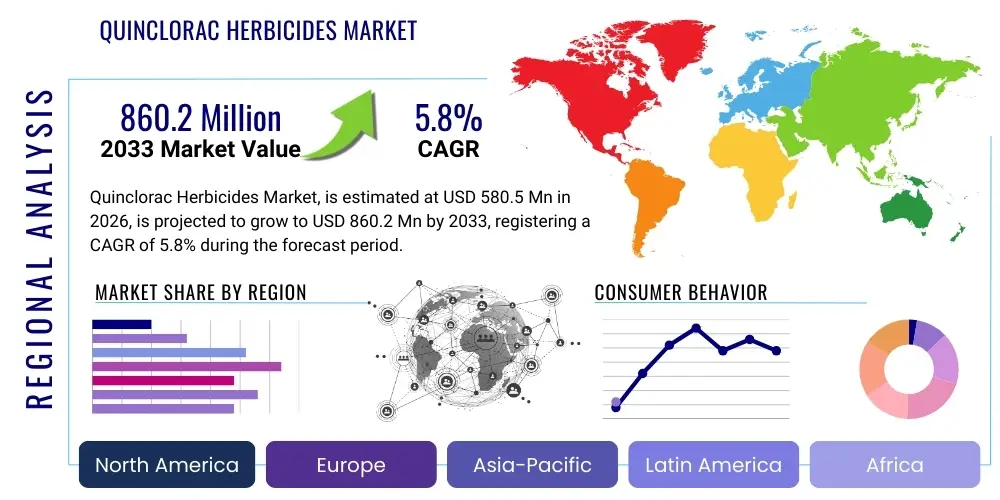

Quinclorac Herbicides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436769 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Quinclorac Herbicides Market Size

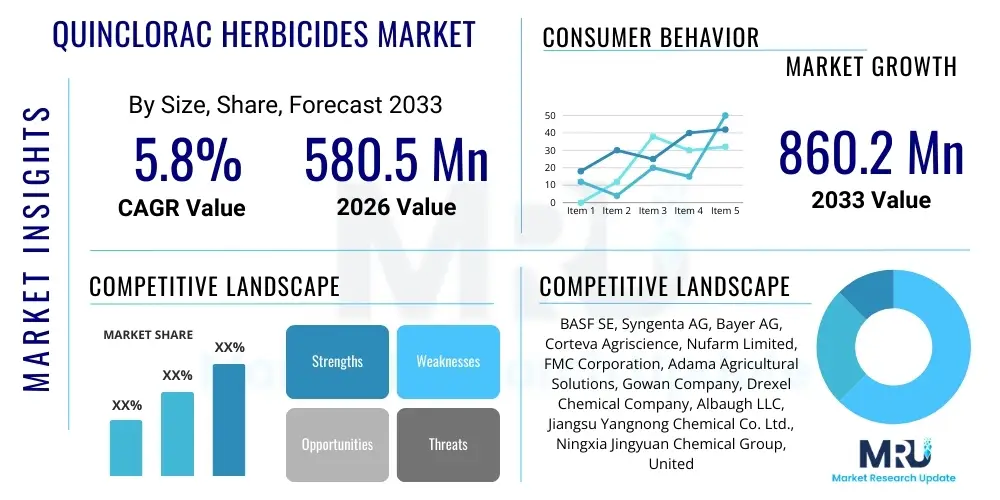

The Quinclorac Herbicides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 580.5 Million in 2026 and is projected to reach USD 860.2 Million by the end of the forecast period in 2033.

Quinclorac Herbicides Market introduction

Quinclorac is a synthetic auxin herbicide primarily utilized for controlling various broadleaf weeds and annual grasses, exhibiting exceptional efficacy in specific major agricultural and non-agricultural sectors. Chemically belonging to the quinoline carboxylic acid group, its primary mode of action involves disrupting plant hormone balance, leading to uncontrolled cell elongation and subsequent plant death. The chemical structure allows it to be particularly effective against challenging weeds like barnyardgrass (Echinochloa crus-galli), a critical threat in rice paddies, and crabgrass (Digitaria spp.) in turfgrass management, establishing it as a cornerstone product in integrated weed management strategies across numerous global regions. Its selective nature ensures crop safety when applied correctly, a significant benefit driving its widespread adoption in high-value crops such as rice and professional lawn care.

The major applications of Quinclorac herbicides span commercial rice cultivation, residential and commercial turf management, and specific uses in controlling invasive species along non-crop areas and infrastructure. In rice farming, which represents its largest application segment, Quinclorac provides crucial post-emergence control, maximizing yield potential in intensive rice production systems prevalent across Asia Pacific. Furthermore, its ability to manage difficult-to-control weeds, especially those developing resistance to older chemistries, underscores its market relevance. The benefits extend beyond weed control to enhanced crop quality and reduced labor costs associated with manual weeding, contributing substantially to agricultural efficiency and sustainability goals.

The market is currently being driven by several macro-environmental factors, including the increasing global demand for rice due to population growth, necessitating higher yields and robust weed management solutions. The persistent challenge of herbicide resistance in various weed biotypes mandates the use of herbicides with diverse modes of action, positioning Quinclorac as an essential rotational component. Additionally, the expansion of commercial landscaping and golf course industries, particularly in North America and Europe, fuels demand for specialized turf herbicides. Regulatory shifts favoring products with low mammalian toxicity profiles further enhance Quinclorac’s competitive position, provided existing regulatory approvals are maintained and extended.

Quinclorac Herbicides Market Executive Summary

The Quinclorac Herbicides market is experiencing robust business trends characterized by strategic formulation advancements and increased geographical penetration, particularly within intensive agricultural zones of the Asia Pacific. The primary growth impetus stems from the reliance of the global rice industry on highly effective post-emergence weed control mechanisms to combat barnyardgrass infestation, coupled with steady demand from the lucrative amenity turf sector. Companies are focusing on developing new liquid and granule formulations that offer improved solubility, enhanced rainfastness, and compatibility with tank-mix partners, optimizing efficacy and ease of application for end-users. Consolidation activities among major agrochemical producers are shaping the competitive landscape, leading to streamlined supply chains and strategic portfolio diversification encompassing patented and generic Quinclorac offerings.

Regionally, Asia Pacific maintains its dominance, driven by extensive rice cultivation in countries such as China, India, and Vietnam, where Quinclorac is critically important for food security and economic stability. However, North America and Europe demonstrate stable, high-value growth primarily centered on the specialized turfgrass market, including golf courses, sports fields, and high-end residential lawns, where aesthetic quality and precise weed control justify premium product pricing. Emerging markets in Latin America, particularly Brazil, are showing potential growth as mechanized rice cultivation expands, offering new avenues for market expansion. The regulatory environment remains a key factor, with stringent pesticide registration processes influencing market entry and product timelines across all major consuming regions.

Segmentation analysis reveals that the soluble liquid concentrate (SL) formulation holds the largest market share due to its ease of mixing and widespread adoption, although water-dispersible granules (WG) are gaining traction for enhanced shelf stability and reduced packaging weight. By crop type, the Rice segment overwhelmingly dominates, reflecting the intrinsic utility of Quinclorac in flooded paddy systems. However, the Turf and Ornamental segment is projected to exhibit a faster growth rate, capitalizing on increased urbanization and investment in professional landscaping services. Future market dynamics will be heavily influenced by the ability of manufacturers to navigate intellectual property challenges and deliver cost-effective, high-performance generic alternatives as original patents expire.

AI Impact Analysis on Quinclorac Herbicides Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Quinclorac Herbicides Market frequently revolve around two core themes: precision application technologies and the optimization of chemical development. Users are keen to understand how AI-driven vision systems and predictive analytics can minimize herbicide usage, specifically by targeting weed patches precisely, thereby reducing environmental impact and application costs associated with broadcast spraying. Concerns also focus on whether AI tools, such as machine learning algorithms, can accelerate the identification of Quinclorac-resistant weed biotypes or assist in the design of new, synergistic formulations that maintain efficacy against resistant strains. Essentially, the market seeks clarity on AI's potential to transition the use of Quinclorac from traditional, widespread application methods to highly specific, site-specific treatment protocols, ensuring both effectiveness and sustainability in weed control.

AI is poised to fundamentally transform the distribution and application efficiency of Quinclorac herbicides through integration with advanced digital agriculture platforms. Machine learning models analyze satellite imagery, drone data, and in-field sensor inputs to create detailed weed maps, enabling Variable Rate Technology (VRT) sprayers to apply Quinclorac only where crabgrass or barnyardgrass pressure is identified above a critical threshold. This precision farming approach significantly reduces the overall volume of herbicide required per hectare, optimizing resource allocation and minimizing off-target chemical drift, which aligns with growing global sustainability mandates and farmer demand for input efficiency. Furthermore, AI helps predict the optimal timing of Quinclorac application based on sophisticated models incorporating weather patterns, soil moisture, and weed growth stage, maximizing the treatment’s efficacy and ensuring successful weed elimination.

Beyond application, AI algorithms are becoming instrumental in accelerating the Research and Development (R&D) lifecycle for agrochemicals, including next-generation Quinclorac formulations or mixtures. High-throughput screening coupled with AI can rapidly model the interaction of Quinclorac with various adjuvants and co-formulants, identifying synergistic mixtures that enhance bio-availability and overcome metabolic resistance mechanisms in weeds. This ability to quickly simulate and test thousands of combinations reduces bench time and laboratory costs. Supply chain optimization is another critical area; AI-powered forecasting tools predict regional demand fluctuations for rice and turf products, allowing manufacturers to manage inventory levels efficiently, ensuring timely delivery and mitigating risks associated with raw material sourcing and logistics bottlenecks.

- AI-driven Variable Rate Technology (VRT) enables site-specific application, reducing Quinclorac consumption by up to 30%.

- Machine learning models enhance weed mapping accuracy for targeted post-emergence spraying in rice and turf.

- AI accelerates R&D by simulating synergistic tank-mix formulations and predicting molecular efficacy against resistant weeds.

- Predictive analytics optimize inventory and logistics, ensuring stable supply chains for seasonal agricultural demand.

- Automated drone scouting integrated with AI identifies early stages of barnyardgrass resistance, informing timely treatment adjustments.

DRO & Impact Forces Of Quinclorac Herbicides Market

The Quinclorac Herbicides market is primarily driven by the indispensable nature of the active ingredient in managing key weed threats in high-value agricultural systems, specifically rice cultivation, globally. However, this growth trajectory is balanced against significant regulatory hurdles and the intrinsic threat of biological evolution, specifically the development of weed resistance. Opportunity lies in expanding into integrated management systems and specialized turf applications. These forces collectively dictate market dynamics, investment decisions, and the speed of innovation in formulation development, ensuring that while demand remains high due to efficacy, the path to sustained growth requires strategic navigation of environmental and regulatory constraints.

Drivers: The fundamental driver is the sustained global dependency on rice as a staple crop, requiring robust solutions against competitive weeds like barnyardgrass, where Quinclorac maintains a high level of efficacy relative to other chemistries. Furthermore, the persistent and increasing incidence of herbicide resistance to other widely used classes, such as acetolactate synthase (ALS) inhibitors, necessitates the rotation and inclusion of different modes of action like Quinclorac, sustaining its demand as a vital tool in resistance management programs. The global expansion of professional turf and amenity horticulture sectors, driven by urbanization and increased leisure spending, provides a stable, high-margin market segment demanding specialized control of perennial and annual grasses like crabgrass.

Restraints: Significant restraints include the increasingly complex and expensive regulatory framework governing agrochemical registration, particularly in mature markets like the European Union and North America, leading to lengthy approval timelines and high compliance costs. The market also faces substantial pressure from increasing occurrences of Quinclorac-resistant weed biotypes documented in various regions, which, if widespread, could undermine its efficacy and necessitate resource-intensive development of new formulations or mixtures. Price volatility of key chemical intermediates and competition from generic manufacturers following patent expiration exert margin pressure, compelling brand-name producers to continuously innovate through formulation science rather than chemical novelty.

Opportunities: Key opportunities lie in the development of sophisticated, low-dose, controlled-release formulations that improve field persistence and reduce environmental exposure, aligning with sustainability trends. The integration of Quinclorac into tailored Integrated Pest Management (IPM) systems, often facilitated by digital agricultural tools, opens new pathways for targeted use and high-efficiency application. There is also a substantial market opportunity in emerging agricultural economies, particularly in Southeast Asia and Africa, where intensification of rice farming methods is underway, increasing the need for modern, effective post-emergence herbicides to maximize yields and secure food supply against rising weed pressures.

Segmentation Analysis

The Quinclorac Herbicides market is primarily segmented based on Formulation Type, Crop Type, and Mode of Action, providing a detailed view of its diverse application landscape and consumer preferences. The dominance of a few specific crop segments, notably rice and turf, defines the demand patterns, while formulation technology dictates ease of use, stability, and environmental risk profile. Understanding these segments is crucial for manufacturers in tailoring their product offerings, optimizing supply chain management, and focusing R&D efforts on enhancing efficacy against specific target weeds and overcoming resistance challenges within high-value markets.

Segmentation by Formulation Type reflects the trade-offs between shelf stability, cost, and field performance. Soluble Liquid (SL) formulations are historically dominant due to their ease of dilution and immediate availability of the active ingredient, making them popular for large-scale agricultural operations. However, Water-Dispersible Granules (WG) and Wettable Powders (WP) are increasing their share, driven by reduced transportation costs, longer shelf life, and often better compatibility in tank mixes. The shift toward microencapsulated or controlled-release formulations represents a technological trend aimed at extending the residual activity of Quinclorac while minimizing immediate environmental exposure, appealing to sustainability-conscious end-users and regulatory bodies.

The segmentation by Crop Type highlights the critical economic importance of Quinclorac in global food production. The Rice segment is the unequivocal market leader, given the product’s unique efficacy against highly competitive rice weeds. Conversely, the Turf and Ornamentals segment, while smaller in volume, commands higher price points due to the specialized nature of turf care, including golf courses, which require aesthetically perfect and weed-free environments. The minor segment comprising non-crop applications, such as managing weeds along railways and industrial sites, contributes to market stability by offering year-round, non-seasonal demand for specialized formulations.

- By Formulation Type:

- Soluble Liquid Concentrates (SL)

- Water Dispersible Granules (WG)

- Wettable Powders (WP)

- Emulsifiable Concentrates (EC)

- By Crop Type:

- Rice

- Turf and Ornamentals (Golf courses, Residential, Commercial)

- Other Crops (e.g., Sorghum, Specific Non-Crop Areas)

- By Application Method:

- Foliar Spray

- Soil Application (Pre-emergence/Early Post-emergence mixes)

- By Mode of Action:

- Auxin Mimicry (Synthetic Auxin)

Value Chain Analysis For Quinclorac Herbicides Market

The value chain for Quinclorac Herbicides begins with the complex upstream sourcing of essential chemical intermediates, primarily involving various substituted quinoline compounds and specialized acids necessary for the synthesis of the active ingredient (AI). This stage is capital-intensive and often concentrated among a few global chemical companies, subjecting the market to potential supply chain disruptions and raw material price volatility. The subsequent critical stage is the chemical synthesis and manufacturing of the technical grade Quinclorac, which requires stringent quality control and adherence to precise chemical reaction parameters. Manufacturers must secure reliable and scalable access to precursors to maintain production capacity and achieve cost efficiencies, especially in light of competitive pressure from generic equivalents.

Midstream activities involve the formulation of the technical grade material into end-use products (e.g., SL, WG, or EC), where innovation in inert ingredients and adjuvants plays a crucial role in enhancing rainfastness, reducing phytotoxicity to crops, and improving shelf stability. Formulation facilities must comply with rigorous environmental and health safety standards. Downstream distribution is managed through a complex network encompassing direct sales to large agricultural cooperatives, specialized distributors catering to the professional turf sector, and retailers serving small farmers and residential users. The effectiveness of the distribution channel hinges on providing localized technical support and agronomic advice regarding optimal timing and mixing protocols, particularly for rice farmers operating under diverse environmental conditions.

The distribution channel is dichotomous: agricultural sales often utilize large-volume, bulk distribution via national distributors who provide credit and logistic services, while the turf and ornamental segment frequently relies on specialized regional distributors who offer premium services, customized small packaging, and high-touch technical consultancy to golf course superintendents. Direct channels are becoming more common for large, consolidated farm operations seeking cost reductions. End-users, who include large commercial rice growers (primarily in APAC) and professional turf management companies (primarily in North America/Europe), base purchasing decisions on proven efficacy against target weeds, pricing, and the reputation of the formulation brand. The strong emphasis on technical service and localized field data is paramount for market penetration and sustained success across all distribution tiers.

Quinclorac Herbicides Market Potential Customers

The primary customer base for Quinclorac Herbicides is highly segmented but predominantly concentrated within the specialized agricultural and non-agricultural sectors where effective control of annual and perennial grasses is paramount. The largest cohort of end-users consists of commercial rice farmers, particularly those utilizing intensive cultivation systems in Asia, who depend on Quinclorac as the most reliable post-emergence defense against barnyardgrass infestations, which can drastically reduce yields. These customers are highly sensitive to product efficacy and cost-efficiency, often requiring bulk purchasing options and relying on strong agronomic support from distributors to maximize application success in varied aquatic environments.

A second, highly specialized customer segment includes professional turf and amenity landscape managers, such as golf course superintendents, municipal park maintenance teams, and commercial lawn care providers. This group prioritizes visual aesthetic quality and highly targeted weed elimination, making them receptive to premium, specialized Quinclorac formulations (e.g., those mixed with safeners or slow-release coatings) tailored for high-end recreational areas. These customers demand reliability, minimal downtime after application, and sophisticated formulations that prevent turf injury while eliminating stubborn weeds like crabgrass. The purchasing cycle in this segment is less seasonal than agriculture, contributing to consistent revenue streams.

Furthermore, indirect buyers, such as agrochemical formulators and compounders, represent significant clients as they purchase technical grade Quinclorac to create proprietary mixtures and branded products for diverse regional markets. Institutional users, including transportation departments managing rights-of-way, utilities maintaining power line corridors, and industrial sites requiring bare ground control, also represent a niche market for specialized Quinclorac applications. These end-users typically require non-selective control alongside residual activity, often blending Quinclorac with other herbicides to achieve broad-spectrum management goals efficiently and effectively across large, non-crop areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580.5 Million |

| Market Forecast in 2033 | USD 860.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, Nufarm Limited, FMC Corporation, Adama Agricultural Solutions, Gowan Company, Drexel Chemical Company, Albaugh LLC, Jiangsu Yangnong Chemical Co. Ltd., Ningxia Jingyuan Chemical Group, United Phosphorus Limited (UPL), Kumiai Chemical Industry Co., Rotam Agrochemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Quinclorac Herbicides Market Key Technology Landscape

The technological evolution within the Quinclorac Herbicides market is primarily focused on optimizing the delivery system and formulation chemistry to enhance field performance, mitigate resistance, and improve environmental safety profiles. A critical technological thrust involves microencapsulation and controlled-release technologies. These advanced formulations enclose the active ingredient within polymer matrices, ensuring a slow, steady release over an extended period. This mechanism maximizes the residual activity of Quinclorac, providing prolonged weed control in systems like flooded rice fields and reducing the frequency of application, which is a major advantage for commercial farmers seeking operational efficiencies and minimizing labor input.

Another pivotal technological area is the development of advanced surfactant and adjuvant systems specifically optimized for Quinclorac. Since Quinclorac is a selective post-emergence herbicide, its efficacy heavily relies on efficient uptake and translocation within the target weed species. Next-generation adjuvant systems utilize non-ionic surfactants and specialized oils to break down the waxy cuticle layer of weeds like crabgrass and barnyardgrass, significantly enhancing foliar absorption. This technological refinement not only boosts efficacy but also allows for potentially lower application rates, further addressing environmental and cost concerns and maintaining product performance even against tougher weed biotypes.

Furthermore, the integration of Quinclorac applications with digital farming tools represents a significant technological shift. High-resolution imagery combined with geospatial data allows for precise mapping of weed populations. This data feeds into prescription maps, enabling Variable Rate Application (VRA) technologies to apply the herbicide differentially across a field based on real-time weed density. This targeted approach, often utilizing GPS-guided sprayers or autonomous application systems, minimizes overall chemical use, reduces input costs for the farmer, and strengthens the overall sustainability credentials of Quinclorac usage, positioning it favorably in modern, highly efficient agricultural ecosystems.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant market for Quinclorac Herbicides, driven by its extensive rice cultivation base. Countries like China, India, and Vietnam are massive consumers, where Quinclorac is essential for controlling barnyardgrass (Echinochloa) in millions of hectares of paddy fields. The region’s growth is characterized by increasing governmental focus on food security, necessitating continuous yield optimization. Market expansion is fueled by rising per capita consumption of rice and the ongoing shift from traditional farming methods to mechanized, chemically intensive agriculture, ensuring high and stable demand for post-emergence weed control solutions.

- North America: North America represents a mature yet high-value market, primarily driven by the professional turf and ornamental sector. Demand centers around controlling difficult annual grass weeds, particularly crabgrass, in commercial settings such as golf courses, sports arenas, and high-end residential lawns. The market here is highly receptive to premium, specialized formulations offering low volatility, extended residual control, and specific application instructions tailored for sensitive turf environments. Strict environmental regulations necessitate continuous innovation in formulation safety and application precision, keeping average selling prices high.

- Europe: The European market for Quinclorac is generally smaller and highly regulated compared to APAC and North America, with specific countries maintaining rigorous approval processes. While agricultural use in rice (e.g., in Spain and Italy) exists, the primary stable demand comes from the professional non-agricultural market, including turf maintenance and industrial weed control. Market dynamics are heavily influenced by the EU's Farm to Fork strategy, which pressures the reduction of chemical inputs, requiring manufacturers to demonstrate exceptional efficacy at minimal dose rates and favorable ecotoxicological profiles.

- Latin America (LATAM): LATAM is an emerging growth hub, particularly due to the expansion of commercial rice cultivation in countries like Brazil, Argentina, and Colombia. These regions are intensifying their agricultural practices to meet rising domestic and export demands, creating a need for effective, high-performance herbicides. Market penetration is accelerating as large-scale farm holdings adopt advanced agrochemical strategies. Infrastructure development and improved distribution networks are key factors supporting robust growth projections for Quinclorac utilization in the region.

- Middle East and Africa (MEA): The MEA region represents a nascent but potentially significant market, driven by sporadic rice cultivation and a growing focus on developing professional landscaping and infrastructure projects in certain Gulf nations. While the agricultural segment is restricted due to arid conditions, the use of Quinclorac in managing weeds along transport corridors and in newly established urban green spaces provides pockets of demand. Market growth is heavily dependent on investment in agricultural modernization and regulatory clarity regarding pesticide imports and use.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Quinclorac Herbicides Market.- BASF SE

- Syngenta AG

- Bayer AG

- Corteva Agriscience

- Nufarm Limited

- FMC Corporation

- Adama Agricultural Solutions Ltd.

- Gowan Company, LLC

- Drexel Chemical Company

- Albaugh LLC

- Jiangsu Yangnong Chemical Co. Ltd.

- Ningxia Jingyuan Chemical Group Co., Ltd.

- United Phosphorus Limited (UPL)

- Kumiai Chemical Industry Co., Ltd.

- Rotam Agrochemical Co. Ltd.

- Hubei Tiansheng Chemical Co., Ltd.

- Lier Chemical Co., Ltd.

- Kenvos Biotech Co., Ltd.

- Sinochem International Corporation

- Cheminova A/S (now part of FMC)

Frequently Asked Questions

Analyze common user questions about the Quinclorac Herbicides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary crop application driving the demand for Quinclorac Herbicides?

The primary crop application driving global demand for Quinclorac Herbicides is commercial rice cultivation, particularly in Asia Pacific. Quinclorac is highly effective as a post-emergence treatment for controlling difficult grass weeds, most notably barnyardgrass (Echinochloa spp.), which significantly impacts rice yield and quality.

How does Quinclorac maintain its efficacy despite increasing herbicide resistance globally?

Quinclorac maintains efficacy because it possesses a unique mode of action—synthetic auxin activity—which differs significantly from many older, overused herbicide classes (like ALS inhibitors). Its utilization in rotational programs prevents cross-resistance development, making it a critical resistance management tool in intensive farming and turf management systems.

Which geographical region holds the largest market share for Quinclorac Herbicides?

The Asia Pacific (APAC) region holds the largest market share for Quinclorac Herbicides. This dominance is directly attributable to the extensive acreage dedicated to rice cultivation in countries such as China, India, and Vietnam, where the need for effective barnyardgrass control is paramount for regional food security.

What technological advancements are influencing the future formulation of Quinclorac products?

Future formulations are being influenced by controlled-release technologies, such as microencapsulation, which extend the residual activity and reduce application frequency. Additionally, the development of optimized adjuvant systems enhances foliar uptake and efficacy, ensuring performance consistency under varying environmental conditions and reducing overall application rates.

Is Quinclorac primarily used for pre-emergence or post-emergence weed control?

Quinclorac is predominantly recognized and utilized as a highly effective selective post-emergence herbicide. It is most successful when applied to actively growing target weeds, such as 1-to-4-tiller barnyardgrass in rice or early-stage crabgrass in turf, allowing for precise and targeted control after the crop or turfgrass has emerged.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager