Radiation Cured Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433309 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Radiation Cured Market Size

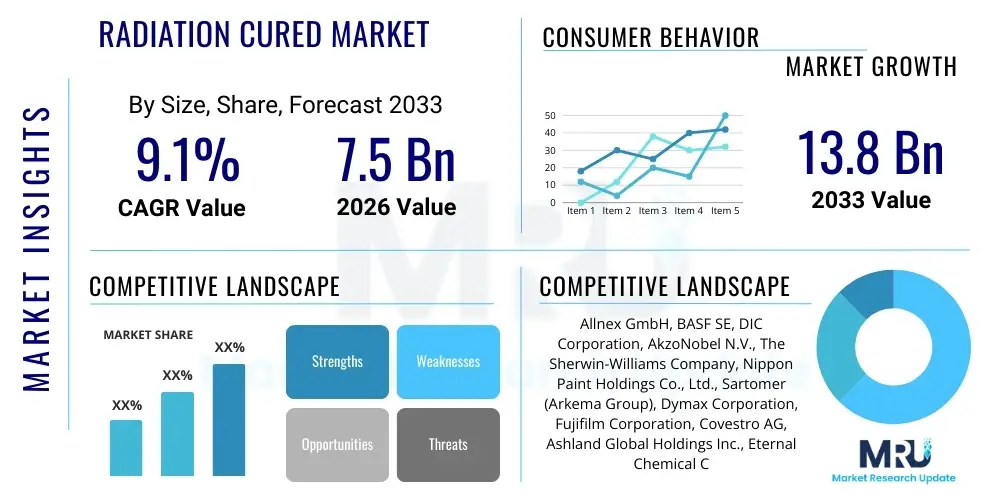

The Radiation Cured Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.1% between 2026 and 2033. The market is estimated at $7.5 Billion USD in 2026 and is projected to reach $13.8 Billion USD by the end of the forecast period in 2033.

Radiation Cured Market introduction

The Radiation Cured Market encompasses advanced material systems, primarily coatings, inks, and adhesives, that undergo rapid polymerization when exposed to high-intensity radiation sources, predominantly Ultraviolet (UV) light or Electron Beam (EB) energy. These materials, typically composed of reactive oligomers, monomers, and photoinitiators (for UV systems), are highly valued across industrial applications due to their ability to cure instantly, offering superior performance characteristics such as exceptional chemical resistance, high gloss, abrasion durability, and minimal Volatile Organic Compound (VOC) emissions. This technology represents a crucial shift away from traditional solvent-borne systems, aligning directly with stringent global environmental regulations and increasing demand for high-throughput manufacturing processes.

The primary benefit driving the widespread adoption of radiation curing is the environmental advantage it offers, providing a 100% solid formulation that eliminates or significantly reduces the need for solvents, thus contributing to a cleaner manufacturing footprint. Applications span a vast range of sectors, including protective coatings for high-end wood finishes, functional inks for flexible packaging and digital printing, and high-performance adhesives critical in electronics assembly and automotive components. The technology’s quick curing speed, often measured in seconds or milliseconds, dramatically increases production efficiency, reduces energy consumption compared to thermal drying, and minimizes floor space requirements in production facilities.

Key driving factors fueling market expansion include the proliferation of digital printing technologies that rely heavily on UV-curable inks for speed and quality, the burgeoning demand for sustainable and food-safe packaging solutions, and the continuous innovation in LED-UV technology which offers smaller footprints, lower energy costs, and increased thermal sensitivity for curing on delicate substrates. Furthermore, the mandatory reduction of VOC emissions mandated by global regulatory bodies such as the EPA and REACH continues to push industries toward these environmentally benign curing methods, solidifying the market's long-term growth trajectory.

Radiation Cured Market Executive Summary

The Radiation Cured Market is experiencing robust growth fueled primarily by sustainability mandates and technological advancements in curing equipment, particularly the maturation and cost reduction of UV-LED systems. Current business trends indicate a strong focus on developing specialized oligomers and monomers that offer enhanced performance traits, such as increased flexibility for packaging films and superior scratch resistance for automotive clearcoats, allowing material producers to capture premium margins in high-specification end-use sectors like aerospace and medical devices. The industry is also seeing consolidation among major chemical manufacturers seeking to integrate vertically and offer complete system solutions, encompassing raw materials, equipment, and application support, thereby simplifying the transition for new adopters.

Regionally, Asia Pacific (APAC) continues to dominate the market share, driven by rapid industrialization, the booming electronics manufacturing sector (especially in China, South Korea, and Taiwan), and massive expansion in the packaging industry, particularly flexible packaging requiring high-speed UV flexo and offset inks. North America and Europe, while mature markets, are leading the charge in high-value applications and regulatory compliance, with stringent environmental regulations (like the EU's Industrial Emissions Directive) compelling a faster transition from solvent-based systems to radiation-cured alternatives. This regulatory pressure is fostering innovation in bio-based and renewable content formulations within radiation-curable chemistry.

Segment trends reveal that the coatings application segment maintains the largest market share due to its heavy usage in industrial wood, metal, and plastic finishing, emphasizing protective and aesthetic attributes. However, the adhesive segment is projected to exhibit the highest CAGR, primarily fueled by specialized requirements in microelectronics, display bonding, and medical device assembly where instant, strong, and precise bonding is critical. Within the material segmentation, acrylic oligomers remain the foundational building blocks, though specialty chemistries such as urethane acrylates and polyester acrylates are gaining prominence for applications demanding high flexibility and outdoor weathering capabilities, optimizing the final product for specific performance criteria.

AI Impact Analysis on Radiation Cured Market

User inquiries regarding AI's impact on the Radiation Cured Market predominantly focus on optimizing formulation complexity, enhancing quality control consistency, and implementing predictive maintenance for high-value curing equipment. Common user concerns revolve around whether AI algorithms can successfully manage the combinatorial complexity of monomer/oligomer/photoinitiator ratios to achieve specific end-use properties (e.g., hardness, flexibility, adhesion) faster than traditional R&D. Furthermore, users seek confirmation on AI's role in real-time monitoring of curing parameters (like dose uniformity and temperature spikes) to prevent defects in high-speed lines, and its capability to predict maintenance needs for expensive UV lamps or EB generators based on operational data analysis, minimizing unscheduled downtime which is highly costly in continuous industrial processes.

- AI-driven Formulation Optimization: Utilizing machine learning algorithms to rapidly screen thousands of potential chemical combinations, drastically accelerating the R&D cycle for specialty radiation-curable materials with targeted performance profiles (e.g., specific elasticity, glass transition temperature).

- Real-time Quality Control (QC): Implementing vision systems and AI pattern recognition to monitor coating thickness, cure depth, and surface defects during high-speed application, ensuring immediate process correction and reducing waste materials.

- Predictive Maintenance: Analyzing sensor data from UV lamps (intensity, temperature, power consumption) or EB units to anticipate component failure, scheduling proactive replacement, and extending the operational lifespan of critical curing equipment.

- Process Parameter Optimization: Applying AI to dynamically adjust curing line speed, radiation dose, and inert atmosphere levels based on substrate variation and environmental conditions (humidity/temperature), guaranteeing consistent cure quality across production batches.

- Supply Chain Forecasting: Utilizing predictive analytics for raw material procurement (monomers and specialized additives) to mitigate supply chain volatility and ensure continuous production of radiation-curable components.

DRO & Impact Forces Of Radiation Cured Market

The market dynamics of the Radiation Cured sector are heavily influenced by the stringent global shift toward sustainability and the requirement for high-efficiency manufacturing. The primary drivers include favorable governmental regulations curtailing VOC emissions and the inherent benefits of these systems, such as instant cure speeds and reduced energy consumption compared to thermal systems. However, the market faces significant restraints, chiefly the high initial capital investment required for specialized curing equipment (particularly EB systems and high-power UV-LED units) and the need for skilled personnel to handle complex photoinitiator chemistry and equipment calibration. Opportunities are abundant in niche high-growth sectors, particularly the integration of radiation curing into 3D printing (additive manufacturing) and the development of curable electronics (OLED displays, flexible circuitry), presenting pathways for sustained market expansion.

Impact forces acting upon this market are predominantly regulatory pressure and technological evolution. Regulatory bodies worldwide are continuously tightening limits on hazardous air pollutants (HAPs) and VOCs, acting as a profound external force compelling manufacturers to adopt radiation curing systems which are inherently low-VOC or zero-VOC. Simultaneously, the rapid advancement in UV-LED technology, offering longer lamp life, reduced heat generation, and lower operational costs compared to traditional mercury vapor lamps, is an internal technological force actively lowering the adoption barrier for medium and small-scale enterprises. These forces combine to create a highly competitive environment where innovation in both material chemistry (e.g., non-yellowing formulations) and equipment design is crucial for securing market leadership.

The balance between high initial investment and long-term operational savings is a critical factor influencing market penetration. While large corporations readily adopt these systems due to economies of scale and capacity expansion needs, smaller manufacturers often delay investment due to the substantial upfront cost, especially in developing economies. However, the growing availability of financing models, combined with increasing operational cost advantages (reduced energy bills, faster turnover), is gradually mitigating this restraint. Furthermore, market expansion is heavily dependent on overcoming formulation challenges associated with curing highly opaque or pigmented materials, an area where advancements in high-powered LED sources and specialized initiators are making significant headway.

Segmentation Analysis

The Radiation Cured Market is comprehensively segmented based on its fundamental chemical composition (Material Type), its ultimate functional application (Application), and the industrial sector where it is utilized (End-Use Industry). This multi-layered segmentation allows for precise market sizing and strategic focus, highlighting that performance characteristics are directly tied to the oligomer backbone used, market demand is concentrated heavily in industrial coatings and packaging, and regulatory compliance drives adoption across all industrial sectors. The segmentation confirms the dominance of acrylates due to their reactivity and versatility, while showcasing the rapid growth of specialized adhesives and inks driven by the electronics and graphic arts industries.

- By Material Type:

- Oligomers (Epoxy Acrylates, Urethane Acrylates, Polyester Acrylates, Polyether Acrylates)

- Monomers (Mono-functional, Di-functional, Multi-functional)

- Photoinitiators and Photoinhibitors

- Additives (Wetting Agents, Defoamers, Stabilizers)

- By Application:

- Coatings (Wood, Plastic, Metal, Paper & Film, Others)

- Inks (Flexo, Litho, Screen, Inkjet/Digital)

- Adhesives (Pressure Sensitive Adhesives, Structural Adhesives, Laminating Adhesives)

- By End-Use Industry:

- Packaging (Food & Beverage, Industrial, Pharmaceutical)

- Graphic Arts

- Automotive & Transportation

- Electronics (Display Manufacturing, Semiconductors)

- Industrial Wood Finishing

- Medical & Healthcare

Value Chain Analysis For Radiation Cured Market

The value chain for the Radiation Cured Market begins with the upstream procurement of essential chemical precursors, predominantly petrochemical derivatives such as acrylic acid, epoxy resins, polyurethane polyols, and various amines, which are then processed by specialty chemical manufacturers into functional oligomers and monomers. This upstream segment is highly concentrated, involving major global chemical players responsible for synthesizing the reactive base materials. Quality control at this stage is paramount, as the purity and consistency of these building blocks directly dictate the performance characteristics (e.g., cure speed, toughness, chemical resistance) of the final formulation.

Moving downstream, the specialized formulators (Tier 1 suppliers like DIC, Allnex, and BASF) take these raw materials, along with specialized photoinitiators and performance additives, to develop market-ready radiation-curable coatings, inks, and adhesives tailored for specific application needs, such as non-migratory inks for food packaging or high-index coatings for optical fibers. This formulation step requires significant intellectual property and application expertise. The distribution channel for these sophisticated products is predominantly direct-to-customer for large industrial consumers (e.g., automotive OEMs, major packaging converters) where technical support and customized batches are required, ensuring precise integration into complex manufacturing lines.

For smaller batches or highly specialized applications, indirect distribution through specialized regional chemical distributors plays a key role, providing localized inventory management and technical service. The final stage involves the end-user application across industrial coating lines, high-speed printing presses, or automated assembly robots, often utilizing integrated curing equipment supplied by dedicated machinery manufacturers (e.g., IST Metz, Honle). The efficiency of this downstream ecosystem, driven by seamless integration between the material, the curing equipment, and the application process, is essential for maximizing the benefits of radiation curing technology.

Radiation Cured Market Potential Customers

Potential customers for radiation-cured products span a wide array of industrial and commercial entities that prioritize high performance, rapid throughput, and environmental compliance in their finishing or assembly processes. The largest segment of buyers comprises high-volume converters in the packaging industry, including flexible packaging companies utilizing UV flexo inks for printing labels and films, and rigid packaging manufacturers requiring highly durable and scratch-resistant coatings for metal cans and plastic bottles. These customers value the immediate cure properties that allow for post-processing operations instantly, enhancing production efficiency and reducing storage needs.

Another significant customer base resides in the electronics manufacturing sector, encompassing producers of printed circuit boards (PCBs), liquid crystal displays (LCDs), OLED panels, and semiconductor components. These customers rely on radiation-cured adhesives and conformal coatings for precision bonding, encapsulation, and protection against moisture and thermal stress. The demand here is driven by the need for extremely precise placement, fast cure times compatible with high-speed robotics, and formulations that meet rigorous specifications for electrical insulation and thermal stability, making UV-cured acrylics and epoxies indispensable.

Furthermore, major players in the automotive sector (OEMs and Tier 1 suppliers) represent key customers, adopting UV-cured coatings for aesthetic clearcoats on plastic components (interior and exterior), and using specialty adhesives for lightweight structural bonding and headlight assembly where fast, reliable bonding is crucial for safety and speed on the assembly line. The furniture and industrial wood finishing industries also remain strong buyers, utilizing UV-cured clearcoats for abrasion resistance and solvent resistance on flooring and cabinetry, seeking to meet high durability standards while minimizing production time and environmental impact through VOC reduction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion USD |

| Market Forecast in 2033 | $13.8 Billion USD |

| Growth Rate | 9.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allnex GmbH, BASF SE, DIC Corporation, AkzoNobel N.V., The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Sartomer (Arkema Group), Dymax Corporation, Fujifilm Corporation, Covestro AG, Ashland Global Holdings Inc., Eternal Chemical Co., Ltd., Axalta Coating Systems, Lord Corporation (Parker Hannifin), Flint Group, IGM Resins B.V., Red Spot Paint & Varnish Co., Sika AG, Henkel AG & Co. KGaA, PPG Industries, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radiation Cured Market Key Technology Landscape

The technological landscape of the Radiation Cured Market is bifurcated primarily between Ultraviolet (UV) curing and Electron Beam (EB) curing, with significant recent advances centered on the shift from traditional UV lamps to UV-LED (Light Emitting Diode) sources. Traditional UV curing relies on medium-pressure mercury vapor lamps, which emit a broad spectrum of light, including harmful ozone and heat, necessitating robust ventilation and temperature management. In contrast, UV-LED technology represents a paradigm shift, utilizing diodes that emit highly specific, narrow-band wavelengths (typically 365 nm, 385 nm, 395 nm, or 405 nm), offering superior energy efficiency, immediate on/off capability, drastically reduced heat emission, and exceptionally long operating life, which is critical for thermally sensitive substrates and demanding industrial environments.

Electron Beam (EB) curing stands as the highest performance radiation curing method, employing high-energy electrons that penetrate deeply into the material, inducing polymerization instantly without the need for photoinitiators. This unique advantage makes EB curing indispensable for applications requiring ultimate performance, such as sterilization-resistant packaging, high-durability composites, and complex multi-layer structures, and is particularly favored in the food contact materials industry due to the absence of photoinitiator migration concerns. Although the capital cost for EB equipment is significantly higher and shielding requirements are complex, the elimination of photoinitiators and the capacity for high throughput across thick films secures its position as the premium technology choice in sectors like advanced flexible packaging and composite manufacturing.

The market is further being shaped by ongoing innovations in material science focused on maximizing compatibility with these curing technologies. This includes the development of low-energy photoinitiator systems optimized for the narrow spectral output of UV-LEDs, specialized EB-curable oligomers that offer excellent adhesion and flexibility, and the integration of hybrid systems. Hybrid systems combine UV and thermal curing mechanisms to enhance cross-linking density, particularly effective for formulations used on complex 3D objects or in challenging industrial coating scenarios where achieving a complete cure across varied thickness and shadow areas is critical. Furthermore, the development of cationic curing systems, which offer better adhesion on non-polar plastics and lower shrinkage, is challenging the traditional dominance of free-radical acrylic systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Radiation Cured Market, primarily due to its position as the global hub for manufacturing, particularly in electronics, automotive components, and large-scale packaging production. Countries like China, India, Japan, and South Korea exhibit high demand, driven by rapid urbanization and the proliferation of digital printing technologies. The adoption is also stimulated by increasing environmental awareness in highly populated industrial zones, pushing manufacturers to invest in low-VOC curing solutions, especially within the fast-moving consumer goods (FMCG) packaging sector.

- North America: North America represents a mature, high-value market characterized by stringent federal and state-level environmental regulations (e.g., California’s air quality standards) that strongly favor zero-VOC technologies like radiation curing. The region leads in technological adoption in specialized areas such as high-end wood finishing, automotive repair coatings, and sophisticated medical device assembly. Investment is heavily focused on replacing existing traditional UV systems with energy-efficient UV-LED technology to reduce operational costs and meet energy consumption mandates.

- Europe: Europe is a highly regulated market, with directives like REACH and the Industrial Emissions Directive providing a powerful impetus for market growth, mandating the replacement of solvent-borne systems. Western Europe, particularly Germany, Italy, and France, shows strong adoption in the graphic arts (labels and flexible packaging) and industrial wood coating sectors. The region is also at the forefront of sustainable chemistry, driving R&D into bio-based and non-toxic oligomer and photoinitiator systems, aiming for compliance with circular economy objectives.

- Latin America (LATAM): LATAM is an emerging market for radiation curing, with growth concentrated in Brazil and Mexico, driven by the expansion of local manufacturing and packaging industries servicing large domestic consumer markets. Market penetration is slower due to higher import costs for specialized equipment, but rapid expansion in digital printing and rising environmental consciousness are expected to accelerate adoption rates throughout the forecast period.

- Middle East and Africa (MEA): The MEA region is currently a smaller contributor but offers significant potential, particularly in the UAE and Saudi Arabia, driven by major infrastructure projects and diversification efforts away from oil dependence. Growth is concentrated in industrial coatings for protective applications (e.g., pipelines, construction materials) and specialized printing for the retail and pharmaceutical packaging sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radiation Cured Market.- Allnex GmbH

- BASF SE

- DIC Corporation

- AkzoNobel N.V.

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- Sartomer (Arkema Group)

- Dymax Corporation

- Fujifilm Corporation

- Covestro AG

- Ashland Global Holdings Inc.

- Eternal Chemical Co., Ltd.

- Axalta Coating Systems

- Lord Corporation (Parker Hannifin)

- Flint Group

- IGM Resins B.V.

- Red Spot Paint & Varnish Co.

- Sika AG

- Henkel AG & Co. KGaA

- PPG Industries, Inc.

Frequently Asked Questions

Analyze common user questions about the Radiation Cured market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary environmental advantage of radiation curing technology?

The primary advantage is the substantial reduction or elimination of Volatile Organic Compounds (VOCs) because the formulations are typically 100% solid, requiring no solvents for dilution, thereby meeting stringent global environmental and occupational safety regulations.

How do UV-LED systems differ fundamentally from traditional mercury vapor lamps in radiation curing?

UV-LED systems emit narrow-band, specific wavelengths, offering higher energy efficiency, generating significantly less heat, having a much longer lifespan, and enabling instantaneous on/off cycling, which is crucial for curing heat-sensitive substrates and reducing energy consumption.

Which application segment holds the largest market share in the Radiation Cured Market?

The Coatings segment holds the largest market share, driven by extensive use in industrial wood finishing (flooring, cabinetry), protective metal coatings, and automotive plastic component finishing, where high durability and fast throughput are essential requirements.

What is the main challenge associated with adopting Electron Beam (EB) curing technology?

The main challenge is the extremely high initial capital investment required for the EB equipment and the need for complex safety shielding and specialized facility infrastructure, which makes it economically viable mainly for high-volume, premium, or highly specialized industrial applications.

What are Oligomers and why are they critical to radiation-curable formulations?

Oligomers are the backbone resins (e.g., epoxy acrylates, urethane acrylates) that determine the final performance properties of the cured film, such as chemical resistance, hardness, adhesion, and flexibility. They are highly reactive macromers essential for building the polymer structure during radiation exposure.

The complexity of radiation-cured chemistry necessitates continuous investment in specialized research and development, particularly concerning the synthesis of novel bio-based monomers and oligomers that can meet regulatory demands while maintaining high performance criteria such as superior adhesion and flexibility, especially crucial in flexible electronics and medical packaging applications. Regulatory evolution in regions such as the European Union often dictates material suitability, with ongoing evaluation of photoinitiator migration and potential cytotoxic effects demanding transparent and traceable supply chains for radiation-curable ingredients.

Furthermore, the competitive landscape is defined by vertical integration, where chemical producers increasingly partner with or acquire equipment manufacturers to offer end-to-end solutions, streamlining the adoption process for end-users. This trend not only strengthens market control but also facilitates rapid feedback loops between material formulation and application technology development, optimizing the curing process for maximum efficiency. Emerging markets in Southeast Asia and Latin America, while currently lower-volume, present substantial opportunities as industrialization accelerates, driving demand for efficient, high-quality industrial finishes and packaging solutions that radiation curing inherently provides.

Strategic growth avenues are opening up through tailored formulations for additive manufacturing (3D printing), where UV-curable resins form the foundation of many high-resolution printing processes. The demand for materials with specific mechanical, thermal, and optical properties that can be rapidly cured layer-by-layer is driving significant innovation in monomer and photoinitiator design. This convergence of radiation curing technology with 3D printing accelerates product prototyping and enables mass customization across various industries, from dentistry and medical devices to specialized tooling and consumer goods.

The shift towards sustainable chemistry is not merely a compliance issue but a core market differentiator. Companies investing in materials derived from renewable resources, such as vegetable oils or lignin, for use as oligomer backbones are gaining a competitive edge, appealing to environmentally conscious consumers and corporate sustainability mandates. This focus on green chemistry requires sophisticated chemical engineering to ensure that the sustainable alternatives match or exceed the performance of traditional petrochemical-derived counterparts in terms of cure speed, physical durability, and long-term stability.

Finally, the industrial adoption cycle is heavily influenced by the total cost of ownership (TCO) calculation, moving beyond the initial capital expenditure to include long-term operational costs, reduced energy consumption from UV-LEDs, lower waste disposal fees due to reduced solvent usage, and increased production throughput. Demonstrating a clear return on investment (ROI) through case studies showcasing superior scratch resistance in wood flooring or enhanced print quality in high-speed packaging is essential for driving future market penetration among medium-sized enterprises previously reliant on cheaper, but less efficient, solvent-based systems. The technological maturity and cost-effectiveness of UV-LED curing are particularly critical in accelerating this shift in the coming years.

The segment of Urethane Acrylates, within the Oligomers type, is particularly noteworthy for its projected rapid growth, attributed to its ability to impart exceptional toughness, flexibility, and abrasion resistance, making it ideal for high-performance applications such as automotive stone chip protection films, specialized electronic encapsulation, and resilient floor coatings. These versatile materials allow formulators to dial in specific mechanical properties that solvent-based systems struggle to achieve without excessive curing times or high thermal loads. The balance between reactivity and resultant film strength in urethane acrylates is constantly being optimized through R&D.

Conversely, Epoxy Acrylates, while maintaining a large market presence, are often selected for their superior chemical resistance and hardness, primarily utilized in metal coatings, industrial wood topcoats, and durable plastic finishes where solvent exposure or harsh environments are anticipated. The challenge with epoxy acrylates often relates to potential yellowing upon long-term UV exposure, spurring the development of stabilized and non-yellowing variants to broaden their applicability in exterior or aesthetic high-end applications, crucial for capturing more market share in premium architectural coatings.

Monomers, the diluents that control viscosity and contribute to final cross-linking density, are seeing innovation aimed at reducing skin irritation and enhancing safety profiles. Multi-functional monomers, while providing the highest cross-link density for maximum hardness and chemical resistance, are continuously being evaluated for improved handling and reduced volatility. This focus on safer, low-viscosity, and highly reactive monomers is vital for expanding radiation curing into sensitive application areas like medical device manufacturing and food-safe packaging, where low extractables and non-toxic profiles are non-negotiable regulatory requirements.

The application of radiation-cured materials in the packaging sector is evolving rapidly. Beyond traditional labeling and flexible packaging inks, there is growing demand for functional coatings, such as barrier coatings and release coatings, that utilize UV or EB technology. These functional layers enhance the longevity, recyclability, and safety of packaging materials. The quick, low-temperature curing process is uniquely suited for thin, heat-sensitive substrates commonly used in flexible packaging, ensuring high-definition print quality without distorting the film.

In the Graphic Arts segment, the dominance of UV-LED inkjet inks is redefining industrial printing. The integration of high-speed, wide-format digital presses utilizing UV-curable inks allows for personalized, short-run, and on-demand printing with exceptional color fidelity and instant durability. This technological convergence is displacing older, slower analog printing methods, especially in the production of signage, decorative prints, and specialty labels, pushing the demand for optimized photoinitiator systems compatible with the limited spectral output of LED arrays.

The development of radiation-curable pressure-sensitive adhesives (PSAs) is significantly impacting the assembly industry. These adhesives offer the flexibility required for bonding dissimilar materials, coupled with the benefit of curing on-demand, which eliminates clamping time and reduces operational footprint. Key end-uses include automotive interior assembly, mounting of electronic components (e.g., batteries, screens), and specialized construction applications, capitalizing on the ability of UV/EB adhesives to cure through demanding gaps and on complex geometries with high precision and throughput.

The value chain is further complicated by intellectual property barriers related to specialized photoinitiator technology. Photoinitiators, despite being used in small quantities, are highly proprietary and essential components that dictate cure speed and efficacy. Suppliers who hold patents on high-performance, low-migration, or low-odor photoinitiators possess significant leverage in the market, often resulting in strategic partnerships or exclusive supply agreements with large formulators, influencing the availability and cost of premium radiation-curable systems globally.

Furthermore, equipment manufacturers, acting downstream from the material formulators, are crucial partners. Their role includes not only supplying the curing systems (UV lamps, EB accelerators, conveyers) but also ensuring compatibility with the chemical formulations and the specific production line requirements of the end-user. Innovation in equipment often precedes market expansion; for instance, the introduction of compact, air-cooled UV-LED systems has democratized the technology, enabling its use in smaller workshops and less sophisticated manufacturing environments previously restricted by the size and cost of traditional mercury vapor systems.

Customer education and technical support are critical components of the indirect value chain. Since radiation curing involves complex material science and sophisticated equipment calibration, end-users require extensive training on safety protocols, formulation handling (especially monomers), and process optimization. Distributors and formulators that offer superior technical service, troubleshooting, and continuous application training establish stronger, long-term relationships with customers, reducing adoption risks and accelerating the transition away from conventional systems.

In terms of regional specifics, the Asian market, while dominated by high volume production, is also rapidly adopting localized R&D focused on addressing region-specific challenges, such as high heat and humidity resistance for coatings used in Southeast Asia, and robust anti-smudge and high-gloss requirements for consumer electronics produced in Northeast Asia. Local chemical players are increasingly competing with global giants by offering cost-effective and functionally equivalent radiation-curable raw materials tailored to regional specifications and shorter lead times, intensifying competition at the precursor level.

The European market, driven by REACH regulations, exhibits the strongest demand for fully characterized and non-migratory radiation-curable systems, especially those approved under the Swiss Ordinance or EU regulations for food contact materials (FCMs). This regulatory environment incentivizes higher pricing for certified, safer formulations, making Europe a key profit center for premium, specialized products such as low-migration UV-LED inks utilized in primary food packaging, emphasizing safety and compliance over sheer volume.

The forecast for the Radiation Cured Market remains exceptionally strong, predicated on the irreversible global trend toward environmental sustainability and manufacturing efficiency. The continuous refinement of UV-LED technology, combined with the development of more sustainable and safer chemical building blocks, ensures that radiation curing systems will continue to replace thermal and solvent-borne processes across all major industrial sectors, positioning the market for sustained double-digit growth in specialized, high-performance segments throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager