Radioactive Source Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435913 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Radioactive Source Market Size

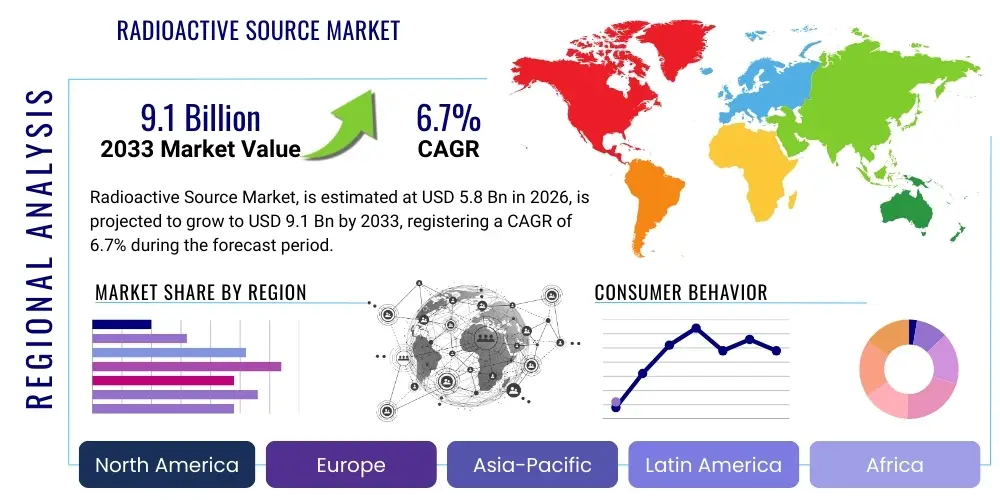

The Radioactive Source Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.1 Billion by the end of the forecast period in 2033.

Radioactive Source Market introduction

The Radioactive Source Market encompasses the production, distribution, and utilization of materials that emit ionizing radiation, crucial for diverse applications ranging from life-saving medical procedures to critical industrial quality control. These sources, typically categorized as sealed or unsealed, contain specific radioisotopes such as Cobalt-60, Cesium-137, and Americium-241, chosen based on their radiation type, energy, and half-life suitable for the intended function. Sealed sources are robustly encapsulated to prevent dispersal, making them ideal for industrial radiography, sterilization, and power generation (e.g., radioisotope thermoelectric generators), while unsealed sources are predominantly used in nuclear medicine for diagnostics (e.g., SPECT, PET) and therapy, allowing for internal targeting and imaging capabilities. The inherent benefits of these sources, including their reliability, precise measurement capabilities, and effectiveness in sterilization processes, solidify their indispensable role across global industries.

Product descriptions within this market vary significantly depending on the radioactive isotope and its intended form. Industrial sealed sources often involve high-activity pellets encased in stainless steel for applications like density gauging, level sensing, and moisture measurement, ensuring operational safety and long-term stability in harsh environments. In contrast, medical applications demand highly purified isotopes, often in liquid or gaseous forms (unsealed sources), optimized for specific biological pathways or short half-lives to minimize patient exposure after treatment or imaging. Major applications span medical sterilization (using Cobalt-60 gamma radiation), cancer treatment (brachytherapy and external beam therapy), non-destructive testing (NDT) in manufacturing and infrastructure assessment, and advanced research in physics and materials science. The market’s sophistication lies in the stringent regulatory framework governing the transport, usage, and disposal of these materials, ensuring public safety and environmental protection.

Driving factors propelling market growth include the escalating global demand for single-use medical devices requiring large-scale sterilization, increasing infrastructure spending that necessitates robust non-destructive testing methods, and continuous innovation in nuclear medicine, particularly the rise of targeted radionuclide therapy (TRT). Furthermore, the stable and reliable nature of radioisotope sources in remote or inaccessible locations, such as deep-sea exploration or spacecraft power systems, ensures sustained niche demand. However, the market faces constraints related to supply chain vulnerabilities (reliance on a few aging research reactors), high associated regulatory costs, and public perception concerns regarding radioactive materials, which necessitate advanced waste management solutions and continuous security enhancements to maintain growth trajectory.

Radioactive Source Market Executive Summary

The Radioactive Source Market is characterized by stable demand driven primarily by compulsory applications in healthcare and industrial quality control, underpinned by critical business trends focusing on enhancing supply chain resilience and developing non-reactor-based isotope production methods. Business trends reveal a shift towards accelerator technology as a viable alternative for producing certain medical isotopes, mitigating risks associated with reactor shutdowns, while industrial users increasingly adopt digital radiography and sophisticated safety protocols to streamline operations and reduce operational liabilities associated with handling high-activity sources. Segmentation trends highlight the dominance of the Sealed Source segment due to widespread industrial use, although the Unsealed Source segment, propelled by advancements in theranostics (combining diagnostics and therapy), exhibits the highest growth potential, necessitating significant investment in radiopharmaceutical manufacturing and specialized logistics. Geographically, North America and Europe currently hold the largest market shares due to advanced healthcare infrastructure and stringent industrial safety regulations, whereas the Asia Pacific region is forecast to demonstrate the most rapid expansion, fueled by expanding nuclear energy programs, rapid industrialization, and growing access to modern radiotherapy techniques in emerging economies like China and India.

Key regional trends emphasize divergent regulatory landscapes; while established markets focus on decommissioning and disposal standards, rapidly developing regions are prioritizing source security and import/export protocols to manage increasing utilization rates. The regulatory complexity acts as both a barrier to entry and a stability factor for established market participants. Furthermore, significant investment is being channeled into research facilities to explore novel isotopes and delivery mechanisms, especially those related to alpha and beta particle emitters for next-generation cancer therapies, shifting the segment focus from high-volume sterilization isotopes to high-value therapeutic isotopes. The executive summary underscores that market success depends on navigating complex geopolitical factors influencing isotope availability and achieving technological integration that enhances safety features while reducing the cost footprint of deployment and monitoring.

The long-term outlook remains positive, contingent upon strategic investments in recycling and refurbishing programs for high-activity industrial sources, thereby addressing environmental concerns and resource scarcity. The convergence of strict adherence to international safety standards (such as IAEA guidelines) and aggressive pursuit of production efficiency will define competitive advantage. The market structure remains moderately consolidated, with key players investing heavily in vertical integration—from isotope production to final source assembly and regulatory management—to control costs and ensure traceability throughout the product lifecycle. The resilience of this market, despite political and supply chain pressures, is testament to the essential nature of radioactive sources in maintaining industrial integrity and enhancing global health standards, making it a critical, yet highly specialized, component of the global economy.

AI Impact Analysis on Radioactive Source Market

User inquiries regarding AI's impact on the Radioactive Source Market predominantly center on how artificial intelligence can enhance safety, optimize logistics, and accelerate research in nuclear medicine. Common questions revolve around predictive maintenance for industrial gauges utilizing radioactive sources, AI-driven image analysis in diagnostic nuclear medicine, and the deployment of machine learning models to improve nuclear material accounting and security protocols, thereby addressing regulatory concerns and reducing human exposure risks. The primary themes emerging from user concerns include the reliability of AI systems in high-stakes environments, the ethical implications of using AI in patient diagnostics involving radioisotopes, and whether AI tools can effectively manage the complex disposal and tracking challenges inherent to the nuclear fuel cycle and sealed source longevity. Users anticipate that AI integration will lead to unprecedented precision in dose delivery for radiotherapy and significant reduction in operational downtime for industrial applications, ultimately minimizing the necessity for direct human interaction with radioactive material.

The introduction of AI and machine learning (ML) capabilities is rapidly transforming the operational dynamics within the Radioactive Source market, particularly in areas related to security and efficiency. AI algorithms are being developed to analyze real-time radiation monitoring data from facilities utilizing radioactive sources, providing predictive insights into potential equipment failures or security breaches long before they occur. This proactive approach not only enhances the physical protection of the sources but also optimizes regulatory compliance by generating comprehensive, automated audit trails. Furthermore, in non-destructive testing (NDT), where radioactive sources (like Iridium-192) are used for quality assurance, AI is used to automatically interpret complex radiographic images, rapidly detecting minute flaws in welds or castings with accuracy surpassing manual human inspection, leading to faster throughput and higher quality control standards in manufacturing sectors such as aerospace and energy.

In the medical segment, the synergy between AI and radioactive sources is most pronounced in personalized medicine. ML models analyze vast datasets including patient genomics, historical treatment responses, and specific radioisotope characteristics to determine the optimal type, amount, and delivery method of the radioactive dose for targeted radionuclide therapy (TRT). This capability is crucial for maximizing therapeutic effectiveness while minimizing toxicity to surrounding healthy tissues. AI also plays a vital role in optimizing the scheduling and logistics of short-lived radiopharmaceuticals, ensuring that isotopes produced remotely reach clinics and hospitals precisely within their effective half-life window, reducing wastage and improving patient scheduling efficiency. While AI penetration is still maturing, its recognized potential for enhancing safety, precision, and operational longevity is rapidly making it a core technological investment across the radioactive source value chain.

- AI optimizes predictive maintenance schedules for industrial radioactive gauges, minimizing downtime and unexpected regulatory events.

- Machine learning enhances the precision of radiation dose planning and delivery in radiotherapy and brachytherapy applications.

- AI-driven image recognition significantly improves diagnostic accuracy and speed in nuclear medicine imaging (SPECT/PET scans).

- Algorithms bolster security and nuclear material accountability by analyzing sensor data and predicting potential insider threats or diversion risks.

- AI assists in optimizing the complex logistics and cold-chain management for short half-life radiopharmaceuticals, reducing transit time and decay losses.

- Deep learning models accelerate research by predicting the performance and stability of novel radioisotopes under various operating conditions.

DRO & Impact Forces Of Radioactive Source Market

The Radioactive Source Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine its growth trajectory and competitive landscape. Key drivers include the mandatory requirement for gamma sterilization in the rapidly expanding global medical device market, the continuous need for non-destructive testing (NDT) to assure structural integrity in critical infrastructure (pipelines, bridges, and aerospace components), and the breakthrough innovations in nuclear medicine, particularly the development of theranostics. These therapeutic and diagnostic applications rely heavily on high-purity, specific radioisotopes, creating sustained, high-value demand. Opportunities primarily lie in the commercialization of non-reactor production methods (accelerators and cyclotrons), which offer better supply chain control and reduce reliance on aging governmental reactors, alongside the development of advanced source encapsulation technologies that increase safety margins and operational lifespans of industrial sources.

Conversely, significant restraints hinder market potential. These include extremely stringent global regulatory requirements for manufacturing, storage, transport, and disposal, which impose substantial compliance costs and administrative burdens on market players. Public perception and geopolitical risks associated with radioactive material further complicate market access and development, often leading to prolonged approval processes. Furthermore, the reliance on a few global research reactors for the production of critical isotopes like Molybdenum-99 (precursor to Technetium-99m) introduces severe supply chain volatility and price fluctuations. The market also faces competition from alternative technologies; for instance, electron beam sterilization and X-ray technologies are gaining traction as non-radioactive alternatives in industrial applications, potentially displacing some low-activity gamma sources.

Impact forces within the market are predominantly driven by technological shifts and regulatory harmonizations. The increasing adoption of accelerator-based production methods represents a powerful disruptive force, shifting the geopolitical balance of isotope supply away from traditional nuclear powers. Simultaneously, global efforts to manage "orphan sources"—radioactive sources lost, stolen, or improperly disposed of—are intensifying regulatory oversight, requiring manufacturers to invest heavily in tracking and security systems (e.g., tamper-proof source housing and GPS tracking). Economic growth in developing regions dictates demand for infrastructure-related NDT applications, acting as a major external force. Ultimately, the successful navigation of this market depends on achieving operational efficiency under extremely high safety standards, making robust quality management systems and comprehensive regulatory expertise essential components of long-term viability.

Segmentation Analysis

The Radioactive Source Market segmentation provides a detailed map of demand distribution based on material properties, application usage, and end-user types, reflecting the diverse necessities across healthcare, industrial, and research sectors. Segmentation by Type (Sealed vs. Unsealed) dictates the safety protocols and logistics involved, with sealed sources dominating the industrial segment due to their robust encapsulation and non-dispersible nature, while unsealed sources are critical for the highly precise and dynamic field of nuclear medicine. Segmentation by Isotope Type is crucial as demand is highly specific; for example, Cobalt-60 dominates bulk sterilization, Americium-241 is essential for smoke detectors and industrial gauging, and specialized isotopes like Lutetium-177 drive high-growth therapeutic radiopharmaceutical segments, reflecting a bifurcated market demand structure where volume and value often diverge significantly.

Segmentation by Application reveals healthcare as the single largest end-use category, driven by radiotherapy and medical sterilization, which mandate predictable and scalable supply chains. However, industrial gauging and measurement remains a foundational market segment, providing stable, long-term revenue through replacement cycles and new infrastructure projects requiring non-contact sensing and quality control. The End-User segmentation further refines this understanding, distinguishing between high-volume, cost-sensitive industrial manufacturers and high-value, quality-sensitive hospitals and research institutions. This differentiation is vital for market participants tailoring their sales, distribution, and regulatory compliance strategies to meet the specific requirements and risk tolerances of each consumer category, ensuring compliance with local radiation safety authorities.

Geographic segmentation is paramount due to variances in regulatory environments and healthcare penetration. North America and Europe possess mature markets characterized by replacement demand and leading-edge technology adoption (especially in theranostics). In contrast, the Asia Pacific market is poised for explosive growth, driven by massive infrastructure developments, increased access to sophisticated medical treatments, and governmental investment in nuclear power generation, all requiring large volumes of industrial and research sources. Understanding these segment dynamics is key to strategic resource allocation, particularly in managing the capital-intensive nature of isotope production and global distribution networks necessary to maintain product integrity and safety across varied climate zones and regulatory jurisdictions.

- By Source Type:

- Sealed Sources (Industrial radiography, Gauging, Sterilization, Brachytherapy)

- Unsealed Sources (Nuclear Medicine Diagnostics and Therapeutics, Research Tracers)

- By Isotope Type:

- Cobalt-60 (Sterilization, Teletherapy)

- Cesium-137 (Gauging, Research)

- Americium-241 (Gauging, Smoke Detection)

- Iridium-192 (Industrial Radiography, Brachytherapy)

- Nickel-63 (Research, Electronic Devices)

- Lutetium-177, Iodine-131, Technetium-99m (Nuclear Medicine)

- Others (e.g., Californium-252, Strontium-90)

- By Application:

- Medical & Healthcare (Radiotherapy, Sterilization, Diagnostics)

- Industrial (Gauging, Non-Destructive Testing (NDT), Process Control)

- Research & Academic (Tracer studies, Neutron Activation Analysis)

- Defense & Security (Detection, Power Generation)

- Food Irradiation & Agriculture

- By End-User:

- Hospitals, Clinics, & Diagnostic Centers

- Industrial Manufacturing and Energy Plants

- Research Institutions and Universities

- Sterilization Service Providers

- Government and Defense Agencies

Value Chain Analysis For Radioactive Source Market

The value chain for the Radioactive Source Market is exceptionally complex and tightly regulated, beginning with the highly specialized process of isotope production. The upstream segment is dominated by a limited number of research reactors (for reactor-based isotopes like Co-60 and Mo-99) or specialized particle accelerators/cyclotrons (for accelerator-based isotopes like F-18 and some therapeutic isotopes). This production phase requires immense capital investment, technical expertise, and stringent governmental licensing, creating high barriers to entry. Once the raw radioactive material is procured or produced, it moves to the manufacturing phase, where the material is processed, encapsulated (for sealed sources), or formulated into pharmaceutical products (for unsealed sources). This manufacturing step involves precision engineering to meet strict safety and performance specifications, often utilizing specialized hot cells and remote handling equipment.

The midstream of the value chain involves complex logistics and distribution channels. Due to the hazardous nature and, often, short half-lives of the products, specialized transportation (often requiring air freight for medical isotopes) compliant with IAEA safety standards is mandatory. Direct and indirect distribution channels are utilized depending on the product’s nature. High-activity sealed sources for industrial or large-scale sterilization are often handled through direct sales agreements or highly controlled, specialized distribution agents who also manage source installation, maintenance, and eventual disposal. Conversely, radiopharmaceuticals (unsealed sources) rely on indirect, rapid logistics networks connecting centralized cyclotron facilities or Mo-99 processing plants directly to hospitals and diagnostic centers, often via sophisticated just-in-time delivery systems to mitigate decay.

The downstream analysis focuses on the end-user application and the critical stage of end-of-life management. After use in industries or healthcare, the spent sources must be collected, stored, and ultimately disposed of or recycled. This process, often referred to as ‘cradle-to-grave’ responsibility, is highly regulated and incredibly expensive, often falling back on the original supplier or specialized waste management companies. The profitability in the downstream segment is tied to the efficiency of waste handling and regulatory compliance. The long-term viability of the value chain depends critically on establishing closed-loop systems, particularly for high-activity sources, where recycling or refurbishment can offset the astronomical costs and environmental risks associated with permanent disposal, thereby optimizing the entire lifecycle cost for the end-user.

Radioactive Source Market Potential Customers

The primary consumers and end-users of radioactive sources span essential and highly regulated sectors globally, driven by non-negotiable requirements for safety, quality assurance, and therapeutic efficacy. In the healthcare sector, potential customers are overwhelmingly Hospitals, Specialized Cancer Treatment Centers, and Diagnostic Imaging Clinics. These entities are the key buyers of unsealed sources for PET and SPECT imaging (e.g., Technetium-99m, Fluorine-18) and sealed sources for brachytherapy (e.g., Iridium-192, Cobalt-60) and large-scale gamma sterilization services for surgical tools and disposable medical supplies. The decision-making process in this segment is influenced by isotope availability, regulatory approvals (FDA, EMA), high purity, and the integration capability with existing medical devices and treatment planning software.

The industrial sector represents a second major customer base, encompassing manufacturing companies (aerospace, automotive), oil and gas corporations, construction firms, and metal fabricators. These customers utilize radioactive sources, particularly sealed high-activity sources (Cesium-137, Americium-241, Iridium-192), primarily for Non-Destructive Testing (NDT) to inspect welds, materials, and infrastructure components, ensuring quality and safety standards are met without damaging the product. Furthermore, sources are integral in industrial process control—gauging liquid levels, density, and moisture content in mining, chemical processing, and food production. For industrial customers, reliability, durability, regulatory compliance of the source container, and low long-term operational costs are the primary purchasing criteria.

Finally, governmental and research institutions constitute a critical, albeit smaller, segment of high-value customers. This includes national laboratories, university research departments, and defense/security agencies. These entities procure sources for fundamental scientific research, calibration standards, environmental monitoring, and specialized defense applications (e.g., detecting illicit nuclear materials). While volume may be lower, the complexity and bespoke nature of these sources often translate to high-margin sales, emphasizing specialized regulatory handling and sophisticated technical support. Additionally, commercial sterilization service providers represent a rapidly growing customer type, acting as intermediaries between source manufacturers and the vast array of medical device companies and pharmaceutical manufacturers globally, focusing primarily on high-output Cobalt-60 sources.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.1 Billion |

| Growth Rate | CAGR 6.7% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eckert & Ziegler, Nordion (Sotera Health), Curium Pharma, comece S.A., QSA Global, Inc., Isotope Technologies Garching (ITG), Revvity, Inc., GE HealthCare, Lantheus Holdings, Inc., IRE ELiT, JSC Isotope, CINJIN Technologies, Inc., Phoenix Nuclear Labs, Starline Inc., BWXT Medical Ltd., KAERI, Australian Nuclear Science and Technology Organisation (ANSTO), CNNC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radioactive Source Market Key Technology Landscape

The technology landscape in the Radioactive Source Market is rapidly evolving, driven by two core imperatives: enhancing safety and reducing dependence on centralized reactor production. Historically, the market relied heavily on the use of research reactors for neutron bombardment to create activation products like Cobalt-60 and Iridium-192. However, the aging fleet of global reactors and subsequent supply disruptions have spurred a technological shift toward accelerator-based production. Cyclotrons and linear accelerators (LINACs) are now widely used to produce critical medical isotopes such as Fluorine-18 (used in PET scans) and increasingly being explored for high-volume production of Molybdenum-99 (Mo-99). This accelerator technology offers greater flexibility, reduced risk of proliferation, and decentralized production capabilities, fundamentally changing the upstream supply chain dynamics and increasing the regional availability of short-lived radiopharmaceuticals.

Another critical area of technological innovation is in source design and encapsulation, specifically targeting sealed sources used in industrial applications and brachytherapy. Modern source encapsulation technologies focus on utilizing advanced materials such as specialized high-integrity alloys (like Hastelloy or Zirconium alloys) to increase the thermal and chemical resistance of the source casing, ensuring integrity over extended operational lifetimes, often exceeding 15-20 years. Furthermore, advanced manufacturing techniques like additive manufacturing (3D printing) are being investigated to create geometrically complex sources optimized for specific therapeutic dose distributions, particularly in personalized brachytherapy, allowing for highly conformal radiation delivery to target tumors while sparing healthy tissue. Safety technologies, including active telemetry systems and remote monitoring (often integrated with AI), are becoming standard, enabling real-time tracking of sources and immediate detection of unauthorized movements or temperature anomalies.

In the downstream application segment, significant technological advancements are centered around digital integration and dosimetry. Digital radiography is increasingly replacing traditional film-based radiography in NDT, allowing for faster processing, reduced need for source repositioning, and enhanced image analysis via automated software. Simultaneously, in radiotherapy, advanced imaging modalities (like adaptive PET-guided therapy) are being integrated with treatment delivery systems. Furthermore, the development of alpha-emitting radionuclides (e.g., Actinium-225 and Thorium-227) represents a frontier technology in therapeutic radiopharmaceuticals, offering high linear energy transfer (LET) radiation capable of delivering highly localized, potent cell-killing power. While production of these alpha emitters remains challenging, their high therapeutic potential drives massive investment in advanced targetry and separation chemistries, pushing the boundaries of radiopharmaceutical manufacturing.

Regional Highlights

- North America: North America, particularly the United States, holds a dominant position in the global Radioactive Source Market, characterized by high investment in advanced nuclear medicine (theranostics), strict industrial safety standards driving NDT adoption, and robust regulatory oversight (NRC, FDA). The region is a pioneer in accelerator technology adoption for medical isotope production, aiming for domestic supply independence for isotopes like Mo-99 and F-18. High healthcare expenditure ensures substantial and predictable demand for both diagnostic and therapeutic sources, while stringent environmental regulations necessitate sophisticated source security and disposal services.

- Europe: Europe is a mature market distinguished by strong regulatory harmonization (Euratom, IAEA guidelines) and a high concentration of specialized radiopharmaceutical manufacturers and nuclear research facilities (e.g., IRE in Belgium). The market is driven by widespread medical sterilization requirements and a historical reliance on centralized reactor production, though there is a strong policy push towards developing recycling capabilities and minimizing the volume of long-lived radioactive waste. Western European countries lead in the clinical adoption of new beta- and alpha-emitting therapeutic isotopes.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This growth is primarily fueled by rapid industrialization, massive infrastructure development (necessitating NDT), expanding healthcare access, and large-scale government investments in nuclear power and research programs, particularly in China, India, and South Korea. While medical penetration is increasing, industrial gauging and large-scale sterilization demand remains the core driver. The region faces challenges related to inconsistent regulatory enforcement and managing high-volume source imports and disposal.

- Latin America (LATAM): LATAM represents an emerging market segment with growth concentrated in key economies like Brazil and Mexico. Demand is steadily increasing, driven by modernization of healthcare infrastructure and necessary upgrades to oil and gas pipeline networks requiring NDT. Market development is often dependent on technology transfer and imported sources, focusing primarily on established, proven radioisotopes for general sterilization and diagnostic imaging applications.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market characteristics. The Middle East, particularly the GCC nations, shows significant investment in advanced healthcare facilities and energy infrastructure, leading to a niche but high-value demand for radiotherapy and specialized industrial sources. Africa's market is primarily focused on essential medical diagnostics and relies heavily on international aid and global distributors for supply stability, with source security remaining a principal concern across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radioactive Source Market.- Eckert & Ziegler

- Nordion (Sotera Health)

- Curium Pharma

- comece S.A.

- QSA Global, Inc.

- Isotope Technologies Garching (ITG)

- Revvity, Inc.

- GE HealthCare

- Lantheus Holdings, Inc.

- IRE ELiT

- JSC Isotope

- CINJIN Technologies, Inc.

- Phoenix Nuclear Labs

- Starline Inc.

- BWXT Medical Ltd.

- KAERI (Korea Atomic Energy Research Institute)

- Australian Nuclear Science and Technology Organisation (ANSTO)

- CNNC (China National Nuclear Corporation)

- Mallinckrodt PLC

- Tracerco (A Johnson Matthey Company)

Frequently Asked Questions

Analyze common user questions about the Radioactive Source market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Radioactive Source Market?

The primary driver is the mandatory requirement for gamma sterilization, largely dependent on Cobalt-60 sources, essential for ensuring the safety and sterility of a vast and growing global supply of single-use medical devices and surgical instruments, complemented by the expansion of targeted radionuclide therapies (theranostics).

How is the market addressing the supply volatility of reactor-produced radioisotopes?

The market is mitigating supply volatility by increasing investment and adoption of non-reactor production methods, specifically using cyclotrons and linear accelerators to produce critical medical isotopes like Molybdenum-99 (Mo-99) and Fluorine-18, ensuring a more resilient, decentralized, and stable supply chain independent of aging research reactors.

What role does Non-Destructive Testing (NDT) play in the market?

NDT is a foundational application, particularly utilizing Iridium-192 and Cesium-137 sealed sources, crucial for quality assurance in high-stakes industrial sectors such as oil and gas, aerospace, and civil engineering, where regulatory compliance mandates structural integrity checks without physical damage to components.

What are the key safety and security challenges faced by the Radioactive Source industry?

The core challenges involve managing the safe transport, storage, and disposal of high-activity sources, preventing misuse or diversion (known as 'orphan sources'), and ensuring strict compliance with evolving international and national security protocols, necessitating advanced tracking technologies and robust regulatory enforcement.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by large-scale governmental investment in infrastructure, rapidly expanding industrial manufacturing bases requiring quality control (NDT), and significant improvements in healthcare access and modern radiotherapy adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager