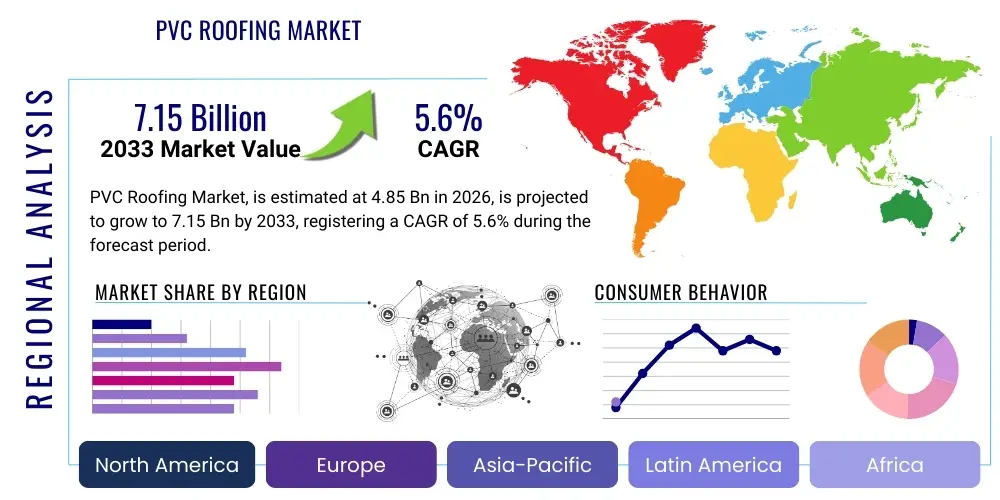

PVC Roofing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439319 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

PVC Roofing Market Size

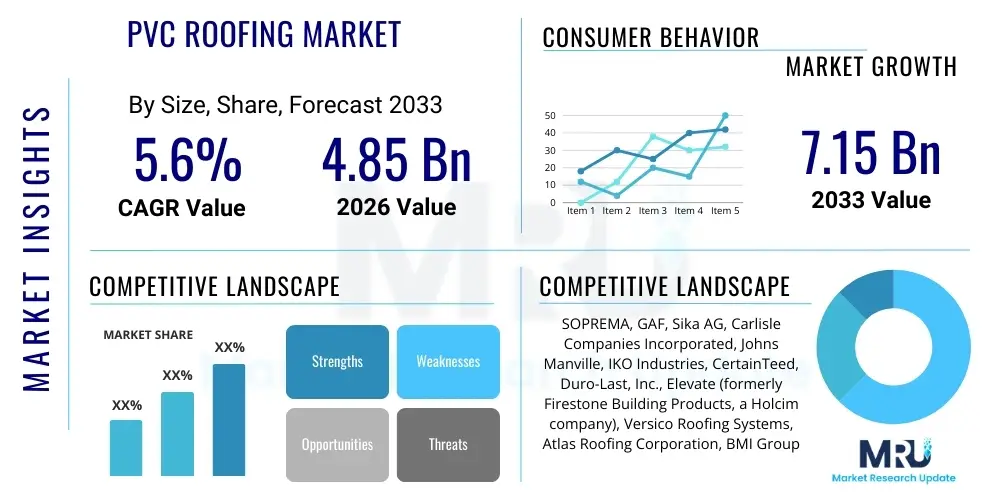

The PVC Roofing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% between 2026 and 2033. The market is estimated at USD 4.85 billion in 2026 and is projected to reach USD 7.15 billion by the end of the forecast period in 2033.

PVC Roofing Market introduction

The Polyvinyl Chloride (PVC) roofing market represents a significant segment within the broader commercial and industrial roofing industry, offering highly durable, long-lasting, and energy-efficient solutions. PVC roofing membranes are thermoplastic materials widely recognized for their inherent strength, flexibility, and resistance to fire, chemicals, and punctures, making them a preferred choice for flat and low-slope roofs across various building types. This market encompasses the production, distribution, and installation of PVC membrane systems, which are typically single-ply membranes mechanically attached, adhered, or ballasted over insulation and a substrate.

Major applications of PVC roofing include large-scale commercial buildings such as warehouses, factories, retail centers, schools, and hospitals, where its robust performance characteristics are highly valued. Its lightweight nature and ease of installation contribute to reduced labor costs and faster project completion times, further enhancing its appeal. The inherent benefits of PVC roofing, such as exceptional waterproofing, reflective cool roof properties that reduce energy consumption, and high resistance to environmental stressors like UV radiation and extreme temperatures, position it as a premium roofing solution.

Driving factors for the PVC roofing market primarily stem from the increasing demand for sustainable and energy-efficient building materials, coupled with stringent building codes emphasizing thermal performance and longevity. The growth of the commercial and industrial construction sector globally, especially in urban areas, further fuels this demand. Additionally, the lifecycle cost advantages, including minimal maintenance and extended service life, make PVC roofing an economically sound long-term investment for property owners and developers, contributing significantly to its market expansion.

PVC Roofing Market Executive Summary

The PVC roofing market is characterized by robust growth, propelled by the global imperative for sustainable construction practices and a rising emphasis on building energy efficiency. Business trends indicate a strong focus on product innovation, with manufacturers developing enhanced formulations that offer superior cool roof performance, increased puncture resistance, and improved environmental profiles, including greater recyclability. Strategic partnerships between membrane manufacturers and installation contractors are becoming more prevalent, aimed at ensuring high-quality application and expanding market reach. Consolidation among key players and investments in advanced manufacturing technologies are also defining current business strategies, reflecting a competitive landscape driven by efficiency and product differentiation. The market is also witnessing a surge in demand for prefabricated PVC roofing systems, streamlining installation and improving consistency.

Regionally, North America and Europe continue to be mature markets for PVC roofing, driven by replacement cycles and a strong regulatory environment favoring energy-efficient materials. However, the Asia Pacific region is emerging as a significant growth engine, fueled by rapid urbanization, substantial investments in commercial and industrial infrastructure, and an increasing awareness of advanced roofing solutions. Latin America and the Middle East & Africa also present lucrative opportunities, albeit with a slower adoption rate, as construction standards evolve and economic development progresses. Localized supply chains and varying climate conditions significantly influence product preferences and market dynamics across these diverse geographical regions, leading to tailored product offerings and marketing strategies.

Segmentation trends highlight a steady demand for reinforced PVC membranes due to their superior strength and durability, particularly in high-wind zones and areas prone to severe weather events. The commercial application segment dominates the market, largely due to the widespread adoption of PVC for large, low-slope roofs, which benefit most from its performance characteristics. Furthermore, the re-roofing segment is projected to hold a substantial share, driven by the need to replace aging roofing systems with more modern, efficient, and resilient materials. Customization options, such as various colors and thicknesses, are also gaining traction, catering to diverse aesthetic and performance requirements across different projects, underscoring the market's adaptability and responsiveness to specific client needs.

AI Impact Analysis on PVC Roofing Market

Users frequently inquire about how artificial intelligence can modernize and optimize traditional construction materials like PVC roofing, focusing on questions around design efficiency, predictive maintenance, supply chain resilience, and waste reduction. Key themes emerging from these inquiries highlight concerns about initial investment costs versus long-term gains, the practical integration of AI tools into existing construction workflows, and the potential for AI to enhance the sustainability and energy performance of roofing systems. Users expect AI to bring about a paradigm shift in how roofing projects are planned, executed, and maintained, moving towards more intelligent, data-driven approaches that minimize errors, improve safety, and extend asset life. There is also a keen interest in AI's role in personalizing roofing solutions and enabling smarter building management systems that integrate with roofing performance data.

- AI-powered design optimization tools enable architects and contractors to model complex roof geometries and material usage more efficiently, reducing waste and improving structural integrity during the planning phase.

- Predictive maintenance analytics, driven by AI and sensor data from installed roofing systems, can anticipate potential issues like leaks or material degradation, allowing for proactive repairs and significantly extending the lifespan of PVC roofs.

- AI algorithms enhance supply chain management by optimizing material procurement, inventory levels, and logistics for PVC membranes and accessories, leading to reduced lead times and lower operational costs.

- Automated quality control systems utilizing computer vision and AI can inspect manufacturing processes for PVC membranes, ensuring consistent product quality and adherence to specifications, thus minimizing defects.

- AI integration into Building Information Modeling (BIM) platforms facilitates better coordination across project stakeholders, improving project efficiency, cost estimation, and lifecycle management of PVC roofing installations.

- Smart building integration with AI can leverage real-time data from roof-mounted sensors (e.g., temperature, moisture) to optimize building energy consumption, directly impacting HVAC efficiency and enhancing the overall performance benefits of cool PVC roofs.

- Robotics guided by AI are beginning to be explored for semi-automated or automated installation of large PVC membrane sections, promising faster deployment, increased safety, and reduced labor dependency on large-scale projects.

- Generative design for PVC roofing components can explore novel material configurations and structural enhancements to improve durability, thermal performance, and wind resistance, pushing the boundaries of traditional roofing system capabilities.

- AI-driven waste management strategies can optimize PVC scrap recycling processes during manufacturing and post-consumer waste sorting, contributing to a more circular economy within the roofing industry.

DRO & Impact Forces Of PVC Roofing Market

The PVC roofing market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and various impact forces that shape its trajectory. A primary driver is the exceptional durability and longevity of PVC membranes, which offer superior resistance to UV radiation, chemicals, and punctures compared to many alternatives. This long service life translates into lower lifecycle costs and reduced maintenance, making it an attractive investment for building owners. Furthermore, the inherent energy efficiency of light-colored PVC cool roofs, which reflect solar radiation, significantly reduces cooling loads in buildings, aligning with global green building initiatives and stringent energy codes. The lightweight nature and ease of installation of single-ply PVC systems also reduce construction timelines and labor requirements, providing tangible benefits to contractors and developers. Increasing awareness of these performance advantages is steadily bolstering market demand.

Despite its advantages, the market faces certain restraints. The relatively higher upfront cost of PVC roofing compared to some traditional roofing materials like asphalt or modified bitumen can be a deterrent for budget-constrained projects, particularly in regions where awareness of long-term value is lower. While modern PVC formulations have improved, historical perceptions regarding the environmental impact of PVC production and disposal continue to be a concern for some stakeholders, even as the industry makes strides in recyclability and sustainable manufacturing processes. Moreover, the sensitivity of PVC to certain chemicals and solvents requires careful consideration during installation and maintenance, potentially limiting its use in specific industrial environments. Raw material price volatility, particularly for petroleum-derived inputs, can also impact manufacturing costs and market pricing, creating uncertainty for both producers and consumers.

Opportunities for growth are abundant, driven by innovations in product development, such as solar-ready PVC membranes designed to integrate seamlessly with photovoltaic systems, and advanced cool roof technologies offering even higher reflectivity and emissivity. The expansion of green building certifications and government incentives for energy-efficient construction provides a strong impetus for adoption. Emerging markets, particularly in Asia Pacific and parts of Latin America, represent significant untapped potential as commercial and industrial infrastructure development accelerates. Furthermore, advancements in recycling technologies and closed-loop manufacturing processes are addressing environmental concerns, positioning PVC roofing as a more sustainable option. The growing demand for resilient roofing solutions in regions prone to extreme weather events further opens doors for PVC due to its robust performance under harsh conditions.

Impact forces on the PVC roofing market include a range of external factors. Technological advancements in polymer science continually lead to improved PVC formulations, enhancing durability, flexibility, and environmental performance. Regulatory changes, particularly those related to building energy codes, fire safety standards, and environmental protection, directly influence product specifications and market acceptance. Economic cycles, including recessions and construction booms, significantly impact overall building activity and, consequently, the demand for roofing materials. The increasing focus on climate change mitigation and adaptation strategies, along with public awareness regarding building sustainability, places pressure on manufacturers to develop and promote greener roofing solutions. Additionally, shifts in consumer preferences towards aesthetic diversity and specialized performance characteristics also exert influence, driving innovation and customization within the market.

Segmentation Analysis

The PVC roofing market is comprehensively segmented to provide a granular understanding of its diverse landscape, considering various attributes that influence demand and supply dynamics. This segmentation helps in identifying specific market niches, understanding consumer preferences, and evaluating competitive strategies across different product types, application areas, installation methods, and end-user segments. Analyzing these segments is crucial for stakeholders to tailor their product offerings, marketing efforts, and distribution strategies to maximize market penetration and profitability. The primary segmentation approaches reflect the technical characteristics of PVC membranes and their varied uses in the construction industry, offering a multi-dimensional view of market opportunities.

- By Product Type:

- Reinforced PVC Membranes: These are PVC membranes strengthened with a fabric scrim (e.g., polyester or fiberglass) embedded between two layers of PVC film, providing enhanced tear strength, dimensional stability, and puncture resistance, making them ideal for mechanically fastened systems.

- Unreinforced PVC Membranes: Consisting solely of a single layer of PVC film, these membranes are typically used in ballasted or fully adhered systems where additional reinforcement is not the primary requirement for structural integrity, often chosen for their flexibility and cost-effectiveness in specific applications.

- By Application:

- Commercial: Includes office buildings, retail centers, schools, hospitals, public institutions, and other large-scale commercial facilities, which constitute the largest application segment due to the widespread use of PVC for their vast, low-slope roofs.

- Industrial: Encompasses manufacturing plants, warehouses, logistics centers, and other industrial facilities requiring robust and chemical-resistant roofing solutions that can withstand harsh operational environments.

- Residential: Though less common than commercial applications, PVC roofing is increasingly being adopted for multi-family dwellings, apartment complexes, and custom homes with flat or low-slope roof designs, valued for its longevity and energy efficiency.

- By Installation Method:

- Mechanically Attached: The most common method, where membranes are fastened to the roof deck using screws and plates, offering cost-effectiveness and good wind uplift resistance, particularly suitable for a variety of building types and climates.

- Fully Adhered: Membranes are glued directly to the insulation or substrate using an adhesive, resulting in a smooth, aesthetically pleasing surface and often providing enhanced wind uplift performance, frequently used for aesthetic reasons or in high-wind zones.

- Ballasted: Membranes are laid loose over the insulation and held in place by a layer of ballast (e.g., river rock, pavers), offering a simple, cost-effective solution without extensive fastening, but requiring a roof structure capable of supporting the additional weight.

- By End-Use:

- New Construction: Refers to the installation of PVC roofing systems on newly built structures, driven by urban development, infrastructure projects, and commercial expansion.

- Re-roofing/Renovation: Involves replacing existing, aging, or damaged roofing systems with new PVC membranes, a significant market segment driven by the need for upgrades, increased energy efficiency, and extended service life for existing buildings.

- By Thickness:

- 40 mil: Thinner membranes often chosen for their cost-effectiveness in certain applications where extreme durability is not the primary concern, or for temporary structures.

- 50 mil: A commonly specified thickness offering a balance of durability, performance, and cost, suitable for a wide range of commercial and industrial applications.

- 60 mil: Provides enhanced puncture resistance, longevity, and overall robustness, frequently chosen for high-traffic roofs, severe weather conditions, or projects requiring extended warranties.

- 80 mil and above: Premium thickness membranes offering maximum durability, extended service life, and superior performance in the most demanding applications, often specified for critical facilities or where very long-term performance is paramount.

Value Chain Analysis For PVC Roofing Market

The value chain for the PVC roofing market is a complex network encompassing multiple stages, from raw material extraction and chemical processing to manufacturing, distribution, and final installation, extending through to the end-of-life management of the product. This chain outlines the interconnected activities that create and deliver the PVC roofing solution to the end-user, highlighting areas of value addition and potential optimization. Understanding this chain is critical for identifying cost efficiencies, improving product quality, and ensuring sustainable practices throughout the lifecycle of PVC roofing materials. Each stage involves distinct participants and processes, all contributing to the final market offering.

Upstream analysis focuses on the sourcing and processing of fundamental raw materials. This begins with the petrochemical industry, which supplies ethylene and chlorine, key components for producing Vinyl Chloride Monomer (VCM). VCM is then polymerized to create PVC resin, the primary constituent of PVC roofing membranes. Plasticizers, stabilizers, UV inhibitors, fire retardants, and reinforcing scrims (typically polyester or fiberglass) are also sourced from various chemical and textile manufacturers. The quality and cost of these upstream inputs directly impact the final product's performance and price. Fluctuations in crude oil prices, which affect ethylene production, as well as the availability and cost of other chemical additives, can significantly influence manufacturing costs for PVC roofing membrane producers.

Downstream analysis covers the transformation of PVC resin into finished roofing membranes and their delivery to the end-user. This stage includes the extrusion or calendering of PVC resin with additives and reinforcement scrims to form membranes, followed by quality control, cutting, and packaging. Distribution channels play a pivotal role, involving wholesalers, distributors, specialized roofing material suppliers, and increasingly, direct sales from manufacturers to large contractors or project owners. Installation contractors are crucial downstream players, responsible for the proper application of the PVC roofing system, which directly impacts its performance and longevity. Post-installation services, including maintenance and eventual recycling or disposal, also form part of the downstream activities, completing the product lifecycle. The effectiveness of the distribution network and the skill of installers are key determinants of market success.

Distribution channels for PVC roofing are varied, encompassing both direct and indirect methods. Direct channels involve manufacturers selling directly to large-scale commercial contractors, national builders, or government entities, often for major projects. This allows for direct communication, custom solutions, and potentially better pricing. Indirect channels, which are more common, utilize a network of distributors and wholesalers. These intermediaries store inventory, provide local availability, offer logistics support, and serve as crucial links to smaller contractors and regional projects. The choice of channel depends on market reach, logistical capabilities, and target customer segments. The complexity of roofing systems often necessitates strong technical support through these channels, ensuring proper product selection and installation guidance for diverse project requirements. The interplay between these channels shapes market access and overall sales efficiency.

PVC Roofing Market Potential Customers

The potential customers for the PVC roofing market are diverse, primarily comprising commercial and industrial entities, but also extending to certain residential sectors with specific architectural needs. These end-users are typically characterized by their demand for durable, long-lasting, energy-efficient, and low-maintenance roofing solutions for their significant investments in infrastructure and property. Understanding the specific needs and decision-making criteria of these customer segments is paramount for manufacturers and contractors to effectively tailor their marketing messages, product offerings, and service packages. The choice of PVC roofing is often driven by a careful evaluation of initial cost versus lifecycle benefits, performance specifications, and compliance with building standards and environmental regulations. These customers often seek solutions that contribute to overall building efficiency and sustainability ratings, such as LEED or BREEAM certifications.

Commercial building owners and developers represent a significant segment of potential customers. This includes owners of large-scale retail complexes, shopping malls, office buildings, hotels, and entertainment venues. Their purchasing decisions are often influenced by the need for a roofing system that offers excellent waterproofing, fire resistance, and a long service life to protect valuable assets and ensure business continuity. Energy efficiency, driven by cool roof properties, is also a major consideration as it directly impacts operational costs. Furthermore, the aesthetics and ability of PVC to accommodate roof-mounted equipment, such as HVAC units and solar panels, make it an appealing choice for these complex commercial structures. For these customers, reliability and a strong manufacturer warranty are often key factors in their selection process, as they seek to minimize future maintenance and replacement expenses.

Industrial facility operators and owners, including those in manufacturing, logistics, and chemical processing, constitute another critical customer base. These entities require roofing systems that can withstand harsh operational environments, including exposure to industrial pollutants, chemicals, and heavy foot traffic for maintenance. PVC roofing's chemical resistance and robust physical properties make it well-suited for such demanding applications. For industrial clients, minimizing downtime during installation and ensuring superior protection for machinery and inventory are paramount. Additionally, institutions such as schools, universities, hospitals, and government buildings frequently opt for PVC roofing due to its long-term durability, low maintenance requirements, and contribution to energy savings, which align with their budgetary and operational goals. The market for re-roofing projects within these sectors is consistently strong, as aging facilities look to upgrade to more modern, high-performance systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 billion |

| Market Forecast in 2033 | USD 7.15 billion |

| Growth Rate | 5.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SOPREMA, GAF, Sika AG, Carlisle Companies Incorporated, Johns Manville, IKO Industries, CertainTeed, Duro-Last, Inc., Elevate (formerly Firestone Building Products, a Holcim company), Versico Roofing Systems, Atlas Roofing Corporation, BMI Group (Braas Monier Building Group), Owens Corning, Malarkey Roofing Products, Polyglass USA, Inc., BASF SE, Dow Inc., Westlake Chemical Corporation, Covestro AG, Kemper System. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PVC Roofing Market Key Technology Landscape

The PVC roofing market benefits from a robust and continuously evolving technology landscape, driven by advancements in polymer science, manufacturing processes, and installation techniques. These technological innovations aim to enhance membrane performance, improve sustainability, and optimize cost-efficiency throughout the product lifecycle. Key technologies focus on improving the durability, energy efficiency, and ease of application of PVC systems, ensuring they remain competitive and meet the increasingly stringent demands of modern construction. The integration of smart materials and digital tools is also beginning to shape the future trajectory of this sector, leading to more resilient and intelligent roofing solutions.

Core technologies revolve around the formulation of the PVC compound itself. This includes advancements in plasticizer technology, moving towards non-phthalate and bio-based plasticizers to improve environmental profiles without compromising flexibility or performance. Stabilizer packages have evolved to provide superior UV and thermal oxidative resistance, significantly extending the membrane's service life, particularly in harsh climates. Fire retardant additives are also continuously improved to meet stringent fire safety codes while maintaining material properties. The development of specialized topcoats and surface treatments enhances reflectivity for cool roof applications, boosting energy efficiency, and improving stain resistance to maintain aesthetic appeal over time. These material science innovations are fundamental to the superior performance characteristics of modern PVC roofing.

Beyond material formulation, manufacturing processes play a critical role. Advanced extrusion and calendering techniques ensure consistent membrane thickness, uniformity, and bond strength between layers, which are vital for product integrity. Quality control systems, incorporating non-destructive testing and real-time process monitoring, ensure that each roll of PVC membrane meets rigorous performance specifications. Furthermore, welding technologies, such as hot-air welding, are continuously refined to provide stronger, more reliable seams on-site, which are crucial for the watertight integrity of the roof system. The development of induction welding systems offers a flameless, faster, and more secure attachment method. Prefabrication technologies for complex roof details and large panel fabrication off-site also streamline installation, reduce field labor, and improve overall system quality. Digital tools for roof design, material optimization, and project management further enhance the efficiency and precision of PVC roofing installations.

Regional Highlights

- North America: A mature market characterized by stringent building codes emphasizing energy efficiency and durability. The U.S. and Canada are significant consumers, driven by extensive commercial and industrial building stock and robust re-roofing demand. Innovation in cool roof technology and sustainable practices are key trends.

- Europe: Another well-established market, with countries like Germany, the UK, France, and Benelux leading in adoption. Strong environmental regulations and a focus on long-term performance and recyclability drive market growth. Demand is high for both new construction and refurbishment projects, particularly in urban areas.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, industrialization, and infrastructure development in economies like China, India, Japan, and Southeast Asian nations. Increasing awareness of advanced roofing solutions, coupled with a booming construction sector, presents significant growth opportunities, though cost-competitiveness remains a factor.

- Latin America: Experiencing gradual growth, with countries like Brazil, Mexico, and Argentina showing increasing adoption of PVC roofing for commercial and industrial projects. Economic development and rising construction standards are contributing factors, albeit with varying rates of market maturity across sub-regions.

- Middle East & Africa (MEA): An emerging market with significant potential, particularly in the GCC countries, driven by large-scale commercial and hospitality projects. The demand for cool roof solutions to combat extreme heat is a major driver, alongside growing investments in sustainable building practices. African nations are showing nascent but growing interest as construction activities expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PVC Roofing Market.- SOPREMA

- GAF

- Sika AG

- Carlisle Companies Incorporated

- Johns Manville

- IKO Industries

- CertainTeed

- Duro-Last, Inc.

- Elevate (A Holcim Company)

- Versico Roofing Systems

- Atlas Roofing Corporation

- BMI Group (Braas Monier Building Group)

- Owens Corning

- Malarkey Roofing Products

- Polyglass USA, Inc.

- BASF SE

- Dow Inc.

- Westlake Chemical Corporation

- Covestro AG

- Kemper System

Frequently Asked Questions

Analyze common user questions about the PVC Roofing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of choosing PVC roofing over other materials?

PVC roofing offers exceptional durability, superior resistance to fire, chemicals, and punctures, and a long service life of 20-30 years or more. It is also highly energy-efficient due to its reflective cool roof properties, reducing cooling costs, and is lightweight, making installation easier and reducing structural load.

Is PVC roofing considered a sustainable or environmentally friendly option?

Modern PVC roofing is increasingly sustainable. It boasts a long lifespan, reducing demand for frequent replacements, and its energy-efficient properties lower a building's carbon footprint. Many manufacturers offer recyclable PVC membranes, and advancements are being made in using recycled content and bio-based plasticizers.

How does PVC roofing perform in extreme weather conditions?

PVC roofing demonstrates excellent performance in various extreme weather conditions. It is highly resistant to UV radiation, severe temperatures (both hot and cold), wind uplift, and hail, making it a reliable choice for diverse climates. Its hot-air welded seams create a strong, monolithic barrier against water intrusion.

What is the typical cost of PVC roofing compared to other commercial roofing systems?

The upfront cost of PVC roofing can be higher than some traditional options like asphalt or modified bitumen. However, its superior durability, energy savings, and minimal maintenance requirements often result in a lower lifecycle cost, providing better long-term value and return on investment for building owners.

What kind of maintenance does a PVC roof require?

PVC roofs require relatively low maintenance. Regular inspections (typically semi-annual), clearing debris, and ensuring drains are free-flowing are generally sufficient. Minor repairs, if needed, are straightforward due to the membrane's weldability. Avoid harsh chemicals or solvents that are not approved for PVC during cleaning.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager