PVC Sheet Tarpaulin Roof System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433038 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

PVC Sheet Tarpaulin Roof System Market Size

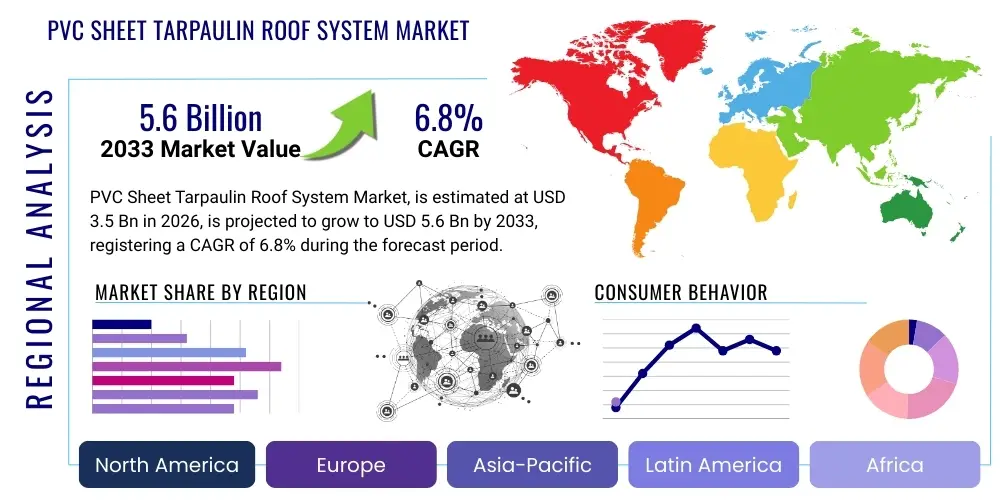

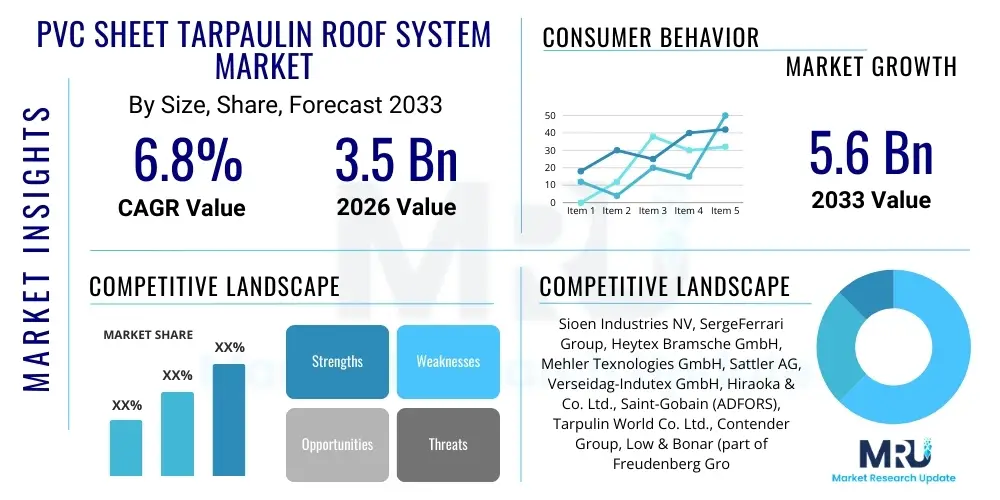

The PVC Sheet Tarpaulin Roof System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

PVC Sheet Tarpaulin Roof System Market introduction

The PVC Sheet Tarpaulin Roof System Market encompasses the manufacturing, distribution, and installation of durable, flexible roofing solutions predominantly used in industrial, agricultural, temporary structures, and recreational applications. These systems utilize polyvinyl chloride (PVC) coated fabrics, known for their exceptional strength, waterproofing capabilities, UV resistance, and fire retardancy. The primary market drivers include the rapid expansion of warehousing and logistics infrastructure globally, increased demand for durable and cost-effective temporary shelters, and stringent regulatory requirements mandating weather-resistant materials in construction projects, particularly in regions prone to extreme climatic conditions.

Key product features of modern PVC sheet tarpaulin roof systems involve advanced welding techniques that ensure airtight seals, incorporating specialized plasticizers for enhanced flexibility in cold weather, and using high-tenacity polyester scrims for superior tear strength. Major applications span agricultural greenhouses, tensioned membrane structures (such as sports facilities and exhibition halls), temporary construction site coverings, and large-scale industrial storage tents. The inherent benefits, such as rapid deployment, longevity (often exceeding 15 years with proper maintenance), and low lifecycle cost compared to conventional roofing, solidify its market position, especially in emerging economies undergoing significant infrastructure development.

Furthermore, the market benefits significantly from ongoing innovations focused on sustainability and performance enhancement. Manufacturers are increasingly integrating recycled PVC content and developing formulations that comply with stricter environmental standards, such as phthalate-free plasticizers. The driving forces are fundamentally rooted in the global shift towards modular and prefabricated construction methods, which highly favor lightweight, durable, and easily installable roofing components like PVC tarpaulin sheets. This adaptability across diverse end-user industries, from mining and resource extraction shelters to disaster relief housing, underpins the robust market expansion forecast.

PVC Sheet Tarpaulin Roof System Market Executive Summary

The PVC Sheet Tarpaulin Roof System Market is characterized by robust growth driven by accelerating industrialization and urbanization, particularly across the Asia Pacific region. Business trends indicate a strong move toward customization and the development of specialized high-performance fabrics, including self-cleaning and photocatalytic PVC membranes, to meet evolving architectural demands and reduce maintenance costs. Major manufacturers are focusing on integrating smart technologies into production lines to enhance efficiency and material consistency, simultaneously expanding their distribution networks to capitalize on the booming infrastructure sector in developing nations. Competition is intensifying, leading to increased focus on vertical integration, ensuring control over raw material procurement (PVC resin, plasticizers, and fabric base), and optimizing supply chain responsiveness to large-scale, time-sensitive construction projects.

Regional trends reveal Asia Pacific as the dominant and fastest-growing market, propelled by massive governmental investments in industrial parks, warehousing facilities, and logistical hubs in China, India, and Southeast Asia. North America and Europe, while mature, exhibit steady growth fueled by the replacement of aging infrastructure and the increasing adoption of sustainable, lightweight roofing solutions in the commercial sector. Specifically, European regulations prioritizing energy efficiency are encouraging the adoption of PVC tarpaulins with enhanced thermal insulation properties. Market performance is highly correlated with global construction spending and commodity prices, particularly for petrochemical derivatives used in PVC production, necessitating dynamic pricing and hedging strategies among leading market participants.

Segment trends highlight the dominance of the Coated Fabric segment based on manufacturing process, favored for its superior durability and printability, widely utilized in large-format tension structures. Application-wise, the Industrial and Commercial Buildings segment holds the largest market share, driven by demand for expansive, column-free internal spaces. Meanwhile, the Agricultural sector, utilizing PVC tarpaulins for protective covers and greenhouses, is poised for the fastest growth, supported by increasing mechanization and the need to protect high-value crops from unpredictable weather patterns. Furthermore, the material thickness segment shows a growing preference for medium to heavy-duty sheets (600 GSM and above), signaling a market shift towards long-term, permanent or semi-permanent installations rather than purely temporary solutions, ensuring extended product lifecycle and improved return on investment for end-users.

AI Impact Analysis on PVC Sheet Tarpaulin Roof System Market

Common user questions regarding AI's influence in the PVC Sheet Tarpaulin Roof System Market primarily revolve around operational efficiency, material quality control, and predictive maintenance capabilities. Users frequently ask: "How can AI optimize the PVC coating process for material consistency?", "Will AI-driven logistics reduce installation time?", and "Can AI predict membrane failure to enhance product safety and lifespan?" This analysis reveals that users are highly focused on how AI can transcend manual labor limitations, moving from reactive quality checks to proactive, data-driven manufacturing and deployment strategies. Key themes include achieving zero-defect production through machine vision, optimizing complex cutting and welding patterns using generative design algorithms, and improving overall supply chain transparency and resilience in material sourcing and distribution.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize the manufacturing aspect of PVC sheeting. Specifically, AI-powered predictive models analyze vast datasets generated during the extrusion and coating processes, including temperature, viscosity, and chemical composition, to instantly adjust parameters, ensuring uniform material thickness, adhesion strength, and color consistency across massive production batches. This precision significantly reduces waste, lowers operational costs, and minimizes the risk of structural defects, thereby elevating the overall quality and reliability of the final roofing product, which is critical for demanding architectural and engineering applications.

Beyond manufacturing, AI significantly impacts the downstream segments, particularly in design, logistics, and maintenance. AI-driven simulation tools allow engineers to optimize the structural design of tensioned membrane roof systems, calculating complex load distributions (wind, snow) and material fatigue characteristics more accurately than traditional engineering software. Furthermore, integrating IoT sensors into large tarpaulin structures enables ML algorithms to monitor structural integrity in real-time. By processing data on strain, temperature fluctuations, and UV exposure, AI can provide precise alerts regarding necessary maintenance or potential failure points, thereby extending the service life of the roof system and drastically improving safety standards for users in commercial and industrial environments.

- AI optimizes PVC formulation and coating processes for higher material uniformity and reduced batch variance.

- Machine Vision systems powered by AI enable real-time defect detection during manufacturing, leading to zero-defect quality control.

- Predictive maintenance models using sensor data forecast membrane aging and potential structural failure in installed roof systems.

- Generative design algorithms assist in optimizing material usage for complex architectural tensioned structures, reducing wastage.

- AI-enhanced supply chain management improves raw material procurement forecasting and logistics efficiency for large, global projects.

- Automated cutting and welding machines leverage AI to enhance precision and speed during the fabrication of custom-sized tarpaulin sheets.

DRO & Impact Forces Of PVC Sheet Tarpaulin Roof System Market

The PVC Sheet Tarpaulin Roof System Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces shaping its trajectory. The primary driver is the accelerating pace of global infrastructure development, coupled with the need for flexible, temporary, or semi-permanent structures in sectors like logistics, events, and construction. However, the market faces significant restraint from the fluctuating price volatility of petroleum-derived raw materials (PVC resin and plasticizers), alongside increasing environmental scrutiny related to the disposal and recyclability of PVC products. The key opportunity lies in developing bio-based or recycled PVC composites and expanding specialized applications, such as high-performance stadium roofing and large-span agricultural covers, leveraging superior durability and architectural versatility.

Impact forces are strongly tilted by regulatory landscapes and technological innovation. Stringent building codes, particularly in developed regions concerning fire safety and structural stability, often act as restraints, forcing manufacturers to continuously invest in certification and material modification. Conversely, the rising popularity of modular construction, which demands lightweight and rapid-assembly components, acts as a powerful accelerating force. The competitive landscape is characterized by innovation in surface treatments, such as anti-microbial and self-cleaning coatings, which enhance the functional appeal and longevity of the product, thereby offsetting some of the cost restraints associated with initial raw material expenditure.

The long-term sustainability outlook depends heavily on overcoming material lifecycle restraints. While PVC is durable, its end-of-life management poses challenges. Consequently, opportunities are emerging in closed-loop recycling systems and chemical recycling technologies that allow high-quality recovery of PVC polymers. Furthermore, geographic expansion into previously underserved markets in Africa and Latin America, where rapid urbanization necessitates economical and fast roofing solutions, provides significant growth leverage. Ultimately, the market trajectory is determined by the ability of key players to mitigate commodity price risks while simultaneously capitalizing on the global demand for durable, weather-proof, and quickly deployable structural coverings, ensuring compliance with tightening environmental regulations.

Segmentation Analysis

The PVC Sheet Tarpaulin Roof System Market is comprehensively segmented based on Type (Fabrication Method), Application (End-Use Industry), and Thickness (Weight), reflecting the diversity of product offerings and functional requirements across different consumer bases. Segmentation by Type includes Coated Fabric and Laminated Fabric, where coated products generally offer superior long-term durability suitable for permanent structures, while laminated products provide a cost-effective solution for short-term or temporary applications. Understanding these segments is crucial for manufacturers to tailor production capabilities and marketing efforts, ensuring that specific end-user demands—whether high UV resistance for desert installations or extreme flexibility for cold climates—are met effectively.

Application segmentation is vital for market sizing and strategic planning, distinguishing between core segments like Industrial and Commercial Buildings, Agriculture, Transportation, and Sports/Tension Structures. Industrial and Commercial represents the largest revenue share, driven by demand for logistics warehouses and factory extensions. The Agriculture segment, encompassing greenhouses and crop protection covers, demonstrates the highest growth potential due to increasing global focus on controlled environment agriculture (CEA). Thickness segmentation (Light Duty, Medium Duty, Heavy Duty) directly correlates with the expected lifespan and environmental stresses the product must endure, with Heavy Duty (>900 GSM) increasingly favored for critical infrastructure and extreme weather areas, justifying higher price points due to enhanced material density and strength.

The complexity of the market necessitates detailed segmentation analysis for accurate forecasting. Manufacturers often leverage these segmentation insights to develop targeted product lines, for instance, developing specialized fire-retardant PVC sheets for event structures (Sports/Tension Structures segment) or anti-fungal sheets for high-humidity agricultural applications. The convergence of these segment variables—for example, Heavy Duty Coated Fabric used in Industrial Applications—defines the premium end of the market, characterized by higher entry barriers, stringent quality standards, and sustained revenue generation. The continuous evolution in material technology further influences these segment boundaries, blurring the lines between traditional materials and advanced PVC composites.

- By Type:

- Coated PVC Fabric Tarpaulin

- Laminated PVC Fabric Tarpaulin

- By Application:

- Industrial and Commercial Buildings (Warehousing, Factories)

- Agricultural Covers (Greenhouses, Crop Protection)

- Transportation and Logistics (Truck Covers, Container Liners)

- Sports and Tension Structures (Stadium Roofs, Event Tents)

- Disaster Relief and Temporary Shelters

- By Thickness/Weight (GSM):

- Light Duty (<450 GSM)

- Medium Duty (450 GSM - 900 GSM)

- Heavy Duty (>900 GSM)

- By Material Substrate:

- Polyester Reinforced PVC

- Nylon Reinforced PVC

- By End-Use Structure:

- Fixed/Permanent Structures

- Temporary/Modular Structures

Value Chain Analysis For PVC Sheet Tarpaulin Roof System Market

The Value Chain for the PVC Sheet Tarpaulin Roof System Market begins with the upstream procurement of essential raw materials, primarily PVC resin (a petrochemical derivative), plasticizers (for flexibility), stabilizing agents (UV protection), pigments, and the core substrate fabric (usually high-tenacity polyester or nylon). This stage is critical as the quality and cost volatility of these inputs directly influence the final product price and performance characteristics. Key upstream suppliers include major chemical and petrochemical companies, who dictate the supply stability and environmental compliance of the raw polymers. Manufacturers must establish robust long-term contracts and potentially backward integrate to mitigate supply chain disruptions and ensure material quality consistency for high-specification architectural applications.

The manufacturing stage involves the specialized process of coating or laminating the PVC compound onto the fabric substrate. Coating typically uses techniques like knife coating or spread coating to embed the PVC matrix into the fabric weave, ensuring superior adhesion and durability, while lamination bonds pre-formed PVC films to the fabric core using heat and pressure. Downstream activities involve fabrication, where the large rolls of tarpaulin material are cut, welded (using high-frequency or hot air welding), and finished into specific roof system components, often customized for size and structure type. The fabrication step requires specialized machinery and skilled labor to maintain seam integrity, which is paramount for the waterproofing performance of the final installed system.

Distribution channels are multifaceted, consisting of direct sales to large architectural firms and industrial clients, and indirect channels through specialized distributors, material wholesalers, and authorized installers. Direct channels are preferred for high-value, custom tensioned membrane projects, offering greater control over installation quality and after-sales service. Indirect channels efficiently service the fragmented construction, agricultural, and small commercial segments. The installer network plays a crucial role in the value chain, as improper installation can negate the quality of the PVC sheet. Therefore, manufacturers often invest heavily in training and certification programs for their distribution and installation partners, ensuring adherence to structural and safety standards. The final stage involves post-installation maintenance and eventual end-of-life recycling or disposal, a segment that is rapidly evolving due to sustainability pressures.

PVC Sheet Tarpaulin Roof System Market Potential Customers

The potential customers for PVC Sheet Tarpaulin Roof Systems are diverse, encompassing a wide array of industrial, commercial, and governmental entities seeking reliable, durable, and cost-effective roofing solutions, especially those requiring large, unobstructed spans or rapid deployment capabilities. The primary buyers are large logistics and warehousing corporations that require quick expansion or temporary storage solutions; these customers prioritize fire resistance, durability, and minimal structural support requirements. Additionally, agricultural enterprises, including large-scale greenhouse operators and livestock farmers, constitute a significant customer base, leveraging PVC tarpaulins for environmental control, protection against pests, and optimizing yield consistency across vast acreage.

Another critical customer segment includes construction and infrastructure development companies. These end-users utilize the product for temporary site shelters, materials protection, and hoarding structures, valuing the tarpaulin system's ability to be easily installed, dismantled, and reused across multiple projects. Furthermore, governmental and non-governmental organizations (NGOs) involved in disaster relief and humanitarian aid are major purchasers, requiring large quantities of rapidly deployable shelter solutions that offer immediate protection against severe weather conditions. These buyers often emphasize ease of transportation and high resistance to environmental degradation in harsh climates.

The market also targets specialized niche buyers such as professional sports organizations and entertainment event promoters. These groups require bespoke, visually appealing tensioned membrane structures for stadiums, arenas, concert venues, and temporary exhibition halls. For these high-profile applications, customers prioritize aesthetics, compliance with stringent fire and wind load regulations, and customizable branding opportunities inherent in PVC sheet material. Ultimately, any industry requiring a large-span, low-maintenance, waterproof enclosure, whether temporary or semi-permanent, falls within the target customer profile for advanced PVC Sheet Tarpaulin Roof Systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sioen Industries NV, SergeFerrari Group, Heytex Bramsche GmbH, Mehler Texnologies GmbH, Sattler AG, Verseidag-Indutex GmbH, Hiraoka & Co. Ltd., Saint-Gobain (ADFORS), Tarpulin World Co. Ltd., Contender Group, Low & Bonar (part of Freudenberg Group), Cooley Group, Seaman Corporation, Takata Corporation (Fabric Division), Zhongshan Tarpaulin Manufacturing Co. Ltd., Hongyuan Tarpaulin Industry Co., Daedong Tarpaulin, TenCate Geosynthetics, Endutex Coated Textiles, Trelleborg Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PVC Sheet Tarpaulin Roof System Market Key Technology Landscape

The PVC Sheet Tarpaulin Roof System Market is heavily influenced by advancements in polymer science and fabrication techniques aimed at enhancing durability, fire safety, and environmental performance. A critical technological aspect is the development of advanced PVC formulations that incorporate low-migration plasticizers and superior UV stabilizers, significantly extending the material's service life, particularly in regions with high solar radiation exposure. Furthermore, manufacturers are increasingly adopting photocatalytic surface treatments, which enable the material to break down organic pollutants and dirt under sunlight, resulting in self-cleaning properties, reduced maintenance costs, and improved aesthetic longevity for architectural applications like tensioned facades and stadium roofs.

Fabrication technology plays an equally crucial role, with the widespread adoption of high-frequency (HF) welding and advanced hot-air welding techniques being paramount. These technologies ensure extremely strong, hermetically sealed seams that are impervious to moisture and resistant to high tensile loads, which is vital for large-span roof systems subjected to extreme wind and snow loads. Continuous research focuses on optimizing automated cutting and welding processes using computer numerical control (CNC) systems, allowing for precise, repeatable fabrication of complex, three-dimensional membrane shapes required for modern tensioned structures, thereby minimizing material waste and speeding up large-scale project execution.

The integration of digital technology, encompassing the Internet of Things (IoT) and Building Information Modeling (BIM), is transforming the design and monitoring phase. BIM compatibility allows architects and engineers to seamlessly integrate PVC membrane specifications into overall building designs, facilitating better load analysis and material optimization. IoT sensors are being embedded within the roofing material or structure to monitor critical performance indicators such as tension levels, ambient temperature, humidity ingress, and structural deflection in real-time. This technological layering provides predictive insights, moving maintenance from a periodic schedule to a condition-based approach, maximizing asset utilization and ensuring the safety and long-term viability of the PVC sheet tarpaulin roof system.

Regional Highlights

The global PVC Sheet Tarpaulin Roof System market exhibits distinct growth patterns across key geographic regions, primarily driven by varying levels of industrial development, climate challenges, and regulatory environments. Asia Pacific (APAC) commands the largest market share and is projected to experience the highest growth rate during the forecast period. This dominance is attributed to large-scale infrastructure projects in countries like China, India, and Indonesia, massive investment in logistics and warehousing facilities to support e-commerce growth, and the extensive utilization of greenhouses and protective covers in the rapidly expanding agricultural sector. Favorable government policies promoting manufacturing and urbanization further cement APAC's lead.

North America and Europe represent mature markets characterized by steady demand driven primarily by replacement and retrofitting activities in the commercial and industrial sectors. In North America, the market benefits from a strong transportation sector, particularly the use of high-durability tarpaulins for truck covers and rail car protection, alongside increasing application in temporary construction enclosures. European growth is supported by stringent energy efficiency and fire safety standards, compelling manufacturers to innovate with specialized PVC sheets that offer superior thermal insulation and fire retardancy, aligning with the EU’s green building directives and focus on sustainable construction materials.

Latin America and the Middle East & Africa (MEA) are emerging markets showing promising potential. Latin American growth is fueled by agricultural expansion and mining activities, which require robust temporary shelters and material covers. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is seeing significant adoption due to massive public works projects, high ambient temperatures necessitating UV-resistant materials, and the need for quickly deployable, shaded structures for events and industrial storage. Challenges in these regions include localized supply chain inconsistencies and the need for region-specific formulations to withstand extreme climatic variations, creating opportunities for localized manufacturing and strategic partnerships.

- Asia Pacific (APAC): Dominant market share; highest growth driven by infrastructure investment, logistics sector expansion, and extensive agricultural applications (China, India, Southeast Asia).

- North America: Mature market focusing on high-specification materials for transportation (trucking) and replacement of aging commercial roofs; strong regulatory push for durability and wind resistance.

- Europe: Stable growth fueled by strict environmental and building codes; focus on high thermal performance, fire-retardant, and recyclable PVC solutions in commercial construction and event structures.

- Latin America: Emerging market with high demand from the mining, resource extraction, and large-scale agricultural sectors, particularly requiring heavy-duty, robust materials.

- Middle East & Africa (MEA): Growth driven by mega-projects, urbanization, and disaster relief needs; emphasis on extreme UV resistance and heat stability in PVC formulations due to harsh desert climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PVC Sheet Tarpaulin Roof System Market.- Sioen Industries NV

- SergeFerrari Group

- Heytex Bramsche GmbH

- Mehler Texnologies GmbH

- Sattler AG

- Verseidag-Indutex GmbH

- Hiraoka & Co. Ltd.

- Saint-Gobain (ADFORS)

- Tarpulin World Co. Ltd.

- Contender Group

- Low & Bonar (part of Freudenberg Group)

- Cooley Group

- Seaman Corporation

- Takata Corporation (Fabric Division)

- Zhongshan Tarpaulin Manufacturing Co. Ltd.

- Hongyuan Tarpaulin Industry Co.

- Daedong Tarpaulin Co. Ltd.

- TenCate Geosynthetics

- Endutex Coated Textiles

- Trelleborg Group

- IFAI (Industrial Fabrics Association International members)

- Texlon International

- Foshan Sansheng Environmental Material Co., Ltd.

- Weifang Tuntong Plastic Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PVC Sheet Tarpaulin Roof System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the PVC Sheet Tarpaulin Roof System Market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by demand from the logistics and infrastructure sectors globally.

Which geographical region dominates the PVC Sheet Tarpaulin Roof System Market?

The Asia Pacific (APAC) region currently dominates the market share and is expected to maintain the highest growth rate due to accelerated infrastructure development and high industrial construction activity in China and India.

What are the primary factors driving the adoption of PVC tarpaulin roof systems?

Key drivers include the need for lightweight, rapidly deployable roofing solutions, the inherent water resistance and durability of PVC, and increased demand from the modular construction and logistics warehousing sectors.

How do PVC Coated Fabrics differ from Laminated Fabrics in this market?

Coated PVC Fabrics offer superior material adhesion, tear strength, and longevity, making them suitable for heavy-duty, semi-permanent installations, whereas Laminated Fabrics are typically more cost-effective for short-term and light-duty applications.

What technological innovations are shaping the future of PVC tarpaulin systems?

Future innovations include the integration of photocatalytic (self-cleaning) coatings, advanced high-frequency welding techniques for superior seam integrity, and the use of IoT sensors for real-time structural monitoring and predictive maintenance.

What material thickness is preferred for heavy-duty industrial applications?

Heavy-duty industrial and permanent structure applications generally prefer PVC sheets with a weight exceeding 900 GSM (Grams per Square Meter) due to their enhanced tear resistance, durability, and resilience against high wind and snow loads.

What is the main restraint impacting the market growth?

The primary restraint is the fluctuating global price and supply volatility of raw materials, specifically petrochemical-derived PVC resins and plasticizers, which affects manufacturing costs and profitability margins.

How is the AI Impact Analysis relevant to PVC Sheet Tarpaulin production?

AI is crucial for enhancing manufacturing precision through machine vision for quality control, optimizing material formulations, and supporting complex design algorithms for tensioned membrane structures, leading to reduced waste and higher product consistency.

Which end-use segment is anticipated to register the fastest growth?

The Agricultural Covers segment, particularly driven by the increasing global adoption of controlled environment agriculture (CEA) and the necessity to protect crops from unpredictable weather, is expected to exhibit the highest Compound Annual Growth Rate.

Who are the primary potential customers for these roof systems?

Potential customers include logistics and warehousing companies, large-scale agricultural enterprises (greenhouses), infrastructure and construction contractors (temporary shelters), and governmental disaster relief organizations.

What is the significance of the Value Chain in this market?

The Value Chain highlights the critical dependency on upstream chemical suppliers for polymer quality, the importance of specialized fabrication (welding) for product integrity, and the necessity of highly trained installers in the downstream segment to ensure optimal product performance.

How do environmental regulations affect the European market?

In Europe, stringent environmental regulations drive the demand for PVC systems utilizing phthalate-free plasticizers, recycled content, and solutions that are designed for ease of eventual end-of-life recycling to comply with EU sustainability mandates.

What is the role of polyester scrim in PVC Sheet Tarpaulin?

Polyester scrim acts as the core reinforcement fabric, providing the tensile strength and dimensional stability necessary for the PVC sheet to withstand significant structural stress, particularly wind uplift and tension in large-span applications.

Are PVC Sheet Tarpaulin Roof Systems considered sustainable?

While traditionally facing disposal challenges, modern systems are improving sustainability through the development of closed-loop recycling programs, use of bio-based plasticizers, and the inherently long lifespan of the material, which reduces replacement frequency.

What is the difference between light-duty and heavy-duty tarpaulin?

Light-duty tarpaulin (typically less than 450 GSM) is used for short-term covers, while heavy-duty tarpaulin (over 900 GSM) is designed for permanent or semi-permanent architectural applications requiring maximum resistance to abrasion, UV damage, and structural loading.

How does the transportation sector utilize these systems?

The transportation sector uses PVC tarpaulin sheets extensively for durable truck side curtains, railway car covers, and protective container liners, valued for their weather protection, ease of handling, and resistance to harsh road conditions.

What are the primary challenges in the Middle East and Africa (MEA) region?

The main challenges in MEA include the requirement for specialized PVC formulations to withstand extreme high temperatures and intense UV radiation, along with managing localized supply chain complexities and ensuring regulatory compliance.

What is the role of plasticizers in PVC sheeting?

Plasticizers are additives crucial for improving the flexibility, elasticity, and processability of the inherently rigid PVC polymer, allowing the sheeting to be easily rolled, folded, and installed, particularly in cold environments without cracking.

Which manufacturing technique is preferred for architectural structures?

Coating techniques, such as knife coating, are preferred for high-end architectural and tensioned structures, as they produce fabrics with superior bond strength, flexibility, and longevity compared to lamination methods.

How does the trend of modular construction affect this market?

Modular construction is a significant driver, as it demands lightweight, highly durable, and easily assembled components; PVC tarpaulin roof systems meet these requirements perfectly, facilitating rapid installation and relocation of temporary buildings.

What is the estimated market size for PVC Sheet Tarpaulin Roof Systems in 2026?

The PVC Sheet Tarpaulin Roof System Market is estimated to be valued at approximately USD 3.5 Billion in the base year 2026, serving diverse industrial and commercial roofing needs globally.

What is the long-term outlook concerning raw material sourcing?

The long-term outlook involves a strategic shift towards securing sustainable or bio-based plasticizers and potentially integrating recycled PVC feedstock to mitigate dependency on volatile petrochemical commodity markets and address environmental pressures.

What is AEO optimization in the context of this report?

Answer Engine Optimization (AEO) ensures that the report structure, especially the FAQs, provides concise, direct, and authoritative answers to common user queries, enhancing visibility in search results and digital assistants seeking specific market data.

What is the primary function of UV stabilizers in PVC tarpaulin?

UV stabilizers are essential chemical additives that prevent the degradation and embrittlement of the PVC polymer when exposed to sunlight, thereby ensuring the material retains its strength and aesthetic appeal over its long service life, especially in sunny climates.

How is the demand for large-span structures influencing PVC tarpaulin usage?

Demand for large-span, column-free internal spaces (like aircraft hangars, sports stadiums, and mega-warehouses) favors PVC tarpaulin roof systems due to their lightweight nature, which reduces the load requirements on the structural frame compared to conventional roofing materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager