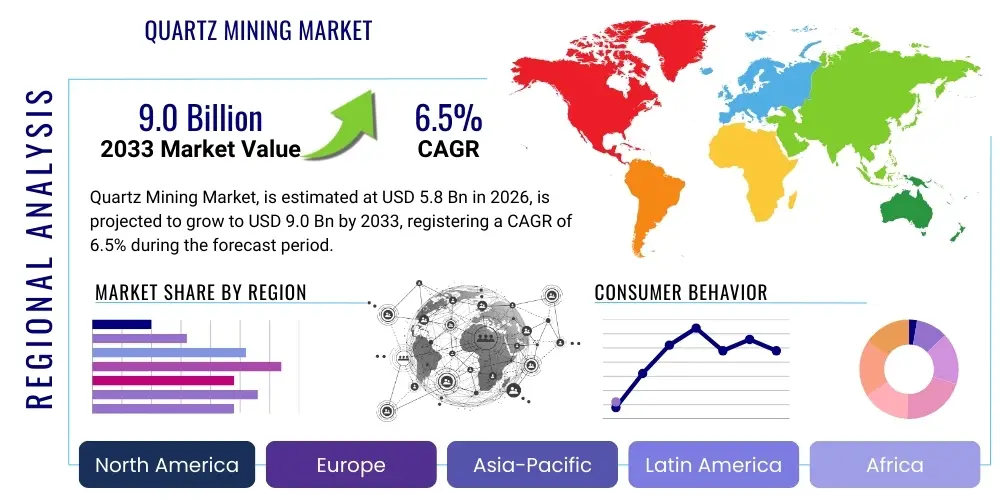

Quartz Mining Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434920 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Quartz Mining Market Size

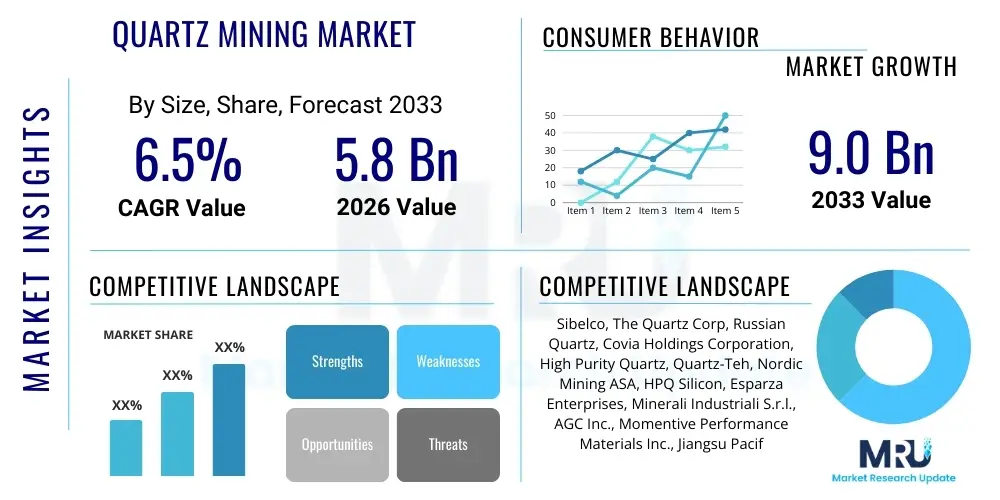

The Quartz Mining Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating global demand for high-purity quartz (HPQ) crucial for the semiconductor and photovoltaic industries, coupled with sustained utilization in traditional sectors like construction and ceramics. Market expansion is highly sensitive to technological advancements in wafer fabrication and solar cell efficiency, which consistently increase the quality specifications required from mined quartz.

Quartz Mining Market introduction

The Quartz Mining Market encompasses the extraction, processing, and distribution of crystalline silica (SiO2) used across a vast spectrum of industrial applications. Quartz, known for its unique physical and chemical stability, piezoelectric properties, and high purity, is indispensable in modern technology. The product, ranging from standard industrial-grade silica sand to highly specialized ultra-high-purity quartz (UHPQ), serves as a foundational material. UHPQ, in particular, is critical for manufacturing crucibles, tubes, and rods used in high-temperature processes within the semiconductor sector, where stringent quality control and minimal impurities are non-negotiable standards for sustaining yield rates.

Major applications driving the market include the electronics industry (microprocessors, memory chips), solar energy production (photovoltaic cells and components), and optical systems (lenses, fiber optics). Beyond these high-tech uses, lower grades of quartz are extensively utilized in construction materials, ceramics, glass manufacturing, and filtration media. The primary benefits derived from quartz are its thermal resistance, electrical insulation properties, and chemical inertness, making it suitable for environments requiring extreme durability. Key driving factors include the rapid global deployment of 5G and 6G infrastructure, monumental investment in renewable energy projects (especially solar farms), and persistent growth in global consumer electronics consumption.

Quartz Mining Market Executive Summary

The global Quartz Mining Market is characterized by a strong convergence of demand from high-technology sectors and persistent supply chain challenges related to achieving and maintaining ultra-high purity standards. Business trends indicate significant capital expenditure focused on advanced beneficiation and purification technologies to transform standard mined quartz into UHPQ, a critical value-add activity dominated by a few specialized global entities. Strategic alliances between mining operations and downstream processors are becoming common to secure the supply chain for critical applications like semiconductors. Market consolidation is also observed as larger entities seek to control high-quality resource deposits.

Regionally, Asia Pacific (APAC) stands as the dominant market consumer due to the concentration of major semiconductor fabrication plants (fabs) and solar module manufacturers in countries like China, Taiwan, South Korea, and Japan. However, resource extraction remains geographically diverse, with significant mining operations in North America, Europe, and parts of the Middle East. Future regional growth is expected to accelerate in emerging economies in Southeast Asia and Latin America as manufacturing shifts and solar deployment gains momentum. Europe maintains a strong position in high-end specialized processing and optical applications, leveraging advanced R&D capabilities.

Segment trends highlight the exceptional growth rate of the High Purity Quartz (HPQ) segment compared to industrial-grade quartz, driven primarily by the cyclical and long-term expansion of the semiconductor market (Moore’s Law continuation and expansion into new areas like automotive electronics). Application-wise, the Electronics segment is the highest revenue generator, but the Solar segment exhibits the fastest growth due to global decarbonization efforts and favorable governmental policies supporting renewable energy adoption. Mining techniques are evolving, with increased focus on selective mining and advanced crushing techniques to minimize contamination at the initial stage, thereby reducing subsequent purification costs.

AI Impact Analysis on Quartz Mining Market

User inquiries regarding the impact of AI on the Quartz Mining Market predominantly center on efficiency gains, safety improvements, and optimization of complex processing chains. Key themes include how AI can be leveraged for predictive maintenance of heavy mining equipment, optimizing the selection and extraction of high-grade ore bodies, and improving the intricate, high-cost purification process required for UHPQ. Users are particularly concerned with utilizing machine learning models to analyze geological data (seismic, drilling logs) to achieve higher precision in resource estimation and operational planning, thereby minimizing waste and operational downtime. Furthermore, there is significant interest in using real-time data analytics and computer vision systems to monitor ore quality on conveyor belts, ensuring only the highest purity material enters the costly purification stages, leading to substantial cost savings and consistent product quality essential for semiconductor customers.

- AI-Powered Predictive Maintenance: Utilizing sensor data and machine learning to forecast equipment failure, minimizing costly unplanned downtime in remote mining operations.

- Geological Data Analysis and Modeling: Employing algorithms to analyze complex subsurface data, optimizing drilling paths, and increasing the accuracy of high-purity quartz vein identification.

- Process Optimization in Beneficiation: Using AI to control variables (e.g., chemical concentration, temperature, flow rates) in the acid leaching and flotation stages, maximizing purity yield.

- Autonomous and Remote Operation: Implementing AI-driven autonomous hauling and drilling systems to enhance safety, reduce human error, and enable 24/7 operations, especially in deep or hazardous mines.

- Real-time Quality Control: Deployment of computer vision and spectroscopic analysis systems integrated with AI models for instantaneous sorting and classification of mined quartz based on impurity levels.

- Supply Chain Forecasting: Utilizing predictive analytics to match production capacity with volatile global semiconductor and solar demand forecasts, improving inventory management.

DRO & Impact Forces Of Quartz Mining Market

The Quartz Mining Market is propelled by robust drivers, including the persistent growth of the global semiconductor industry, particularly in advanced nodes requiring UHPQ components, and aggressive governmental targets worldwide for renewable energy capacity expansion, stimulating demand for solar-grade quartz. These drivers are intrinsically linked to the high-impact force of technological dependency; modern electronics cannot function without the unique properties of high-purity quartz. Simultaneously, significant restraints challenge market growth, notably the exceptionally high capital expenditure required for establishing UHPQ processing facilities, stringent regulatory hurdles concerning environmental impact and permitting for new mines, and the difficulty in securing stable, non-contaminated raw material sources.

Opportunities abound, centering on the development of new, cost-effective purification techniques, enabling miners to convert lower-grade quartz deposits into marketable UHPQ material, thereby expanding the available resource base. Furthermore, the burgeoning demand for quartz in emerging applications such as lithium-ion battery separators and specialized medical devices presents new avenues for market diversification. Impact forces are strongly influenced by the geo-political environment; trade disputes and resource nationalism can severely disrupt the specialized UHPQ supply chain, as production is concentrated among a few key suppliers globally. The environmental impact force requires continuous innovation in water management and waste reduction to maintain social license to operate, particularly as demand for sustainable sourcing increases among end-users.

The interplay of these forces dictates market profitability and strategic direction. While the long-term outlook remains positive due to unstoppable digitalization and energy transition trends, market players must navigate risks associated with price volatility in end-user markets (semiconductors are cyclical) and the intense, continuous investment required to meet ever-increasing purity specifications. Successful market participation requires not only control over high-quality reserves but also technological superiority in processing. This dynamic environment places continuous pressure on companies to optimize extraction efficiency and reduce contamination at every stage of the value chain.

Segmentation Analysis

The Quartz Mining Market is primarily segmented based on Purity Grade, Application, and Mining Method, reflecting the vast differences in processing requirements and end-use characteristics. Segmentation by Purity Grade, differentiating between Low Purity, High Purity (HPQ), and Ultra-High Purity Quartz (UHPQ), is the most critical factor influencing market price and technology investment, with UHPQ commanding premium prices due to its necessity in advanced semiconductor fabrication. The complexity of purification technology directly correlates with the required purity level, creating distinct supply chains for each grade.

The Application segmentation distinguishes between dominant sectors such as Electronics (semiconductor components), Solar (crucibles, tubes), Optics (lenses, filters), and Construction/Industrial (silica sand, fillers). The growth rates within these segments vary dramatically, with Electronics and Solar applications providing the primary impetus for innovation and market expansion, while Construction remains a stable, high-volume segment utilizing lower-cost, industrial-grade quartz. Analysis of these segments is vital for stakeholders to allocate resources appropriately, focusing R&D on the most demanding and rapidly expanding end-use markets.

- By Purity Grade:

- Low Purity Quartz (Industrial Grade)

- High Purity Quartz (HPQ)

- Ultra-High Purity Quartz (UHPQ)

- By Application:

- Electronics (Semiconductors, Quartz Crystal Oscillators)

- Solar (Photovoltaic Crucibles and Components)

- Optics (Fiber Optics, Lenses, Prisms)

- Lighting (UV Lamps, Halogen Bulbs)

- Construction and Industrial Fillers (Ceramics, Glass)

- By Mining Method:

- Open Pit Mining

- Underground Mining

Value Chain Analysis For Quartz Mining Market

The value chain for the Quartz Mining Market is highly specialized, moving from resource extraction through intensive purification processes to final component manufacturing. Upstream analysis focuses on geological exploration and mining operations. Securing deposits with naturally high-grade quartz is paramount, as the cost of purification heavily depends on the initial level of impurities. The mining stage (whether open-pit or underground) emphasizes selective extraction and stringent measures to prevent contamination from non-quartz materials, moisture, or heavy metals during handling and transport. Efficiency in the upstream phase, including crushing and initial washing, directly impacts downstream profitability.

The midstream (processing) is where significant value addition occurs. This stage involves complex beneficiation, acid leaching (using hydrochloric or hydrofluoric acid), flotation, and subsequent high-temperature purification steps. For UHPQ, processors require highly controlled cleanroom environments and proprietary purification recipes to achieve the required impurity levels (often parts per billion, ppb). This processing stage is a bottleneck and is dominated by a few technologically advanced players globally. Distribution channels are typically direct for HPQ/UHPQ, moving from specialized processors directly to large-scale semiconductor material suppliers or solar component manufacturers (e.g., crucible makers). Industrial-grade quartz, conversely, utilizes a more traditional indirect distribution model through commodity traders and bulk suppliers to construction or glass manufacturers.

Downstream analysis centers on the utilization of quartz materials. For electronics, quartz is transformed into crucibles for silicon crystal growth, reactor tubes, and furnace components. In solar, it is used for manufacturing large, high-temperature crucibles essential for polysilicon refinement. The relationship between the processor and the end-user is highly collaborative, often involving long-term supply agreements and joint R&D to meet future purity specifications driven by continuous miniaturization in electronics. The high barrier to entry at the midstream processing level makes it the most lucrative and strategically sensitive part of the quartz value chain.

Quartz Mining Market Potential Customers

Potential customers in the Quartz Mining Market are highly segmented based on the required purity level of the material, which dictates their end-product sophistication and tolerance for impurities. The primary consumers are large-scale manufacturers operating within high-tech sectors. Semiconductor fabrication companies (fabs) represent the most demanding customer segment, requiring UHPQ for crucial components that affect chip yield and reliability. These buyers prioritize purity, consistency, and long-term supply security above all else, often engaging in multi-year contracts with certified suppliers.

The second major group consists of solar photovoltaic manufacturers and their component suppliers, who require high volumes of HPQ for producing large quartz crucibles used in pulling silicon ingots. While purity requirements are slightly less stringent than those for advanced semiconductors, consistency and volume capacity are key decision-making factors for this customer base, which is highly price-sensitive due to the competitive nature of the solar market. Other significant buyers include manufacturers of specialty glass and optical systems, who utilize quartz for fiber optics, UV lamps, and scientific instrumentation due to its high transparency across a wide electromagnetic spectrum.

Finally, traditional industrial customers, such as construction material producers, ceramic manufacturers, and abrasive producers, constitute a high-volume, low-margin customer base. These end-users typically purchase low-purity, industrial-grade silica sand and quartz powder, focusing primarily on cost-efficiency and bulk availability. The procurement strategies across these customer groups vary significantly, ranging from highly technical qualification processes for UHPQ buyers to commodity purchasing driven by regional logistics for industrial-grade buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sibelco, The Quartz Corp, Russian Quartz, Covia Holdings Corporation, High Purity Quartz, Quartz-Teh, Nordic Mining ASA, HPQ Silicon, Esparza Enterprises, Minerali Industriali S.r.l., AGC Inc., Momentive Performance Materials Inc., Jiangsu Pacific Quartz Co., Ltd., Shin-Etsu Chemical Co., Ltd., Guilin Leyuan Quartz Materials Co., Ltd., I-Minerals Inc., Unimin Corporation (Sibelco), Lianyungang Wancheng Quartz Products Co., Ltd., Kaolin AD, 3M Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Quartz Mining Market Key Technology Landscape

The technological landscape of the Quartz Mining Market is heavily defined by the necessity of achieving ultra-low impurity levels, particularly for applications in advanced electronics. Conventional mining techniques (drilling, blasting, hauling) are being modernized through automation and IoT integration to ensure selective extraction and minimal external contamination at the source. However, the most critical technological advancements are concentrated in the midstream purification processes, which involve sophisticated material science and chemical engineering. Advanced beneficiation techniques such as high-intensity magnetic separation, froth flotation, and specialized washing are employed to remove initial mineralogical impurities, metals, and particulates before chemical treatment.

The core technology driving the high-purity segment is the multi-stage acid leaching process, often involving hydrofluoric and hydrochloric acids at controlled temperatures and pressures. Innovations in this area focus on reducing the cycle time, minimizing chemical waste, and improving the efficiency of impurity removal down to sub-parts per billion levels (ppb). Furthermore, the integration of spectroscopic analysis and real-time process monitoring, utilizing technologies like Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Atomic Absorption Spectroscopy (AAS), is crucial for maintaining tight quality control and certifying material purity essential for semiconductor customers.

Emerging technologies include alternative, potentially more environmentally friendly purification methods (e.g., bio-leaching or advanced plasma treatments) and improvements in thermal processing, specifically high-temperature vacuum furnaces used for devitrification and final purification steps. The adoption of AI and machine learning for analyzing geological data and optimizing purification recipes is also becoming a key differentiator, enabling miners to maximize recovery from complex ore bodies and ensuring consistent output purity regardless of minor variations in the input material. Given the stringent standards in the electronics market, technological superiority in purification is the most significant competitive advantage.

Regional Highlights

The global Quartz Mining Market exhibits pronounced regional disparities in terms of resource endowment, processing capabilities, and end-user demand concentration. Asia Pacific (APAC) dominates the consumption landscape, driven by its unchallenged position as the world's primary manufacturing hub for electronics and solar components. Countries like China, Taiwan, South Korea, and Japan house the vast majority of semiconductor fabs and solar module production facilities, leading to intense and continuous demand for HPQ and UHPQ. While China is a massive consumer, it is also a significant producer, rapidly investing in domestic processing capabilities to reduce reliance on imported high-purity materials.

North America and Europe are crucial regions regarding resource quality and technological processing. The United States, particularly through deposits like those found in Spruce Pine, North Carolina, has historically been a critical source of some of the world's highest quality quartz raw material suitable for UHPQ production. These regions maintain a competitive edge in sophisticated processing technology, intellectual property development related to purification, and supplying specialized niche markets like aerospace optics and high-end scientific instrumentation. However, operating costs and environmental regulations in these regions are generally higher, influencing global supply economics.

Latin America and the Middle East & Africa (MEA) play important roles primarily as resource providers. Brazil, in particular, possesses substantial reserves of industrial-grade quartz and is growing its capabilities in basic processing. MEA, while still developing in terms of large-scale, high-purity processing, is gaining importance due to localized solar projects and potential undiscovered high-grade deposits. The strategic focus for market players in these regions is the efficient extraction and export of raw or partially processed quartz to the major consumption and purification centers in APAC, Europe, and North America.

- Asia Pacific (APAC): Highest volume consumer due to semiconductor and solar manufacturing dominance; rapid investment in domestic UHPQ processing capacity (China, South Korea, Taiwan).

- North America: Critical source of high-quality raw quartz (e.g., Spruce Pine) and a center for advanced purification technology and R&D; significant demand from high-tech defense and optics sectors.

- Europe: Focus on specialized, high-end applications (e.g., optical fibers, scientific equipment) and leading the development of stringent environmental standards influencing mining practices; key processing hubs in Norway and Germany.

- Latin America: Important source of industrial-grade quartz and silica sand; emerging focus on exploiting high-grade reserves to support regional manufacturing growth.

- Middle East and Africa (MEA): Growing regional demand for solar-grade quartz due to large-scale renewable energy initiatives; increasing exploration for new high-purity deposits.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Quartz Mining Market.- Sibelco

- The Quartz Corp (TQC)

- Russian Quartz (Kyshtym Mining)

- Covia Holdings Corporation

- High Purity Quartz (HPQ)

- Nordic Mining ASA

- C-E Minerals

- Minerali Industriali S.r.l.

- Jiangsu Pacific Quartz Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Momentive Performance Materials Inc.

- Tateho Chemical Industries Co., Ltd.

- Unimin Corporation (part of Sibelco)

- Guilin Leyuan Quartz Materials Co., Ltd.

- I-Minerals Inc.

- Lianyungang Wancheng Quartz Products Co., Ltd.

- 3M Company

- AGC Inc.

- Treibacher Industrie AG

- Vast Resources plc

Frequently Asked Questions

Analyze common user questions about the Quartz Mining market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Ultra-High Purity Quartz (UHPQ)?

The primary factor is the relentless expansion and technological advancement within the global semiconductor industry. UHPQ is essential for manufacturing crucibles and furnace components required for growing silicon crystals and processing wafers, where even minimal impurities can destroy delicate microcircuitry and drastically reduce yield rates.

How do purity standards affect the pricing structure in the Quartz Mining Market?

Purity standards fundamentally dictate pricing; as the required purity level increases (moving from industrial grade to UHPQ), the price escalates exponentially due to the high capital expenditure, proprietary technology, and complex, multi-stage chemical purification required to remove impurities down to parts per billion (ppb) levels.

Which geographical region holds the most significant consumption share for high-purity quartz?

Asia Pacific (APAC) holds the most significant consumption share, driven by the concentration of the world’s largest semiconductor fabrication plants (fabs) and major photovoltaic (solar) manufacturing centers located in countries such as China, Taiwan, South Korea, and Japan.

What major regulatory challenge faces new quartz mining projects globally?

The most significant challenge is navigating strict environmental regulations and securing social license to operate. Quartz purification, especially UHPQ processing, involves the intensive use of corrosive chemicals like hydrofluoric acid, necessitating rigorous waste management protocols and highly complex permitting processes that can delay project initiation and increase operational costs substantially.

What is the role of AI and automation in optimizing the quartz purification value chain?

AI and automation optimize the value chain by improving geological targeting, ensuring selective extraction to minimize contamination, and crucially, fine-tuning the complex chemical purification stages in real-time. This leads to reduced processing costs, higher yield of desired purity grades, and enhanced predictive maintenance for specialized processing equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager