Radiation Protection Materials and Radiation Protection Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435296 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Radiation Protection Materials and Radiation Protection Fiber Market Size

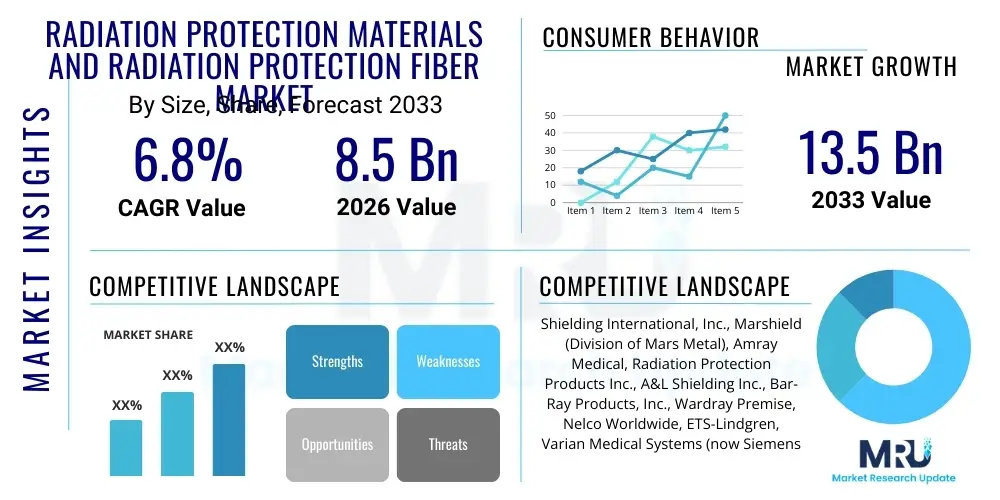

The Radiation Protection Materials and Radiation Protection Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Radiation Protection Materials and Radiation Protection Fiber Market introduction

The Radiation Protection Materials and Radiation Protection Fiber Market encompasses highly specialized substances and engineered textiles designed to attenuate or absorb harmful ionizing and non-ionizing radiation, ensuring the safety of personnel, equipment, and the environment. These materials are crucial in environments exposed to X-rays, gamma rays, beta particles, and neutrons, finding extensive utility across complex sectors such as healthcare, nuclear energy, defense, and industrial non-destructive testing (NDT). The necessity for robust safety protocols, coupled with increasing diagnostic and therapeutic medical procedures involving radiation exposure, underpins the consistent demand for advanced shielding solutions. Key products include lead-based sheeting, lead-free composite polymers, radiation-absorbing fabrics woven with high-atomic-number elements, and specialized concrete additives.

The core product offering, radiation protection fiber, represents a sophisticated subset of this market, involving the incorporation of radiation-shielding particles—such as bismuth, tungsten, or other metal oxides—into polymer matrixes to create flexible, lightweight, and durable textiles. These fibers are pivotal in manufacturing protective apparel, including aprons, gloves, and surgical drapes, which are essential for medical professionals operating X-ray and computed tomography (CT) equipment. The growing trend toward replacing traditional heavy lead-based aprons with lighter, more ergonomic composite fiber alternatives is a significant defining characteristic of the modern market landscape, driven by concerns over user comfort and long-term musculoskeletal health.

Major applications of these materials span critical infrastructure and services. In healthcare, they are indispensable for constructing shielded rooms (e.g., radiotherapy bunkers, cath labs) and producing personal protective equipment (PPE). In the nuclear sector, high-density materials are required for reactor containment and spent fuel storage. Driving factors include stringent regulatory mandates set by bodies like the International Atomic Energy Agency (IAEA) and increasing global investment in modernizing healthcare facilities, particularly in rapidly developing economies where the installed base of imaging equipment is expanding dramatically. The market benefits significantly from ongoing technological innovation focused on developing high-performance, environmentally benign, and multi-functional shielding solutions capable of addressing various energy spectrums.

Radiation Protection Materials and Radiation Protection Fiber Market Executive Summary

The global Radiation Protection Materials and Radiation Protection Fiber Market is characterized by robust growth, primarily propelled by escalating safety regulations in the medical and nuclear industries and a decisive shift toward advanced, lead-free composite materials. Business trends indicate a strong emphasis on research and development, aiming to optimize material density-to-weight ratios and enhance flexibility, particularly for wearable applications. Strategic alliances, mergers, and acquisitions focused on securing supply chains for rare earth elements and specialized polymers are becoming common among key market participants to gain a competitive edge in high-value segments like aerospace and defense. Furthermore, the market is experiencing consolidation as major players seek to vertically integrate manufacturing capabilities, spanning from raw material processing to the final production of complex shielding textiles and architectural materials.

Regionally, North America and Europe maintain dominance, driven by mature healthcare infrastructure, substantial spending on nuclear decommissioning activities, and early adoption of premium lead-free technologies. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid urbanization, significant government investments in healthcare accessibility, and the expansion of domestic nuclear energy programs in countries such as China, India, and South Korea. This regional growth is characterized by high demand for basic shielding materials for new hospital construction as well as sophisticated radiation protection fibers for their burgeoning medical tourism sectors. Latin America and the Middle East and Africa (MEA) are emerging markets, primarily driven by investments in oil and gas NDT procedures and limited expansion of specialized diagnostic centers.

Segment trends reveal that the healthcare sector remains the largest application segment due to the pervasive use of X-ray and CT scans globally, necessitating both architectural shielding and personal protection. By product type, composite polymers and specialized protective textiles are rapidly gaining market share over traditional lead materials, especially in clinical environments where staff fatigue is a key concern. Technological advancements are continuously improving the attenuation effectiveness of these non-lead alternatives, making them viable replacements. The increasing focus on neutron shielding materials, crucial for advanced research reactors and fusion energy projects, also represents a high-potential, albeit niche, growth segment within the materials market.

AI Impact Analysis on Radiation Protection Materials and Radiation Protection Fiber Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can enhance the effectiveness and safety standards of radiation protection systems. Key themes revolve around optimizing material composition, predicting failure points in shielding structures, and personalizing radiation dose monitoring for workers. Concerns often center on the practical implementation costs, the integration of complex ML models into traditional manufacturing processes, and the reliability of AI-driven material stress analysis in high-stakes environments like nuclear power plants. There is a strong expectation that AI will significantly reduce the required weight of protective apparel by enabling precise material distribution and tailoring material properties based on predictive modeling of radiation scatter, leading to ultra-efficient, next-generation shielding products.

- AI algorithms enable predictive modeling of radiation interaction with novel materials, accelerating the development of new, highly efficient composite shields.

- Machine Learning optimizes manufacturing processes for specialized fibers, ensuring uniformity in particle dispersion and maximizing attenuation consistency across large textile batches.

- AI-driven simulation tools allow for complex radiation transport modeling, reducing the need for costly physical testing and optimizing shielding thickness in architectural designs (e.g., radiotherapy bunkers).

- Integration of AI with personal dosimeters facilitates real-time, personalized exposure tracking and risk assessment, enhancing worker safety protocols, particularly in nuclear decommissioning.

- Computer vision systems utilizing AI can automatically inspect installed shielding materials for micro-cracks or structural degradation, predicting maintenance needs before safety compliance is compromised.

DRO & Impact Forces Of Radiation Protection Materials and Radiation Protection Fiber Market

The dynamics of the Radiation Protection Materials and Radiation Protection Fiber Market are driven by stringent global health and safety regulations, restraint by high material costs and disposal challenges, and opportunities stemming from innovation in lead-free technology and emerging markets. Drivers primarily include the escalating volume of medical imaging procedures worldwide, particularly in oncology and interventional radiology, which necessitates expanded protective measures for clinical staff and patients. Mandates to adhere to occupational exposure limits set by international bodies exert continuous pressure on healthcare providers and industrial operators to adopt superior shielding solutions. This regulatory impetus ensures a baseline level of consistent market demand, regardless of economic cycles.

Restraints largely center on the high acquisition cost of advanced, lead-free composite materials, which can be prohibitively expensive for smaller clinics or less developed regions. Furthermore, the specialized nature of materials like tungsten and bismuth oxide fibers contributes to manufacturing complexity and elevated prices. A significant environmental challenge is the disposal of traditional lead-based waste, which often faces severe regulatory hurdles and incurs substantial costs, prompting users to seek sustainable alternatives but simultaneously increasing the initial investment required for the transition. The long product life cycle of some fixed shielding installations also occasionally slows down market growth as replacement cycles can be decades long.

Opportunities are abundant in the field of material science innovation. The ongoing quest for ultralight, highly effective, multi-functional composite materials that can protect against mixed radiation fields (e.g., X-ray and neutron simultaneously) offers immense potential, especially for defense and space exploration applications. Geographically, untapped potential lies in expanding market penetration across APAC and MEA, capitalizing on rapid industrialization and the governmental prioritization of modernizing public health infrastructure. The shift towards non-invasive and image-guided surgery also opens new niche markets for sterile, flexible, radiation-attenuating fabrics designed for the operating room. The confluence of regulatory pressure and technological feasibility dictates the market's direction, forcing a continuous evolution toward safer and more sustainable products.

Segmentation Analysis

The Radiation Protection Materials and Radiation Protection Fiber Market is meticulously segmented based on material type, product form, application industry, and geography, reflecting the diverse and highly technical needs of end-users. This granularity is essential for market players to tailor product development and strategic market entry. The market segmentation reveals a clear trend toward high-performance, customizable solutions that can meet specific radiation energy requirements, ranging from low-energy diagnostic X-rays to high-energy gamma rays encountered in nuclear decommissioning sites. Analyzing these segments helps delineate the competitive landscape and identify fast-growing niches, such as flexible textiles for medical PPE.

The material segmentation is crucial, differentiating between traditional lead, lead-free composites (bismuth, antimony, tungsten), and specialized shielding concrete/glass. The application segmentation highlights the dominant role of healthcare (radiology, nuclear medicine) but also tracks the essential, albeit cyclical, demand from the nuclear power sector and the constant demand from defense and aerospace for highly specialized, weight-constrained solutions. Furthermore, the segmentation by product form—rigid sheets, modular barriers, protective apparel, and dedicated coatings—allows suppliers to focus on the form factors most valued by specific user groups, such as flexible fibers for comfort-critical medical use versus rigid, dense materials required for industrial containment structures.

- By Material Type:

- Lead-based Materials (Sheets, Blocks)

- Lead-free Composites (Bismuth, Tungsten, Antimony Polymers)

- Specialty Concrete (High-density, Boron-loaded)

- Ceramics and Glass (Lead-glass windows, Specialized optical fibers)

- Engineered Textiles and Fibers

- By Product Form:

- Protective Apparel (Aprons, Vests, Thyroid Shields)

- Architectural Shielding (Walls, Doors, Ceilings)

- Modular Shields and Barriers

- Coatings and Paints

- By Application:

- Healthcare (Diagnostic, Interventional, Radiotherapy)

- Nuclear Power Plants (Containment, Decommissioning)

- Defense and Aerospace

- Industrial Non-Destructive Testing (NDT)

- Research and Academic Institutions

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Radiation Protection Materials and Radiation Protection Fiber Market

The value chain for the Radiation Protection Materials and Radiation Protection Fiber Market begins with the highly specialized upstream analysis involving the sourcing and refinement of rare earth elements (like tungsten and bismuth) and high-purity lead, alongside the synthesis of specific polymers and resins. This stage is capital-intensive and subject to geopolitical supply chain risks, particularly concerning metals like tungsten, which heavily influence the final cost of advanced fibers and composites. Key challenges at this stage include ensuring the uniform dispersion of high-atomic-number particles within the polymer matrix to maintain consistent shielding effectiveness, which requires advanced nanotech and compounding processes.

Midstream activities involve sophisticated manufacturing and processing. For fibers, this means extrusion, spinning, and weaving into medical-grade fabrics. For materials, it includes casting lead sheets, fabricating lead-free panels, and molding custom composite components. This stage adds significant value through compliance testing and certification (e.g., ASTM standards, ISO certification), ensuring the product meets required attenuation levels for specific radiation types and energies. Manufacturers must employ rigorous quality control to prevent shielding gaps or material degradation, as failure in this market can have catastrophic safety implications.

Downstream analysis focuses on distribution and end-user engagement. The distribution channel is often complex, involving direct sales to large nuclear or defense contractors, and specialized distributors for healthcare equipment and PPE. Direct channels are common for large, custom architectural shielding projects (e.g., MRI suites, proton therapy centers), while indirect channels handle standardized protective apparel and small modular units. Key end-users rely heavily on technical consultation and installation services provided by manufacturers or specialized vendors, underscoring the importance of post-sales support and regulatory adherence throughout the product lifecycle. The highly regulated nature of this market dictates that distribution must prioritize traceability and precise documentation.

Radiation Protection Materials and Radiation Protection Fiber Market Potential Customers

Potential customers for Radiation Protection Materials and Radiation Protection Fiber are concentrated across highly regulated and technically demanding sectors where occupational or public radiation exposure is a constant threat. The largest segment remains the healthcare industry, specifically hospitals, specialized oncology clinics, and diagnostic imaging centers that require both fixed architectural shielding for infrastructure and flexible, lightweight protective apparel for radiologists, cardiologists, and surgical staff performing fluoroscopy and interventional procedures. The demand here is continuous, driven by the replacement of aging equipment and the expansion of advanced medical services globally.

The nuclear energy sector constitutes another critical customer base, encompassing operational power plants, reprocessing facilities, and, significantly, nuclear decommissioning projects. These users require extremely high-density shielding materials (e.g., specialized concrete, massive lead/steel blocks) and robust, durable protective fibers and clothing for personnel handling hazardous waste or working within reactor containment areas. Furthermore, military and defense organizations are key buyers, demanding lightweight, high-performance materials for naval nuclear propulsion, specialized vehicles, and protection against improvised nuclear devices, emphasizing material effectiveness under severe constraints.

Finally, industrial sectors, including aerospace (for high-altitude radiation exposure testing), manufacturing (for isotope handling), and construction (for NDT), represent specialized buyers. Academic and national research laboratories, especially those operating particle accelerators or performing materials science research utilizing high-energy radiation, also represent an essential segment, often requiring bespoke shielding solutions and advanced radiation monitoring equipment integrated with protective apparel. These customers prioritize attenuation efficiency, material durability, and compliance with specific national and international safety standards above all else.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shielding International, Inc., Marshield (Division of Mars Metal), Amray Medical, Radiation Protection Products Inc., A&L Shielding Inc., Bar-Ray Products, Inc., Wardray Premise, Nelco Worldwide, ETS-Lindgren, Varian Medical Systems (now Siemens Healthineers), D-Fend Solutions, Mirion Technologies, Zippertubing, Koning & Associates, Ray-Bar Engineering Corp., Ali Industrial, Gichner Systems Group, Trelleborg AB, Burlington Textiles, SGL Carbon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radiation Protection Materials and Radiation Protection Fiber Market Key Technology Landscape

The technology landscape in the Radiation Protection Materials and Radiation Protection Fiber market is dynamic, shifting away from heavy, monolithic shielding toward advanced, multi-functional composite materials and smart fibers. A primary technological focus is the development of lead-free composites utilizing high-atomic-number elements such as tungsten, bismuth, and barium sulfate dispersed within polymer matrices. Nanotechnology plays a critical role in achieving uniform dispersion of these particles at the nanoscale, maximizing the effective cross-section for radiation absorption while minimizing material density. This innovation is crucial for creating lightweight protective apparel that offers equivalent or superior attenuation to traditional lead products, addressing the pervasive issue of occupational injuries among healthcare workers.

Another significant technological advancement is the integration of specialized boron isotopes into shielding materials, primarily for enhanced neutron radiation protection, which is vital for applications in advanced nuclear reactors, fusion research, and high-energy physics laboratories. Furthermore, the development of flexible, transparent shielding materials, often based on specialized metal oxides embedded in polymers, is transforming the design of protective barriers, windows, and eyewear, offering improved visibility and ergonomic features without compromising safety standards. These transparent solutions are increasingly sought after in interventional radiology where constant visual monitoring is critical but direct line-of-sight protection is essential.

In the realm of radiation protection fibers specifically, technological innovation focuses on developing hybrid textiles capable of multi-hazard protection—offering shielding against radiation alongside antimicrobial properties or enhanced fire resistance. Advanced fiber weaving and layering techniques are used to build gradient protection structures within apparel, optimizing shielding only where needed most based on known scatter patterns. Moreover, the emergence of smart PPE, integrating miniature sensors within the protective fabric to monitor real-time dose, temperature, and material integrity, represents a futuristic trend that leverages IoT and material science to provide proactive safety management and significantly enhance worker security and compliance across various high-risk environments globally.

Regional Highlights

North America (U.S., Canada, Mexico) is the dominant market leader, characterized by highly stringent regulatory environments (FDA, NRC) and significant expenditure on advanced medical infrastructure and nuclear facility safety upgrades. The region is a primary hub for innovation in lead-free composite materials, driven by a strong consumer preference and legislative push for sustainable and ergonomic protective solutions in healthcare settings. The U.S. government’s continued investment in defense applications, particularly in modernizing naval fleets and aerospace systems requiring lightweight, high-attenuation shielding, further solidifies its market position. High market maturity means growth is primarily focused on technological replacement cycles and the adoption of premium products in high-value interventional and diagnostic sub-segments.

Europe (Germany, U.K., France, Italy) holds a substantial market share, marked by a robust nuclear decommissioning industry, particularly in countries like the U.K. and Germany, requiring large volumes of temporary and fixed shielding materials. Furthermore, Europe boasts a highly sophisticated healthcare sector with widespread adoption of high-precision radiotherapy technologies, which mandates substantial architectural shielding investments. European manufacturers are leaders in developing specialized radiation protection glass and advanced composite materials, often dictated by stringent EU directives on worker health and environmental disposal of hazardous materials. The market here is highly competitive, emphasizing product compliance with European standards (CE marking) and a strong focus on sustainable and recyclable shielding solutions.

Asia Pacific (APAC) (China, Japan, India, South Korea) is projected to be the fastest-growing region during the forecast period. This rapid growth is underpinned by massive government investment in expanding public healthcare access and aggressive nuclear energy programs, particularly in China and India, necessitating vast quantities of shielding materials for new construction and operational safety. Japan and South Korea, with established, advanced medical device markets, are rapidly adopting lead-free fibers for their clinical personnel. The sheer scale of new hospital construction and the concurrent expansion of industrial NDT services across emerging APAC economies drive unparalleled volume demand for both basic and sophisticated shielding products. Market participants are increasingly forming local partnerships to navigate diverse regulatory landscapes and optimize regional distribution logistics.

Latin America (LATAM) remains an emerging market, with pockets of significant growth tied to modernization projects in major economies like Brazil and Mexico. The demand is primarily focused on essential diagnostic radiology shielding and materials for industrial radiography in the oil, gas, and mining sectors. Market growth is slower compared to APAC, constrained by limited healthcare budgets and reliance on imported technology, though increasing awareness regarding occupational health standards is steadily boosting the uptake of certified protective apparel. Regional players focus on providing cost-effective solutions that balance necessary safety levels with budget constraints.

Middle East and Africa (MEA) growth is predominantly driven by substantial investment in high-end medical tourism facilities (particularly in the GCC states) and burgeoning industrial applications in the energy sector. Countries like Saudi Arabia and the UAE are rapidly commissioning specialized hospitals and research centers, creating demand for state-of-the-art architectural shielding. In Africa, limited specialized infrastructure restricts large-scale market penetration, but donor-funded projects and increasing focus on basic healthcare infrastructure are slowly stimulating demand for standard radiation protection PPE and foundational shielding materials for newly installed X-ray machines in regional medical facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radiation Protection Materials and Radiation Protection Fiber Market.- Shielding International, Inc.

- Marshield (Division of Mars Metal)

- Amray Medical

- Radiation Protection Products Inc.

- A&L Shielding Inc.

- Bar-Ray Products, Inc.

- Wardray Premise

- Nelco Worldwide

- ETS-Lindgren

- Varian Medical Systems (now Siemens Healthineers)

- D-Fend Solutions

- Mirion Technologies

- Zippertubing

- Koning & Associates

- Ray-Bar Engineering Corp.

- Ali Industrial

- Gichner Systems Group

- Trelleborg AB

- Burlington Textiles

- SGL Carbon

Frequently Asked Questions

Analyze common user questions about the Radiation Protection Materials and Radiation Protection Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the shift from lead-based to lead-free radiation protection materials?

The primary driver is the combined pressure of health concerns (reducing the ergonomic burden of heavy lead apparel on healthcare workers) and strict environmental regulations governing the disposal of hazardous lead waste. Lead-free composites using tungsten or bismuth offer comparable attenuation properties while being lighter, non-toxic, and easier to handle and dispose of safely, meeting modern sustainability standards and occupational safety requirements.

How effective are advanced radiation protection fibers compared to traditional lead aprons?

Advanced radiation protection fibers, typically incorporating high-atomic-number metal oxides into flexible textiles, are engineered to provide equivalent attenuation for common diagnostic X-ray energies (typically up to 100 kVp) at significantly lower weights. While standard lead remains superior for very high-energy applications (e.g., in nuclear facilities), composite fibers meet or exceed required safety standards for most medical imaging and interventional procedures, maximizing user comfort and mobility.

Which application segment holds the largest market share for radiation protection materials?

The Healthcare sector holds the largest market share. This dominance is due to the sheer volume and global proliferation of diagnostic imaging (X-ray, CT) and radiation therapy procedures, which require extensive architectural shielding (bunkers, walls) and mandatory personal protective equipment (aprons, shields) for millions of medical professionals worldwide, ensuring continuous demand and frequent material replacement cycles.

What role does nanotechnology play in enhancing radiation protection fiber performance?

Nanotechnology is critical for integrating shielding agents like tungsten or bismuth into polymer fibers. By reducing these materials to nanoparticles, manufacturers can achieve uniform dispersion within the textile matrix. This precision maximizes the surface area interaction with radiation, leading to superior attenuation efficiency and allowing for the creation of thinner, lighter, and more flexible protective fabrics without compromising safety standards, which is key for advanced medical apparel.

What are the critical regional growth factors driving the APAC Radiation Protection Materials market?

The critical growth factors in the Asia Pacific (APAC) region include massive public and private investment in healthcare infrastructure expansion, substantial government commitment to new nuclear energy programs (especially in China and India), rapid industrialization necessitating increased non-destructive testing (NDT), and rising regulatory awareness concerning occupational radiation safety, collectively generating high volume demand across all product segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager