Radio Remote Control Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432575 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Radio Remote Control Equipment Market Size

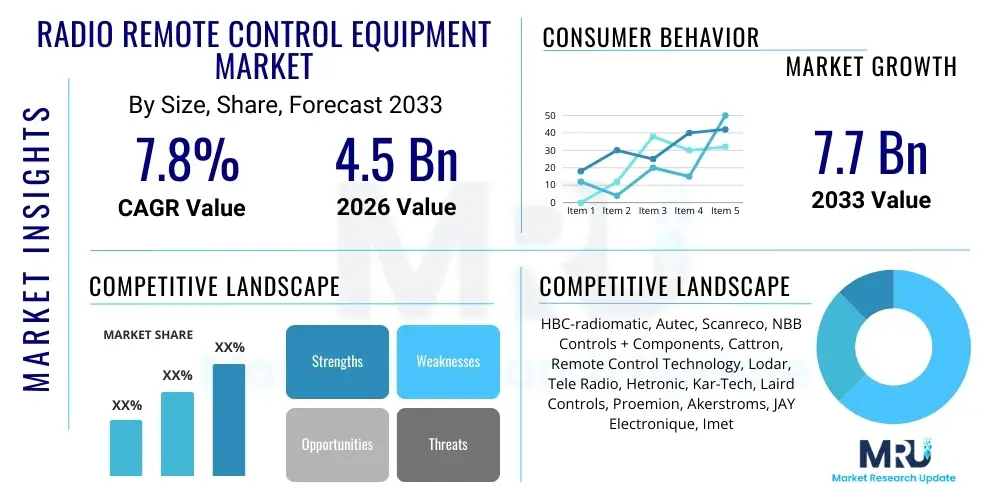

The Radio Remote Control Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.7 billion by the end of the forecast period in 2033.

Radio Remote Control Equipment Market introduction

The Radio Remote Control (RRC) Equipment Market encompasses systems designed to wirelessly control machinery and processes from a safe and ergonomic distance. These systems typically comprise a handheld or mounted transmitter unit and a corresponding receiver unit connected to the target machinery. RRC equipment is fundamentally employed to enhance operational safety, improve efficiency, and provide greater flexibility in environments that are hazardous, confined, or require high precision in movement control, such as heavy lifting, construction, and mining operations. The core technological objective is to replace wired controls, minimizing operational downtime and reducing the risk of accidents caused by proximity to dangerous moving parts or high-voltage installations.

Major applications for RRC equipment span diverse industrial sectors, including the control of overhead cranes, mobile hydraulics, concrete pumps, locomotives, winches, and sophisticated industrial automation systems. The product sophistication ranges from simple toggle-switch controls to complex proportional systems offering fine-tuned control over multiple functions simultaneously. Key benefits derived from adopting RRC systems include enhanced worker safety due to standoff operation, improved productivity through better visibility and maneuverability for operators, and cost reduction associated with labor optimization and reduced equipment damage. Furthermore, the ergonomic design of modern transmitters, often featuring customizable interfaces and robust housing, contributes significantly to operator comfort during long shifts.

Driving factors propelling market expansion include the stringent implementation of industrial safety regulations globally, particularly in developed economies, mandating safe operational distances for heavy machinery. The increasing demand for automation and optimization across manufacturing, construction, and logistics sectors is also a significant catalyst. Technological advancements, specifically the integration of reliable digital communication protocols (e.g., frequency hopping spread spectrum or FHSS), improved battery life, and the development of lightweight, highly durable components, ensure the reliability and broader applicability of these control systems. The ongoing trend toward modernizing legacy infrastructure, particularly in infrastructure projects and material handling facilities, further stimulates the replacement cycle for older, wired control mechanisms.

Radio Remote Control Equipment Market Executive Summary

The global Radio Remote Control (RRC) Equipment Market is characterized by robust growth, primarily driven by mandatory safety standards across high-risk industries and the persistent push for industrial automation efficiency. Business trends indicate a strong move towards digitized and interoperable RRC solutions, featuring advanced diagnostics, customizable software, and integration capabilities with broader Industrial Internet of Things (IIoT) frameworks. Key market participants are focusing on vertical integration and strategic partnerships to offer tailored solutions for highly specialized applications, such as large-scale mining trucks and complex multi-crane coordination systems. There is a noticeable competitive shift toward providing comprehensive service models that include installation, maintenance, and system upgrades, moving beyond simple product sales.

Regionally, North America and Europe maintain dominance, characterized by high levels of industrial automation maturity and strict regulatory frameworks emphasizing worker protection. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by massive infrastructure investments, rapid urbanization, and the aggressive expansion of manufacturing capacities, particularly in countries like China, India, and Southeast Asia. The adoption in APAC is often characterized by a focus on cost-effective yet reliable solutions. In contrast, emerging markets in Latin America, the Middle East, and Africa are showing nascent but steady growth, driven largely by oil and gas exploration and expanding logistics hubs requiring modern material handling equipment.

Segment trends reveal that the Cranes & Lifting Equipment application segment remains the largest consumer, though the construction machinery and industrial automation segments are exhibiting faster expansion rates due to increased deployment of smart factories and specialized remote-controlled vehicles. Based on component type, receivers, particularly those with enhanced fault tolerance and embedded microprocessors for complex signal processing, account for a substantial market share. Furthermore, the market is observing a trend toward dual-band and multi-frequency solutions to ensure resilience against signal interference in densely industrialized environments, thereby enhancing the overall reliability and safety performance of the deployed RRC systems.

AI Impact Analysis on Radio Remote Control Equipment Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Radio Remote Control Equipment Market frequently center on themes of enhanced operational autonomy, predictive maintenance capabilities, and the potential for AI-driven safety protocols. Users are primarily concerned about how AI can move RRC systems beyond simple teleoperation towards semi-autonomous functions, optimizing complex movements like load swinging minimization or path planning in dynamic environments. Key expectations revolve around using machine learning algorithms to analyze real-time operational data gathered via RRC systems (such as motor load, control inputs, and environmental factors) to predict component failure, reduce operator fatigue, and ultimately increase equipment uptime. Questions often arise regarding the cybersecurity implications and regulatory hurdles associated with delegating critical control decisions to AI models in high-risk applications like heavy lifting or mining.

AI is fundamentally transforming RRC systems by introducing intelligence directly into the control loop. Machine learning algorithms embedded within high-end RRC transmitters and receivers are increasingly used for sophisticated tasks such as load stability calculation, anti-collision systems in congested work areas, and adaptive control mechanisms that automatically adjust control sensitivity based on operational conditions (e.g., wind speed or floor vibration). This shift enhances the utility of RRC equipment from being purely control devices to sophisticated operational assistants. For example, AI can analyze thousands of historical movement patterns to generate optimized control trajectories, reducing the skill level required by the operator while maintaining or even improving precision.

The application of AI also significantly impacts the maintenance and service model of RRC equipment. By monitoring communication quality, battery degradation, button usage patterns, and receiver response times, AI tools can generate highly accurate predictive maintenance alerts. This proactive approach minimizes unexpected system failures, which are particularly costly in continuous operations such as large ports or automated warehouses. Furthermore, AI contributes to safety through anomaly detection, immediately identifying and flagging control inputs or equipment responses that deviate from established safety parameters, potentially overriding human input if a catastrophic failure is imminent. This integration necessitates robust, secure, and low-latency communication networks to handle the increased data flow and decision-making complexity.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast component wear and scheduling preemptive repairs for RRC hardware (transmitters, receivers, relays).

- Enhanced Safety and Collision Avoidance: Implementing machine vision and deep learning to enable autonomous object detection and dynamic safety zone management for remotely controlled machines.

- Semi-Autonomous Operation: Developing AI models that assist operators with complex maneuvers, such as automated load stabilization and oscillation damping in crane operations.

- Adaptive Control Systems: Algorithms adjusting control sensitivity and response characteristics in real-time based on environmental inputs and payload dynamics.

- Optimized Power Management: Machine learning adjusting transmission power and sleep cycles to maximize battery life without compromising signal integrity.

- Operator Performance Monitoring: Analyzing control inputs to assess operator fatigue or skill level and provide tailored haptic feedback or warnings.

DRO & Impact Forces Of Radio Remote Control Equipment Market

The Radio Remote Control (RRC) Equipment Market is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces shaping its trajectory. The primary Driver is the unrelenting global regulatory push for worker safety, particularly in industries involving heavy machinery, compelling companies to adopt RRC solutions to maintain operational compliance and reduce liability. This is coupled with the growing necessity for optimizing industrial throughput; RRC systems offer improved visibility and control, leading to quicker cycle times and enhanced operational efficiency. Simultaneously, technological advancements, including robust digital signaling and highly durable hardware designed for extreme industrial environments, enhance the perceived value and reliability of these systems. These driving forces solidify the RRC market's role as a critical enabler of safe and efficient industrial operations.

Restraints, however, pose challenges to widespread adoption. A major concern is the inherent vulnerability of wireless communication to radio frequency (RF) interference, especially in crowded industrial parks or metropolitan areas, which can compromise system reliability and safety. Furthermore, the high initial investment cost associated with high-end, custom RRC systems, particularly those incorporating advanced features like proportional control and extensive feedback diagnostics, can be prohibitive for Small and Medium-sized Enterprises (SMEs). Cybersecurity risks are also emerging as a significant restraint; as RRC systems become integrated with IIoT networks, they become potential targets for malicious attacks seeking to disrupt or hijack critical machinery, necessitating continuous investment in secure communication protocols and encryption.

Opportunities for market growth are vast and largely tied to technological convergence and untapped end-use sectors. The expansion into emerging markets, coupled with extensive government investment in modernization of public infrastructure (rail, ports, and utilities), provides substantial growth avenues. The key opportunity lies in integrating RRC systems with augmented reality (AR) and virtual reality (VR) interfaces for remote training and operation, allowing expert oversight from distant locations. Furthermore, the development of standardized, secure, and low-power RRC solutions tailored for specialized applications, such as drone control for industrial inspection or advanced agricultural machinery, represents fertile ground for product innovation and market penetration, ensuring sustained momentum throughout the forecast period.

- Drivers: Strict industrial safety regulations; increasing adoption of industrial automation and smart manufacturing practices; demand for enhanced operational efficiency and flexibility; technological improvements in battery life and signal robustness.

- Restraints: Susceptibility to radio frequency interference (RFI) and signal congestion; high initial deployment costs for advanced proportional systems; growing concerns related to cybersecurity of wireless control systems; limited standardization across diverse industrial protocols.

- Opportunity: Expanding applications in specialized robotics and industrial drone control; integration with IIoT platforms for centralized monitoring and predictive maintenance; market penetration in emerging economies focusing on infrastructure development; development of robust, fail-safe systems using AI and secure communication standards.

- Impact Forces: Safety compliance mandates creating inelastic demand; rapid pace of digitization driving integration requirements; competitive pressure emphasizing total cost of ownership (TCO) over initial price; global supply chain dynamics influencing component availability.

Segmentation Analysis

The Radio Remote Control Equipment Market is segmented based on component type, application, frequency, and end-use industry, providing a granular view of market dynamics and adoption patterns across various industrial landscapes. Understanding these segments is crucial for strategic planning, as different applications demand distinct features—ranging from rugged durability in mining controls to high precision and low latency in surgical robotics systems (a niche RRC application). The component segmentation helps identify revenue streams derived from proprietary hardware versus standardized peripherals. Application segmentation, meanwhile, highlights the core industrial pillars driving volume growth, with material handling being historically dominant but sectors like construction and agriculture showing dynamic potential.

The segmentation by frequency band is vital due to regulatory compliance and operational reliability requirements. Systems operating in regulated industrial, scientific, and medical (ISM) bands (like 2.4 GHz) offer high bandwidth but can face congestion, while lower frequencies (400-490 MHz) offer better penetration through obstacles but with limited data rates. End-use industry segmentation directly correlates RRC equipment adoption with specific industrial CAPEX cycles and technological maturity levels. Mature markets like Automotive and Aerospace demand highly certified, robust, and often customized RRC solutions that seamlessly integrate into highly controlled manufacturing environments, whereas sectors like Utilities focus more on robust long-range reliability for infrastructure management.

The market analysis indicates a pronounced trend toward fragmentation in component offerings, where specialized receivers capable of managing complex I/O (Input/Output) protocols are gaining traction. Application growth is accelerating in infrastructure-heavy sectors where human presence poses significant risk, such as tunneling and specialized demolition. Furthermore, competitive differentiation is increasingly achieved through software and service offerings layered onto the base hardware, including sophisticated diagnostic suites and user interface customization, moving the industry focus toward integrated solutions rather than standalone hardware sales. This focus on value-added services underscores the market's evolution toward holistic control solutions.

- By Component:

- Transmitters (Handheld, Belly-box/Waist-mounted, Console/Fixed)

- Receivers (Standard, Advanced Digital, Safety-rated)

- Actuators and Relays

- Power Supply and Battery Units

- Ancillary Components (Antennas, Cables, HMI interfaces)

- By Application:

- Cranes & Lifting Equipment (Overhead Cranes, Tower Cranes, Mobile Cranes)

- Construction Machinery (Concrete Pumps, Excavators, Dozers)

- Industrial Automation and Robotics

- Mining & Metals Handling

- Transportation & Logistics (Locomotives, AGVs)

- Oil & Gas and Energy Utilities

- Agriculture and Forestry Equipment

- By Frequency:

- 400 MHz to 490 MHz (UHF/Narrowband)

- 900 MHz to 2.4 GHz (ISM Band)

- Other Licensed and Unlicensed Bands

- By End-Use Industry:

- Automotive Manufacturing

- Aerospace & Defense

- Marine and Ports

- Manufacturing (General)

- Utilities and Waste Management

Value Chain Analysis For Radio Remote Control Equipment Market

The value chain for the Radio Remote Control Equipment Market begins with upstream activities focused heavily on the sourcing and manufacturing of highly specialized electronic components. This stage involves the procurement of semiconductors, high-frequency transceivers, durable housing materials (often reinforced polymers or aluminum), and specialized batteries. Key challenges upstream include managing global supply chain volatility for critical semiconductor components and ensuring compliance with stringent industrial and safety certifications (e.g., SIL 3, PLe) for all electronic modules. Companies often rely on specialized third-party component manufacturers, requiring robust quality control mechanisms to guarantee the reliability essential for safety-critical control systems.

Midstream activities encompass the design, assembly, and integration of the final RRC systems. This stage is dominated by core RRC manufacturers who invest significantly in R&D to develop proprietary communication protocols, frequency hopping technologies, and user interface designs. Manufacturing processes require high precision in PCB assembly and encapsulation to ensure environmental protection (IP ratings). Downstream activities focus on the distribution and delivery of the finished product to end-users. The distribution channel is characterized by a mix of direct sales to large, multinational OEMs (Original Equipment Manufacturers) who integrate RRC systems into their machinery (e.g., crane manufacturers) and indirect channels utilizing authorized distributors, system integrators, and value-added resellers (VARs) who provide local installation, customization, and after-sales support.

The reliance on indirect channels is particularly strong for servicing the aftermarket and smaller industrial clients who require tailored installation services and localized technical support. Direct sales are preferred for high-volume OEM contracts or complex, highly customized projects (like bespoke mining equipment controls). After-sales services, including maintenance, repair, training, and certified parts supply, represent a critical and high-margin segment of the downstream value chain. Suppliers who can offer comprehensive lifecycle support, digital diagnostics, and rapid turnaround on repairs gain a significant competitive advantage, solidifying long-term customer relationships and moving beyond a transaction-based model toward a partnership approach.

Radio Remote Control Equipment Market Potential Customers

Potential customers for Radio Remote Control Equipment are predominantly enterprises and organizations operating heavy, moving, or hazardous machinery across various high-value industrial sectors. The largest customer base resides within the material handling industry, specifically businesses utilizing large fleets of overhead cranes, gantry systems, and hoists in factories, warehouses, and port facilities. These customers seek RRC solutions primarily to enhance operator safety by removing them from direct proximity to swinging loads or high-voltage power lines, simultaneously aiming to increase load placement precision and speed up logistics processes.

Another significant group includes construction and infrastructure development companies. These end-users, dealing with complex and dynamically changing worksites, require robust RRC systems for concrete pumps, large mobile construction cranes, and specialized site machinery. The ability to control equipment while maintaining optimal line-of-sight view of the operation, which is often impossible with tethered controls, is a core value proposition for this segment. Furthermore, the mining and metals industries are high-priority customers, demanding extremely durable, often explosion-proof (ATEX/IECEx certified) RRC systems for controlling heavy haul trucks, crushers, and subsurface equipment in harsh, dusty, and potentially explosive environments.

Beyond these heavy industries, the expanding industrial automation sector, including manufacturers deploying Automated Guided Vehicles (AGVs), customized robotics, and sophisticated production lines, represents a rapidly growing customer demographic. These customers prioritize low-latency, highly reliable, and network-integrable RRC solutions that can communicate seamlessly within a smart factory ecosystem. The common thread among all potential customers is the need to mitigate risk, improve labor efficiency, and comply with safety mandates, making RRC equipment an essential capital expenditure rather than a discretionary purchase, thereby ensuring steady market demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 7.7 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HBC-radiomatic, Autec, Scanreco, NBB Controls + Components, Cattron, Remote Control Technology, Lodar, Tele Radio, Hetronic, Kar-Tech, Laird Controls, Proemion, Akerstroms, JAY Electronique, Imet |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radio Remote Control Equipment Market Key Technology Landscape

The technology landscape of the Radio Remote Control Equipment Market is defined by a continuous drive toward enhanced security, reliability, and functionality, moving beyond basic on/off control toward complex proportional and feedback systems. A core technological focus is on frequency management, particularly the widespread adoption of Frequency Hopping Spread Spectrum (FHSS) technology. FHSS systems drastically improve immunity to interference by rapidly cycling between numerous narrow frequency channels within a given band. This ensures robust and reliable communication even in electromagnetically noisy environments, which is paramount for safety-critical operations. Complementing FHSS is the use of proprietary or highly secure digital coding schemes (such as cyclic redundancy checks, or CRCs) embedded in the communication payload to prevent unauthorized control and ensure that the receiver only executes authenticated commands, thereby fulfilling stringent safety integrity level requirements.

Another key technological differentiator is the shift towards advanced feedback systems and Human-Machine Interfaces (HMIs). Modern RRC transmitters are increasingly equipped with high-resolution color displays, haptic feedback mechanisms, and sophisticated diagnostics. The feedback loops allow the operator to receive real-time data regarding the machine's status, such as load weight, motor temperature, battery level, or tilt angle, directly on the handheld transmitter. This integration of diagnostics elevates the RRC system from a simple control device to a comprehensive supervisory tool. Furthermore, the development of proportional control technology, utilizing potentiometers and joysticks to provide smooth, variable speed control rather than abrupt start/stop motions, is essential for applications requiring precision, such as hydraulic manipulation or precise load positioning.

Power management and connectivity standards are also areas of intense technological development. Manufacturers are innovating with lithium-ion and advanced battery chemistries to maximize operational duration and reduce the transmitter's weight, enhancing operator ergonomics. Furthermore, there is an increasing trend toward integrating RRC receivers with industrial fieldbus standards like PROFINET, Ethernet/IP, and CAN bus. This seamless integration enables RRC systems to communicate directly with Programmable Logic Controllers (PLCs) and supervisory systems, facilitating IIoT connectivity, centralized monitoring, and remote diagnostics, thus positioning RRC equipment as an integral component of the smart factory ecosystem. The development of modular, scalable hardware platforms allows manufacturers to quickly adapt their offerings to diverse application requirements without complete redesigns.

Regional Highlights

Regional dynamics in the Radio Remote Control Equipment Market reveal significant disparities in maturity, regulatory influence, and growth potential, driven primarily by industrial output and investment in infrastructure. North America is a mature market characterized by high adoption rates across construction, energy, and logistics sectors, largely mandated by strict occupational safety and health administrations (OSHA) regulations. The region consistently adopts high-specification, technologically advanced RRC systems, focusing on integration with existing enterprise resource planning (ERP) systems and sophisticated safety features like emergency stop systems compliant with international standards. Major regional investments in modernizing aging ports and rail systems further drive demand for advanced, heavy-duty RRC solutions.

Europe represents another key region, where market growth is underpinned by stringent EU machinery directives and a strong emphasis on smart factory initiatives (Industry 4.0). Countries like Germany and Scandinavia lead the market in adopting highly sophisticated, customized RRC solutions for precision engineering and advanced manufacturing. The focus in Europe is heavily skewed toward robust system reliability, certification (CE marking), and energy efficiency. The European market also benefits from a high density of key manufacturing players who not only supply the regional market but also export advanced RRC systems globally, setting benchmarks for quality and technological integration across various industrial applications.

The Asia Pacific (APAC) region is the fastest-growing market globally, propelled by unparalleled infrastructure spending in emerging economies and the continuous relocation and expansion of global manufacturing bases. While price sensitivity remains a factor in certain sub-regions, the demand is soaring for RRC systems used in mega-projects such as high-speed rail construction, port expansion, and urbanization efforts. China and India are major consumers, witnessing accelerated adoption due to rapidly professionalizing industrial practices and a growing awareness of worker safety standards. Local manufacturing in APAC is intensifying, often focusing on producing cost-effective, yet reliable, components that adhere to necessary functional safety requirements to serve the vast regional industrial base.

Latin America (LATAM), the Middle East, and Africa (MEA) constitute emerging markets with concentrated demand derived primarily from resource extraction industries—mining in LATAM, and oil & gas in the MEA. Growth in these regions is heavily tied to commodity cycles and foreign direct investment. The MEA, particularly the GCC countries, is witnessing substantial investment in construction and logistics hubs (e.g., automated ports), creating nascent but strong demand for reliable RRC solutions capable of withstanding extreme environmental conditions (high temperatures, sand exposure). Adoption often involves large-scale governmental or private sector projects that prioritize long-range control and exceptional hardware durability.

- North America: Driven by strict OSHA regulations, high technological adoption, and major investments in energy infrastructure and heavy machinery modernization.

- Europe: Characterized by high compliance with EU machinery directives, strong emphasis on Industry 4.0 integration, and dominance of high-precision applications in manufacturing and automation.

- Asia Pacific (APAC): Highest growth region fueled by urbanization, massive infrastructure projects (China, India), and expanding low-to-mid-cost manufacturing bases demanding robust, scalable RRC solutions.

- Latin America (LATAM): Demand concentrated in mining, agriculture, and infrastructure, with market growth heavily dependent on global commodity prices and industrial investment cycles.

- Middle East and Africa (MEA): Growth stimulated by large-scale oil & gas projects, substantial port development, and construction sectors requiring specialized, rugged RRC equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radio Remote Control Equipment Market.- HBC-radiomatic GmbH

- Autec S.r.l.

- Scanreco AB

- NBB Controls + Components GmbH

- Cattron (A business unit of Laird Controls)

- Remote Control Technology Pty Ltd

- Lodar Ltd

- Tele Radio AB

- Hetronic International, Inc.

- Kar-Tech, Inc.

- Akerstroms Björbo AB

- JAY Electronique

- Imet S.r.l.

- VETTER Krantechnik GmbH

- Cavotec SA

- Conductix-Wampfler (A business unit of Delachaux Group)

- Pulsar Systems, Inc.

- OMEL Srl

- Proemion GmbH

- WAGO Kontakttechnik GmbH & Co. KG (Indirect presence)

Frequently Asked Questions

Analyze common user questions about the Radio Remote Control Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key safety standards governing Radio Remote Control equipment adoption?

Key safety standards include ISO 13849 (Performance Level), IEC 61508 (Safety Integrity Level or SIL), and regional directives such as the EU Machinery Directive and OSHA standards in North America. These mandates drive the market by requiring certified fail-safe functionality and secure communication protocols.

How does Frequency Hopping Spread Spectrum (FHSS) technology improve RRC system reliability?

FHSS significantly improves reliability by rapidly shifting the transmission signal across multiple frequencies. This technique minimizes the impact of localized radio frequency interference (RFI) and signal congestion, ensuring continuous and robust control in noisy industrial environments without manual intervention.

What is the primary difference between proportional and digital RRC control systems?

Digital (or on/off) RRC systems offer binary control (start/stop or open/close). Proportional RRC systems offer smooth, variable control over machine functions, such as speed or intensity, crucial for precision tasks like fine load positioning or hydraulic movement, providing better operational finesse.

Which industrial application segment holds the largest share in the RRC Equipment Market?

The Cranes and Lifting Equipment segment holds the largest market share. This includes overhead cranes, gantry cranes, and mobile cranes used extensively across manufacturing, construction, and port logistics, where remote operation is mandatory for enhancing worker safety and visibility.

How is the integration of RRC systems with the Industrial Internet of Things (IIoT) evolving?

Integration is evolving through the incorporation of fieldbus communication protocols (e.g., CAN, PROFINET) into RRC receivers. This allows real-time operational data from the controlled machinery to be fed back into centralized IIoT platforms for advanced diagnostics, predictive maintenance, and optimized fleet management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager