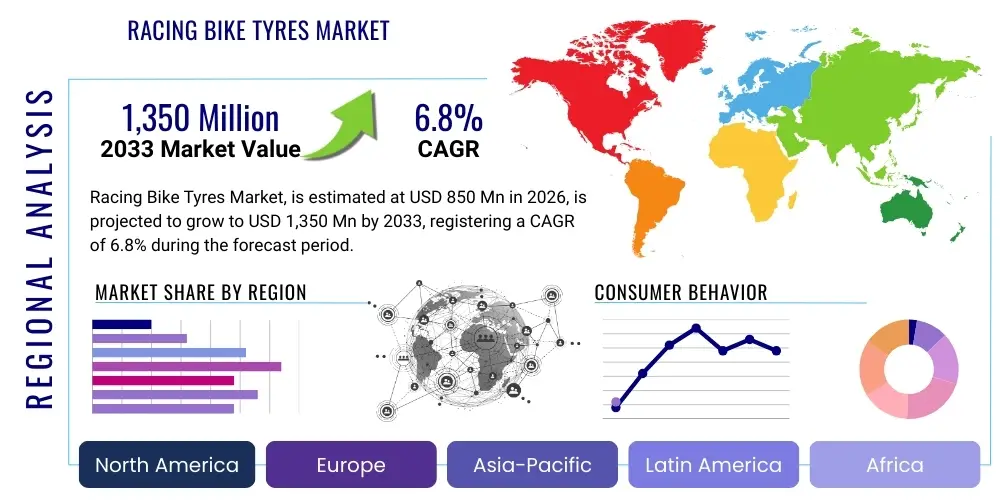

Racing Bike Tyres Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437401 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Racing Bike Tyres Market Size

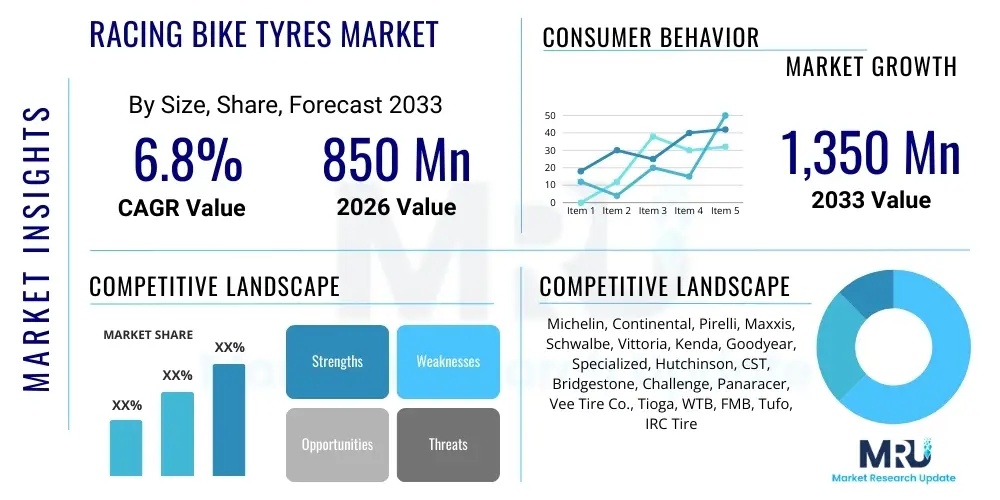

The Racing Bike Tyres Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust growth trajectory is underpinned by increasing global interest in professional cycling events, rising disposable income leading to higher participation in amateur racing, and continuous technological advancements in tyre materials and construction designed for optimal speed and grip. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,350 million by the end of the forecast period in 2033, demonstrating a significant expansion in volume and value driven primarily by the high-performance segment.

The valuation reflects the specialized nature of racing tyres, which command a premium price due to extensive research and development focused on minimizing rolling resistance, maximizing puncture protection, and optimizing handling characteristics under extreme conditions. Furthermore, the short replacement cycle inherent to competitive cycling, where performance degradation mandates frequent tyre changes, contributes substantially to the sustained market demand and overall size. Key regions, particularly Europe and North America, remain central hubs for competitive cycling infrastructure, fueling consistent demand for premium racing consumables.

Racing Bike Tyres Market introduction

The Racing Bike Tyres Market encompasses highly specialized pneumatic components designed explicitly for competitive cycling disciplines, including professional road racing, time trials, cyclocross, and cross-country mountain biking. These products prioritize attributes such as low rolling resistance, exceptional cornering grip, reduced weight, and predictable handling, often balancing these performance needs against considerations of wear resistance and puncture protection, which are paramount in high-stakes environments. The primary product categories include tubular tyres, clincher tyres, and the increasingly dominant tubeless systems, each serving distinct professional or high-performance amateur segments, dictated by specific race conditions and rider preference.

Major applications of these tyres extend across international governing body events like the UCI World Tour, national championships, and a burgeoning ecosystem of organized amateur endurance events. The intrinsic benefits of using dedicated racing tyres include marginal performance gains critical for competitive advantage, enhanced safety through superior grip in wet or high-speed cornering, and weight reduction that improves acceleration and climbing efficiency. The market is fundamentally driven by technological innovation, the escalating professionalism of cycling teams demanding the absolute best equipment, and consumer adoption of elite technologies filtering down to performance enthusiasts.

Driving factors propelling market expansion include the globalization of major cycling events, substantial investment in sports marketing by tyre manufacturers to validate product performance at the highest levels of competition, and the continuous material science breakthroughs, such as the incorporation of graphene and advanced silica compounds, which allow manufacturers to achieve previously unattainable balances of speed, durability, and grip. Moreover, the increasing adoption of tubeless technology in road racing is revolutionizing the market, offering puncture resilience and the ability to run lower pressures for improved comfort and speed, making it a pivotal growth catalyst.

Racing Bike Tyres Market Executive Summary

The Racing Bike Tyres Market is characterized by intense technological competition and a pronounced shift towards tubeless systems, marking the most critical business trend impacting leading manufacturers like Continental, Michelin, and Vittoria. These firms are heavily investing in R&D to optimize bead design, sealant compatibility, and carcass construction to meet the rigorous demands of professional teams transitioning away from traditional tubular setups. Furthermore, sustainability is emerging as a critical trend, with manufacturers exploring bio-based or recycled rubber components to appeal to environmentally conscious consumers and adhere to stricter global manufacturing standards, signaling a longer-term strategic shift in product development.

Regionally, Europe retains its status as the market powerhouse, dictated by the concentration of professional cycling infrastructure, iconic races, and a deeply entrenched cycling culture, leading to the highest per-capita consumption of high-performance tyres. However, the Asia Pacific (APAC) region is demonstrating the most significant growth momentum, fueled by rising affluence in economies like China and India, increased government support for cycling infrastructure, and the subsequent expansion of domestic and international racing calendars. North America continues to be a crucial market for technological adoption, especially in niche segments like gravel and endurance racing, driving demand for specialized, durable products.

Segment trends reveal that the Tubeless segment is poised for the fastest expansion, gradually eroding the dominance of the traditional Clincher and Tubular segments, particularly in the road racing domain. In terms of application, the Road Racing segment holds the largest market share due to the sheer volume and global exposure of professional road events. Material science segmentation highlights the accelerating use of advanced composite materials and specialized rubber blends designed to offer superior all-weather grip without compromising the crucial metric of rolling resistance, demonstrating a market emphasis on holistic performance attributes rather than single-metric optimization.

AI Impact Analysis on Racing Bike Tyres Market

Common user questions regarding AI's influence in the Racing Bike Tyres Market primarily revolve around how artificial intelligence and machine learning (ML) contribute to material science breakthroughs, optimize tyre design, and enhance manufacturing efficiency. Users frequently inquire if AI can predict tyre wear patterns more accurately than traditional methods, how it aids in simulating complex road-tyre interaction under varying race conditions, and if it will lead to the creation of truly "smart tyres" capable of real-time data feedback. The core concern centers on leveraging AI to achieve the theoretical limit of rolling resistance reduction while maintaining safety and durability, areas where traditional R&D methods often involve costly, time-consuming physical prototyping and testing. The key themes summarized from user inquiries emphasize the expectation of faster innovation cycles, highly customized products, and increased manufacturing consistency driven by AI-powered quality control.

AI's role is rapidly expanding beyond simple data analysis into predictive engineering and material discovery. ML algorithms are now employed to analyze massive datasets of material properties, test results, and performance telemetry from professional races, identifying optimal compound mixtures and carcass constructions that minimize energy loss and maximize surface contact area. This predictive capability significantly reduces the time required for compound development, allowing manufacturers to quickly iterate on formulations incorporating novel materials like enhanced silicas or specialized polymers. Furthermore, AI-driven simulations allow designers to model the dynamic deformation of the tyre during cornering and braking with unprecedented accuracy, ensuring the final product delivers predictable and superior performance across a wider range of temperatures and pressures encountered during competitive events.

In manufacturing, AI and computer vision systems are integrated into the curing and assembly lines to ensure consistency, a critical factor in high-performance tyres where slight variations can compromise structural integrity or performance metrics like rolling resistance. AI-powered quality control systems monitor vulcanization processes, detecting anomalies in rubber density or structural flaws invisible to the human eye, thereby dramatically reducing defect rates and ensuring that every unit meets the exacting standards demanded by elite athletes. This integration of AI optimizes resource usage, lowers production costs, and accelerates the scaling of highly complex, multi-compound tyre designs, directly impacting market supply and profitability.

- AI-driven material simulation accelerates the discovery of optimal rubber compounds, reducing R&D cycles.

- Machine learning algorithms analyze race telemetry data to customize tread patterns and sidewall stiffness based on specific course requirements.

- Predictive modeling optimizes manufacturing processes, ensuring consistent curing and minimizing variations in rolling resistance across product batches.

- Integration of smart sensors and AI processors enables real-time tyre pressure, temperature, and wear monitoring for enhanced safety and performance optimization.

- AI-powered visual inspection systems enhance quality control, drastically lowering defect rates in high-precision racing tyre production.

DRO & Impact Forces Of Racing Bike Tyres Market

The Racing Bike Tyres Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary impact forces shaping the industry's evolution and profitability. Key drivers include the perpetual need for speed and efficiency in professional sports, which mandates continuous investment in performance-enhancing equipment, thereby sustaining the demand for premium, short-lifespan products. Restraints often center on the high costs associated with advanced material sourcing (e.g., graphene, specialized elastomers), the inherent trade-off between speed and durability that limits product lifespan, and the vulnerability of the supply chain to fluctuations in petrochemical pricing. Opportunities, conversely, lie in the rapid growth of non-traditional racing segments such as gravel and e-bike racing, the development of sustainable rubber alternatives, and the commercialization of smart tyre technology offering real-time performance diagnostics.

Impact forces stemming from technological progress are particularly pronounced; the shift from traditional clinchers to highly efficient tubeless systems is compelling major manufacturers to re-engineer their entire product lines, creating both competitive pressure and new market potential. The impact of regulatory bodies, such as the UCI (Union Cycliste Internationale) setting technical specifications for racing equipment, acts as a constraining force on radical innovation, yet simultaneously guarantees a baseline of safety and fair competition. Economic forces, particularly the expansion of the affluent demographic interested in high-end sporting goods across APAC, provide a strong positive momentum, counteracting the cyclical nature of demand typically associated with performance-focused markets.

The overall market trajectory is driven by a strong alignment between consumer expectations for professional-grade performance and manufacturers' capabilities to deliver increasingly complex, multi-compound tyres. The force of competitive differentiation means companies must continually innovate—not just in raw materials, but also in specialized manufacturing techniques and patented technologies like specific casing layouts or tread treatments—to justify the premium pricing structure essential for funding further R&D. The ability of a manufacturer to successfully manage the delicate balance between minimizing rolling resistance (a primary driver) and maximizing puncture resistance (a critical consumer expectation) will ultimately determine market leadership and sustained growth throughout the forecast period.

Segmentation Analysis

The Racing Bike Tyres Market is segmented based on Type, Application, Material, and Distribution Channel, allowing for precise market analysis tailored to specific consumer needs and technological adoption rates. Segmentation by Type—Tubeless, Tubular, and Clincher—is particularly dynamic, reflecting the ongoing transition in professional road cycling towards tubeless setups due to superior puncture resistance and performance at lower pressures. The Application segmentation clearly delineates demand profiles across Road Racing (largest volume), Mountain Biking Racing (demanding robust grip and durability), and Cyclocross (requiring specialized mud-shedding tread patterns). Material composition is increasingly vital, moving beyond standard butyl or natural rubber to incorporate high-performance additives like carbon black, advanced silica, and cutting-edge materials such as graphene, dictating pricing and performance characteristics.

Analyzing these segments provides crucial insights into market opportunities. For instance, while Tubular tyres retain a niche dominance in highly specific professional time trial environments due to low weight, the broader market growth is overwhelmingly driven by Tubeless systems, which offer a compelling balance of speed, weight, and everyday reliability for both professional training and elite amateur racing. Manufacturers are strategically allocating R&D resources towards solving the remaining challenges of tubeless installation and compatibility across different rim types to capture this high-growth segment. Furthermore, the Mountain Biking Racing segment requires constant innovation in tread compounds and sidewall reinforcement to handle increasingly technical and aggressive race courses, creating specialized demand distinct from road applications.

The interplay between Material and Application segments is crucial; for example, tyres destined for wet road racing heavily rely on advanced silica compounds for maximizing water dispersion and grip, whereas dry, fast road races often utilize formulations optimized strictly for minimizing rolling resistance, potentially incorporating graphene for structural integrity without significant weight penalties. Distribution analysis shows a high reliance on specialized bike shops and online performance retailers, as consumers in this market seek expert advice and direct access to high-end, niche products. Understanding these granular segment dynamics is essential for market participants planning product launches, optimizing supply chains, and targeting specific high-value customer demographics globally.

- By Type:

- Tubeless

- Tubular

- Clincher (Foldable/Wire Bead)

- By Application:

- Road Racing (Including Time Trials)

- Mountain Biking Racing (MTB Cross-Country, Downhill)

- Cyclocross and Gravel Racing

- By Material:

- Natural Rubber

- Synthetic Rubber and Elastomers

- Silica Compounds

- Carbon Black and Graphene Composites

- By Distribution Channel:

- Specialty Bike Retailers

- Online Sales Channels

- Original Equipment Manufacturers (OEM)

Value Chain Analysis For Racing Bike Tyres Market

The Value Chain for the Racing Bike Tyres Market is intensive and highly specialized, beginning with the upstream segment dominated by petrochemical suppliers and specialized compound manufacturers providing natural rubber, synthetic polymers (e.g., butyl, latex), carbon black, silica, and advanced additives like aramid fibers and graphene. Control over proprietary rubber blending formulas and access to high-quality raw materials are critical leverage points in this phase, as material purity and consistency directly translate into the final tyre's performance metrics, such as rolling resistance and grip. Manufacturing involves complex, multi-stage processes including compounding, extrusion, casing construction (often hand-made for tubulars), and highly controlled vulcanization (curing), where manufacturers must maintain strict quality standards to ensure performance and structural integrity suitable for high-speed racing.

The downstream analysis focuses heavily on market distribution and end-user engagement. Due to the technical nature and high cost of racing tyres, the distribution channel relies significantly on specialized, knowledgeable intermediaries. Direct channels include supplying Original Equipment Manufacturers (OEMs) for high-end race bikes and direct contractual relationships with professional cycling teams, which serve as crucial validation platforms and marketing assets. Indirect distribution is dominated by specialty bicycle retailers, both brick-and-mortar and sophisticated online performance shops. These retailers provide essential expertise on installation, pressure setting, and product compatibility, acting as trusted advisors to the performance cycling community and ensuring correct product application, which is vital for consumer safety and satisfaction.

The efficiency of the distribution network is crucial for maintaining market responsiveness, especially given the continuous technological updates and seasonal product releases. Manufacturers frequently employ a dual-channel strategy: leveraging direct sales to elite teams for instant feedback and high-visibility marketing, while relying on the established dealer network for broad consumer reach and service. The strong link between racing success and commercial appeal means that performance validation, often through sponsorships and victories in major events, adds significant, non-material value to the product line, reinforcing the overall premium positioning within the value chain and sustaining high profit margins for market leaders who successfully manage their intellectual property and brand perception.

Racing Bike Tyres Market Potential Customers

The primary customer base for the Racing Bike Tyres Market consists of distinct segments unified by a pursuit of peak cycling performance and a willingness to invest significantly in marginal gains. The most critical segment comprises professional cycling teams and elite athletes across road, mountain, and cyclocross disciplines. These buyers operate on annual contracts and strict equipment regulations, prioritizing the absolute lowest rolling resistance and best grip, regardless of lifespan, viewing tyres as critical determinants of race outcomes. Their purchasing decisions are often centralized, driven by sponsorship contracts and technical performance data provided by manufacturer R&D teams, often leading to rapid adoption of the newest, most expensive technologies.

The second major group is the high-performance amateur and master racer community, often referred to as performance cycling enthusiasts. These consumers participate in local and national competitive events and seek professional-grade equipment to enhance their own performance. While price sensitive compared to professional teams, they prioritize a balance of performance (speed and grip) and practical factors, such as durability and reasonable puncture protection for extended training use. Their purchasing is heavily influenced by reviews, technical specifications, and the equipment used by professional athletes they admire, making targeted digital marketing and specialized retail advice highly effective channels for engagement.

A growing segment includes manufacturers of premium, high-end racing bicycles (OEMs), who constitute large-volume buyers integrating racing tyres onto their top-tier models to attract performance-focused consumers. For OEMs, the tyres serve as a critical component in the overall bike package, enhancing the perceived value and performance capabilities of the bicycle upon purchase. These potential customers demand consistent quality, reliable supply chains, and advanced technological features that can be prominently marketed, requiring B2B negotiations focused on long-term supply agreements and joint marketing initiatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Continental, Pirelli, Maxxis, Schwalbe, Vittoria, Kenda, Goodyear, Specialized, Hutchinson, CST, Bridgestone, Challenge, Panaracer, Vee Tire Co., Tioga, WTB, FMB, Tufo, IRC Tire |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Racing Bike Tyres Market Key Technology Landscape

The technology landscape within the Racing Bike Tyres Market is highly competitive and centered around achieving superior performance through advanced material science and manufacturing precision. A pivotal technological trend is the extensive application of nanotechnology, specifically the integration of graphene, which significantly enhances the mechanical properties of rubber compounds. Graphene-infused tyres exhibit markedly lower rolling resistance while simultaneously improving wet grip and puncture resistance, a critical achievement in mitigating the traditional performance trade-off. This technology requires specialized compounding techniques and precise dispersion methods to ensure the nanomaterial's benefits are fully realized throughout the tyre structure, differentiating premium offerings from standard rubber compositions.

Another crucial area is the refinement of Tubeless Ready (TR) systems for high-pressure road applications. This involves the development of high-TPI (Threads Per Inch) casings that are supple yet airtight, coupled with proprietary bead materials designed to seat securely onto hookless and hooked rims without compromising structural integrity under extreme forces. Manufacturers are investing heavily in Finite Element Analysis (FEA) software to simulate tyre deformation under dynamic loads, allowing engineers to optimize tread curvature, sidewall support, and casing ply layup before physical prototyping, thereby accelerating the design cycle and ensuring predictable handling at race speeds. This simulation technology is essential for fine-tuning the pneumatic performance of tubeless setups.

Furthermore, manufacturing precision, particularly the automated application of multi-compound treads, represents a significant technological barrier and competitive advantage. High-end racing tyres often feature distinct rubber compounds in the center for speed and on the shoulders for cornering grip. Advanced extrusion and curing processes, frequently employing robotics and thermal monitoring, ensure seamless transitions between these compounds and consistent adhesion to the high-TPI casing. This precision manufacturing, often coupled with advanced quality control using AI-driven optical scanners, guarantees the homogeneity and reliability demanded by professional competitors, solidifying the technological dominance of established market leaders who possess these specialized production capabilities.

Regional Highlights

The global Racing Bike Tyres Market exhibits pronounced regional variances in demand, technological maturity, and market size, dictated largely by local cycling culture, economic development, and infrastructure for competitive racing. Europe is unquestionably the dominant market leader, driven by its historical status as the epicenter of professional road cycling. Countries such as Italy, France, Belgium, and Spain host the majority of iconic UCI World Tour events, translating into high demand from professional teams, a robust network of specialty retailers, and a large, performance-conscious consumer base. European manufacturers also benefit from proximity to key R&D centers and leading cycling component brands, fostering rapid technological adoption, particularly concerning high-end tubular and tubeless systems.

North America (primarily the US and Canada) constitutes the second largest market, characterized by strong growth in niche segments, especially mountain biking racing (MTB) and the rapidly expanding gravel racing scene. Consumers in this region are early adopters of technology and prioritize versatility and durability alongside performance, leading to strong demand for specialized tubeless and reinforced casing designs capable of handling diverse terrains. The market is also heavily influenced by direct-to-consumer sales and online channels, requiring manufacturers to maintain a strong digital presence and provide extensive technical support, catering to a highly engaged and technically literate consumer base.

Asia Pacific (APAC) represents the fastest-growing region, projected to significantly increase its market share throughout the forecast period. This growth is attributable to rising affluence, increasing governmental and corporate investment in developing cycling infrastructure and promoting sports participation, particularly in rapidly urbanizing economies like China, Japan, and Australia. While the market initially lagged in adopting premium racing technologies, the influx of international professional events and the growing middle class’s disposable income dedicated to leisure and high-performance sporting goods are now driving explosive demand for advanced tyres, establishing APAC as the key future battleground for market share expansion.

- Europe: Dominant market share due to established professional road cycling culture, high concentration of R&D, and premium consumer spending on competitive gear. Key countries include Italy, Germany, and France.

- North America: Significant growth in specialized segments like MTB and gravel racing; characterized by early technology adoption and a high proportion of online sales for performance products.

- Asia Pacific (APAC): Highest CAGR, fueled by increasing disposable income, government promotion of cycling, and the professionalization of local racing scenes in China, Japan, and Australia.

- Latin America (LATAM): Emerging market with growing interest in competitive cycling, often focusing on value-performance products but showing increasing demand for established global brands in specific segments.

- Middle East & Africa (MEA): Small but emerging market, driven primarily by investments in high-end sporting events and luxury consumer spending in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Racing Bike Tyres Market. These companies are actively engaged in strategic initiatives such as advanced material research, global distribution channel optimization, and high-profile team sponsorships to maintain and expand their competitive edge in this high-performance sector.- Michelin

- Continental

- Pirelli

- Maxxis

- Schwalbe

- Vittoria

- Kenda

- Goodyear

- Specialized

- Hutchinson

- CST

- Bridgestone

- Challenge

- Panaracer

- Vee Tire Co.

- Tioga

- WTB (Wilderness Trail Bikes)

- FMB (FMB Tubulars)

- Tufo

- IRC Tire (Inoue Rubber Co.)

Frequently Asked Questions

Analyze common user questions about the Racing Bike Tyres market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant technological trend impacting the racing bike tyre market currently?

The shift towards tubeless technology (Tubeless Ready) for high-performance road racing is the most significant trend. Tubeless systems offer superior puncture resistance, the ability to run lower pressures for increased comfort and grip, and minimal rolling resistance compared to traditional tubular or clincher setups, driving market innovation and new product development globally.

How does the incorporation of materials like graphene affect racing tyre performance?

Graphene integration significantly improves the performance triangle of speed, grip, and durability. It enhances the structural integrity of the rubber compound, allowing manufacturers to reduce rolling resistance without sacrificing wet weather grip or increasing the risk of punctures, making it a critical differentiator in premium race tyre manufacturing.

Which regional market is exhibiting the fastest growth in racing bike tyre consumption?

The Asia Pacific (APAC) region is demonstrating the fastest Compound Annual Growth Rate (CAGR). This acceleration is due to rising disposable incomes, increased investment in professional cycling events, and a burgeoning affluent consumer base willing to purchase high-end performance cycling equipment, particularly in developing economies.

What is the primary factor driving the premium pricing strategy in the racing tyre segment?

The primary factor is the intensive Research and Development (R&D) expenditure required for material science innovation and proprietary manufacturing processes. Racing tyres are highly specialized, requiring frequent testing and short product cycles to meet the demanding performance standards of professional competition, justifying the premium pricing structure.

What is the typical lifespan for a high-performance racing bike tyre?

The typical lifespan for a high-performance racing tyre is relatively short, often ranging from 1,000 to 3,000 kilometers, depending on the specific compound, race application (road vs. training), and rider weight. Racing tyres prioritize marginal gains in speed over maximum durability, necessitating frequent replacement to maintain optimal performance characteristics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager