Pyonex Needles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435523 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pyonex Needles Market Size

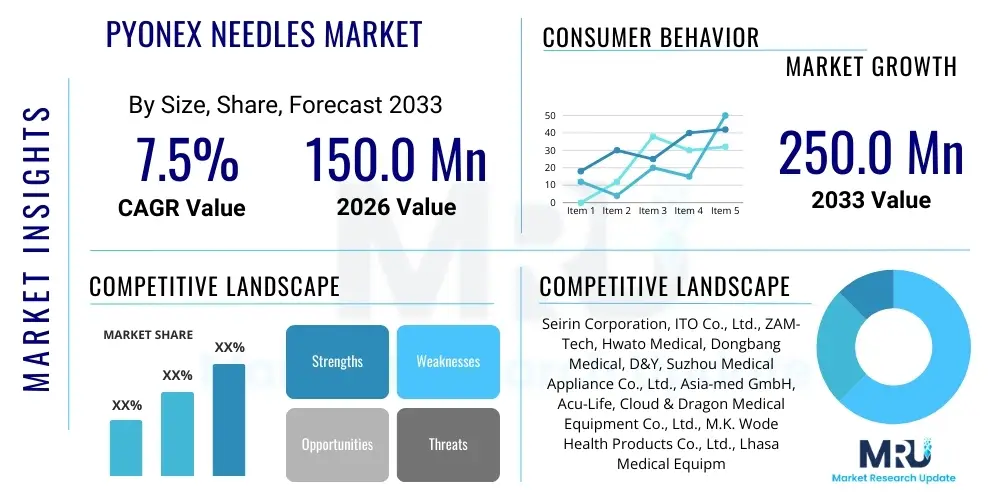

The Pyonex Needles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 150.0 Million in 2026 and is projected to reach USD 250.0 Million by the end of the forecast period in 2033.

Pyonex Needles Market introduction

The Pyonex Needles Market encompasses the manufacturing, distribution, and utilization of specialized intradermal and press needles, primarily used in acupuncture, auriculotherapy, and localized pain management. Pyonex needles, often characterized by their ultra-fine gauge and specialized adhesive or spring-loaded applicators, are designed for superficial and long-duration needling, offering minimal invasiveness and enhanced patient comfort compared to conventional filiform needles. These devices are crucial in treating chronic conditions, managing localized pain syndromes, and supporting cosmetic and wellness treatments due to their discrete placement and ease of use.

Product descriptions typically highlight the unique structure of Pyonex needles: a very short needle (often 0.3mm to 1.5mm in length) permanently affixed to a small, breathable adhesive plaster or mounted within a protective plastic housing. Major applications include sustained stimulation of acupoints, particularly in areas like the ear (auriculotherapy) or joints, providing continuous therapeutic effect without requiring the patient to remain stationary. The fundamental benefits driving market adoption include superior patient compliance, reduced procedural discomfort, extended therapeutic action, and significantly decreased risk of infection compared to reusable or less specialized needling devices.

Driving factors for the growth of this specialized medical device market include the accelerating global acceptance of Traditional Chinese Medicine (TCM) and complementary therapies, coupled with the rising demand for non-pharmacological pain management solutions. Furthermore, advancements in manufacturing techniques that allow for mass production of sterile, single-use Pyonex needles at competitive price points are making these products accessible to a broader range of practitioners, including physical therapists, chiropractors, and specialized wellness clinics, thereby expanding the overall market footprint globally and sustaining robust growth throughout the forecast period.

Pyonex Needles Market Executive Summary

The Pyonex Needles Market demonstrates strong upward momentum, fueled by significant business trends focusing on disposable, high-quality medical supplies and the expansion of minimally invasive therapeutic options. Key business strategies involve enhanced supply chain efficiency, focusing on sterile packaging innovations, and strategic partnerships between manufacturers and global distributor networks specializing in medical and wellness supplies. Companies are heavily investing in product differentiation, offering various gauges and needle lengths to cater to specific clinical protocols, alongside developing hypoallergenic adhesives to improve patient tolerance and extend treatment duration. This focus on product diversity and clinical utility ensures sustained market relevance and profitability, especially within the specialized niche of sustained stimulation therapies.

Regional trends indicate North America and Europe currently dominate the market share due to established healthcare infrastructures, high adoption rates of alternative pain therapies, and strong regulatory frameworks supporting medical device usage. However, the Asia Pacific region is projected to exhibit the fastest growth trajectory, driven by the profound cultural acceptance and widespread practice of acupuncture, coupled with rapidly expanding healthcare expenditures and increasing disposable incomes in countries like China, India, and South Korea. Manufacturers are keenly targeting these emerging markets through localized distribution channels and educational initiatives aimed at increasing practitioner adoption of modern, high-standard Pyonex products over conventional alternatives.

Segment trends highlight the Application segment, specifically Pain Management and Wellness/Cosmetic Acupuncture, as the primary revenue generators. Within the Type segment, the static adhesive patch type remains dominant due to cost-effectiveness and versatility, although spring-loaded applicators are gaining traction for enhanced precision and ease of application by practitioners. Furthermore, End-User analysis reveals specialized pain clinics and private acupuncture practices are the leading purchasers, emphasizing the critical role these needles play in chronic care settings where sustained, continuous treatment is essential for optimal patient outcomes. The overall market trajectory remains highly positive, driven by unmet needs in chronic pain management and increasing global acceptance of natural therapeutic interventions.

AI Impact Analysis on Pyonex Needles Market

User inquiries regarding AI's influence on the Pyonex Needles Market often center on how automation might affect manufacturing efficiency, how predictive analytics could optimize inventory and supply chains, and whether AI-driven diagnostic tools could standardize or improve the precise application of these needles. There is also significant user interest in how AI could be integrated into clinical practice—specifically, developing algorithms that correlate patient biometric data (gathered via wearables) with optimal acupoint stimulation protocols using Pyonex needles, thereby potentially automating treatment planning and monitoring effectiveness. Users generally expect AI to enhance operational logistics rather than directly alter the physical product itself, focusing on precision, standardization, and supply chain reliability.

The application of Artificial Intelligence within the Pyonex needles sector is anticipated to revolutionize the manufacturing workflow, primarily through predictive maintenance and quality control systems. AI-powered vision systems can inspect micro-components, such as the needle tips and adhesive integrity, with unparalleled accuracy and speed, drastically reducing defect rates and ensuring consistent product sterility and performance. This automation not only increases throughput but also mitigates human error in the delicate assembly processes required for ultra-fine medical devices, addressing major quality concerns often raised by practitioners regarding disposable needle consistency.

Moreover, AI holds transformative potential in the distribution and clinical support realms. Machine learning algorithms can analyze global demand patterns, seasonal variations in pain incidence, and regulatory changes across different regions to optimize inventory levels, minimizing waste and ensuring just-in-time delivery to clinics. Clinically, AI could support the development of sophisticated treatment protocols by analyzing vast datasets of successful Pyonex applications correlated with patient demographics and specific chronic conditions, offering practitioners data-driven recommendations for optimal needle gauge, placement duration, and targeted acupoints, thereby enhancing therapeutic efficacy and standardizing best practices across the market.

- AI-driven Quality Control: Enhanced microscopic inspection of needle tips and adhesive bonds, ensuring superior product consistency and reducing manufacturing defects.

- Predictive Supply Chain Optimization: Use of machine learning to forecast regional demand, manage inventory, and optimize logistics for sterile, disposable devices.

- Clinical Protocol Standardization: Development of AI models analyzing patient response data to recommend optimal Pyonex application points and duration for various conditions.

- Manufacturing Automation: Implementation of robotics and AI for precision assembly of the needle-plaster system, improving efficiency and scalability.

- Patient Monitoring Integration: Potential integration with AI platforms analyzing wearable data to assess the ongoing efficacy of sustained Pyonex stimulation.

DRO & Impact Forces Of Pyonex Needles Market

The Pyonex Needles Market dynamics are shaped by powerful Drivers, substantial Restraints, and evolving Opportunities, which collectively constitute the primary Impact Forces determining the market trajectory. The key driver is the surging global preference for non-pharmacological and minimally invasive treatments, particularly for chronic musculoskeletal and neuropathic pain, positioning Pyonex needles as a safe and effective adjunct therapy. This is counterbalanced by significant restraints, primarily regulatory hurdles concerning disposable medical devices in specific emerging economies and persistent challenges related to market education, as awareness of specialized press needles remains relatively low among general practitioners compared to traditional acupuncture needles.

Impact forces are predominantly positive, driven by technological improvements in material science, allowing for the creation of ultra-sharp, smaller-gauge needles that minimize pain during insertion and ensure better adherence to the skin for prolonged periods. Furthermore, the rising investment in research and development proving the efficacy of continuous acupoint stimulation solidifies the clinical basis for Pyonex usage. Opportunities arise from expanding applications beyond traditional pain management into areas such as sports recovery, veterinary medicine, and specialized aesthetic treatments, which offer new, high-value avenues for market penetration, especially in developed markets where wellness trends are booming.

The delicate balance between promoting the undeniable benefits (minimal invasiveness, sustained effect) and overcoming the structural restraints (cost comparison with generic needles, need for standardized practitioner training) dictates the market's overall pace of growth. Successful manufacturers leverage robust clinical evidence and targeted digital marketing campaigns (AEO/GEO optimization) to educate both practitioners and consumers, thereby mitigating the knowledge gap restraint and accelerating the adoption of Pyonex needles as a premium, effective therapeutic tool in integrated healthcare settings globally.

Segmentation Analysis

The Pyonex Needles Market is systematically segmented based on Type, Application, and End-User, providing granular insights into demand patterns and growth areas. The segmentation based on Type typically differentiates between the static adhesive patch design, which is highly prevalent due to simplicity and cost, and the more advanced spring-loaded dispenser systems, which offer enhanced safety and precise, standardized insertion depth. Analyzing these segments helps manufacturers tailor product development towards either high-volume, general-use products or specialized, high-precision clinical tools, optimizing manufacturing and marketing efforts across different price points.

The Application segmentation is critical as it highlights the primary therapeutic areas driving revenue. Pain management remains the dominant category, covering treatment for conditions like back pain, migraines, and nerve entrapment syndromes, where continuous stimulation is beneficial. However, the rapidly expanding categories of cosmetic and wellness applications, including facial acupuncture and recovery treatments, are showcasing exponential growth potential, attracting new entrants and diversification strategies from established market players. Understanding the nuanced needs of these diverse application fields—from the required needle length for deep tissue stimulation to the necessity for non-irritating adhesives in cosmetic use—is vital for market strategy.

Lastly, End-User segmentation provides insight into the distribution channel efficiency. While specialized Acupuncture and TCM Clinics are the foundational purchasers, the growing adoption in institutional settings like Hospitals (for inpatient pain management protocols) and increasingly, in Chiropractor and Physical Therapy practices (as part of integrated rehabilitation programs), signals a significant broadening of the professional user base. This necessitates developing targeted distribution strategies, potentially leveraging specialized medical device distributors for hospital access and direct-to-practitioner e-commerce platforms for smaller clinic sales, ensuring optimal market reach and sustained growth across all segments.

- Type

- Adhesive Patch (Static)

- Spring-Loaded Dispenser

- Application

- Pain Management (Chronic & Acute)

- Acupuncture (Traditional & Auricular)

- Wellness and Stress Reduction

- Cosmetic and Anti-Aging Treatments

- End-User

- Acupuncture and Traditional Chinese Medicine Clinics

- Hospitals and Pain Management Centers

- Chiropractic and Physical Therapy Practices

- Spas and Wellness Centers

Value Chain Analysis For Pyonex Needles Market

The Value Chain for the Pyonex Needles Market starts with Upstream Analysis, which focuses heavily on the procurement of specialized raw materials, primarily medical-grade stainless steel wire (Japanese or Korean steel is often preferred for its precision and anti-corrosion properties), high-quality hypoallergenic adhesives, and sterile plastic components for housing and packaging. The successful execution of upstream activities relies on stringent supplier qualification, ensuring materials meet high biocompatibility and sterilization standards. Innovations in steel alloy composition for achieving finer gauges and sharper tips while maintaining flexibility are continuous areas of focus, directly impacting the final product’s quality and user acceptance.

Midstream activities encompass the precise manufacturing, sterilization, and assembly processes. This stage is complex due to the micro-scale nature of the product, requiring highly automated machinery for wire cutting, tip grinding, siliconizing, and the delicate integration of the needle onto the adhesive patch or within the applicator housing. Ethylene Oxide (EO) or gamma radiation sterilization is mandatory, followed by cleanroom packaging to ensure product safety and regulatory compliance. Efficient manufacturing processes are crucial for managing production costs and maintaining the high volume required by a disposable medical device market, distinguishing low-cost producers from premium manufacturers.

Downstream analysis involves distribution channels, which are bifurcated into Direct and Indirect models. Direct distribution often utilizes e-commerce platforms and dedicated sales teams targeting large hospital chains or institutional buyers. Indirect distribution relies heavily on regional specialized medical distributors (MSOs) or wholesale pharmacy networks that handle logistics and inventory management for thousands of smaller clinics, individual practitioners, and international markets. The choice of channel strategy heavily influences pricing, market reach, and inventory turnover, with efficient last-mile delivery being a critical competitive differentiator in ensuring timely access to these necessary sterile supplies for continuous patient care.

Pyonex Needles Market Potential Customers

The primary End-Users and potential buyers of Pyonex Needles are specialized healthcare practitioners who integrate sustained acupressure or focused intradermal stimulation into their therapeutic modalities. These core customers include licensed acupuncturists, professionals in Traditional Chinese Medicine (TCM), and specialized pain physicians operating out of private clinics. Their high-volume consumption is driven by the recurrent nature of chronic pain treatments and the necessity of using sterile, single-use products for every application, ensuring a steady, predictable demand cycle within this professional segment.

A rapidly growing segment of potential customers includes integrated healthcare facilities such as specialized rehabilitation centers, hospital-based pain management units, and physical therapy practices. These institutions often adopt Pyonex needles as part of comprehensive, multidisciplinary pain protocols, particularly when managing sports injuries or post-operative discomfort where minimizing pharmacological intervention is prioritized. Institutional purchasing decisions are often centralized, focusing on regulatory compliance, bulk pricing, and evidence of clinical effectiveness supported by robust scientific literature and supplier reliability.

Furthermore, the expanding wellness and aesthetic market constitutes a third, high-potential customer base. This includes cosmetic acupuncturists, dermatologists offering holistic skin treatments, and high-end spas focused on anti-aging and stress-reduction therapies. These customers prioritize premium product attributes such as minimal skin irritation, aesthetic discretion (e.g., clear or skin-toned adhesive patches), and proven efficacy in stimulating collagen production or reducing muscle tension, signifying a segment willing to pay a premium for specialized features tailored to cosmetic outcomes and high-touch patient experiences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.0 Million |

| Market Forecast in 2033 | USD 250.0 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Seirin Corporation, ITO Co., Ltd., ZAM-Tech, Hwato Medical, Dongbang Medical, D&Y, Suzhou Medical Appliance Co., Ltd., Asia-med GmbH, Acu-Life, Cloud & Dragon Medical Equipment Co., Ltd., M.K. Wode Health Products Co., Ltd., Lhasa Medical Equipment Co., Ltd., Kingli Medical, Shenlong Medical, Wuxi Huakang Medical Equipment Co., Ltd., Guangzhou Nanfang Medical Apparatus Co., Ltd., Sanyata Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pyonex Needles Market Key Technology Landscape

The technological landscape of the Pyonex Needles Market is dominated by advancements in material science, focusing on creating needles that are simultaneously stronger, thinner, and sharper, minimizing patient discomfort upon insertion. Key innovations revolve around ultra-fine gauge technology, where needle diameters are consistently being reduced (e.g., moving towards 0.12mm or 0.10mm) using advanced cold-drawing and grinding techniques. Furthermore, the application of sophisticated siliconization processes ensures smooth penetration through the epidermal layer, reducing friction and the sensation of pain, which is critical for patient adherence to prolonged treatment plans utilizing these press needles.

Another crucial technological area involves the development of specialized adhesive components. Since Pyonex needles remain on the skin for extended periods (often several days), the adhesive must be medical-grade, highly breathable, hypoallergenic, and possess superior staying power, even when exposed to moisture or movement. Manufacturers are increasingly utilizing hydrocolloid or advanced acrylic adhesives that mitigate skin irritation while ensuring the needle maintains precise contact with the acupoint. Research into bio-absorbable or time-release adhesive formulations represents a frontier technology aimed at improving both comfort and environmental sustainability.

Moreover, manufacturing technology, particularly in high-precision automation and sterilization, underpins the market's reliability. Automated machinery ensures the consistent alignment and secure attachment of the minuscule needle to the adhesive patch, guaranteeing standardized insertion depth and sterility across millions of units. Techniques such as fully integrated, closed-loop manufacturing systems and advanced real-time quality assurance using high-resolution optical scanning (as noted in the AI section) are essential for maintaining the medical device standards required in regulated markets, ensuring that the technology used in production supports the core claims of safety and efficacy.

Regional Highlights

- North America: This region commands a significant market share, driven by high healthcare expenditure, established regulatory pathways (FDA approval is critical), and a strong consumer trend towards complementary and alternative medicine (CAM), especially for managing chronic conditions like fibromyalgia and back pain. The U.S. and Canada benefit from a high density of professional acupuncturists and integrated medical practices actively incorporating Pyonex needles into diverse treatment regimens, focusing on premium, high-quality disposable devices.

- Europe: Europe represents the second-largest market, characterized by strong governmental support for integrating traditional therapies into public health systems (particularly in Germany, the UK, and France). Demand is robust, especially for specialized pain clinics and physical rehabilitation centers. The market is highly sensitive to CE mark certification and focuses on environmental sustainability, driving innovation towards minimal packaging and eco-friendly sterilization methods.

- Asia Pacific (APAC): Projected to be the fastest-growing region, APAC is the cultural birthplace of acupuncture, leading to widespread practitioner density and acceptance. Market growth is fueled by increasing healthcare infrastructure investment, rising disposable incomes, and the sheer volume of patients seeking TCM therapies, particularly in China and Southeast Asia. The focus here is often on balancing high-volume production with competitive pricing, though a shift towards premium, internationally certified products is observed in urban centers.

- Latin America: This emerging market shows steady growth, primarily focused in Brazil and Mexico. Expansion is driven by the gradual professionalization of alternative medicine practices and increasing awareness among medical communities regarding the benefits of non-opioid pain solutions. Challenges include complex import regulations and price sensitivity, necessitating localized distribution partnerships and flexible pricing models for manufacturers.

- Middle East and Africa (MEA): MEA currently holds the smallest market share but presents significant long-term opportunities, especially within wealthy Gulf Cooperation Council (GCC) countries investing heavily in advanced healthcare and medical tourism infrastructure. Adoption is concentrated in private wellness centers and specialized hospitals. Growth depends heavily on clinical education efforts and overcoming regional skepticism toward non-conventional treatments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pyonex Needles Market.- Seirin Corporation

- ITO Co., Ltd.

- ZAM-Tech

- Hwato Medical

- Dongbang Medical

- D&Y

- Suzhou Medical Appliance Co., Ltd.

- Asia-med GmbH

- Acu-Life

- Cloud & Dragon Medical Equipment Co., Ltd.

- M.K. Wode Health Products Co., Ltd.

- Lhasa Medical Equipment Co., Ltd.

- Kingli Medical

- Shenlong Medical

- Wuxi Huakang Medical Equipment Co., Ltd.

- Guangzhou Nanfang Medical Apparatus Co., Ltd.

- Sanyata Technology Co., Ltd.

- 3B Scientific GmbH

- Carbo Medical Supplies

- Evergreen Herbs

Frequently Asked Questions

Analyze common user questions about the Pyonex Needles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Pyonex needles and traditional acupuncture needles?

Pyonex needles are specialized intradermal or press needles that are significantly shorter (typically 0.3mm to 1.5mm) and are affixed to an adhesive plaster, designed for sustained, continuous stimulation of acupoints over several days. Traditional acupuncture needles are longer, filiform, and generally used for temporary stimulation during a single treatment session.

Which application segment drives the highest demand for Pyonex Needles?

The Pain Management segment, encompassing chronic conditions like myofascial pain, headaches, and localized musculoskeletal pain, drives the highest demand. Pyonex needles are favored for their ability to provide continuous, non-pharmacological relief, improving patient compliance and extending therapeutic benefits outside of the clinic setting.

What are the key technological advancements expected in the Pyonex Needles market?

Key technological advancements include the further reduction of needle gauge for painless insertion, development of superior hypoallergenic and breathable adhesives for extended wear, and the implementation of AI and automation in manufacturing for enhanced quality control and product consistency, ensuring high sterility standards.

Which geographic region exhibits the fastest growth rate for Pyonex Needles adoption?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to the deep cultural integration of Traditional Chinese Medicine, rapid expansion of healthcare access, and increasing investment in modern, sterile medical consumables across key economies like China, South Korea, and India.

Are Pyonex needles suitable for cosmetic treatments?

Yes, Pyonex needles are increasingly utilized in cosmetic and anti-aging acupuncture. Their ultra-fine nature and sustained stimulation capability make them highly effective for facial protocols, targeting specific points to promote circulation, reduce inflammation, and support collagen production with minimal downtime or risk of bruising.

Extended Market Dynamics and Competitive Strategy

The competitive landscape of the Pyonex Needles Market is characterized by intense rivalry between established Japanese and South Korean precision manufacturers and high-volume producers based in China. The strategic focus for premium players, such as Seirin and ITO, remains on technological superiority, maintaining ultra-low defect rates, and securing clinical endorsements that validate their higher price points. These companies invest heavily in intellectual property protecting their unique application systems and specialized stainless steel alloys, creating high barriers to entry for competitors attempting to match their product quality and consistency in critical medical applications.

Conversely, volume-focused competitors leverage scale and cost efficiencies to capture market share, particularly in price-sensitive regions like Latin America and parts of Asia. Their strategy centers on efficient supply chain management and broad distribution networks, often supplying large wholesalers and generic medical device suppliers. However, as global standards for sterile medical devices become increasingly stringent, even these manufacturers must continually invest in advanced sterilization and quality control technologies to remain compliant, gradually narrowing the quality gap with premium brands and driving overall market maturation.

A crucial factor influencing competitive strategy is the direct-to-practitioner sales model versus the traditional distributor model. Companies successfully leveraging digital platforms and robust AEO/GEO strategies to reach individual clinics directly gain a significant advantage in terms of margin control and rapid product feedback integration. This dynamic encourages marketing content focused on clinical evidence and ease of use, making the practitioner decision cycle a central battleground for market penetration and brand loyalty, especially as younger generations of practitioners integrate digital purchasing habits into their supply logistics.

- Competitive Differentiation: Focus on needle gauge precision (ultra-fine) and proprietary hypoallergenic adhesive formulations.

- Geographic Expansion: Strategic investment in APAC and Latin America to capture emerging demand centers.

- Distribution Channel Focus: Optimization of e-commerce platforms for direct B2B sales to clinics, complementing traditional medical distributor partnerships.

- Intellectual Property Protection: Continuous innovation in applicator design (spring mechanisms) and material science to maintain market leadership.

- Clinical Validation: Investment in independent studies proving efficacy, essential for gaining traction in institutional End-User segments (Hospitals).

Regulatory Landscape and Standardization Challenges

The global regulatory environment for Pyonex needles, classified as sterile, single-use, minimally invasive medical devices, varies significantly across major regions, posing a critical restraint on rapid international expansion. In North America, obtaining FDA 510(k) clearance requires extensive documentation demonstrating equivalence to predicate devices, focusing intensely on biocompatibility of materials (steel and adhesive) and sterilization process validation (Sterility Assurance Level - SAL). The European market necessitates CE Mark certification under the Medical Device Regulation (MDR), which has heightened scrutiny on post-market surveillance and clinical evaluation data, demanding more rigorous evidence of long-term safety and performance.

The lack of universal standardization in practitioner training and device usage protocols across different countries adds complexity. While licensing bodies in TCM are well-established, Pyonex needles are increasingly used by other healthcare professionals (physiotherapists, chiropractors) whose training in intradermal needling techniques may lack uniformity. This variance creates a risk profile that regulators are increasingly examining, potentially leading to future restrictions or mandatory specialization certificates for Pyonex application, impacting the speed of adoption outside of traditional acupuncture settings.

Furthermore, regulatory divergence concerning packaging, labeling, and language requirements mandates substantial adaptation for localized market entry. Manufacturers must maintain traceability records across complex global supply chains to comply with evolving regulations designed to prevent counterfeit or substandard medical consumables from reaching the market. The compliance burden is particularly heavy on smaller manufacturers attempting to access high-value regulated markets, creating a consolidation pressure favoring larger firms with robust regulatory affairs departments capable of navigating the global patchwork of medical device governance.

- FDA 510(k) Compliance: Essential for North American market entry, focusing on material biocompatibility and sterilization validation.

- EU MDR Requirements: Demand rigorous post-market surveillance and comprehensive clinical evaluation data for CE marking.

- International Standardization: Need for ISO certifications (e.g., ISO 13485) to demonstrate quality management systems compliance.

- Counterfeit Mitigation: Implementation of robust serialization and traceability systems to protect brand integrity and patient safety.

- Training Harmonization: Industry efforts required to standardize training protocols for non-acupuncturist practitioners utilizing Pyonex devices.

Impact of Chronic Pain Epidemic and Aging Populations

The increasing global burden of chronic pain serves as a fundamental market driver for Pyonex needles. Chronic conditions, including low back pain, arthritis, and neuropathies, affect hundreds of millions globally, spurring massive healthcare expenditures and intense patient demand for effective, non-addictive pain relief alternatives. Given the ongoing public health crisis associated with opioid addiction, healthcare systems are actively seeking and reimbursing therapies that minimize pharmaceutical dependency, positioning Pyonex needles—which offer continuous, localized relief without systemic side effects—as an attractive component of multimodal pain management strategies.

Simultaneously, the rapidly aging populations across major developed economies (North America, Europe, Japan) contribute significantly to the prevalence of age-related degenerative joint conditions and musculoskeletal ailments. Older patients often present with multiple comorbidities and are particularly sensitive to the side effects of conventional medications, making minimally invasive and well-tolerated therapies like Pyonex needles highly desirable. The ease of application and the ability for the needle to remain in place for several days appeal to both practitioners managing complex geriatric care protocols and patients seeking continuous comfort.

This demographic shift compels hospitals and clinics to expand their offerings in geriatric and rehabilitative care, requiring a steady supply of specialized, comfortable, single-use devices. Market growth is therefore intrinsically linked to successful public health initiatives aimed at mitigating pain and improving quality of life for the elderly, further validating the essential nature of specialized needles in modern clinical practice. Manufacturers must ensure their product sizing and adhesive technology caters specifically to the sensitive skin and movement patterns often associated with older patient demographics to fully capitalize on this major demographic driver.

- Opioid Alternative Demand: Growing need for non-addictive pain interventions fuels adoption in hospitals and pain clinics.

- Geriatric Care Focus: Pyonex suitability for sensitive skin and non-pharmacological pain relief appeals to aging patient cohorts.

- Chronic Condition Prevalence: High global incidence of musculoskeletal disorders drives long-term, recurrent purchasing cycles by clinics.

- Reimbursement Trends: Increasing acceptance and reimbursement coverage for complementary pain therapies accelerates institutional adoption.

- Quality of Life Improvement: Products supporting long-term, continuous therapy align with patient-centered care models.

Emerging Opportunities in Sports Medicine and Wellness

Beyond traditional pain and TCM applications, the Pyonex Needles Market is finding substantial and high-margin opportunities within the specialized fields of sports medicine, physical therapy, and high-end wellness centers. Athletes and sports professionals require rapid recovery solutions that address muscle trigger points, joint inflammation, and localized trauma without the downtime or side effects associated with injections or heavy medication. Pyonex needles, utilized for targeted dry needling or sustained myofascial release, offer an ideal solution for continuous micro-stimulation to accelerate healing and reduce muscular tension, often integrated into rigorous training and rehabilitation regimes.

The wellness sector, encompassing aesthetic treatments and stress management, is also emerging as a significant growth vector. Cosmetic acupuncture, particularly facial revitalization, utilizes Pyonex needles to stimulate specific points, promoting microcirculation and collagen synthesis. Patients in this segment prioritize minimal invasiveness and visible results, making the high-quality, discrete application of these needles essential. High-end spas and wellness clinics often incorporate specialized Pyonex products into their offerings, viewing them as premium tools that enhance the perceived quality and efficacy of their holistic services, thereby generating premium price realizations for manufacturers.

Capitalizing on these emerging segments requires targeted marketing strategies emphasizing clinical performance data related to athletic recovery times and cosmetic efficacy metrics. Manufacturers developing products with features specifically tailored for these niches—such as unique color codes for quick identification of treatment zones or enhanced biocompatibility for facial use—will capture disproportionate market share. The intersection of preventative health, performance enhancement, and aesthetic well-being positions Pyonex needles favorably for sustained commercial success in these rapidly expanding, high-growth domains globally.

- Sports Injury Management: Use in accelerated recovery protocols, targeting trigger points and localized inflammation in elite and recreational athletes.

- Aesthetic Acupuncture: High-margin application in facial revitalization, collagen stimulation, and minimizing fine lines.

- Physical Therapy Integration: Adoption by physiotherapists for targeted, sustained muscle release and rehabilitation post-injury.

- Wellness Center Partnerships: Strategic placement in luxury spas and wellness clinics offering holistic, non-invasive stress and pain management services.

- Targeted Product Development: Creation of specialized kits and packaging optimized for mobile practitioners and cosmetic applications.

Material Science and Manufacturing Precision

Advancements in material science are fundamental to maintaining the premium positioning and safety profile of Pyonex needles. The core technology relies on high-tensile strength, medical-grade stainless steel, typically imported from specialized mills, which allows for the drawing of extremely fine wires (down to 0.10 mm) without compromising structural integrity or flexibility. Precision grinding and polishing techniques are paramount; the final needle tip geometry must be consistently perfect—often using diamond-tipped tools—to ensure a painless, smooth insertion (minimal penetration resistance), which is a key selling point differentiating premium Pyonex brands from generic alternatives.

Manufacturing precision is further enforced by stringent siliconization processes. A thin, uniform layer of medical-grade silicone is applied to the needle shaft. This coating acts as a lubricant, dramatically reducing the coefficient of friction as the needle passes through the skin, minimizing sensation during insertion and protecting the tissue from micro-trauma. The quality and longevity of this silicone layer are critical, as the needle remains in the body for an extended period. Any variation in coating uniformity can lead to increased insertion discomfort or, worse, premature adhesive failure.

The integration of the needle with the adhesive patch requires extremely high tolerance assembly in cleanroom environments. Automated optical inspection systems are essential at this stage to verify that the needle is centered, properly secured, and that no adhesive residue contaminates the sterile needle tip or shaft. This focus on automation and precision engineering not only guarantees product safety and regulatory compliance but also maximizes manufacturing yield and reduces the marginal cost of production, underpinning the market's ability to scale while maintaining its reputation for specialized, high-quality medical devices tailored for sustained therapeutic effect.

- Ultra-Fine Wire Drawing: Utilization of advanced metallurgy to produce needles as fine as 0.10mm, enhancing patient comfort.

- Precision Tip Grinding: Diamond-tool polishing techniques ensure conical or lancet tips minimize insertion pain.

- Medical-Grade Siliconization: Uniform application of silicone lubricant to reduce friction and tissue trauma during skin penetration.

- Cleanroom Assembly: Automated, highly sterile assembly processes prevent contamination and ensure consistent needle-to-plaster bonding.

- Biocompatible Adhesives: Research into next-generation, porous, and highly hypoallergenic adhesives to improve extended wear and skin tolerance.

Supply Chain Vulnerabilities and Resilience Strategies

The Pyonex Needles Market, relying heavily on specialized raw materials and complex, regulated manufacturing, faces inherent supply chain vulnerabilities. The dependence on a few global suppliers for premium medical-grade stainless steel (often located in specific Asian countries) means geopolitical events, trade disputes, or catastrophic weather incidents can rapidly disrupt material availability and significantly inflate costs. Since the needles are single-use disposables, maintaining a continuous, uninterrupted supply flow is non-negotiable for clinical operations, making supply chain resilience a top priority for major market participants.

A crucial vulnerability also lies in the sterilization process, particularly the reliance on Ethylene Oxide (EO) sterilization, which is subject to increasingly strict environmental regulations globally due to its toxicity. Manufacturers are under pressure to investigate and transition to alternative sterilization methods (such as advanced irradiation techniques or hydrogen peroxide gas plasma), which requires substantial capital investment and regulatory re-validation of product safety and efficacy, potentially causing temporary production delays.

To mitigate these risks, leading manufacturers are adopting resilience strategies including geographically diversifying their raw material sourcing, establishing dual or multi-site manufacturing capabilities, and implementing advanced predictive analytics (often AI-driven, as discussed earlier) to monitor and forecast potential bottlenecks. Furthermore, strategic stockpiling of critical components and signing long-term contractual agreements with key logistics providers help buffer against short-term volatility, ensuring clinical end-users receive reliable access to these essential disposable medical supplies, which is critical for patient continuity of care and maintaining professional trust in the brand.

- Raw Material Diversification: Reducing reliance on single geographic sources for specialized stainless steel and adhesive compounds.

- Sterilization Method Transition: Investing in alternatives to Ethylene Oxide (EO) to comply with tightening environmental regulations.

- Geographic Manufacturing Redundancy: Establishing multiple production sites to minimize disruption from local events.

- Logistics Optimization: Utilizing global logistics partners with cold chain capabilities for certain sensitive components, ensuring timely delivery.

- Regulatory Compliance Checkpoints: Integrating real-time monitoring of evolving import/export rules to prevent customs delays.

Market Potential in Veterinary Applications

While Pyonex needles are predominantly used in human medicine, a significant, though niche, opportunity is emerging within the veterinary sector, specifically for animal pain management and rehabilitation. Veterinary acupuncture and dry needling are increasingly utilized for treating chronic pain in companion animals (especially dogs and horses) suffering from conditions such as arthritis, hip dysplasia, and neurological deficits. Pyonex needles are particularly suitable for animals due to their ease of application, short length (reducing the risk of deep insertion in restless patients), and the ability for the owner to manage sustained stimulation treatments at home following professional placement.

The demand in this sector is driven by increasing pet owner expenditure on advanced care and a growing professional interest among veterinarians in holistic and minimally invasive treatments to complement traditional pharmacological approaches. Veterinary applications often require specialized training for practitioners and tailored marketing materials demonstrating efficacy in diverse animal anatomies. Furthermore, the selection of adhesives must be rigorously tested for use on animal skin and fur, ensuring maximum adherence and comfort without causing localized irritation or allergic reactions in species with sensitive skin.

Manufacturers aiming to capitalize on this segment must collaborate closely with veterinary specialists and research institutions to generate species-specific clinical evidence validating the use of Pyonex needles in animals. Establishing dedicated distribution channels catering to veterinary hospitals, large animal practices, and specialized animal rehabilitation centers will be necessary. This niche offers premium pricing potential, as pet owners are often willing to invest significantly in high-quality, non-drug pain management solutions for their animals, representing a valuable, untapped market expansion avenue for specialized needle manufacturers.

- Companion Animal Pain Relief: Primary application in dogs and cats suffering from chronic joint and muscle pain.

- Equine Rehabilitation: Use in horses for targeted muscle release and performance enhancement.

- Specialized Adhesives: Need for rigorous testing of adhesives on animal skin and fur for safety and long-term adherence.

- Veterinary Training Focus: Development of specialized courses to educate veterinarians and animal acupuncturists on appropriate Pyonex application protocols.

- High-Value Niche: Offers potential for premium pricing due to significant emotional investment by pet owners in animal well-being.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager