Quality and Safety Reporting System for Healthcare Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431976 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Quality and Safety Reporting System for Healthcare Market Size

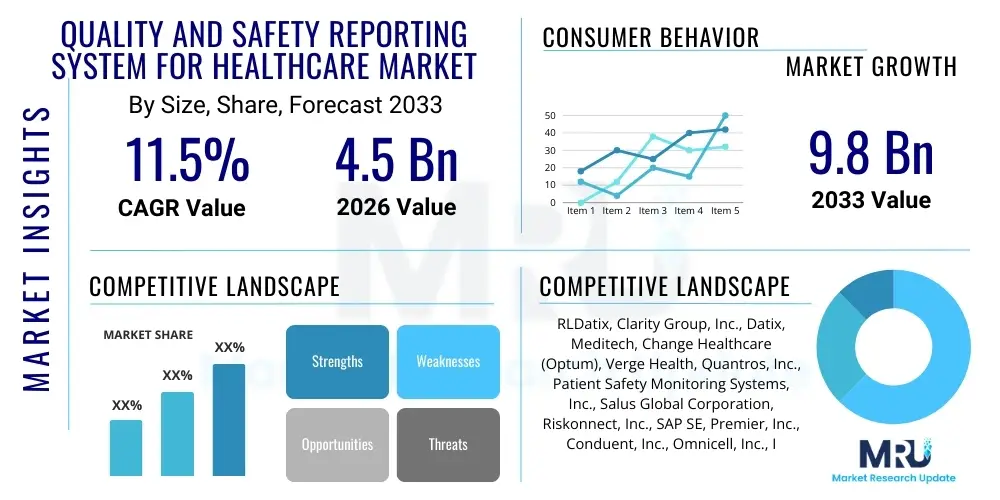

The Quality and Safety Reporting System for Healthcare Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 9.8 Billion by the end of the forecast period in 2033. This substantial expansion is driven by increasing global focus on patient-centric care models, stringent governmental mandates concerning adverse event reporting, and the imperative for healthcare organizations to transition from reactive error management to proactive risk mitigation strategies. Investment in digital health infrastructure across developed and rapidly developing economies further catalyzes this growth trajectory, emphasizing the integration of sophisticated analytics platforms for continuous quality improvement.

Quality and Safety Reporting System for Healthcare Market introduction

The Quality and Safety Reporting System for Healthcare Market encompasses specialized software solutions and platforms designed to systematically capture, track, analyze, and manage incidents, near misses, adverse events, and quality metrics within clinical and administrative healthcare settings. These systems provide a centralized mechanism for documenting potential or actual failures in care delivery, facilitating root cause analysis (RCA), and implementing corrective and preventive actions (CAPA) to enhance patient safety outcomes. The primary objective is to create a culture of transparency and non-punitive reporting, which encourages frontline staff to document safety concerns accurately, thereby providing robust data for systemic improvements and adherence to regulatory bodies such as the Joint Commission and national patient safety initiatives. The market scope includes solutions deployed across hospitals, ambulatory surgical centers, long-term care facilities, and diagnostic laboratories.

The core product offerings within this market include incident management software, risk management modules, compliance tracking tools, and quality assurance dashboards. Major applications revolve around clinical risk management, medication error reporting, infection control surveillance, and workforce safety documentation. These advanced systems integrate seamlessly with Electronic Health Records (EHRs), allowing for automated data capture and minimizing manual entry errors, which is crucial for maintaining data integrity. The immediate benefits realized by adopting these systems include reduced litigation risk, improved reputation through demonstrated commitment to safety, and optimization of clinical workflows, ultimately leading to superior patient outcomes and cost efficiencies derived from preventing recurring errors. Furthermore, these platforms are evolving rapidly to incorporate predictive analytics capabilities, shifting the focus from historical reporting to foresighted identification of potential safety hazards before they materialize.

Driving factors for market acceleration include the global shift towards value-based care models, where quality metrics directly impact reimbursement rates. Regulatory pressure, particularly in North America and Western Europe, mandates comprehensive safety reporting, compelling healthcare providers to invest in reliable, auditable systems. Additionally, the increasing complexity of medical procedures and polypharmacy management necessitates robust digital tools to monitor patient journeys and identify critical junctures where errors are most likely to occur. The growing prevalence of chronic diseases and the subsequent increase in patient volume further strains existing manual reporting processes, thereby making automated, intelligent quality and safety reporting systems an indispensable component of modern healthcare infrastructure.

Quality and Safety Reporting System for Healthcare Market Executive Summary

The global Quality and Safety Reporting System for Healthcare Market is experiencing robust growth, primarily propelled by stringent regulatory landscapes and the technological imperative to reduce medical errors, which are cited as a leading cause of death globally. Business trends indicate a strong move toward cloud-based deployment models, favored for their scalability, accessibility, and lower upfront capital expenditure compared to traditional on-premise solutions. Furthermore, market consolidation is evident, with major technology providers acquiring specialized safety reporting vendors to integrate comprehensive risk management portfolios into their broader health IT ecosystems. Investment is heavily directed towards developing predictive analytics capabilities powered by Artificial Intelligence (AI) and Machine Learning (ML), allowing systems to flag high-risk situations proactively, such as potential patient falls or adverse drug interactions, moving the industry towards truly preventive safety protocols.

Regional trends highlight North America as the dominant market, attributed to high awareness regarding patient safety, significant healthcare IT expenditure, and the presence of mandatory federal and state-level reporting requirements (e.g., CMS programs, Patient Safety and Quality Improvement Act). However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive healthcare modernization initiatives, increasing adoption of EHR systems in emerging economies like India and China, and governmental focus on improving public health standards. Europe maintains a strong foothold, guided by frameworks like the EU Patient Safety Strategy and national initiatives aimed at standardizing clinical governance and improving data interoperability across member states. The regional landscape is characterized by varying levels of regulatory maturity, requiring vendors to offer highly customizable and locally compliant solutions.

Segment trends underscore the supremacy of incident reporting software within the Component segment, although root cause analysis (RCA) and audit management modules are showing accelerated adoption rates as organizations mature their safety programs. By End-User, hospitals and large healthcare systems remain the primary consumers due to the complexity and volume of care provided; however, ambulatory care centers and long-term care facilities represent rapidly expanding segments as regulatory scrutiny extends to all points of care delivery. The shift towards enterprise-wide risk platforms, which unify safety, compliance, and clinical quality data, is a pivotal segment trend, replacing siloed departmental solutions with holistic governance frameworks that provide a single source of truth for organizational performance metrics.

AI Impact Analysis on Quality and Safety Reporting System for Healthcare Market

User queries regarding the integration of Artificial Intelligence (AI) in Quality and Safety Reporting Systems frequently center on its ability to move beyond passive data storage to active risk prediction. Users are keen to understand how AI can sift through massive volumes of unstructured data—such as clinical notes, discharge summaries, and reported incidents—to identify subtle patterns and latent conditions that precede adverse events, a task infeasible for human analysts. Key themes involve the accuracy and interpretability of AI algorithms, particularly concerning clinical decision support and identifying causation in complex medical environments. Concerns typically focus on data privacy, algorithmic bias potentially affecting patient care equity, and the requisite infrastructure needed for ML model training and deployment. Expectations are high, anticipating AI-driven platforms that automate risk scoring, prioritize follow-up actions, and provide personalized safety alerts tailored to specific clinical workflows, thereby transforming the reporting system from a documentation tool into a preemptive safety net.

The direct impact of AI implementation is profoundly reshaping the functional scope of safety reporting systems. Traditionally, these systems relied on voluntary staff reporting, often resulting in underreporting or biased data. AI addresses this deficiency by automatically scanning EHR data, laboratory results, and claims data to detect anomalies and flag potential safety events that might otherwise go unreported. For example, AI algorithms can monitor patient vital signs and medication administration records in real-time, cross-referencing this against known risk factors to generate timely alerts for conditions like sepsis or acute kidney injury. This capability not only improves reporting accuracy but also transforms the system into a continuous, active monitoring tool, integrating predictive risk visualization directly into the clinical dashboard, making safety management an omnipresent feature of patient care rather than a periodic review process.

Furthermore, AI significantly enhances the efficiency of the investigation and analysis phases following an incident. By using Natural Language Processing (NLP), AI systems can rapidly categorize, cluster, and summarize narrative data from incident reports, identifying recurring themes and root causes far faster than manual review processes. This enables quality improvement teams to allocate resources more effectively, focusing on systemic fixes rather than isolated occurrences. The use of machine learning for forecasting failure modes and effects analysis (FMEA) allows healthcare organizations to simulate the impact of proposed process changes before implementation, ensuring that safety interventions are evidence-based and maximally effective. The future trajectory of this market is inextricably linked to the successful deployment of explainable AI (XAI) models that provide transparency into their risk assessments, building trust among clinical users and regulatory bodies.

- AI enables predictive risk modeling based on real-time clinical and operational data.

- Natural Language Processing (NLP) automates the extraction and categorization of safety data from unstructured clinical text.

- Machine Learning (ML) identifies latent systemic patterns that lead to recurrent adverse events, improving Root Cause Analysis (RCA).

- Automated incident detection and reporting reduce reliance on voluntary staff documentation, improving data completeness.

- AI-driven prioritization tools flag high-severity incidents for immediate investigation and intervention.

- Enhanced clinical decision support for medication safety and infection control through predictive alerting.

- Optimization of staff training needs by identifying recurring human error trends through data analysis.

DRO & Impact Forces Of Quality and Safety Reporting System for Healthcare Market

The Quality and Safety Reporting System market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global focus on reducing preventable medical errors and the resulting high societal cost of healthcare harm, prompting greater investment in robust reporting infrastructure. Mandates for reporting serious adverse events imposed by national health ministries and accreditation bodies (e.g., JCI, DNV) serve as a primary impetus for adoption. Conversely, significant restraints hinder growth, notably the substantial initial implementation costs, the inherent complexities of integrating these systems with heterogeneous legacy EHR environments, and resistance from clinical staff who perceive reporting as an additional administrative burden. This restraint often manifests as poor data quality or underreporting, undermining the system's effectiveness. Opportunities are abundant, specifically in the expansion of interoperable, cloud-native platforms, the application of predictive AI for proactive risk management, and market penetration into outpatient settings and smaller healthcare practices that are currently underserved by enterprise-level solutions. The key impact forces driving market shape are technological innovation, regulatory mandates, and organizational culture shifts toward non-punitive safety reporting.

Drivers are primarily regulatory and economic in nature. Economically, healthcare providers are realizing that investments in quality and safety yield significant returns by reducing malpractice costs, minimizing patient readmissions (especially under penalties imposed by value-based care models), and improving operational efficiency. Technologically, the rapid maturation of cloud computing and big data analytics provides scalable and cost-effective methods for managing vast amounts of safety data, making sophisticated analysis accessible even to smaller providers. Furthermore, global initiatives, such as the WHO’s Global Patient Safety Action Plan, create heightened institutional awareness and external pressure on providers to demonstrate continuous quality improvement. The imperative to standardize data collection using frameworks like the Common Format (C-Format) for patient safety event reporting also drives the adoption of compliant, standardized software solutions.

Restraints are often rooted in organizational barriers and data management challenges. Data silos across different departments (e.g., pharmacy, nursing, laboratory) make unified safety analysis difficult, requiring vendors to develop complex integration strategies. User resistance is another formidable restraint; if reporting systems are perceived as difficult to use or are not integrated into daily workflows, usage rates plummet. Moreover, cybersecurity concerns related to sensitive patient safety data stored in cloud environments necessitate robust security protocols, adding to development and maintenance complexity and cost. Opportunities are heavily concentrated in developing specialized modules for high-risk areas such as surgical safety, behavioral health, and telehealth quality monitoring. Expanding the geographical footprint into rapidly digitizing APAC and Latin American markets, which are starting to implement foundational patient safety regulations, presents a substantial long-term growth avenue for international market players offering localized and language-specific solutions.

- Drivers

- Increasing incidence of medical errors globally requiring systemic mitigation.

- Stringent regulatory requirements and mandatory adverse event reporting laws (e.g., PSQIA, EU directives).

- Shift towards value-based care models tying reimbursement to quality and safety outcomes.

- Advancements in cloud computing and data analytics enabling complex safety monitoring.

- Need for standardized, interoperable safety data collection across diverse health systems.

- Restraints

- High initial investment costs and complexity of system implementation.

- Challenges integrating new reporting systems with existing, often proprietary, Electronic Health Record (EHR) systems.

- Resistance to change and fear of retribution among clinical staff leading to underreporting.

- Concerns related to data security, privacy, and compliance with varying international regulations (e.g., GDPR, HIPAA).

- Lack of skilled personnel capable of effectively analyzing large volumes of safety data.

- Opportunities

- Integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive risk analysis.

- Expansion into specialized markets like ambulatory care centers and long-term care facilities.

- Development of mobile-enabled reporting tools for increased usability and point-of-care documentation.

- Growth in demand for enterprise-wide risk management platforms unifying GRC (Governance, Risk, and Compliance) functions.

- Geographic expansion into high-growth, modernizing healthcare systems in the Asia Pacific region.

- Impact Forces

- Technology Convergence: The merging of quality reporting with advanced clinical surveillance and EHR data analytics.

- Regulatory Evolution: Continuous updates to mandated reporting metrics and formats, forcing platform modernization.

- Economic Pressure: Providers seeking ROI by reducing readmissions and improving efficiencies through robust safety programs.

- Cultural Shift: Transition from blame-based culture to system-based, non-punitive safety practices.

Segmentation Analysis

The Quality and Safety Reporting System for Healthcare Market is comprehensively segmented across several dimensions, including component type, deployment model, end-user application, and geographical region. This detailed segmentation reflects the diverse needs of the healthcare sector, ranging from large integrated delivery networks (IDNs) requiring complex enterprise solutions to smaller clinics prioritizing ease of use and affordability. Component segmentation, covering software and services, highlights the growing significance of implementation, training, and maintenance services, which are crucial for the successful uptake and sustained optimization of these sophisticated systems within resource-constrained healthcare environments. The deployment model split, dominated increasingly by the cloud, showcases the industry trend towards flexible, subscription-based models that facilitate faster updates and better scalability compared to legacy on-premise infrastructure.

Application-based segmentation is critical, detailing the specific use cases driving demand, such as incident reporting, risk management, compliance reporting, and audit management. Incident reporting, being foundational, holds the largest market share, but risk management and predictive analytics segments are anticipated to demonstrate the fastest growth due to the shift toward proactive safety initiatives. End-user segmentation reveals that hospitals, due to their size, patient volume, and regulatory oversight, constitute the largest consuming segment. However, the regulatory net is expanding, leading to significant projected growth in the use of these systems by ambulatory surgical centers and long-term care facilities, which increasingly require structured mechanisms to demonstrate accountability and quality of care provided outside the traditional inpatient setting.

- By Component

- Software (Incident Reporting, Risk Management, Compliance Tools, Analytics Dashboards)

- Services (Implementation, Training, Consulting, Maintenance, Managed Services)

- By Deployment Model

- Cloud-based

- On-premise

- By Application

- Incident Reporting and Management

- Risk Management and Assessment

- Compliance and Accreditation Management

- Audit Management and Tracking

- Claims Management

- Infection Control Surveillance

- By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Long-Term Care Facilities

- Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies (for safety surveillance)

- By Region

- North America (U.S., Canada)

- Europe (U.K., Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Quality and Safety Reporting System for Healthcare Market

The value chain for Quality and Safety Reporting Systems is complex, starting with core software development and progressing through integration, distribution, deployment, and end-user optimization. The upstream segment is dominated by specialized software developers and data analytics firms that invest heavily in R&D to incorporate advanced features like AI/ML, NLP, and robust cybersecurity frameworks. Key activities here include data standardization, platform architecture design (increasingly API-first and microservices-based), and adherence to global interoperability standards like HL7 and FHIR, ensuring the core product is technologically sound and compatible with diverse healthcare IT environments. Strategic partnerships at this stage often involve EHR vendors to ensure seamless data exchange capabilities, which are paramount for accurate reporting and real-time risk assessment.

Midstream activities involve distribution and implementation. Distribution channels are bifurcated into direct sales teams targeting large hospital systems and indirect channels utilizing strategic partnerships with regional system integrators and value-added resellers (VARs) who provide localized expertise. Implementation services are critical and complex, requiring detailed workflow analysis, system configuration specific to the client's organizational structure, and comprehensive training for clinical and quality assurance staff. This stage involves transforming a generic software platform into a functional, custom risk mitigation tool. The success of the system heavily relies on the quality of deployment services, which must ensure high user adoption rates and minimize workflow disruption.

Downstream activities center on ongoing maintenance, optimization, and data utilization by the end-users. Direct channels involve vendors providing subscription-based support, continuous software updates (especially regulatory changes), and consulting services to help clients extract maximum value from the collected safety data. Indirect channels, through third-party consultants, often focus on advanced data interpretation, benchmarking performance against industry peers, and facilitating accreditation compliance audits. The value generated at the downstream level is highly dependent on the system's ability to facilitate continuous quality improvement cycles (Plan-Do-Study-Act or PDSA), ultimately impacting patient safety and operational efficiency within the healthcare provider organization.

Quality and Safety Reporting System for Healthcare Market Potential Customers

Potential customers for Quality and Safety Reporting Systems are fundamentally any institution or entity involved in direct patient care or regulatory oversight of healthcare services, driven by the dual mandates of clinical excellence and regulatory compliance. The largest and most immediate customer base consists of Integrated Delivery Networks (IDNs) and large public and private hospital chains. These entities require enterprise-level platforms capable of managing complex, high-volume data streams across multiple facilities, specialty areas, and geographies. Their procurement is often centralized, focusing on solutions offering modular scalability, extensive interoperability with existing IT infrastructure, and sophisticated analytics for organizational risk aggregation.

A rapidly growing segment of customers includes non-hospital settings, specifically Ambulatory Surgical Centers (ASCs), specialized clinics (e.g., dialysis, oncology), and long-term care and skilled nursing facilities. While these customers may require less complex, more affordable systems, their need for standardized reporting is increasing due to expanding regulatory scrutiny and the shift of complex procedures to outpatient environments. For these buyers, the key purchasing criteria include ease of use, rapid deployment (often cloud-based), and modules tailored to specific outpatient risks, such as falls, infection transmission, and procedural complications unique to ambulatory settings. Furthermore, governmental and regulatory bodies, including national health services and state departments of health, represent key customers, using these systems internally for surveillance, benchmarking, and policy development related to systemic patient safety issues.

Other vital, though sometimes indirect, customers include healthcare insurance providers (payers) and pharmaceutical/med device companies. Payers utilize quality and safety data to inform network quality scores and value-based contract design. Pharmaceutical companies use safety reporting platforms for pharmacovigilance and adverse event reporting (AER), ensuring compliance with global drug safety monitoring standards. Therefore, the customer landscape is broad, encompassing clinical providers seeking operational efficiency, regulators seeking oversight, and life science companies needing compliant safety surveillance infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RLDatix, Clarity Group, Inc., Datix, Meditech, Change Healthcare (Optum), Verge Health, Quantros, Inc., Patient Safety Monitoring Systems, Inc., Salus Global Corporation, Riskonnect, Inc., SAP SE, Premier, Inc., Conduent, Inc., Omnicell, Inc., IBM Corporation, Health Catalyst, Inc., Healthstream, Inc., CompliCare, Inc., Symplr, PerfectServe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Quality and Safety Reporting System for Healthcare Market Key Technology Landscape

The technological evolution of Quality and Safety Reporting Systems is characterized by a foundational shift from simple electronic forms toward intelligent, interconnected risk surveillance platforms. The current landscape is heavily influenced by the adoption of interoperable data standards, primarily driven by Fast Healthcare Interoperability Resources (FHIR) and Health Level Seven (HL7), which are essential for integrating reporting systems with core Electronic Health Records (EHRs), laboratory information systems (LIS), and pharmacy management platforms. This interoperability ensures that incident reports are enriched with comprehensive patient context, such as clinical history and demographics, minimizing manual data entry and enhancing the precision of root cause analysis. Cloud computing, specifically Software-as-a-Service (SaaS) models, represents the dominant deployment architecture, offering scalability, continuous updates, and enhanced security features necessary to meet strict regulatory standards like HIPAA and GDPR, especially for handling sensitive safety data across multi-site healthcare networks.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful emerging technologies, fundamentally changing the utility of these systems. AI, powered by Natural Language Processing (NLP), is crucial for analyzing unstructured data found in patient narratives, notes, and staff feedback, automatically tagging and categorizing risk factors that human reviewers might miss. ML models are deployed for predictive analytics, training on historical incident data and real-time clinical data to calculate a dynamic risk score for individual patients or specific units, enabling "pre-hindsight" safety interventions. For example, systems can predict the likelihood of a patient developing a pressure ulcer or experiencing a fall based on their current clinical parameters and historical institutional trends, automating the generation of preventative checklists and alerts for clinical staff directly within their workflow interface, moving the reporting function from retrospective analysis to prospective risk mitigation.

Furthermore, the market relies heavily on robust data visualization and business intelligence (BI) tools. Modern reporting systems offer highly configurable dashboards that aggregate data from safety incidents, compliance audits, and patient satisfaction surveys, providing quality officers and executive leadership with a holistic view of institutional risk performance. Mobile technology is also crucial; vendors are increasingly offering mobile applications for quick, secure incident reporting at the point of care, significantly improving the timeliness and completeness of initial documentation. Blockchain technology is beginning to gain exploratory traction for creating immutable, auditable records of safety events and corrective actions, potentially enhancing transparency and trust in institutional safety compliance reporting across regulatory domains, ensuring data integrity against tampering or unauthorized modification while adhering to rigorous standards of digital chain of custody.

Regional Highlights

- North America (U.S. and Canada)

North America holds the largest market share, characterized by high technological maturity, mandatory reporting requirements (e.g., the requirements under the Patient Safety and Quality Improvement Act of 2005 in the U.S.), and significant investment in advanced health IT infrastructure. The U.S. market is highly fragmented but sophisticated, driven by the intense competition among hospital systems and the influence of accreditation bodies like The Joint Commission. The shift toward value-based care and penalties for hospital-acquired conditions (HACs) heavily incentivize providers to adopt advanced quality and safety systems, particularly those offering predictive analytics and robust compliance management modules. Canada exhibits steady growth, focusing on national health standards and integrated systems across provincial healthcare networks.

- Europe (U.K., Germany, France, etc.)

Europe represents the second-largest market, fueled by strong governmental emphasis on patient safety harmonization (e.g., the European Patient Safety Strategy) and the need to comply with rigorous data protection regulations such as GDPR, which impacts how safety data is collected and stored. Countries like the UK (NHS) and Germany show high adoption rates, primarily driven by centralized health services and established quality assurance frameworks. The market is increasingly seeking cloud-based solutions that allow for scalable deployment across vast, multi-lingual healthcare provider networks. A key driver in Europe is the focus on interoperability between national reporting schemes and local hospital systems, demanding flexible and highly customizable vendor solutions.

- Asia Pacific (APAC) (China, India, Japan, etc.)

The Asia Pacific region is projected to register the fastest CAGR during the forecast period. This accelerated growth is primarily attributed to large-scale healthcare modernization projects, increasing governmental expenditure on improving public healthcare quality, and the rapid digitization of patient records through widespread adoption of EHRs in populous nations like China and India. While safety standards are less mature than in the West, the huge volume of patients and increasing global medical tourism necessitate robust quality controls. The market demands affordable, mobile-accessible solutions suitable for deployment in facilities with varying levels of IT sophistication, focusing initially on foundational incident reporting before transitioning to advanced predictive modules.

- Latin America (LATAM)

The Latin American market is nascent but shows potential, driven by privatization trends and growing awareness among large private hospital groups regarding international accreditation standards (e.g., JCI). Economic volatility and limited IT budgets pose restraints, but the demand for basic, efficient incident reporting systems is rising, particularly in Mexico and Brazil, as large urban healthcare centers seek to standardize clinical governance and reduce high rates of preventable harm. Cloud solutions providing low cost of entry are particularly favored in this region.

- Middle East and Africa (MEA)

Growth in the MEA region is concentrated in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia, Qatar), which are heavily investing in world-class healthcare infrastructure to support strategic diversification and health tourism goals. These nations frequently adopt international safety standards (U.S. and European) immediately upon implementation, driving demand for best-in-class, enterprise-level risk management platforms. Africa's market remains largely undeveloped, constrained by infrastructure and funding, with uptake primarily limited to specialized private sector hospitals and donor-funded public health initiatives focused on infection control reporting.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Quality and Safety Reporting System for Healthcare Market.- RLDatix

- Clarity Group, Inc.

- Datix (part of RLDatix)

- Meditech (Medical Information Technology, Inc.)

- Change Healthcare (Optum)

- Verge Health

- Quantros, Inc.

- Patient Safety Monitoring Systems, Inc.

- Salus Global Corporation

- Riskonnect, Inc.

- SAP SE

- Premier, Inc.

- Conduent, Inc.

- Omnicell, Inc.

- IBM Corporation (Watson Health focus)

- Health Catalyst, Inc.

- Healthstream, Inc.

- CompliCare, Inc.

- Symplr

- PerfectServe

- Ascom Holding AG

- Cerner Corporation (now Oracle Health)

- Alchemer LLC

- DNV GL Healthcare

Frequently Asked Questions

Analyze common user questions about the Quality and Safety Reporting System for Healthcare market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Quality and Safety Reporting System in a hospital?

The primary function is to provide a standardized digital platform for documenting, analyzing, and mitigating adverse events, near misses, and system failures. It facilitates root cause analysis (RCA) and supports continuous quality improvement (CQI) by transforming anecdotal incidents into structured, actionable data for systemic safety enhancement and regulatory compliance.

How does AI contribute to improving patient safety reporting effectiveness?

AI significantly enhances effectiveness by employing Natural Language Processing (NLP) to analyze unstructured incident report narratives, identifying hidden patterns and latent risk factors that are often missed in manual review. Machine learning algorithms enable predictive risk scoring, allowing healthcare providers to proactively intervene before a potential adverse event occurs, shifting the system from reactive to preemptive safety management.

What are the main deployment models available in this market?

The two main deployment models are cloud-based (Software-as-a-Service or SaaS) and on-premise solutions. Cloud-based models are increasingly dominant, offering advantages in terms of lower upfront costs, greater scalability, easier maintenance, and continuous regulatory updates, making them highly favored by both large and smaller healthcare organizations seeking operational flexibility.

Which segment is driving the highest growth in the Quality and Safety Reporting Market?

The Services component segment, encompassing implementation, training, consulting, and analytics support, is driving substantial growth. Although software is foundational, the successful deployment and optimization of complex risk platforms, particularly those integrating advanced AI features, require expert services to ensure high user adoption and accurate data utilization, thereby guaranteeing effective ROI.

What is the biggest challenge in adopting a new safety reporting system?

The biggest challenge is achieving high user adoption and minimizing resistance among clinical staff. This often stems from concerns about complexity, the added administrative burden of documentation, and historical fears of punitive actions based on reported errors. Vendors must overcome this by offering intuitive, workflow-integrated systems and promoting a non-punitive culture of safety endorsed by organizational leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager