Quick Connect Fitting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434662 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Quick Connect Fitting Market Size

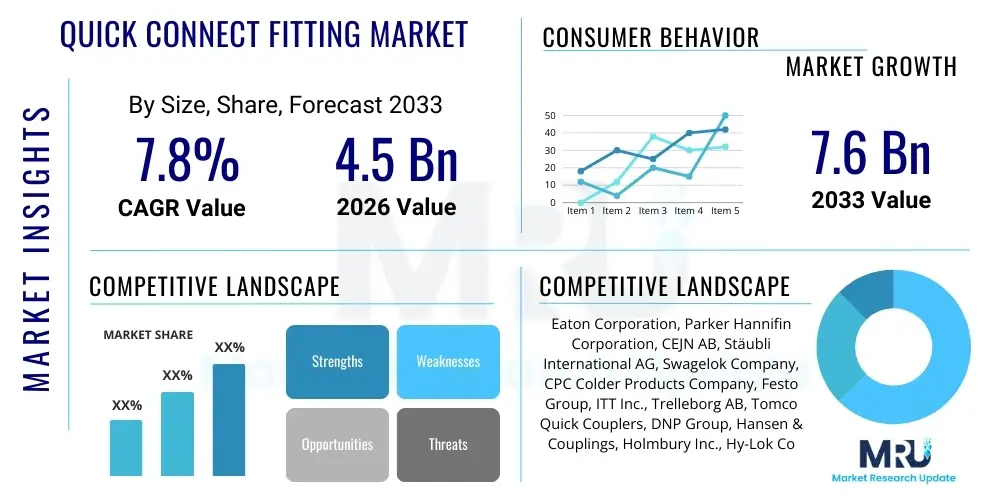

The Quick Connect Fitting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Quick Connect Fitting Market introduction

The Quick Connect Fitting Market encompasses specialized mechanical components designed to provide rapid, tool-free connection and disconnection of fluid or air lines in various industrial and commercial applications. These fittings are crucial for maintaining system integrity, reducing downtime during equipment changes, and ensuring leak-free performance in high-pressure hydraulic and pneumatic systems. Products range widely in material composition, including durable stainless steel, brass, and high-performance engineering plastics, catering to diverse environments such as chemical processing, automotive manufacturing, and medical device assembly. The core function of these fittings is to enhance operational efficiency by streamlining maintenance routines and enabling modular design philosophies in modern machinery.

The operational landscape for quick connect fittings is predominantly defined by the rising adoption of industrial automation and the necessity for robust fluid conveyance solutions. These components are integral to robotic systems, assembly line tooling, and specialized testing equipment where frequent changeovers are required. The technological advancement in sealing materials and locking mechanisms has significantly improved the pressure and temperature tolerances of modern fittings, allowing for their deployment in increasingly demanding applications, such as high-purity systems in the semiconductor industry or harsh environments in the oil and gas sector. The primary benefits realized by end-users include enhanced safety, minimized fluid loss during disconnections, and substantial time savings compared to traditional threaded connections.

Major applications driving market expansion include the automotive sector, where fittings are used extensively in paint shops and assembly lines for air tools and hydraulic clamping, and the heavy machinery industry, utilizing quick couplers for reliable hydraulic power transfer in construction and agriculture equipment. Key driving factors stimulating market growth include stringent regulatory standards concerning workplace safety and environmental protection against leaks, coupled with the global trend toward implementing flexible manufacturing systems that require adaptable and reliable connection interfaces. This continuous push for efficiency and precision across industrial verticals cements the Quick Connect Fitting Market’s trajectory for sustained expansion.

Quick Connect Fitting Market Executive Summary

The Quick Connect Fitting Market is experiencing robust expansion driven by pronounced business trends centered on enhancing industrial productivity and material science innovation. A significant business trend involves the shift towards lightweight and highly durable polymer fittings, particularly in applications sensitive to weight and corrosion, such as the aerospace and food and beverage industries. Furthermore, manufacturers are increasingly integrating advanced locking mechanisms and ergonomic designs to improve usability and reduce the risk of human error during connection procedures. The competitive landscape is characterized by strategic partnerships aimed at developing standardized fitting solutions that are interoperable across different manufacturers' systems, addressing a historical challenge related to proprietary connections and interchangeability issues within the industry.

Regionally, the Asia Pacific (APAC) market is emerging as the dominant growth driver, primarily fueled by massive infrastructural development, rapid urbanization, and the significant expansion of the manufacturing and automotive sectors in countries like China, India, and South Korea. This regional growth is coupled with increased investment in automated production lines, which heavily rely on pneumatic and hydraulic quick-connect technology. North America and Europe maintain substantial market share due to the maturity of their respective industrial bases, particularly in high-specification sectors such as medical devices and aerospace maintenance, where demand centers around premium, high-reliability stainless steel and exotic alloy fittings. Regional trends also reflect a higher uptake of specialized fittings that adhere to demanding regulatory certifications, such as those governing drinking water and food contact materials in Western economies.

Segment trends underscore the supremacy of push-to-connect fittings due to their ease of installation and suitability for low-to-medium pressure pneumatic applications, which are ubiquitous across general factory automation. However, the hydraulic segment, although smaller by volume, commands higher revenue due to the need for robust, high-pressure fittings typically manufactured from specialized metals, crucial for heavy machinery and industrial tooling. Material segment analysis highlights the accelerating adoption of advanced thermoplastics and composite materials, displacing traditional brass and steel in non-critical or corrosive environments, aligning with global sustainability initiatives and the push for reduced equipment weight. Overall, the market is poised for sustained growth, underpinned by foundational demand from core industrial sectors and accelerated by technological shifts favoring operational agility and reliability.

AI Impact Analysis on Quick Connect Fitting Market

User queries regarding the impact of Artificial Intelligence (AI) on the Quick Connect Fitting Market primarily focus on themes of manufacturing optimization, quality assurance, and supply chain resilience. Users are keen to understand how AI-driven predictive maintenance models can reduce unexpected fitting failures in critical systems, thereby minimizing costly downtime. They frequently ask about the role of machine learning (ML) in automating the visual inspection of complex fitting geometries for defects and ensuring zero-defect production runs. Another key area of interest revolves around how AI algorithms can optimize inventory management for the massive variety of fitting sizes and types, improving logistics and reducing warehousing costs for manufacturers and distributors. The consensus suggests that AI's influence will transition the industry from reactive maintenance and quality control to proactive, data-informed operations, enhancing product reliability and optimizing the overall value chain.

- AI-powered visual inspection systems increase the speed and accuracy of defect detection on fitting surfaces and threads, ensuring higher quality standards.

- Predictive maintenance algorithms utilize sensor data (pressure, temperature, flow) to forecast potential failure points in fittings and couplings, extending equipment lifespan.

- Machine learning optimizes manufacturing parameters, such as injection molding cycles or machining tool paths, improving material efficiency and reducing scrap rates in fitting production.

- AI enhances supply chain visibility and demand forecasting for the diverse SKUs (Stock Keeping Units) of fittings, minimizing stockouts and optimizing procurement strategies.

- Generative Design algorithms, informed by operational data, can be used to engineer new, lighter, and more durable fitting designs that withstand specific stress profiles.

- AI-driven automation integrates seamlessly with robotic systems that handle and assemble fittings on the production line, boosting overall manufacturing throughput.

DRO & Impact Forces Of Quick Connect Fitting Market

The Quick Connect Fitting Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Key drivers include the pervasive global push towards industrial automation, particularly in sectors such as automotive, aerospace, and robotics, where rapid tool changing and flexible production lines necessitate robust, reliable, and swift connection mechanisms. Simultaneously, the market faces restraints stemming primarily from concerns regarding standardization across different manufacturers, which often leads to incompatibility issues and limits user flexibility. Opportunities, however, abound through technological innovation, specifically the development of smart fittings integrated with sensors for monitoring operational parameters like pressure and temperature, aligning with the industry trend toward the Industrial Internet of Things (IIoT).

Impact forces are currently trending positively due to sustained high demand for efficiency improvements across all manufacturing verticals. The crucial element driving adoption is the reduction in Mean Time To Repair (MTTR) achieved by utilizing quick connect solutions, directly impacting production uptime and profitability for end-users. Conversely, a major restraining force remains the critical safety requirement in high-pressure hydraulic applications; ensuring zero leakage under extreme operational stress necessitates expensive, precision-engineered metal fittings, potentially limiting broader adoption where cost sensitivity is paramount. Moreover, the increasing regulatory scrutiny on fluid systems, demanding compliance with strict environmental leakage standards, simultaneously acts as both a driver for high-quality, specialized fittings and a restraint due to the increased complexity and certification costs involved in their manufacturing and deployment.

The strategic opportunity lies in penetrating emerging markets and developing advanced materials. The ongoing expansion of manufacturing capacity in emerging economies, coupled with significant investment in advanced food processing and medical infrastructure, opens new geographical avenues for fitting manufacturers. Furthermore, research and development focused on creating next-generation composite and polymer fittings that offer the strength and durability of metal but at a fraction of the weight and cost presents a transformative market opportunity. Manufacturers who successfully leverage these technological advancements and address the current limitations regarding universal interchangeability are poised to capture substantial market share, effectively mitigating the restraining forces currently impacting market growth trajectory.

Segmentation Analysis

The Quick Connect Fitting Market is highly fragmented and segmented based on fundamental product characteristics and application requirements, enabling tailored solutions for diverse industrial needs. Segmentation is primarily driven by the medium being conveyed (pneumatic or hydraulic), the material used in the fitting’s construction (metal or plastic), the mechanism employed for connection (push-to-connect, ball-locking, flat face), and the specific end-use industry (automotive, construction, medical, etc.). This multifaceted segmentation ensures that manufacturers can supply products that meet precise operational specifications, such as resistance to chemical corrosion in the food and beverage industry or the ability to withstand extreme pressure in heavy construction applications. The dominant segments, both in terms of volume and revenue, reflect the ubiquity of factory automation and the pervasive use of hydraulic power in industrial machinery globally, necessitating a wide range of reliable fitting solutions.

Detailed analysis reveals that the Material segment is undergoing a significant transformation, with engineered plastics gaining substantial ground over traditional metal fittings, especially in environments where weight reduction and corrosion resistance are prioritized. While metal fittings (stainless steel and brass) remain indispensable for high-pressure and high-temperature hydraulic systems, the cost-effectiveness and chemical inertness of materials like PEEK and polypropylene are expanding their use in general assembly and process industries. Furthermore, the segmentation by End-Use Industry clearly shows that the Manufacturing and Automotive sectors constitute the largest consumer base, utilizing quick connect fittings extensively in their production lines for air tools, fluid conveyance, and rapid fixture changeovers. The demand here is highly standardized, favoring volume production of common push-to-connect and bayonet-style fittings.

The segmentation by Type, specifically distinguishing between Hydraulic and Pneumatic applications, highlights a revenue divergence. Pneumatic fittings, characterized by lower pressure requirements, dominate in volume due to their wide usage in general factory automation and robotic systems. Conversely, Hydraulic fittings, though fewer in number, generate higher average selling prices due to the required precision engineering, robust sealing mechanisms, and use of expensive, high-strength materials necessary to handle thousands of PSI without failure. Strategic market positioning requires manufacturers to specialize in either high-volume, cost-effective pneumatic solutions or high-margin, specialized hydraulic components to maximize profitability within the complex segmentation structure of the market.

- By Type:

- Hydraulic Quick Connect Fittings

- Pneumatic Quick Connect Fittings

- By Mechanism:

- Push-to-Connect Fittings (PTC)

- Threaded Fittings

- Bayonet/Camlock Fittings

- Ball Locking Fittings

- Flat Face Couplings

- By Material:

- Metal (Stainless Steel, Brass, Aluminum)

- Plastic (Polypropylene, Polyurethane, Nylon, PEEK)

- By End-Use Industry:

- Automotive and Transportation

- Construction and Heavy Equipment

- Oil and Gas

- Food and Beverage Processing

- Medical and Healthcare Devices

- Aerospace and Defense

- Chemical Processing

- General Manufacturing

Value Chain Analysis For Quick Connect Fitting Market

The value chain for the Quick Connect Fitting Market begins with the upstream procurement of raw materials, primarily high-grade metals such as stainless steel and brass, and specialized engineering plastics, which require stringent quality control due to their direct impact on the fitting's pressure rating and durability. Upstream activities also involve the manufacturing of specialized components like springs, seals (O-rings, PTFE), and precision machining tools necessary for producing the intricate geometries of the locking mechanisms. Suppliers of these primary materials and highly technical sub-components exert moderate bargaining power, particularly those supplying certified, specialty alloys required for high-pressure applications, thus influencing the final production cost of the finished fitting unit.

The midstream stage involves the design, precision machining (or injection molding), assembly, and rigorous testing of the quick connect fittings. This manufacturing process is highly capital-intensive, relying on sophisticated CNC machinery and advanced surface treatment processes to ensure corrosion resistance and dimensional accuracy. Distribution channels form the crucial link to end-users, typically segmented into direct sales (for large OEMs and specialized applications like aerospace) and indirect channels (distributors, wholesalers, and specialized industrial supply houses). Indirect channels dominate volume sales, providing broad market access and localized inventory management, crucial for supplying the vast array of standardized fittings required by smaller manufacturing operations and MRO (Maintenance, Repair, and Operations) activities.

Downstream analysis focuses on the integration and use of the fittings by end-users across numerous sectors. The success of the fitting is measured by its performance in the field—leak prevention, durability, and ease of use—which feeds back into the research and development loop for continuous product improvement. Direct distribution allows manufacturers to maintain tight relationships with major buyers, enabling custom design and specialized inventory stocking, which is essential for industries like medical devices or oil and gas. The robustness of the distribution network, supported by reliable logistics and technical after-sales support, is a key determinant of market competitiveness, ensuring that the right fitting is available quickly to minimize critical downtime in industrial operations globally.

Quick Connect Fitting Market Potential Customers

The potential customer base for quick connect fittings is extensive, spanning nearly every sector that utilizes fluid power (hydraulic or pneumatic) or requires rapid changeovers of tooling, media lines, or instruments. Primary end-users are large Original Equipment Manufacturers (OEMs) in the automotive, construction, and heavy machinery sectors, who integrate these fittings directly into their new machinery buildouts, demanding high volumes of standardized and reliable components. These customers prioritize fittings that offer guaranteed performance specifications, ease of integration into complex systems, and cost-effective bulk pricing, ensuring continuity of production line operations without unplanned interruptions or fluid loss incidents.

Secondary, yet highly profitable, potential customers include Maintenance, Repair, and Operations (MRO) divisions across all industries, particularly those managing large fleets of machinery or highly automated production facilities, such as food processing plants and aerospace maintenance bases. These MRO customers purchase fittings on an ongoing basis for repair, replacement, and system upgrades, often requiring smaller, specialized batches of fittings with quick turnaround times. Their purchasing criteria focus heavily on interchangeability with existing systems, durability under extreme working conditions, and immediate availability through regional distribution networks, making the role of local industrial suppliers critical in serving this segment efficiently.

Furthermore, specialized industries represent niche, high-value customer segments, including medical device manufacturers requiring sterile, easy-to-clean fittings for fluid administration and diagnostic equipment, and semiconductor fabricators demanding ultra-high purity (UHP) fittings to prevent contamination in gas and chemical lines. These customers require fittings made from inert materials (like PEEK or specialized stainless alloys) that adhere to stringent regulatory standards (e.g., FDA, USP Class VI). Targeting these high-specification markets necessitates specialized product lines, rigorous certification processes, and direct, consultative sales approaches to meet the unique and exacting requirements of these technically demanding applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Parker Hannifin Corporation, CEJN AB, Stäubli International AG, Swagelok Company, CPC Colder Products Company, Festo Group, ITT Inc., Trelleborg AB, Tomco Quick Couplers, DNP Group, Hansen & Couplings, Holmbury Inc., Hy-Lok Corporation, Kurt Manufacturing Co., Rectus TEMA, K couplings, Dixon Valve & Coupling Company, VOSS Fluid GmbH, Ryco Hydraulics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Quick Connect Fitting Market Key Technology Landscape

The technology landscape in the Quick Connect Fitting Market is rapidly evolving, driven by the need for enhanced reliability, higher pressure tolerances, and integration into modern digital factory ecosystems. A primary technological focus involves advanced sealing mechanisms, moving beyond traditional O-rings to incorporate proprietary elastomer compounds and specialized metallic seals that maintain integrity under extreme thermal cycling and chemically aggressive media. Flat face coupling technology represents a significant advancement, particularly in hydraulic systems, as it minimizes fluid spillage and air inclusion during connection and disconnection, addressing critical environmental and operational concerns related to fluid loss and system contamination. The precision required for manufacturing these flat-face surfaces demands the use of high-accuracy Computer Numerical Control (CNC) machining and advanced surface finishing techniques.

Another crucial technological development involves the incorporation of smart features into quick connect fittings, aligning with the principles of Industry 4.0. This includes integrating miniature sensors—such as RFID tags, NFC chips, or pressure and temperature sensors—directly into the fitting body. These smart fittings enable condition monitoring, asset tracking, and verification of correct connection status, feeding real-time operational data back to centralized control systems. This capability is paramount for implementing effective predictive maintenance strategies, allowing operators to preemptively identify fittings that are beginning to degrade or leak before catastrophic failure occurs, significantly enhancing system uptime and operational safety.

Furthermore, material science innovations are continually shaping the technology landscape. The development of advanced, high-performance polymers, like chemically resistant PTFE variants and carbon-fiber reinforced composites, allows for the creation of fittings that are significantly lighter than their metal counterparts while maintaining comparable strength and pressure ratings for specific applications. Additive manufacturing (3D printing) is also beginning to play a role, particularly in prototyping and producing highly customized, low-volume fitting geometries that are otherwise challenging or prohibitively expensive to produce via traditional machining. This technological evolution underscores the industry's commitment to optimizing both the functional performance and the logistical management of fluid conveyance components.

Regional Highlights

- North America: This region holds a substantial market share, characterized by high adoption rates of premium, specialized quick connect fittings, particularly in the aerospace, defense, and high-end automotive manufacturing sectors. The focus in North America is on highly reliable, certified products that comply with stringent safety and environmental regulations. Demand is driven by MRO activities and substantial investments in automation technologies, particularly in the US and Canada. The market here favors specialized stainless steel and brass fittings for hydraulic power and demanding industrial automation applications. Technological readiness and the presence of major global quick connect fitting manufacturers also contribute to market maturity and advanced product uptake, particularly in integrating IIoT-enabled smart fittings for predictive maintenance protocols across the heavy equipment sector.

- Europe: Europe is a mature market distinguished by strong regulatory mandates regarding industrial safety, leak prevention, and environmental compliance, driving demand for high-quality, standardized fittings (especially those conforming to ISO and DIN standards). Countries like Germany and Italy, leaders in machinery manufacturing and industrial automation, represent core consumers. The automotive industry, including large commercial vehicle manufacturers, remains a significant end-user. The regional market shows a strong preference for flat face couplings in mobile hydraulic systems due to their superior anti-spill properties, aligning with strict EU environmental directives. Research intensity in material science supports the local production of advanced, lightweight composite fittings for specialized industrial equipment.

- Asia Pacific (APAC): APAC is the fastest-growing region, projected to dominate market expansion over the forecast period. This rapid growth is directly attributable to booming industrialization, significant infrastructure projects, and the expansion of the manufacturing base across China, India, and Southeast Asian nations. The region is characterized by substantial demand for both cost-effective, high-volume pneumatic fittings for general assembly lines and increasingly sophisticated hydraulic fittings for the growing construction and heavy machinery sectors. Government initiatives promoting domestic manufacturing and foreign investment in automated factories further accelerate the adoption of quick connect technology. While price sensitivity remains a factor, the increasing focus on quality and efficiency in exported goods is pushing demand towards reliable, mid-to-high quality fittings.

- Latin America (LATAM): The LATAM region, though smaller, exhibits steady growth primarily driven by the mining, agricultural, and petrochemical industries in countries such as Brazil and Mexico. Demand is highly focused on robust, durable hydraulic fittings capable of operating under harsh, dusty conditions typical of heavy machinery applications in these sectors. Market expansion is closely tied to commodity price stability and foreign investment in industrial modernization projects. Logistics and distribution channels often present challenges, favoring manufacturers who maintain local inventory and strong distributor networks capable of providing prompt technical support.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated within the oil and gas sector and water treatment facilities, demanding fittings resistant to corrosion, extreme temperatures, and high pressure. The large-scale infrastructure projects in the GCC (Gulf Cooperation Council) countries, coupled with investment in diversification away from hydrocarbon dependence, are stimulating demand in construction and utility segments. Specialized fittings, often made from exotic alloys, are highly valued here for their critical performance in environments demanding maximum safety and operational integrity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Quick Connect Fitting Market.- Eaton Corporation

- Parker Hannifin Corporation

- CEJN AB

- Stäubli International AG

- Swagelok Company

- CPC Colder Products Company

- Festo Group

- ITT Inc.

- Trelleborg AB

- Tomco Quick Couplers

- DNP Group

- Hansen & Couplings

- Holmbury Inc.

- Hy-Lok Corporation

- Kurt Manufacturing Co.

- Rectus TEMA

- K couplings

- Dixon Valve & Coupling Company

- VOSS Fluid GmbH

- Ryco Hydraulics

Frequently Asked Questions

Analyze common user questions about the Quick Connect Fitting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Quick Connect Fitting Market?

The primary driver is the accelerating global trend of industrial automation and the increasing necessity for systems that allow for rapid, leak-free connection and disconnection of fluid and pneumatic lines, minimizing equipment downtime and enhancing operational flexibility across manufacturing sectors.

What are the key differences between hydraulic and pneumatic quick connect fittings?

Hydraulic fittings are engineered for extremely high pressure (often thousands of PSI) and are typically made from robust metals like stainless steel to ensure durability and zero leakage, commonly used in heavy machinery. Pneumatic fittings are designed for lower pressure air systems and prioritize rapid connection speed, often utilizing plastic or brass materials for use in factory automation and air tools.

Which material segment currently holds the largest market share in the fittings industry?

Metal fittings, particularly those manufactured from stainless steel and brass, currently hold the largest revenue share due to their necessity in high-pressure hydraulic and high-temperature applications. However, the plastic segment is experiencing faster growth driven by demand for lightweight, corrosion-resistant solutions in specific industries like medical and food processing.

How does the integration of IIoT technology impact the performance of quick connect fittings?

IIoT integration, through the use of smart fittings equipped with sensors and RFID technology, enables real-time condition monitoring, allowing operators to track operational parameters such as pressure and temperature. This facilitates predictive maintenance, significantly reducing the risk of unexpected component failure and improving system reliability and safety.

What challenges do manufacturers face regarding the standardization of quick connect fittings?

A major challenge is the lack of universal interchangeability between fittings produced by different manufacturers, often leading to proprietary locking mechanisms. This limits flexibility for end-users and necessitates sourcing specific replacement parts, a restraint the industry is attempting to address through greater adherence to international standards like ISO 16028 for flat face couplings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager