Radioactive Waste Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436129 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Radioactive Waste Management System Market Size

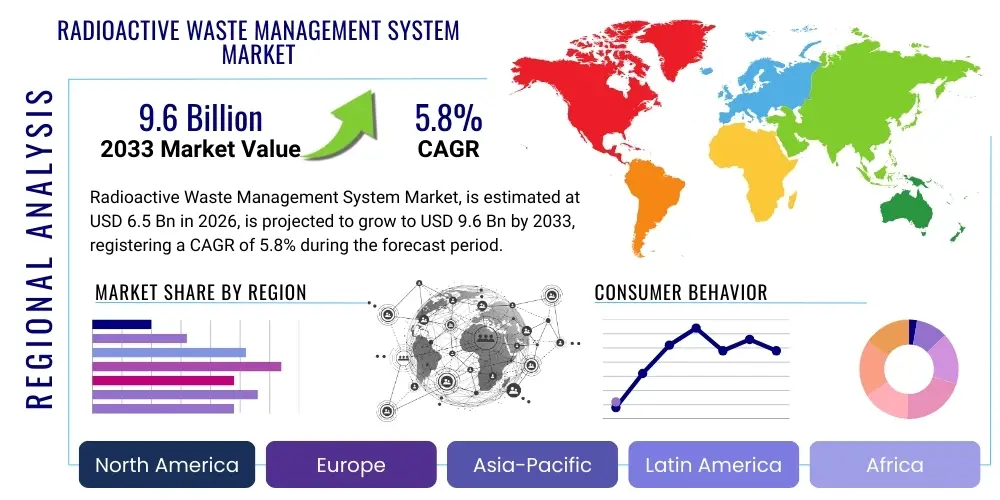

The Radioactive Waste Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the global imperative to manage hazardous nuclear byproducts generated across the energy, industrial, and medical sectors. Increased investment in nuclear power plant decommissioning activities, coupled with stringent international regulatory frameworks designed to enhance public and environmental safety, are primary market accelerators.

The consistent expansion of nuclear energy capacity, particularly in emerging economies seeking sustainable baseload power solutions, necessitates robust and reliable waste management infrastructures. Furthermore, continuous technological advancements in waste volume reduction techniques, such as vitrification and plasma treatment, are contributing significantly to the market valuation. The inherent challenges associated with long-term disposal, particularly high-level waste (HLW), mandate substantial governmental and private sector funding into research and development, solidifying the market's long-term financial viability and projected expansion throughout the forecast period.

Radioactive Waste Management System Market introduction

The Radioactive Waste Management System Market encompasses the processes, technologies, and infrastructure utilized for the safe handling, treatment, conditioning, storage, and disposal of radioactive materials resulting from nuclear activities. These activities span the entire nuclear fuel cycle, including uranium mining, fuel fabrication, reactor operation, post-irradiation handling, reprocessing, and final decommissioning. The core objective of these systems is to isolate hazardous waste from the biosphere for the required period until its radioactivity has decayed to innocuous levels, ensuring minimal risk to human health and the environment. Key products and services include waste characterization instruments, volume reduction technologies, encapsulation systems, and sophisticated long-term repository designs.

Major applications of these systems are critically centered around nuclear power generation facilities, national laboratories and research institutions, defense and military operations producing spent fuel, and medical facilities employing radioisotopes for diagnostics and therapy. The effective management of low-level waste (LLW), intermediate-level waste (ILW), and high-level waste (HLW) requires diverse technological approaches tailored to the specific isotopic composition and activity level of the waste stream. Benefits derived from robust waste management systems include regulatory compliance, enhanced public trust in nuclear technology, minimization of environmental contamination risks, and optimized operational efficiency across the nuclear industry lifecycle.

Driving factors propelling market expansion include the global resurgence of interest in nuclear power as a stable, low-carbon energy source, particularly in regions committed to decarbonization goals. Mandatory decommissioning of aging nuclear reactors across North America and Europe represents a massive, sustained revenue stream for waste management services. Moreover, continuous innovation aimed at developing advanced recycling and reprocessing capabilities, coupled with increasing governmental scrutiny and investment in deep geological repositories (DGRs) for permanent disposal, ensures sustained market momentum. The medical and industrial sectors, with their growing use of radioisotopes, also contribute substantially to the demand for reliable low-level waste processing and disposal services.

Radioactive Waste Management System Market Executive Summary

The Radioactive Waste Management System Market is undergoing significant transformations driven by heightened regulatory stringency, technological innovation focused on waste minimization, and geopolitical shifts favoring nuclear energy expansion. Business trends indicate a consolidation within the specialized treatment and disposal segments, with major engineering, procurement, and construction (EPC) firms focusing on comprehensive, integrated waste solutions that cover the entire lifecycle, from characterization to final closure. The trend towards modular reactor (SMR) development, while generating new waste streams, simultaneously necessitates standardized, efficient waste handling solutions, driving innovation in compact processing units. Sustainability and circular economy principles are increasingly influencing market practices, promoting spent fuel reprocessing and resource recovery wherever economically and technically feasible.

Regionally, North America and Europe currently dominate the market due to the extensive inventory of aging nuclear facilities requiring decommissioning and the high volume of accumulated legacy waste that demands long-term remediation. However, the Asia Pacific (APAC) region, led by China, India, and South Korea, is projected to exhibit the highest growth rate, fueled by aggressive nuclear power build programs and the consequential need for domestic waste infrastructure development. Regulatory environments significantly impact regional market structures; for instance, European markets are heavily influenced by EU directives on radiation protection and waste classification, necessitating substantial compliance investments from operators.

Segment trends highlight the dominance of the High-Level Waste (HLW) treatment and disposal segment in terms of value, primarily due to the complex, costly, and politically sensitive nature of spent fuel management and geological repository construction. The Treatment & Conditioning segment is witnessing rapid technological uptake, particularly in advanced volume reduction methods like pyrolysis and compaction, seeking to lower storage burdens. Furthermore, the segmentation by Service reveals a robust demand for Decommissioning and Site Remediation services, reflecting the widespread shutdown of first and second-generation nuclear plants globally, which ensures predictable, long-term contractual opportunities for specialized waste management providers.

AI Impact Analysis on Radioactive Waste Management System Market

Common user questions regarding the impact of Artificial Intelligence (AI) on Radioactive Waste Management Systems frequently revolve around improving safety, optimizing complex processes, and enhancing decision-making in hazardous environments. Users are primarily concerned with how AI can minimize human exposure during handling and storage, predict equipment failures in remote operations, and optimize resource allocation in large-scale decommissioning projects. Key themes emerging from these queries include the application of machine learning for accurate waste characterization and sorting, the use of predictive analytics for repository monitoring and integrity assessment, and leveraging robotics guided by computer vision for high-radiation tasks. The consensus expectation is that AI integration will lead to significant cost reductions, improved precision in regulatory reporting, and substantial enhancements in operational safety protocols.

AI’s role is becoming central in managing the vast amounts of data generated during the nuclear lifecycle, especially during reactor operation and decommissioning phases. Machine learning algorithms can analyze historical sensor data, radiological surveys, and material properties to classify waste streams more accurately and efficiently than traditional methods. This precision is critical for selecting the appropriate treatment and disposal pathway, ensuring regulatory compliance, and preventing misclassification which could lead to environmental risks or unnecessary expenditures. Furthermore, the integration of AI with simulation models allows operators to predict the long-term behavior of waste packages and repository barriers under various geological and thermal conditions, crucial for demonstrating long-term safety.

In high-hazard environments, AI-powered computer vision and autonomous navigation systems guide specialized robotics to perform tasks such as remote cutting, decontamination, and container stacking. This shift drastically reduces human intervention in areas with high dose rates. Predictive maintenance, another vital AI application, analyzes operational data from treatment facilities (like evaporators or incinerators) to forecast potential component failures, allowing for scheduled maintenance before catastrophic breakdowns occur, thereby ensuring operational continuity and minimizing unplanned exposure events during repairs. These AI implementations collectively elevate the safety margin and operational efficacy across the entire waste management spectrum.

- Enhanced Waste Characterization: AI uses deep learning to rapidly analyze spectral data, improving accuracy in isotopic identification and volume measurement.

- Optimized Sorting and Segregation: Robotics guided by computer vision and reinforcement learning automate the segregation of LLW and ILW, minimizing human radiation dose.

- Predictive Maintenance: Machine learning models forecast failure in critical infrastructure (pumps, ventilation systems, remote handling equipment) within treatment plants and repositories.

- Repository Monitoring and Safety: AI analyzes geotechnical sensor data (temperature, pressure, seismicity) to predict the structural integrity and long-term performance of deep geological storage facilities.

- Decommissioning Optimization: Algorithms plan optimal sequences for dismantling and decontamination, minimizing project timelines and associated costs.

- Regulatory Compliance and Reporting: Automated data processing and anomaly detection ensure precise tracking and documentation of waste movements, simplifying complex regulatory filings.

DRO & Impact Forces Of Radioactive Waste Management System Market

The Radioactive Waste Management System Market is significantly shaped by a confluence of accelerating drivers and constraining factors, whose net impact pushes the market towards sophisticated, integrated solutions. Key drivers include the global push for nuclear power as a climate mitigation strategy, generating sustained demand for waste services; the inevitable and costly process of decommissioning legacy nuclear facilities; and the continuous expansion of radioisotope use in medical diagnostics and industrial processes. These drivers are fundamentally reinforced by mandatory, often evolving, international and national regulatory standards that compel nuclear operators to invest heavily in proven, safety-focused waste management technologies, creating a stable expenditure environment for service providers. Regulatory compliance acts as both a market stimulus and a barrier to entry, ensuring high-quality standards.

Conversely, the market faces considerable restraints, primarily the high capital expenditure required for developing advanced treatment facilities and permanent disposal sites, particularly deep geological repositories (DGRs). Political and public opposition (often referred to as the 'Not In My Backyard' or NIMBY syndrome) poses a substantial challenge to the site selection and licensing process for disposal facilities, leading to decades of delays and escalating project costs. The technical complexity and long-term liability associated with High-Level Waste (HLW) disposal necessitate specialized expertise and financial guarantees stretching over millennia, presenting unique financial and technical risks that restrain faster infrastructure development.

Opportunities for market players are abundant in technological innovation, particularly in volume reduction, waste conditioning techniques (such as advanced cementation and vitrification), and spent fuel reprocessing aimed at recovering valuable fissile material. The development of standardized, containerized solutions for Small Modular Reactors (SMRs) represents a nascent but high-potential segment. The transition from temporary storage solutions to permanent, licensed disposal facilities, particularly in nations like Finland, Sweden, and the US, unlocks major long-term contracts. The interplay of these forces—where mandatory safety regulations meet high investment costs and public scrutiny—creates a dynamic environment rewarding technologies that demonstrably reduce long-term risk and liability.

Segmentation Analysis

The Radioactive Waste Management System Market is comprehensively segmented based on the type of waste handled, the service provided, and the source of the waste generation. This stratification helps market participants tailor technologies and strategies to specific regulatory and technical requirements inherent in different waste classes. The segmentation by waste type—Low-Level Waste (LLW), Intermediate-Level Waste (ILW), and High-Level Waste (HLW)—is critical, as each class dictates vastly different handling, conditioning, and final disposal methods, ranging from near-surface disposal for LLW to complex, multi-barrier geological repositories for HLW. HLW management, especially spent fuel, remains the most technically challenging and value-intensive segment.

Segmentation by service type, encompassing Decommissioning, Treatment & Conditioning, Storage, and Disposal, highlights the sequential needs of the nuclear industry. Decommissioning services are currently expanding rapidly due to reactor closures, demanding integrated project management expertise. Conversely, the Disposal segment represents the final and most complex stage, offering lucrative, multi-decade contracts once regulatory hurdles are overcome. Furthermore, classifying the market by source—Nuclear Power Plants, Industrial Sources, and Medical & Research Institutions—allows for focused technological development; for example, solutions for nuclear power plants must handle large volumes of diverse waste, while medical waste requires efficient management of short-lived isotopes.

- By Waste Type:

- Low-Level Waste (LLW)

- Intermediate-Level Waste (ILW)

- High-Level Waste (HLW)

- By Service:

- Decommissioning and Site Remediation

- Waste Treatment and Conditioning

- Storage

- Disposal (Near-Surface, Deep Geological Repository)

- By Source:

- Nuclear Power Plants

- Industrial Sources (Oil & Gas, Mining)

- Medical and Research Institutions

- Defense and Government Programs

- By Treatment Technology:

- Volume Reduction (Compaction, Incineration, Melting)

- Aqueous Processing (Ion Exchange, Evaporation)

- Solidification and Stabilization (Cementation, Bituminization, Vitrification)

Value Chain Analysis For Radioactive Waste Management System Market

The value chain for radioactive waste management is intricate, commencing with upstream activities centered on raw material procurement and specialized technology development. Upstream primarily involves suppliers of containment materials (e.g., highly corrosion-resistant steel, specialized concrete mixes), robotics and remote handling systems manufacturers, and developers of proprietary treatment technologies like plasma torch vitrification or advanced separation processes. The criticality lies in ensuring the quality and longevity of materials designed to withstand harsh radiation environments over extremely long periods. Research and development institutions, often subsidized by government grants, play a crucial role in validating and licensing new technologies before they can be integrated into operational systems.

Midstream activities form the core of operational waste management and include Waste Characterization, Treatment & Conditioning, and temporary Storage. This stage involves specialized engineering firms and service contractors who operate dedicated facilities for sorting, volume reduction, and stabilizing waste into transportable and disposable forms (e.g., drumming, cementing). Distribution channels in this regulated sector are highly controlled and typically involve direct contractual agreements between the waste generator (e.g., a nuclear utility) and the licensed waste management organization. Transportation is a distinct, high-security element, relying on specialized fleets and internationally compliant Type B or Type C packaging designed to prevent release even under severe accident conditions, necessitating collaboration with highly regulated logistics providers.

Downstream activities focus on the permanent disposition and long-term monitoring of conditioned waste. This involves the construction, operation, and eventual closure of licensed disposal facilities, such as near-surface repositories for LLW and deep geological repositories (DGRs) for HLW and spent fuel. The direct nature of the value chain is pronounced, as major contracts are typically negotiated directly between government agencies (or appointed entities like National Waste Management Organizations) and specialized engineering consortia responsible for repository design and execution. Indirect influence comes from regulatory bodies and international organizations (IAEA), which set the safety standards that define operational requirements and technology deployment across the entire chain, creating high entry barriers but ensuring high service quality.

Radioactive Waste Management System Market Potential Customers

The primary customer base for Radioactive Waste Management Systems is heterogeneous, spanning multiple sectors heavily regulated by national atomic energy commissions and environmental protection agencies. The largest segment by volume and long-term contract value consists of electrical power utilities operating commercial nuclear power plants (NPPs). These utilities are perpetual buyers of waste treatment services, spent fuel storage solutions, and, increasingly, comprehensive decommissioning packages as first and second-generation reactors reach the end of their operational lifespan. Given the significant liability associated with nuclear waste, these customers seek integrated, reliable, and cost-predictive management solutions over multi-decade contracts.

A second major customer category includes governmental entities and national defense departments responsible for legacy waste generated by military programs, nuclear weapon production, and large-scale environmental remediation efforts. Examples include the U.S. Department of Energy (DOE) or the UK’s Nuclear Decommissioning Authority (NDA). These governmental programs manage highly complex and varied waste streams, often requiring bespoke, highly specialized characterization and treatment technologies for mixed waste (radioactive and chemical hazards). Their purchasing decisions are often driven by legislative mandates and public safety concerns, leading to massive, long-duration projects demanding collaboration with consortia capable of managing vast project scopes.

Finally, a growing segment comprises medical facilities (hospitals and oncology centers), academic research institutions, and various industrial users employing radioisotopes for sterilization, quality control, and testing (e.g., Non-Destructive Testing). While the volume of waste generated by this group is significantly smaller, it requires standardized, decentralized, and cost-effective collection, conditioning, and disposal services, typically managed through specialized third-party aggregators. These end-users prioritize simplicity, regulatory compliance, and minimal operational disruption, driving demand for containerized and easily deployable waste processing units for LLW.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Orano, Veolia Environnement S.A., Waste Control Specialists LLC, Bechtel Corporation, EnergySolutions, Babcock International Group PLC, Kurion (Veolia), Westinghouse Electric Company, Fluor Corporation, Nuclear Waste Management Organization (NWMO), SUEZ, Magnox Ltd., AECOM, Studsvik AB, Chase Environmental Group, GNS Gesellschaft für Nuklear-Service mbH, Holtec International, Bhabha Atomic Research Centre (BARC), China National Nuclear Corporation (CNNC). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radioactive Waste Management System Market Key Technology Landscape

The technological landscape of radioactive waste management is characterized by continuous evolution, primarily aimed at achieving three core objectives: minimizing waste volume, stabilizing waste into safe forms for storage, and ensuring long-term containment integrity. Key technologies in the treatment phase include advanced volume reduction techniques such as super-compaction, which drastically reduces the volume of LLW and some ILW, saving significant storage space and costs. Furthermore, high-temperature thermal treatment methods, including incineration and plasma gasification, are increasingly deployed for combustible radioactive waste streams. Plasma vitrification, in particular, offers a highly robust means of incorporating hazardous materials into a stable, durable glass matrix, capable of resisting leaching for millennia, making it crucial for certain ILW and potential HLW applications.

In the conditioning and storage realm, innovation focuses on barrier materials and container design. Cementation and bituminization remain standard processes for immobilizing low and intermediate-level aqueous waste, but research is progressing into geopolymers and advanced ceramic encapsulation methods that offer superior chemical durability and radiation resistance over the long term. For High-Level Waste (HLW) and spent fuel, the technology is dominated by dry storage casks—massive, thick-walled metal containers used for interim storage at reactor sites—and the development of engineered barrier systems (EBS) necessary for Deep Geological Repositories (DGRs). EBS technology involves multiple layers of protection, including highly corrosion-resistant canisters (e.g., copper or stainless steel alloys) and buffer materials like bentonite clay, which swell to seal gaps and inhibit groundwater movement.

The monitoring and characterization segment is heavily reliant on non-destructive assay (NDA) and robotics. Sophisticated gamma and neutron detection systems, often integrated with AI-driven image processing, are essential for rapidly and accurately identifying the isotopic content and activity level of waste packages, critical for regulatory compliance and efficient segregation. Remote handling and deployment technologies, encompassing specialized robotic arms, remotely operated vehicles (ROVs), and automated guided vehicles (AGVs), are vital for minimizing human exposure during handling operations in hot cells and disposal tunnels. The future technological trajectory is moving toward digital twinning and simulation platforms that model the full lifecycle and long-term behavior of waste packages within a repository setting, ensuring maximum safety and regulatory confidence.

Regional Highlights

The global Radioactive Waste Management System Market exhibits distinct regional dynamics shaped by differing levels of nuclear energy utilization, regulatory maturity, and the presence of large legacy waste inventories. North America, primarily driven by the United States, represents a dominant market segment. The US possesses the largest inventory of nuclear reactors undergoing decommissioning, alongside extensive defense-related legacy waste requiring complex environmental remediation (e.g., Hanford Site). The demand here is massive, sustained, and focused heavily on long-term storage solutions for spent nuclear fuel (ISFSIs) and developing final disposal options. Canada's market is also substantial, driven by the Nuclear Waste Management Organization's (NWMO) progression towards establishing a DGR for spent fuel, creating immense project opportunities.

Europe holds a commanding position, especially in decommissioning services and advanced conditioning technologies. Countries like France, the UK, Germany, and Sweden have well-established, highly regulated nuclear sectors. The market is propelled by the systematic shutdown of older reactors, particularly in Germany, and significant progress in establishing DGRs (e.g., Finland’s Onkalo repository). European firms are often leaders in innovative volume reduction and vitrification technologies. Regulatory alignment through EURATOM directives ensures standardized safety protocols, but political debates surrounding nuclear phase-outs occasionally introduce market uncertainty.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is directly tied to ambitious nuclear energy expansion programs in China, India, and South Korea, which are rapidly building new reactors to meet escalating power demand and decarbonization targets. As these reactors come online, the need for robust domestic waste management infrastructure—including treatment facilities, centralized storage, and eventual disposal solutions—skyrockets. While many countries in APAC rely on short-term storage, the regulatory pressure for comprehensive, long-term solutions is mounting, presenting high-growth opportunities for international technology transfer and infrastructure development.

- North America: Dominance due to extensive decommissioning of aging reactors and massive legacy military waste cleanup programs, focusing on long-term dry storage solutions.

- Europe: Strong market driven by strict regulatory mandates (EURATOM), leadership in DGR development (Finland, Sweden), and high demand for advanced volume reduction technologies during phase-outs.

- Asia Pacific (APAC): Highest growth rate globally, fueled by aggressive nuclear power plant construction in China, India, and South Korea, requiring rapid development of domestic waste infrastructure.

- Latin America and MEA: Emerging markets driven by smaller, nascent nuclear programs (e.g., UAE, Argentina, Brazil) and oil & gas industry waste (NORM/TENORM), seeking specialized imported technologies for LLW and ILW management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radioactive Waste Management System Market.- Orano

- Veolia Environnement S.A.

- Waste Control Specialists LLC

- Bechtel Corporation

- EnergySolutions

- Babcock International Group PLC

- Westinghouse Electric Company

- Fluor Corporation

- SUEZ

- AECOM

- Studsvik AB

- GNS Gesellschaft für Nuklear-Service mbH

- Holtec International

- Kurion (Veolia)

- Nuclear Waste Management Organization (NWMO)

- Magnox Ltd.

- Jacobs Engineering Group Inc.

- Técnicas Reunidas S.A.

- China National Nuclear Corporation (CNNC)

- ROSATOM

Frequently Asked Questions

Analyze common user questions about the Radioactive Waste Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High-Level Waste (HLW) and how is it safely managed long-term?

HLW consists mainly of spent nuclear fuel or the liquid waste resulting from its reprocessing, characterized by high radioactivity and heat generation, requiring isolation for thousands of years. Long-term management involves conditioning (often vitrification) and subsequent placement into highly durable casks, followed by final disposal in Deep Geological Repositories (DGRs) where engineered and natural barriers ensure containment far from human contact.

How is the growth of Small Modular Reactors (SMRs) expected to influence future radioactive waste management?

SMR proliferation is expected to drive demand for standardized, modular, and potentially integrated waste management solutions. SMRs may simplify waste logistics due to their smaller, standardized cores and lower absolute volume of spent fuel compared to large conventional reactors, necessitating specialized, often compact, on-site processing and centralized storage solutions.

What are the key technical challenges facing the construction of Deep Geological Repositories (DGRs)?

The primary technical challenges include validating the long-term integrity of the engineered barrier systems (EBS) and canisters against corrosion and radiation damage, characterizing complex geological formations over extreme depths, managing heat dissipation from HLW, and predicting groundwater flow patterns over multi-millennial timescales to ensure public safety.

What role does Artificial Intelligence (AI) play in improving the safety of waste handling operations?

AI significantly enhances safety by deploying advanced robotics and remote handling systems guided by computer vision for sorting and manipulating highly radioactive materials, thereby minimizing human exposure. Additionally, AI-driven predictive maintenance prevents unplanned equipment failures in hazardous environments, ensuring continuous, safe operation of containment systems.

Which service segment is currently driving the largest volume of contracts in the market?

The Decommissioning and Site Remediation service segment is currently driving the largest volume of new contractual activities, particularly in North America and Europe. As numerous first and second-generation nuclear power plants reach the end of their operational licenses, mandatory clean-up and dismantling efforts create a steady, multi-billion dollar demand for specialized waste characterization and remediation expertise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager