Radio Pallet Shuttle System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438176 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Radio Pallet Shuttle System Market Size

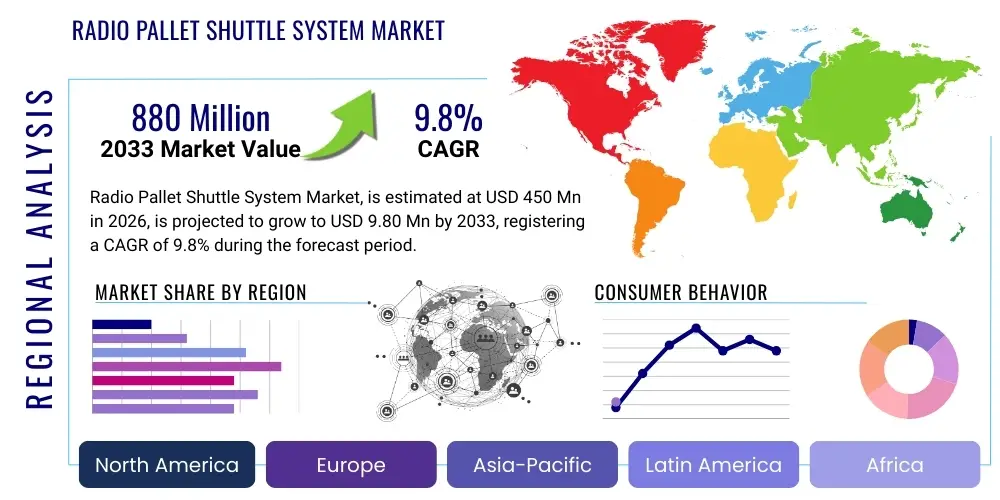

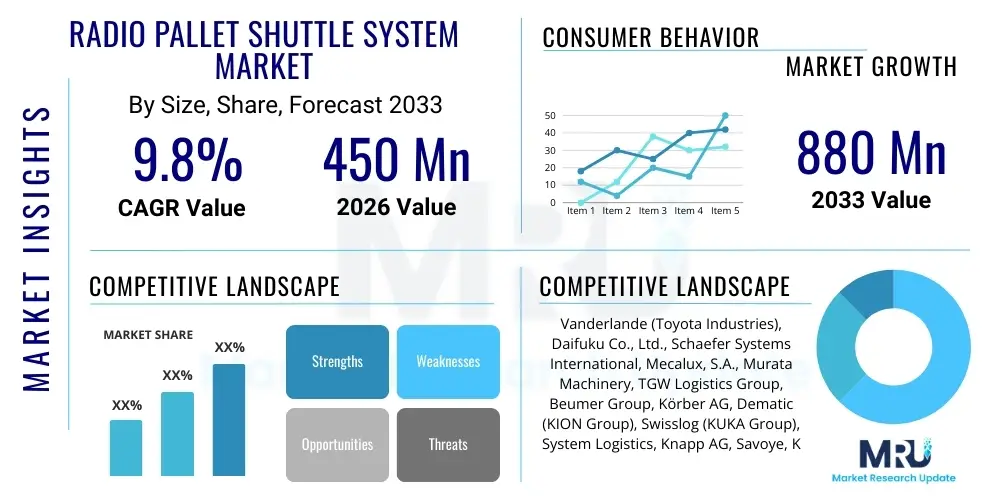

The Radio Pallet Shuttle System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 880 Million by the end of the forecast period in 2033.

Radio Pallet Shuttle System Market introduction

The Radio Pallet Shuttle System Market encompasses advanced automated storage and retrieval solutions primarily utilized in high-density warehousing environments, designed to maximize storage capacity while significantly improving operational efficiency. These systems feature a motorized carriage, known as a shuttle, which moves independently within specialized racking channels, controlled remotely via radio frequency (RF) technology. This mechanism allows for the deep storage of pallets, operating under both First-In, First-Out (FIFO) and Last-In, First-Out (LIFO) principles, drastically reducing the reliance on conventional forklifts entering the racking structure. The product is fundamentally defined by its ability to separate the storage function from the transportation function, enabling faster throughput and safer handling of goods, particularly in cold storage or temperature-controlled facilities where labor efficiency is critical.

Major applications of radio pallet shuttle systems span across various sectors, most notably in Fast-Moving Consumer Goods (FMCG), food and beverage processing, pharmaceuticals, 3PL (Third-Party Logistics), and general manufacturing. These industries are characterized by high volume, relatively standardized pallet sizes, and an intense pressure to optimize warehouse footprint due as land and construction costs escalate globally. The primary benefits driving adoption include superior utilization of vertical and horizontal space, up to 85% compared to traditional selective racking; reduced labor costs associated with manual handling; minimized product damage because the shuttle performs all internal movements; and enhanced inventory accuracy through integration with sophisticated Warehouse Management Systems (WMS). The efficiency gains offered by these systems are becoming non-negotiable for businesses pursuing supply chain resilience and speed.

The driving factors for market expansion are multifaceted, anchored by the rapid growth of e-commerce necessitating expansive and highly efficient distribution centers. Furthermore, the persistent global shortage of skilled warehouse labor pushes companies towards greater automation investments. Technological advancements, particularly in battery life, sensor technology, and control software, have made radio pallet shuttles more reliable, faster, and easier to integrate into existing logistical infrastructures. Finally, the need for safe, high-density storage solutions, especially in frozen and chilled environments, provides a strong impetus, as the automated nature of the shuttle mitigates the need for extensive human intervention in hazardous conditions, ensuring operational continuity and employee well-being.

Radio Pallet Shuttle System Market Executive Summary

The Radio Pallet Shuttle System Market is poised for robust expansion, driven primarily by evolving business trends that emphasize supply chain digitization and automation resilience. Key business trends include the increasing centralization of distribution networks into mega-warehouses, necessitating highly scalable storage solutions, and the shift towards integrated logistics platforms where handling systems communicate seamlessly with conveying and sorting equipment. There is a strong movement among logistics providers to offer customizable, high-density storage services, positioning radio shuttles as a core competitive advantage. Furthermore, manufacturers are increasingly offering rental or 'Robotics-as-a-Service' (RaaS) models, lowering the initial capital expenditure barrier and accelerating market penetration, especially for Small and Medium Enterprises (SMEs) seeking flexible automation.

Regionally, the market dynamics are highly differentiated, with Asia Pacific (APAC) emerging as the primary growth engine, fueled by massive investments in modern logistics infrastructure in China, India, and Southeast Asian nations responding to booming domestic consumption and e-commerce penetration. North America and Europe, characterized by high labor costs and stringent safety regulations, maintain strong demand for fully integrated automated systems, driving the uptake of semi-automated and fully automated shuttle solutions, often paired with Automated Guided Vehicles (AGVs) or Autonomous Mobile Robots (AMRs) for enhanced material flow. The Middle East and Africa (MEA) region is showing promising growth, particularly in the UAE and Saudi Arabia, due to diversification efforts and large-scale government infrastructure projects prioritizing cold chain logistics and food security.

Segment trends reveal a dominant preference for the semi-automated systems due to their balance of cost-effectiveness and efficiency, though the fully automated segment (often incorporating stacker cranes or vertical lifts) is expected to demonstrate the highest CAGR, catering to the needs of highly centralized, 24/7 operations. In terms of end-use, the Food & Beverage sector holds the largest market share, directly attributed to the critical requirement for cold storage and high throughput of perishable goods. However, the 3PL sector is rapidly closing the gap, positioning itself as a major consumer of shuttle systems to manage diversified client inventory profiles and fluctuating demand volumes, demanding flexible and highly dense storage solutions that the radio pallet shuttle effectively provides across multiple operational contexts.

AI Impact Analysis on Radio Pallet Shuttle System Market

User queries regarding AI's impact on the Radio Pallet Shuttle Market frequently revolve around optimizing operational efficiency, predictive maintenance capabilities, and the seamless integration of shuttle fleets within broader automated ecosystems. Key themes often address how AI algorithms can enhance dynamic slotting (determining the best storage location in real-time based on order history and outbound velocity), whether AI can eliminate human intervention entirely by optimizing task allocation among multiple shuttles, and concerns about data privacy and the complexity of managing AI-driven software interfaces. Users expect AI to move beyond basic automation toward intelligent orchestration, anticipating potential bottlenecks, and dynamically adjusting shuttle speeds and routes to maximize throughput during peak hours, thereby transitioning the systems from merely automated hardware to intelligent, self-optimizing logistical assets.

- AI-driven Predictive Maintenance: Algorithms analyze sensor data (vibration, motor temperature, battery cycling) to forecast component failure, drastically reducing unexpected downtime and optimizing maintenance scheduling.

- Dynamic Task Orchestration: AI manages real-time assignment of tasks across multiple shuttles and coordinating equipment (like stacker cranes), minimizing empty runs and ensuring load balancing.

- Optimized Inventory Slotting: Machine learning analyzes historical order data and product seasonality to determine the optimal physical storage location, decreasing retrieval times (AEO).

- Enhanced Energy Management: AI optimizes charging cycles and operational speed based on workload forecasts, extending battery life and reducing overall energy consumption.

- Simulation and Digital Twins: AI creates virtual models of the warehouse operation, allowing managers to test various scenarios (e.g., peak demand surges) without disrupting physical operations.

DRO & Impact Forces Of Radio Pallet Shuttle System Market

The Radio Pallet Shuttle System Market is significantly shaped by a confluence of accelerating drivers related to labor shortage and e-commerce growth, balanced by substantial restraints concerning high initial investment costs and complexity, while being driven forward by opportunities in advanced integration and emerging markets. The primary driving force is the relentless pursuit of space optimization in high-cost urban logistics hubs, coupled with an increasing recognition that automation is essential for business continuity in a volatile supply chain environment. Simultaneously, the impact forces of technology integration (like IoT and 5G connectivity) and intense competition among automated material handling providers are shaping pricing strategies and product feature sets, demanding continuous innovation from manufacturers to maintain competitive differentiation and value proposition alignment with operational necessity.

Key drivers include the aforementioned rise of e-commerce, which demands higher throughput and 24/7 operations, and the critical need for cold chain logistics solutions in the rapidly expanding frozen food and pharmaceutical segments, where the enclosed operation of the shuttle system excels. However, the high capital expenditure required for installing the specialized racking and purchasing the shuttle fleet remains a major restraint, particularly for smaller enterprises or facilities with highly diverse inventory profiles that don't maximize the system's density benefits. Furthermore, the reliance on proprietary software and the specialized training required for maintenance staff can present integration challenges and create a dependency on the original equipment manufacturer (OEM), which some logistics operators view as a long-term risk.

Opportunities for growth are concentrated in the development of more standardized, modular systems that reduce installation complexity and cost, alongside the integration of advanced technologies such as vision systems for enhanced load detection and accuracy, and more robust energy recovery systems. The expansion into developing economies, particularly those undertaking large infrastructure upgrades and seeking rapid optimization of distribution capabilities, presents significant untapped potential. The increasing focus on sustainability also provides an opportunity, as automated shuttle systems, when combined with optimized routing software, can significantly reduce the energy consumption and carbon footprint compared to traditional forklift operations, appealing to environmentally conscious corporations prioritizing ESG (Environmental, Social, and Governance) goals in their supply chain investments.

Segmentation Analysis

The Radio Pallet Shuttle System Market is segmented across key dimensions including System Type, Automation Level, Racking Structure, and End-Use Industry, reflecting the varied needs and operational scales of global logistics providers. Analyzing these segments provides strategic insights into investment priorities, regional adoption rates, and technological maturity across different vertical markets. The System Type segmentation distinguishes between single and multi-level applications, addressing the complexity of the warehousing architecture. Automation Level differentiates between semi-automated solutions, where a human operator controls the shuttle via remote, and fully automated systems, which are typically integrated with stacker cranes or conveyors for complete hands-off operation, catering to different capital investment budgets and required throughput levels.

- By System Type:

- Single-Level Pallet Shuttle Systems

- Multi-Level Pallet Shuttle Systems

- By Automation Level:

- Semi-Automated Systems

- Fully Automated Systems (Integrated with AS/RS)

- By Racking Structure:

- Drive-In/Drive-Through Racking

- Deep Lane Storage Racking

- By End-Use Industry:

- Food and Beverage (including Cold Chain)

- Pharmaceuticals and Healthcare

- 3PL (Third-Party Logistics) and E-commerce

- General Manufacturing

- Automotive

- Retail and Consumer Goods

Value Chain Analysis For Radio Pallet Shuttle System Market

The value chain for the Radio Pallet Shuttle System market begins with upstream activities dominated by the sourcing of high-precision components, including motors, batteries, advanced sensors (LiDAR, proximity sensors), radio control units, and robust structural steel for specialized racking systems. The reliability and cost of specialized components, particularly high-density lithium-ion batteries and sophisticated motor controllers, significantly influence the final product cost and performance metrics. Relationships with specialized technology suppliers for control software and high-frequency RF communication modules are critical at this stage. Manufacturers focus heavily on rigorous quality control and assembly efficiency, often performing final system integration and software configuration in-house to ensure seamless interaction between the shuttle hardware and the facility’s Warehouse Control System (WCS). This emphasis on technology integration differentiates leading market players from general material handling equipment providers.

The downstream segment of the value chain involves installation, integration, and ongoing maintenance services, which are highly complex and specialized. Distribution channels are typically a mix of direct sales teams handling large, custom projects for major multinational corporations, and highly specialized system integrators (indirect channels) who incorporate the radio pallet shuttle into a broader automated warehouse design, alongside conveyors, stacker cranes, and WMS solutions. The effectiveness of the indirect channel is paramount in penetrating SME markets and delivering localized support. Post-sales service, including software updates, predictive maintenance contracts, and spare parts supply, forms a significant and high-margin revenue stream. The ability of manufacturers to offer rapid, globalized technical support is a crucial factor influencing customer satisfaction and long-term contract renewal, especially in international deployments where complexity multiplies.

Direct distribution often involves dedicated sales engineers and project management teams engaging directly with large-scale end-users (like major retailers or food processors) who require highly customized solutions designed specifically for their unique facility footprint and throughput requirements. Indirect distribution relies on established partnerships with local automation integrators who manage the entire automation project lifecycle, from initial consultation and layout design to commissioning and operator training. These integrators benefit from economies of scale and local market knowledge, making the radio pallet shuttle system accessible to a broader range of enterprises. The shift towards 'as-a-service' models is also influencing the value chain, requiring manufacturers to maintain ownership and responsibility for the assets, demanding more robust monitoring and predictive maintenance capabilities to manage fleet utilization and lifetime profitability effectively.

Radio Pallet Shuttle System Market Potential Customers

The primary customers and end-users of Radio Pallet Shuttle Systems are large-scale operators across various sectors characterized by high inventory throughput, standardized load sizes, and a pressing need for space efficiency. These include major food and beverage manufacturers, particularly those dealing with frozen, chilled, or perishable goods, where minimizing exposure time and maximizing density in expensive cold rooms is non-negotiable. Third-Party Logistics (3PL) providers represent an exceptionally high-growth customer segment, as they require flexible, high-density storage solutions to service a diversified client base with fluctuating demands. The inherent flexibility of the shuttle system allows 3PLs to quickly reconfigure storage methods (FIFO/LIFO) based on client requirements, providing a superior competitive edge in capacity management. Furthermore, e-commerce fulfillment centers and large retail distribution hubs, handling massive volumes of fast-moving items, increasingly adopt these systems to buffer inventory and manage surge capacity demands associated with seasonal peaks and promotional events.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 880 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vanderlande (Toyota Industries), Daifuku Co., Ltd., Schaefer Systems International, Mecalux, S.A., Murata Machinery, TGW Logistics Group, Beumer Group, Körber AG, Dematic (KION Group), Swisslog (KUKA Group), System Logistics, Knapp AG, Savoye, Kardex Group, DMW&H, Storax, Egemin Automation, Viastore Systems, Bastian Solutions, and Automated Logistics Systems (ALS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radio Pallet Shuttle System Market Key Technology Landscape

The technology landscape of the Radio Pallet Shuttle System market is rapidly evolving, moving beyond simple automated carriage movement toward sophisticated, integrated fleet management and operational intelligence. Core technologies include advanced battery management systems (BMS), utilizing high-capacity lithium-ion technology coupled with smart charging features, often involving opportunity charging mechanisms within the racking structure to ensure 24/7 availability. The propulsion systems rely on precise servo motors and closed-loop control systems to ensure accurate positioning and safe handling of loads, even at high speeds. Communication protocols are increasingly transitioning towards Wi-Fi 6 or specialized 5G private networks within the warehouse, enabling high-bandwidth, low-latency communication between the centralized Warehouse Control System (WCS) and the mobile shuttle fleet, crucial for real-time task allocation and performance monitoring in large installations.

Sensor technology constitutes another vital pillar, with modern shuttles incorporating robust safety features such as LiDAR (Light Detection and Ranging) sensors, ultrasonic sensors, and vision cameras to detect obstacles, confirm pallet positioning, and manage clearances within the deep lanes. These sensors feed data back to the WCS, allowing for dynamic speed adjustments and collision avoidance, significantly improving operational safety and system reliability. Furthermore, the market is increasingly adopting modular design principles, utilizing standardized mechanical components that simplify assembly, maintenance, and scalability. This modularity allows customers to expand their storage capacity incrementally with minimal disruption, addressing evolving business needs without necessitating a complete system overhaul, thereby improving the long-term ROI of the installation.

The convergence of industrial IoT (IIoT) and sophisticated analytical software is perhaps the most significant technological advancement. Shuttles are now generating vast amounts of operational data regarding speed, cycle times, battery health, and fault occurrences. This data is leveraged by cloud-based analytics platforms to provide actionable insights for predictive maintenance and performance optimization, as discussed in the AI analysis section. Furthermore, the integration with higher-level automation components, specifically Automated Guided Vehicles (AGVs) or Autonomous Mobile Robots (AMRs) that handle the transfer of pallets to and from the racking entrance, is enabled by standardized API interfaces and interoperable software layers. This seamless integration ensures the radio pallet shuttle system is not an isolated unit but a fundamental, interconnected part of a fully automated intralogistics system, facilitating end-to-end material flow without human intervention.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily fueled by the explosive growth of e-commerce, rapid industrialization, and massive infrastructural investments in logistics and cold chain facilities, particularly in China, India, Japan, and Australia. High population density and rising labor costs in key urban hubs make space optimization a critical necessity.

- North America: Characterized by high labor costs and substantial adoption of automation technology, North America remains a highly mature market, driven by the massive scale of 3PL operations and the requirement for rapid fulfillment capabilities to meet demanding consumer expectations. Focus is placed on fully automated, high-throughput systems integrated with AGVs/AMRs.

- Europe: Europe exhibits strong demand, particularly in Western economies (Germany, UK, France) due to stringent safety regulations and established food and pharmaceutical supply chains requiring high-reliability automation. The market shows a balanced mix of semi-automated solutions for cost-sensitive operations and fully integrated AS/RS for specialized logistics centers.

- Latin America (LATAM): Growth is accelerating in LATAM, concentrated in Brazil and Mexico, spurred by foreign direct investment and the modernization of distribution centers serving large retail chains and manufacturing sectors. The focus here is often on semi-automated systems that offer immediate efficiency gains without the full cost of complete automation.

- Middle East and Africa (MEA): This region is an emerging market with significant growth potential, driven by government initiatives related to economic diversification, food security, and investment in modern cold storage infrastructure, particularly in the UAE and Saudi Arabia. Adoption is focused on large-scale centralized distribution projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radio Pallet Shuttle System Market.- Daifuku Co., Ltd.

- Dematic (KION Group)

- Vanderlande (Toyota Industries)

- Schaefer Systems International

- Mecalux, S.A.

- Murata Machinery

- TGW Logistics Group

- Körber AG

- Swisslog (KUKA Group)

- Knapp AG

- System Logistics

- Beumer Group

- Savoye

- Kardex Group

- Bastian Solutions

- DMW&H

- Storax

- Egemin Automation

- Viastore Systems

- Automated Logistics Systems (ALS)

Frequently Asked Questions

Analyze common user questions about the Radio Pallet Shuttle System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a Radio Pallet Shuttle System over traditional racking?

The primary advantage is dramatically increased storage density, often exceeding 85% utilization, by minimizing aisle space and allowing deep lane storage (up to 40 pallets deep), which is crucial for expensive real estate or cold storage environments.

Are Radio Pallet Shuttle Systems suitable for both FIFO and LIFO inventory management?

Yes, radio pallet shuttle systems are highly versatile. They can be configured for Last-In, First-Out (LIFO) when operating from a single entry point, or configured for First-In, First-Out (FIFO) when using a drive-through racking structure with entry and exit points.

What is the typical Return on Investment (ROI) period for installing a shuttle system?

While ROI varies significantly based on labor costs and throughput, specialized high-density applications, such as cold storage or high-volume 3PL operations, often see an ROI within three to five years due to massive savings in space utilization and operational labor efficiency.

How does AI contribute to the efficiency of a radio pallet shuttle fleet?

AI enhances efficiency through dynamic task optimization, ensuring shuttles are always performing the highest priority tasks with minimal travel distance, and enabling predictive maintenance to prevent costly unexpected operational downtime.

Which industries are the largest adopters of Radio Pallet Shuttle Technology?

The largest adopters are the Food and Beverage industry (especially cold chain), Third-Party Logistics (3PL), and large-scale E-commerce distribution centers, driven by their need for high throughput and maximal storage capacity.

Advanced Market Dynamics and Competitive Landscape

The competitive landscape within the Radio Pallet Shuttle System market is characterized by intense technological rivalry between established global material handling giants and specialized automation providers. Major players often leverage their comprehensive product portfolios, integrating radio shuttles seamlessly with their broader Automated Storage and Retrieval Systems (AS/RS), conveyors, and Warehouse Management Software (WMS). This strategy allows them to offer complete, end-to-end intralogistics solutions, positioning them as single-source providers for complex, large-scale automation projects. Price competition remains significant, particularly in Asia Pacific, but the differentiation is increasingly shifting from hardware cost to the sophistication, reliability, and interoperability of the control software and the availability of globalized, high-quality after-sales service and support infrastructure. Furthermore, mergers and acquisitions remain a consistent feature, as large technology conglomerates strategically acquire niche shuttle providers to gain access to patented technology or expand their regional footprint and specialized expertise, thus continually reshaping the market hierarchy and fostering consolidation.

A crucial market dynamic involves the shift towards flexible manufacturing and warehousing, often termed 'Industry 4.0' readiness. End-users are increasingly demanding modular, easily reconfigurable radio pallet shuttle systems that can adapt to evolving product lines or seasonal inventory fluctuations without extensive engineering modifications. This demand is pushing manufacturers to develop systems that are not tied to a fixed infrastructure but can operate alongside mobile robotics and other flexible components. Furthermore, environmental sustainability concerns are influencing purchasing decisions; customers prioritize shuttles with energy-efficient propulsion systems, regenerative braking capabilities, and optimized routing algorithms that minimize energy consumption per pallet move. Manufacturers who can credibly demonstrate superior energy performance and use sustainable materials gain a competitive edge in mature markets like Europe and North America where ESG reporting is mandatory for large corporations, thereby influencing procurement criteria.

Another pivotal dynamic is the ongoing pressure on supply chain resilience, exacerbated by recent global disruptions. This has encouraged manufacturers to regionalize their production of key components and establish more robust, diversified supply networks, moving away from heavily centralized component sourcing. This affects the pricing and lead times for new shuttle installations globally. For end-users, this volatility underscores the necessity of having highly reliable, automated systems that reduce dependency on manual labor and geographical bottlenecks, further accelerating the adoption cycle for radio pallet shuttles. The development of standardized protocols for communication and safety, moving away from proprietary interfaces, is also a growing trend, facilitating easier integration with multi-vendor systems and reducing the long-term operational friction experienced by customers managing diverse automation fleets. This drive for open architecture promises to lower integration costs and democratize access to advanced automation technologies.

Future Market Outlook and Strategic Recommendations

The future outlook for the Radio Pallet Shuttle System Market is exceptionally positive, projected to maintain its aggressive growth trajectory through the forecast period, driven by sustained global expansion of automated distribution networks and the continued search for solutions that tackle labor scarcity and land constraints. The market is expected to witness significant advancements in 'shuttle intelligence,' leveraging edge computing and on-board processing capabilities to make real-time operational decisions independent of the central WCS for increased redundancy and speed. Furthermore, system architectures will become increasingly hybrid, seamlessly integrating high-density deep-lane storage offered by shuttles with the agility and accessibility provided by Autonomous Mobile Robots (AMRs) for inter-zone transportation, creating truly integrated, dynamic automated warehouses that optimize both storage volume and retrieval speed. This trend indicates a blurring of lines between traditional static automation and flexible mobile robotics, demanding that manufacturers offer highly compatible and standardized hardware and software platforms.

A key strategic development will be the widespread adoption of standardized, modular, and cloud-based Fleet Management Systems (FMS). These systems will not only monitor the performance of shuttle fleets but also provide sophisticated capacity planning, simulation capabilities, and energy usage optimization across multiple geographical locations for global enterprises. The push for standardization and simplified installation processes will open up the market to a wider range of SMEs who previously viewed the technology as prohibitively complex or costly. Manufacturers are advised to strategically target vertical market segments like e-commerce fresh food delivery and pharmaceutical cold chain, where the benefits of temperature control and rapid, accurate pallet retrieval are most pronounced and where the willingness to invest in premium solutions is highest. This focused approach on high-value niche applications ensures differentiation from competitors focused solely on general warehousing needs.

Strategic recommendations for market participants include heavy investment in developing AI-powered operational software that transitions from simple task execution to predictive operational management, thereby enhancing the customer value proposition beyond pure hardware performance. Companies should explore innovative financing models, such as Robotics-as-a-Service (RaaS) and long-term lease agreements, particularly in emerging markets and for smaller enterprises, to overcome the initial high capital barrier. Furthermore, establishing localized production and service centers in high-growth regions like Southeast Asia and Latin America will be critical for reducing lead times, mitigating supply chain risks, and providing timely, localized technical support. Focusing on robust cybersecurity features within the shuttle control systems is also paramount, as fully automated warehouses represent critical infrastructure, making them potential targets for cyber-attacks, and secure operation will become a key selling point in the B2B technology space.

Policy and Regulatory Impact on Radio Pallet Shuttle Market

The regulatory environment significantly impacts the Radio Pallet Shuttle Market, primarily concerning industrial safety standards, battery handling and disposal regulations, and international trade policies. Safety regulations, particularly in mature markets like the EU and North America, mandate rigorous testing and certification (e.g., CE marking) for automated machinery operating in proximity to personnel. Compliance with these standards necessitates substantial investment in advanced sensor technology, fail-safe mechanisms, and software validation, driving up development costs but ensuring a higher quality and safer product. Conversely, consistent global safety standards help facilitate international trade and reduce the need for market-specific modifications. Changes in labor laws, particularly minimum wage increases and worker safety mandates, indirectly favor automation, as companies seek systems that reduce workplace risk and dependency on expensive human labor for strenuous or repetitive tasks within challenging environments, such as deep-freeze storage.

Environmental policies, notably the EU’s Waste Electrical and Electronic Equipment (WEEE) Directive and similar regulations focusing on battery lifespan and recycling, require manufacturers to design shuttle systems with sustainability in mind. This includes using easily separable components, minimizing toxic materials, and ensuring clear labeling for recycling processes. Furthermore, global intellectual property (IP) laws and patent protections play a vital role in maintaining competitive advantage; companies aggressively protect their proprietary racking designs, shuttle movement algorithms, and unique battery management systems, often leading to complex and costly legal disputes. The ability to innovate and secure robust IP protection determines long-term market leadership and pricing power, acting as a significant barrier to entry for new competitors attempting to quickly replicate specialized, high-performance designs.

International trade policies, including tariffs and regional trade agreements (like the USMCA or agreements within the ASEAN bloc), directly influence the cost of raw materials (steel, specialized electronics) and the final price of the imported shuttle systems. Geopolitical tensions can lead to supply chain fragmentation, prompting manufacturers to regionalize component sourcing to avoid punitive tariffs or embargoes. Additionally, data protection regulations (like GDPR) impose requirements on how operational data collected by the shuttle systems and WCS is stored and utilized, especially if customer or employee performance data is captured. Manufacturers must ensure their integrated software solutions adhere strictly to these regulations, adding another layer of compliance complexity, particularly for those operating global fleets and managing cross-border data flows. These regulatory hurdles compel businesses to partner with solution providers who offer not only technological superiority but also proven expertise in global compliance and localized certification.

In-Depth Supply Chain and Manufacturing Analysis

The supply chain for Radio Pallet Shuttle Systems is characterized by high reliance on specialized engineering skills and a global sourcing network for critical components. Manufacturing is often concentrated in high-tech industrial zones, particularly across Germany, Japan, and increasingly, China. The upstream segment involves the procurement of high-grade steel for racking and rails, precision-machined mechanical parts, and advanced electronics, including programmable logic controllers (PLCs), high-performance motors, and sensors (LiDAR, encoders). Disruptions in the global semiconductor supply chain continue to pose a constraint, impacting lead times for the sophisticated control units housed within the shuttle itself. Manufacturers must manage complex inventory strategies to buffer against volatility in commodity prices (especially steel and aluminum) and ensure continuous availability of proprietary electronic modules, often necessitating long-term agreements with specialized sub-component suppliers to guarantee both quality and volume stability.

Midstream activities involve the specialized assembly and rigorous testing of the shuttle units. Unlike general material handling equipment, radio shuttles require extremely precise tolerances in assembly to ensure safe, high-speed operation within narrow racking channels. Quality control is paramount, as failure of a single shuttle can halt deep-lane operations. Companies often use advanced robotics and lean manufacturing principles to achieve high repeatability and standardization in the build process. Furthermore, the integration of hardware and software is critical at this stage; proprietary operating systems must be flashed onto the units and calibrated to communicate effectively with the specific racking geometry and the client's WCS. This customization and testing phase represents a significant portion of the total manufacturing cycle time and requires highly skilled engineering talent capable of bridging mechanical, electrical, and software disciplines efficiently.

The downstream distribution and installation phase involves highly complex logistics and site-specific project management. Transporting the bulky racking components and sensitive electronic shuttles requires specialized handling. The installation process itself is intensive, demanding highly skilled commissioning engineers to align the racking perfectly and perform extensive system dry runs before going live. The shift towards offering modular and pre-assembled racking components is aimed at simplifying on-site installation and reducing the overall project implementation timeline, which is a major pain point for customers eager to activate their automated capacity. Successful project delivery relies heavily on effective coordination between the shuttle OEM, the racking supplier (if separate), civil engineering contractors, and the end-user’s IT team responsible for integrating the WCS, making robust communication and project management methodologies essential differentiators in the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager