Quilt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432001 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Quilt Market Size

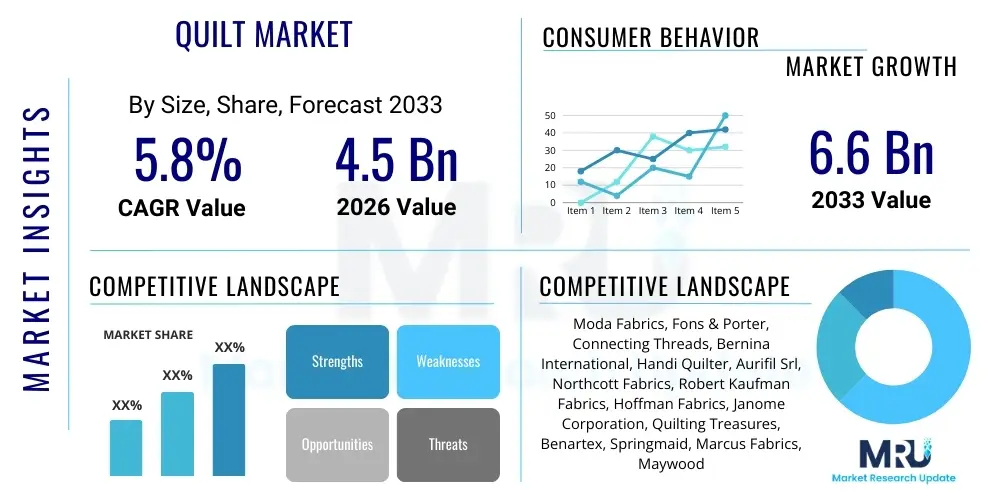

The Quilt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2033.

Quilt Market introduction

The Quilt Market encompasses the global trade of finished quilted products, quilt kits, raw materials (fabric, batting, thread), and specialized equipment used for quilting activities. Historically centered around artisanal craft and home décor, the modern market has diversified significantly, integrating into high-end textiles, industrial applications requiring thermal or sound insulation (utilizing quilted structures), and a rapidly expanding global Do-It-Yourself (DIY) sector fueled by e-commerce platforms and social media tutorials. The defining feature of a quilt is its layered structure, typically comprising a top fabric layer, a middle insulating batting layer, and a backing layer, all held together by stitching (quilting). This construction technique imparts unique aesthetic, thermal, and structural qualities, making it suitable for diverse applications ranging from luxurious bedding and functional apparel to sound dampening panels and protective industrial coverings. The resilience of the market is underpinned by the enduring consumer demand for personalized and handmade goods, counterbalanced by efficient, high-volume production of machine-made quilts satisfying budget-conscious segments.

The core product in this market includes finished quilts (bedding, throws, wall hangings), pre-cut fabric kits designed for specific patterns, and essential supplies such as batting (filling material like cotton, wool, or polyester), threads, and patterns/templates. Major applications span residential use (bedding, decorative throws, nursery items), commercial lodging (hotels, resorts), and gifting, where custom-made quilts hold significant sentimental value. Key benefits driving market expansion include superior thermal insulation properties, aesthetic versatility allowing for extensive customization, durability, and the rising interest in sustainable and natural fiber products, particularly organic cotton and wool batting. The emotional connection associated with quilted items, often viewed as heirlooms or personalized gifts, ensures premium pricing potential in niche segments, contrasting with the cost-efficiency of mass-produced synthetic quilts serving the broad consumer base. The proliferation of specialized longarm quilting machines and advanced sewing technology has democratized the craft, enabling faster production and more intricate designs, thus broadening market accessibility.

Driving factors propelling the Quilt Market forward include the global resurgence of craft hobbies, accelerated by pandemic-era activities and the widespread availability of online educational resources (e.g., specialized quilting tutorials and virtual workshops). Furthermore, disposable income increases in emerging economies have translated into higher expenditure on home aesthetics and luxury textile goods. The market also benefits substantially from the constant evolution of digital printing technologies, allowing manufacturers to offer highly personalized and limited-edition fabrics, which fuels demand among serious hobbyists and professional quilters. Marketing strategies focused on sustainability, ethical sourcing, and the cultural narrative behind quilting resonate strongly with modern consumers. Regulatory environments that favor natural fiber production or mandate specific safety standards (e.g., flame resistance in certain industrial quilted materials) also subtly shape innovation and product development, ensuring the continuous influx of advanced materials and machinery into the value chain.

Quilt Market Executive Summary

The Quilt Market Executive Summary reveals robust expansion driven primarily by shifting consumer demographics favoring personalized and sustainable home décor, coupled with technological advancements in textile manufacturing and automated quilting machinery. Key business trends underscore a strong bifurcation: the premium, artisanal segment thrives on customization, high-quality natural materials (like organic cotton and bamboo batting), and direct-to-consumer digital marketing; conversely, the mass-market segment leverages efficient global supply chains, synthetic fillers (polyester), and advanced computer-aided design (CAD) to deliver affordable, trendy, machine-made goods. Strategic investments are increasingly focused on optimizing the e-commerce supply chain for fragmented fabric orders and specialized equipment, reflecting the highly engaged nature of the end-user base. The incorporation of subscription box models for quilt kits and pattern delivery represents a significant revenue stream, capitalizing on the recurring interest of hobbyists and minimizing inventory risks for suppliers. Furthermore, intellectual property protection concerning unique quilt patterns is becoming a critical business consideration, particularly for independent designers utilizing digital distribution channels.

Regional trends indicate North America remains the dominant consumer market, characterized by a deeply entrenched quilting culture, high spending on specialized equipment (such as high-end sewing machines and longarm quilters), and a robust network of physical and online craft retailers. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by two key dynamics: rapidly increasing urbanization and middle-class expansion leading to higher demand for home furnishings in countries like China and India, and the region's established role as a major global textile manufacturing and fabric sourcing hub, offering cost efficiencies for raw material procurement and finished product assembly. Europe exhibits steady, mature growth, emphasizing heritage, sustainability, and high-design quilts, often integrated into luxury interior design projects. Regional supply chains are evolving, with manufacturers in APAC investing heavily in advanced automated quilting lines to meet international quality standards and high-volume demands while simultaneously exploring localized, sustainable fiber sourcing to mitigate transportation costs and environmental impact, appealing directly to environmentally conscious buyers in Western markets.

Segmentation trends highlight the Machine-made segment holding the largest market share due to its scalability and ability to serve both the bedding industry and promotional product sectors efficiently. However, the Handmade/Artisanal segment commands the highest price points and margins, particularly in luxury and bespoke applications. Among material types, Cotton remains the dominant choice globally, valued for its breathability, durability, and natural feel, although the rapid adoption of specialized synthetic blends (e.g., fire-retardant polyester for commercial use or specialized microfiber for lightweight insulation) is notable, especially where performance characteristics outweigh traditional aesthetic considerations. The shift towards Quilt Kits and Patterns as a revenue stream, distinct from finished products, reflects the consumer preference for engagement and personalized creation. This segment benefits from lower shipping costs compared to bulky finished goods and offers suppliers high-margin digital content, solidifying its role as a key growth driver, specifically leveraging social media and digital pattern sales platforms.

AI Impact Analysis on Quilt Market

User queries regarding the impact of Artificial Intelligence (AI) on the Quilt Market frequently revolve around design innovation, automation's threat to artisanal skills, and supply chain efficiency. Common questions include: Can AI generate unique quilt patterns that are aesthetically pleasing and mathematically sound? How will AI-powered automated cutting and stitching affect the job market for professional quilters? And can machine learning optimize fabric sourcing and inventory management for small, independent quilting businesses? The consensus theme extracted from these inquiries suggests a mixture of excitement and apprehension: users anticipate AI streamlining repetitive tasks and unlocking unprecedented creative complexity, particularly in personalized pattern generation (Geometric AI), but simultaneously fear the devaluation of traditional, human-centric craft skills. Users expect AI to enhance customization options while demanding tools that remain accessible and supportive of small-scale entrepreneurs rather than solely benefiting large industrial textile operations. Focus areas include AI assisting with color palette selection, identifying optimal fabric usage to minimize waste, and predicting consumer pattern trends.

- AI-driven Pattern Generation: Algorithms generate intricate, novel, and mathematically precise quilt block designs based on user input parameters (color schemes, block size, style requirements).

- Optimized Material Sourcing: Machine learning analyzes global fabric supply chains, predicting price fluctuations, assessing material quality (e.g., cotton staple length consistency), and identifying sustainable sourcing alternatives.

- Automated Cutting Efficiency: AI integrates with Computer Numerical Control (CNC) fabric cutters to optimize layout (nesting) of pattern pieces across material yardage, significantly reducing textile waste (scrap minimization).

- Personalized Marketing and Recommendations: AI analyzes consumer purchase history and viewing behavior to recommend specific quilt kits, batting types, or virtual workshops, enhancing targeted sales efforts for craft retailers.

- Quality Control in Manufacturing: Vision systems powered by AI inspect finished quilts for stitching consistency, pattern alignment flaws, and defect detection in large-scale automated quilting production lines.

- Virtual Reality (VR) Try-On: AI facilitates the creation of virtual quilt mock-ups, allowing customers to visualize custom designs on their own beds or walls before purchase or creation.

DRO & Impact Forces Of Quilt Market

The dynamics of the Quilt Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces dictating market trajectory and profitability. The primary Driver is the increasing consumer shift towards personalized, custom, and artisanal goods, where a quilt represents not just a functional item but an emotional investment and a unique piece of home décor, commanding significant margins in the luxury segment. This is strongly supported by the growth of the global DIY and crafting industry, sustained by social media influence (e.g., specialized quilting communities on platforms like Instagram and Pinterest) and the accessibility of educational content. Restraints, conversely, include the volatility of raw material prices—primarily cotton and specialty fibers—which directly impacts the cost of goods sold, putting pressure on both large manufacturers and small craft businesses. Furthermore, the market faces competition from cheaper, high-volume textile substitutes, such as mass-produced blankets and throws, which do not require the labor-intensive multi-layered construction of a traditional quilt. Opportunities lie significantly in expanding digital channels for pattern sales and specialized kits, exploiting niche markets (e.g., sustainable/organic quilts, pet quilts, specialized medical textiles utilizing quilted structures), and leveraging automation (longarm machine quilting services) to bridge the gap between handmade quality and mass-market speed.

The impact forces are particularly evident in the supply chain resilience and technological adoption rates. Increased automation, particularly the integration of high-speed, multi-needle computerized quilting systems (Drivers), has reduced manufacturing timelines and lowered the labor cost component for mass producers, making quilted products more accessible. However, this automation requires significant upfront capital investment, acting as a potential Restraint for smaller players. The sustainability movement presents a critical Opportunity; consumers are increasingly willing to pay a premium for quilts made from recycled fabrics or ethically sourced organic fibers, pressuring manufacturers to adopt circular economy practices and transparent sourcing (Impact Force: Environmental Responsibility). The ongoing global economic uncertainty (Restraint) can lead consumers to postpone purchases of high-end, non-essential home goods, affecting the high-margin bespoke segment. Consequently, strategies focusing on value-driven kits or digital patterns, offering enjoyment and utility at a lower price point, become essential for market stability. The overall effect is a market that rewards innovation in material science and efficiency in digital distribution, while demanding authenticity and unique craftsmanship in the premium tiers.

A key opportunity remains the geographical expansion of the crafting culture into emerging markets. As disposable incomes rise in APAC and Latin America, the hobby of quilting is gaining traction beyond its traditional North American and European strongholds. This opens up new avenues for sales of educational content, specialized equipment, and imported high-quality fabrics, necessitating tailored marketing strategies that respect local textile traditions and aesthetics. The high barrier to entry for new, high-quality, large-scale fabric manufacturers (Restraint) reinforces the dominance of established textile mills, but also provides a distinct opportunity for niche fabric suppliers focusing on unique, digitally printed, small-batch designs favored by modern quilters. The impact forces compel companies to adopt a dual strategy: maximizing the efficiency of machine production for scale while simultaneously emphasizing the unique story, heritage, and personalization capabilities of the handmade sector. Successfully navigating this duality—by offering scalable technology solutions to the artisan segment—is crucial for sustained competitive advantage and growth in the forecast period.

Segmentation Analysis

Segmentation of the Quilt Market is essential for understanding the divergent demands of hobbyists, commercial buyers, and industrial users. The market is primarily categorized based on Product Type (Finished Quilts, Kits & Patterns, Supplies), Material Type (Cotton, Synthetic, Blends, Natural Specialty), and Application (Home Decor, Gifting, Industrial/Specialty). This structure allows market participants to tailor their offerings, whether focusing on high-volume machine-made bedding or high-margin, unique, handcrafted wall hangings. The Finished Quilt segment dominates revenue due to its immediate utility in the residential and hospitality sectors, but the Supplies segment (fabric, batting, thread) drives recurring revenue, reflecting the consistent activity of the vast global community of hobbyist quilters. The underlying trend across all segments is the increasing demand for sustainable and certified organic materials, influencing sourcing and pricing strategies across the board.

Analyzing segmentation by material reveals Cotton’s enduring dominance, favored for its breathability and ease of use, making it the standard choice for traditional quilting. However, the Synthetic segment, primarily utilizing polyester batting and microfibers, is rapidly expanding, especially in commercial and budget-conscious applications where durability, washability, and specialized performance features (like water resistance or lower weight) are prioritized over natural feel. The rise of blended fabrics seeks to capture the best of both worlds, offering cost efficiency while maintaining some natural fiber attributes. From an application perspective, Home Decor, encompassing bedding and decorative throws, remains the largest application area, intrinsically linked to global housing market trends and consumer spending on interior design. The specialized Industrial/Specialty application, though smaller, offers high growth potential by utilizing quilted technology for acoustic dampening, technical apparel insulation, and automotive components, demonstrating the versatility of the core product structure beyond traditional domestic use.

The fastest-growing segment is undeniably Kits and Patterns, driven by the democratization of learning through online platforms and the convenience they offer to new quilters. These kits provide pre-cut or precisely measured fabric pieces, comprehensive instructions, and often curated design elements, significantly lowering the barrier to entry for beginners. Furthermore, the digitization of patterns allows independent designers to generate revenue globally with minimal overhead, leveraging instant digital downloads. This segment is highly responsive to social media trends and influential designer collaborations. Manufacturers must therefore maintain a flexible inventory strategy that supports both the massive quantities of base materials required for finished goods and the highly diverse, small-batch, specialty fabrics demanded by kit suppliers and individual artisans, ensuring market penetration across the entire spectrum of consumer engagement, from buying a completed product to engaging in the full creative process.

- By Product Type:

- Finished Quilts (Bedding, Wall Hangings, Throws)

- Quilt Kits & Patterns (Digital Patterns, Physical Kits)

- Quilting Supplies (Fabric Yardage, Batting, Thread, Notions)

- Quilting Machinery & Equipment (Longarm Quilters, Specialized Sewing Machines)

- By Material Type:

- Cotton

- Synthetic (Polyester, Nylon)

- Blends

- Natural Specialty (Wool, Silk, Bamboo)

- By Application:

- Home Decor (Residential & Commercial Hospitality)

- Gifting & Personal Use

- Apparel & Fashion Accessories

- Industrial & Specialty (Insulation, Acoustics)

Value Chain Analysis For Quilt Market

The Quilt Market value chain is inherently complex, bridging global raw material sourcing with highly localized artisanal production and centralized industrial manufacturing. The upstream analysis begins with the sourcing of primary raw materials: fibers (cotton, polyester, wool) and threads. Large-scale manufacturers rely on global commodity markets and large textile mills, particularly those in Asia, for cost-effective, high-volume fiber processing and fabric production. Quality and sustainability certifications (like organic cotton standards) add layers of complexity and cost at this initial stage. Specialized quilters, conversely, often source from niche fabric designers and smaller, high-end textile printers who provide unique, limited-edition designs. The middle stage involves design, cutting, and assembly. This is where the major distinction between highly automated, industrial production lines (utilizing advanced multi-needle quilting machines) and labor-intensive, often home-based, artisanal creation occurs. Industrial players prioritize efficiency and scale, while artisans focus on bespoke quality and intricate, hand-guided stitching patterns. The integration of CAD software and specialized longarm quilting services optimizes the middle section, catering to diverse production requirements.

The downstream analysis focuses on distribution and retailing channels, which are characterized by significant diversification. Direct channels are increasingly important, especially for specialty quilt makers and designers who leverage e-commerce platforms (personal websites, Etsy) to sell high-margin, custom finished products and digital patterns directly to consumers, bypassing traditional retail markups. This direct engagement fosters brand loyalty and allows for immediate feedback on design trends. Indirect channels constitute the traditional retail network, including large craft supply chains (e.g., Joann, Hobby Lobby), specialized local quilt shops (LQS), wholesale distributors supplying hotels and commercial clients, and large online retailers (Amazon, specialized fabric distributors). Local Quilt Shops remain vital for the hobbyist segment, providing essential community, education (workshops), and specialized supplies that require expert advice. The choice of channel is dictated by product type; high-volume, standard bedding goes through mass retail/wholesale, while bespoke, high-end items rely on direct-to-consumer models.

The efficiency of the distribution channel is crucial for maintaining profitability, particularly given the varying sizes, weights, and urgency of products. Raw materials and finished bedding often move through traditional freight logistics, optimized for bulk. In contrast, the rapid growth of the Quilt Kits and Patterns segment relies heavily on highly efficient, small-parcel shipping logistics (for physical kits) or instantaneous digital delivery (for patterns). The fragmentation of the end-user base (millions of small-scale hobbyists) necessitates robust digital infrastructure for customer relationship management and order fulfillment. The direct channel's importance extends beyond sales; it is a critical tool for market intelligence, allowing manufacturers and designers to quickly adapt to consumer preferences regarding color, pattern complexity, and material type, ensuring that inventory remains aligned with fast-changing trends, thereby mitigating the risk of obsolete fabric stock.

Quilt Market Potential Customers

Potential customers for the Quilt Market can be broadly categorized into three distinct segments: Dedicated Hobbyist Quilters, Commercial & Hospitality Buyers, and Luxury/Bespoke Consumers. The Dedicated Hobbyist segment represents the largest volume of purchasers for raw materials, kits, patterns, and specialized machinery (sewing machines, longarm quilters). These consumers are deeply engaged in the craft, often participate in guilds and workshops, and prioritize quality and unique design in their fabric purchases. They seek recurring purchases of supplies and digital content, making them highly valuable for subscription services and specialized local quilt shops. Their buying behavior is heavily influenced by designer reputation and community recommendations, requiring suppliers to invest heavily in community engagement and educational content creation. This segment is characterized by high expertise and a low tolerance for inferior material quality, driving demand for premium cotton and specialty batting.

Commercial and Hospitality Buyers represent a high-volume, procurement-driven segment focused primarily on finished quilts and bedding, prioritizing durability, washability, and compliance with institutional standards (e.g., fire safety, anti-microbial treatments). This segment includes hotels, resorts, hospitals, long-term care facilities, and corporate gifting departments. Their purchasing decisions are price-sensitive but driven equally by bulk discounts and the ability of suppliers to meet stringent quality and volume specifications. For this customer group, manufacturers must emphasize material performance (e.g., polyester blends for resilience) and logistical reliability. Furthermore, the specialized industrial sector, utilizing quilted textiles for insulation purposes (e.g., acoustic panels, thermal blankets for machinery), also falls into the commercial buyer category, demanding high technical specifications and certifications over aesthetic considerations.

The Luxury and Bespoke Consumer segment consists of high-net-worth individuals, interior designers, and collectors seeking unique, one-of-a-kind textile art pieces. These customers demand the highest level of craftsmanship, often preferring hand-stitched or expertly longarm-quilted finished products utilizing rare, natural, and ethically sourced fibers like silk, linen, or high-grade Pima cotton. Price sensitivity is low, but expectations for customization, narrative, and exceptional quality are extremely high. Suppliers targeting this segment typically operate via direct sales, luxury retailers, or designer showrooms, focusing on the story and heritage of the quilt maker. This segment ensures the continuation of traditional, high-skilled quilting methods and acts as a powerful driver for innovation in pattern design and material exclusivity, offering the highest average transaction value in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moda Fabrics, Fons & Porter, Connecting Threads, Bernina International, Handi Quilter, Aurifil Srl, Northcott Fabrics, Robert Kaufman Fabrics, Hoffman Fabrics, Janome Corporation, Quilting Treasures, Benartex, Springmaid, Marcus Fabrics, Maywood Studio, Husqvarna Viking, Brewer Sewing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Quilt Market Key Technology Landscape

The Quilt Market has undergone a significant technological transformation, moving far beyond traditional hand stitching, although that remains a vital part of the artisanal segment. The core of technological advancement lies in automation and precision tools. Computerized Longarm Quilting Machines represent the most critical development, enabling professional quilters and commercial services to execute complex, edge-to-edge patterns with speed and accuracy that manual methods cannot replicate. These machines utilize sophisticated Computer Numerical Control (CNC) systems, allowing users to import digital pattern files, scale them instantly, and execute precise stitching, often covering large areas of fabric in a fraction of the time previously required. This technology has professionalized the finishing stage of quilting, significantly boosting output capacity for businesses that cater to hobbyists who assemble the quilt top but outsource the final quilting process. Furthermore, multi-needle industrial quilting machines are standard in high-volume textile manufacturing, capable of continuously producing quilted fabrics for bedding, apparel, and industrial insulation at immense scale.

Fabric production and preparation utilize advanced textile printing and cutting technologies. Digital Fabric Printing allows designers to bypass traditional screen printing limitations, offering high-resolution, short-run, customizable fabrics quickly and cost-effectively. This facilitates the rapid introduction of new, trend-driven designs and supports the niche market of limited-edition quilting fabrics. Precision Cutting Technology, including laser cutters and die-cutters, integrated with optimization software, ensures perfect geometrical shapes for quilt pieces, dramatically improving the accuracy and efficiency of assembly, especially in pre-cut kit production. The software component, specifically Computer-Aided Design (CAD) software tailored for quilting, permits designers to mathematically draft patterns, simulate color palettes, and plan fabric usage before a single cut is made. These technological tools standardize quality control and minimize the material waste inherent in textile production, appealing to both economic and environmental sustainability goals.

In the consumer sphere, advanced home sewing machines equipped with features like automated thread cutting, embroidery capabilities, precise tension control, and integrated Wi-Fi connectivity have elevated the quality of domestic quilting projects. These machines offer specialized quilting feet and guides, making complex techniques more accessible to the average hobbyist. Beyond physical machinery, the rise of digital infrastructure, including specialized cloud-based platforms for pattern distribution and virtual reality (VR) tools for design visualization, constitutes a key technology force. These platforms allow for instant global distribution of intellectual property (patterns) and foster virtual learning communities, ensuring that technological investment in the Quilt Market extends beyond manufacturing equipment into the realm of digital content delivery and customer engagement, securing the industry’s future growth by lowering barriers to entry for new participants.

Regional Highlights

- North America (NA): North America holds the largest share of the global Quilt Market revenue, primarily driven by a deeply ingrained historical and cultural tradition of quilting, particularly in the United States. The region boasts the highest consumer spending per capita on quilting supplies, specialized machinery (longarm machines), and attending quilting events and trade shows. E-commerce penetration is extremely high, supporting both large national retailers and thousands of independent sellers of custom quilts and patterns. The focus here is on high-quality cotton materials, designer fabrics, and technology adoption that supports professional, at-home quilting businesses. The market is mature but exhibits steady growth, fueled by retirement-age demographics and younger generations adopting crafting hobbies through social media.

- Europe: The European Quilt Market is characterized by a strong emphasis on sustainability, heritage, and high-design aesthetics, often integrating quilting into high-end interior textiles and luxury fashion. Countries like Germany and the UK show robust demand for both machinery and high-quality natural fibers, including certified organic cotton and linen. The market is highly influenced by national craft guilds and fairs, maintaining a strong preference for traditional techniques alongside modern, machine-aided production. Demand is stable, prioritizing ethical sourcing and localized small businesses, distinguishing itself from the volume-driven approach seen in some other regions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by its dual role as both a primary global manufacturing hub for textiles, cotton, and finished machine-made quilts, and a rapidly emerging consumer market. Countries such as China, India, and Vietnam are key producers, benefiting from lower labor costs and established textile supply chains. Simultaneously, rising disposable incomes in urban centers are translating into increased demand for home décor, boosting the domestic consumer market for finished quilts and associated supplies. Investment in advanced automated quilting technology is intense across APAC to meet global export demands for quality and scale.

- Latin America (LA): The Latin American market for quilting is nascent but growing, largely focused on imports of specialized machinery and high-end fabrics, with local production primarily serving domestic demand. Growth is slow but steady, driven by local craft movements and increasing exposure to global quilting trends via digital media. Economic stability remains a key determinant of consumer spending on non-essential craft supplies and luxury finished goods.

- Middle East and Africa (MEA): The MEA market is highly fragmented. The Middle East exhibits demand for luxury and customized quilted goods, particularly for high-end interior decoration, often utilizing fine silks and specialty embroidery techniques. Africa has strong, localized textile traditions, but the industrial quilting market is generally underdeveloped, focusing mainly on basic machine-made bedding and apparel insulation. Opportunities exist in importing specialized equipment and establishing local training centers to foster the craft economy.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Quilt Market.- Moda Fabrics

- Fons & Porter (F+W Media)

- Connecting Threads (Craftsy)

- Bernina International AG

- Handi Quilter (HQ)

- Aurifil Srl

- Northcott Fabrics

- Robert Kaufman Fabrics

- Hoffman Fabrics

- Janome Corporation

- Quilting Treasures (Cranston Print Works)

- Benartex (Kanvas Studio)

- Springmaid (Springs Global)

- Marcus Fabrics

- Maywood Studio

- Husqvarna Viking (SVP Worldwide)

- Brewer Sewing

- Penny Rose Fabrics

- QT Fabrics

- FreeSpirit Fabrics

Frequently Asked Questions

Analyze common user questions about the Quilt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trajectory of the Quilt Market?

The primary growth drivers are the surge in the global Do-It-Yourself (DIY) and crafting movement, increased consumer spending on customized and high-quality home decor, and the rapid expansion of digital platforms enabling easy access to patterns, kits, and educational content worldwide. Sustainability concerns are also prompting growth in the organic and ethically sourced material segments.

How is the Quilt Market segmented by product, and which segment is growing fastest?

The market is primarily segmented into Finished Quilts, Quilt Kits & Patterns, Supplies, and Machinery. While Finished Quilts hold the largest revenue share, the Quilt Kits and Patterns segment is experiencing the fastest growth, largely due to the convenience they offer to hobbyists and the global scalability of digital pattern distribution.

What is the role of technology, specifically AI, in modern quilting?

Technology plays a critical role through computerized Longarm Quilting Machines, precision laser cutting, and digital fabric printing. AI is increasingly impacting design by generating complex patterns, optimizing material nesting to reduce fabric waste, and personalizing marketing efforts for customized quilt sales, enhancing both efficiency and creative output.

Which geographical region dominates the Quilt Market in terms of consumer spending?

North America currently dominates the Quilt Market in terms of overall consumer spending, supported by a strong established quilting culture, high disposable incomes, and robust retail infrastructure for specialized equipment and high-end fabrics. However, the Asia Pacific region is expected to exhibit the fastest growth rate in the forecast period.

What are the key differences between the artisanal and industrial quilt market segments?

The artisanal segment focuses on bespoke, labor-intensive, often hand-guided creation, emphasizing unique designs, natural materials, and high margins. The industrial segment focuses on high-volume, cost-efficient production using multi-needle automated machinery, synthetic materials, and standardized designs, primarily serving the mass-market bedding and commercial sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager