Radiation Effects Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432839 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Radiation Effects Testing Market Size

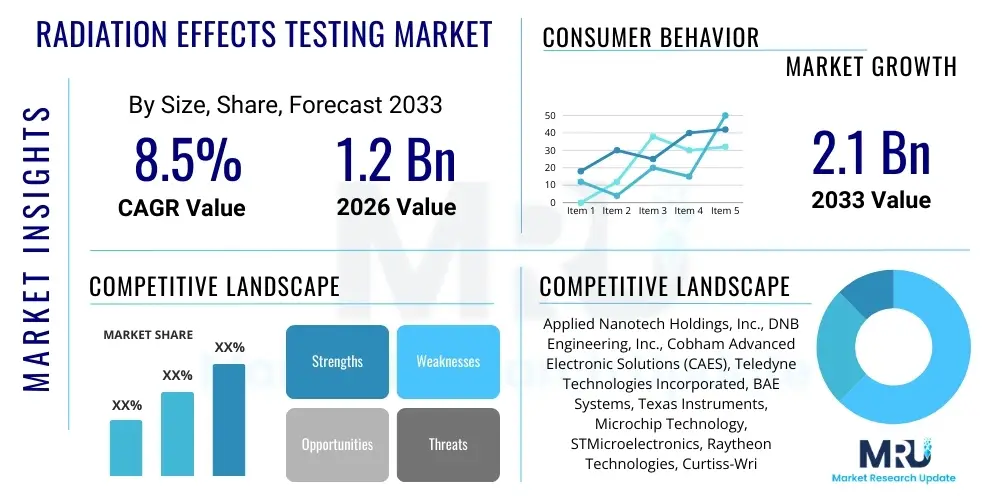

The Radiation Effects Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Radiation Effects Testing Market introduction

The Radiation Effects Testing Market encompasses specialized services and equipment dedicated to assessing the resilience and reliability of electronic components, materials, and systems when exposed to various forms of radiation environments, particularly those encountered in space, nuclear facilities, and medical applications. Products tested range from microprocessors and memory chips to integrated circuits and complex satellite subsystems. Major applications include qualifying components for critical space missions, ensuring the long-term operational integrity of avionics systems, and verifying safety standards in nuclear reactor control systems. The primary benefit of this testing is risk mitigation, preventing catastrophic system failures due to radiation-induced errors (such as Single Event Upsets or Total Ionizing Dose degradation). Driving factors include the increasing launch frequency of satellites (especially LEO constellations), heightened military and defense expenditure on resilient electronics, and stricter regulatory mandates concerning safety and reliability in high-radiation environments.

Radiation Effects Testing Market Executive Summary

The global Radiation Effects Testing Market is experiencing robust expansion driven by the exponential growth of the commercial space sector and the ongoing miniaturization of electronics, which makes components more susceptible to radiation damage. Business trends indicate a shift towards outsourcing testing services to specialized facilities, fostering growth among independent testing laboratories and Original Equipment Manufacturers (OEMs) diversifying their service offerings. Regionally, North America maintains market dominance due to the presence of key space and defense agencies (NASA, DoD) and leading semiconductor manufacturers, while the Asia Pacific region is forecast to exhibit the fastest growth, propelled by ambitious national space programs in China, India, and Japan. Segment trends show that Single Event Effects (SEE) testing commands a significant share, given the immediate operational risk posed by transient errors in highly sensitive digital systems, and the aerospace and defense application segment remains the foundational pillar of market demand, continually requiring higher levels of radiation hardness assurance (RHA).

AI Impact Analysis on Radiation Effects Testing Market

User queries regarding the impact of Artificial Intelligence often center on how machine learning can streamline the testing process, improve fault prediction accuracy, and reduce the high costs and long lead times associated with physical radiation testing campaigns. Key themes include the desire for intelligent test protocol design, automated data analysis of complex radiation test signatures, and the creation of highly accurate predictive simulation models capable of replacing some physical component exposure runs. There is also significant concern regarding the validation and trustworthiness of AI-generated radiation hardness predictions, given the mission-critical nature of the components being tested. The expectation is that AI will initially act as a powerful co-pilot, optimizing experimental throughput and accelerating the discovery of radiation-induced failure mechanisms, rather than fully replacing human expertise or regulatory-mandated physical testing.

- AI-driven simulation models enhance predictive capabilities for Total Ionizing Dose (TID) and Single Event Effects (SEE), minimizing the need for extensive physical irradiation campaigns.

- Machine learning algorithms optimize beam time utilization at accelerator facilities by intelligently adjusting testing parameters and managing large datasets generated during irradiation tests.

- Automation and robotic integration in testing labs, guided by AI, reduce human exposure to radiation sources and increase the precision and repeatability of complex experimental setups.

- AI facilitates anomaly detection in real-time testing data, rapidly identifying subtle component degradation or transient errors that might be missed by traditional analysis techniques.

DRO & Impact Forces Of Radiation Effects Testing Market

The market is primarily driven by the escalating global investment in space exploration, satellite proliferation for communication and surveillance, and the inherent need to ensure the survivability of mission-critical electronics in harsh environments. However, growth is tempered by substantial restraints, notably the high capital expenditure required for sophisticated testing facilities (particle accelerators, cobalt-60 sources) and the scarcity of qualified, specialized technical personnel capable of executing complex radiation physics experiments. Opportunities abound in the burgeoning SmallSat and CubeSat market, where cost-effective, rapid radiation testing solutions are highly sought after, alongside the expansion into automotive electronics requiring radiation tolerance for autonomous driving systems operating at higher altitudes. These forces interact critically; the demand for radiation hardness drives investment, but the inherent complexity and specialized infrastructure requirements act as bottlenecks, concentrating market influence among established, resource-intensive players.

Market Drivers Detailed Analysis

The unprecedented growth in the deployment of Low Earth Orbit (LEO) satellite constellations, particularly for global connectivity and defense applications, represents the most significant driver for the Radiation Effects Testing Market. Components used in LEO must withstand substantial cumulative radiation doses and high fluxes of energetic particles, necessitating rigorous testing protocols before launch. Furthermore, the commercialization of space, moving beyond traditional government programs, introduces new actors who are often less experienced in radiation hardness assurance (RHA) but still require certified components, thereby increasing demand for third-party testing services. This rapid pace of development mandates faster turnaround times for testing and pushes the industry toward more standardized, yet flexible, testing methodologies.

A second crucial driver is the increasing complexity and vulnerability of modern electronic systems. As semiconductor manufacturing processes shrink feature sizes (below 28nm), electronic devices become inherently more susceptible to Single Event Effects (SEE) caused by single particle strikes. This heightened sensitivity means that virtually every new generation of commercial-off-the-shelf (COTS) components intended for space or high-altitude aerial platforms requires new rounds of specialized radiation verification. Governments worldwide, particularly in defense sectors, are mandating higher resilience standards for crucial infrastructure and military hardware, translating directly into larger testing budgets and ongoing research into advanced hardening techniques and testing methodologies.

- Exponential growth in LEO and MEO satellite deployments.

- Increasing military and defense budgets dedicated to radiation-hardened electronics.

- Miniaturization of semiconductor geometries increasing susceptibility to transient errors.

- Stricter global regulatory requirements for nuclear, aerospace, and critical infrastructure electronics safety.

Market Restraints Detailed Analysis

The primary constraint facing the Radiation Effects Testing Market is the high capital cost associated with establishing and maintaining accredited testing infrastructure. Particle accelerator facilities, which are essential for simulating space radiation environments (especially high-energy protons and heavy ions for SEE testing), require massive initial investment and continuous, specialized operational funding. This cost barrier limits the entry of new competitors and concentrates testing capacity geographically, often leading to long queues and high prices for commercial users, thereby slowing down the component qualification cycle for smaller aerospace entities or startups.

Another significant restraint is the shortage of highly specialized scientific and engineering talent. Radiation effects testing requires expertise spanning nuclear physics, electrical engineering, materials science, and semiconductor design. Finding and retaining personnel proficient in operating complex beamline equipment, designing radiation test fixtures, and interpreting nuanced radiation degradation data is extremely challenging. This talent scarcity acts as a bottleneck on market growth, hindering the ability of labs to scale operations quickly in response to surging demand. Furthermore, the lack of universally harmonized international standards for specific radiation environments and component types occasionally complicates cross-border service provision and component certification.

- High operational costs and capital expenditure for required testing facilities (accelerators, reactors).

- Shortage of specialized radiation effects engineers and physicists.

- Long lead times and geographical limitations imposed by limited access to high-energy radiation sources.

- Complexity and ambiguity in correlating ground-based testing results with actual orbital performance.

Market Opportunities Detailed Analysis

A major opportunity lies in the development of streamlined, cost-effective testing protocols specifically tailored for the rapidly expanding SmallSat and CubeSat market segment. Traditional radiation qualification processes are often overkill for these short-lifespan, low-cost missions. Developing smaller, more localized irradiation sources or highly efficient predictive simulation toolsets combined with minimal physical verification runs offers a lucrative niche for specialized service providers. Furthermore, the integration of Radiation Effects Testing earlier into the component design cycle (Design-for-Radiation-Hardness) presents a significant growth avenue, shifting testing from a purely verification stage to an integral part of the initial semiconductor design process, driven by Electronic Design Automation (EDA) tools.

The second major opportunity involves expanding the application scope beyond traditional space and military uses. Emerging sectors, such as high-reliability automotive systems (especially those used in advanced autonomous vehicles operating at high altitudes or near nuclear facilities), medical diagnostics equipment (PET scanners, linear accelerators), and terrestrial critical infrastructure (5G networks, financial data centers), are increasingly recognizing the need for resilience against atmospheric neutron radiation and electromagnetic interference. Standardizing tests and providing customized hardening solutions for these commercial, high-volume applications can unlock vast, previously underserved market potential, requiring industry players to adapt their service models from bespoke, low-volume aerospace testing to scalable commercial solutions.

- Development of accelerated, cost-effective testing solutions for the booming SmallSat/CubeSat industry.

- Expansion into terrestrial commercial applications requiring radiation resilience (e.g., automotive, 5G infrastructure, high-altitude aviation).

- Integration of advanced simulation and Machine Learning (ML) techniques to reduce physical testing duration.

- Growing demand for expertise in testing advanced materials, such as compound semiconductors (GaN, SiC), for radiation tolerance.

Impact Forces Detailed Analysis

The collective impact of market forces dictates the investment and innovation trajectory of the Radiation Effects Testing Market. The primary impact force is the technological obsolescence cycle inherent in the semiconductor industry. As commercial components rapidly evolve, the established methods for radiation hardening and testing must continually be adapted. This force drives perpetual investment in simulation tools and compels test facilities to upgrade equipment to handle smaller, faster, and more complex System-on-Chips (SoCs). Failure to keep pace results in a critical shortage of qualified parts for modern missions.

A secondary, but equally potent, impact force is the regulatory environment, particularly the influence of international treaties and national space policies. Stricter standards regarding space debris mitigation, mission longevity, and safety protocols directly heighten the required level of radiation hardness assurance. For example, defense agencies requiring assured access to space necessitate domestic, secure testing capabilities, impacting regional market concentrations and encouraging government investment in domestic infrastructure. These external political and regulatory pressures exert a consistent upward force on demand for high-quality, traceable radiation testing, mitigating the constraining effects of high costs and limited capacity by prioritizing mission success over expense minimization.

Segmentation Analysis

The Radiation Effects Testing Market is comprehensively segmented across several dimensions, primarily based on the type of radiation effect being studied, the component being tested, and the end-use application. Understanding these segments is crucial as different radiation effects (TID vs. SEE) require fundamentally different test methodologies and infrastructure, thereby influencing investment decisions by testing service providers. The application segment, particularly Aerospace & Defense and Space, dictates the stringency and regulatory compliance required for testing services, significantly affecting pricing and capacity utilization across the industry. The focus on developing new component types, such as advanced memory and high-performance computing components for deep space, continuously introduces new segmentation challenges and testing requirements.

- By Component:

- Integrated Circuits (ICs)

- Discrete Semiconductors

- Optoelectronics

- Materials & Polymers

- By Test Type:

- Total Ionizing Dose (TID) Testing

- Single Event Effects (SEE) Testing

- Displacement Damage Dose (DDD) Testing

- Prompt Dose Testing

- By Source Type:

- Cobalt-60 Gamma Sources

- Particle Accelerators (Cyclotrons, Synchrotrons)

- Neutron Sources/Reactors

- X-ray Sources

- By Application:

- Space (Satellites, Deep Space Probes, Launch Vehicles)

- Aerospace & Defense (Avionics, Military Communications)

- Nuclear Power & Research

- Medical & Healthcare

- Industrial & Terrestrial Critical Infrastructure

Value Chain Analysis For Radiation Effects Testing Market

The value chain for the Radiation Effects Testing Market is highly specialized and sequential, beginning with the provision of upstream technical infrastructure, moving through the execution of complex testing services, and culminating in the delivery of certified data to downstream end-users. Upstream activities involve the ownership and operation of high-capital testing assets, such as particle accelerators, which are often government-funded or university-affiliated, or high-activity isotope sources like Cobalt-60, which requires strict regulatory oversight. Downstream analysis focuses on the end-users—system integrators and component manufacturers—who utilize the test results for mission qualification and system design. Distribution channels are predominantly direct, involving detailed contractual agreements between the testing facility and the client, although specialized consultants sometimes act as indirect intermediaries, managing the complex logistics of preparing and submitting components for testing and analyzing the resulting data.

The upstream segment of the value chain is characterized by a strong dependence on advanced technology providers and infrastructure managers. Key players include the organizations that design and maintain the irradiation sources (e.g., manufacturers of cyclotrons or specialized gamma irradiators), and the semiconductor foundries that develop radiation-hardened or radiation-tolerant components. Innovation at this stage focuses on improving beam uniformity, increasing beam energy stability, and developing automated sample handling systems. The high barrier to entry here ensures that only a few entities globally possess the necessary resources and regulatory clearances to operate these foundational assets, driving global capacity constraints.

The midstream and downstream elements involve the testing services themselves and the final application of the results. The midstream involves specialized testing labs (both independent and captive labs operated by large defense contractors) that design the test protocols, execute the irradiation, and perform detailed electrical measurements before, during, and after exposure. Downstream demand is driven almost entirely by mission assurance requirements from entities like NASA, ESA, DoD, and major satellite operators (e.g., SpaceX, OneWeb). The direct channel dominates due to the necessity of proprietary data exchange and highly customized testing procedures, ensuring results meet strict component traceability and quality standards required for mission success.

Radiation Effects Testing Market Potential Customers

The primary consumers of radiation effects testing services are entities involved in the design, manufacturing, and operation of systems destined for harsh radiation environments, particularly space and defense. These potential customers include major government space agencies requiring qualification for deep space missions and orbital assets, large aerospace and defense prime contractors who integrate these components into aircraft, satellites, and missile systems, and specialized semiconductor manufacturers who seek to certify their commercial-off-the-shelf (COTS) or custom-designed components as radiation-tolerant (Rad-Tolerant) or radiation-hardened (Rad-Hard). Furthermore, operators of critical infrastructure, such as nuclear power plants and medical linear accelerators, represent a growing customer base requiring certification of control and safety electronics.

The buyer landscape is highly sophisticated and quality-driven. For the space sector, procurement decisions are non-price sensitive when dealing with mission-critical components, prioritizing reliability, demonstrated expertise, and compliance with stringent government standards (e.g., MIL-STD-883, ESA standards). These buyers require comprehensive documentation, detailed failure analysis, and often mandatory oversight by their internal engineering teams during the testing process. The complexity of these missions means buyers are looking for integrated service packages that combine physical testing with advanced simulation and failure prediction modeling.

A secondary, rapidly growing customer segment is the commercial space industry, including launch providers and constellation operators. These customers are more price-sensitive and volume-driven. They require faster, cheaper, and often tailored testing approaches (e.g., rapid screening tests for COTS parts). Their purchasing decisions are influenced by the testing facility's ability to offer high throughput, quick turnaround times, and flexible, commercially scalable contracts, differing significantly from the bespoke, high-cost model preferred by government agencies. This segmentation of buyer needs forces testing service providers to offer a diverse portfolio of services ranging from military-grade qualification to commercial-grade screening.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Nanotech Holdings, Inc., DNB Engineering, Inc., Cobham Advanced Electronic Solutions (CAES), Teledyne Technologies Incorporated, BAE Systems, Texas Instruments, Microchip Technology, STMicroelectronics, Raytheon Technologies, Curtiss-Wright Corporation, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Infineon Technologies AG, Xilinx (AMD), Qorvo, Analog Devices. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radiation Effects Testing Market Key Technology Landscape

The technology landscape in radiation effects testing is constantly evolving, driven by the need to simulate increasingly complex and severe natural and man-made radiation environments accurately. A core technology remains the use of high-energy particle accelerators, such as cyclotrons and synchrotrons, which are essential for producing beams of heavy ions and high-energy protons necessary to induce Single Event Effects (SEE) failures in microelectronics. Advancements in beamline technology, including precision beam steering and focused spot sizes, allow for highly localized testing of specific circuit features, which is critical for verifying the resilience of state-of-the-art semiconductor architectures.

Complementary to physical testing, simulation and modeling software represent another critical technology area. Tools utilizing Monte Carlo methods (like GEANT4) and advanced Finite Element Analysis (FEA) are used to predict particle transport and energy deposition in complex semiconductor structures. These simulation technologies are crucial for optimizing test conditions, extrapolating ground test data to predict orbital performance, and reducing the total required beam time, which is both expensive and time-consuming. The current trend focuses on integrating these simulation tools with AI/ML frameworks to improve predictive accuracy and accelerate the validation process for new component designs.

Furthermore, the development of sophisticated in-situ monitoring and dosimetry systems is vital for maintaining the fidelity of the test environment. High-precision dosimeters are used to accurately measure the total accumulated radiation dose, while advanced high-speed data acquisition systems are necessary to capture transient electrical phenomena associated with SEE, such as Single Event Upsets (SEUs) and Single Event Burnouts (SEBs), often occurring on nanosecond timescales. Innovation in this area centers on creating automated, remote-controlled test setups capable of handling high-volume testing of complex System-on-Chips (SoCs) and minimizing interference from the noisy radiation environment.

Regional Highlights

The Radiation Effects Testing Market exhibits strong regional disparities, primarily dictated by national defense priorities, the presence of major space agencies, and the concentration of high-technology manufacturing. North America holds the largest market share, driven by extensive defense contracting activities, the centralized operations of NASA, and the large number of leading semiconductor and aerospace primes requiring domestic, certified testing capacity. This region benefits from a well-established ecosystem of government labs, university research facilities, and commercial testing services offering a comprehensive range of capabilities, particularly in high-energy SEE testing and advanced radiation-hardened component design.

Europe, driven by the activities of the European Space Agency (ESA) and various national defense programs, represents a significant and stable market. European growth is focused on collaborative research projects aimed at developing indigenous radiation-tolerant technologies and expanding internal testing capacity to reduce reliance on foreign facilities. The emphasis here is often on robust standardization and certification protocols, ensuring component interoperability and mission reliability across international consortiums. Key growth points are observed in countries with strong nuclear research pedigrees, which often translates into established radiation testing infrastructure.

Asia Pacific (APAC) is projected to be the fastest-growing region over the forecast period. This rapid expansion is fueled by significant government investments in national space programs (China’s ambitious space station and lunar exploration, India’s ISRO missions, and Japan’s JAXA projects). The region is characterized by a massive manufacturing base, pushing demand for localized testing and qualification of domestically produced electronic components intended for space use. While historical reliance on imported testing services has been common, there is now a substantial push towards establishing independent, large-scale particle accelerator facilities and dedicated irradiation testing labs, making APAC a critical region for future capacity expansion and technological adoption.

- North America: Dominates the market due to robust defense spending, large installed base of particle accelerators (e.g., in US national labs), and the high demand generated by major space primes and military contractors (Lockheed Martin, Boeing, Northrop Grumman).

- Europe: Characterized by strong governmental and institutional demand (ESA, CERN), focusing on developing radiation-hardened components for scientific missions and maintaining a high standard of quality assurance through harmonized certification bodies.

- Asia Pacific (APAC): Highest growth rate expected, propelled by national space initiatives in China, India, and South Korea, coupled with massive investment in domestic semiconductor manufacturing and localized testing infrastructure development.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets with nascent space programs. Demand is generally focused on procuring certified components from established international suppliers, but regional interest in small satellite launches and telecommunication infrastructure is slowly driving localized testing requirements, often supported by international partnerships.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radiation Effects Testing Market.- Applied Nanotech Holdings, Inc.

- DNB Engineering, Inc.

- Cobham Advanced Electronic Solutions (CAES)

- Teledyne Technologies Incorporated

- BAE Systems

- Texas Instruments

- Microchip Technology

- STMicroelectronics

- Raytheon Technologies

- Curtiss-Wright Corporation

- Honeywell International Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Infineon Technologies AG

- Xilinx (AMD)

- Qorvo

- Analog Devices

- Vanderbilt University (testing services)

- NASA facilities (e.g., Goddard Space Flight Center)

Frequently Asked Questions

Analyze common user questions about the Radiation Effects Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between TID and SEE testing?

Total Ionizing Dose (TID) testing measures the cumulative, permanent degradation of a component’s electrical performance due to prolonged exposure to radiation, typically using gamma rays (Cobalt-60). Single Event Effects (SEE) testing assesses transient or destructive failures caused by a single high-energy particle strike, usually requiring high-energy particle accelerators.

Why is the Radiation Effects Testing Market experiencing significant growth?

Growth is fueled primarily by the boom in commercial LEO satellite constellations, which require large volumes of components to be screened or hardened for operation in severe orbital radiation environments. Increased global defense spending on resilient electronics and the miniaturization of semiconductors also contribute significantly to rising testing demand.

Which regions currently dominate the demand for radiation effects testing services?

North America is the current market leader due to the presence of major space and defense organizations (NASA, DoD) and a highly established infrastructure of testing laboratories. However, the Asia Pacific region is forecast to exhibit the fastest growth owing to aggressive expansion of national space programs.

Are Commercial Off-the-Shelf (COTS) components suitable for space missions?

COTS components are increasingly used in cost-sensitive missions like CubeSats, but they must undergo rigorous, customized radiation effects testing and screening (known as upscreening or characterization) to understand their specific radiation tolerance limits and implement necessary mitigation strategies before deployment in high-radiation zones.

What is the largest constraint facing the scaling of radiation effects testing capacity?

The largest constraint is the extremely high capital cost and maintenance requirement for essential testing infrastructure, particularly high-energy particle accelerators needed for accurate Single Event Effects (SEE) simulation, coupled with the critical shortage of specialized radiation effects engineering talent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager