile and footwear manufacturing. Focus on scaling production capacity and meeting regional construction demand.

- Europe: Mature market characterized by stringent environmental regulations (REACH), driving innovation in non-phthalate and specialized, high-purity resin grades for medical and high-end automotive applications.

- North America: Stable demand driven by resilient automotive and residential construction markets. Strong emphasis on high-performance coatings, particularly anti-corrosion and NVH dampening materials.

- Latin America (LATAM): Emerging market showing significant potential due to increasing domestic manufacturing activity and regional investment in infrastructure and housing projects.

- Middle East & Africa (MEA): Growing market underpinned by major construction projects in the GCC states and developing industrial sectors in South Africa, relying primarily on imported high-specification resins.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PVC Paste Grade Resins Market.- Kaneka Corporation

- Vynova Group

- KEM ONE

- Mexichem S.A.B. de C.V. (Orbia)

- Wanhua Chemical Group Co., Ltd.

- Formosa Plastics Corporation

- INEOS Compounds

- CIRES, S.A.

- LG Chem

- Hanwha Solutions

- Xinjiang Tianye Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- PolyOne Corporation (Avient)

- Axiall Corporation (Westlake Chemical)

- Ercros S.A.

- China General Plastics Corporation

- Vestolit GmbH (Mexichem)

- Reliance Industries Limited

- Solvay S.A.

- Thai Plastic and Chemicals PCL

Frequently Asked Questions

Analyze common user questions about the PVC Paste Grade Resins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the PVC Paste Grade Resins Market?

The market is primarily driven by the robust expansion of the global construction industry, particularly in emerging economies, leading to high demand for flexible floor and wall coverings. Additionally, the increasing use of plastisols for anti-corrosion and noise reduction coatings in the rapidly growing automotive manufacturing sector significantly contributes to market acceleration.

How do Homopolymer and Copolymer PVC paste resins differ in application?

Homopolymer resins are standard, cost-effective options used for general-purpose applications like basic coatings and flooring. Copolymer resins are specialized grades formulated with co-monomers to achieve specific performance traits, such as lower fusion temperatures, enhanced clarity, or improved adhesion, making them suitable for high-specification automotive and medical applications.

What are the main regulatory challenges affecting PVC Paste Grade Resins manufacturers?

The major regulatory challenge stems from global legislation, such as the EU's REACH, mandating the restriction or phase-out of traditional phthalate plasticizers. Manufacturers must invest heavily in R&D to transition to non-phthalate alternatives (e.g., DOTP, bio-based plasticizers) to ensure product compliance and market accessibility, particularly in Europe and North America.

Which geographical region dominates the global market for PVC Paste Grade Resins?

The Asia Pacific (APAC) region holds the largest market share globally. This dominance is attributed to high-volume manufacturing activities, aggressive infrastructure investment, and rapid urbanization, particularly in high-growth economies such as China, India, and other Southeast Asian nations that consume vast quantities of these resins for textiles and construction materials.

How does the implementation of AI impact the manufacturing of PVC Paste Grade Resins?

AI implementation is focused on optimizing polymerization efficiency and material predictability. AI models monitor real-time reactor conditions to ensure batch consistency, reduce energy consumption, and rapidly predict the optimal formulation for new specialty resins, thereby significantly shortening the research and development cycle for high-performance plastisols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager